USDe, The Next $1b+ Stablecoin? An Interview w/ Ethena

USDe is powered by the Ethena Protocol and labeled as the 'internet bond'. Here's how it's solving the stablecoin trilemma.

UPDATE (19/2/2024): Ethena just went live on mainnet today and launched with an airdrop program - read more about it at the bottom of the article.

On-chain stablecoins have historically had a tough time competing with their centralized counterparts. As a result, USDC and USDT dominate the stablecoin sector with a cumulative market share of over 95%. The issues with on-chain stablecoins arise from them either being difficult to scale due to their over-collateralized nature or otherwise having trouble maintaining their peg if they’re under-collateralized.

In March 2023, Arthur Hayes wrote an article named ‘Dust on Crust‘ in which he talks about the rise of stablecoins and the purpose of these amongst traders and market makers. He then presents the idea of an on-chain fully decentralized stablecoin called “The Satoshi Nakamoto Dollar“ backed by equal amounts of spot long and futures short BTC exposure creating a delta neutral one-to-one backed synthetic dollar.

This idea has since been materialized by Ethena Labs who is building USDe, a synthetic dollar powered by the ETH staking yield and perpetual swaps. In short, USDe is collateralized one-to-one by ETH LSTs like stETH from Lido while this exposure is hedged on perpetual futures by shorting the equivalent amount of ETH. As this generates a high yield, currently over 20%, USDe is being labeled as ‘the internet bond‘.

Ethena is backed by Dragonfly, Wintermute, OKX Ventures and investors like Cobie, Arthur Hayes and Anthony Sassano. I had the pleasure of talking with Guy, the founder of Ethena, to hear more about the underlying design and upcoming roadmap including the mainnet launch, DeFi integrations and the upcoming airdrop program.

Thanks for reading DeFi Frameworks! Subscribe to receive a free research report twice/week 🗞

