Yield on Yield With Summer.fi

Earn additional yield on top of Aave, Morpho, Maker and more with Summer.fi's RAYS campaign.

This report is made in collaboration with Summer.fi and is therefore sponsored.

Introduction

Navigating DeFi isn’t easy. The open source and composable nature of crypto means DeFi trades can be looped endlessly for maximum efficiency, which entails constant yield-hunting for the best strategies across different protocols and tedious monitoring of protocol parameters to avoid liquidation.

That’s why dapps like Summer.fi exist. Previously known as Oasis, Summer.fi is a one-stop shop aggregator that lets you manage all your DeFi trades and portfolio P&L on one nifty dashboard.

Summer.fi also recently launched its RAYS points campaign which lets you earn additional yield on top of existing strategies. This article brings you up to speed with everything you need to know about Summer.fi and the RAYS campaign.

What is Summer.fi

Today, Summer.fi operates across four networks: Ethereum mainnet, Arbitrum, Optimism and Base, aggregating ~$4.7B in assets across five protocols: Aave, Maker, Spark, Morpho and Ajna. Summer.fi curates the most popular and best yield trades across the best protocols so DeFi traders can find the optimal strategy suiting their specific needs.

There are primarily three Summer.fi products: Borrow, Multiply and Earn.

- Borrow lets users borrow stablecoins and other assets against collateral.

- Multiply lets you take leveraged positions to increase your exposure to a large variety of asset. In just one transaction, users can use flashloans to make trades, deposits and withdrawals at your desired multiple.

- Earn allows users to compound long-term yields (including yield looping) on your capital.

Strategy Highlight

Let’s take for example the common stETH/ETH yield loop trade. The general idea with this trade is that if you’re bullish ETH and holding it, that’s idle capital that you can swap to stETH and and generate a yield from while waiting for the bull market to take off. To further optimize the trade, you’d like to borrow even more ETH based on your original capital. The composability of DeFi smart contracts lets you do this, but traders have to execute a series of somewhat complex steps.

The outcome however is that you end up with a yield-acruing stash of stETH and a debt position of ETH on Aave which can be a more optimal position than sitting on just ETH. Instead of having to go through multiple complicated steps across various different protocols to execute a strategy like this, Summer.fi offers this in a single atomic transaction.

Not only that, Summer.fi makes your position management much easier with an intuitive dashboard of features like automated buys, sells, profit-taking and stop-loss. The dapp also automates calculations of your potential earnings, streamlining risk management into a simple process, all while retaining self-custody.

In addition to the stETH/ETH yield loop trade just explained, the team curates a variety of the best DeFi yield strategies, thus reducing the time to hunt for yield comparisons between different protocols.

