The Future of DEX Liquidity with Mangrove

Mangrove is a Blast-native DEX with a variety of unique and innovative features.

This report is made in collaboration with Mangrove and is therefore sponsored.

Intro

As the Blast L2 ecosystem continues to expand, leading up to the launch of $BLAST, there are many protocols to keep an eye on. One of these is Mangrove, a Big-Bang competition winner which recently launched their native points program for early users.

Mangrove is a Blast-native DEX with a design resembling Uniswap V4. The team consists of previous employees from Morpho, Aave, Paraswap and Nethermind and has raised funds from notable VCs like Wintermute, Cumberland, Gumi and Greenfield. Today’s report dives into the design of the Mangrove DEX, recent performance, points campaign and upcoming features.

Want access to more free research reports? Subscribe below and join 10,400+ weekly readers 🗂

Design

General Design

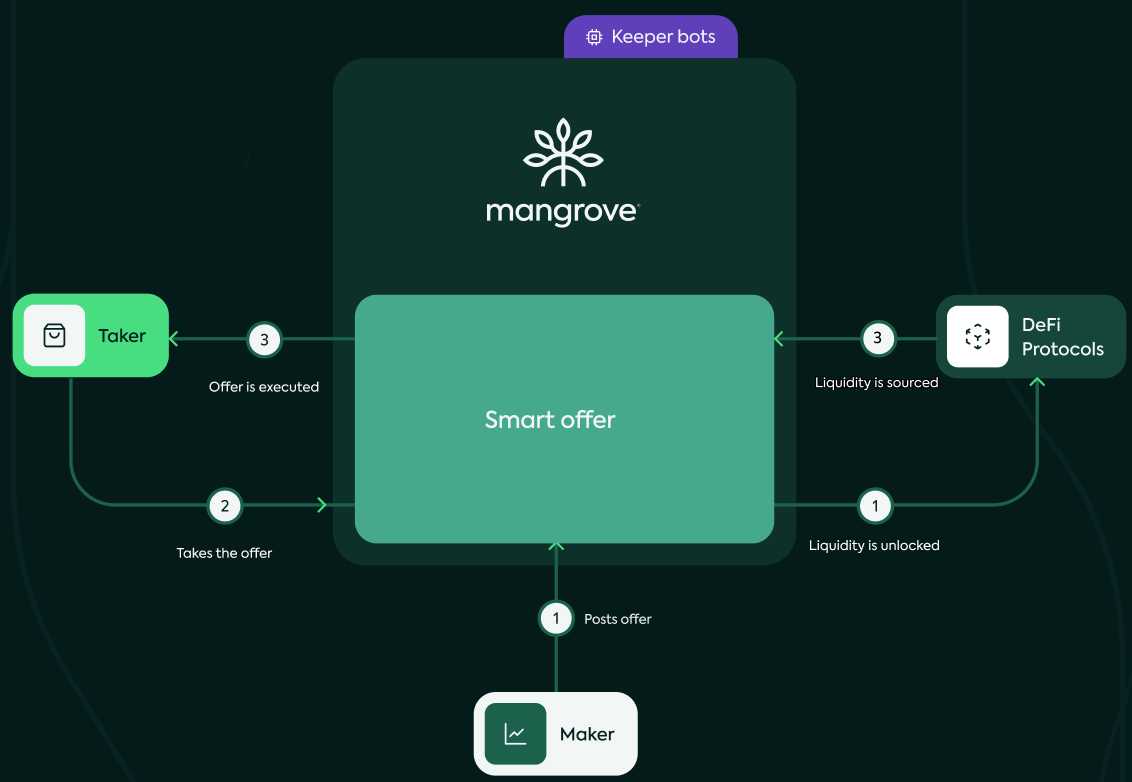

The Mangrove DEX and orderbook is powered by makers, takers and keepers.

- Makers - place limit orders at a specific price for a token pair (similar to liquidity providers).

- Takers - users that swap on the Mangrove DEX and ‘take‘ the liquidity posted by makers.

- Keepers - Function as bots to ensure the orderbook stays efficient by removing failed orders, keeping the gas price up to date and more.

