The New Wave of Stablecoins

An in-depth report on eight new stablecoin protocols

Stablecoins are the answer https://t.co/bKwGbeuZVz

— Thlither (@0xthlither) September 6, 2024

Good introductory crash course from the Odd Lots squad on the importance of stablecoins

Sponsor - Kamino Finance

Today's report is sponsored by Kamino Finance - the leading money market on Solana. Kamino has surged in popularity over the past months now with more than $2.5b supplied on the lending market. On Kamino lend, users can supply, borrow and loop a wide range of assets to capture yield and obtain leveraged exposure.

Kamino recently launched the Jito Market, an isolated market to borrow and lend SOL and JitoSOL. Isolated markets like this open up for custom risk parameters and consequently a higher LTV (90% versus 80% on the main market). With a higher LTV, users can leverage via the 'Multiply' strategy on Kamino with up to 10x leverage on the JitoSOL staking yield.

1/ Introducing the Jito Market

— Kamino (@KaminoFinance) November 4, 2024

Built to scale JitoSOL on Kamino Lend, the Jito Market will also power Kamino's first-ever 10x Multiply Vault—already live in the app!

To fuel the launch, SOL depositors will receive 8,000 JTO incentives in the new market. Every. Single. Week. pic.twitter.com/wcGDsd0m7F

To read more about how 'Multiply' works in general and how Kamino reduces the risk of liquidation via e.g the contract based pricing oracle, check out OCT's Kamino report below.

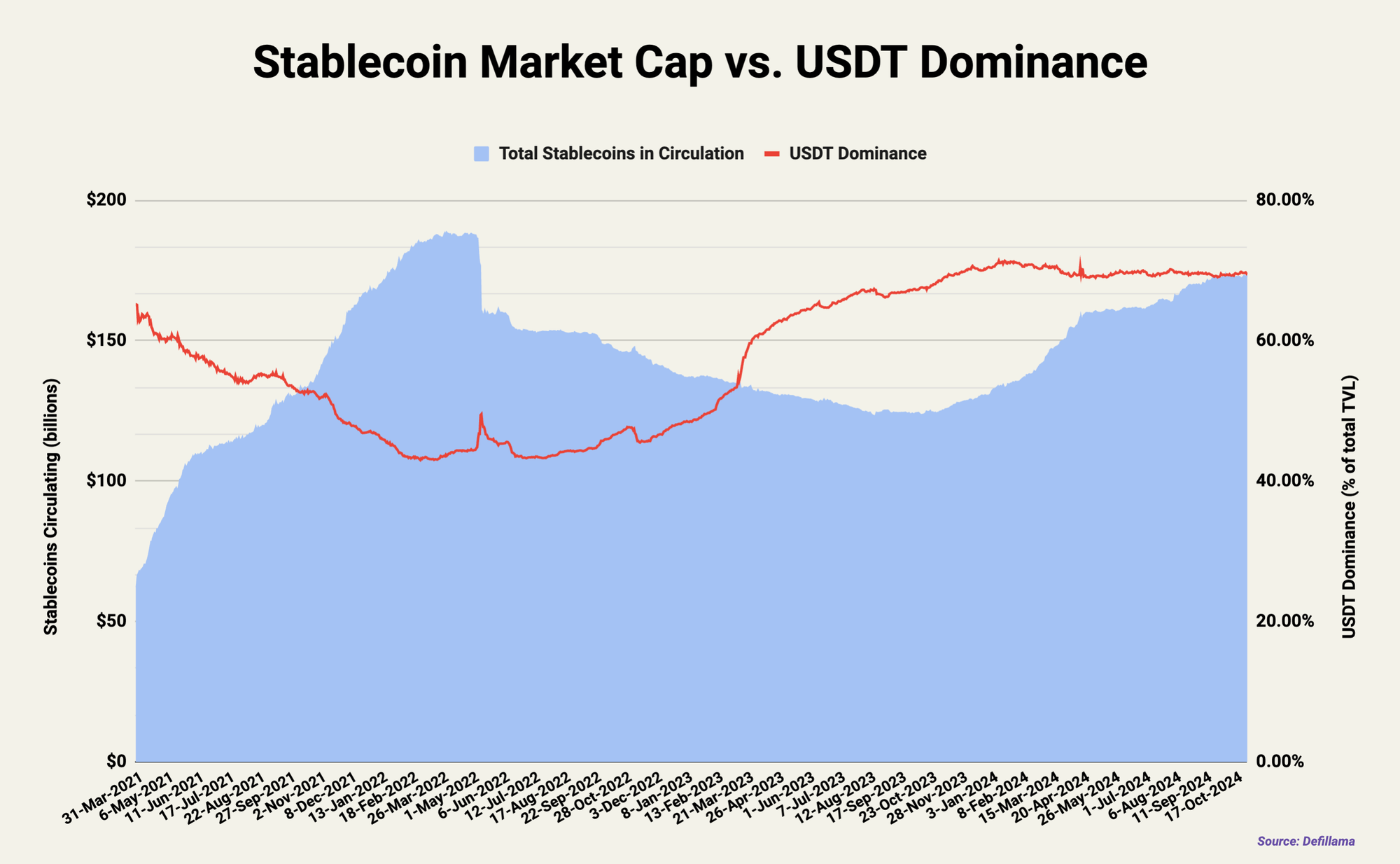

Today's Stablecoin Market

If you follow me on X, you know it's no secret that stablecoins are currently my number one favorite vertical in crypto. After a 2023 full of uncertainty, 2024 has seen the stablecoin market cap increase 34% to $177b, a capital flow bringing with it several impressive stats, such as the fact that if Tether were a country it would now be the 19th largest holder of U.S. Treasuries ($108b, putting it between Germany and South Korea). Looking at stablecoin market cap vs. USDT dominance graphed shows a clear picture of regained trust in both institutions this year:

If you look more closely at this graph, however, another angle becomes apparent. 2024 has also seen the launches of dozens of new stablecoin projects boasting novel backing, yield, and protocol mechanisms. Despite this, none of them seem to have made much of a dent in Tether's peak dominance, which is currently sitting just a few percentage points away from ATH. As I have spent a great deal of time researching these various new protocols, I have found myself asking when they might start to make a serious dent in Tether's market share.

I know that I shouldn't make assumptions, but I do have several about the readership of On Chain Times, including that they've probably heard about the headliners of this category such as Ethena USDe/sUSDe, Usual USD0/USD0++, and Blackrock BUIDL - these are the projects I feel as though the general on-chain crowd has spent the most time learning about.

For that reason, I've chosen 8 different protocols to cover - 7 that I hope you don't know as much about yet, plus 1 short Ethena update at the end. All 8 were announced in 2024:

Protocols Covered

- DeFi-Native: Cap Labs, Elixir, Level

- Collateralized Debt Positions: Ducat, Felix

- RWA-Backed: Anzen, Superstate, Ethena (UStb udpate)

For each of these projects, I want to talk quickly through some key details, like protocol design, traction (TVL growth), potential airdrops, and technical specifications when needed. I want this to be easy to read through, so I'm going to distill some complex information considerably so that you can easily digest it. With that, let's get into it:

1) DeFi-Native

These stables utilize primarily defi-native collateral backing, choosing to forgo the ease of centralized execution and assets in favor of the transparency and immutability of DeFi.

