The Path of Least Slippage

Softening the rough edges of spot trading on the people's chain.

Disclosure

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

High volume. Low clarity. For all its growth, Solana’s spot trading landscape remains fragmented—fast, yet fragile. Beneath the surface, friction persists: scattered routes, lost edges, silent failures. But evolution rarely arrives with noise. It moves quietly, in layers.

Introduction

It's often said that on-chain trading volumes mean very little when it comes to gauging activity, especially on low-cost chains where such metrics can easily be spoofed. While that critique holds merit, the sustained market presence and mindshare of Solana tells a more nuanced story.

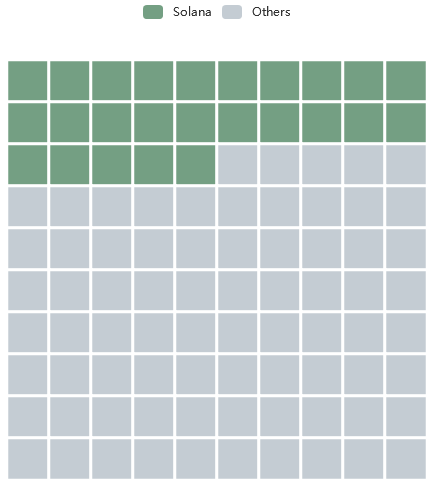

Following the memecoin insanity earlier this year, the chain at one point in time commanded almost half of the global trading activity for a whole month. This has now halved as the dust settled and attention alongside liquidity moved elsewhere.

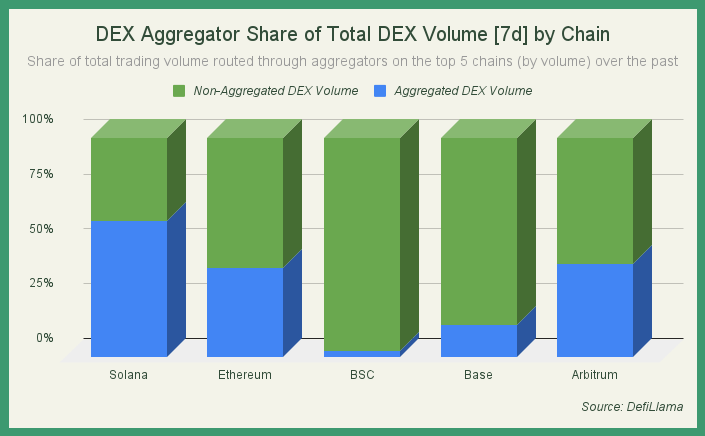

Aggregators, in this day and age, are commonplace on most networks due to their innate convenience for both new entrants and experienced users. Wide-spread use tends to indicate a maturing ecosystem where users prioritize efficiency and ease of access.

As the chart shows, Solana stands out with the highest proportion of aggregated decentralized exchange trading volume among major chains—roughly 62.32% of trades are routed through aggregators. Far surpassing that of Ethereum, Base, Binance Smart Chain (BSC), and Arbitrum. In particular, the lion’s share of that is handled by Jupiter, which accounts for an overwhelming 96% of the turnover.

The data suggests a clear pattern: as networks scale in transaction capacity and reduce costs, trading behavior increasingly centralizes around aggregation services—creating new challenges and opportunities for protocols competing in this area.

Metamorphosis

Suffice to say Kamino has been incredibly resourceful with their infrastructure, most notably with the introduction of limit orders at the end of last year. A feature that was initially intended to service solely the liquidation engine, has evolved to a competitive trading venue in the form of Kamino Swap, which offers users more benefits than first-world governments.

We outlined the thought process leading up to the inception of this product, alongside its technical specifications and capabilities in an earlier article four months ago. For those unfamiliar with the addition, we suggest catching up with it before continuing to truly grasp the scope.

Prefaced in the post above, was the possible integration of market orders that allow users to instantaneously buy or sell assets without the hassle of manually setting execution prices. It just so happens that premonition recently came into fruition, adding yet another infinity stone to the gauntlet that upon completion solidifies the platform's ambitions of becoming the epicenter of decentralized finance on Solana.

Just as the ancient Silk Road connected disparate trading hubs across continents, creating the world's first truly global marketplace, Kamino's Meta-Swap weaves together the fragmented liquidity landscapes of Solana into a unified network of value exchange. With aggregation routes spanning across Pyth's Express Relay, Jupiter, DFlow, Fluxbeam, Raydium, and Autobahn—traders are virtually guaranteed to be subjected to the most optimal quotes at any given time.

