The Upcoming L2 Bullrun🐂 - An Introduction To Proto-Danksharding⚙️

What is Proto-Danksharding and the EIP-4844? And what is the bull case for Ethereum layer 2's this year?

As of writing this post, both ARB and OP are trading at around the $1 mark. I expect that in the next six months, both of these will outperform the broader market. EIP-4844 brings the first part of the Danksharding upgrade to Ethereum: Proto-Danksharding. Today, I aim to break down this scaling solution and explain why this could cause one of the largest narratives in the second half of this year.

The article is divided into a few sections:

- Rollups 101🗺

- Danksharding⚡️

- Proto-Danksharding 🔜

- The Economic Benefit for rollups💰

- The Narrative 🦄

Thanks for reading DeFi Frameworks! Subscribe for free to stay up to date with future research⚡️

Rollups 101🗺

Rollups

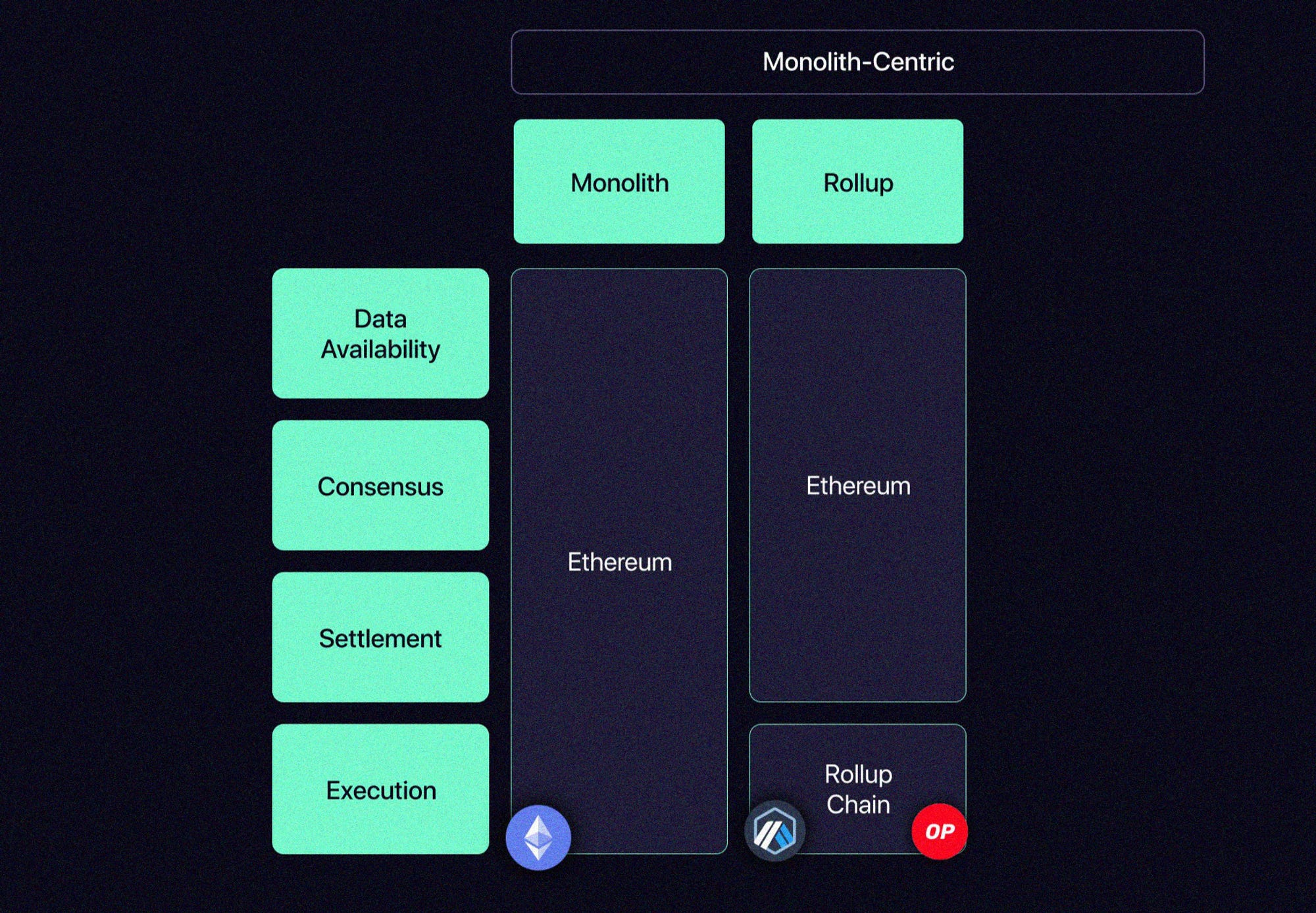

What is a rollup? It’s a difficult question to answer, and there are intense discussions on Twitter concerning whether rollups even are a thing. In simple terms, however, a rollup is a separate chain that extends and inherits the security from the underlying layer-1 blockchain (in this case Ethereum). Rollups operate with a so-called sequencer, which is a designated node responsible for accepting rollup transactions in the mempool and ordering these accordingly. Finally, the sequencer posts the bundles of rollup transactions to Ethereum mainnet to update the state of the rollup. While the general roadmap is to create a decentralized sequencer network, all current solutions operate with one centralized sequencer controlled by the respective teams.

It’s no secret that there are security and scalability bottlenecks with rollups. Some of the most prominent ones include bridge risks and the centralized sequencer mentioned above. Rollups still have a way to go, but the rollup-centric Ethereum vision is shaping up nicely overall.

Both optimistic and zk-rollups act as a so-called execution layer to Ethereum. An execution layer essentially provides an environment for dapps and processes the transactions from these. The rollups then use Ethereum for the remaining layers (settlement, consensus, and data availability).

As of today, one of the largest scaling bottlenecks keeping rollups (L2's) from being cheaper and more efficient is the amount of data that needs to be submitted to the L1 (Ethereum), which, in turn, also puts a large workload on the mainnet nodes. This is also defined as data availability and currently comes with large costs. An estimated 90% of transaction costs on rollups are being used to pay for posting data on Ethereum! EIP-4844, and Danksharding in general, is all about making the data that rollups use less expensive.

