Yieldfarms, Airdrops & Catalysts In June

Time to run back DeFi summer? An update on Ethena, Etherfi, Karak and more

Introduction

Hey everyone, Thor here. I have been spending the past few days deep in the trenches (Google Sheets) with the objective of finding the best yieldfarms/airdrops for my stables and ETH. I believe I’ve found some pretty good strategies. Today’s post covers some major events/catalysts for June and several DeFi/airdrop strategies worth looking at now. Make sure to subscribe if you are new and want free access to more content like this in the future.

🗂 Events/Catalysts List

⛓️ L1/L2s

- Peercoin Hard fork - June 3rd

- Sagaxyz ‘Vault 2‘ airdrop snapshot

- LayerZero rumoured to airdrop in June

- zkSync airdrop happening on June 13th

- Blast L2 airdrop happening on June 26th

- Lisk L2 blockchain launch and token migration

- Taiko L2 zkEVM airdrop (5% of supply) happening some time in June

- Fluent has announced Blend (Blended execution) - L2 combining WASM, EVM & SVM

🪙 DeFi

- Fractal (Frax finance) hackathon to stimulate the ecosystem

- Ether.fi S2 airdrop program concludes June 30th (5% of supply)

- Maker begins phase 1 of “Endgame” (potential launch of subDAOs?)

- Platypus Finance has been acquired by Stable Jack - Token conversion

- Stake RabbitX’s native RBX for their new BFX token - Snapshot June 1st

- Swell TGE to happen in a few weeks alongside ‘Voyage’ airdrop (8% of supply)

- ‘Ether.fi Cash’ to go live soon with a native savings account and Visa credit card

🤖 Crypto x AI/DePIN

- Apple Worldwide Developers Conference - June 10th

- Tesla AGM (annual meeting) - June 13th

- NVIDIA AGM (annual meeting) - June 26th

- Aethir TGE rumoured to happen in June

- Ionet TGE rumoured to happen in June

🎮 GameFi/SocialFi

- DeGameFi conference

- FOMO Network release date - June 1st

- BeeCasinoGames airdrop campaign live until June 30th

🏴 Significant Token Unlocks

- June 1st $SUI 3.58% of float

- June 1st $ENA 3.63% of float

- June 1st $DYDX 11.9% of float

- June 1st $1INCH 8.5% of float

- June 12th $APT 2.6% of float

- June 14th $IMX 1.72% of float

- June 15th $STRK 5.61% of float

- June 16th $ARB 3.49% of float

- June 25th $ALT 6.9% of float

🏦 Macro

- Jun 7th: Unemployment rate = Any prints above 4% would likely be taken as a huge risk-off signal.

- Jun 12th: Core CPI

- Jun 12th: Fed funds rate and press conference

- Jun 13th: PPI

- Jun 18th: Retail sales

- Jun 21st: Flash services & manufacturing PMI

- Jun 27th: Final GDP q/q

- EU MiCA (Markets in Crypto-Assets) law to go into effect (in part) 30 June

💰 Fundraises in May 2024

- NodeOps raises $5m

- StripChain raises $10m

- Zeta Markets raises $5m

- Farcaster raises $150m in a Series A

- Blockless raises $8m in a seed round

- Babylon raises $70m led by Paradigm

- Gamefi project Paramlabs raises $7m

- Orbiter Finance Fork Owlto Finance raises $8m

- Ecosystem-owned liquidity pioneers Mitosis raises $7m

- Blockchain Service Platform Lagrange raises $13.2m in its seed round

- Linea-based Social gaming project Gamic raises $1.8m led by Binance Labs

- Lava Network the Cosmos-based data service platform raises $11m with Coingecko, Gate.io and Animoca brands on board

- Web3 Publishing Platforms Paragraph and Mirror merge under Paragraph. They Raised $5m

- Fantom Foundation raised $10M and announced the launch of the Sonic Foundation $S and Sonic Labs alongside its upcoming blockchain

🎯 Notable DeFi Strategies

Calculator/sheets for all these strategies here.

