The Future of Solana DeFi Featuring Kamino Finance

Disclosure

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

Solana experienced a resurgence in 2023, leading to the development of a large ecosystem of dApps with diverse products and use cases. One that stands out here and has seen meteoric growth this year is Kamino Finance. With over $2.4b in liquidity supplied and $800m borrowed, Kamino has become one of the largest Solana dApps and offers a series of high-yielding products involving their unique money market. There appears to be no stopping to this growth and with Kamino 2.0 getting closer, the path to $10b in TVL is laid out.

Today's report will cover Kamino finance, namely the underlying product, recent traction, V2 and more.

Products

1) Borrow / Lend

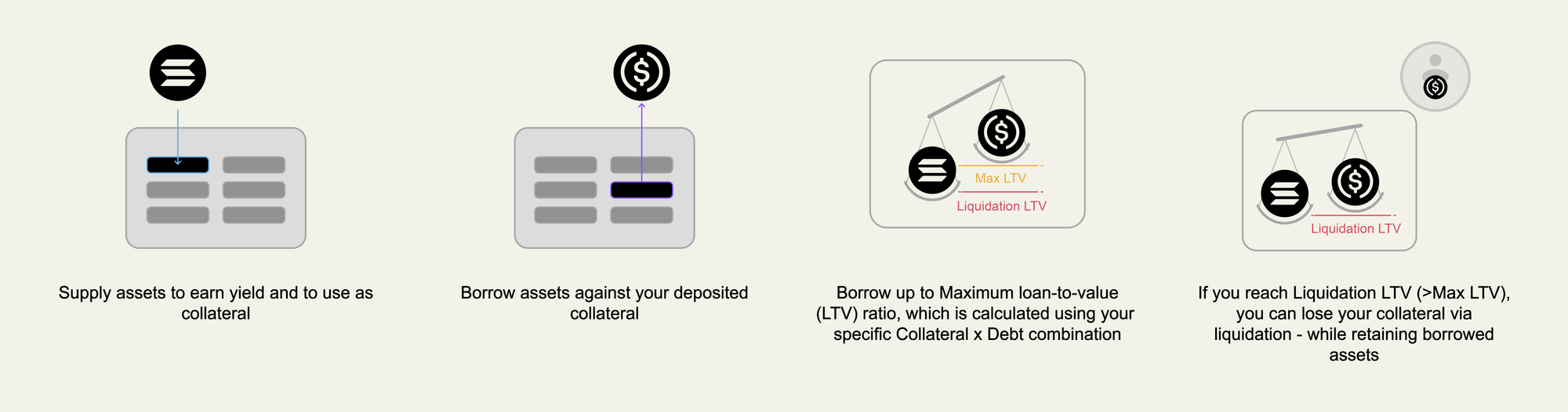

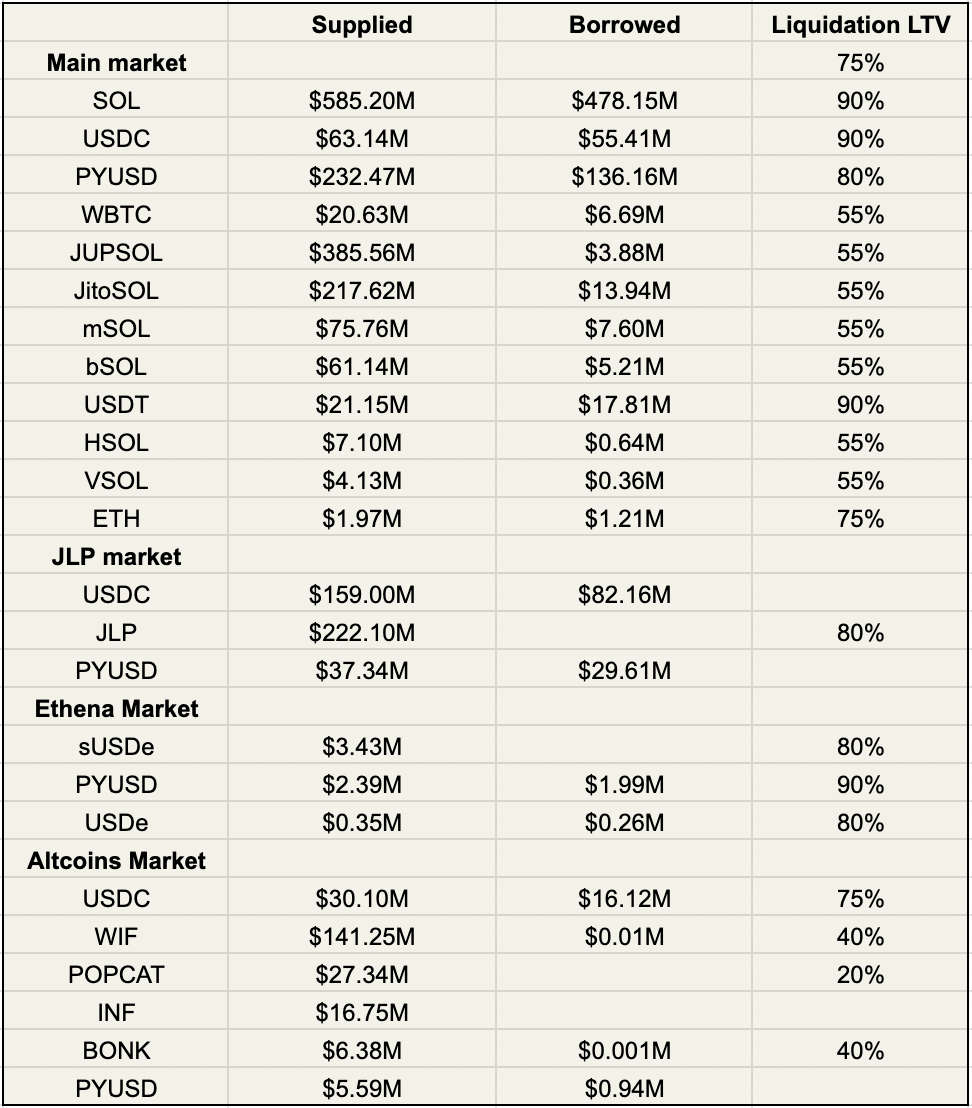

At the core of the Kamino protocol lies Kamino Lend which currently consists of four different markets: The 'main market', the 'JLP market', the 'Ethena market' and the 'altcoin market'. Within each of these markets, users can supply collateral and borrow against this up to a certain LTV threshold (loan-to-value). The various assets and liquidity supplied/borrowed can be viewed in the table below.

Last week, Kamino launched 'isolated mode' in relation to borrowing assets. Up until recently, borrowing and lending on Kamino was only possible in 'cross mode' in which multiple collateral and borrowed assets are within the same position. With 'isolated mode', users can borrow just one asset against one type of collateral per position. This allows for specified risk parameters and higher LTV for certain assets. As this is in beta, it is only live for select assets for now:

- SOL/PYUSD (main market)

- USDC/USDT (main market)

- LST/SOL pairs (main market)

Read more about how this works here.

