The Extended November Token Watchlist🗒

Nearing the end of the eventful Uptober, it’s time to set sights on interesting developments and catalysts for November while the ball is still rolling.

Along with breakouts on charts, many market participants (especially on Twitter) have overcome a mental slump caused by prolonged periods of volatile and poor price action, as a glimmer of hope emerges. With metrics such as total stablecoin market cap bottoming out and TVLs consistently increasing across the board, activity has seen a significant boost. This means that teams aiming to take advantage of the momentum will have numerous updates in the works.

Thanks for reading DeFi Frameworks! Make sure to subscribe for a high-signal signal analysis delivered to you once per week⚡️

1️⃣ Bitcoin ETF

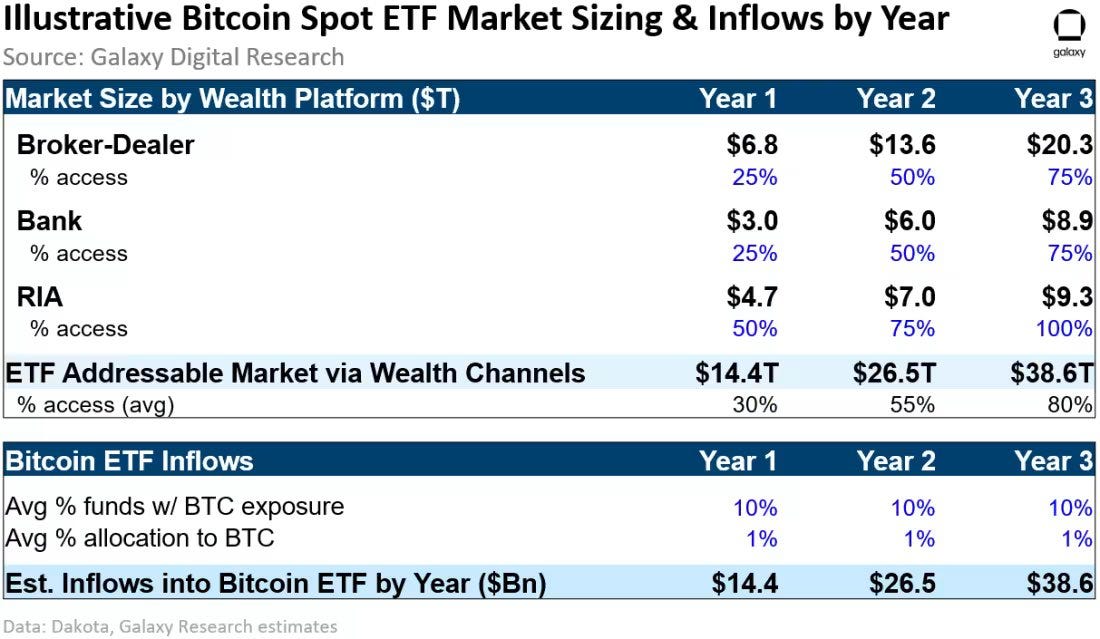

Since we previously covered this story a week ago, no additional details have been released on the matter. This topic seems to get covered a lot, but most of the time news outlets are just looking to capitalize on the narrative while providing no fresh, valuable information. While we await further developments, let’s take a look at Galaxy Digital Research’s inflow estimations once a spot Bitcoin ETF hits the shelves.

What are the amount of inflows we can expect?

That’s a hard question to answer with absolute certainty, so we can only make assumptions. Looking at the total addressable market and using conservative asset allocation estimates, we can expect inflows of ~$79b over the course of three years.

How would this impact the price of Bitcoin?

Increased buying pressure would obviously be favorable to offset selling from third parties (e.g. the US government) and/or miners. Drawing parallels from the Gold market, and taking potential estimated inflows into account, it’s possible to see a 74.1% price impact within the first year based on Galaxy Digital’s calculations.

In case you want to delve deeper into the topic, check out the in-depth research Alex Thorn from Galaxy Digital recently posted on his Twitter.

2️⃣ Frax

Boasting a solid array of already released products and more interesting developments on the horizon, Frax is definitely something worth keeping an eye on.

sFRAX

Successfully creating a yielding mechanism for FRAX holders utilizing Real World Assets (RWAs), sFRAX has enjoyed comfortable growth while offering competitive yields for depositors.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

frxETH v2

A highly anticipated upgrade with novel mechanics for frxETH is right around the corner. Catering towards validators and decentralization instead of solely chasing yields, Frax aims to bring forth innovation in the booming LSD sector.