Blobs💧

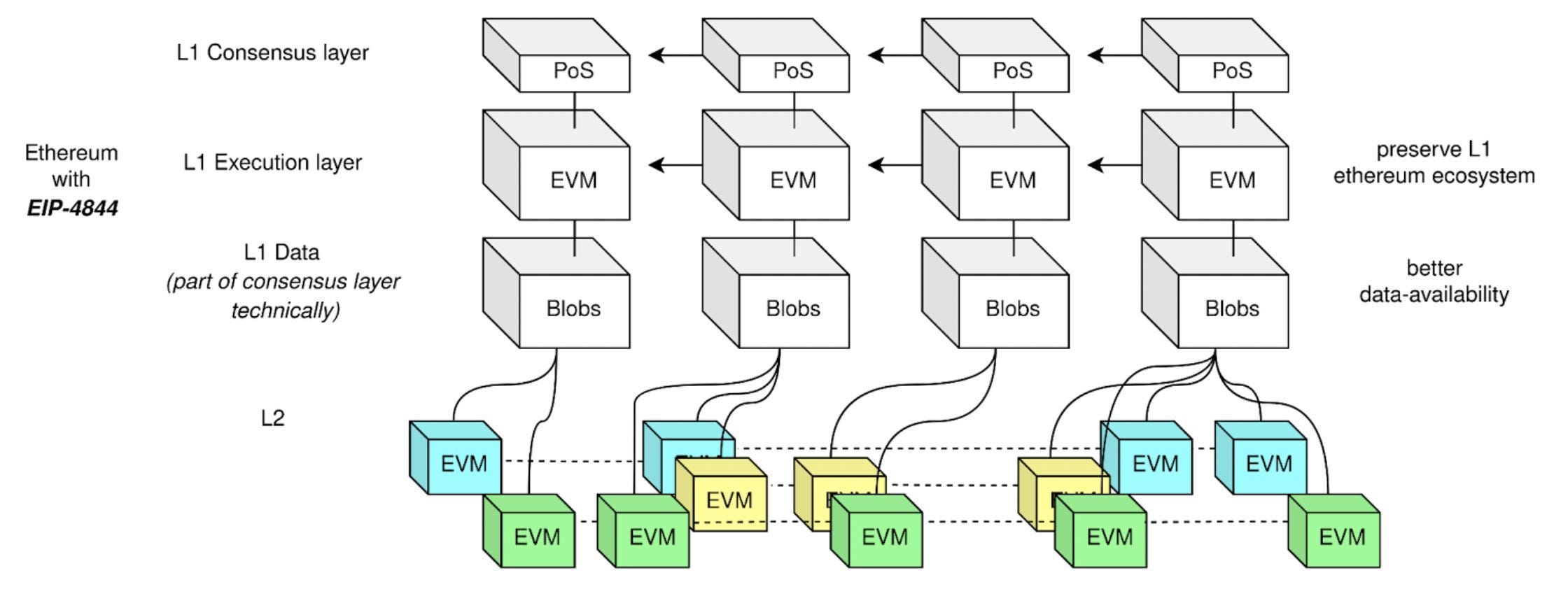

Explained simply, a blob is a specific type of transaction that is significantly larger (~125kB) than regular transactions (~0.2-0.5kb). The idea with Danksharding is for 1) Ethereum to allow these types of blocks, and 2) for the data space in the blobs to be used by layer-2 rollups as they support high-throughput transactions.

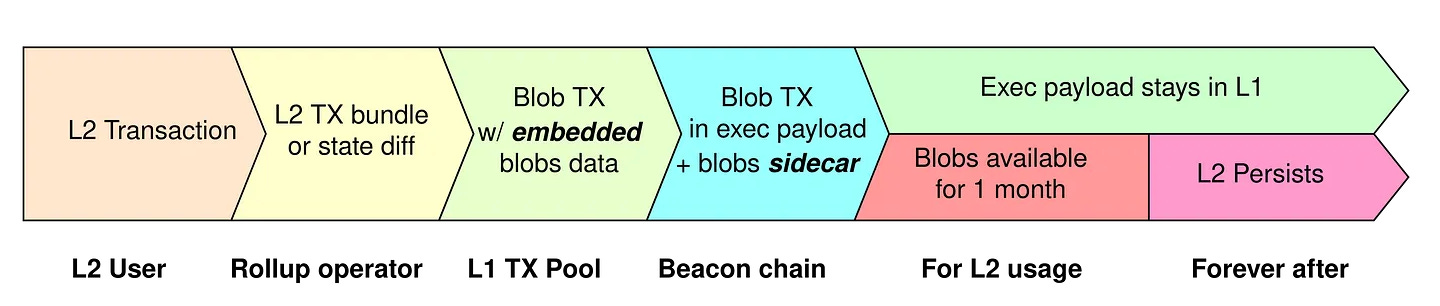

