Yieldfarming in a Bull Market

Introduction

While most investors are occupied with finding the next 100x AI memecoin or figuring out which coin from 2017 will pump next, some are taking advantage of the high yields that can be found in DeFi currently. Bull market demand has resulted in on chain yield spiking which leads to some interesting strategies. Today's report dives into sUSDe looping on various lending markets, a calculator to estimate exact return, JLP and more.

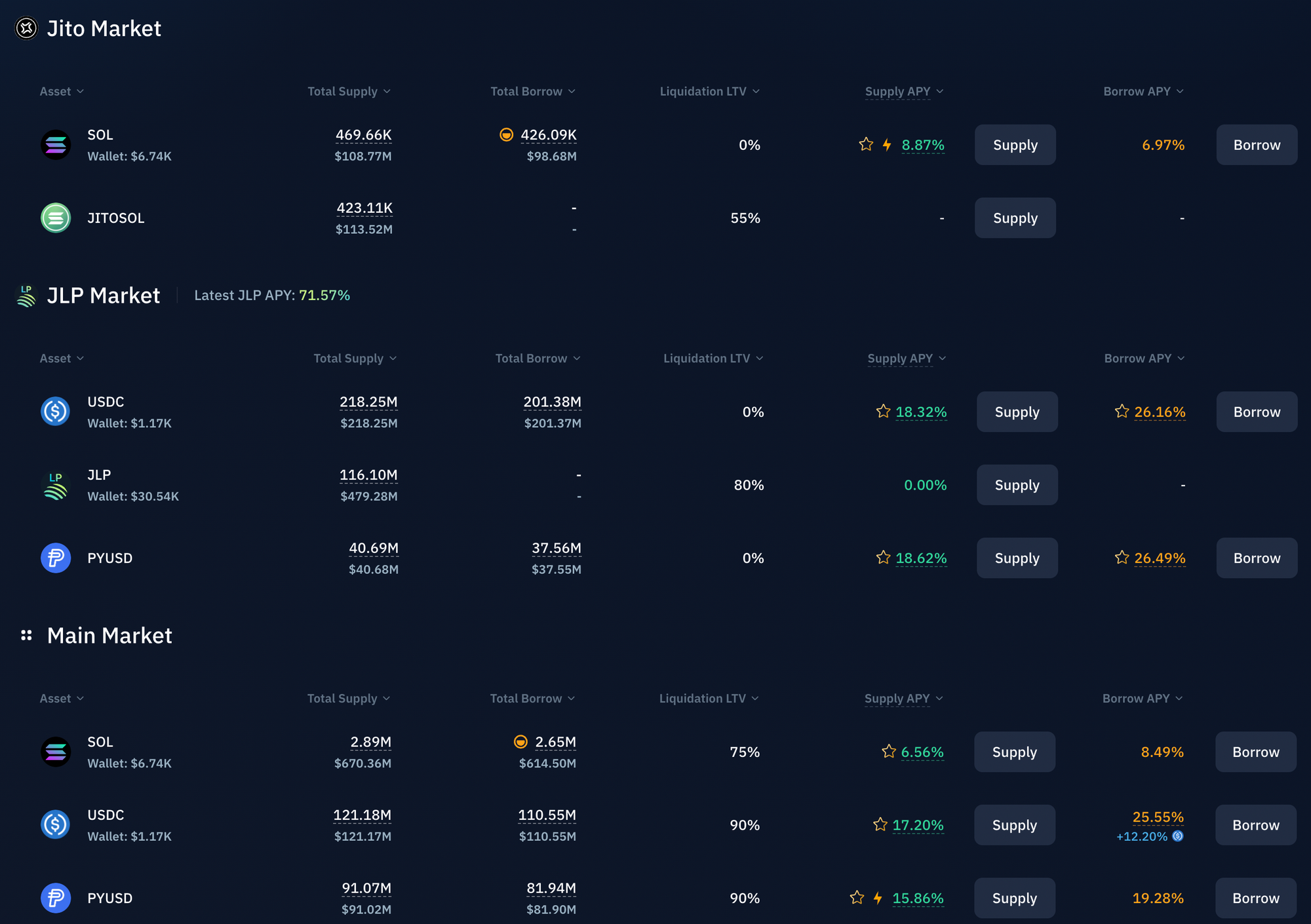

Sponsor - Kamino Finance

Today's report is sponsored by Kamino Finance. Kamino metrics such as TVL and fees keep trending upwards and the protocol currently boasts some of the highest yields on assets such as SOL, SOL LSTs and stablecoins. These yields can be obtained simply by depositing them into the lending market. This includes:

- 18.3% APY on USDC

- 27% APY on PYUSD (Ethena market)

- 15% on USDS

- 9% on SOL

More sophisticated yield strategies on Kamino involve their Multiply product which allows for leverage on SOL LSTs (to effectively get leveraged exposure to the SOL staking yield) as well as JLP. With the current JLP APY and USDC borrow APY, JLP multiply positions are earning >100% APY.