Blackwing ✈️

Blackwing is a DEX layer built as a modular rollup on top of Initia. What’s unique is their ‘limitless pools’ design which abstracts away bridging and allows for liquidation free leverage trading for long tail assets. Blackwing has raised a $4.5m strategic round led by Hashed and Gumi Cryptos.

Blackwing is currently running its Tomcat-1 testnet in which users can deposit liquidity to earn ‘BXP‘ (native Blackwing points). Some of the assets that can be deposited include

- ETH, USDC, PEPE, SHIB

- LRTs (eETH, ezETH, rsETH, rswETH and more)

- Pendle PT tokens (PT-ENA, PT-sUSDe, PT-rsETH and more)

I have personally deposited some of my Pendle PT-sUSDe which is already earning a 46% APY. Due to this, I view Blackwing as an extra reward on top of a strategy I would use anyway. Let’s take a look at the potential return here.

Blackwing is in an invite-only phase but you can sign up with the link here.

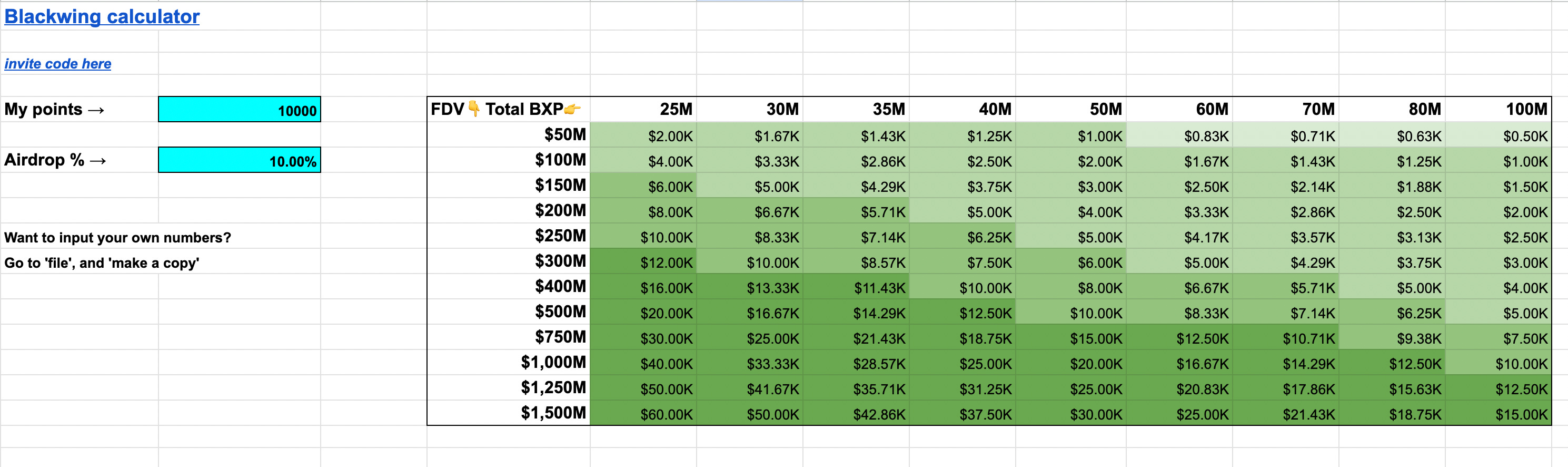

I’ve created a calculator that lets you input your points as well as your expected airdrop % of total supply. Based on this, the FDV of the Blackwing token and the total BXP supply, you can view your expected airdrop. How much BXP will be emitted in total? Well it depends on the TVL and when the campaign ends. I’ve speculated that this maybe could be in September which leads me to the following:

Roughly 40m BXP in total given a 100% growth rate. Note that this number easily could be far off either to the upside or downside. In terms of how many points you earn, this depends on when you deposit. The points APR falls over time as more liquidity enters. From personal experience, I deposited ~$160k earlier this week (Monday I think) and have roughly 3,200 BXP (if I don’t count referral points).

All in all, disregarding the smart contract risk, if you are earning fixed yield on your ETH or stablecoins already from Pendle, depositing this into Blackwing feels like a no-brainer. Seems like like could potentially double or triple the yield you’re earning already. But of course keep in mind that nothing is risk-free!