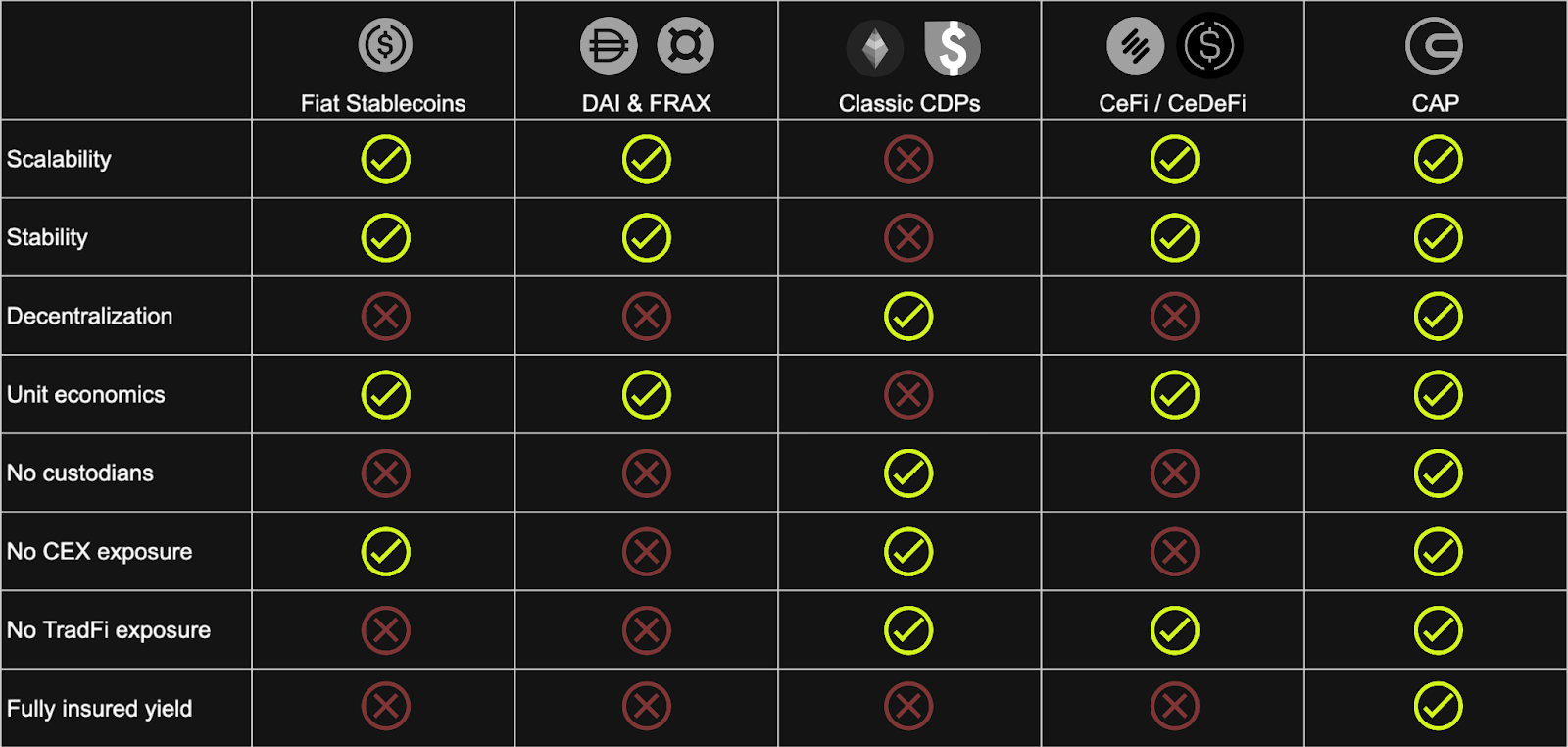

Cap Labs CAP

Cap (announced 10/12) aims to open the gates to a hidden side of yield previously only accessible to wealthy insiders and institutions. Sick of endogenous protocol designs that require constant growth in order to be able to produce yield, monolithic strategies like UST's, and a general lack of user protections, Cap created a new stablecoin engine that will produce redeemable tokens of various denominations (USD, BTC, ETH, etc) with the goal of democratizing access to what were previously the most sought-after sources of on-chain yield.

Mechanism

The CAP engine is quite radical in that it does not rely on an internal team to manage its yield-producing strategies - instead, they allow a system of external agents, such as market makers, MEV actors and RWA protocols, to access collateral and generate independent yield on behalf of holders. These actors get to keep any profits over a predetermined threshold, and are therefore independently incentivized to earn as much as possible. Their behavior is kept in check by security delegations from restaking protocols, which support good actors and penalize bad ones for native restaking rewards.

CAP essentially aims to function as a complete system of rewards and penalties with no reliance on the Cap Labs team; every aspect of the protocol will work as a decentralized marketplace of predefined incentives:

- First, users deposit collateral to mint stables denominated in an underlying token of their choosing. These stablecoins can be interest bearing (growing in balance over time like stETH) or pegged to a stable value with interest accruing separately

- Next, potential agents apply for a loan from CAP's collateral basket - in this application they will lay out a plan for how they'll earn yield for CAP users, and will need to be approved by security delegations from restakers. These AVS operators police agents on the network for a financial reward

- Agents use their loans (CAP collateral) to independently execute various white-label yield plays, such as arbitrage, MEV, and DeFi strategies like basis trades. A large set of agents means that CAP can operate a diverse set of strategies, optimized to produce a consistent return

- Agents return the collateral at a preset time and share yield with restakers, CAP stablecoin holders, and Cap itself. After these predetermined distributions, agents can keep any additional yield as their own profit

So, pretty simple - users only need to choose which denomination they want to hold; after that, all yield-producing strategies are handled on the backend, with agents competing to out-earn each other for increased access to CAP collateral, and AVS's patrolling the network to ensure that no agents act maliciously.

This is a buy-and-forget stable for people who love decentralization. Cap Labs has no reliance on an individual investment team or dev, and nobody in the entire ecosystem, including the founding Cap team, will ever have unilateral control over the system or its funds. Cap also claims to fully cover yield, meaning that all CAP stables are fully insured against losses from the trades agents make. It'll be interesting to see how they go about fulfilling this difficult guarantee.

TVL - N/A

Cap has no official TVL, as they've launched neither a private nor public beta. They plan to release their platform in Q1 of 2025.

How to use it today

Cap is pre-launch, but keep an eye on their X account for important updates as we move into early '25. They've already mentioned that CAP stables will be integrated in all upcoming stablecoin protocols on MegaETH and will play a key role in their TVL bootstrapping process. This sounds like a recipe for both competitive yields and airdrop farming alike.