For a full guide on how Kamino Multiply vaults work, and how they are designed to mitigate risk of liquidation, see our recent report below:

Ethena sUSDe Looping

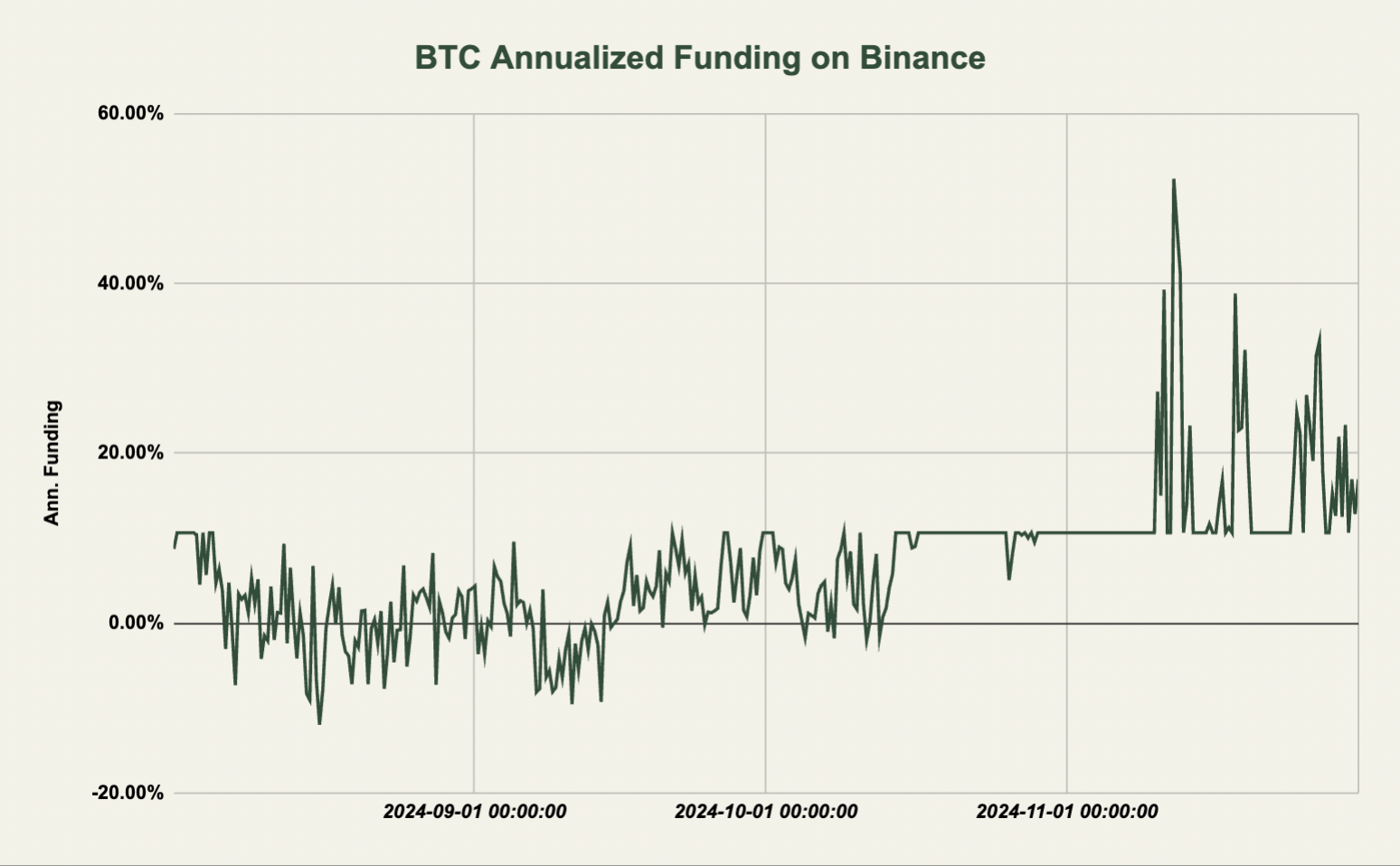

Since the election in early November, funding rates on exchanges have increased drastically for assets like BTC and ETH:

Ethena's revenue, and the APY earned from holding sUSDe, are positively correlated with these funding rates as the protocol is hedging the underlying asset spot exposure by shorting the futures contracts. As a result, sUSDe APY has increased significantly over the past weeks and is currently sitting around 21% APY. Below are some ways to take advantage of this.