A Breakdown of USDe & Ethena

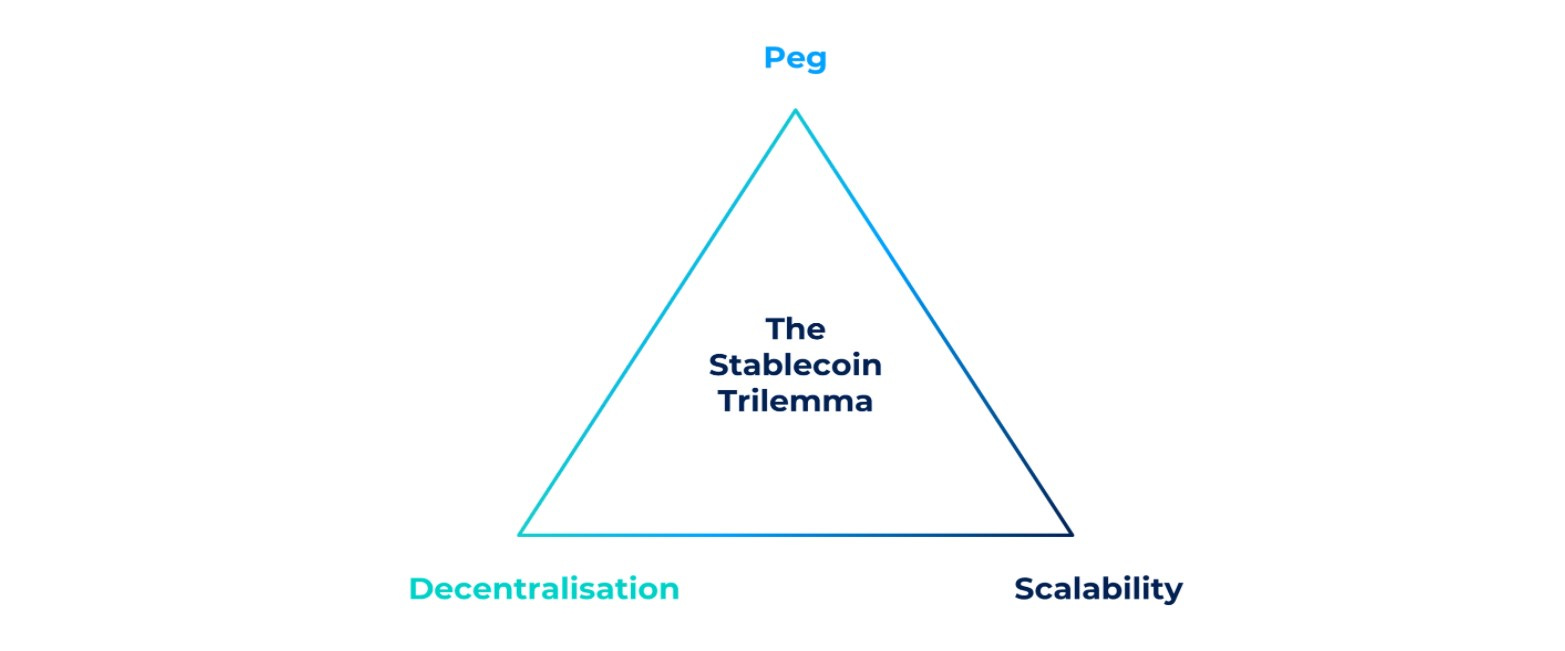

The ‘stablecoin trilemma’ was introduced several years ago and states that a stablecoin can’t have all three of the following properties:

- Maintain a peg to the underlying asset

- Be scalable

- Be decentralized

- Stablecoins like USDC and USDT are both scalable and can maintain their peg to the dollar but they are not decentralized.

- LUSD from Liquity on the other hand is highly decentralized and maintains its peg to the USD well but has trouble scaling as it is highly over-collateralized.

- UST from Terra was both decentralized (to a degree) and very scalable but unable to maintain its peg.

USDe from Ethena aims to contain all three properties hence solving the stablecoin trilemma. USDe is currently only live for private access but has despite this grown to a supply of over $115 million in just over a month. Here’s how it works:

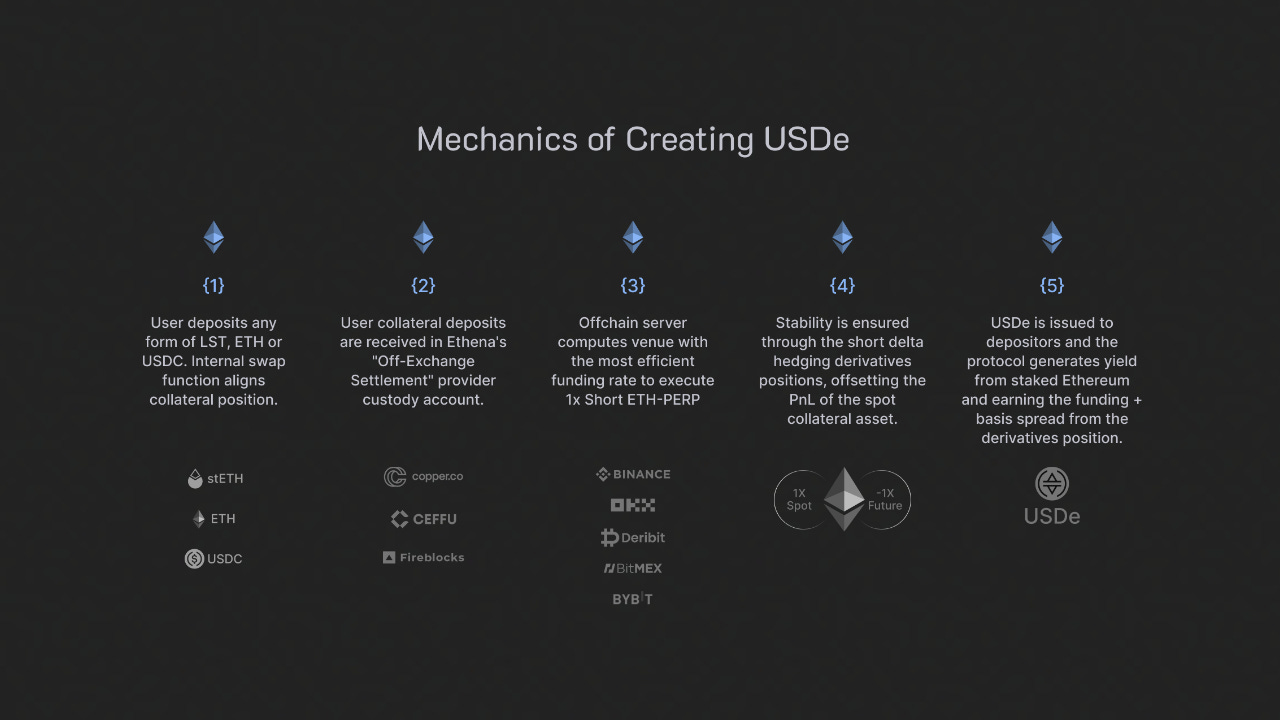

There are two ways for users to get access to USDe. First, by buying it on decentralized exchanges like Uniswap or Curve. Second, by minting it on the Ethena protocol. With the public launch, user will be able to mint USDe with a variety of assets through the Ethena front-end which are then converted to ETH LSTs like stETH, mETH and wbETH on the backend. This is then deposited as collateral within an institutional custodian and used to create ETH short positions across centralized exchanges. This hedge creates a dollar position which USDe is issued against.

There is no leverage applied on the short side of the collateral as the focus of USDe is to be a safe base layer:

“The philosophy around the product is to try and make it as secure and safe at the base layer as possible. There are interesting things that you can start to do with leverage to try and juice up the returns in some ways, but we really just want to create a solid base which other people can go and build upon and start to use leverage in other interesting ways, whether that's in money markets or on perp dexs.”

USDe maintains its peg through arbitrage. If USDe is trading below peg on an exchange like Curve, Uniswap or Binance, arbitragers can buy USDe and redeem it for $1 on the Ethena frontend for a profit. If USDe is trading above peg on an exchange, arbitragers can in a similar fashion mint USDe on Ethena and sell it on the exchange. As long as USDe is collateralized 1:1, the peg will remain stable.