Elixir deUSD

Elixir, a modular DPoS network built to power liquidity on order book exchanges in DeFi, has been around for the better part of two years. By staking your ETH with them in early 2024, you could earn points (potions) and yield for providing liquidity to exchanges that use Elixir. More recently, they've announced on-chain partners such as Vertex, Bluefin and ORDERLY. Here's a great full Elixir report released by Delphi; today, however, I'm only going to be focusing on Elixir's newest offerings, announced 7/31: deUSD, a fully collateralized synthetic dollar powered by the Elixir Network and specifically structured to be resilient during negative funding rate environments, and sdeUSD, its yield-bearing counterpart.

Mechanism

deUSD is a dollar-pegged stable not dissimilar in mechanism to Ethena's USDe - upon minting, your collateral is used to buy stETH, which then is used to open a short ETH perpetual future of equivalent value, creating a delta-neutral ETH basis trade that profits from positive funding rates. Initially, this trade will run on centralized exchanges and use blue-chip custodians like Copper Clearloop, but Elixir claims to have a clear path to move it on-chain in the future.

In negative funding rate environments, deUSD has two tricks up its sleeve to protect from negative protocol yield:

- When the basis trade is on, Elixir diverts a portion of protocol revenue into the Over-Collateralization Fund, or OCF. Currently holding $3.2m, the OCF is used to cover short-term periods of negative funding. If funding stays negative over time, causing OCF to health fall to a pre-set trigger level, Elixir takes action...

- ... by choosing to shift deUSD collateral backing from stETH into sDAI, which currently yields 7.1% APY from a mix of Maker fees and USTs, while at the same time closing the short leg of the basis trade. If the OCF falls by >20% from its peak value, deUSD will have moved to 100% sDAI backing, with the basis trade closed completely

If funding recovers, deUSD backing will start to re-enter the basis trade, creating a yield-bearing system that finds healthy ground in both positive and negative funding rate environments. At any given time, the collateral makeup can be found on Elixir's transparency dashboard.

To earn protocol yield, holders have to stake their deUSD in order to receive sdeUSD, a familiar setup to users of other DeFi stables like DAI.

TVL - $160.2m

Since July, Elixir has done an excellent job of converting existing ETH deposits into deUSD, currently sitting at 65% of their pre-announcement TVL. This was a bit of a point of contention at the time, as Elixir expected users who had deposited ETH to continue on their flywheel for longer than initially asked.

Currently, ~$65m is earning 7.69% APY + potions while staked into sdeUSD, representing roughly 41% of deUSD TVL.

How to use it today

- Swap supported assets for deUSD on Elixir

- Use DeFi integrations such as Morpho, Curve, and EtherFi, or stake in protocol for 7.69% APY & a 2x potion boost for the upcoming ELX governance token airdrop

- You can even deposit deUSD/sdeUSD into Level to earn points there, stacking two sources of yield concurrently

- Keep an eye out for future announcements on X - Elixir says that they're currently working on integrating with order book monsters like Hyperliquid, dYdX and Synthetix. Pay attention for some of these partnerships to hopefully debut as time goes on

Level lvlUSD

Level, which came out of stealth over the summer, believes that the two most important verticals in crypto are 1) permissionless access to USD and 2) the ability to secure decentralized networks against malicious attacks. To serve both of these needs at once, they created a lvlUSD, which is powered by underlying stables invested into two passive, yield-producing primitives: lending protocols and restaking vaults.

By holding lvlUSD, you can earn yield and provide security for decentralized networks without the complexity of having to source & manage positions across multiple protocols yourself, and with the added benefit of being able to use your dollars to produce additional yield across DeFi.

Mechanism

LvlUSD is backed by a basket of USDC & USDT that is then used on-chain to produce a return powered by both a base and restaking yield. Base yield comes from lending dollars on Aave, and is stacked on top of restaking yield, which comes from depositing dollars into AVS's on restaking protocols like Eigenlayer, Symbiotic and Karak.

In the future, Level aims to launch Level LRTs that can be used in DeFi while underlying stables are restaked, providing further utility to lvlUSD. They've also already announced support for other dollar-denominated tokens such as Usual USD0/USD0++ and Elixir deUSD/sdeUSD, allowing traders to stack various sources of stablecoin yield vertically by depositing into Level. The team sees lvlUSD as a sort-of DeFi bond:

"Staking at its core represents an agreement between the bond issuer (the protocol) and the bond holder (the validator/delegator). The bond holder lends resources in return for periodic incentive payments known as rewards."

By buying into Level's internet bond, holders will be able to take advantage of two of the most basic types of decentralized yield in order to passively earn on their DeFi dollars.

TVL - $10.04m

Level recently opened up to the general public on 11/8 after surpassing $10m in TVL during its private beta (which started 8/29).

1/ Announcement: $10 million TVL and launching lvlUSD

— Level (@levelusd) November 8, 2024

We've grown to $10 million in TVL since launching our waitlist deposits program 2 months ago

Today, we're publicly launching lvlUSD, the first stablecoin backed by restaked dollar tokens pic.twitter.com/cvaOdOLnts

How to use it today

- Use USDT or USDC to mint lvlUSD on Level - collateral sent to lvlUSD contract

- Deposit lvlUSD into protocol to earn protocol yield + 10x Level Points (for future airdrop), tracked on Level Dashboard

- Can also deposit USDC, USDT, USD0/USD0++, FRAX/sFRAX, deUSD/sdeUSD to earn 1x points

- Claim yield on dapp as it comes, or use lvlUSD across defi. Pay attention to ecosystem partner/airdrop campaign updates

2) Collateralized Debt Positions (CDPs)

CDP protocols allow users to borrow assets by locking up collateral. When a user creates a CDP, they deposit a certain amount of ETH, BTC, USDC, or other assets into the protocol to borrow a proportionate amount of another asset, in this case a stablecoin. If the value of the deposited collateral falls below a specified threshold (loan-to-value level or collateral ratio), the CDP becomes under-collateralized and is recalled, or liquidated, with the protocol automatically selling off the underlying assets to repay the debt and maintain the stability of the system. After the underlying collateral is liquidated, the user usually gets to keep the asset they’ve borrowed, minus some kind of liquidation penalty.

Ducat UNIT and Felix feUSD are both CDP-based stablecoins, along with well-known projects of the past like Liquity's LUSD and MakerDAO's DAI.