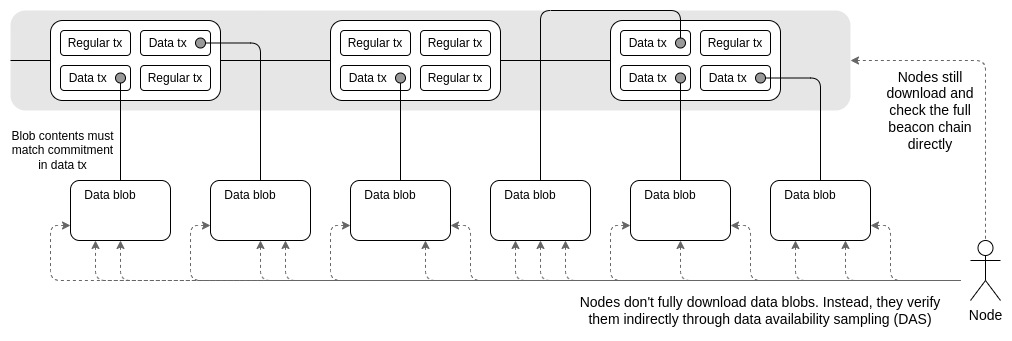

With Proto-Danksharding, rollups submit bundles of transactions in blobs to the Ethereum mainnet. Mainnet validators are not interpreting the data in the blob but simply verify that it is available and can be downloaded (more on this later). Because of this, blobs are not competing with the gas usage of regular transactions on Ethereum (i.e., won't spike gas fees on the mainnet).