Growing USDe Liquidity

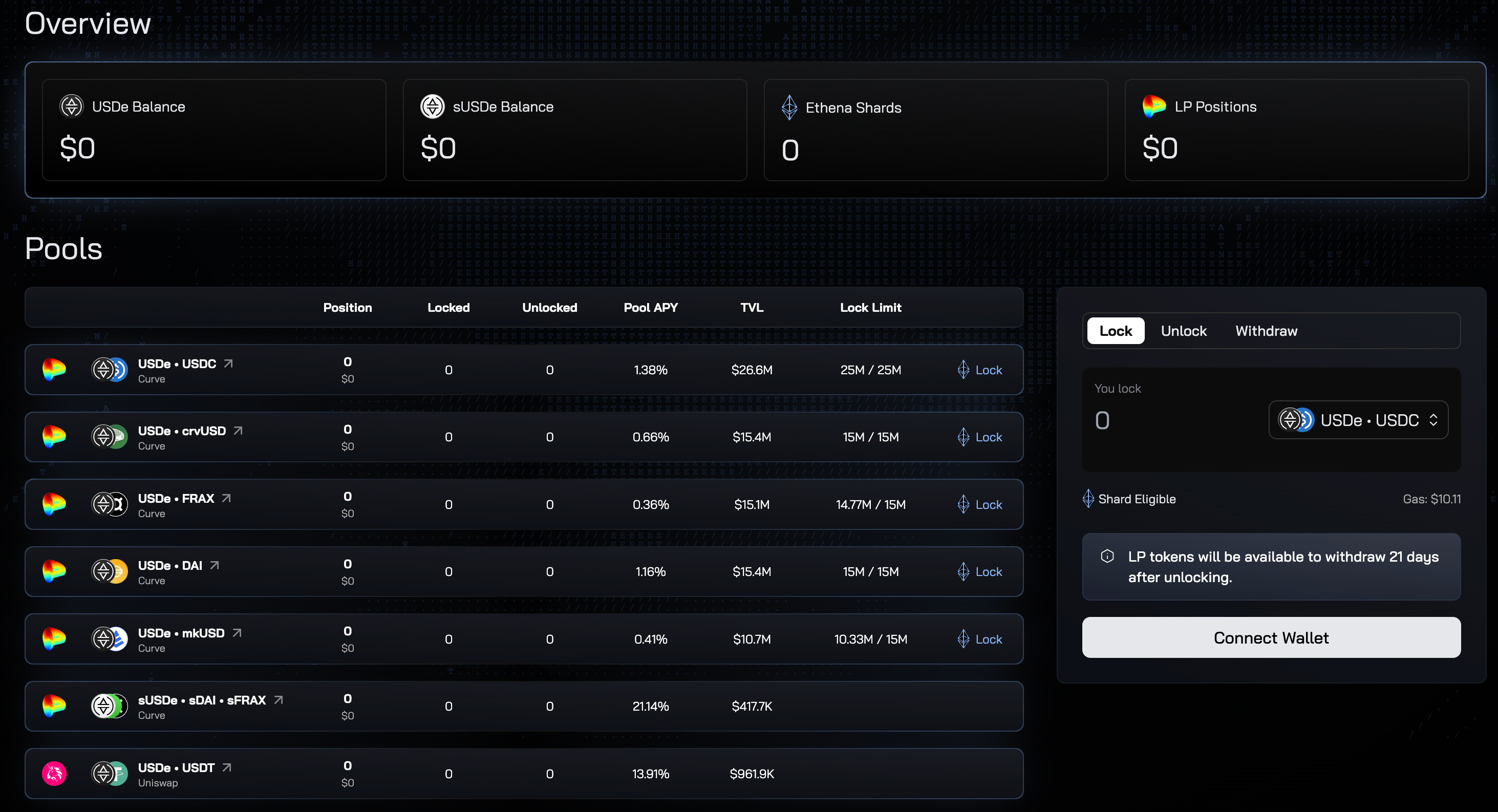

In order for stablecoins to keep their peg to the underlying asset, liquidity is incredibly important. Ethena aims to grow USDe liquidity across various decentralized exchanges like Curve Finance which is the dominant on-chain exchange for stable assets. At the public launch later in January, Ethena will be doing an incentivized push to ensure deep liquidity for USDe on Curve. As of writing, there are a few USDe liquidity pools live on Curve including USDe/USDC, USDe/crvUSD and USDe/FRAX.

The Yield Flywheel

As quickly outlined earlier, both the long and short side of the USDe collateral generates a yield which is distributed to users who chose to stake USDe. The yield comes from:

- Spot long: Ethereum staking yield (consensus and execution layer rewards).

- Futures short: Funding fees and basis spread earned from the derivatives positions.

