The MKR Bull Case - A Fundamental Analysis & Valuation of Maker

With a growing DAI supply and the Maker Endgame around the corner, MKR is positioned for significant upside in 2024.

Introduction

In recent months, the returning of the bull market with various positive catalysts around the Maker ecosystem such as the Ethena integration and Maker’s Endgame governance roadmap has warranted a fresh look at the protocol’s business model. This article aims to supply a realistic growth projection of DAI and what that might mean for the MKR governance token.

Maker DAO 101

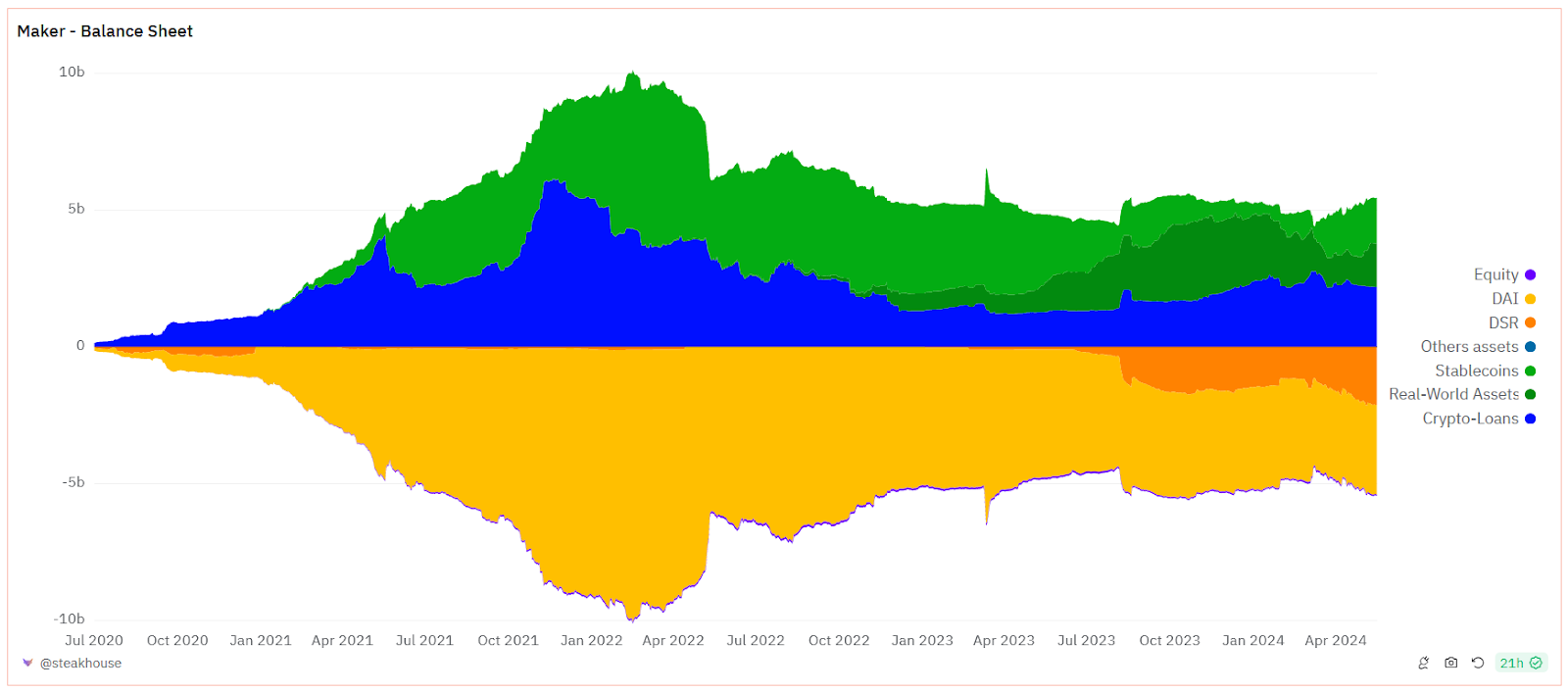

Maker has been called DeFi’s “central bank”. At its core, Maker is a simple stablecoin protocol. Maker takes in deposits in crypto collateral, which is then used to issue out loans in its DAI stablecoin which it earns an interest rate from. At its genesis, Maker only accepted ETH collateral in line with its ideological vision of creating a censorship-resistant and decentralized stablecoin. This however proved difficult to scale DAI against its USDC and USDT competitors due to a lack of demand to hold DAI in bear market conditions.