For an overview of Ethena and the design of USDe/sUSDe, read our article from January here.

Aave

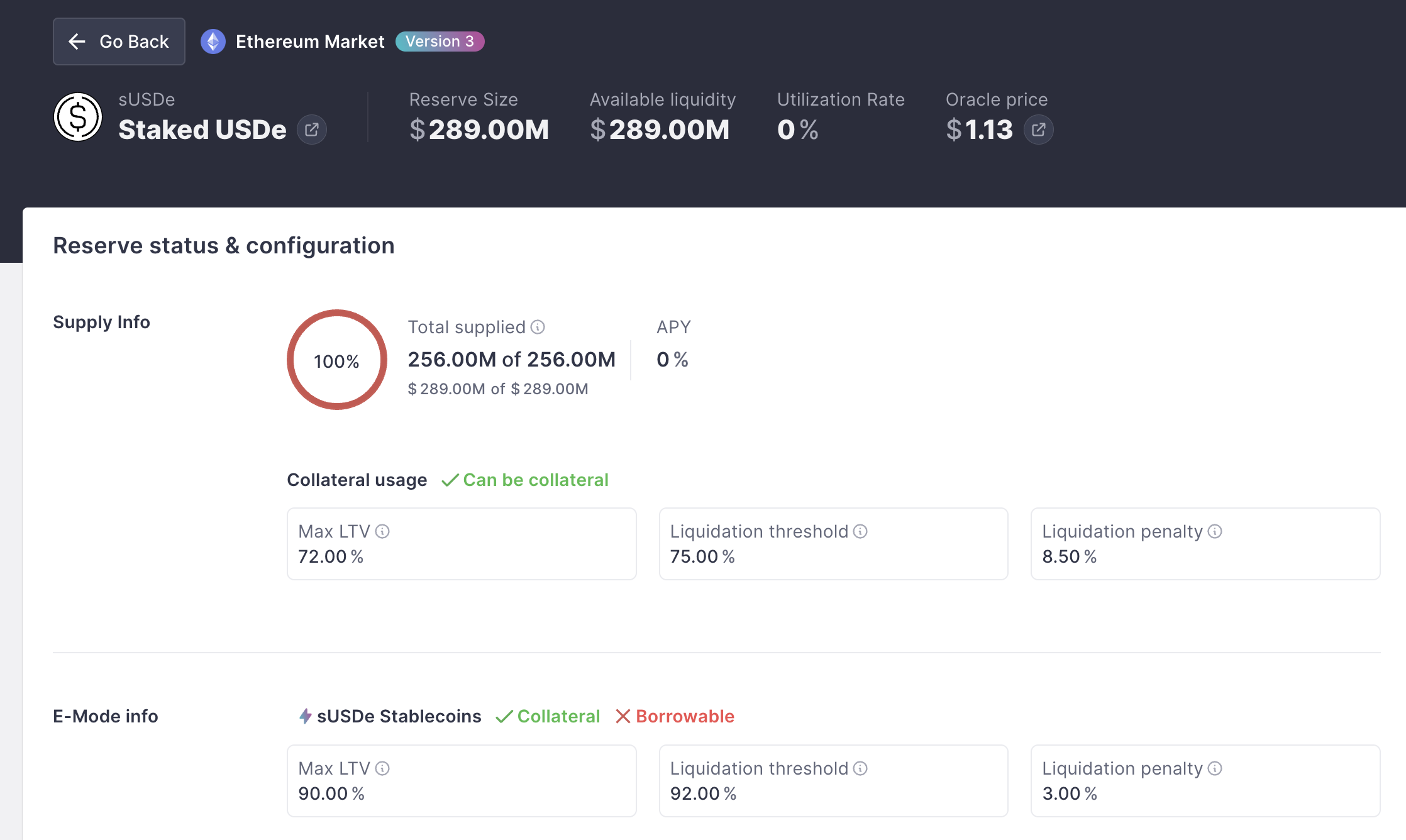

There are several ways to get exposure to the high sUSDe yield. One of the more recent strategies involves the sUSDe integration on Aave. By:

- Supplying sUSDe as collateral on Aave

- Borrowing a stablecoin such as USDC against this collateral

- Swap USDC to sUSDe

- Repeat 1.