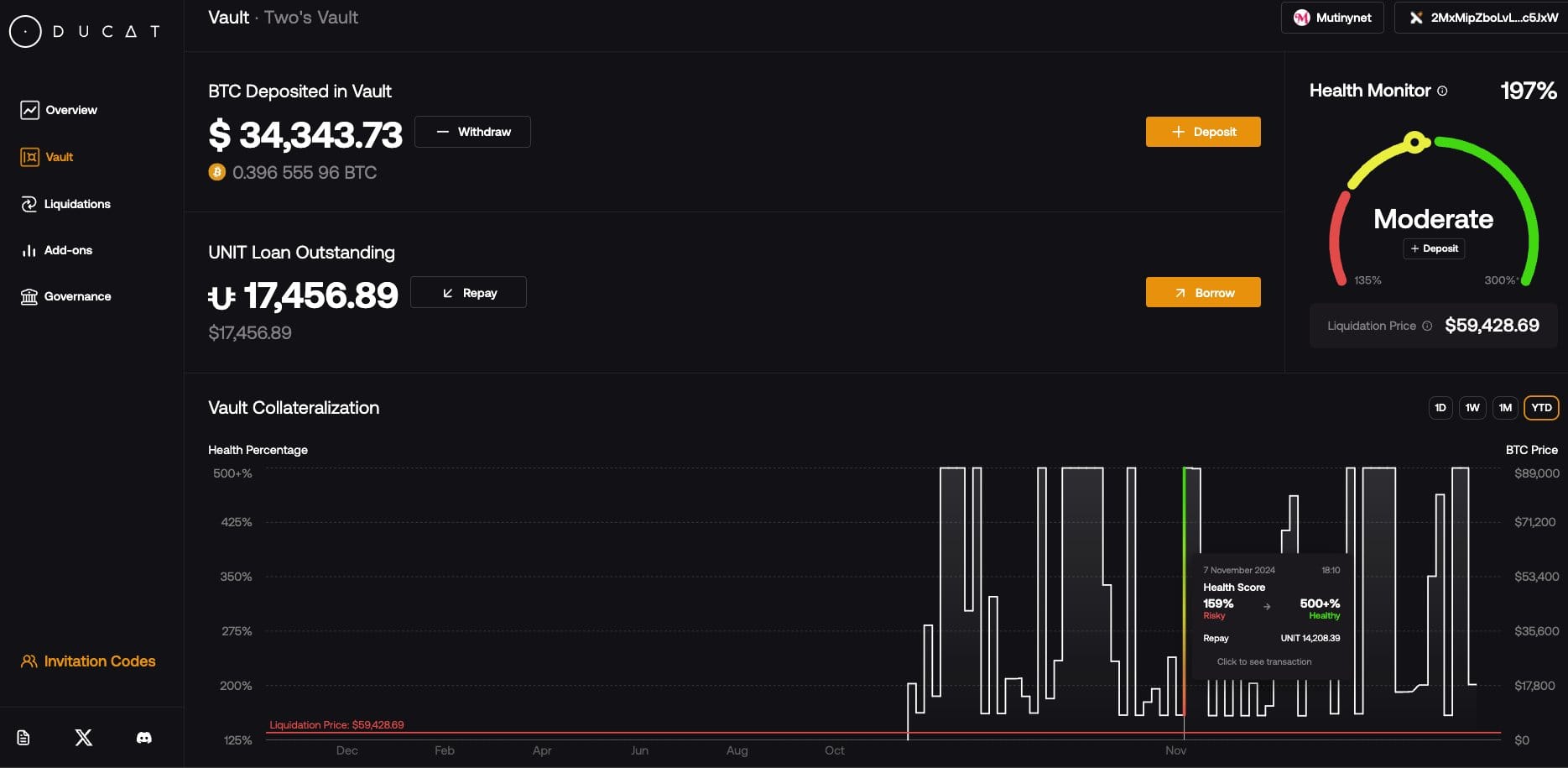

Ducat UNIT

Until recently, the Bitcoin-native economy has been extremely isolated from the rest of DeFi. On-chain finance exists almost exclusively on EVM-based networks that don't necessarily fit into the aggressively decentralized and censorship-resistant ethos of native BTC. DeFi clearly hasn't proven attractive to BTC holders yet, with 89% of all outstanding BTC sitting idle outside of PoS chains or centralized exchanges.

Ducat believes that decentralized money needs truly decentralized collateral, and is addressing this by building UNIT, the first Bitcoin L1-native, decentralized stablecoin, offering 150% protocol over-collateralization and tokenized via Bitcoin Runes. With UNIT, Bitcoin maxis no longer have to choose between keeping their BTC native and participating in the broader crypto ecosystem. UNIT aims to balance a mixture of stability, censorship resistance and growth constrains to create the first great stablecoin of BTCFi. Ducat is so unique it doesn't even see itself as having competitors, believing itself to be sufficiently differentiated from stables like USDT, USDC, DAI, and USDe.

Mechanism

Of the 8 protocols covered here, Ducat probably has the most complicated mechanism with the most new tech.

The UNIT stablecoin is backed only by native BTC, and is minted/burned using the BITE standard, which is a trustless, BTC-inscribed execution environment. BITE acts as an extension of the core BTC script, requires no forking, and can power transactions with more complex logic than simple transfers. With this new standard, Ducat can store data on-chain as ZK circuits in the form of Ordinals inscriptions, essentially recreating smart contract logic using BTC-native tech. Ducat implements several other layers in this process, including an MPC network to create a pseudo-rollup that allows for non-state-dependent transactions, something nascent in BTC.

Like other CDPs, UNIT utilizes a series of loans, liquidators and collateral auctions to function. Here's how it works:

- Users deposit BTC (and in the long-term future, other approved BTC-native assets) into the Ducat inscription contracts to create a CDP Vault (loan) and borrow newly-minted UNIT, which is soft-pegged to USD at 1.01-1.04 UNIT/USD

- These loans will have conservative leverage, with targeted collateral ratios of 125-150%, an exogenous collateralization chosen to balance BTC's historical 10-min vol & ensure the protocol holds up under stress. If your Vault ratio stays healthy, you can use the UNIT you borrowed and repay your loan when it's time

- If your ratio dips below the collateral liquidation threshold, one of two processes will be triggered: a decentralized liquidation auction, in which the protocol flags loans that are close to liq and invites new users to pre-bid on those assets in the same block, or a rolling auction, in which the protocol assumes ownership of liquidated BTC and sells it at a discount until no more bad debt remains. Both events are designed to defend the UNIT peg

- Liquidators are incentivized to participate in this process because it allows them to target 5-25% arbitrage profit per liquidation

- If your vault hits its liquidation level, you lose your collateral (+ a 16% liquidation fee) but get to keep your underlying UNIT

Ducat also has a plan in the event of a worst-case depeg scenario in which BTC drops more than 35% in a short time period, called the Failsafe Reserve UNIT Buyback System, or Reserve. In this scenario, the protocol wouldn't have enough time to clear its unsterilized debt, which begins to grow reflexively; debt for auction value falls well below UNIT in circulation, causing a catastrophic depeg.

To mitigate this disaster, Ducat needs to give itself time to defend the peg and provide redemption liquidity for holders - in this scenario, the protocol approves auction prices well below the peg, offering users exit liquidity at a significant discount and hopefully preventing some amount of Vault liquidations.

TVL - N/A

Announced in May, Ducat still hasn't fully launched, but their cryptic tweets seem to suggest an imminent release - take that how you will.

How to use it today

There's no way to use Ducat today, but keep an eye out for points when it does launch - the inclusion of DUCAT as a governance token closely matches the setup for other airdrop campaigns. UNIT will also be the preferred collateral for Bitflow, a dex built on the Bitcoin L2 Stacks. Bitflow will allow Bitcoin users to borrow, swap and earn against their native stables, another first. Exciting times ahead for BTCFi!