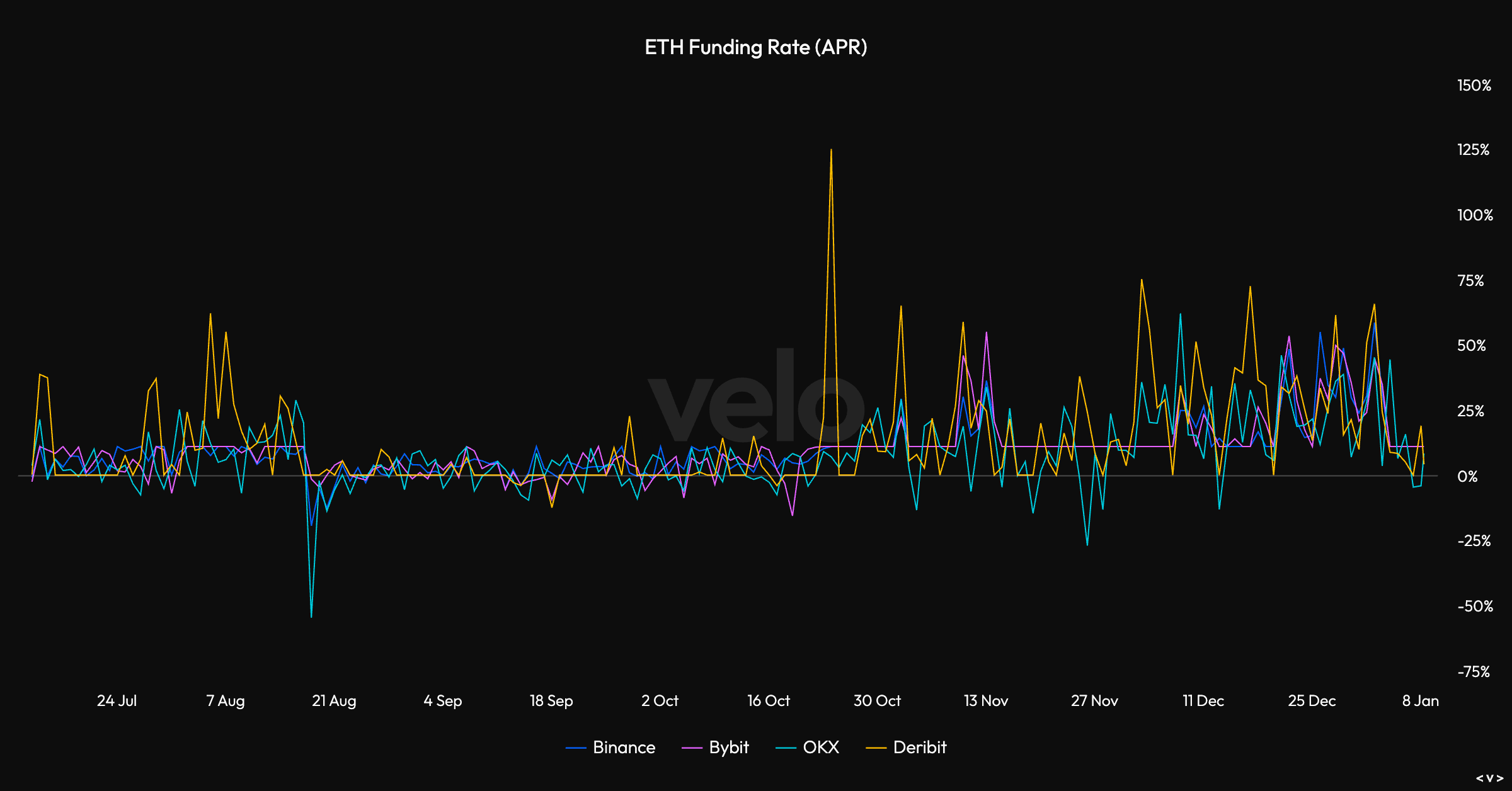

The ETH staking yield usually fluctuates between 3-5% annually, whereas the funding rate on ETH derivatives fluctuate more drastically and depends highly on the market demand for futures trading. As seen below, the ETH futures funding rate spiked to over 70% recently as the market rallied and traders looking to long ETH are willing to pay high fees for this position. This borrowing fees (funding) is paid to short positions by long positions.

In a bullish environment with high funding, the yield generated on USDe collateral can very well exceed 30-40%. Historically, and on a longer time frame, this has proven to be closer to 5-15% APY however.

