TON: The Most Credible “Mass Adoption” Chain Yet

A look at the TON "The Open Network" blockchain

Introduction

The Web3 pie is small. It’s why the most bullish investment theses for crypto projects tend to center around the potentials of “mass adoption”. This was true for when Polygon launched partnerships with Big Tech, when CoinBase with its 110M+ KYC users launched its L2, when real-world-asset protocols onboarded TradFi giants, and more.

As far as “mass adoption” goes, TON (The Open Network) represents the most credible opportunity yet for onboarding non-crypto-native users. This hypothesis hinges around one crucial statistic: Telegram has 900 million monthly active users (MAU). TON’s tight technological integration with the mainstream messenger app brings an easy-to-use UX to users in terms of a one-click-deploy wallet, “text message” on-chain transfers and Telegram bots for just about any DeFi or GameFi dapp – all without users having to install anything more than Telegram.

Want access to more free research reports? Subscribe below and join 10,600+ weekly readers 🗂

TON was originally a blockchain with the planned GRAM token. Developed by Telegram founders Pavel and Nikolai Durov, the project raised an eye-popping 1.7B in a 2018 ICO, but was forced to shut down in May 2020 after an SEC lawsuit. Subsequently, TON relaunched in August 2021 officially under the TON Foundation with the TON native token (hereafter referred to as Toncoin), and remains closely affiliated with Telegram.

After development for two years, TON is shaping up to be one of the leading alt-L1s of this cycle. The chain has a secure legal path ahead and has punched up aggressively on the business development front as seen by its recent partnership with Tether to integrate USDT on-chain.

This article gives a brief runthrough of what TON is, network usage, tokenomics and major catalysts to forming an investment thesis around Toncoin.

TON tech

TON is a PoS L1 running on an “infinite sharded multichain” architecture. Think of it as a “blockchain of blockchains”. TON’s underlying architecture consists of a Masterchain where network consensus is enforced by validators. Within the Masterchain hosts up to 2^32 Workchains, separate parallelized appchains with its own rules, consensus mechanisms and tokenomics. Workchains can then be dynamically sharded into further subchains called “Shardchains”, of which that can be 2^60. As of today, only one workchain is in operation.

Thanks to its horizontal sharding architecture, TON is highly scalable. It claims to be the fastest L1 today at a TPS of 104,715. Ton runs on its own VM, the TON Virtual Machine (TVM), and uses the FunC and Tact programming languages.

TON network activity

The PoS TON chain is validated by 340 validators today across 29 countries with ~10% of its circulating supply (513M Toncoin) staked.

After a long period of stagnation, TON’s TVL saw an explosive growth in late February 2024 to its current levels of ~157M. This was largely due to the confluence of two factors: 1) a Feb 28 announcement to launch a 50% revenue-share program for Telegram channels, of which payments and withdrawals will be exclusively transacted on TON in Toncoin and 2) the commencement of 30M Toncoin incentives.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

This burst in TVL is also correlated with network activity. In terms of daily active users, TON is hitting ~160K users (~1.8M monthly active users), inching into the range of most used L1s alongside Aptos, Avalanche and Cardano.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

On the daily transaction count front, TON fares better at ~3.2M daily transactions, putting it within range of other cheap alt-L1 chains such as BNB Chain and Polygon.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Another noteworthy metric to track on TON is USDT liquidity. Currently, over ~114M USDT has been issued on TON, almost a 100% increase in the last week. This injection of stablecoin liquidity given its recent partnership with Tether and its accompanying 50% USDT Earn incentive program, and will continue to trend up over the next couple months.

TON dapps are listed in the “Telegram App Center”, an App Store of sorts. Hundreds of dapps already exist, but here are a few noteworthy ones:

Tonstakers: Toncoin liquid staking with ~208M TVL and 3.6% APY. Toncoin has one of the highest liquid staking rates versus MATIC, AVAX, SOL

STON.fi and DeDust: TON’s run-of-the-mill AMM DEXs

Storm Trade: Perps DEX with ~9M TVL for pre-launch tokens and TradFi assets (soon)

EVAA Protocol: Lending platform with 5.1M TVL

Games: Notcoin is a notable mindless clicker game where users receive tokens but saw a staggering 3.5M DAUs. Tap Fantasy is another MMORPG that saw 600K players in Jan 2024.