To remain competitive, Maker relies on various mechanisms. Firstly, Maker induces the demand of DAI by offering yield for staking DAI – known as the DAI Savings Rate (DSR). Second, it enabled in 2022 the ability for market arbitrageurs to swap DAI against USDC stablecoins at a 1:1 fixed ratio to stabilize DAI’s USD peg (this is known as the PSM or peg-stability module). Third, Maker bought up billions in real-world assets like US T-bills when demand to borrow DAI was low during the bear. These measures sacrificed the decentralization of DAI but went a long way in scalability as well as stabilizing the peg of DAI.

Today, DAI has a supply of 5.3 billion. The protocol generates $128M in annualized earnings, making it the most profitable Web3 business model, third only to Ethereum and Tron.

Projecting Maker’s growth

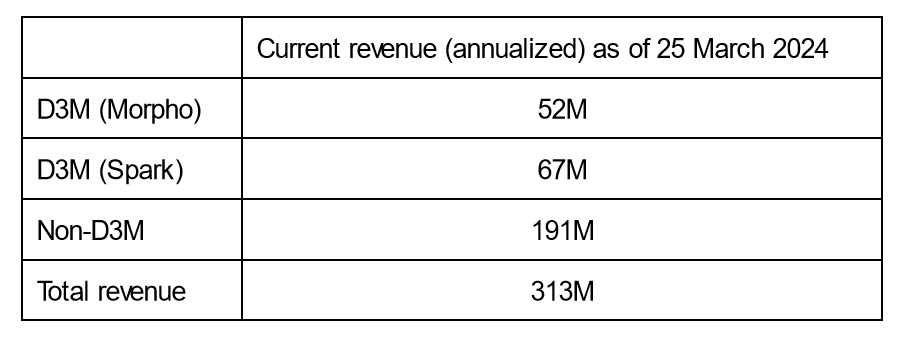

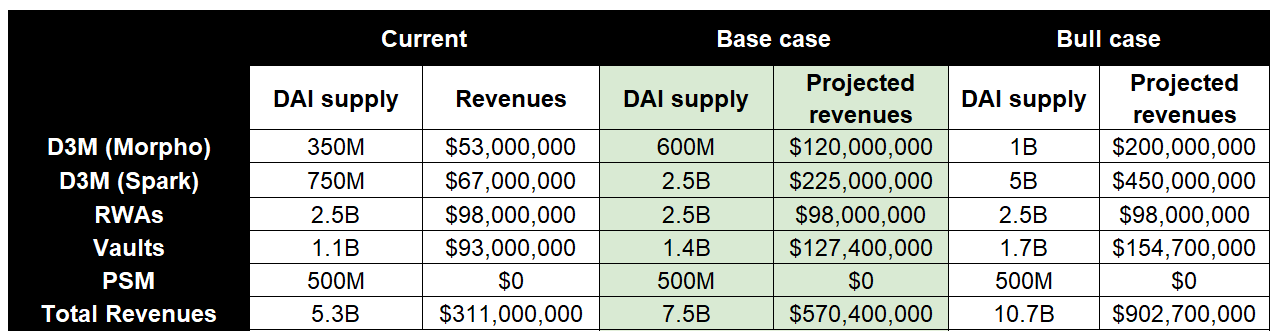

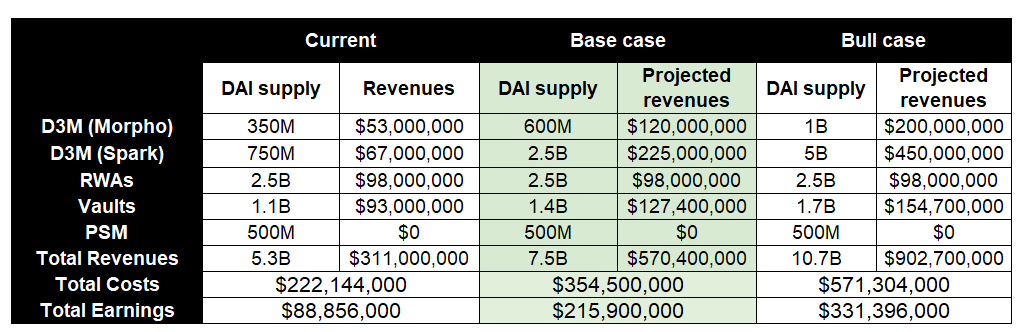

To project DAI’s growth, the primary sources of Maker’s revenue cash flow are broken into three parts as follows:

The D3M (Direct Deposit Module) is a wholesale credit facility engine that integrates Maker with selected third-party lending protocols. Due to the significant revenue gains Maker has made in its Ethena partnership launched two months ago, I’ve split D3M revenues into Morpho and Spark to make more nuanced growth projections. Morpho is a lending platform used to integrate DAI lending against Ethena USDe, while Spark is a Maker SubDAO that enjoys the privilege of a D3M (as Aave and Compound have in the past) to operate a lending service for borrowing DAI against ETH/stETH/WBTC collateral.