If you find these strategies valuable, don’t forget to subscribe🫡

Ethena S2

The Ethena S2 ‘sats campaign‘ has been ongoing for nearly 2 months at this point. As S2 concludes in September, there are still 3 months left and plenty of time to participate. The beauty of the Ethena <> Pendle strategy is that leverage increases over time. The difference between farming this for 4 months versus 3 months is therefore somewhat insignificant.

Sign up to Ethena here if you haven’t already

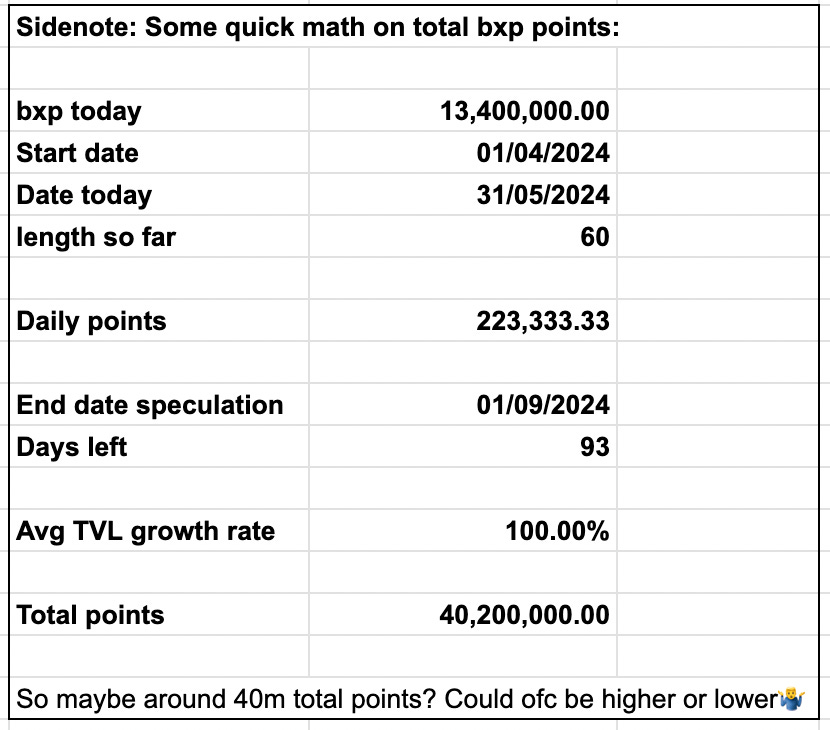

Points leverage (YT-sUSDe)

If you’re bullish on $ENA and want to maximize your S2 airdrop, the Pendle sUSDe market is by far the best strategy as you not only get leverage on the points earned but also the high yield paid out to sUSDe holders (currently 36% APY). Be aware that the sUSDe market on Pendle has a limit in terms of how much can be deposited so you might have to act fast.