Rather than providing static, optimistic rates that aren't market and slippage agnostic, real-time transaction simulations using inputs from the swap interface are performed in perpetuity (once every 2.5 seconds) and compared with available alternatives to determine the highest-yielding offer. Any and all changes are visually reflected under the primary modal.

An added benefit of simulating transactions prior to, and upon submission, is to ensure a swap's validity, subsequently lessening the odds of it failing. This process is comparable to conducting test transactions on a forked network that maintains its present state using Foundry, all without risking actual funds.

[122209] SwapExample::run()

├─ [122209] SwapRouter::exactInputSingle()

│ ├─ [114777] UniswapV3Pool::swap()

│ │ ├─ [51942] OP::transfer()

│ │ │ ├─ emit Transfer()

│ │ │ ├─ emit DelegateVotesChanged()

│ │ │ └─ ← [Return] true

│ │ ├─ [2457] WETH::balanceOf()

│ │ │ └─ ← [Return] 148551971560896842732 [1.485e20]

│ │ ├─ [15572] SwapRouter::uniswapV3SwapCallback()

│ │ │ ├─ [11500] WETH::transferFrom()

│ │ │ │ ├─ emit Transfer()

│ │ │ │ └─ ← [Return] true

│ │ │ └─ ← [Stop]

│ │ ├─ [457] WETH::balanceOf()

│ │ │ └─ ← [Return] 148551971561896842732 [1.485e20]

│ │ ├─ emit Swap()

│ │ └─ ← [Return] 10000000000 [1e10], -24428824635501 [-2.442e13]

│ └─ ← [Return] 24428824635501 [2.442e13]

└─ ← [Stop]

Ultimately, reducing the frustration frequently experienced when interacting with less liquid or highly volatile pools, albeit at the detriment of Kamino's RPC provider bills.