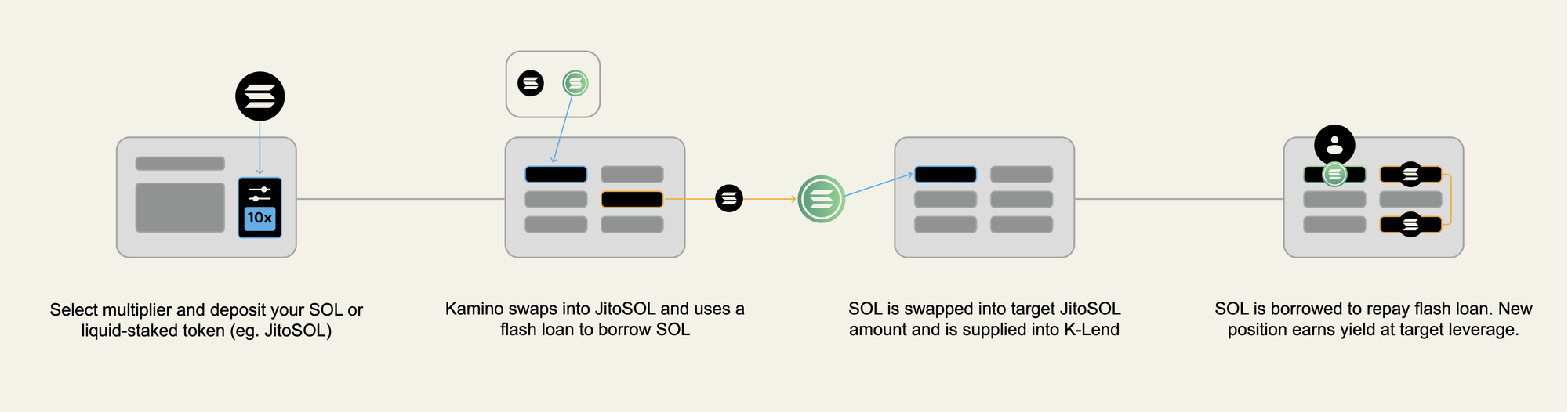

2) Multiply

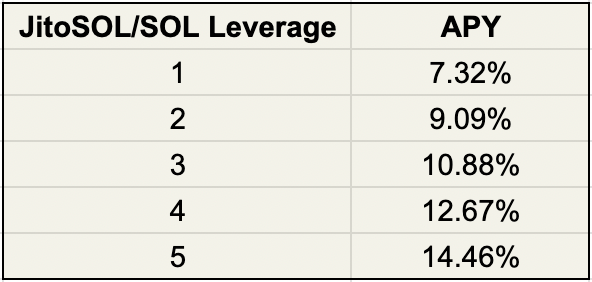

Another core product of Kamino is the automatic looping of a borrow/lend position with up to 5x leverage. Examples of this include JitoSOL/SOL and works by using flashloans to borrow SOL against the collateral posted, e.g JitoSOL. This results in leveraged exposure to the yield of the underlying token. For JitoSol, the effective yield can be seen in the table below.

The design of the multiply product is quite unique, specifically concerning the risk of liquidation. The Kamino team has taken two specific measures to decrease this risk. For one, there is an inherent risk of a LST depeg where an asset like JitoSOL or JupSOL depegs against the underlying price of SOL. This can be due to limited exchange liquidity and spontaneous sell pressure. Most of these depegs are however temporary and arbitraged back to the peg shortly after. On many lending markets, this short term depeg can cause a liquidation on leveraged positions (like JitoSOL/SOL). On Kamino, the price oracle is contract based and looks at the individual stake pool balances. Therefore, should an LST depeg but the reserves remain at 1:1 in SOL, 'multiply' positions will not get liquidated.

The second measure relates to interest rate risk. A position could, in theory, get liquidated should the interest rate on a borrowed position spike up and remain there for a longer period of time. Usually, lenders supply additional assets to the market as they can capture the yield from this high interest which lowers the interest shortly after. To mitigate this scenario, albeit unlikely, Kamino has capped the SOL utilization ratio at 87% which corresponds to 6.5% annual interest on borrowed SOL.

As per a recent post from the Kamino team, "A SOL Multiply position has NEVER been liquidated on Kamino - whether at 2x or 5x leverage."

For more details about this design, see here.

Another interesting multiply strategy on Kamino is JLP/PYUSD but it involves additional risk as the price of JLP and PYUSD aren't fully correlated like e.g JitoSOL/SOL. You can read more about what JLP is and what risks to be aware in a recent report:

3) Long/Short

Similarly to multiply, users can get leveraged exposure to various assets via Kamino's underlying money market design. Rather than leveraging JitoSOL/SOL in Multiply, all assets are paired with borrowed USDC in Long/Short. E.g go long SOL/USDC with up to 2.9x leverage, WBTC/USDC with up to 3.3x and more.

4) Liquidity

Liquidity is Kamino's first product which launched in 2022 and lets users supply assets to various liquidity pools across DEXes like Orca, Raydium and Meteora. Kamino issues a fungible representation of the liquidity position which can be used as collateral in the Kamino lending market.