The purpose of blobs is to add a 'data-layer' to Ethereum without breaking composability. A blob will be available for just enough time (1 month) to ensure that the rollup-sequencer can challenge the state of the L2. The 'life of a blob' can be viewed in the image below.

Note that a lot of technical specifications are left out for simplicity’s sake, but this has provided a brief overview.

Danksharding⚡️

Before diving into the upcoming upgrade (EIP-4844, aka Proto-Danksharding), it’s important to understand the full vision of Danksharding. Danksharding is the newest proposed sharding design for Ethereum and is a major upgrade that will be released in multiple stages over the coming years. It's different from previous sharding implementations as it's designed from a rollup-centric perspective. Rather than providing more space for transactions, Danksharding provides more space for blobs of transactions (meant for rollups). To avoid Ethereum mainnet nodes from having to download these large blobs containing a lot of transactions, 'data availability sampling' is introduced.

Data availability sampling (DAS)

With data availability sampling, nodes on Ethereum don't have to fully download these blobs containing rollup transactions. Instead, they take samples from the blob to become confident that the data is available. The more samples that the node takes from the blob, the more confident it becomes that the data is available (which is important from a security perspective). The thread below by Nick White, COO of Celestia Labs, provides a great overview of DAS.

https://twitter.com/nickwh8te/status/1559977957195751424

Other features

Other features with full Danksharding include:

- Merged fee-market: A single block-proposer chooses which transactions go into a slot

- Proposer/builder separation: Proposing and building blocks will become two separate roles - reduces MEV and increases decentralization.

Proto-Danksharding 🔜

Proto-Danksharding (EIP-4844) is scheduled for Q3/Q4 this year with the Cancun hardfork. It implements several features presented in full Danksharding, such as data-blobs for rollup transactions. This, in turn, is estimated to reduce rollup costs by up to 20x! However, Proto-Danksharding will not implement sharding or data availability sampling (DAS) for mainnet nodes. Therefore, as these nodes will still have to validate the availability of the full data, only fees on rollups will be reduced, not on Ethereum mainnet itself. With Proto-Danksharding, nodes will have to download full blob contents. The targeted Ethereum block capacity is 1-2MB of space, compared to 16MB with full Danksharding (where DAS will be possible). For reference, the current Ethereum block capacity is 50-100kB.

All in all:

- Proto-Danksharding (EIP-4844) will decrease rollup-fees significantly.

- Full Danksharding is going to not only decrease rollup fees even further, but also decrease mainnet fees while increasing network decentralization.

The Economic Benefit for rollups💰

Now that we have an idea of the features and benefits coming with Proto-Danksharding and EIP-4844, let’s consider how this will impact current rollups and their native tokens.