As a trader on the Mangrove DEX, you have access to a variety of different order types. Most DEXes offer standard market orders which lets users swap between a trading pair at the current price.

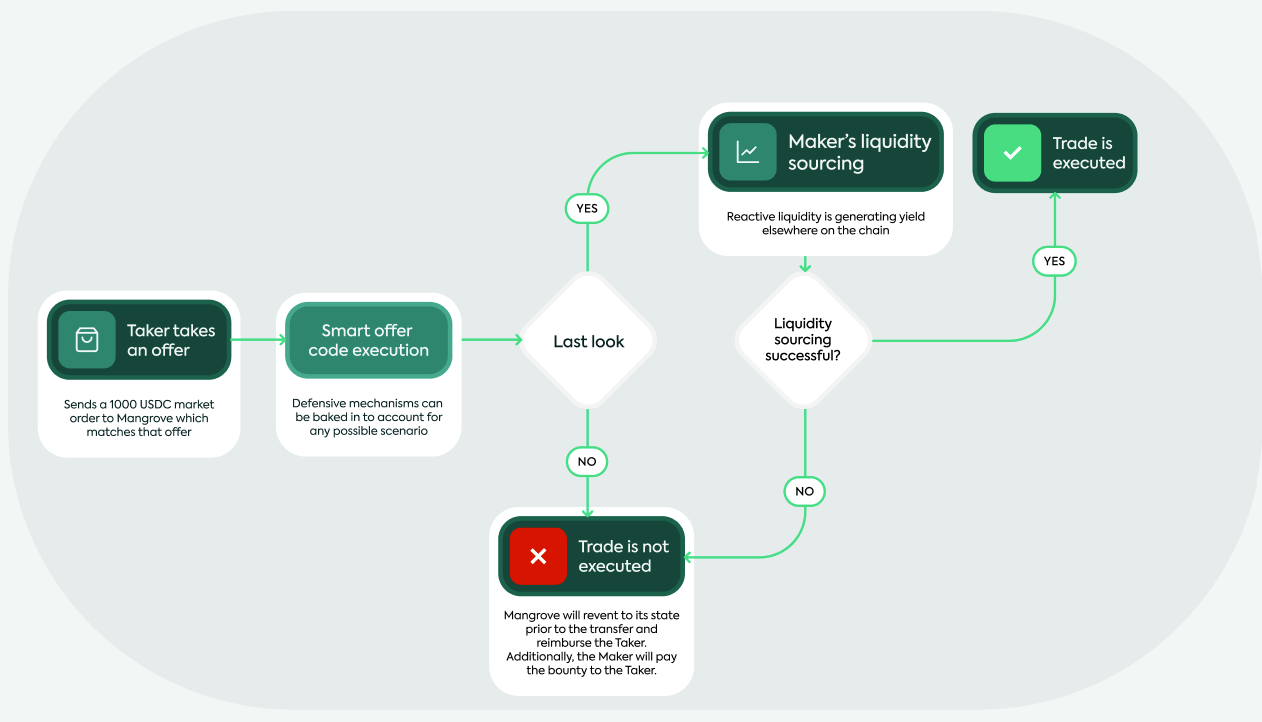

In addition to this, Mangrove offers limit orders which lets you place an order that activates at a specific price e.g. swap 2 ETH for USDB if the price reaches $4000. In Contrast to other trading avenues with limit orders however, users don’t have to lock up liquidity on Mangrove for these limit orders. Instead, Mangrove has implemented ‘liquidity sourcing‘ which taps into liquidity in your wallet as well as liquidity on various Blast-native lending markets such as ZeroLend, Orbit and Pac Finance. Users are therefore able to place a limit order on the DEX which is executed at the specified price and sources the liquidity from e.g. the Orbit lending market. You are therefore able to have active limit orders while earning yield with the liquidity elsewhere at the same time.

As a result of this, Mangrove has introduced amplified orders which lets you post multiple orders across different markets & pairs using the same liquidity. This opens up for a lot of flexible strategies. One such example is posting limit buy orders for various tokens at different prices with the same liquidity. If one order is filled the others are either cancelled (if all liquidity is used) or updated (if parts of the liquidity is used) automatically.