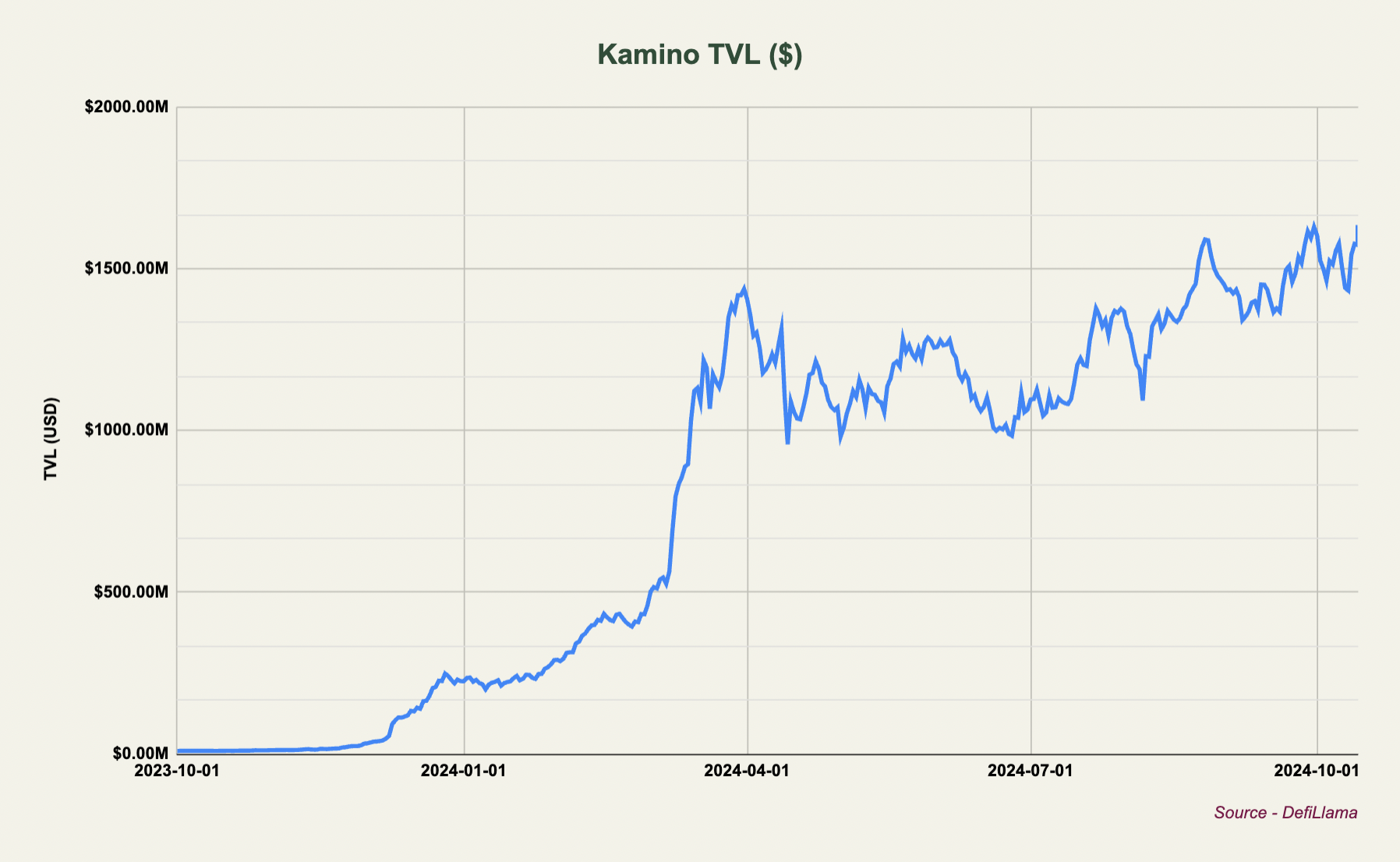

Traction

As the Solana ecosystem gained momentum towards the end of last year, Kamino quickly grew to become one of the largest applications on the chain. Today, Kamino is the second largest Solana protocol with ~$2.4b in deposits and $850m borrowed on the platform which adds up to a TVL of nearly $1.6b.