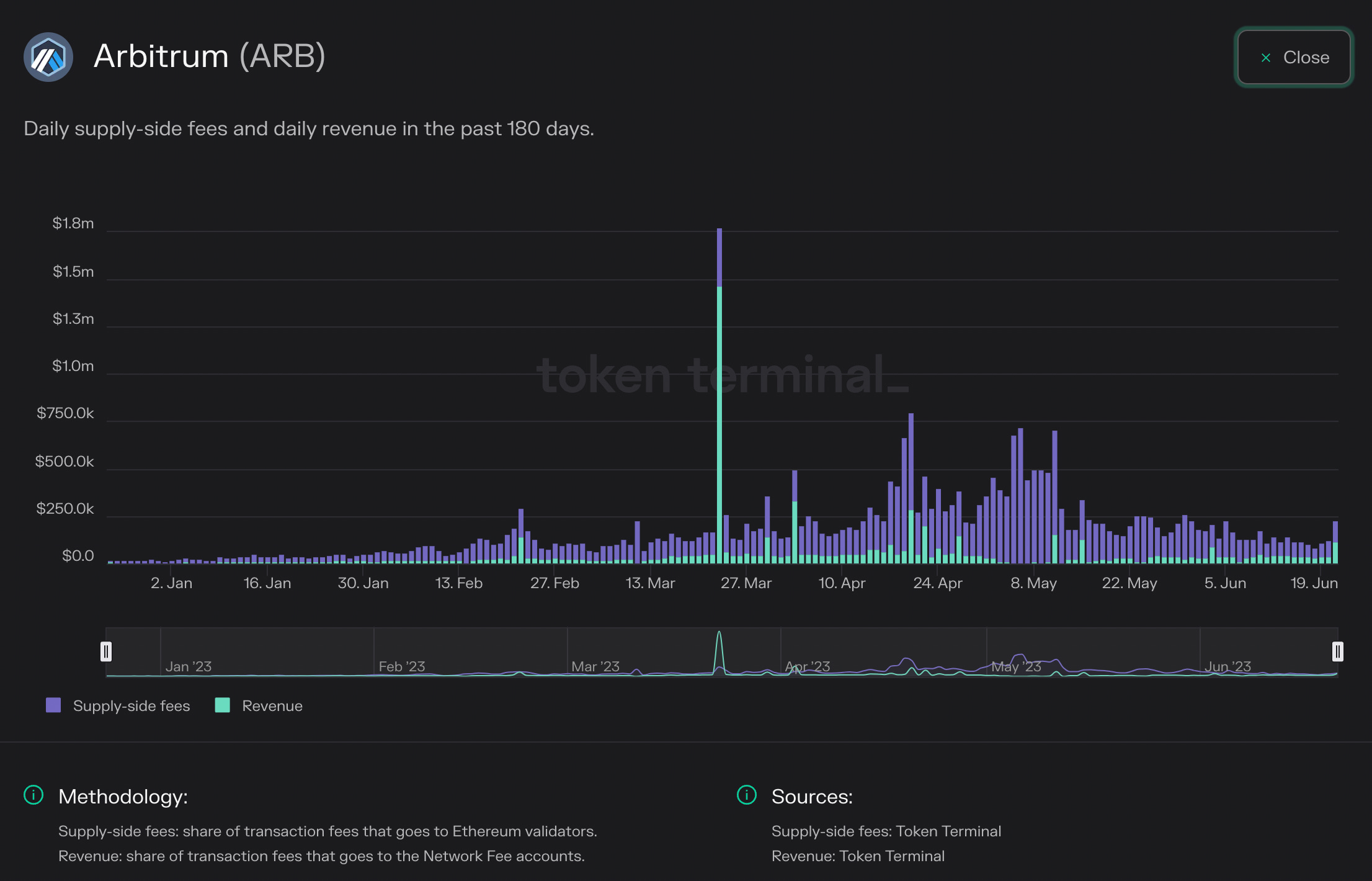

From the chart above provided by Token Terminal, it’s evident that fees generated on Arbitrum have increased significantly this year. However, as of today, approximately 75% of all these fees are paid to Ethereum mainnet validators. This represents a huge expense, and out of the roughly $32m generated in fees this year, only $8m has been kept as revenue. It’s estimated that with the new implementations from Proto-Danksharding, Ethereum mainnet execution costs will be largely reduced. This not only makes it much cheaper from a consumer perspective to use Ethereum rollups but also increases profit margins for Arbitrum, Optimism, and other rollups.

It’s important to note that as of now, none of the revenue flows directly to the users in the case of either Arbitrum or Optimism. Whether or not this is considered a negative, as the revenue is used internally to grow the product by paying employees, etc., to ship new features, is not something I want to dwell on today. However, I'm sure that as time progresses and sequencers become decentralized, these rollups will implement some sort of increased utility, such as a fee-sharing model. While there might not be much token utility at this point, it shouldn't be concluded that this will always be the case.

The Narrative 🦄

The largest narrative this year has undoubtedly been Ethereum liquid staking. Total value in this sector has grown from $7b Jan 1st to over $18b today. What caused this major rally and narrative to take shape was the Shanghai hardfork which has made it possible to unstake ETH. Historically, these major upgrades to Ethereum has formed strong narratives. The months leading up to the merge last year, $ETH rallied over 100% to $2100. The next big upgrade is as this article describes Proto-Danksharding. As stated in the previous section, the direct beneficiaries are the rollups building on top of Ethereum.

