The Monad Deep Dive - The Most Anticipated L1 In 2024

Monad aims to solve many of the EVM scaling bottlenecks through parallelized execution, the Monad dB and more.

Introduction

Gmonad! Welcome back to yet another research report. For today’s piece, I had the pleasure of interviewing Kevin (@intern) who is working on growth at Monad.

Monad is an upcoming layer-1 chain set to launch later this year. Despite not being live, Monad has amassed a massive community already, reaching an almost cult-like status with members having created their own pet, Molandak, several mixtapes on Soundcloud and more.

Monad stands out by aiming to become a highly scalable monolithic L1 blockchain that’s both EVM compatible and able to process over 10,000 transactions per second with a 1 second blocktime. What allows this scalable perfomance without compromising security and decentralization is parallelised execution, the Monad Db and more. Monad raised $19m in a seed round led by Dragonfly with participation from Placeholder, Shima Capital, Lemniscap, Cobie and others.

Bullets

- The Monad Origin Story 🌄

- The Monad Tech Stack 📟

- Which apps can be built on Monad? 🎮

- Roadmap 🛣

- Conclusion

Thanks for reading DeFi Frameworks! Subscribe to receive a free research report twice/week 🗞

The Monad Origin Story 🌄

Monad has been in development for roughly two years and is founded by Keone Hon, James Hunsaker and Eunice Giarta. Keone and James are the two technical co-founders and worked together for eight years at Jump Trading. Sitting at the same high frequency trading desk and competing against 20 other teams internally at Jump, Keone and James were able to consistently rank as one of the top performing desks over the years, facilitating more than $10 trillion dollars in notional trading volume per year. With this level of volume, and by conducting thousands of transactions per second, Keone and James experienced firsthand the difference a microsecond makes in execution.

After moving into crypto, Keone was working on Solana DeFi and James was building Pyth. They started building Monad in 2022 after realizing that it’s possible to implement a series of fundamental optimizations to the EVM, which have been standard in high performance computer science over the last 20 years, but have not yet been implemented to the EVM. By introducing these components, you can create an EVM that is much more performant and solve many of the current scaling bottlenecks.

“They were really the first people who pushed for a parallel EVM. They have a better understanding of it than anyone in all of crypto right now. There's no doubt in my mind that a lot of the things that other chains currently are claiming to be a parallel EVM, Monad have had finalized over a year and a half ago. So really just multiple years of full force heads down engineering, understanding the true ins and outs to create the best possible product for a highly performing EVM. Monad is very close to having the first working product on it. I would say within a month, we will have the first internal private testnet up and running.“

The Monad Tech Stack 📟 - Is Parallelization Just a Narrative?

It turns out parallelization is far from just a buzzword/narrative but can enable scalable and efficient execution. What makes Monad scalable and able to process over 10,000 transactions per second however is much more than just the parallelized execution engine.

“I think a lot of people think of parallel execution as the active ingredient. And if you can add parallel execution to the EVM, then all of a sudden it's way more performant. But that's actually not the case. Parallel execution on its own really doesn’t do much in terms of creating a more performant EVM. It's really parallel execution, combined with a few other optimizations, that allows parallel execution to unlock a lot of performance.“

Let’s look at each of these individually:

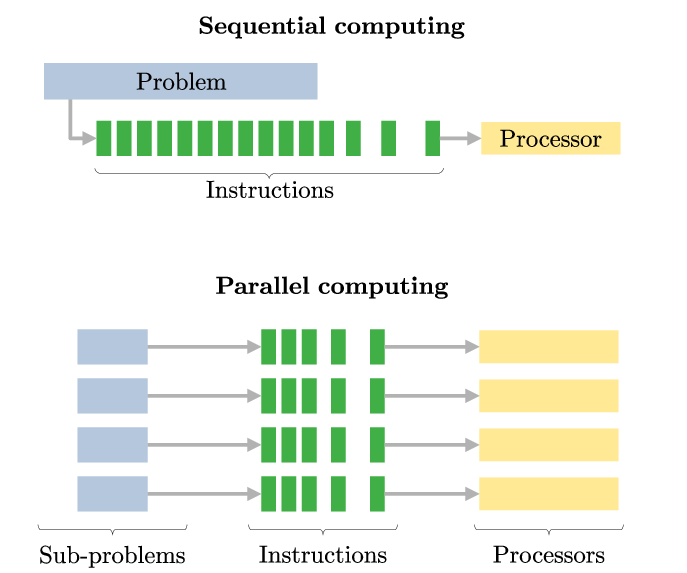

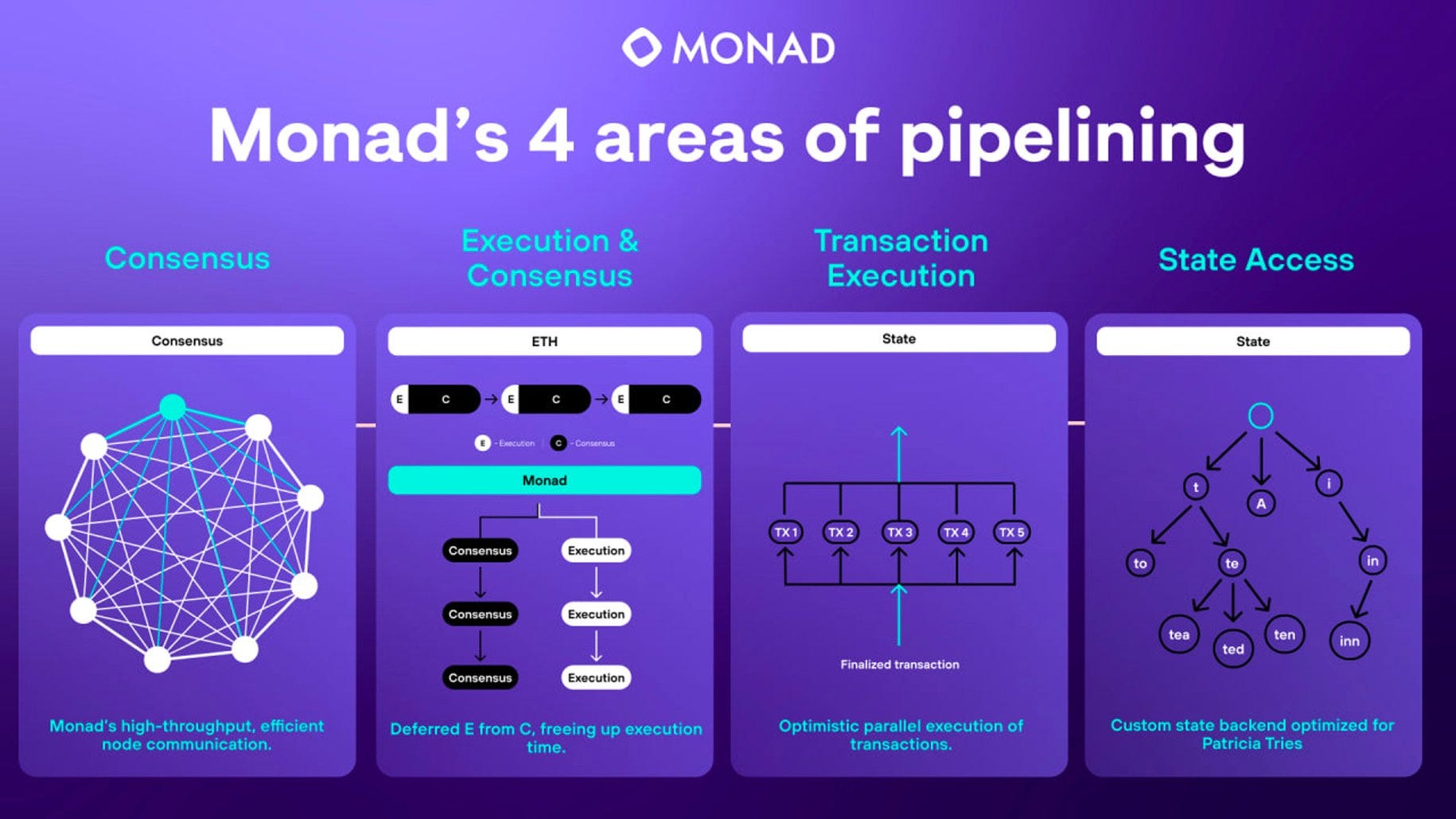

Parallel execution

Parallelisation refers to the ability of executing multiple tasks at the same time, instead of one after the other (sequentially). While parallelized processing can be more complex, it can significantly reduce processing time and increase efficiency by dividing the workload amongst multiple processors:

Monad utilizes parallel execution which allows several transactions to be processed at the same time. It’s important to note that Monad blocks still are a linearly ordered set of transactions just like on Ethereum.

Monad uses optimistic execution which means that the chain will start executing transactions before earlier transactions in the block have completed. To avoid errors and incorrect execution, the state of transactions are merged sequentially in the blocks to ensure correctness.

MonadDb

A parallelized execution engine doesn’t add much to the blockchain performance if there isn’t also a state database that allows for parallelized reading and writing to the disk. Let’s look at with an example 🚙

Sequencial execution (Ethereum): Picture a one-lane highway with a single tollbooth allowing one car to pay their ticket and pass through at a time.

Parallelized execution: There are now 20 lanes on the highway and 20 tollbooths but there can still only pass one car through the entire highway at a time. So if a car is passing through toll 1, the cars in toll 2 or toll 3 will have to wait.

Parallelized execution with a parallelized data base: All 20 tolls can be used at the same time and 20 cars in different lanes can pass through at the same time.

The MonadDb (Monad Database) is what unlocks parallel processing and the fast finality/high TPS of the chain.