Dual Token Design

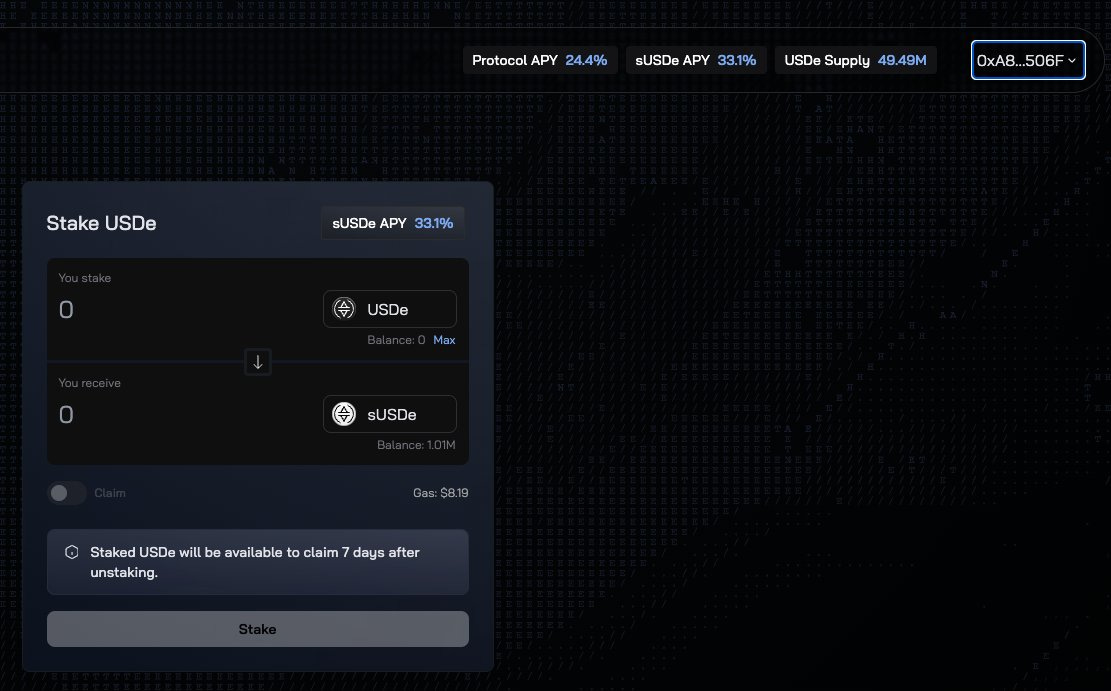

As explained earlier, users are only receiving the yield generated on USDe if they stake the stablecoin as sUSDe. If the yield on USDe collateral is 15% but only half of USDe is staked, sUSDe stakers receive (15%/50%) = 30% APY.

As USDe liquidity will be incentivized across DEXs like Curve and further integrated into various money markets and other DeFi applications, it’s to be expected that not all USDe will be earning the protocol yield. This is portrayed in the image below in which the total yield on collateral is ‘Protocol APY‘ and the sUSDe yield is ‘sUSDe APY‘.

Ethena will in addition have a unique focus on integrating USDe onto centralized exchange orderbooks as a way to differentiate the product from other on-chain stablecoins and to create broader adoption.

DeFi Integrations & Path to Decentralization

“We want to separate the most important instrument in crypto, which is the stablecoin, from the banking system. The point of everything we're trying to do is to create a self sufficient system, and yet the most important asset is completely centralized”.

The core thesis of Ethena is simple; to separate the largest product in crypto (stablecoins) from the traditional banking system. With USDe, there is no collateral exposure to centralized assets such USDC or U.S treasury bills. The only exposure is ETH which is one of the most decentralized and permissionless assets in the world.