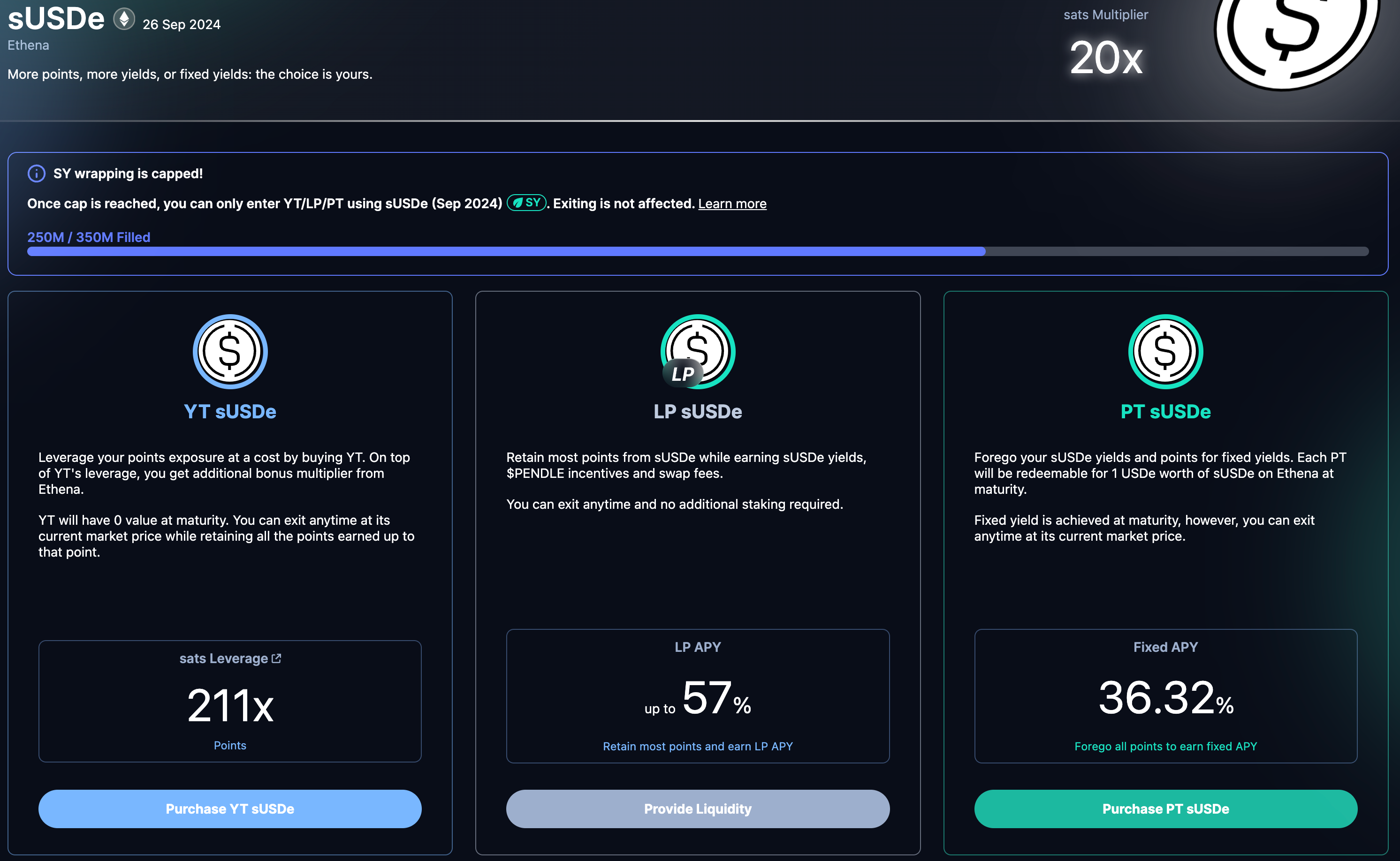

Below is an estimation of the return if you were to buy $20,000 worth of the YT-sUSDe token today.

From a previous analysis, I estimated roughly 10trillion sats to be emitted in total. With recent growth however, it appears 12t might be more realistic. According to additional assumptions seen above, buying $20,000 worth of YT-sUSDe would net

- A $22,643 ENA airdrop

- $13,393 in sUSDe yield if the average sUSDe yield is 25% from now till Sep 2nd

Note that the $20,000 spent on YT-sUSDe goes to 0 towards maturity so the real return is $16,037 which is equivalent to an 80% ROI (not too shabby). As seen roughly 40% of the return comes from the sUSDe yield. If you believe funding rates will be high for the next few months and the sUSDe yield will stay at around 35% rather than the estimated average around 25%, your return from the sUSDe yield will be $21,394 rather than $13,393. On the other hand, if Ethena’s revenue decreases due to low funding rates, the return from the strategy will be dampened.

More risk-averse? You an also simply lock in a fixed yield of 36% annually for the next 3 month simply by buying the PT-sUSDe token. This is a pretty incredible yield and is even fixed. Hard to beat if you’re looking for some passive income on your stablecoins. You can additionally deposit your PT-sUSDe tokens into Blackwing to farm an additional airdrop on top of this passive yield.

