The Modular Watchlist for 2024 - 35 Modular Protocols You Should Know

Modular season is here but it's tough to keep up with the ecosystem. Here's what you should know.

Introduction

It’s Modular Money season. But what does modular money actually imply? And why are there 100’s of new ‘modular‘ protocols on my X timeline?

Modularity has been a hot narrative this year and was kickstarted by the launch of Celestia and the TIA token last year. It’s more than just a buzzword however as modular infrastructure components can help solve the scaling bottleneck for blockchains by offloading certain components to specialized infrastructure.

It’s important to underline that modularity isn’t a short term narrative that fades away as we progress further into the bull market. Rather, it’s a core design principal for blockchains and will likely play an increasing role in the future of crypto. With that in mind, it’s important to have an understanding of the what modularity means and which protocols you should have on your watchlist. Today’s research report explores just that.

Bullets

- What is Modularity?

- Modular Ecosystem Watchlist

Thanks for reading On Chain Times. Subscribe to receive a free research report every 🗞

What is Modularity?

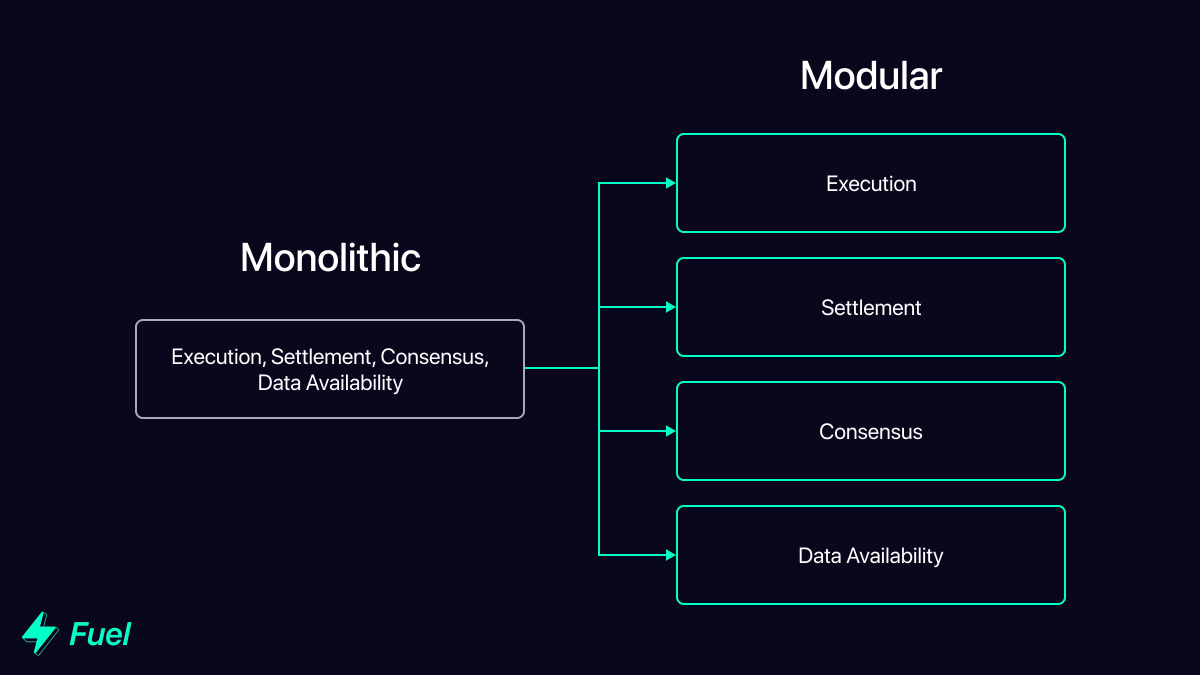

What does modularity within blockchain architecture signify? You’ve likely heard about this by now but as a quick refresher, the image below demonstrates it beautifully:

At its core, blockchains have four roles, or in other words consist of four layers:

- Execution layer - Processing transactions from dapps on the chain and executing smart contracts. It’s here computation takes place and account balances are updated.