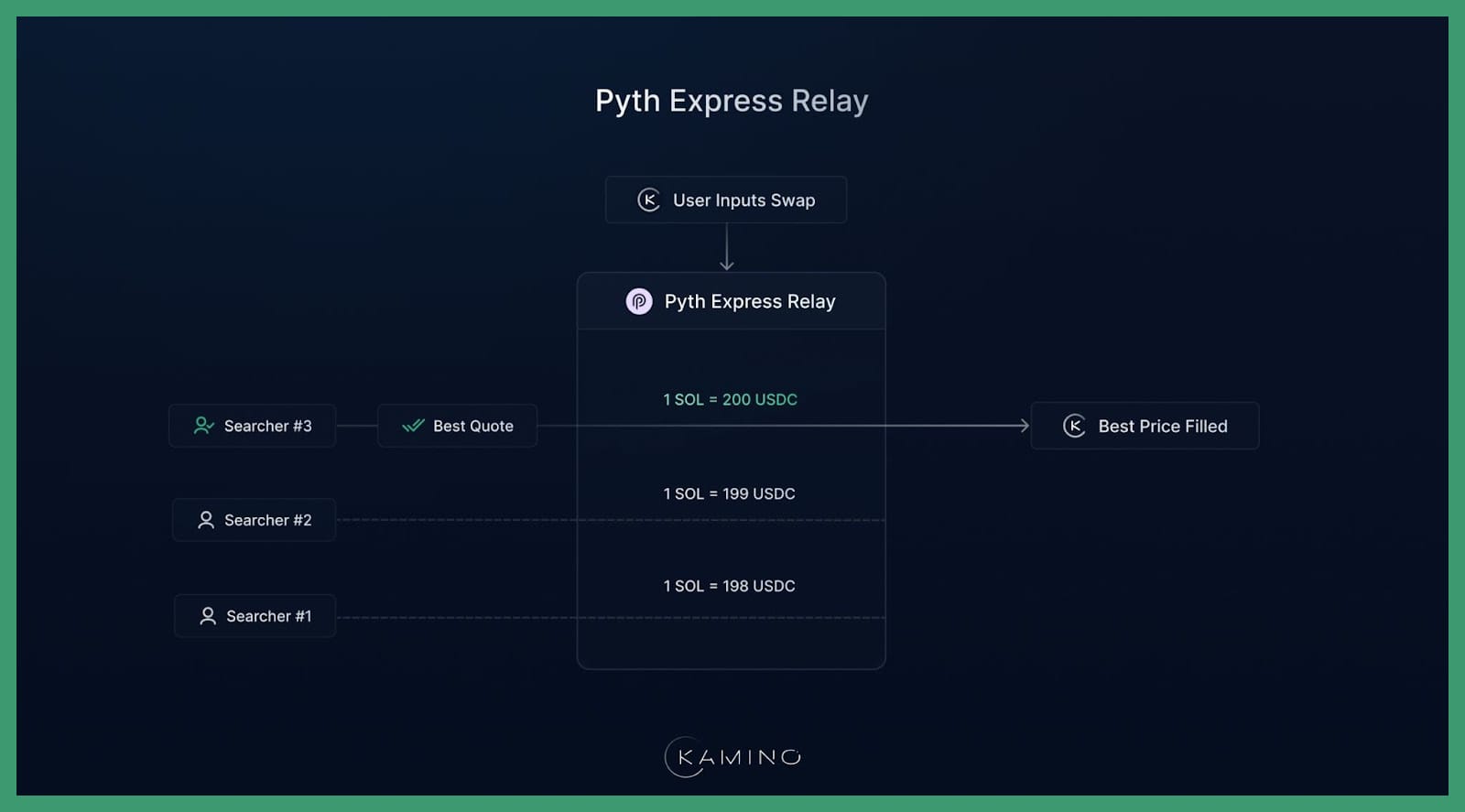

Despite the abundance of outlets, it is very likely that trades get routed through Pyth's Express Relay, the exact same technology that facilitates liquidation auctions and limit orders on the protocol. Powered by a proprietary request-for-quote (RFQ) system, the existing architecture is now able to process on-demand orders, while upholding its three core tenets: zero slippage, zero MEV and zero fees.

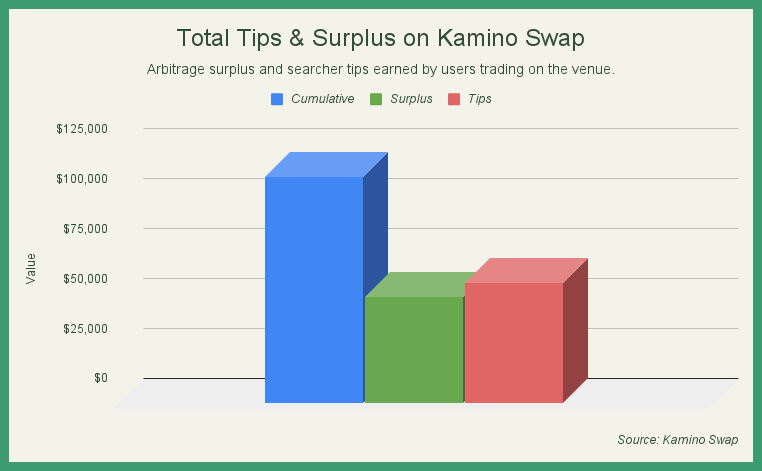

Built to handle size and incentivize trading through searcher tips and surplus kickbacks, the express relay serves as a reliable gateway for executing efficient transactions, void of hidden costs. Metrics attainable from Kamino's website and API are an attestation to this claim, as the solution has, to date, returned over $100,000 in value back to its users.

It's worth noting that this figure does not represent any savings on either fees, MEV nor slippage. Accounting for those values as well, would without a doubt boost the perceived efficacy of the transaction rail, although we refrained from doing so since the exact details are nearly impossible to obtain and would end up being more speculative than informative.

Three weeks after its debut, Meta-Swap has already processed around $300 million in volume, earning a spot on the podium alongside Jupiter. Dethroning the leader won’t be easy—but as they say, the king of the hill has only one way to go.

Looking ahead, Kamino's development roadmap for extending the product's functionality and further improving user experience seems promising.

Smarter Transactions

Feeless transactions with automatic slippage and priority settings handling as well as real-time optimizations, courtesy of Smart Swaps.

Granular Route Control

Though the routes on the aggregator are currently enforced by the application, users will soon gain the freedom to manually include or exclude specific venues based on their individual preferences.

Surgical Precision Swaps

For those who yearn for precision, the upcoming Exact Out Mode will enable specifying the exact amount to receive rather than the input amount.