Getgems: Leading NFT marketplace

Fragment: A marketplace to trade tokenized Telegram usernames

Toncoin tokenomics

Like ETH and SOL, Toncoin does not have a capped token supply. The current total supply of Toncoin is 5.1B with a 0.6% linear inflation rate, which is great. Unfortunately though, there is no information around Toncoin allocations. Without that, it is hard to tell when and where investor cliffs might be, which represents a major sticking point for Toncoin.

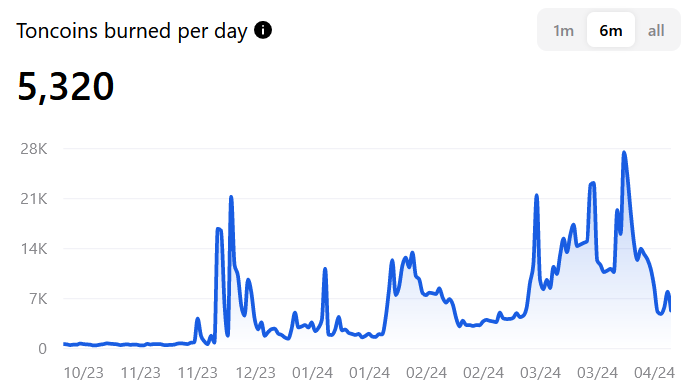

In terms of value accrual, Toncoin receives 50% of network fees from a deflationary token burn of gas fees paid, as of a June 2023 governance proposal. Based on the last 7 days timeframe , the daily burn rate of Toncoin is ~7794 or about 5.41 Toncoin/min.

As of March’s burst of activity, TON is generating 50-200K in daily fees.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

For a quick comparison, TON’s fee generation is still behind that of major chains but already ahead of many Alt-L1 competitors.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Competitor analysis

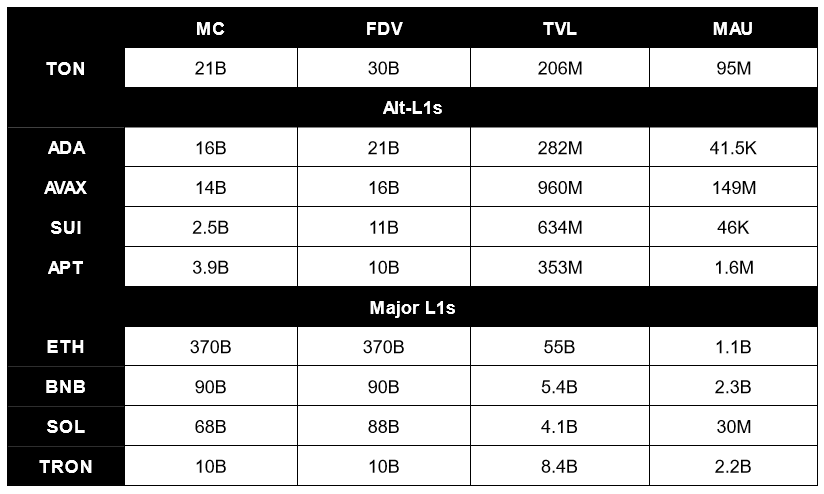

Based on the above numbers, one can conclude one of two things:

- TON is overvalued at present given its MC:TVL ratio against smaller Alt-L1 competitors

- Markets are pricing in TON’s “mass adoption” thesis and thinks TON will rerate to the upside within range of BNB or SOL

It is not a stretch to imagine TON gathering a strong foothold in the developing world where hyperinflation is the norm and Telegram is already in use. According to Statista, Telegram usage by geography is highest in Asia, with India and Russia in first and second place respectively. This is a space where Tron has historically dominated due to its inexpensive chain, and TON will likely eat into this market share.

+ catalysts

A Toncoin investment thesis is not complete without a study of Telegram, so let’s take a quick look at the messenger app.