...you effectively obtain leveraged exposure to the sUSDe yield where your actual return is the sUSDe yield minus the USDC borrow rate times the leverage applied.

Note that current deposit caps have been reached but are expected to be raised within a few days, so pay close attention to this if you wish to deposit.

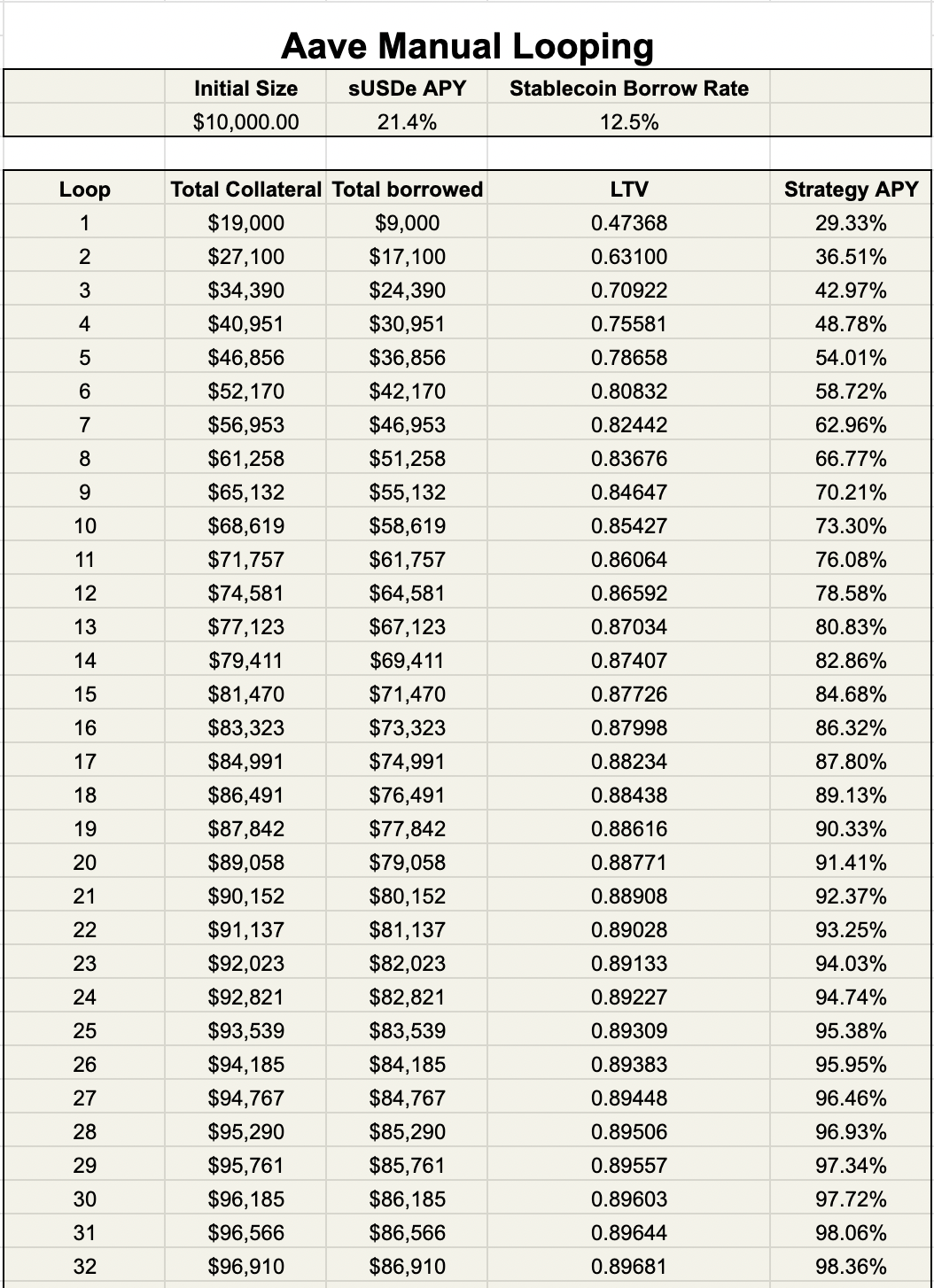

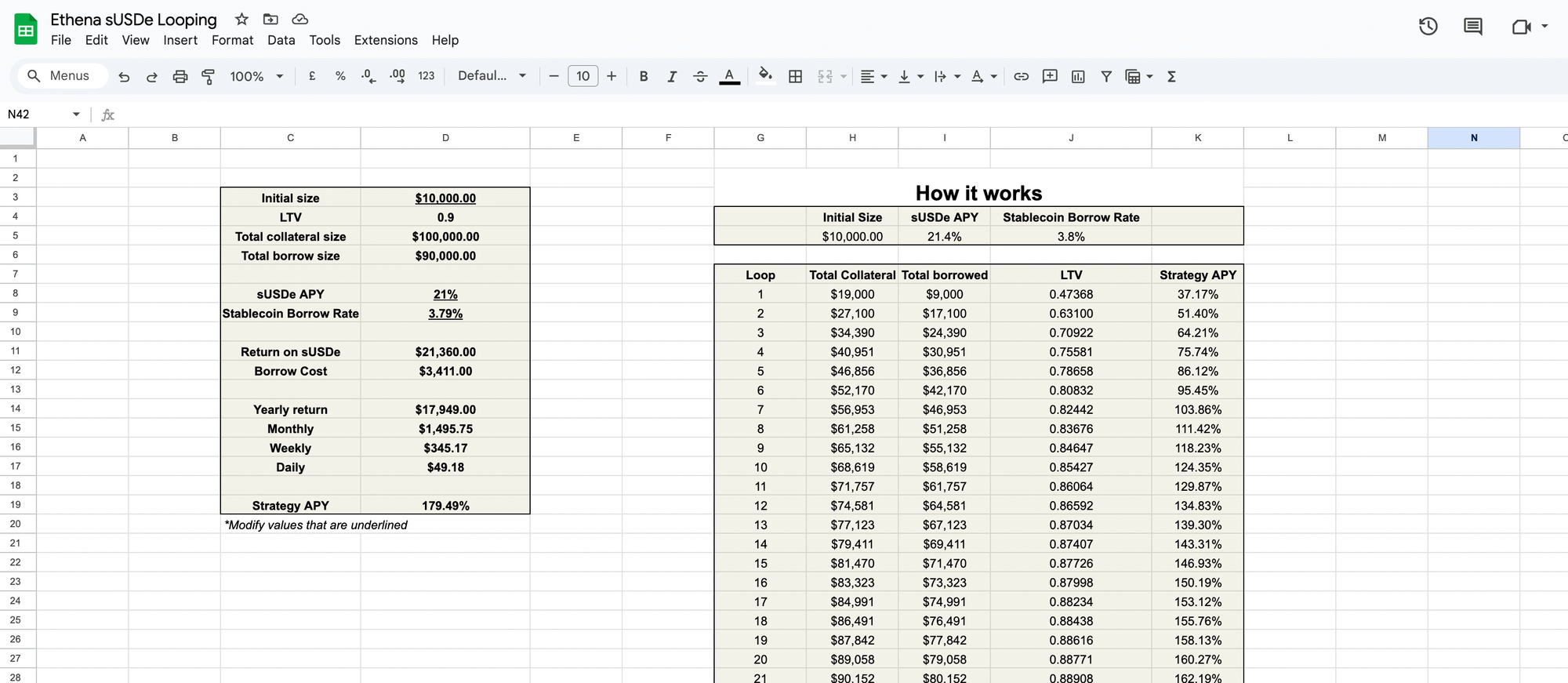

As the max LTV is 90% on Aave when applying E-Mode, depositors can access up to 10x leverage on their assets. The table below shows the return on this strategy for each loop with the sUSDe APY at 21% and a USDC borrow rate of 12.5%. In this instance, $10,000 worth of sUSDe is supplied as collateral on the market. $9,000 USDC is borrowed and converted into sUSDe which then again is supplied as collateral. The total collateral balance is now $19,000 and $8100 USDC is borrowed making the total amount of USDC borrowed $17,100. This process can be repeated up to a 100 times or until the total strategy LTV reaches 90% (0.9). As seen from the table, the more times this loop is performed, the higher the strategy APY.

Keep in mind that doing this manually takes some effort and doing multiple loops costs a lot of gas both when opening and closing the position. It therefore mostly makes sense if the strategy is done with larger size.

For an automated and less gas costly version of this strategy, we turn to Fluid.