“Example: I have 10,000 USDB on ZeroLend, post a limit offer on mangrove to buy WETH at $3,300 with my 10,000 USDB, with sourcing on ZeroLend, and also deposit on ZeroLend. Once my offer is taken, Mangrove will take my USDB from ZeroLend, give it to the taker, and take the taker funds, deposit it on ZeroLend.“

Hooks

More than this, the Mangrove exchange bears similarities to Uniswap V4 due to its implementation of ‘hooks‘. In short, a hook in relation to a decentralized exchange is essentially custom logic (code) attached to a LP position by a liquidity provider. This allows for more customization when it comes to market making and allows for more sophisticated and advanced strategies. Some examples of potential hooks:

- Limit orders - allow users to place limit orders within the pool

- Multi-sig - require multiple signatures for specific actions related to the pool such as adding/removing liquidity

- Stop loss/take profit on orders

- NFT owners only

- Liquidity bootstrapping functionalities

- Automated treasury buybacks in the pool

And many more.

On Mangrove, these are referred to as smart offers, i.e offers in which code/logic can be attached to. This enables liquidity that’s deposited elsewhere in the Blast ecosystem to be used on Mangrove (as described in the section above). As a result, there is no liquidity deposited into Mangrove. Other protocol features include ‘last look‘ which is a condition that can be incorporated to cancel orders if e.g. market conditions have changed and ‘persistence‘ to repeat the current logic applied for future positions.