Efficient Dollar-Cost Averaging

Finally, the DCA feature will allow systematic buying at fixed intervals with fixed amounts, all while leveraging Pyth Express Relay for best-in-class price execution.

As of now, there isn't an exact date for when these updates are rolled out, or in which order they'll be implemented, but it's worth keeping an eye on the project's official communication channels to be in the know once they make it to production.

Conclusion

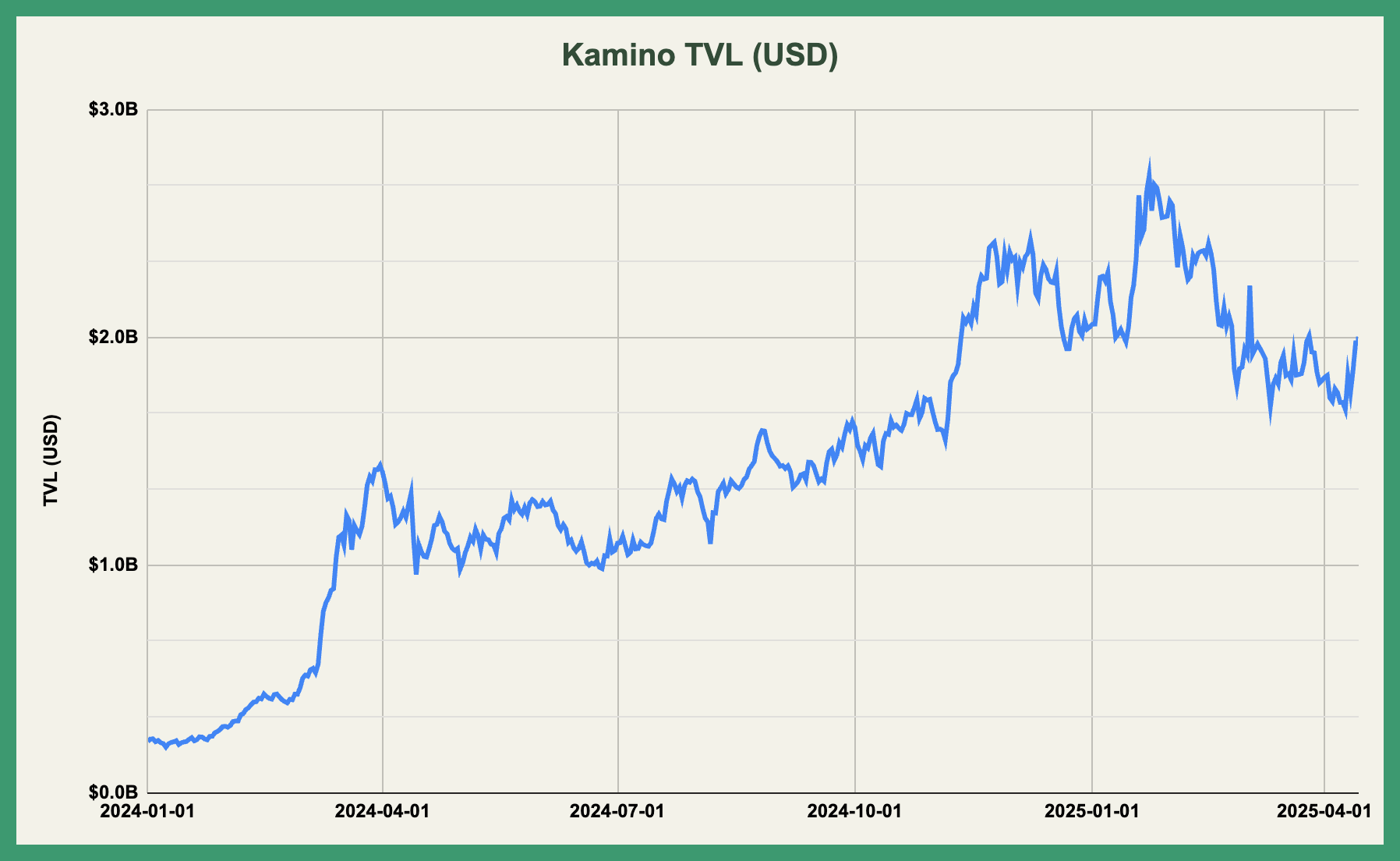

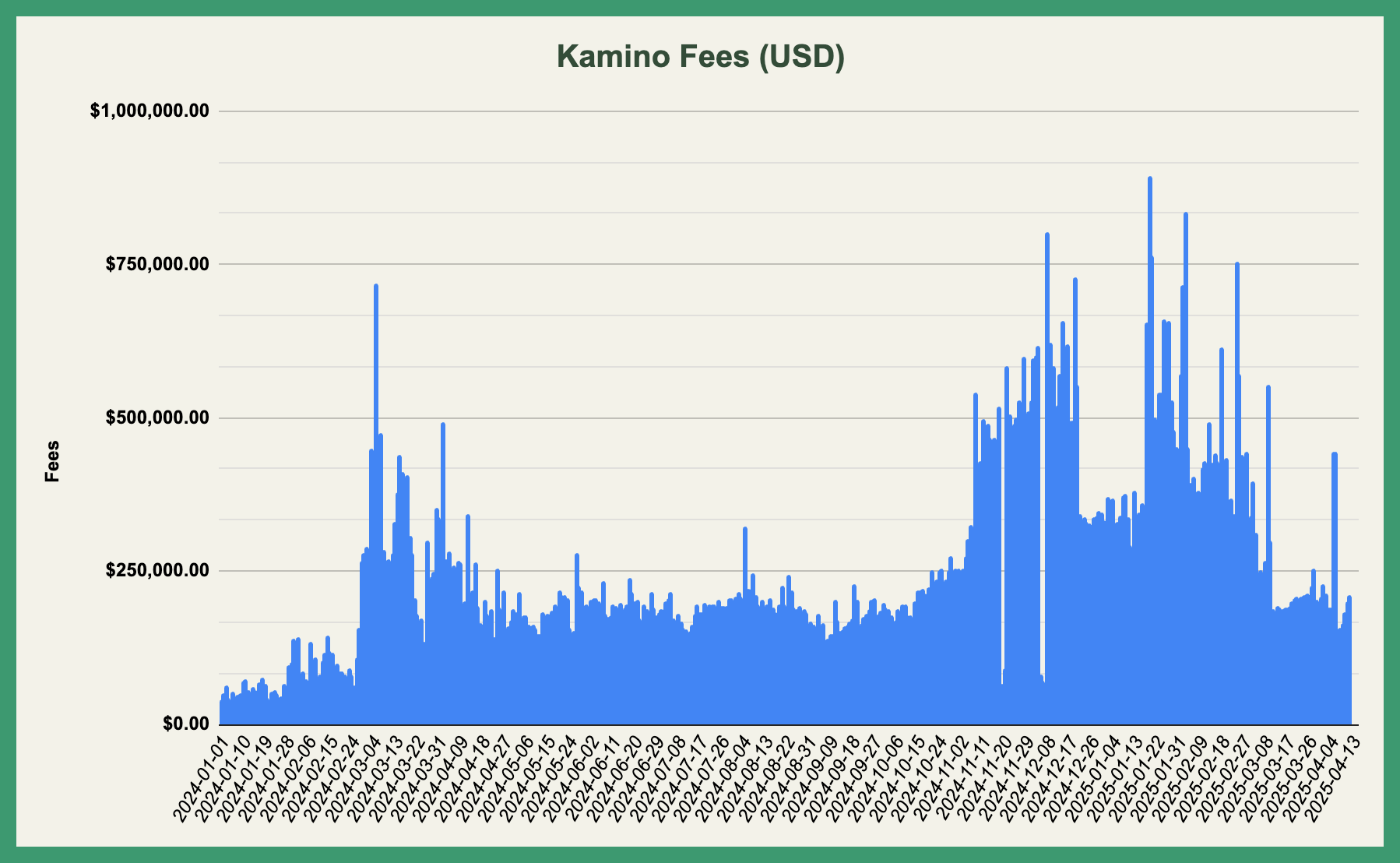

Kamino remains one of the core applications in DeFi and the premier lending market on Solana with around $2b in TVL and over $200k in daily fees generated by various activities on the platform.

Over the past few years Kamino has grown from being a small lending and borrowing platform to a DeFi powerhouse with multiple products including 'Kamino Lend', 'Kamino Multiply' and now 'Kamino Swap'. The protocol is no longer just the place for the best yields on Solana but now also offers the best execution on swaps.

Job's not finished.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.