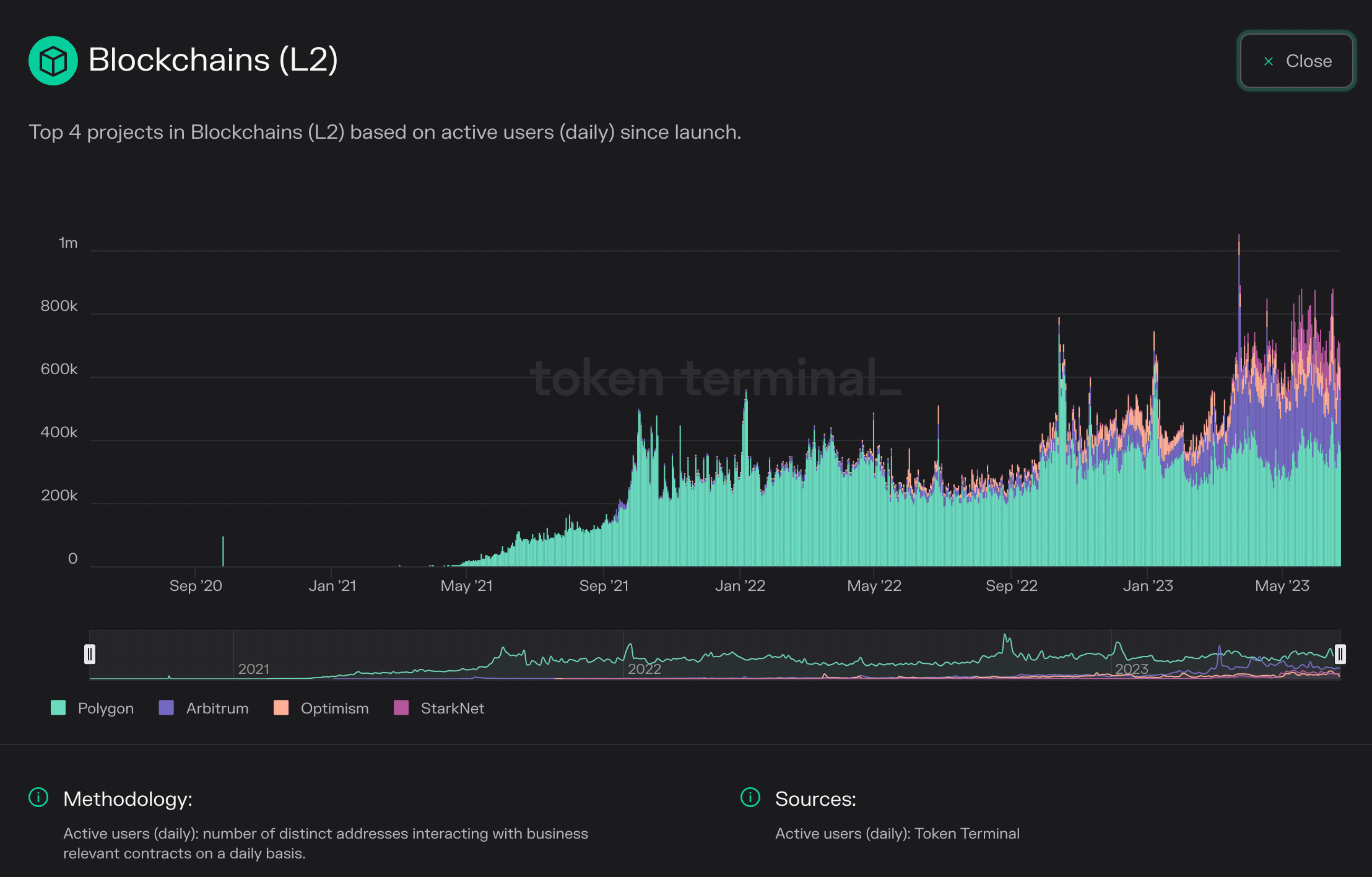

The majority of innovation is happening on Ethereum at the moment. Arbitrum and Optimism continue to rise in terms of daily users, zkEVMs are beginning to pick up momentum and new rollups like Base (by Coinbase) and Mantle (by Bitdao) are being built at the moment. It’s clear that Ethereum attracts the majority of innovation and a large reduction in fees on these rollups will only deepen this.

ARB

Arbitrum has been the leader in terms of onboarding users onto the layer 2 landscape and has seen significantly more daily transactions than e.g Optimism despite for a long time not incentivizing users to transact on the chain via a native token. That tells us that adoption has happened organically and the community therefore is more ‘sticky‘ compared to if they just joined for the ARB incentives. Ecosystem projects on Arbitrum are further beginning to distribute their ARB allocation which could cause a boost in daily users/txs. ARB is trading at a market cap of slightly more than $1b and the upcoming catalyst with Proto-Danksharding could impact the token positively given a somewhat decent overall market.