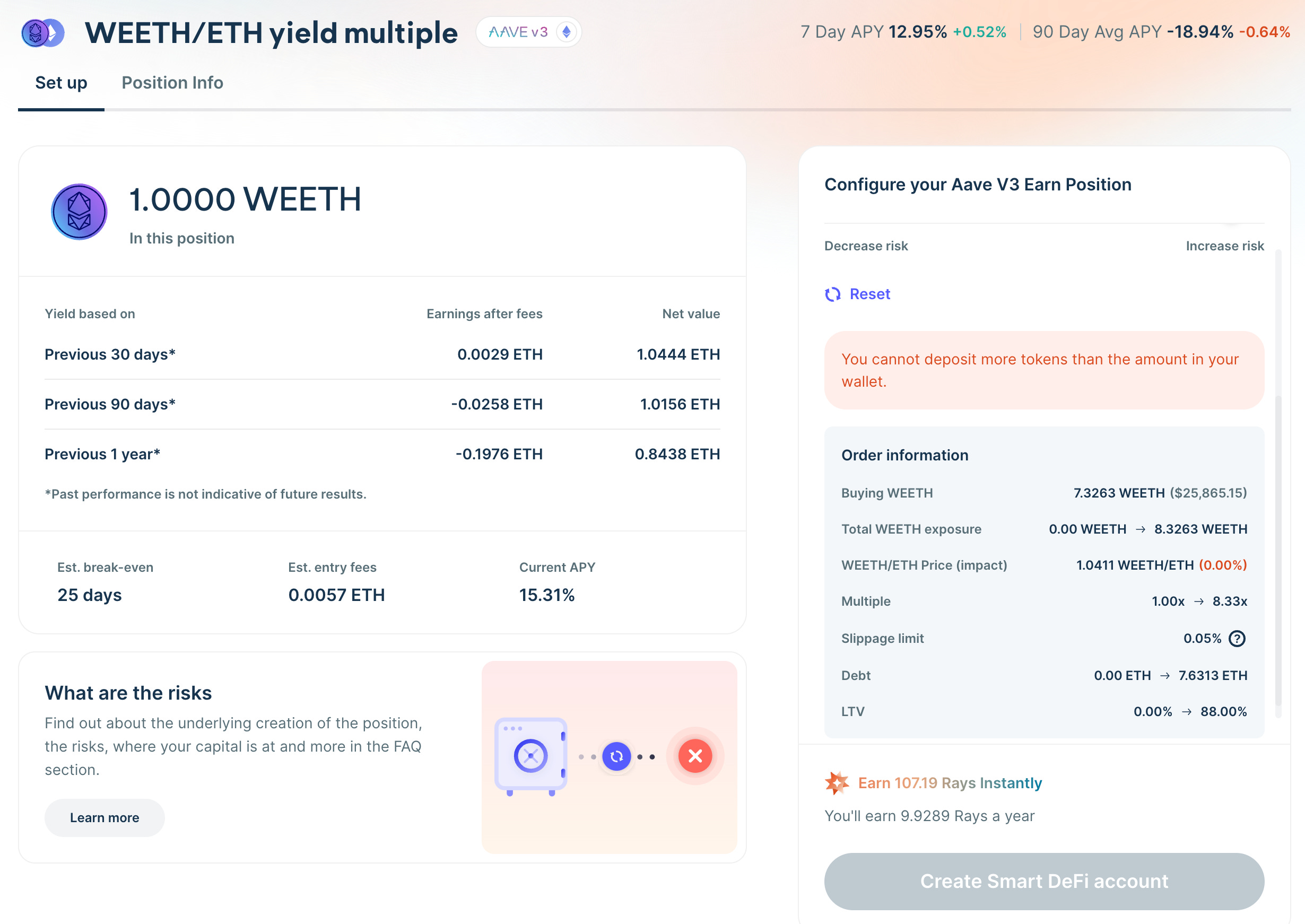

This includes a looping strategy on Aave V3 in which weETH is deposited as collateral, ETH is borrowed and converted into more weETH. In the example below, the position is looped at a 88% loan-to-value ratio and 8.33x leverage. This yields an estimated 15% APY without accounting for Ether.fi loyalty points and RAYS earned by the user.