Kandel

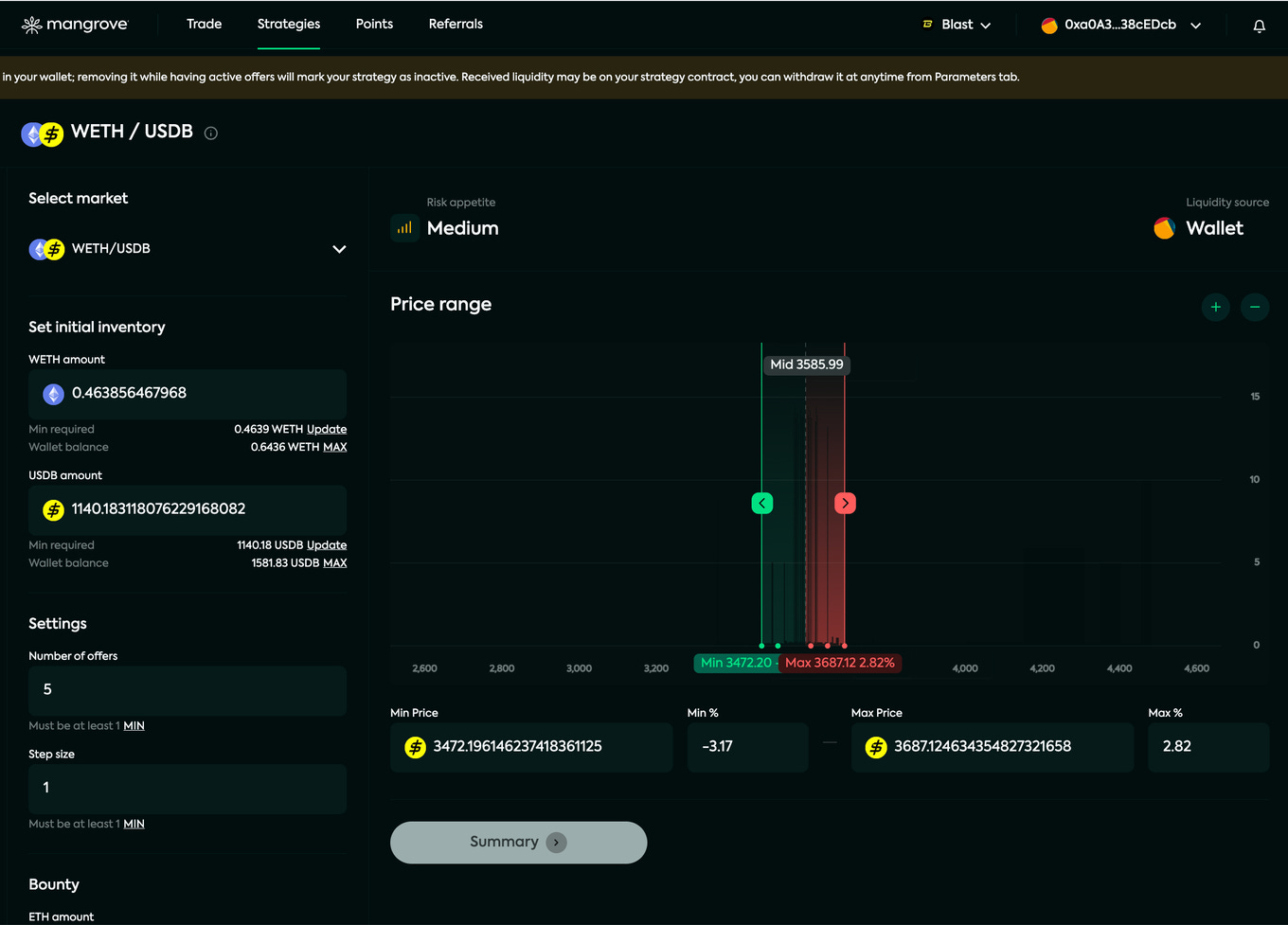

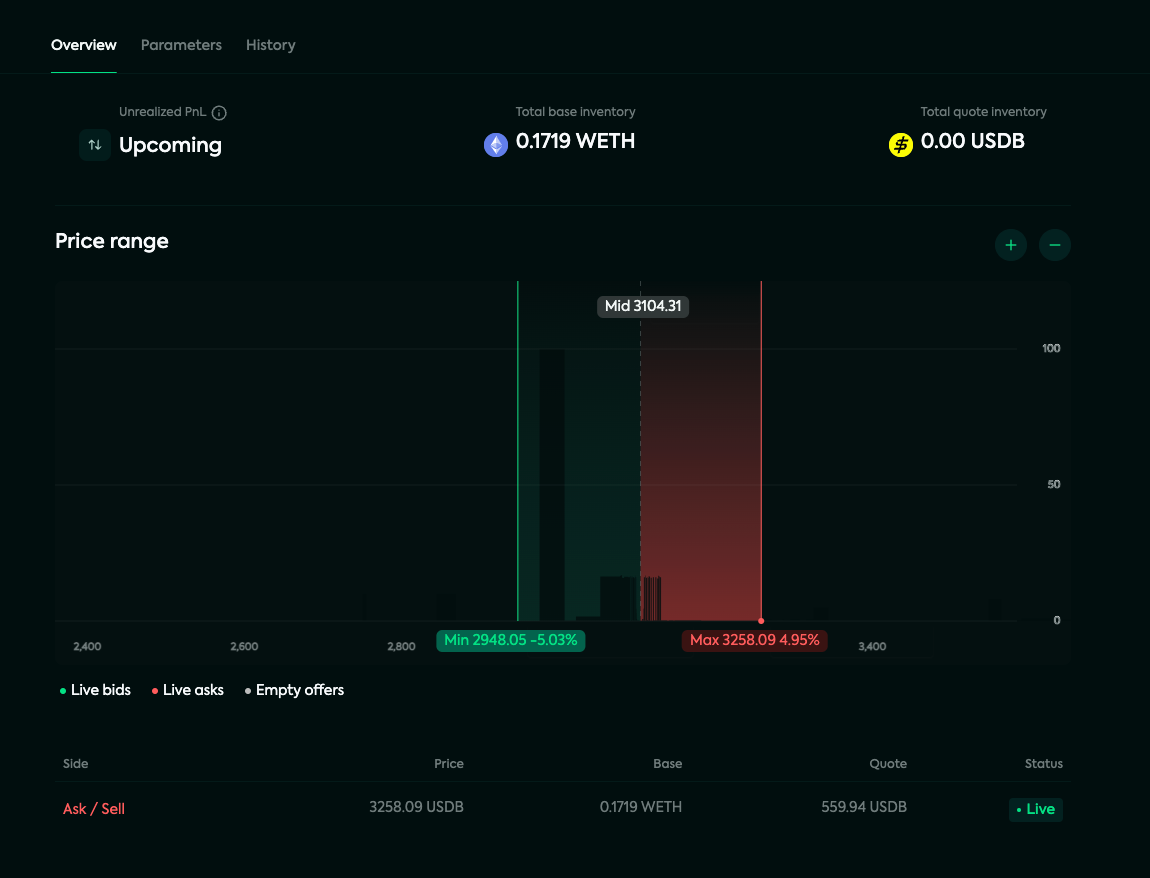

With these features, it’s possible to run custom designed market making strategies on the orderbook. One example is ‘Kandel’, a custom market making strategy built out by the Mangrove team using the ‘hooks’ logic. It can be compared to a market making bot and generates a profit in the following way; Offers are added frequently around the current price as both asks and bids (buy and sell orders). The return comes from the spread (difference) between the buy and sell orders similar to traditional market making. When setting up the strategy, there are a few different parameters to set up:

- Market

- Price range

- Amount of base (WETH) and quote (USDB) similar to Uni V3.

- Number of offers posted within the price range

The liquidity you provide is active within the price range and the amount of offers determine how many times the liquidity is used by traders on both sides of the book (bids and asks). In the coming weeks, Kandel will implement liquidity sourcing allowing outside capital to be used for the strategy.

You can read more about how Kandel works here.

Below is an example of what a strategy might look like. The price range is set fairly tight with 5% to both sides from the current price of wETH/USDB. The more liquidity allocated to this strategy, the more offers you can enable, potentially increasing the PnL. It is also worth noting that no assets are deposited as Mangrove access the liquidity in the wallet instead, giving more flexibility to the user.

Incentives & Rewards

Blast Big Bang Winner

Mangrove is one of the winning protocols from the ‘Blast Big Bang Competition‘ and has been awarded over 152k Blast Gold for the first batch of incentives. All of these incentives will be distributed to Mangrove users based on their maker and taker activity (swapping and providing liquidity).

MS1 Points Program

MS1 refers to the Mangrove Season 1 points program which is currently live and rewards active users of the protocol. There are a few different ways to earn points:

- Trading Points: Based on specific market weightings and your relative trading volume on the Mangrove DEX. This includes both market, limit and amplified orders.

- Liquidity Provision Points: Also market-weighted and is based on the amount of volume the liquidity generates (i.e. how much it has been used by traders) as well as the uptime of the position.

- Boosts: Mangrove has introduced a tiered system with levels that is determined by trading volume and LP volume generated. By leveling up as more volume is traded/generated, users receive a boost to their newly earned points.

- Referral points: By signing up via a referral link, both the users signing up and the referrer receives a 10% bonus in points based on the referee’s LP and trading points.

- Community points: Additional points rewarded to users participating in MangroveDAO-organised campaigns.

The MS1 points have an impact on the amount of Blast Gold you receive as well as future unconfirmed functionalities.