Felix feUSD

Announced on 10/14, Felix Protocol is a synthetic dollar protocol built on the Hyperliquid L1. Felix allows users to deposit HyperEVM collateral, like HYPE, PURR and bridged majors, in order to take out a CDP loan denominated in Felix's stablecoin feUSD. Holders of feUSD can deposit into Felix Vaults, where they receive passive protocol yield.

Felix is the first stablecoin designed exclusively for Hyperliquid-native assets like HYPE, and aims to allow users to borrow against their long term holdings in order to participate in Hyperliquid DeFi. Felix’s operation happens exclusively on-chain, with zero off-chain dependencies including backing assets, custodians and exchanges.

Mechanism

Felix uses an exclusive license from Liquity AG for the right to repurpose and deploy Liquity V2 on HyperEVM, allowing them to come to market with an audited and tested product. Their BOLD fork, feUSD, is a CDP that works similarly to Ducat’s UNIT - users can deposit different types of collateral to mint feUSD, and are assigned a pre-set term and minimum collateralization ratio. If you violate either of these two conditions, your collateral is seized while you retain the feUSD you borrowed, effectively closing your debt position.

After minting feUSD, you can deposit it into a Vault corresponding to a specific collateral asset, where it will serve as a liquidation backstop for outstanding feUSD debt. Stakers take on this bad debt risk in exchange for compensation in the form of borrower interest and liquidation proceeds.

Together, these two forces function to maintain a $1 feUSD peg - when collateral is liquidated, feUSD is worth less than its NAV and can be acquired on secondary markets for a discount; and when users deposit into Vaults, their feUSD is used to backstop the value of collateral upon liquidation. When a borrower’s position is eventually liquidated, their outstanding debt is distributed proportionally across Vault stakers.

Felix lists a few main risks for feUSD, including collateral asset and bridge receipt failures, liquidation cascades, and smart contract exploits - fairly boilerplate stuff in the world of exclusively on-chain CDP stables.

TVL - N/A

Felix has yet to launch. If I had to guess, I'd say that they'll be ready to go when the Hyperliquid L1 goes live soon.

How to use it today

Other than joining their Discord and reading their protocol docs to better understand how it works, there's no way to interact with Felix today. Best to wait until the HyperEVM officially launches.

3) RWA-Backed

These protocols are backed primarily by off-chain real-world assets. Buyers of these stables want to maintain exposure to these assets while gaining the utility, ease of access, and transparency that comes with on-chain crypto.

Anzen USDz

Private credit in TradFi is a $1.5T market that is highly disorganized and fragmented, unlike public credit. This industry features two distinct, mutually exclusive asset types: debt securities not listed on any exchanges or freely-tradable in public markets, and structured credit products listed in unsecured forms such as fintech lending, venture debt, and mid-market/commercial loans. In America, the hierarchy of private credit lending can be visualized as a pyramid, with capital flowing from large institutional investors at the top to small lenders and eventually end borrowers like consumers and small businesses at the bottom. Sub-markets include consumer/corporate lending, U.S. private placement and structured credit.

In May, Anzen launched USDz, a stablecoin backed by a diverse & fully collateralized portfolio of these types of asset-backed, private credit securities. By staking USDz for sUSDz, Anzen users have a chance to earn sustainable rewards and diversify their holdings, gaining exposure to these often difficult-to-reach types of investments.

Mechanism

Each USDz minted is classified as a secured private credit token, or SPCT, a permissionless token representing a share of Anzen's RWA pool and serving as an on-chain record to ensure that every dollar in circulation is fully collateralized. Anyone can acquire USDz through DeFi, but to mint new USDz you have to pass KYC through Anzen.

USDz is backed by a basket of private collateral held by RWA partner Percent with very specific underwriting criteria and stringent portfolio risk controls. These criteria, overseen by an independent third party, necessitate that included asset-backed securities must be fully collateralized & based in the USA, as well as placing concentration limits on any single asset or market. Anzen also offers liquidation timelines for these securities with an estimate of the time it'd take to fully convert all collateral to cash, under both normal and stressed market conditions. All of Anzen's current RWA backing and a lot more can be tracked on their transparency dashboard.

After minting USDz, users can elect to earn automatically-compounded rewards by staking for sUSDz, which has a current effective APY of 13.7%. They can also enter an Anzen Vault, which essentially functions as a fixed-term trade not dissimilar to a zero-coupon bond or Pendle PT position. By committing USDz up front, you can buy more at a discounted price with a fixed rate earned over a set term, receiving the full amount at maturity. Anzen currently offers pretty competitive rates on these bonds, and plans to offer additional vaults that will provide "maximum points exposure," which sounds kind of like a PT-YT setup. This is definitely something I'll be keeping an eye on.