Borrowing Validators instead of ETH

To improve decentralization, nodes themselves pose as borrowers, with the lenders being verifiers. Deposited collateral from node operators are placed into existing validators.

Low Collateral Requirements

The cost of borrowing a validator could be as little as 4 ETH or any other collateral option with it’s own configuration decided by governance participants.

Variable Interest Rates

Validators will be charged with a variable fee rate, set by the market instead of the protocol operators.

Unused Asset Utilization

Any Ether that is not actively being used for validators, is sent directly to Curve in order to mint LP tokens for deeper liquidity and additional revenue.

Addressing centralization concerns, while offering a good yield will surely give competitors a run for their money.

Fraxchain

Acting as a central hub for the Frax ecosystem, the upcoming L2 roll-up is said to be launched in the tail end of the year.

3️⃣ Rollbit

Well-known DeFi cash cow Rollbit makes an appearance on this Substack yet again with some interesting things coming up this month.

Rollbit Duel Arena

Unveiled by Rollbit’s co-founder on Twitter, the Duel Arena is said to be a 0% edge PvP game that heavily draws inspiration from RuneScape’s infamous Sand Casino which facilitated insane wagers back in the day.

A core component of this new addition will be the negotiating phase, taking place prior to the match, allowing duelists to voice their terms for the wager. NFT staking for additional benefits was also promised, although the exact details of this are up for speculation.

To benefit RLB holders, the gambling platform operator uses a significant percentage of it’s revenue towards buying back tokens from the open market and proceeding to burn them:

- 30% of futures revenue;

- 20% of sports betting revenue;

- 10% of casino revenue;

As of now 37.87% of the total token supply has been burnt.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Swell Network