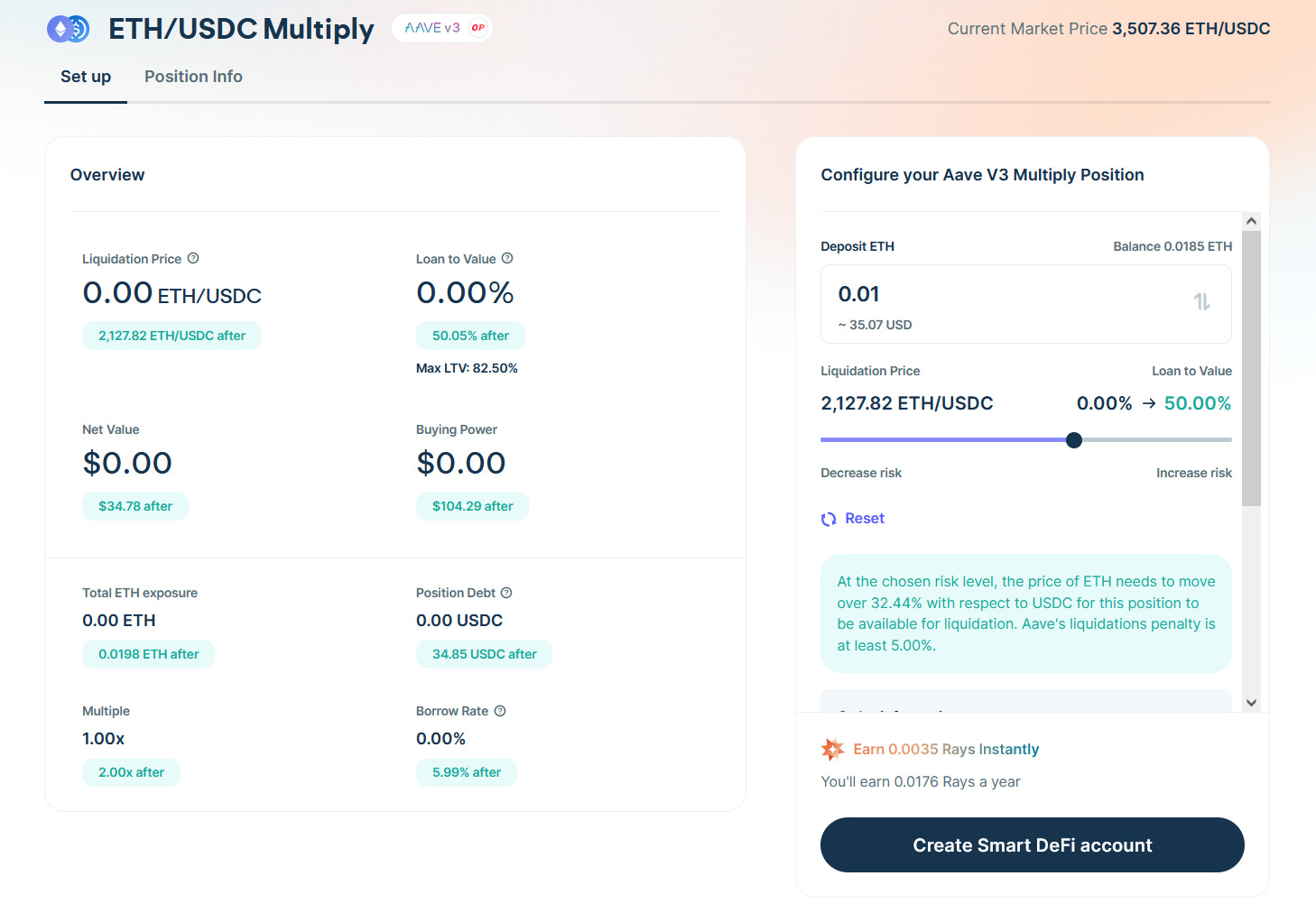

Another strategy involves borrowing USDC against ETH on the Aave V3 Optimism market. If you’re looking for a place to borrow USDC against ETH, Summer.fi can help find the cheapest borrowing rate while also rewarding you additional yield in the form of RAYS (points).

Metrics

Utilizing Summer.fi’s yield loops via the Earn product results in significantly higher yields across a variety of assets like ETH staking wrappers, stablecoins and more. Some examples of this can be seen in the figure below which depicts the base asset APY versus the median and mean loop APYs. woETH from Origin offers 4.15% in base APY whereas looping this on Summer.fi yields an APY of 20.5% currently.