The third chunk of cashflows to Maker are all non-D3M revenues generated from its RWA collateral, as well as crypto collateral in vaults used to mint DAI.

Let’s take each of these in turn.

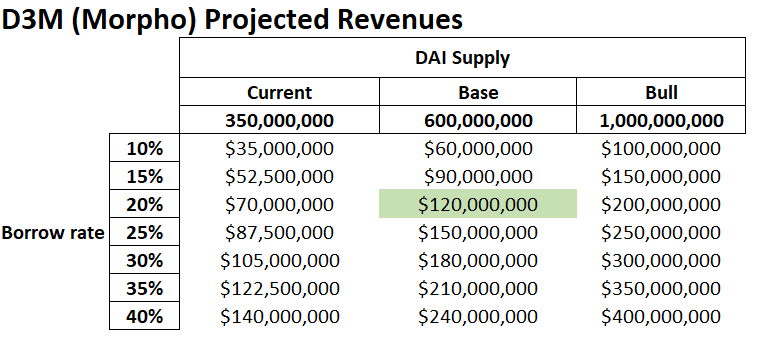

Projecting D3M revenue (Morpho)

When Maker announced two months ago its decision to loan DAI against USDe collateral via Morpho, it received significant backlash. Ethena is the new kid on the block, it hasn’t been battle-tested and was too much risk for Maker DAO to be taking on. Yet no one denies that the Ethena partnership has proven to be a highly lucrative cash cow. At current borrow rates of ~15%, this presently generates ~52M annualized revenue. making up ~16% of Maker’s revenues today. Maker governance has officially approved one billion of DAI for loans against USDe, though the current capped ceiling on issued DAI is 350 million.

With the bull market in swing, this cap is expected to lift soon to 600M DAI, thereby generating projected annualized revenues of ~$120M, assuming current borrow rates of 20%. In a bull case scenario where the Morpho lending facility hits its maximum cap of 1 billion DAI, it would earn Maker ~$200M.

A quick caveat: It goes without saying that these DAI borrow rates depend on the underlying USDe yields. This is sustainable insofar as Ethena’s business model continues to work i.e. exploiting the arbitrage in positive funding rates on perps between DeFi and CEXs, which in turn relies on the ongoing bull market. Since Ethena’s launch in February, USDe yields have ranged between 20-40%, and retail users have continued to “loop” their USDe exposure to borrow DAI.

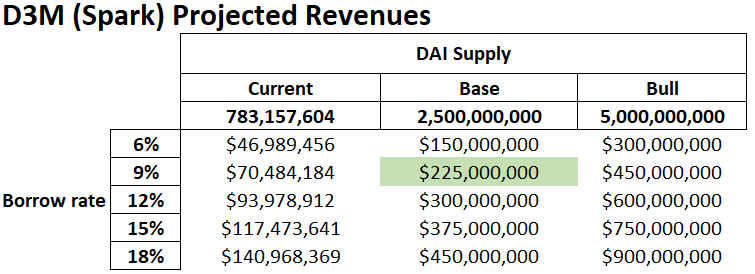

Projecting D3M Revenue (Spark)

Spark currently issues 783M DAI, generating ~67M in annualized fees. It is assumed here that the current debt ceiling of 2.5B is reached in this bull cycle, generating $225M in revenues at the current 9% borrow rate (or $450M should the debt ceiling be raised to $5B)

Projecting non-D3M revenues

Finally, we consider all non-D3M revenues. These comprise of:

- Maker’s RWA holdings – this is held constant at the current $98M annualized revenue.

- ETH, WBTC and stETH held in Maker protocol vaults, minted through alternative dapps such as Summer.fi, DeFi Saver, Instadapp, etc – assuming here a growth of 21.5% to 1.4B, earning an average interest rate of 9.1% across all eight existing protocol vaults.