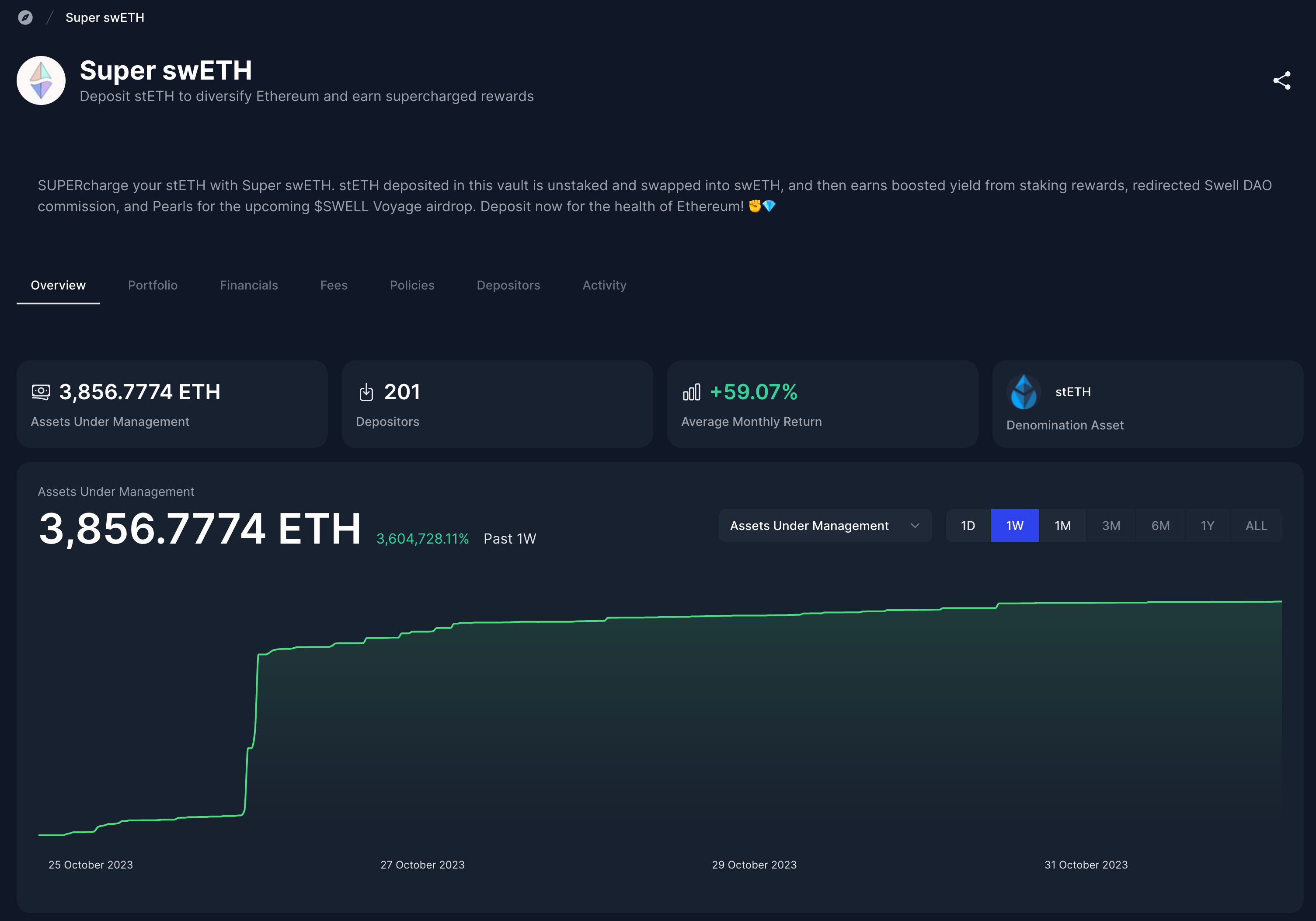

Today’s newsletter is sponsored by Swell Network. Swell is a liquid staking provider and operates the native ETH LST ‘swETH’ which has reached close to 50k ETH in TVL ($95m). swETH holders earn competitive staking yields as well as ‘pearls‘ which translates to the native $SWELL token once released at some point early next year.

Swell recently introduced the ‘Super swETH‘ vault which allows users to stake their stETH (from Lido) and in return receive swETH which sits in the vault. The purpose is to grow the swETH supply while diversifying the ETH liquid staking landscape and further decentralizing the Ethereum network. The vault is live for 180 days and receives boosted pearl as well as all DAO revenue for the entire duration. As seen from the picture, this adds up to a current yield of 59%.

Read more about this here.

4️⃣ dYdX v4

Pivoting to full decentralization in the v4 update, the platform will be subject to radical change in every conceivable aspect. Instead of relying on an L2 roll-up to host it’s exchange on, the team decided to make their own standalone app-chain by leveraging the capabilities of Cosmos. With this release, dYdX let the community take the wheel when it comes to future decisions regarding the protocol.

What does this update mean for users?

There are a myriad of benefits for people trading on the platform. Gas fees have been completely eliminated, allowing traders to only pay fees only for trading related fees. Additionally the dYdX chain can process up to 2000 transactions per second (a 200x improvement over v3), greatly improving trade execution. DYDX token holders can now stake their coins to receive a share of the revenue generated from fees.