- TON’s “mass adoption” thesis hinges on Telegram’s user base. Today Telegram boasts a total 1.5B users. Monthly active users sit at 900M (versus Whatsapp’s 2B), up from 500M at the beginning of 2021 and continue to grow. 900M is over 50 times larger than the current total Web3 users of ~15M. If even 10% of Telegram users onboard to TON, that is a non-trivial number of 90M users coming on-chain and growing Web3 userbase by 6x.

- Telegram is in good financial shape. According to Statista, Telegram made 6.1M in Feb 2024 (annualized 73M). In a Financial Times interview, Durov cited Telegram’s revenues in the range of “hundreds of millions of dollars” after introducing ads and premium subscriptions since 2022 and is “hoping to become profitable” by 2024/2025.

- Telegram’s multibillion dollar ad market is generating significant cash flow that will translate to usage on TON with its recently announced program that shares 50% of ad revenue with channel owners.

- Durov hinted in March 2024 at an impending Telegram IPO. Taking a page out of Reddit’s playbook, Telegram is also considering “airdropping” shares to loyal users.

- Telegram has raised zero venture capital but $2B from debt financing in 2021-2022.

Other catalysts for TON:

TON has a superb UX. The usual way of navigating Web3 — installing wallet browser extensions, visiting individual dapp websites and constant transaction signing — are abstracted away. TON dapps are deployed directly in Telegram as per its “open platform” philosophy, creating a smooth UX. In the past year, memecoin trading bots such as Unibot have undergone a strong market-tested fit with tens of millions in dollars in trading volume. Users do not need to install anything more than Telegram. Token/NFT transfers have negligible gas fees, are almost instant and sent like text messages via integrated custodial or non-custodial wallets in Telegram.

Telegram is tokenizing usernames as NFTs on the Fragment auction platform, generating ~$350M in sales in the last 18 months

Another potential revenue stream is the tokenizing of TG stickers and emojis as NFTs

Durov has also hinted at the use of AI-powered chatbots on Telegram for customer service and content moderation, and it’ll be interesting to see how similar “Wayfinder”-like AI solutions will be deployed towards use on TON as well.

CEX activity:

Binance is likely to list Toncoin soon, having already listed Toncoin perps

Bybit announced in March 2024 a 150,000 USDT TON trading competition. Bybit is also an LP in TON, offering liquidity via TON’s wallet “TON Space” with RFQ tech, thereby easing onramping

KuCoin Ventures also has an ongoing partnership with Ton Foundation to provide grants for the ecosystem

As part of its partnership with Tether, 11M Toncoin incentives are going toward providing a massive liquidity boost for the chain. These incentives are directed towards TON’s top DEXs STON.fi and DeDust to boost USDT liquidity, as well as a 50% APY for users simply depositing USDT. Moreover, USDT withdrawals to major exchanges like OKX, Bybit and KuCoin are free until the end of June 2024.

TON Foundation is also allocating 30M in Toncoin incentives for three months as part of its “The Open League” prize pool to boost its nascent on-chain ecosystem.

Huge publicity for Telegram as Pavel Durov gives first interview in seven years with journalist Tucker Carlson and also presence at Token2049 Dubai

Funds activity:

DWF Labs runs two TON validators and invested 10M in TON ecosystem

Animoca is an investor in TON and also running one of its largest validators

Yolo Investment invested 8M into TON

Concluding thoughts

Perhaps TON’s weakest link is its latecomer status to DeFi. Although TON does have its share of DeFi primitives (liquid staking, DEXs, lending, etc), the chain is not seen as a DeFi-centric chain and it is hard to imagine them overtaking existing L1 chains over a longer timeframe. Many of its existing dapps are cobuilt with TON’s “The Open Platform”, not independent devs looking to innovate. TON’s non-EVM-compatibility and the use of its own unique programming languages (FunC, Tact) is another entry barrier for developer innovation.

Yet, TON is poised to shine where market demand is the strongest, that is, fast and cheap global transfer of stablecoins. Perhaps that’s all that is needed.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.