Summary of projections

Therefore under the base case scenario that:

- DAI supply in Morpho grows to 600M

- DAI supply in Spark grows to 2.5B

- RWA revenues stay constant

- ETH/stETH/WBTC collateral in Maker protocol vaults grows to 1.4B

The total projected annualized revenues for Maker will be $570M at a DAI supply of 7.5B.

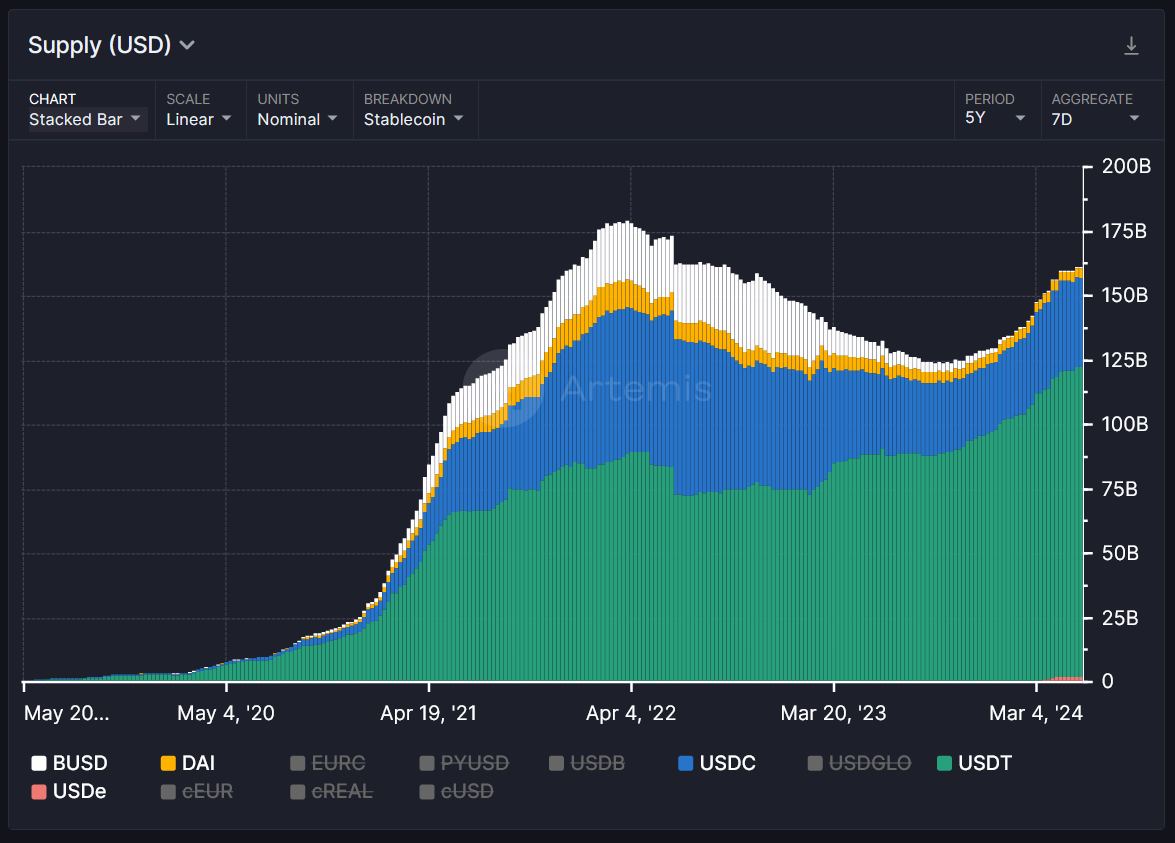

Is a total overall DAI supply of 7.5B realistic? Consider that DAI’s current supply today is 5.3B. With the recent growth of the total stablecoin market, it is reasonable to expect a slow rotation from centralized stablecoins as users come on-chain to take advantage of the DSR. For context, DAI’s market cap hit 10B at the peak of the last bull cycle.