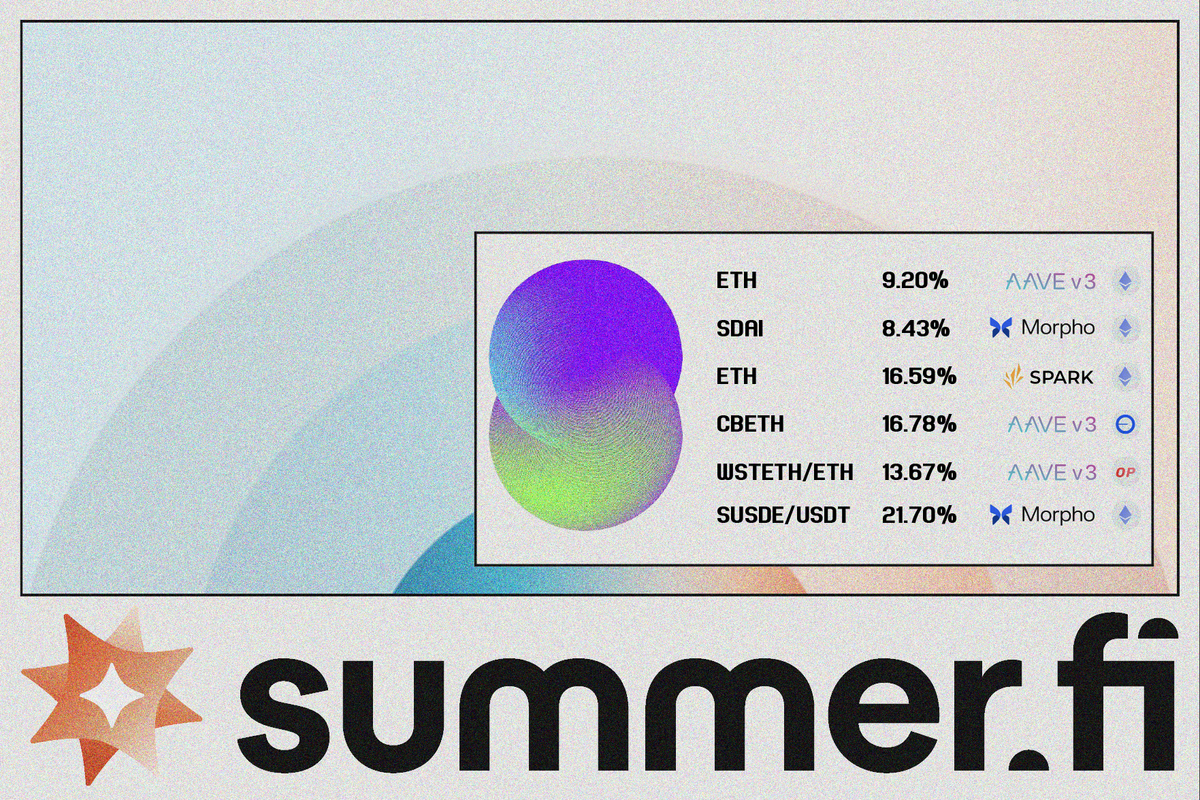

Looking for the strategies with the most available liquidity? The top liquid strategies on Summer.fi include yield loops where ETH is borrowed against either wstETH, rETH, cbETH or weETH as well as others seen in the figure below:

RAYS campaign

💥 Introducing $RAYS: https://t.co/ccpDrJSnsA's points program that rewards you for using DeFi’s Highest Quality Protocol 💥

— Summer.fi ☀ (formerly Oasis.app) (@summerfinance_) June 20, 2024

Borrow, Multiply, and Earn with DeFi's best, and get $RAYS!https://t.co/DBiqOlZwxS pic.twitter.com/nI2ejhEXpS