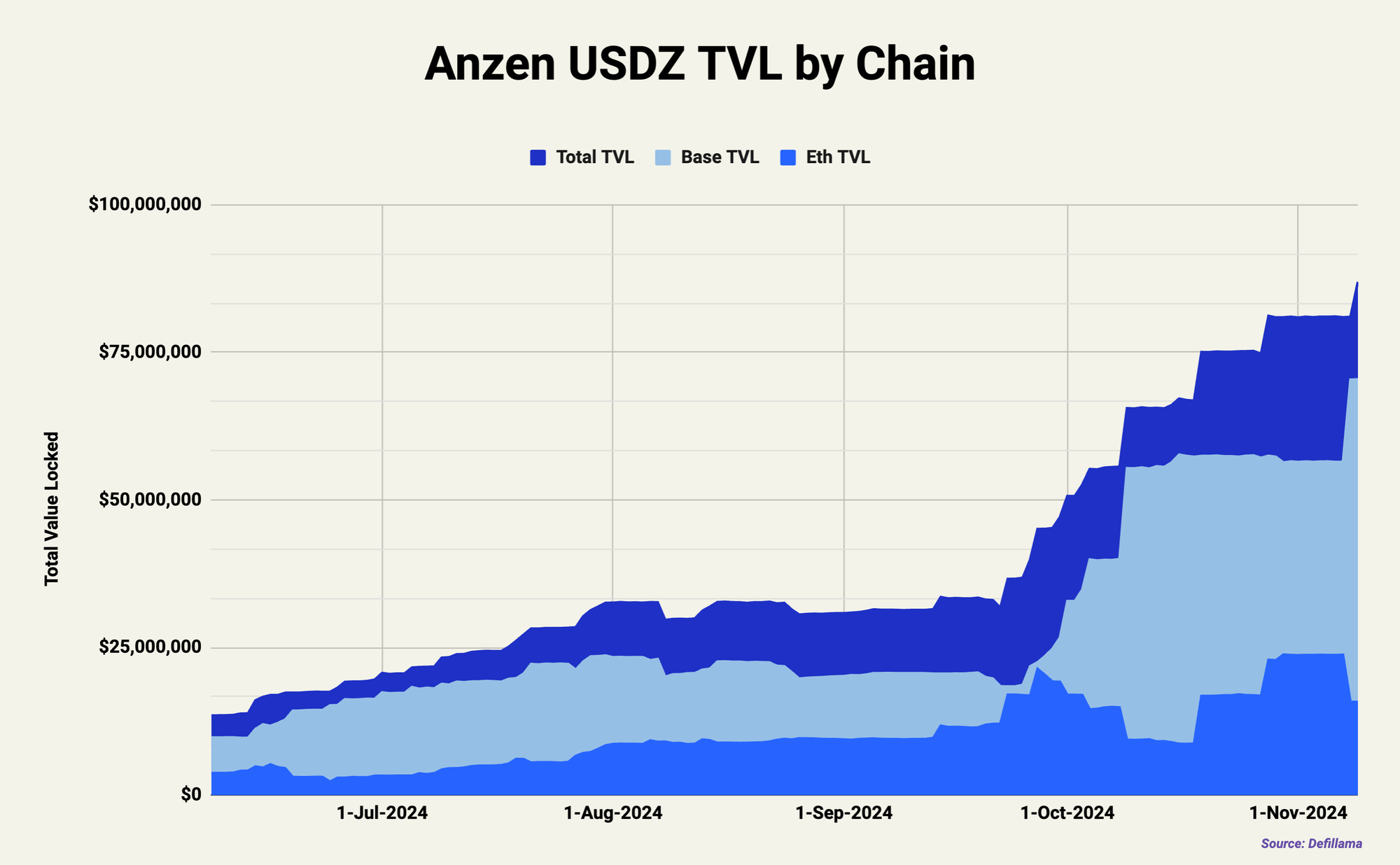

TVL - $86.9m

Since launching in May, Anzen has not only consistently grown its TVL across multiple chains, they've also succeeded in driving a majority of their usage on Base, forging a partnership with Aero to offer USDC/USDz LP rewards there. Anzen has also partnered with LayerZero to build a native bridge, allowing its TVL to freely flow between supported chains.

How to use it today

- Acquire USDz on ETH or several L2's by either minting with USDC thru Anzen or by swapping for it in DeFi. Use Anzen's native bridge to send it to the chain of your choice

- Stake for sUSDz to gain exposure to yield from private credit RWA portfolio. Staking rewards distributed every 7 days

- Deposit into a Vault (fixed-rate bond) to earn more yield on your dollars

- Hold and use USDz/sUSDz in DeFi to earn Z points for Anzen's eventual governance token airdrop. A list of integrations and point rates can be found here

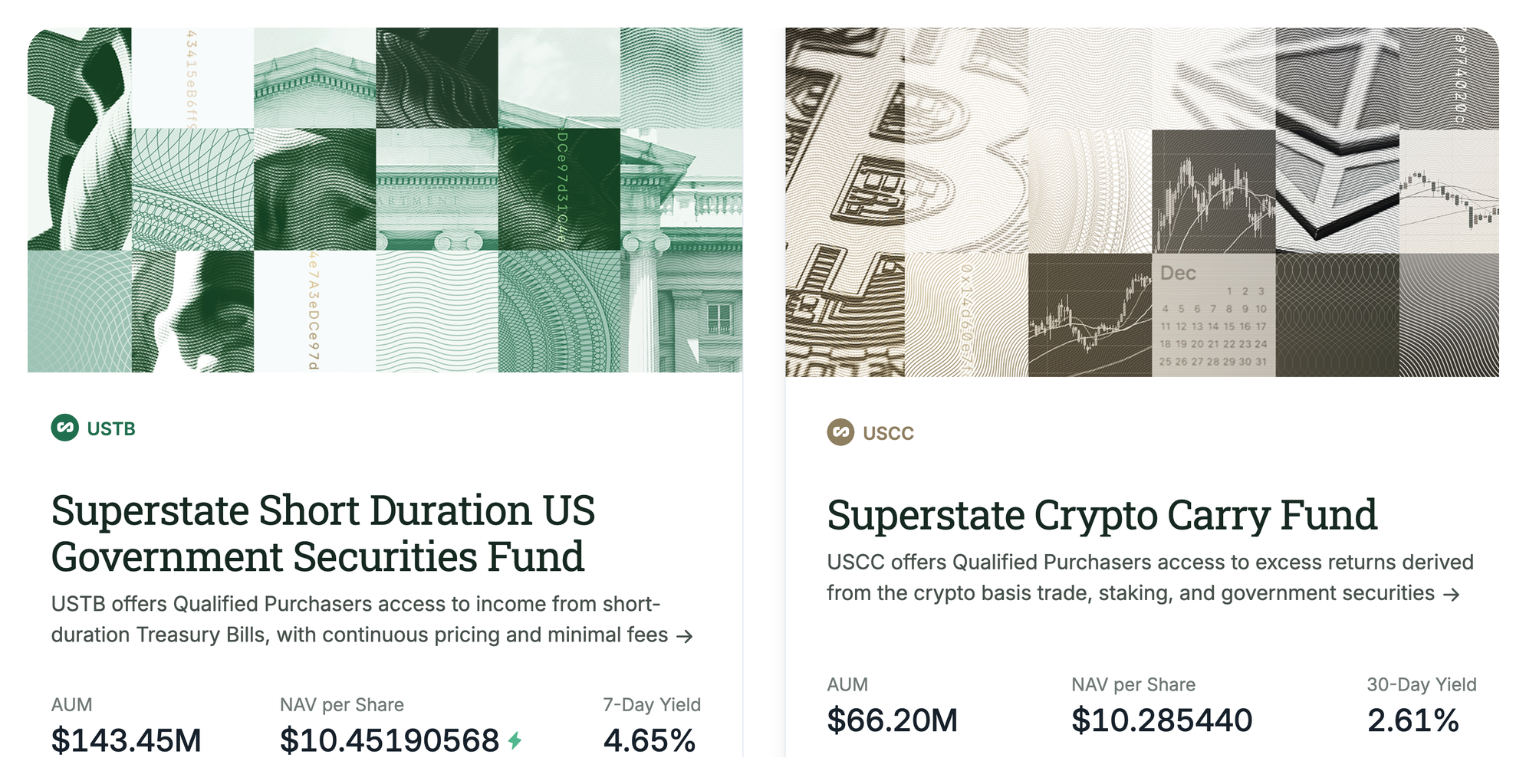

Superstate USTB & USCC

One main goal of this year's new wave of stablecoin innovation is to increase accessibility for institutions that have to take traditional risk parameters into account, unlike a lot of on-chain traders (you know who you are). Superstate is an asset management firm bringing traditional assets on-chain for this institutional audience, allowing them to benefit from the speed, programmability and compliance advantages of tokenization. To join Superstate and mint their stablecoins, you have to be a qualified purchaser who passes KYC and applies for their platform through their IR team.

If this is you, however, you may be interested in learning about Superstate's bifurcated offering: a treasury-backed RWA stable called USTB, and a cash-and-carry backed DeFi stable called USCC.

Mechanism

USTB (announced 2/1) and USCC (7/22) are unique from the other stablecoins in this report in that access to them is heavily restricted. Both tokens feature allowlists for minting, redeeming and transferring, and can't be swapped or borrowed for in DeFi. Assets for these coins are custodied by UMB Bank (USTB) and Anchorage Digital Banks, and private keys for users are managed by Fireblocks. Let's get into how they work and where they reside.