Ether.fi S2

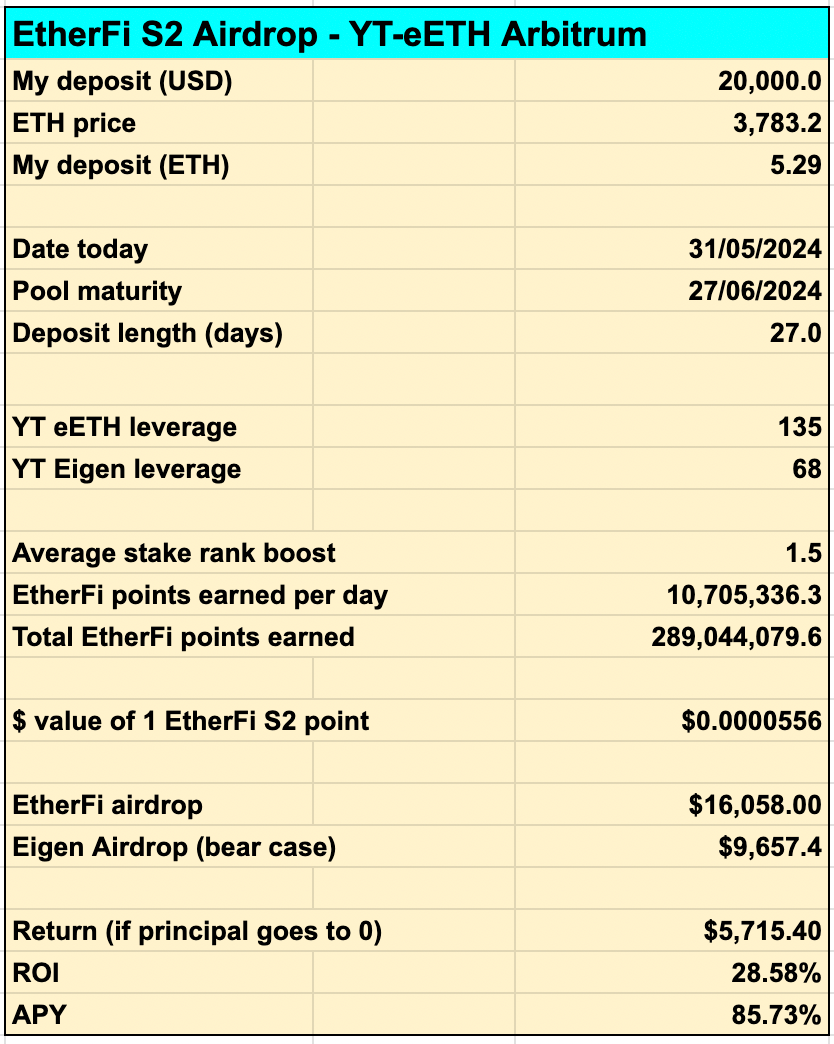

Ether.fi is the largest liquid restaking protocol with over $6b in TVL. The ether.fi season 2 points program concludes at the end of June with a 5% airdrop. This effectively means that you have little time left to participate. Due to the high leverage on the Pendle YT-eETH Arbitrum market however, it appears to still be a profitable strategy when accounting for the EIGEN airdrop earned as well. The pool currently offers 135x leverage on Ether.fi points and 68x leverage on EIGEN points. If you are already in the Ether.fi Stakerank level 8, the return is an estimated 55% from Ether.fi and EIGEN. If not, the expected return is 28.58% as seen below.

Note that while a lot of the information regarding Ether.fi S2 has been confirmed by the team, it is unknown exactly how EigenLayer will be delegating points for S2. Make sure to therefore take these estimations with a grain of salt. The full estimation can be found in the sheets here.

Karak

Karak is a competitor to EigenLayer with nearly $800m in TVL. There are several interesting strategies related to Karak including depositing LRTs which are already earning LRT points & EIGEN points and will now also be earning Karak XP.