- Settlement layer - Determining the overall state of the blockchain. Finalizes the state of transactions on the chain.

- Consensus layer - Sequencing of transactions by ensuring nodes reach a common understanding of the state of the chain.

- Data availability layer - ensuring data (transactions, blocks etc.) is publicly available i.e. accessible to all network participants.

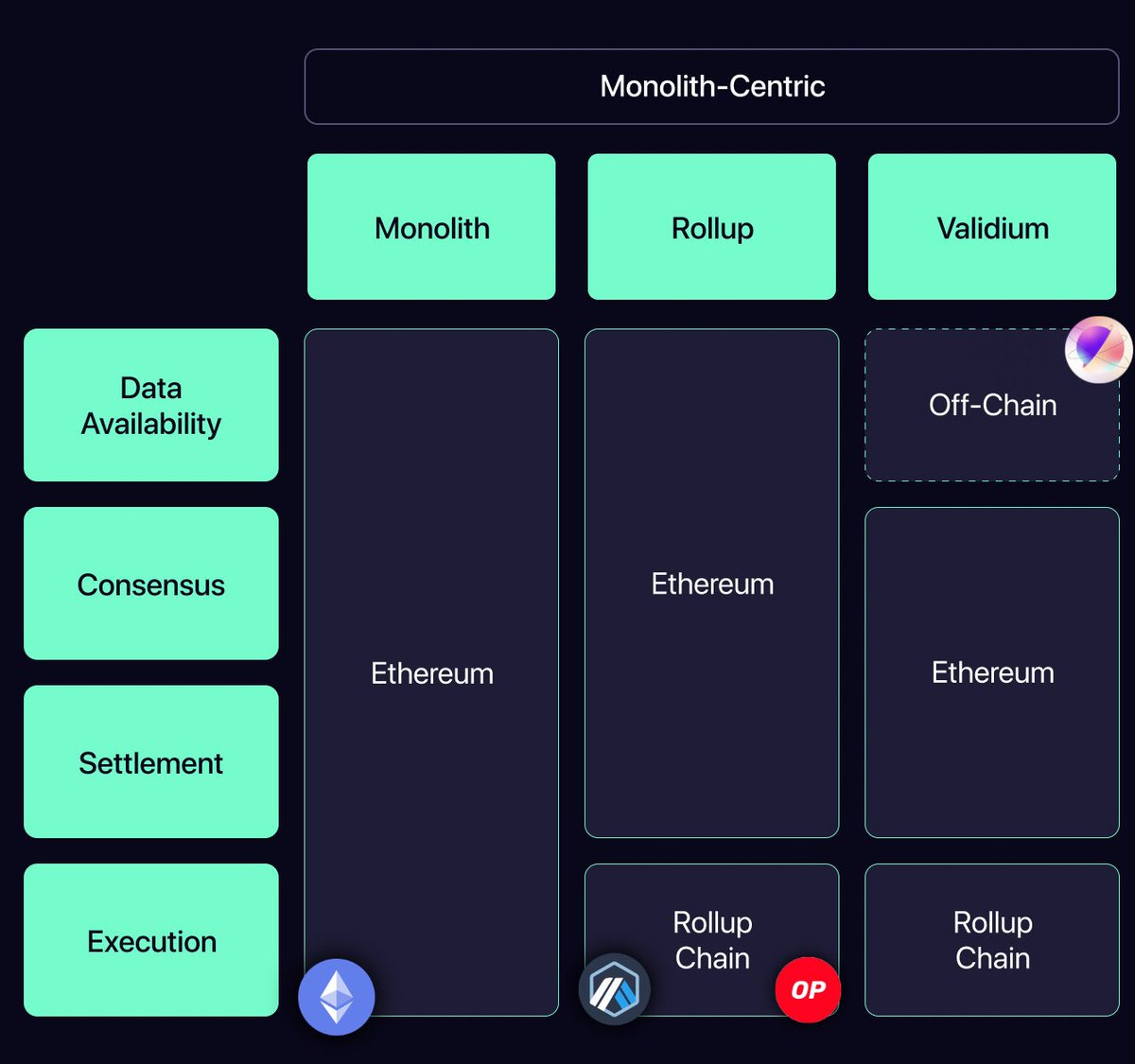

Monolithic chains like Ethereum mainnet, Solana, Avalanche, Sui, Sei and more are all monolithic chains handling all these components themselves. Optimistic rollups like Arbitrum and Optimism are a part of the modular stack as they act as execution environments, offloading data availability, settlement and consensus to Ethereum mainnet.