USTB, Superstate's Short Duration USG fund, invests in short-term treasury bills, targeting an ROI in line with the American federal funds rate (currently 4.58%). To mint USTB you must deposit either fiat USD or USDC with a minimum investment of $100k, and can only either redeem your tokens or send them to another allowlisted address. Income from USTB RWA holdings are reflected every day in the fund's NAV, and a 15bp management fee for the fund's assets won't accrue until $200m in AUM. The price of USTB started at $10/share, and will continue to appreciate over time as the NAV increases - you're minted a static amount and your token balance stays the same over time while the price creeps up to reflect the positive change in NAV. Recently, Superstate announced that USTB would feature real-time NAV pricing, interest accrual and operations (a departure from usual t+1 speed).

Superstate's other stable USCC has a fee structure, $10/token base NAV, and allowlist very similar to USTB, but instead of investing in treasuries, it takes its capital on-chain to open cash-and-carry, staking and on-chain RWA positions for its holders. If this sounds familiar, it's because it is - this is a very similar setup to the stETH-sDAI-short perp trio that Elixir uses (and that Ethena is implementing). It's a great way to combine the unique value prop of funding rate arb with the stability of the American risk-free rate in times of stress. Unlike USTB, USCC implements t+1/2 settlement (depending on order time) to give the fund a short buffer to unwind DeFi positions.

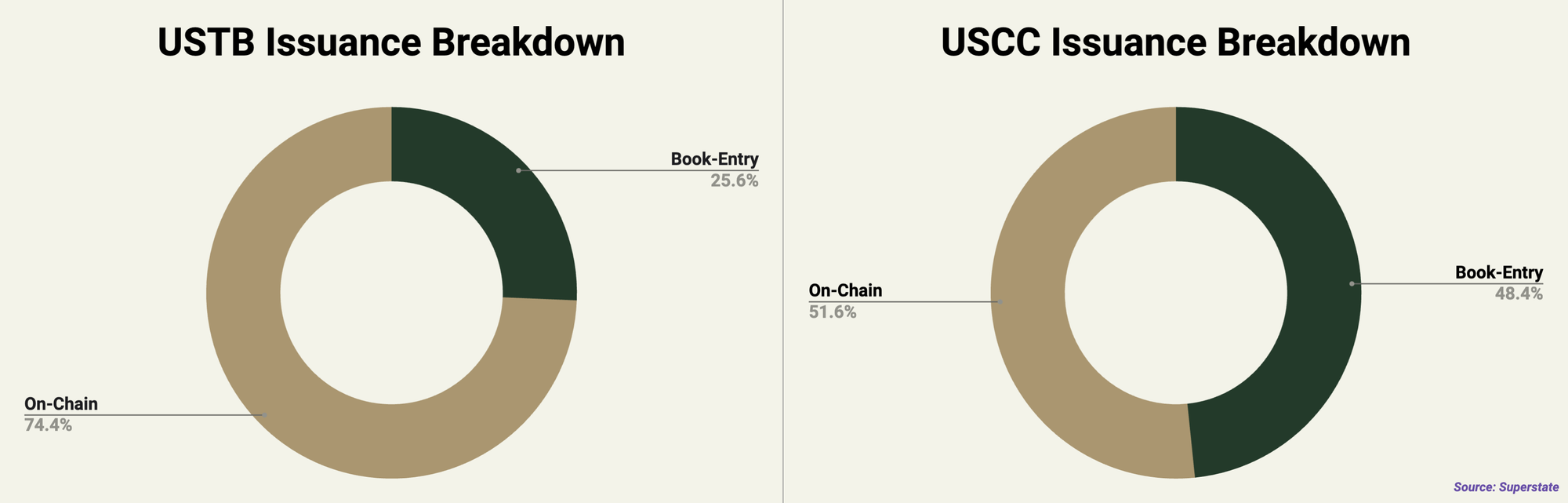

When you mint one of Superstate's stablecoins, you can choose between two methods of delivery: book-entry, in which the tokens are controlled by you but custodied by Superstate, and on-chain, in which you provide Superstate with an ETH address and receive ERC-20 tokens. These two differentiated options provide one choice for people who never want to learn what an ETH wallet is, and another for those who do want to venture into DeFi. Both are popular with Superstate's users, as seen below:

Superstate is legally organized as an asset trust, serving as the investment manager, meaning it benefits from bankruptcy remoteness. It's also exempt from SEC registration because it's only offered to QP's. Overall, this is a stablecoin protocol set up top-down for institutional capital.