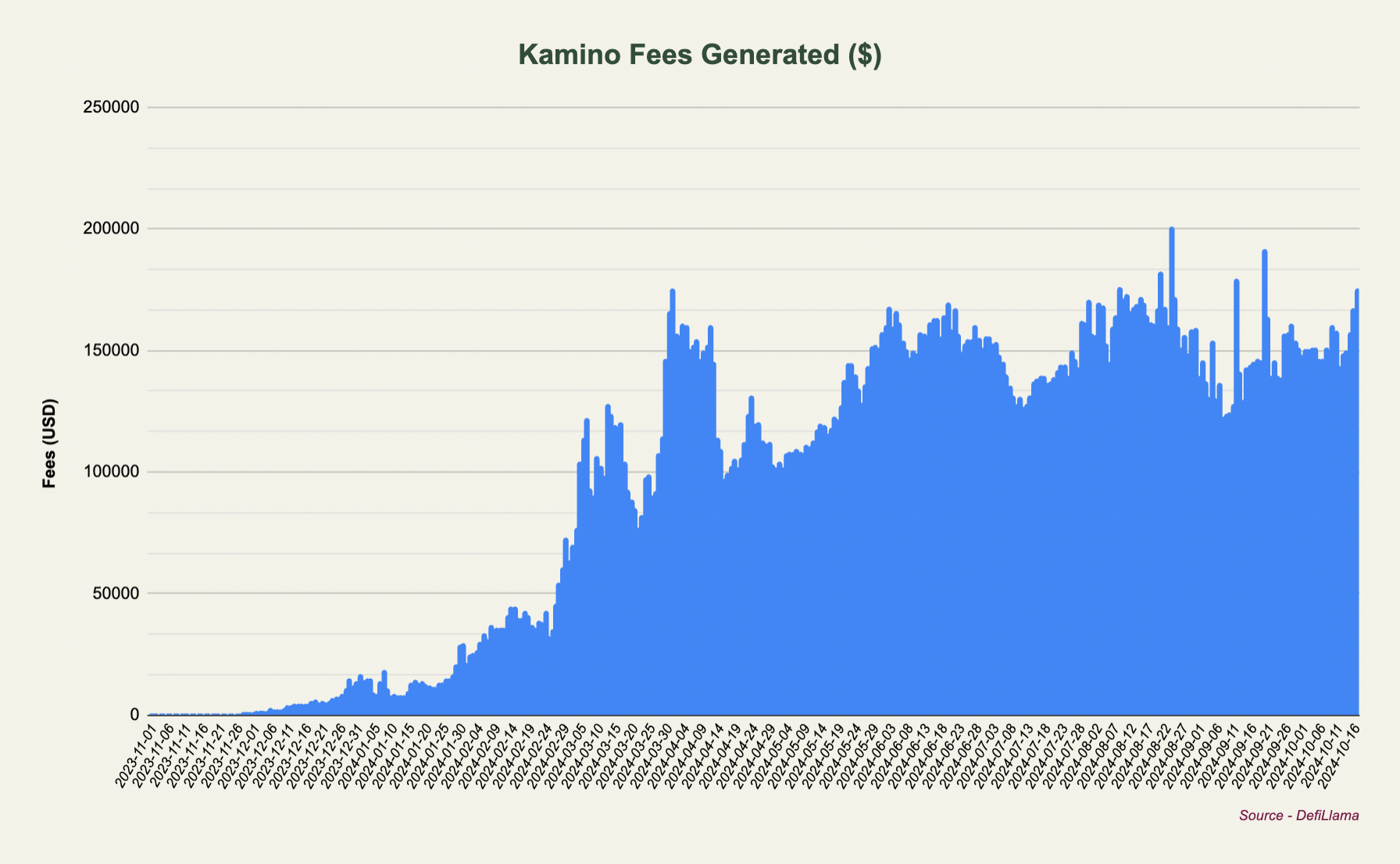

The large growth in TVL has resulted in fees skyrocketing. Throughout most of the year, Kamino has consistently generated ~$100k-$150k in fees daily which amounts to nearly $55m yearly. In a future report, we'll be breaking down the fees and revenue landscape in more depth.