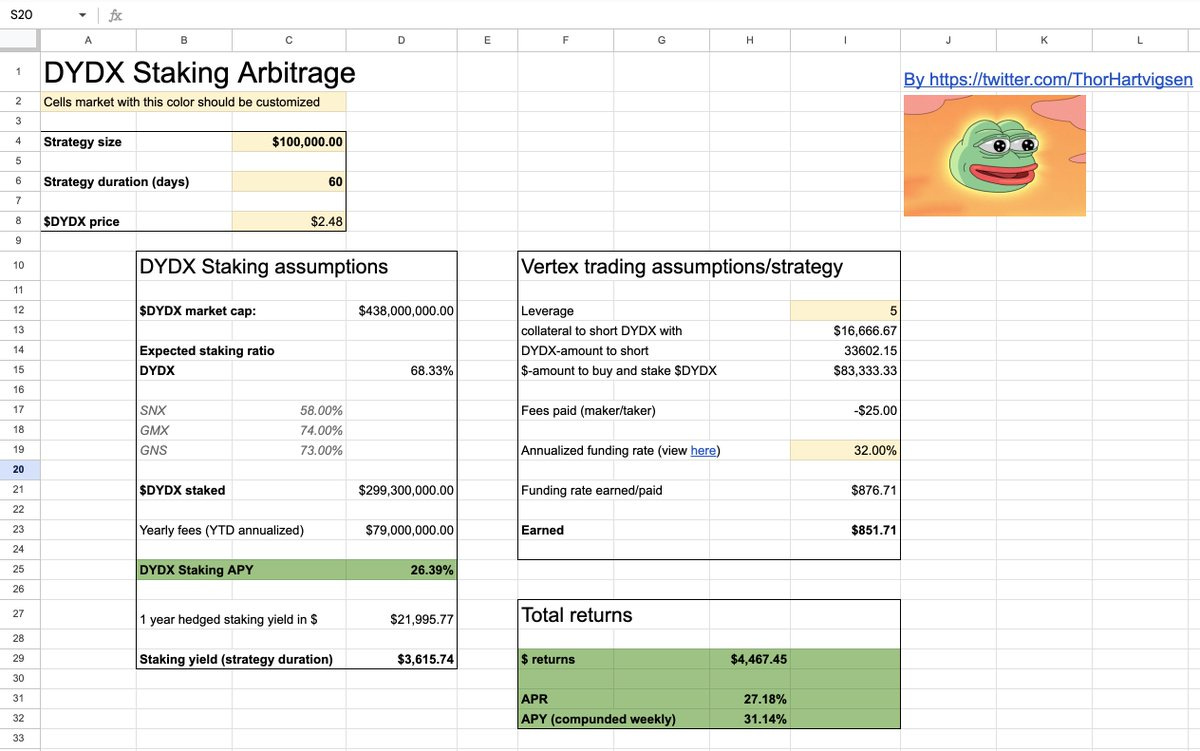

What yields can we expect from staking?

While there is not an exact number out there that we can make an educated guess using information currently available for us.

First we need to figure out the possible staking ratio. We can estimate this by averaging out staking ratios of similar protocols such as SNX, GMX and GNS. With this approach, we get an estimated staking ratio of 68.33%. The total value staked using this ratio would be ~$271.22m. Next we need to take into account yearly fees generated by the exchange. As of now the annualized fees are $77.4m according to token terminal. Using these values, we can calculate an estimate which comes out to ~28.54%, assuming that all of the fees are distributed to stakers. We built a calculator for this a few days ago which can be played around with here.

Since it’s inception dYdX has proven again and again that they are a forced to be reckoned when it comes to perpetual trading by asserting its dominance as an industry leader.