Summer.fi points campaign launched last week on June 20th. The campaign aims to incentivize users to use Summer.fi in a variety of ways to earn points, or RAYS. See here for the official blog post on the RAYS program.

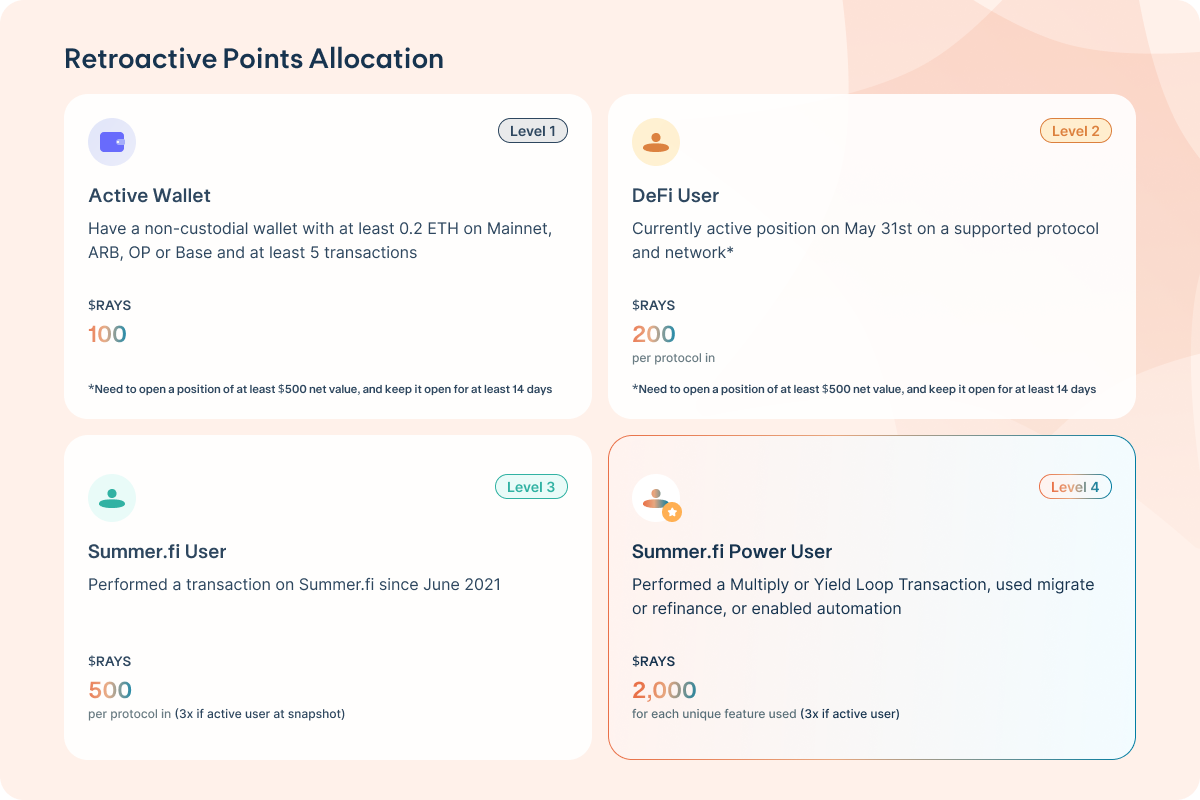

Phase 1 - Retroactive Points Allocation

A snapshot was taken June 17th 2024 to retroactively recognize not only Summer.fi users, but also DeFi users with an active wallet. You can check your eligibility here. Users are classed into four levels as follows:

Level 3 and 4 Summer.fi users are already eligible for RAYS. For Level 1 and 2 users to be eligible for eventual tokens however, users need to open a position of minimally $500 for 14 days between June 20 to August 31.