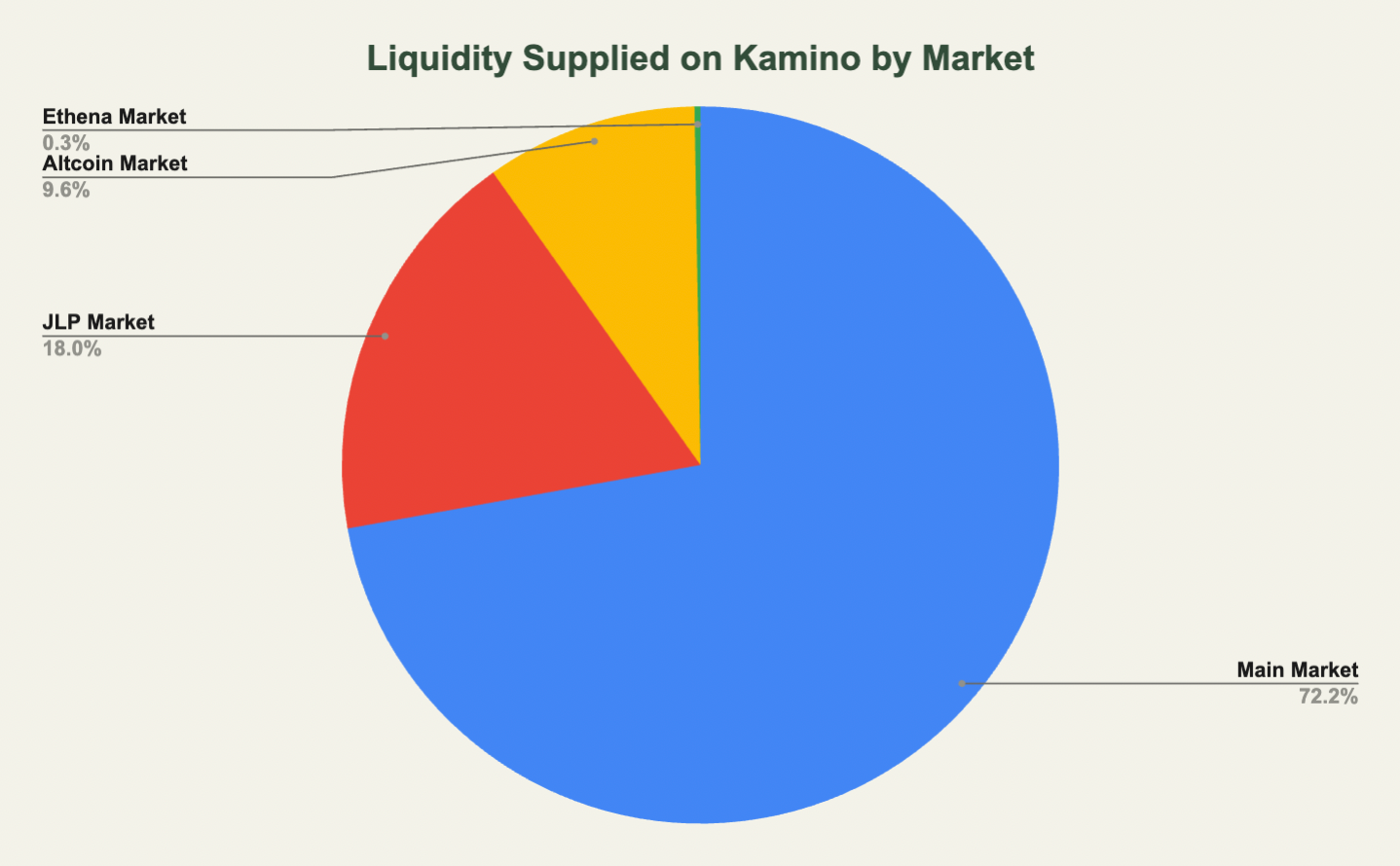

Most of the liquidity resides in the main market. The JLP market has however gained significant momentum lately with the addition of PYUSD which allows for cheap looping of JLP due to the incentives paid by PayPal to PYUSD lenders.