A rollup like Manta is even more modular as it is an execution environment using Celestia for cheap data availability and Ethereum mainnet for consensus and settlement.

There are many examples and many different combinations of modular infrastructure. By knowing the ones below, you are on the right trajectory in you modular journey.

The Modular Ecosystem

[In alphabetical order]

Aethos ~ Decentralized policy engine for smart contracts. Allows embedded requirements in smart contracts such as completing milestones in a game in order to claim in-game items, ban exploiters from using smart contracts, integrated identities on rollups, embedding token policies and more. Aethos is an AVS that taps into EigenLayer. Read more.

AltLayer ~ Offers rollups-as-a-service and restaked rollups. Restaked rollups tap into Eigenlayer restaking and further offers decentralized sequencing. AltLayer is working with Arbitrum to easily create Arbitrum Orbit L3 chains with the option of further using EigenDA or Celestia for DA. Altlayer Raised $14.4m led by Polychain and is an AVS that taps into EigenLayer. Read more.

Astria ~ A shared sequencer network for rollups. With Astria, rollups can tap into a unified network of decentralized sequencers to get fast, censorship resistant and permissionless block confirmations. Astria appears to be working closely with the Celestia team. Read more

Avail ~ “Base-layer for blockchains“ - Avail recently announced the ‘Avail Trinity’: 1. data-availability, 2. consensus, and 3. a shared security layer for all types of rollups (zk, optimistic, sovereign and app-specific). Avail further raised $27m led by Dragonfly and Founders Fund. Read more

Babylon ~ Babylon offers native permissionless BTC staking on Bitcoin which accrues yield from securing rollups. Babylon is working together with AltLayer to build a “decentralized verification layer for rollups secured by BTC“. Read more.

Blockless ~ Modular infrastructure for launching nnApps (network neutral). With Blockless, applications can be powered by usage via community devices being linked with computational tasks. Blockless is an AVS that taps into EigenLayer. Read more

Caldera ~ Rollups-as-a-service. Easily deploy a rollup with a few clicks on Arbitrum, Optimism or Polygon and choose between a large variety of data-availability providers. See the video below. Read more

Cartesi ~ An application specific protocol built with the Cartesi virtual machine which contains a Linux operating system. The power of Linux is “giving Web3 developers access to decades of existing code libraries, programming languages, and open-source tooling“. $CTSI, the native governance token has been live since 2020. Read more

Celestia ~ Data-availability provider built as a Cosmos chain. Celestia is already powering Aevo, Lyra, Manta, Dymension, Arbitrum orbit chains, Altlayer, Berachain, Eclipse and many many more. Celestia kickstarted the modular era and $TIA is sitting at a $15b+ valuation. Read more

Conduit ~ Rollups-as-a-service on Arbitrum and Optimism with multiple data-availability solutions. Some rollups that already build with Conduit include Zora, Aevo, Lyra, Mode, Parallel and more. Read more

Drosera ~ “Decentralized Automated Responder Collective (DARC)”. Drosera offers a permissionless security marketplace to mitigate and contain exploits. Drosera raised $1.5m with participation from Arrington Capital, Comfy capital and more and is further an AVS powered by EigenLayer. Read more

Dymension ~ A protocol powering ‘Rollapps‘, a standardized template for modular rollups built on top of the Dymension hub and powered by the Cosmos IBC bridge. “RollApps are ERC-20 tokens, but for chains“. The Dymension hub handles the settlement and consensus of the rollapps while off-loading data-availability to Celestia. Read more

Eclipse ~ An upcoming rollup on Ethereum. Built with the Solana virtual machine for execution, Ethereum for settlement, Celestia for data-availability and Risc 0 for proofs. Aims to bring Solana dapps to Ethereum. Read more in the article below:

A Solana Rollup on Ethereum? An Interview With Eclipse

Thor • Oct 4, 2023

Last week I had the pleasure of interviewing Neel Somani, the founder of an upcoming Ethereum layer-2 by the name of Eclipse. Eclipse is different from other Ethereum rollups as it embraces modularity from top to bottom. I asked Neel about these design choices as well as various other subjects such as the mainnet release, fee structure/value-accrual, a…

Read full story →

EigenLayer ~ A permissionless marketplace for Ethereum restaking. ETH stakers can deposit ETH and ‘restake‘ to power actively validated services (AVS’) that wish to inherit Ethereum native security for their rollup, bridge, oracle or something else. These AVS’ pay restakers for their service. EigenLayer recently announced a $100m series B investment by a16z. Read more

EigenDA ~ The first EigenLayer AVS. EigenDA is an Ethereum native data-availibility layer. Once live, EigenDA is set to power Mantle, Celo, Caldera, certain Arbitrum Orbit chains, and several more. Read more

Espresso ~ Offers the ‘Espresso sequencer‘ for rollups. Espresso recently announced ‘Based Espresso‘ which is a marketplace for shared sequencing in which different types of rollups can sell blockspace to block proposers. Espresso raised $32m back in 2022 from Electric Capital, Sequoia and more and is an AVS powered by EigenLayer for Ethereum alignment and strong economic security. Read more

Thanks for reading On Chain Times. Subscribe to receive a free research report once/week 🗞

Ethos ~ Bringing Ethereum security to the Cosmos ecosystem via their integration with EigenLayer and restaking. EigenLayer restakers can chose to provide security to Ethos which is an AVS and is used to power the Ethos L1 chain. Restakers earn additional yield as Cosmos chains tap into this security and pay for it. Read more

Fluentxyz ~ Building the Fluent zkWasm L2 on top of Ethereum, the Fluent virtual machine (VM) and a modular framework for spinning up Wasm execution environments. Wasm stands for WebAssembly and is is a ‘platform independent and highly efficient binary instruction format for a stack-based virtual machine’. Fluent execution environments have multiple DA layers to tap into as the protocol is integrating EigenDA, Celestia and more. Read more

Fuel ~ “The rollup operating system for Ethereum“. Utilizing a UTXO approach, Fuel is a design framework and SDK for parallel transaction and high throughput execution environments/rollups on Ethereum. Fuel has created its own programming language called Sway inspired by Rust and other languages. Fuel raised $80m in 2022 led by Blockchain Capital. Read more

Hyperlane ~ An interoperability layer that aims to connect blockchains. Hyperlane makes it possible for modular rollups to incorporate Hyperlane interoperability in just a few clicks to avoid liquidity fragmentation. Hyperlane raised $18.5m back in 2022 led by Variant. Read more

Hyperspace AI ~ A Peer-to-Peer Artificial Intelligence Network. Hyperspace AI is a project which aims to create a large network of LLM’s that can be used in a permissionless fashion by anyone. The network runs on community infra with a low entry barrier (smartphones, browsers etc. can run nodes). Read more

Initia ~ “A network for interwoven rollups“. Initia makes it possible to build and scale interconnected blockchains with different modular components integrated. The first rollup to launch on Initia is Blackwing, a modular rollup for margin trading. Initia raised $7.5m led by HackVC and Delphi Ventures. Read more

Karak ~ A “risk management Layer 2 blockchain supercharging restaking, AI, and a new generation of secure applications“. Karak powers ‘rollaps’ via their modular security, high customization and built-in machine learning tools. Karak recently announced a $48m Series A round from Lightspeed, Pantera and more. Read more

LaGrange ~ Building ‘state committees‘ which are used by optimistic rollups to generate zero-knowledge proofs. These can be embedded into bridges and other cross-chain messaging protocols increasing the security by orders of magnitude. Lagrange operates as an EigenLayer AVS in the sense that restaking powers the Lagrange zk lightclients. Lagrange raised $4m from 1kx, Maven11, Lattice Fund and more. Read more