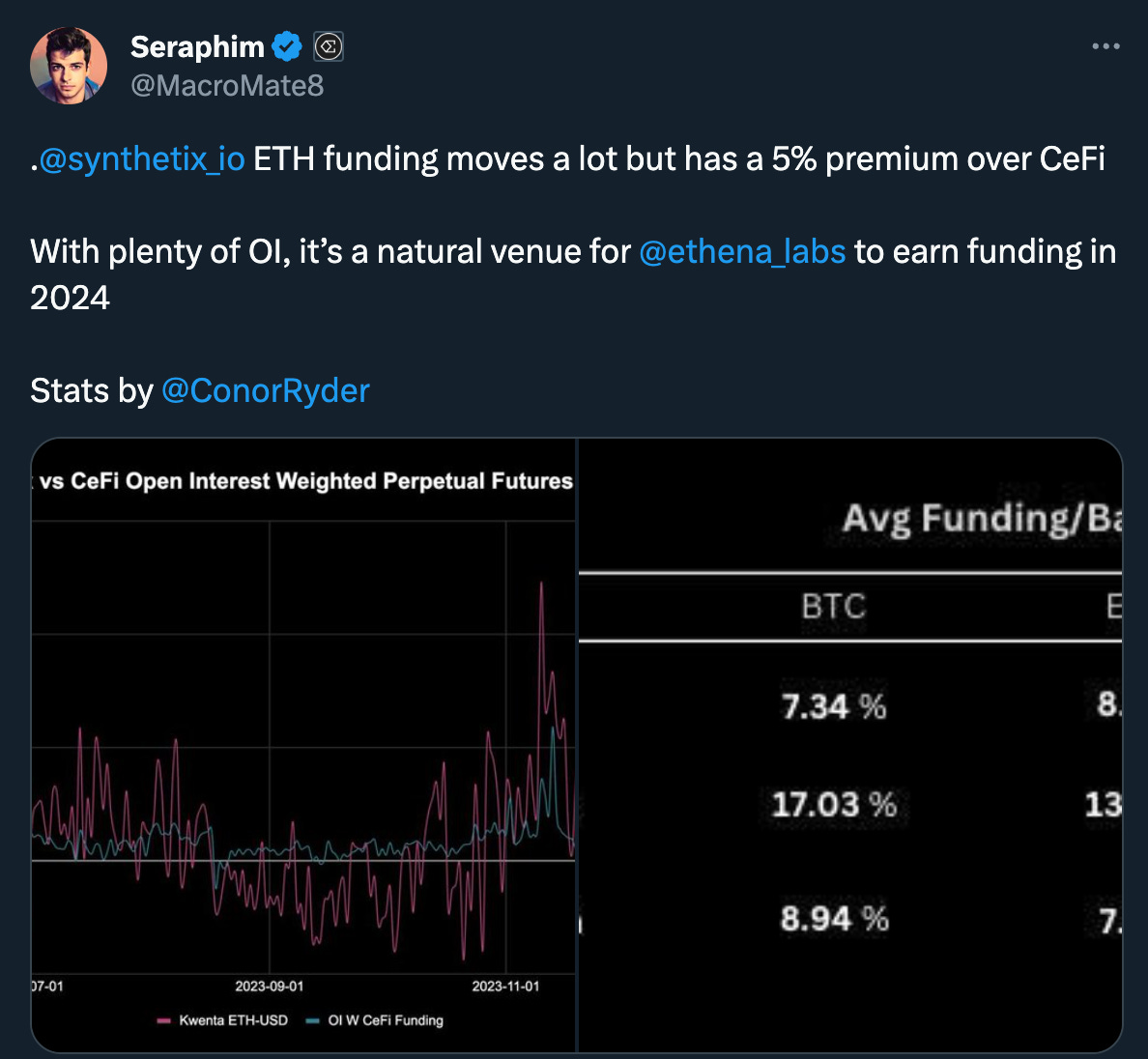

But Ethena still has points of centralization today. One of these is hedging the staked ETH exposure on centralized exchanges. The reason for this is that the majority of liquidity still resides there. Ethena is working towards full decentralization but still waiting for DEX derivatives to mature. The first step seems to be to utilize Synthetix, and a Synthetix front-end, as the first DEX for this hedging which is a part of the larger roadmap later this year.

Some verticals in which USDe/sUSDe integrations make a lot of sense:

- USDe can be adopted as collateral for other stablecoins. FRAX and DAI are both heavily reliant on yield from traditional assets and they might want to diversify their exposure and capture crypto native yield from sUSDe.

- Money markets such as lending platforms like Aave. Leveraged looping strategies can be enabled with potentially very high yields for sUSDe holders adding leverage.

- sUSDe as a high yield bearing collateral for leverage trading on CEXs and DEXs

2024 Roadmap

In the short term, Ethena is gearing up for its public launch with the ability to mint and redeem USDe on the protocol as well as stake USDe for sUSDe to receive the yield generated by the collateral. In addition, Ethena will be incentivizing liquidity on various DEXs to ensure that users can swap in and out of the stablecoin with minimal slippage. The estimated timeline for this is late January where an airdrop program potentially will be announced as well for the upcoming governance token.

Mid to longterm, Ethena plans to integrate USDe into a large variety of DeFi protocols and centralized exchanges in order to grow the supply and create strong utility. Ethena also plans to decentralize the stablecoin further by moving the short positions from centralized exchanges to DEXs.

In addition to this, Ethena will also be exploring other assets as collateral to USDe such as BTC and jitoSOL. These will also be delta hedged and the integration ultimately depends on whether there is deep liquidity for these assets and whether the funding fees are favorable from a yield perspective.

Conclusion

All in all, I am very excited for the full launch of Ethena. given the current yields generated from staking and funding rewards, it seems likely that USDe grows to become one of the largest on-chain stablecoins in crypto. I am personally looking forward to first and foremost seeing USDe and sUSDe flywheels being created through a variety of DeFi integrations and second, Ethena moving to a more decentralized model. With the growth potential of USDe, we can cross our fingers that the Ethena smart contracts have been extensively audited and that there will be no collapse of CEXes which Ethena utilizes for hedging. There are obvious risks like any other DeFi protocol but there is a lot of potential for Ethena and USDe this year.