MKR valuation

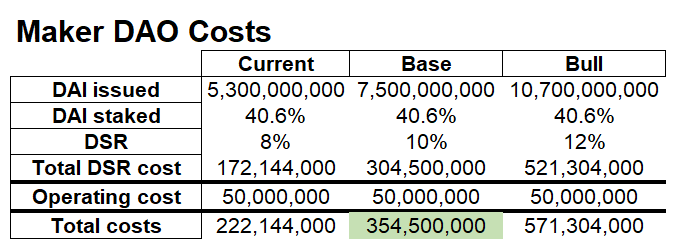

To incentivize users to stake DAI, Maker pays out a “DAI savings rate” (DSR), popularly used in the Web3 economy as the benchmark interest rate. How much does the DSR cost Maker? The current DSR is 8%. Assuming a 10% DSR in the base case, a stake rate of 40% and a total supply of 7.5B DAI, it would cost Maker ~305M. Adding in fixed operating costs of $50M per annum, Maker would spend ~$355M in costs.

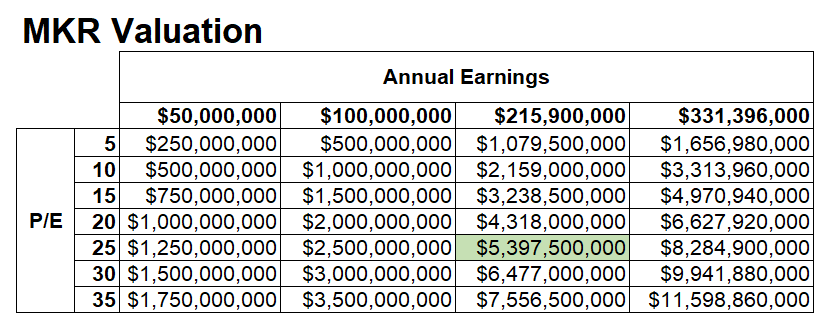

In our base case scenario then: Maker would generate ~$216M in annualized profits.

Applying a P/E ratio of 25 would result in a MKR valuation of ~$5.4B FDV. This indicates a potential price upside of ~2x (base case) from today’s FDV of 2.73B, or ~3x in the bull case scenario, suggesting that MKR might be undervalued as the market begins to swing into a bull.

Other Maker catalysts on the horizon

The Maker business model works.

Yet crypto is still a mercenary and narrative-driven market. Investors care less about “fundamentals”, and more about short-term speculative profits. That means all the cash flows in the world may not necessarily translate to a significant upside in MKR since older tokens are perceived as a “value” bet, as opposed to a “growth” bet on the shiniest new altcoin in the meta with a potential 30x upside. On that front, Maker DAO is punching up with perhaps one of crypto’s most significant governance proposals of 2024: “Endgame”, an ambitious multi-year roadmap to rebrand and improve Maker from the ground-up.

Endgame will commence in summer 2024 and plans to introduce several significant changes:

- DAI will transition over a period of years into two separate stablecoins. Users can choose to convert DAI into either a centralized USD-pegged stablecoin, or a free-floating-pegged decentralized stablecoin, known as “PureDAI”. The former is backed by RWAs and will be freezable (like USDC/USDT), so as to allow DAI to pursue growth and integration with TradFi in a regulatory-compliant manner. PureDAI on the other hand is backed by ETH/stETH, will be immediately immutable (and therefore governance-free) and serves to satisfy the original Maker philosophical ideals of censorship-resistant money for those who wish it. This dual stablecoin plan in effect allows Maker to execute on what has long been competing ideological visions of what DAI should be.

- A new governance token will be launched (with a planned airdrop), convertible at a rate of 1 MKR to 24,000 NewGovToken.

- Six new SubDAOs with their own individual native tokens are planned to be launched, the first of which has been Spark Protocol. The idea around SubDAOs is to simplify Maker as a stablecoin protocol at its core and decentralize its day-to-day operational bureaucracy to innovate at the edges. SubDAOs will be largely autonomous and serve a focused purpose such as lending (Spark), managing its new stablecoins or its RWA balance sheet, managing internal governance etc.

- Maker plans to introduce the “Lockstake Engine” (LSE), a funnel of yield farming inflationary rewards to users that lock MKR or its new governance token. These yield rewards include 30% of all Maker’s protocol surplus income, 30% of all SPK and future SubDAO tokens. The key point is that MKR is poised to receive massive accretive value.

- A native bridge will be launched to seamlessly connect the Maker ecosystem on Ethereum mainnet to major L2s. This will diversify DAI across different chains, a departure from its historical concentration of 90%+ on mainnet. From Maker’s perspective, that is a market opportunity that Circle/Tether currently controls. From the user's perspective, they’ll be able to take advantage of the DSR from more chains.

When all the above has been successfully implemented over a few years, Maker will launch its own L1 chain where all governance takes place. Existing tokens will continue to exist on Ethereum.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.