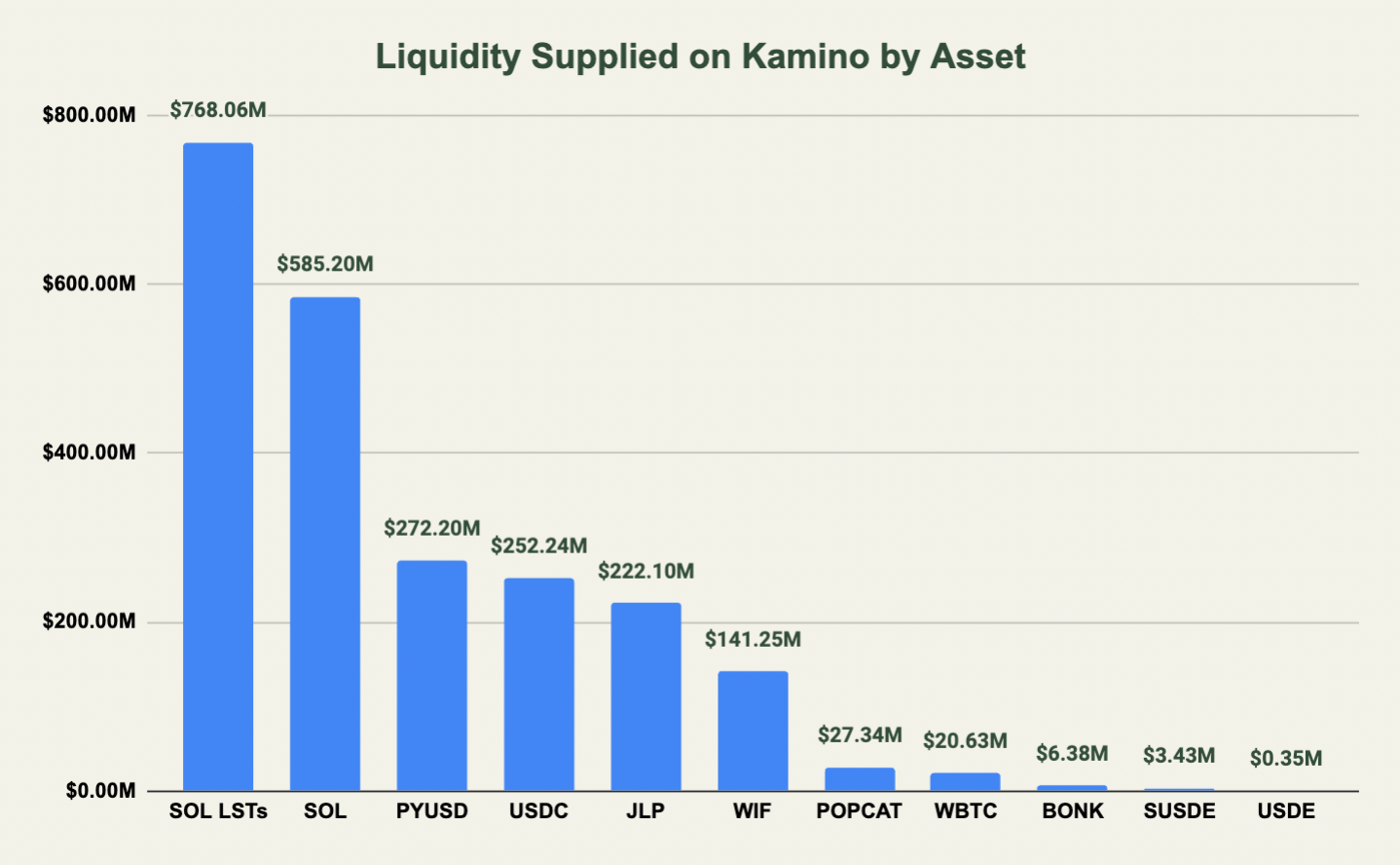

Looking more granularly, SOL LSTs and SOL itself make up the majority of the liquidity on Kamino with over $1.3b supplied across various markets. Memecoins have, in addition, gained popularity as collateral against USDC and PYUSD with the largest token in terms of TVL being WIF at $141m supplied.