OP

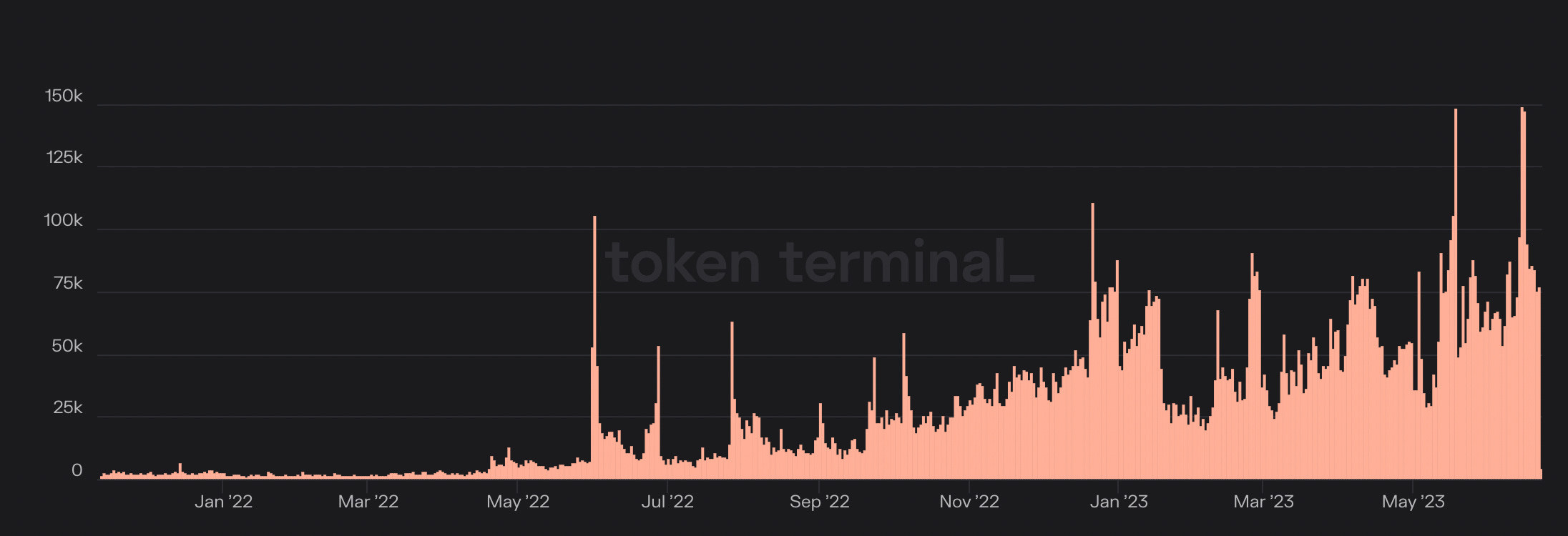

Like Arbitrum, Optimism continues to trend higher in daily users on the chain.

OP has historically been criticized for the large token emissions and investor unlocks. While this undoubtedly should be taken into consideration when determining future performance, it’s often the case that the importance of unlocks is exaggerated in the short term and understated in the long term. As Proto-Danksharding should arrive by the end of the year I wouldn’t count out OP for this reason alone.

Optimism further has a few tailwinds. Bedrock just shipped which makes Optimism the cheapest L2 at the moment and this implementation lays ground for the other chains building with the The OP-stack. Coinbase is building their own L2 called Base with the OP-stack, Binance is building their own rollup called opBNB and these are just to mention a few. This creates additional revenue for Optimism through the shared sequencer program and Base has even disclosed that 10% of their profits will go to Optimism.

All in all, both tokens have significant potential not only in the second half of the year but also on a higher time frame. I further wouldn’t count out new investment opportunities in the rollup-space such as Mantle and zkSync but their tokens are not yet live.

That’s all I had for today! Curious to know your thoughts in the comments below.

Want to stay ahead of the heard? Make sure to subscribe for more in depth content like this in the future⚡️

Please be advised that nothing shared is financial advice