Lava Network ~ A modular data layer that chains and rollups can tap into. Lava is essentially an rpc and indexing layer for chains. Data-accessing is in many cases fragmented and so by using the Lava network, chains can ensure easy and fast data-access for users and developers. Lava raised $15m from Hashkey, Jump, Tribe Capital and more. Read more

MegaETH ~ “Building ultra high-throughput & low-latency EVM-compatible L2s.“ MegaETH is focusing on improving the Ethereum execution client via parallel execution amongst other things in order to scale L2 rollups. The vision is to supply ‘MegaRollups’ both zk and optimistic that can handle 100-200k transactions per second. MegaETH will use EigenDA for data availability. Read more

Mitosis ~ “The modular liquidity protocol“. Mitosis aims to unify the increasingly fragmented liquidity landscape of DeFi by building a cross-chain protocol for facilitating assets and message transfers between blockchains. Mitosis is capital efficient by making the bridge collateral liquid. Mitosis has partnered with Hyperlane making it easy to deploy Mitosis smart contracts and connect modular chains. Read more

Movement labs ~ Creating a network of modular blockchains built with the Move programming language. Movement runs a builders program to onboard developers and have created M2; a MoveEVM zk layer 2 on Ethereum with parallelized execution and shared sequencing. Movement raised a $3.4m pre-seed round to grow adoption around Move. Read more

Neutron ~ A Cosmos app-chain powering ‘Integrated Applications‘, a framework for building defi applications on the Neutron L1 that inherit features from both app-chains and smart contracts. Integrated applications have access to mempools, block automation, customization of their blockspace and more. Neutron raised $10m in 2023 led by Binance labs. Read more

Omni ~ “Low latency interoperability network that connects Ethereum rollups securely through the use of restaking”. The Omni L1 (communication layer) is secured by restaked ETH and has already gotten a commitment from EtherFi of $600m in restaked ETH. Omni has further partnered with Mantle, Injective and several others and has raised $18m from Pantera, Two Sigma, Coinbase and more. Read more

Plume ~ Plume network is a modular L2 designed for RWA applications. What this entails is a focus on compliance (built in KYC and AML feautes), easy user onboarding, instant settlement and more. The Plume L2 integrates with Celestia, Hyperlane, EigenLayer, Omni and more. Read more

Risc Zero ~ zk Proving that modular infrastructure components can tap into. Offering Bonsai, a smart contract SDK, the Risc Zero zkVM and the Risc Zero proof system. For one, Eclipse (the SVM L2 described above) uses Risc Zero for their zero-knowledge proofs. Other protocols building with Risc Zero includes Altlayer, Citrea, Drosera, Layer N, Optimism, Avail and many more. Risc Zero raised a $40m series A in 2023 led by Blockchain Capital. Read more