You can sign up to Karak with the code: 9s8z1

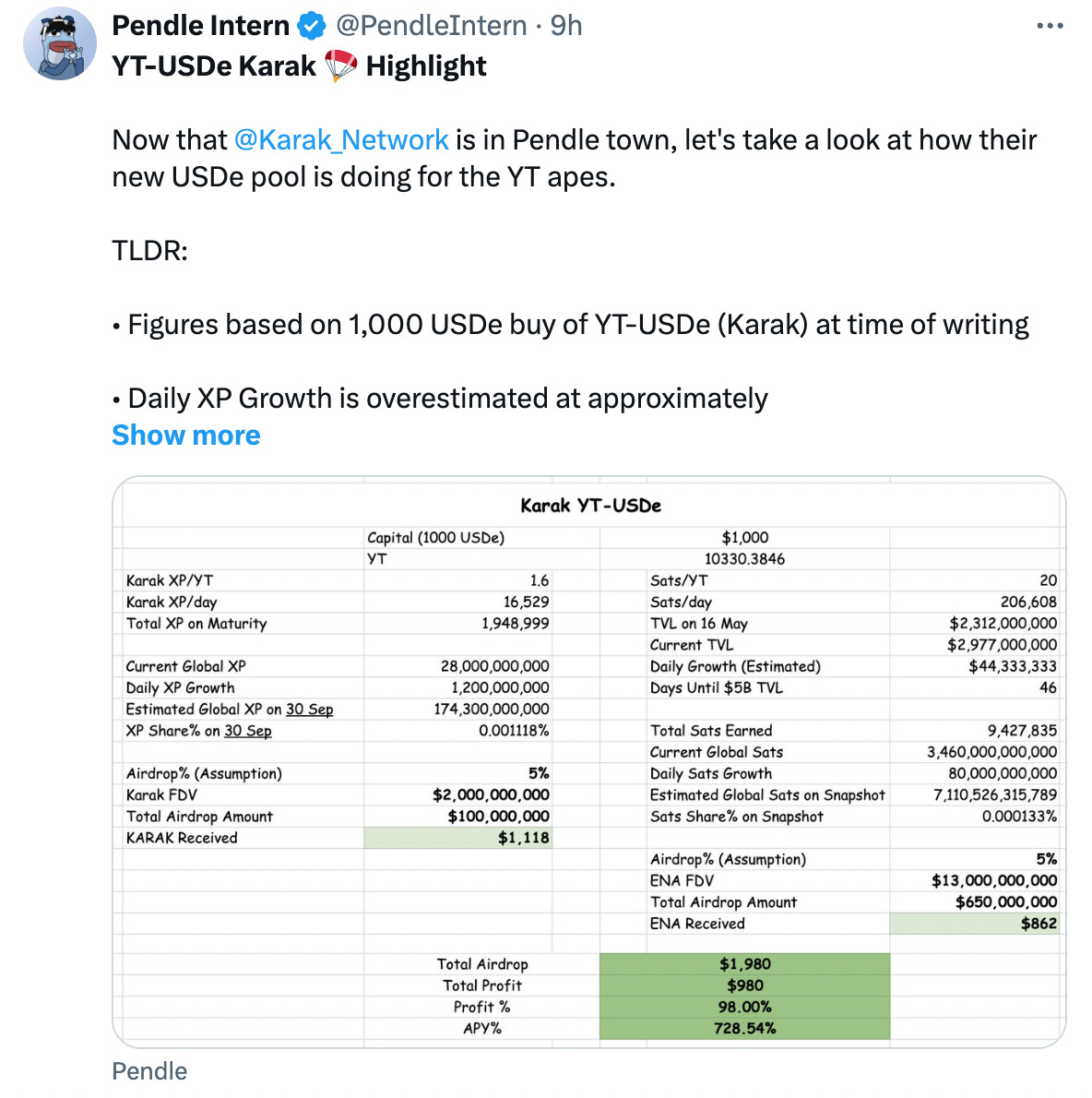

In addition, Pendle recently launched three Karak markets, one for Karak USDe, one for Karak sUSDe and one for Karak eETH. This allows user to either lock in fixed yield on these assets or get leveraged exposure to all of the underlying points. Pendle Intern was able to retrieve information from the team regarding total XP supply amongst other things and has posted a great breakdown on the expected yield related to this strategy:

In conclusion, there are several good strategies in June to grow your portfolio. I am personally farming all of these but remember that a lot of the returns are based on speculative assumptions. And that’s all for now! See you next time🫡

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.