Fluid

Fluid might have appeared on your radar recently as they've been getting a lot of attention due to their recent DEX integration, which introduced smart debt and smart collateral. On Fluid, users can leverage and deleverage automatically making the process faster and cheaper.

The max LTV on the sUSDe<>USDC or USDT markets on Fluid is also 90% allowing for up to 10x leverage. In contrast to Aave however, the liquidation penalty is only 2% rather 3% and the risk of liquidation is significantly lower. Fluid uses smart contract pricing as oracle for sUSDe. As a result, should sUSDe experience a short term depeg due to a liquidity crunch, multiply positions won't experience a liquidation despite the price decreasing. The only way positions can get liquidated is if borrow rates stay high for a long time and a user fails to pay attention to this or if the sUSDe contract is exploited.

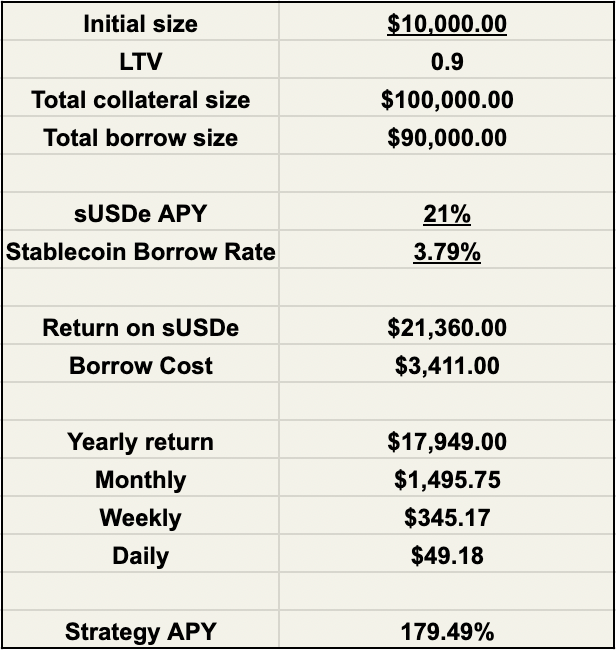

With the introduction of the Fluid DEX and smart debt, users can borrow sUSDe against a USDC/USDT liquidity pool position which earns trading fees. The debt will therefore be a mixture of USDT and USDC and the borrow cost will be reduced due to the positive trading fees earned on these assets. See the example below. Instead of paying between 8 and 9% in borrowing costs, the actual borrow APY is 8.56%-4.77% = 3.79%.

paying 9% on the $USDC part of my debt

— lito.eth (@litocoen) December 1, 2024

paying 8% on the $USDT part of my debt

but net apr of my debt is only 4.7% because i'm earning trading fees

that's the power of fluid dex

lenders can earn high rates, borrowers can pay low rates all at the same time pic.twitter.com/msmLBDNDUw

This results in a far greater APY as long as USDT and USDC borrow rates are below the sUSDe APY. At current rates displayed in the tweet above and when looping up to a 90% LTV, the strategy APY is 179.5%!

You can access this calculator here if you're a subscriber of On Chain Times (free).

Keep in mind that the sUSDe<>USDC/USDT vault currently is at max capacity but is expected to be increased soon. In the meantime, users can access the standard sUSDe<>USDT or sUSDe<>USDC vaults which also feature automatic leverage and deleveraging.

In general, when it comes to these strategies, it is advised to pay close attention to the borrow rates as they can be quite volatile and potentially make the strategy unprofitable. Also be aware that nothing in DeFi is risk free and smart contract exposure can lead to a loss of funds should an exploit occur.

Sidenote - How to Calculate the Actual sUSDe APY

Ethena distributes rewards to the sUSDe contract based on the fees earned in the prior week. As a result, the APY displayed on the Ethena UI is often different than the actual real time APY. This is a big deal as a few %-points can be the difference between a profitable and an unprofitable looping trade.

To calculate the actual APY, look at the rewards sent to the sUSDe contract here. Rewards are sent every 8 hours. By adding the past three transactions (past 24h rewards) and dividing by the total USDe supply, which can be found here, and finally multiplying by 365 days, you have the real time sUSDe APY.

Keep in mind that sUSDe yield is obtained through sUSDe price appreciation and not a yield that can be claimed.

JLP

JLP has been discussed on many different occasions here at On Chain Times. We first dove into the underlying design earlier this year, concluding that JLP is outperforming nearly all crypto assets from a volatility-adjusted perspective. If you're completely unfamiliar with JLP, see our initial report below.