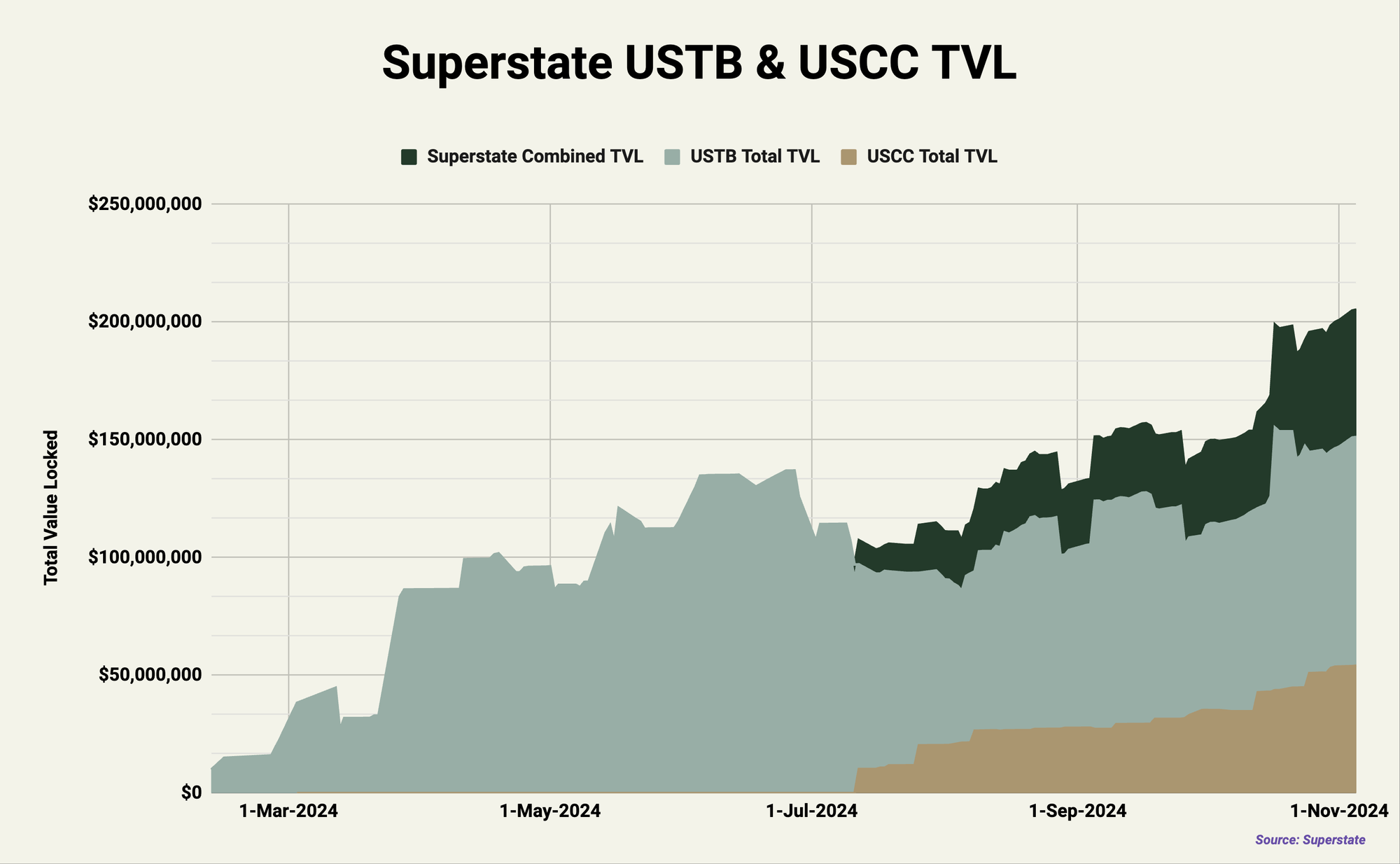

TVL - $205.3m

Since launching both USTB and USCC this year, Superstate has enjoyed fairly linear TVL growth. Currently, USTB accounts for almost 69% of TVL, but since launching in July USCC has grown as well. I'd expect it to grow more as the funding rate environment turns positive again (meaning the c&c trade is profitable once more).

How to use it today

You can't use Superstate unless you're an institutional investor, but if you are, fill out an application on their website.

Ethena UStb Update

Since Ethena has been around for a while, I'm not going to fully discuss how the protocol works, only this new product. If you want to check out Ethena in full, here's a link to their app and docs.

On 9/26, Ethena announced an update to its protocol mechanism: UStb, a new stablecoin fully backed by Blackrock BUIDL in partnership with Securitize, enabling a second fiat stable product alongside USDe. UStb will invest its collateral into BUIDL, Blackrock's tokenized asset fund that invests in short-term treasuries, USD, and repurchase agreements - very similar in function to traditional stables like USDC. UStb will operate completely separately from USDe, with a different risk profile and backing.

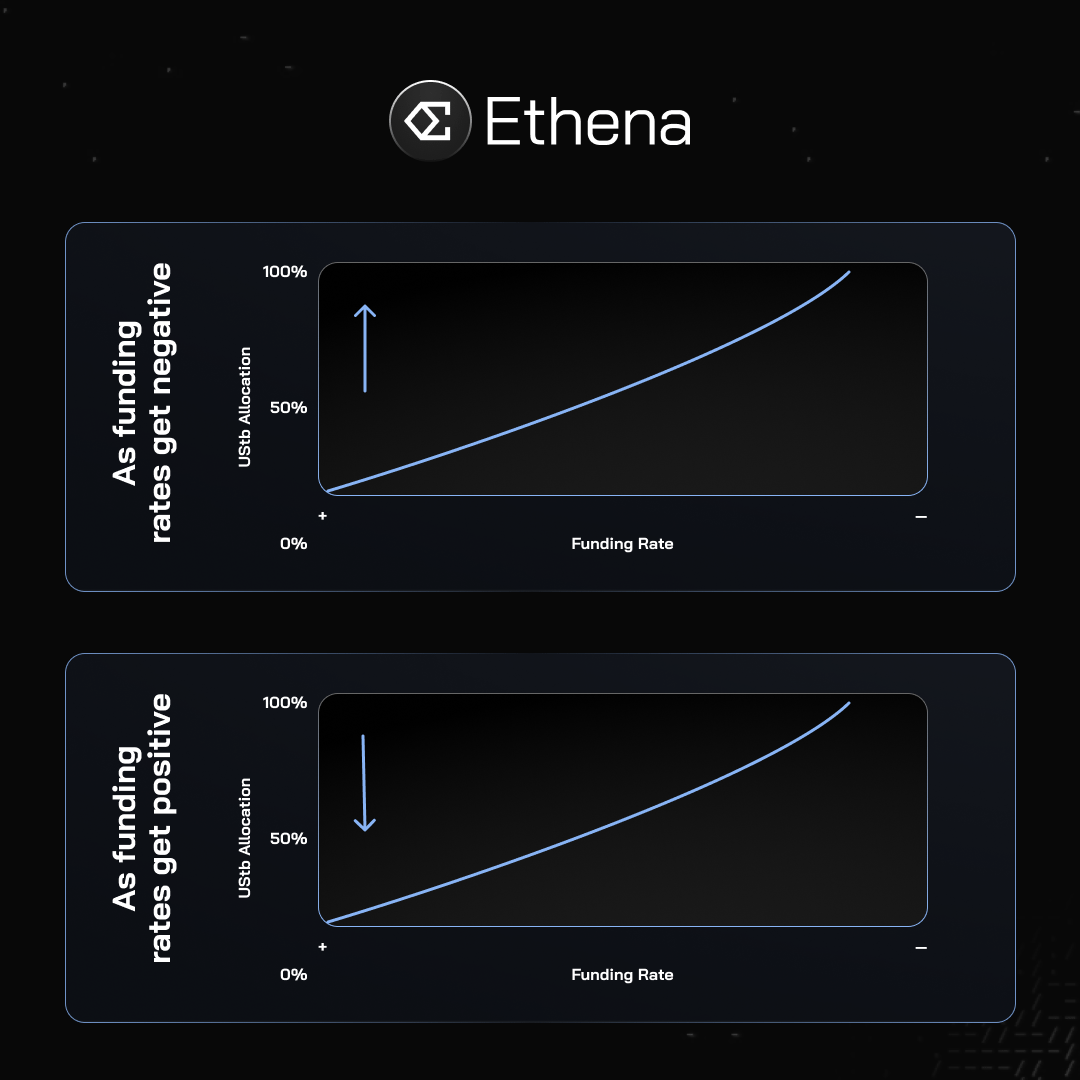

Ethena will also use UStb during negative funding environments in the same way Elixir uses sDAI - when funding turns, the protocol will be able to close hedging positions backing USDe and re-allocate into UStb. This will give Ethena increased downside protection against prolonged periods of negative funding.

TVL - N/A

Yet to launch.

How to use it today

Keep an eye out for further announcements from Ethena on X and Mirror involving UStb's debut. It also wouldn't be shocking if UStb received some kind of special incentives or multiplier for the season 3 airdrop.

In Conclusion

I know I just threw a metric ton of information at you, but hopefully you were able to navigate through this article effectively and learn something. All 8 of these protocols are differentiated, well-thought-out, well-funded, and offer exciting new ways to put USD to work in the wide world of on-chain crypto. Keep an eye on all of them, and on non-Circle/Tether stables in general, to both continue building TVL and chipping away at USDC/T dominance in the broader market.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.