Asynchronous Execution and Consensus

Another part of the Monad stack enabling 10k TPS and 1 second block time is asynchronous execution and consensus:

“Right now in an ethereum block, execution happens in about 1/10th of a second and then the next 11.9 seconds are all done on consensus. What Monad does is split this up so that instead of having a 12 second block and a 1/10th of a second spent on execution, now you have two separate swim lanes, so you can unlock 100% of the budget for a block for execution. Think about it as like if Ethereum had 12 seconds per block for execution instead of a 1/10th of a second. That's a 100x increase. It's very standard and something that a lot of people have been implementing it in computer science for a long time, but it just doesn't exist in the EVM currently. So that's another big unlock.”

“So all this combined, that's really what gets all of the performance. You need all of them for it to actually function and get to 10,000 transactions per second of throughput.”

All this, combined with being fully EVM compatible is what makes Monad stand out from the competition. Any EVM protocol can deploy on Monad in an easy fashion and tap into the high execution environment.

For a full description of the Monad design, visit the v1 docs here.

Which Apps Can Built On Monad? 🎮

Now that the tech stack has been covered, let’s explore the upcoming Monad ecosystem. In general terms, all protocols benefit from improved execution, i.e. faster finality and more TPS. There are however some specific applications that are suddenly unlocked by building on a fast chain like Monad.

One of the most obvious use-cases that jump to mind is trading protocols. Specifically for on-chain orderbook DEXs (both spot and futures), it will be attractive to build on Monad. Orderbook exchanges have historically been centralized (Bybit, Binance, Coinbase) etc and while most of these offer deep liquidity, fees are relatively high and there are obvious risks tied to the lack of self-custody. The AMM model, utilized by GMX, Gains, Synthetix, etc., allows for on-chain self-custody but liquidity can be limited causing poor execution and slippage for traders. As a result, on-chain decentralized orderbook exchanges are, therefore, considered by many to offer the best of both worlds. Instead of having to spin up a custom app-chain for efficient execution however, orderbook DEXs can seamlessly deploy on Monad which is EVM compatible throughout the entire stack.

One of the early builders on Monad is the Elixir Protocol which is a delegated proof of stake network powering liquidity on various orderbook exchanges. With Elixir, users can deposit liquidity into various vaults which act as market makers on orderbook exchanges. Elixir is currently live on Vertex and Rabbit X and is set to launch on Injective, dYdX, Bluefin, Monad and more. For a full breakdown of Elixir, see the article published a few weeks ago:

Orderbooks vs AMMs - Democratizing Market Making w/ Elixir Protocol🔮

Thor • Dec 27, 2023

Perpetual futures remain one of the largest verticals in DeFi and have evolved a lot since being introduced by Bitmex many years ago. Today, there are many different on-chain iterations of perpetual futures including orderbook based protocols like dYdX, Vertex, Hyperliquid and Aevo but also AMM based protocols like GMX, Gains and Synthetix.

Read full story →

Furthermore, The Pipeline, a native Monad content platform recently did a podcast episode with Pike Finance who have expressed early excitement around launching on Monad later this year. Pike Finance is an omnichain money market powered by wormwhole, Circle and Pyth which launched their beta a few days ago on various EVM chains.

Another use-case is large-scale on-chain games requiring high throughput in order to function properly.

“I think gaming is something that on paper it sounds really good. You have this whole virtual economy and world, but you really need the performance of the underlying base layer to allow it to have a million daily active users. An example would be playing Fortnite with your friends. If only 500 people could play Fortnite at a time, it's not that fun. You need like a million, right? And that's where it really becomes interesting and fun and competitive. So on the gaming side, we allow games to go from a few hundred active users at any given point to millions“

Monad is seemingly already talking with gaming studios about building and enabling truly high throughput games on-chain.

Roadmap 🛣

Monad is set to launch on mainnet later this year, potentially at some point in Q3. It is therefore still early days for the chain however the devnet, which is an internal testnet, is set to go live soon.

There has already been large interest both from existing EVM protocols looking to bridge over due to the high scalability and EVM compatibility but also from teams looking to build native applications on the Monad blockchains. In addition, Monad recently announced a day one partnership with Layerzero which will make it significantly easier to bridge liquidity to the ecosystem.

Given the large interest from both the user community and developers, the hype around Monad will likely continue to grow going towards the public testnet and mainnet later this year.

Conclusion

In a world where new L1 and L2 chains are launching on what seems to be almost a daily basis, Monad stands out due to the scalable tech, very capable team and cult-like community. As Monad is a monolithic chain, I’d say its closest competitor is Solana and perhaps Sui. There are however many different scaling approaches trying to gain adoption (rollups, app-chains, modular stacks etc). It’s therefore going to be interesting to see whether Monad is able to attract liquidity, users and developers in this highly competitive infrastructure environment but given the large excitement already, this seems likely. So while it still is early days for Monad, you would be doing yourself a favour keeping up to date with what’s happening within the ecosystem.

To stay updated I recommend following Monad on Twitter, following The Pipeline and subscribing to my research newsletter if you haven’t already🫡

Thanks for reading DeFi Frameworks! Subscribe to receive a free research report twice/week 🗞

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.