Kamino V2

Shaping lending on Solana with the initial release of Kamino Lend has not been the extent of the project's ambitions, as they recently unveiled a trove of material surrounding the upcoming iteration of the wildly successful, original implementation. Expanding on its rigorously tested code base by further enhancing existing features, introducing novel primitives, protocol-level mechanisms and products, at its core – this upgrade is designed to significantly improve user experience on the platform and cater to a broader audience.

Though most modern lending applications facilitate an array of markets, they do however lack the innate functionality of creating and interacting with custom markets. Effectively neglecting emerging assets in an environment that is heavily narrative driven, thus barring a great deal of willing participants from soliciting their services. This is where the first novel primitive, the Market Layer comes in to meet the demand for permissionlessly deploying fully customizable markets, able to support any asset or asset combinations with configurable parameters.

Potentially paving the way for niches that allow speculators to express their freedom of exposure by participating in markets that align with their individual asset preferences and risk profiles, from a single interface.

As the range of markets inevitably expands, manually optimizing yields across all available verticals will become increasingly time-consuming and complex. To automate efficient yield capture with minimal user intervention, a series of single-asset vaults with unique charecteristics will be integrated, thus forming the Vault Layer, the second novel primitive. On this layer, depositors can explore a wide set of options, ranging from conservative, risk-adjusted return strategies to more aggressive, yield-driven approaches aimed at maximizing gains. Additionally, this development serves as grounds for offering bespoke lending vaults, tailored to third parties (e.g. projects, fund managers, institutions) and curated vaults carefully vetted by Kamino's internal Risk Council in collaboration with external risk specialists.

Providing tools to generate strong returns has long been the core focus of any sustainable DeFi protocol with a long-term vision. However, maintaining its integrity and safeguarding users must be equally prioritized. This is particularly crucial in the realm of on-chain finance, where core protocol mechanics often revolve around leverage and rely on the accuracy of oracles.

Scam wick protection

Keeping this in mind, Kamino has placed a great deal of effort into revamping its proprietary liquidation engine to ensure solvency and protect users from liquidations (unless it's absolutely necessary). An exciting attribute included in the changes is the discernment and subsequent rejection of sudden, momentary price movements commonly referred to as "scam wicks" that are notorious for causing unanticipated liquidations, stemming from anomalous oracle responses. While these events might be infrequent, users are still susceptible to liquidations under normal circumstances.

Liquidation auctions

In the event of liquidation, an auction process that benefits borrowers by reducing penalties through competitive bidding is performed, enabled by the introduction of limit orders. Those who find themselves in this scenario could face lower penalties than in traditional fixed-fee liquidations, making the entire experience less harsh as well as softening any price impact from larger forced position closures.

Points

Kamino offers points to borrow and lenders, with multipliers for taking specific actions or using certain products. While Season 3 of points is currently live, looking back at earlier this year, season 1 ended in May and consisted of 7.5% of the $KMNO supply whereas season 2 lasted for three months (May-July) and consisted of 3.5% of the $KMNO supply.

While there is no confirmed end date of season 3, one might assume that the duration is 3 months similar to season 2 and therefore ends at the end of October. Looking at the points dashboard, there are 232,000 accounts receiving points with a total current S3 point supply of 441,411,636,112 points (411b) as of October 16th. Assuming S3 ends October 31st and that there are no big TVL changes in the remaining two weeks, there could be roughly 514b points in total for season 3. Take this number with a grain of salt however.

Conclusion

Since the launch in 2022, Kamino has become a DeFi powerhouse on Solana with several products and integrations (Ethena, Paypal etc.). Kamino is positioned for growth due to the continued momentum for Solana as well as the upcoming launch of Kamino V2. We'll be monitoring the dApp closely and dive deeper into its revenue model and yield opportunities in future reports.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.