Phase 2 - Continuous accruing points

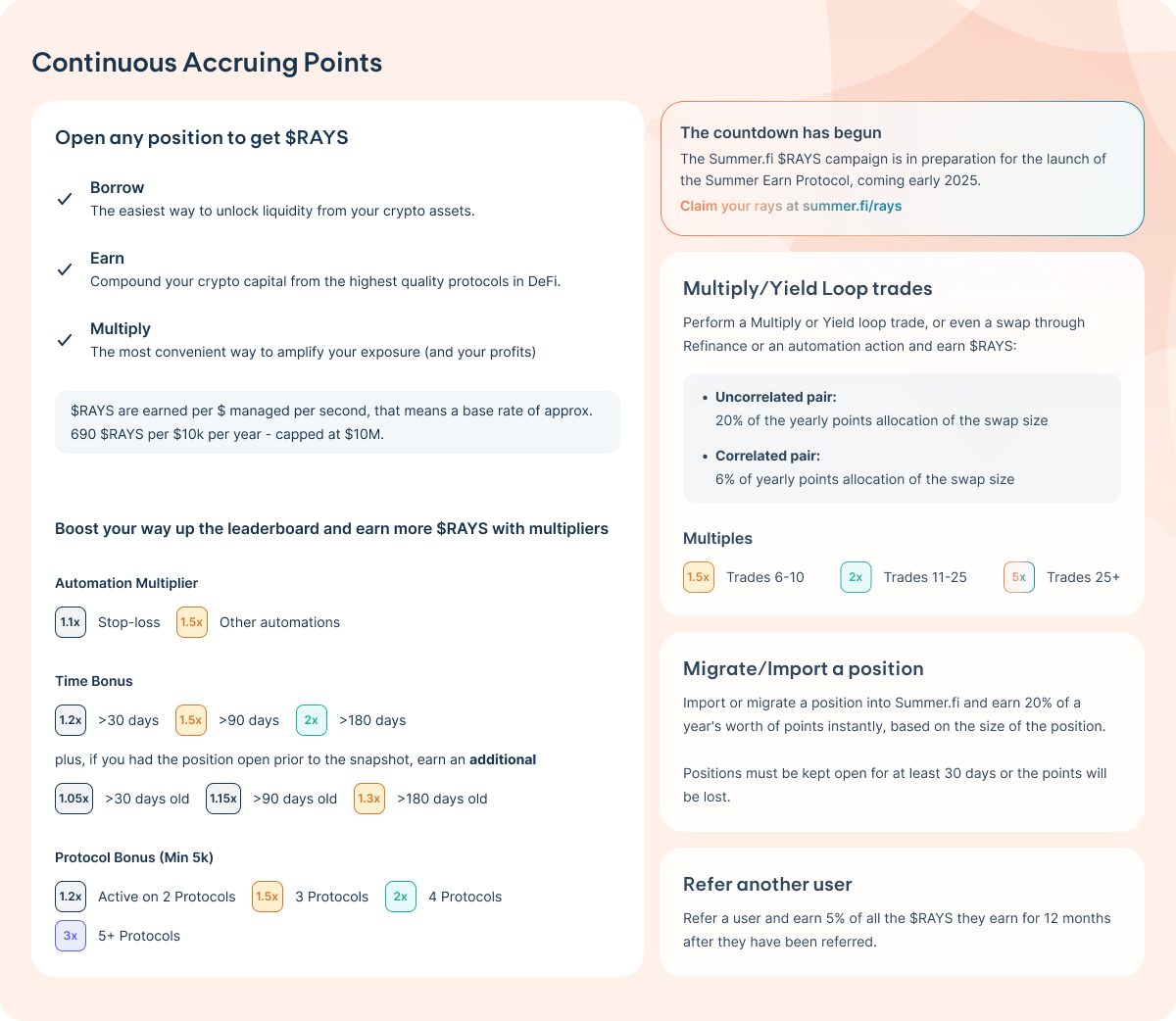

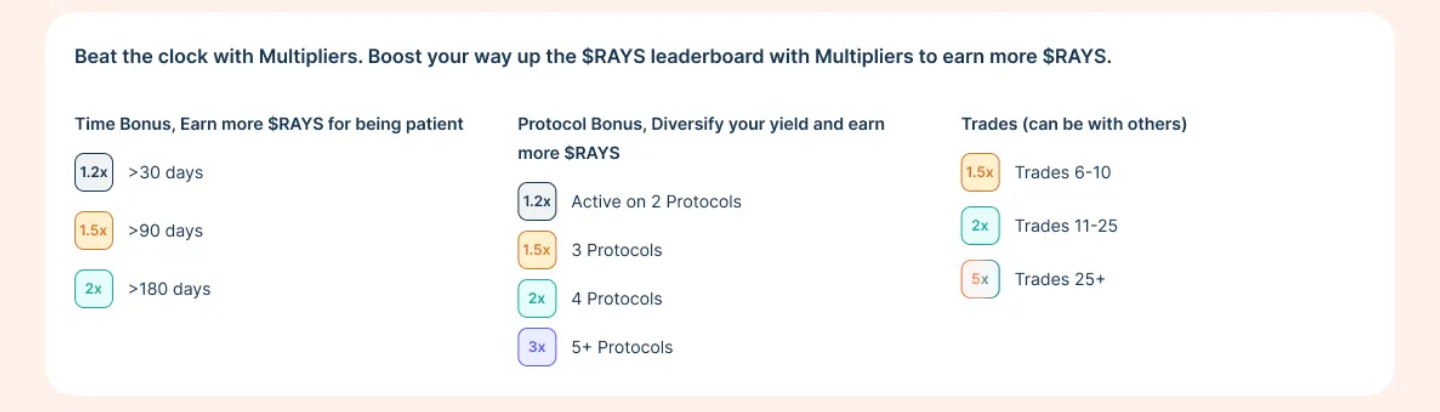

RAYS are earned at per dollar value per second. For example, with $10,000 capital, users accumulate a base rate of ~690 RAYS per annum, capped at 10M.

Existing users can boost their RAYS multiplier by engaging with the dapp’s various products Borrow, Earn or Multiply. The multiplier rate depends on several factors such as:

- The number of protocols users engage with

- The number and size of trades being executed

- The duration of the position

- The use of automation features like stop-losses, auto buy/sell

- Migrating in positions from other support interfaces, such as Aave, Morpho, Spark etc

- And user referrals.

RAYS are being awarded to over 2M user addresses as of the snapshot. A total of 25% of the community token allocation (8.75% of total supply) will be awarded for these retroactive users.

It all finally culminates in Phase 3, where the campaign will conclude with the launch of the Summer Earn Protocol, coming early 2025. There are several ways to boost your RAYS earnings such as depositing over a longer period, interacting with several protocols and conducting multiple trades.

The Summer.fi community has built a calculator that lets you see how many RAYS are earned yearly depending on the amount of liquidity deposited and whether this is migrated from the native protocol to Summer.fi.

If you hold a position on @aave or @sparkdotfi, you can easily move it to https://t.co/ccpDrJSnsA and earn more $RAYS 💥

— Summer.fi ☀ (formerly Oasis.app) (@summerfinance_) June 25, 2024

Some of the benefits include:

✅ Simplified Your Risk Management

✅ Boost $RAYS

✅ Effortless Position Closing

✅ Automation features

An example:

A… pic.twitter.com/xsNtQaTILS

Whale Watching

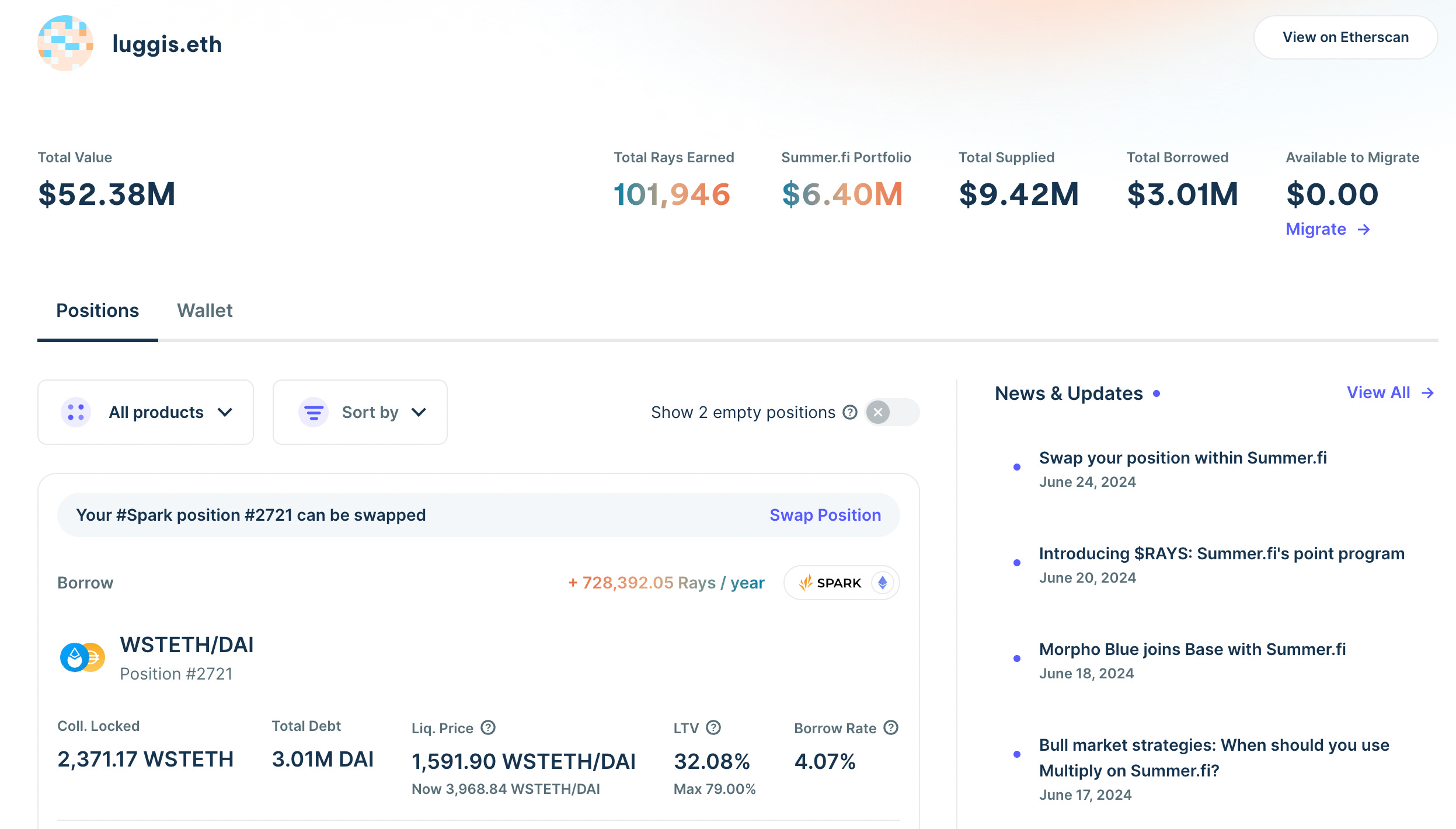

Summer.fi has also launched a learderboard containing the wallets with the most RAYS earned to date. The specific strategies of these wallets can also be viewed by anyone which can give some good insight into what whales are doing on Summer.fi.

The top Summer.fi user “luggis.eth” is in a “Borrow” position currently borrowing 3M DAI at a ~32% LTV against 2371 wstETH from a Spark vault. This strategy was migrated to Summer.fi as there is minimal costs to this and the position is now earning 728k RAYS annually while having accrued 100.5K already. To protect against liquidation in the event that ETH’s price dumps, the user has an automated stop-loss turned on.