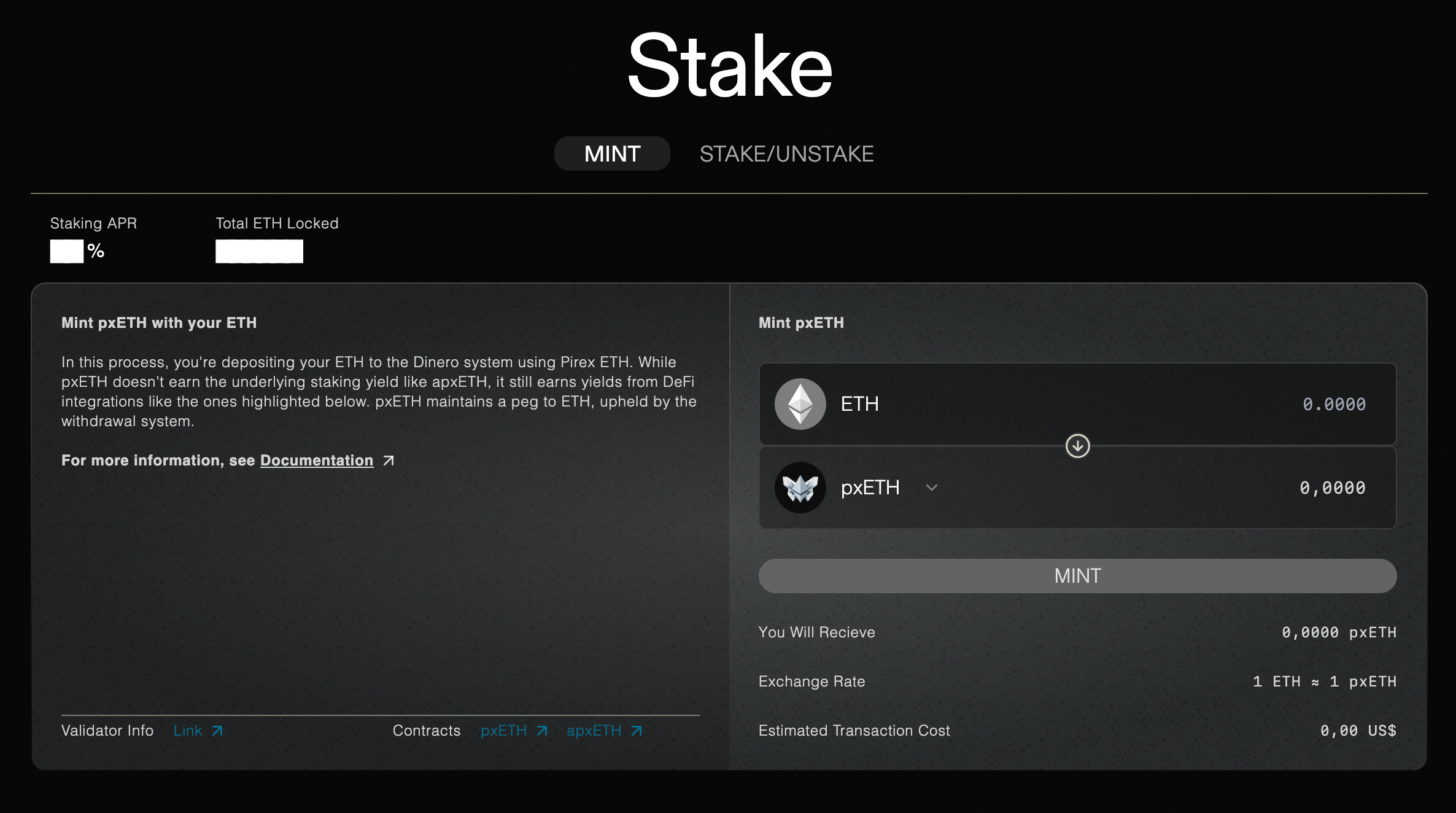

5️⃣ Redacted Cartel

In early October, the folks over at Redacted Cartel deployed Pirex ETH (pxETH) — a liquid and tokenized representation of staked ETH on Ethereum Goerli Testnet. This marked the first big step towards the phased emergence of Dinero. Redacted Cartel’s take on LSDs lets users decide between just holding pxETH or depositing to an auto compounding rewards vault for apxETH. Yield generated from Dinero’s revenue is then funneled into the rewards vault. The next key element following pxETH will be the DINERO stablecoin and a custom RPC for users.

6️⃣ Synthetix

Non-custodial derivatives exchange Synthetix has recently set out on a mission to increase DeFi adoption by seeking to overcome the shortcomings of decentralized exchanges in order to bridge the stark volume gap between DEXs and CEXs.

Infinex

Their solution? Infinex. By simplifying the tedious process of bridging assets to more scalable and efficient L2s, introducing one-click trading and eliminating the need to sign every action you make on the platform, Infinex aims to bring the many conveniences of traditional centralized exchanges to the blockchain minus the dreaded counter-party risks (e.g. insolvency, sensitive data breaches). The protocol will be hosted on Optimism, the release date is to be determined, although signups for the waitlist are currently live on their website.

This approach is definitely a net positive for all of DeFi as onboarding new users with little or no prior experience has always been a challenge for builders trying to grow their userbase.

Synthetix has had consistently large amounts of trading volume over the year as it remains a key player in the market. If their Infinex thesis plays out, the expected volume uptick should be reflected on the activity charts.

7️⃣ Arbitrum Grant Winners

Following up on the recently concluded Arbitrum Foundation Grant Program, we already know that household names such as GMX, Pendle and Frax successfully passed the quorum and received fairly sizeable grants respectively. How many tokens did they receive exactly and what are they intending to do with their ARB tokens?

GMX

Initially asking for 14m tokens and later changing it to 12m, GMX was by far the biggest grant recipient in terms of value. The intended use case for their grant is to stimulate on-chain activity on Arbitrum by increasing adoption and activity focused on their V2 protocol. Most if not all of tokens received will go towards creating a diverse range of highly liquid and capital-efficient perpetual and spot pools.

Proposed grant usage breakdown:

- 50% (6m ARB) - trader incentives;

- 50% (6m ARB) - liquidity incentives;

Pendle

The 2M tokens that Pendle received from the Arbitrum Foundation will be used towards increasing yield trading volume, deepening liquidity on already existing pools and offering token incentives for users to bootstrap liquidity for newly listed Pendle markets.

Proposed grant usage breakdown:

- 55% (1.1m ARB) - liquidity incentives;

- 40% (800k ARB) - trader incentives;

- 5% (100k ARB) - integration incentives;

Frax

The project with the lowest ask of 1.5M tokens of the three, Frax applied for the grant with purpose of incentivizing the protocol’s extensive Ethereum Mainnet user base to try out Arbitrum’s growing DeFi ecosystem.

Proposed grant usage breakdown:

- 100% ( 1.5m ARB) - user/liquidity incentives;

8️⃣ Radiant Ethereum Mainnet Launch

Initially, Radiant had planned to launch on October 3rd. However, they decided to delay the deployment until the 15th in order to optimize gas costs and improve the user experience on the platform. Unfortunately, that delay was followed by another delay. As of a few hours ago (November 1st), the Ethereum mainnet expansion is officially out with integrated assets such as wstETH, sDAI, rETH and several more than can be lent and borrowed. Radiant is another protocol who is confirmed to receive a sizeable ARB grant this month.

That’s all for this week! Make sure to subscribe for weekly analyses like this delivered straight to your inbox completely free of charge🫡

Nothing stated should be construed financial advice!