Thanks for reading DeFi Frameworks! Subscribe to receive a free research report twice/week 🗞

(Update: Airdrop Campaign - Earning Shards)

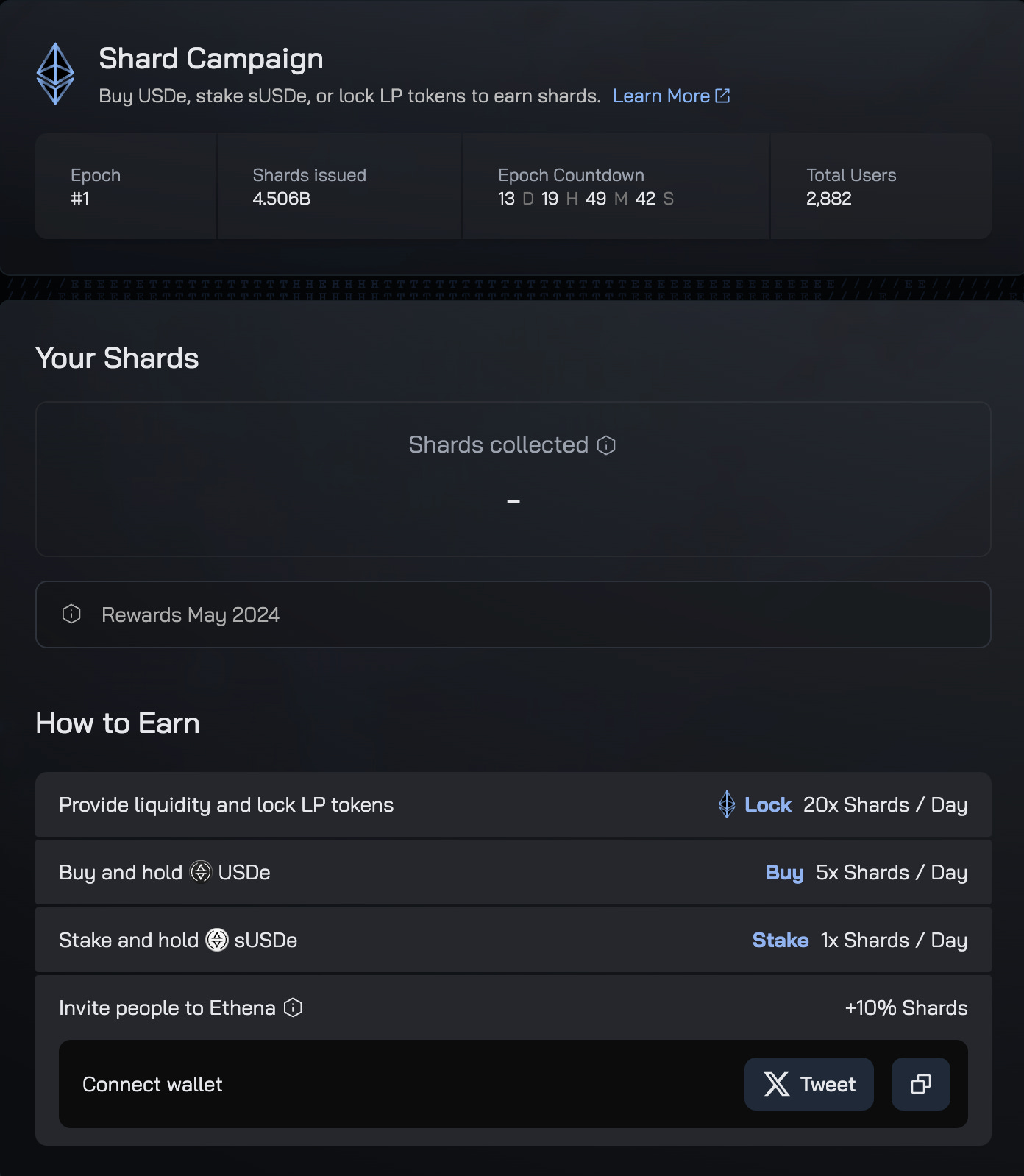

When I first wrote this article, the airdrop program was not described in detail. With the launch of mainnet, we now have all the information available so let’s quickly break down how this works:

You can earn shards (similar to points) by holding USDe, sUSDe or providing liquidity on Curve - Shards are only live for 3 months or until USDe hits a 1b supply!

- For every 1 USDe held, 5 shards are earned per day

- For every 1 sUSDe held, 1 shard is earned per day

- For every $1 LP’ed into the curve pools shown below and locked on Ethena, 20 shards are earned per day - as seen from the picture these are filled at the moment but perhaps they will increase the limits in the future

Earn additional shards by signing up to Ethena via this link here.

Nothing stated should be construed as financial advice!