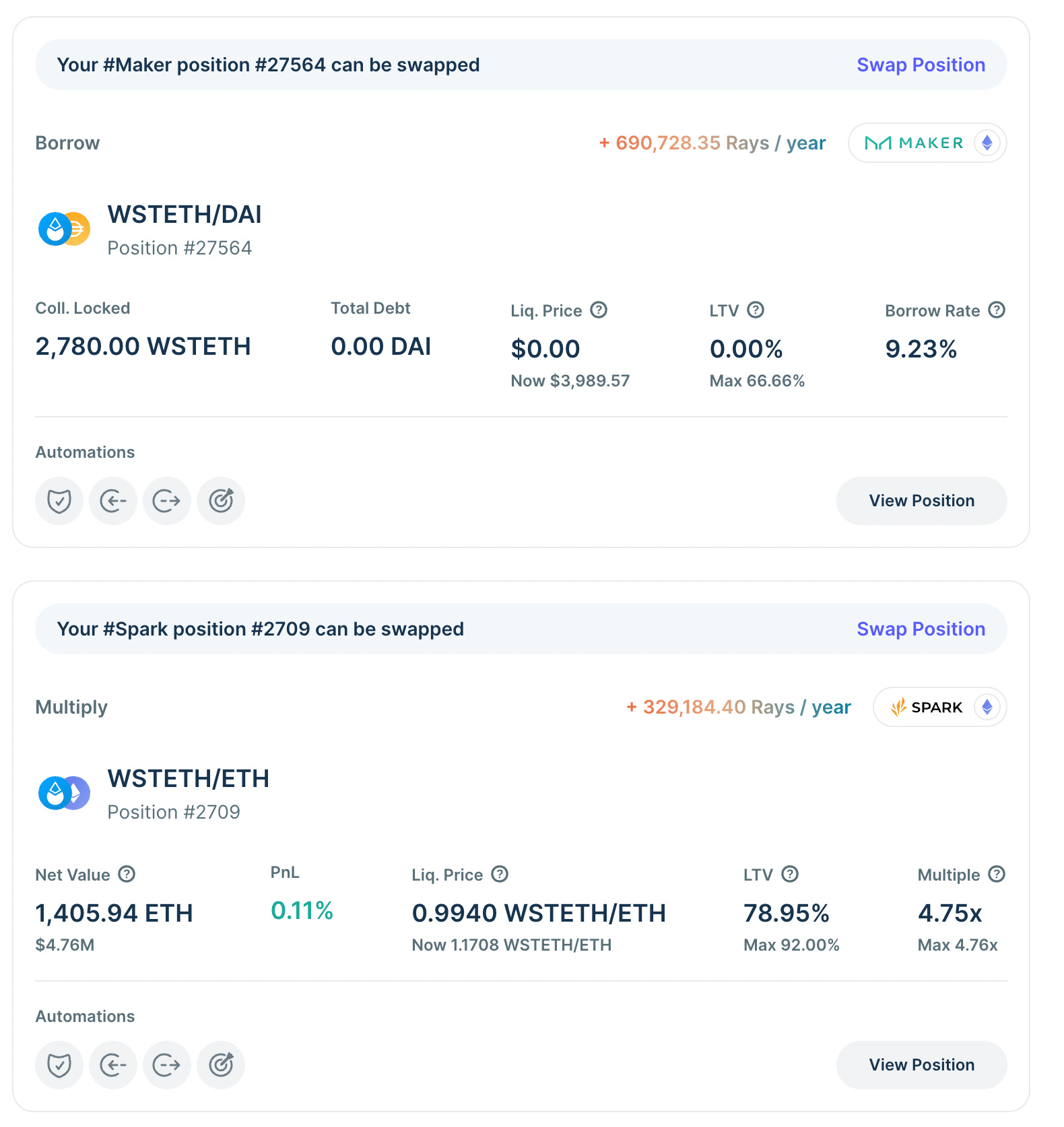

The third largest user has two major positions stacking 690K RAYS and 332K RAYS per annum respectively. The first position is a “Borrow” position locking 2780 wstETH in a Maker vault but not borrowing any DAI at present. The second position is a yield-looping “Multiply” position of 1406 ETH net value. This trade is depositing ETH on Spark to make DAI flashloans, then swapping to wstETH, and repeating the loop — currently generating 5.15% APY.

How to get started - Earning RAYS for your market outlook

If you are already using applications like Aave, Maker, Spark, Ajna or Morpho, migrating to Summer.fi is simple and beneficial due to the simplified overview of positions and increased yield from RAYS. If you have limited experience using these OG DeFi apps, Summer.fi helps find the suitable strategy for your needs:

- Looking for yield on stablecoins? The sDAI/FRAX yield loop utilizing Aave or the sDAI/USDC yield loop utilizing Maker both offers ~12% APY.

- Bearish outlook on the market? Borrow ETH or wBTC and sell it (shorting) against collateral such as USDC and DAI. Borrowing on Aave or Spark costs only 0.5-2% annualized at the moment.

- Bullish outlook on the market? Borrow stablecoins against e.g stETH and convert to more stETH for a leveraged long position.

- Farming airdrops/staking yield? Borrow ETH against weETH from Ether.fi to farm Ether.fi loyalty points and staking/restaking yield.

All of these strategies accrue RAYS on top which increases the overall yield earned on these positions.

All in all, if you’re an active DeFi trader, using Summer.fi greatly reduces the complexity of position and risk management. Additionally, Summer.fi grants access to increased yield via the newly launched RAYS campaign. Additional information can be found on their website.

To learn more about the campaign, check out the team's recent video interview covering the topic.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.