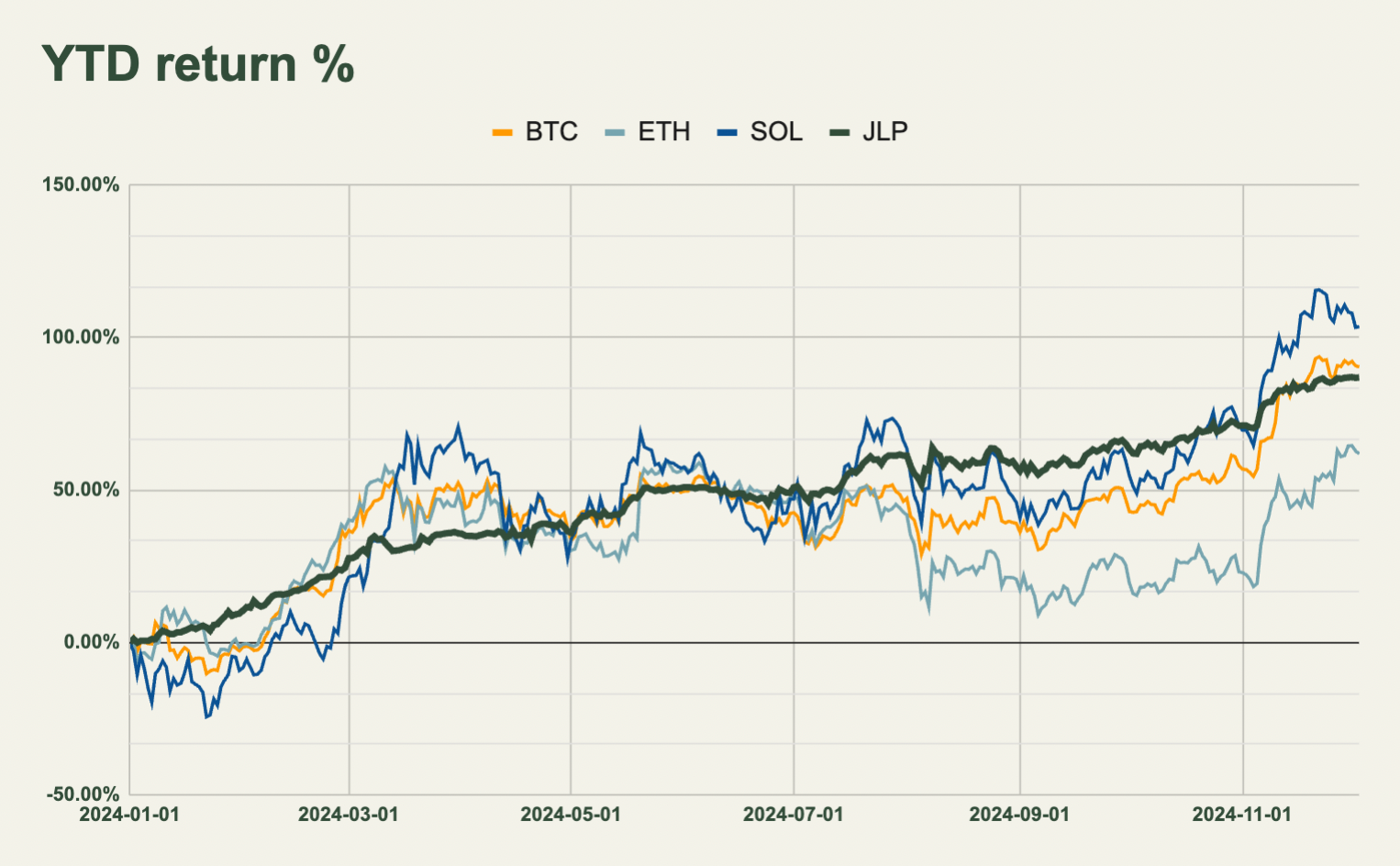

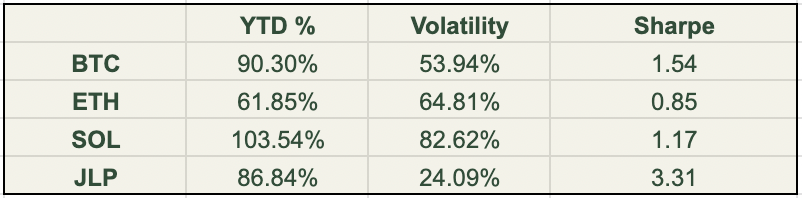

On a year-to-date basis, is up 87% whereas BTC is up 90%, ETH 65% and SOL 104%.