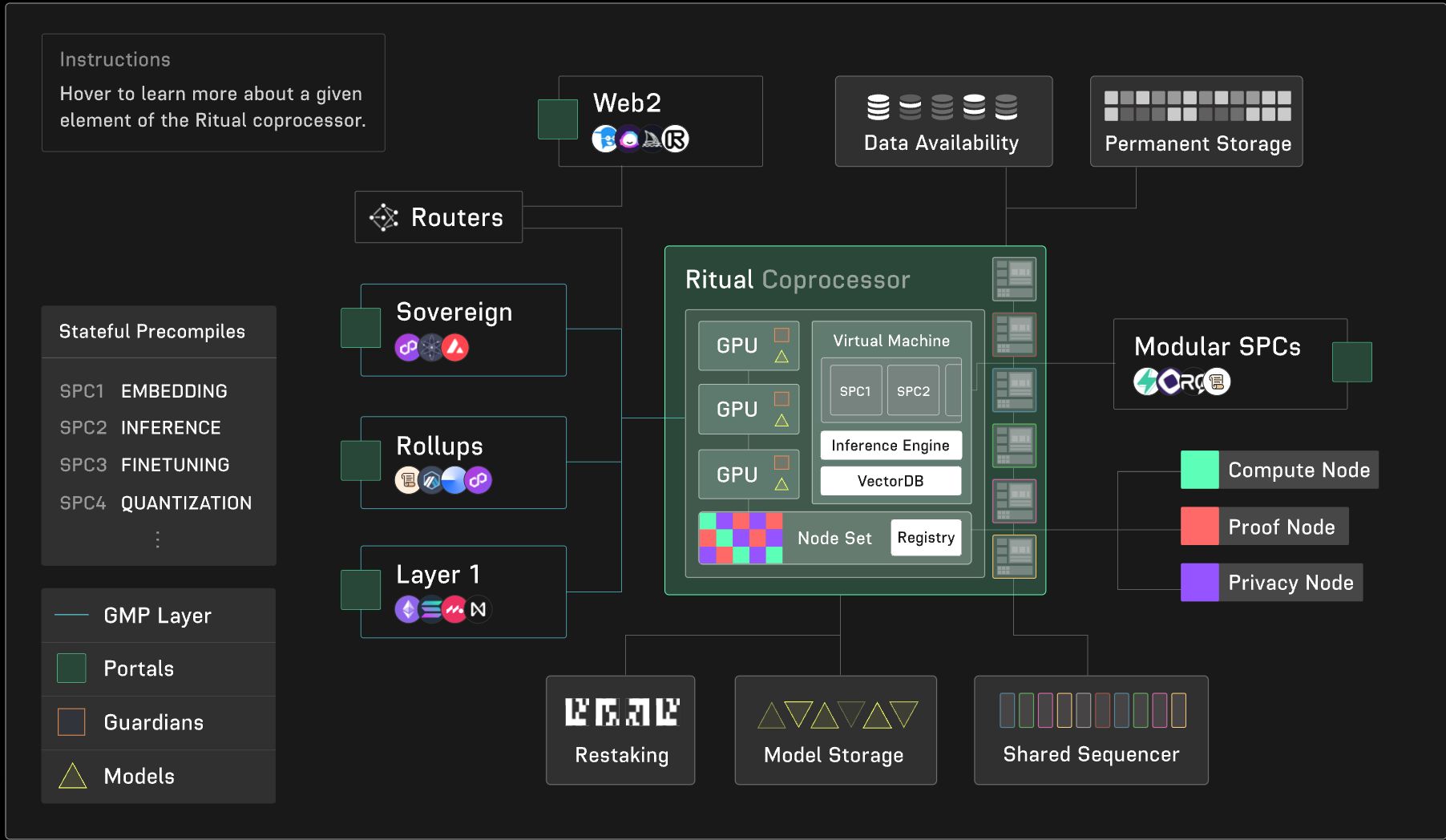

Ritual ~ A community owned AI network. Ritual offers an AI coprocessor for blockchains making it easy to integrate AI models into crypto applications. The Ritual Superchain is a suite of modular execution layers revolving around different AI models. To bootstrap the ecosystem, Ritual will use EigenLayer for security. Ritual raised a $25m series A led by Archetype. Read more

Ternoa ~ “A cross-layer multi chain tech stack designed to maximize developer accessibility“. Ternoa offers a privacy focused filesystem and a layer 1 blockchain amongst other things. The chain has been live since 2022 and has over 50 dapps building on it. The native governance token of Ternoa ($CAPS) has been trading since 2021. Read more

Taiko ~ Building an Ethereum equivalent (type 1) zkEVM. Taiko is further designing a ‘Based Contestable Rollup‘ which is a rollup architecture featuring based sequencing and a contestation mechanism. Based sequencing is a decentralized and permissionless way of sequencing L2 transactions. The Taiko tech-stack stands out by being Ethereum equivalent and highly scalable at the same time. Taiko has raised $22m led by Sequoia China and Generative Ventures. Read more

That was a lot! If you made it this far, hats off to you. Remember that these are just a some of the protocols from a rapidly expanding ecosystem. Also, the more familiar household names like Ethereum, Arbitrum, Optimism, zkSync, Polygon, Near and more are also all building their own version of the modular stack with L3’s, DA layers and more. But that’s for a separate article.

If you enjoyed, kindly leave a like and subscribe if you haven’t already.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.