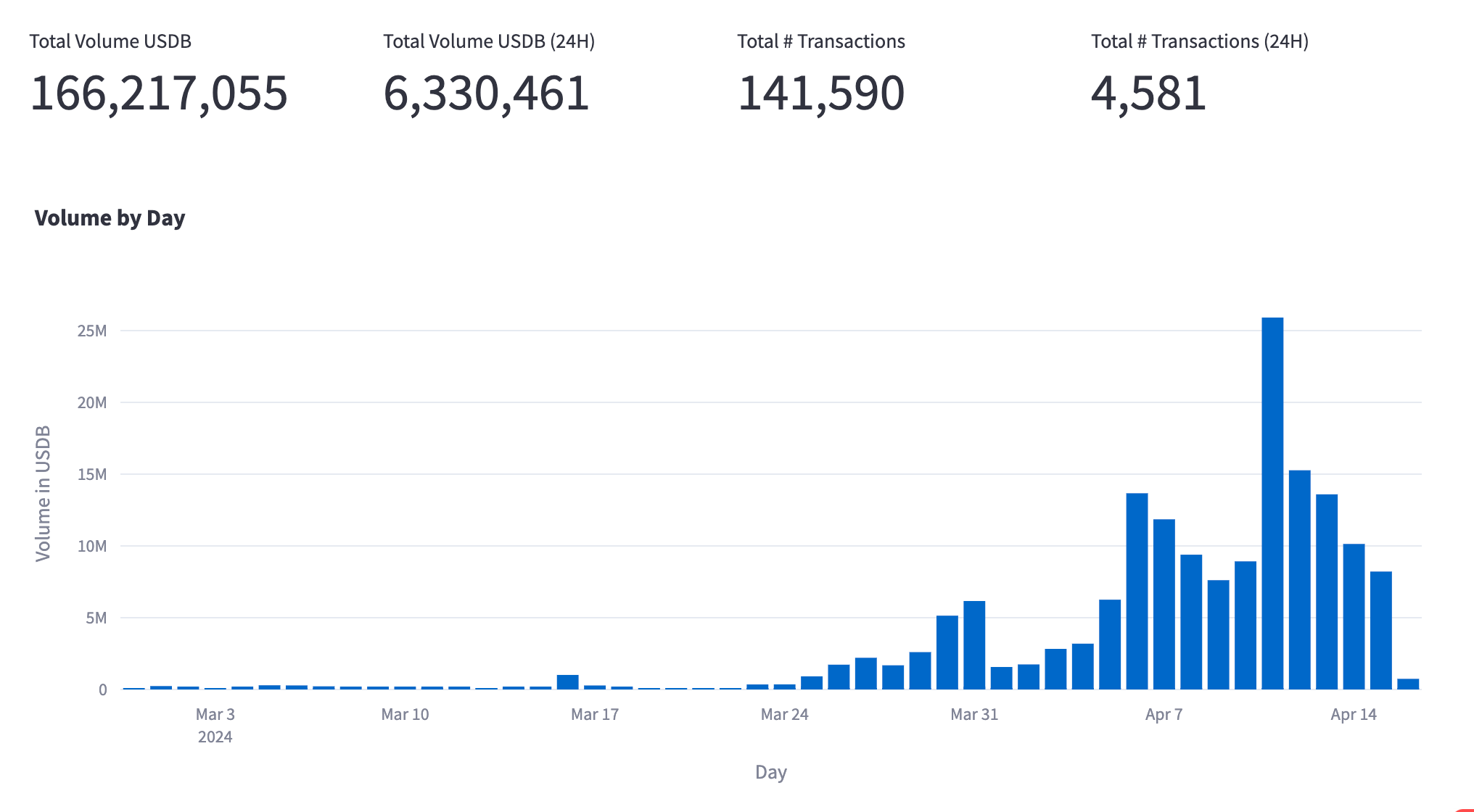

Traction

Since launching earlier this year, Mangrove has seen a large increase in both active users and daily trading volume. The recent increase can be accredited to the growth of the general Blast ecosystem, the launch of the Mangrove points program and in general more users noticing the benefits of the Mangrove DEX.

The leading DEX in terms of volume on Blast is for the time being Thruster Finance, facilitating roughly $30m in trading volume on a daily basis. The Mangrove team recently published an analysis which found that the ETH prices obtainable by DEX users are better on Mangrove than on Thruster on more than 8/10 occasions. In the period from April 9th to April 16th, selling prices have been better 82.43% of the time while buying prices outperformed 84.71% of the time. The reason for this lies in the underlying design of Mangrove outlined earlier in the report.

Conclusion

Mangrove is an innovative DEX on Blast with unique features such as hooks and liquidity sourcing. With their native strategy Kandel, anyone can become a market maker on the DEX. Over the coming weeks and months, Mangrove will expand the capabilities of the DEX by introducing additional trading pairs, improving the trading strategy functionalities as well as distribute Blast rewards to users. To stay updated on Mangrove, make sure to follow them on X here. You can also check out the DEX here.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.