From a volatility-adjusted perspective, we calculate the Sharpe ratio which factors in the volatility and the 'on chain risk-free rate' set to 7% annually in this case. As seen, JLP has outperformed BTC and other majors by more than 2x when factoring in this volatility.

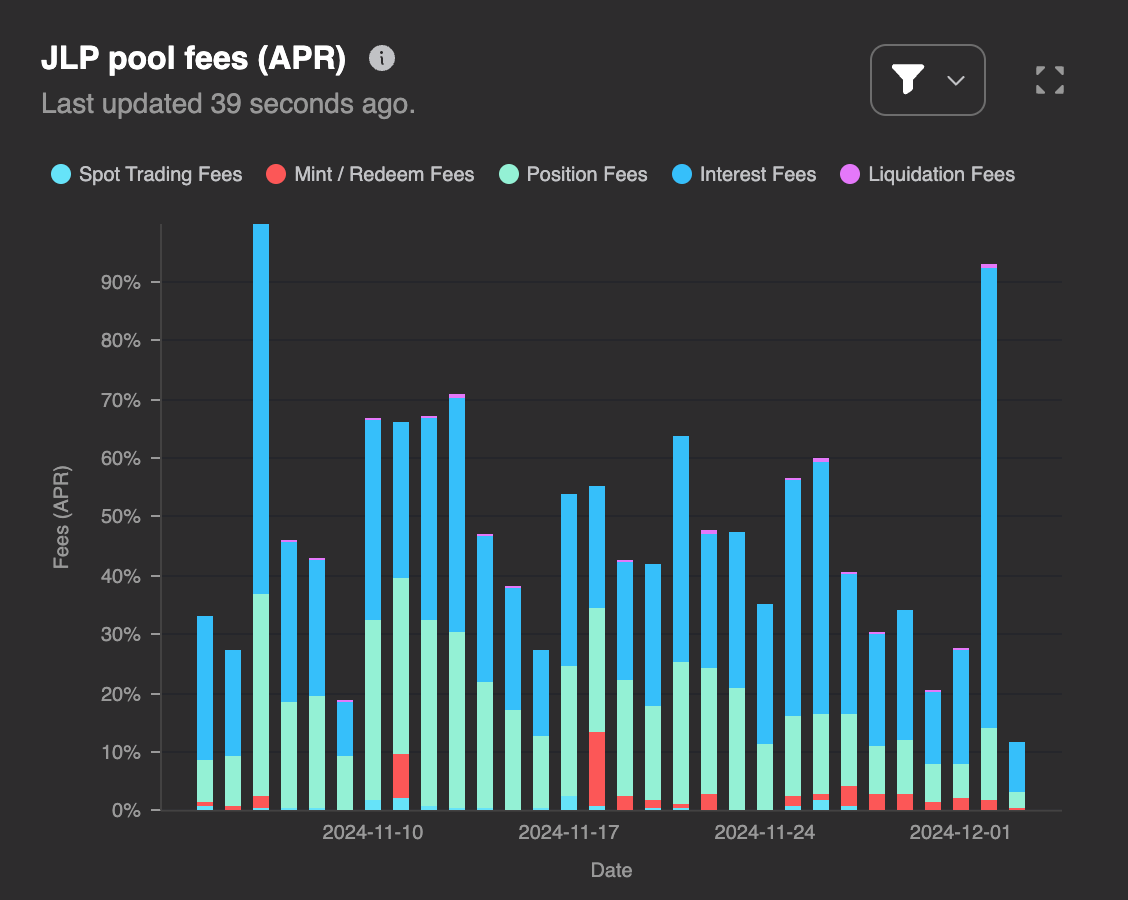

JLP continues to outperform due to the large amount of fees paid by perp traders on Jupiter as seen by the figure below:

You can find more information about JLP on the Gauntlet dashboard.

For a higher risk/higher upside JLP strategy, see the multiply vault on Kamino Finance which we covered in the report below:

Conclusion

In today's report, two popular yield farming strategies were covered. In this sort of environment however there are several additional high yielding strategies available such as high fixed yield on Pendle, YT tokens, basis trading and more. These contain various levels of risk and potential return and will be covered in a future report. In order to not miss this, make sure to subscribe to On Chain Times if you haven't already.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.