The Dawn of a Decentralized Capital Management Network

Social media sentiment suggests that many investors are rethinking their overweight altcoin positions as these portfolios struggle to keep pace with Bitcoin and traditional markets, where stocks continue to rally. Memecoin holders have been squeezed dry of nearly all available liquidity. So, where will these market refugees turn next when quitting isn't an option? Good, old yield farming.

Introduction

Given the composable nature of decentralized finance protocols and the ingenuity of individuals in the space that build on top of existing solutions—akin to that of legos—there is an abundance of yield strategies to employ. From simple leverage loops to convoluted multi-protocol arbitrage, the opportunities seem endless and are bound by one's creativity and technical capabilities. But with great yield, comes great responsibility. Thorough due diligence, constantly babysitting positions, attempting to figure out how frequently to compound and so forth. While some are willing to roll up their sleeves and allocate the time, most, to be frank, simply can't be asked to. Unless deploying a significant amount of capital, the difference in effort weighted returns when comparing automated or curated strategies to actively managed, hand-crafted ones is often negligible. Adding risk to the equation makes the manual approach even less appealing to the average user looking to earn additional yield on their stablecoins and medium to long term holdings. Though there may be a gap, it's no reason for complacency as markets inevitably find ways to bridge inefficiencies. There's even an accurate anecdote about this notion.

"Two economists are walking down the street and pass by a hundred dollar bill without picking it up. A little while later one turns to the other and asks “was that a hundred dollar bill on the ground?” To which the other replies “nope, if it was, someone would have picked it up already.”

A handful of prominent tech CEOs predict that AI will eventually replace software engineers. If that truly reflects the consensus, then simpler tasks, like position management, would likely be automated first. In case you’re wondering, who is building this?—the answer lies at the heart of this article covering SummerFi, a protocol leading the charge in offering enhanced yield for no additional costs or inputs on behalf of the user.

Shift in Approach

The platform is far from a newcomer to the industry. With years of operation and $3.29 billion managed, it has demonstrated both resilience and credibility. The team behind it has real skin in the game, leveraging extensive data and experience to navigate the ecosystem effectively and identify new growth opportunities.

Outlined in the litepaper and loosely prefaced in the introduction, onboarding new entrants to on-chain finance is a daunting task. Providing relatively complex financial tools and swaths of technical documentation to inexperienced users in hopes of engagement rarely leads to a favorable outcome for either party. To overcome this hurdle and grow the sector, SummerFi has launched a second, user-centric, iteration of it's core product dubbed as "Lazy Summer" to unlock optimized yields for everyone, not only crypto native power users.

For the sake of compartmentalization, the recent deployment has overtaken the default "summer.fi" domain, with the legacy front end moved to "pro.summer.fi", still accessible for more advanced individuals. This change signifies the turning of a new page and the project's commitment to catering to newcomers.

As for the contents of said page? An array of vaults powered by blue-chip protocol integrations (e.g. Aave, Sky, Morpho), actively managed by autonomous agents, referred to as "keepers". By continuously monitoring all available sources, the keepers are authorized to meticulously rebalance positions across venues to achieve a vault composition resulting in the highest possible risk-adjusted returns. The agents operate within strict constraints set by higher-level smart contracts, ensuring they adhere to governance-approved parameters. Additionally, they must reach consensus within the keeper network prior to interacting with the vaults, preventing any unauthorized actions or a single agent going rogue.

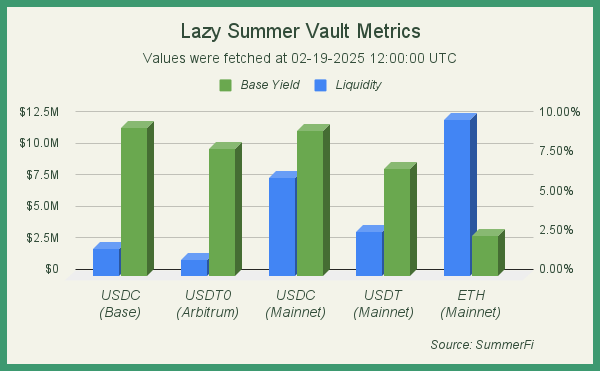

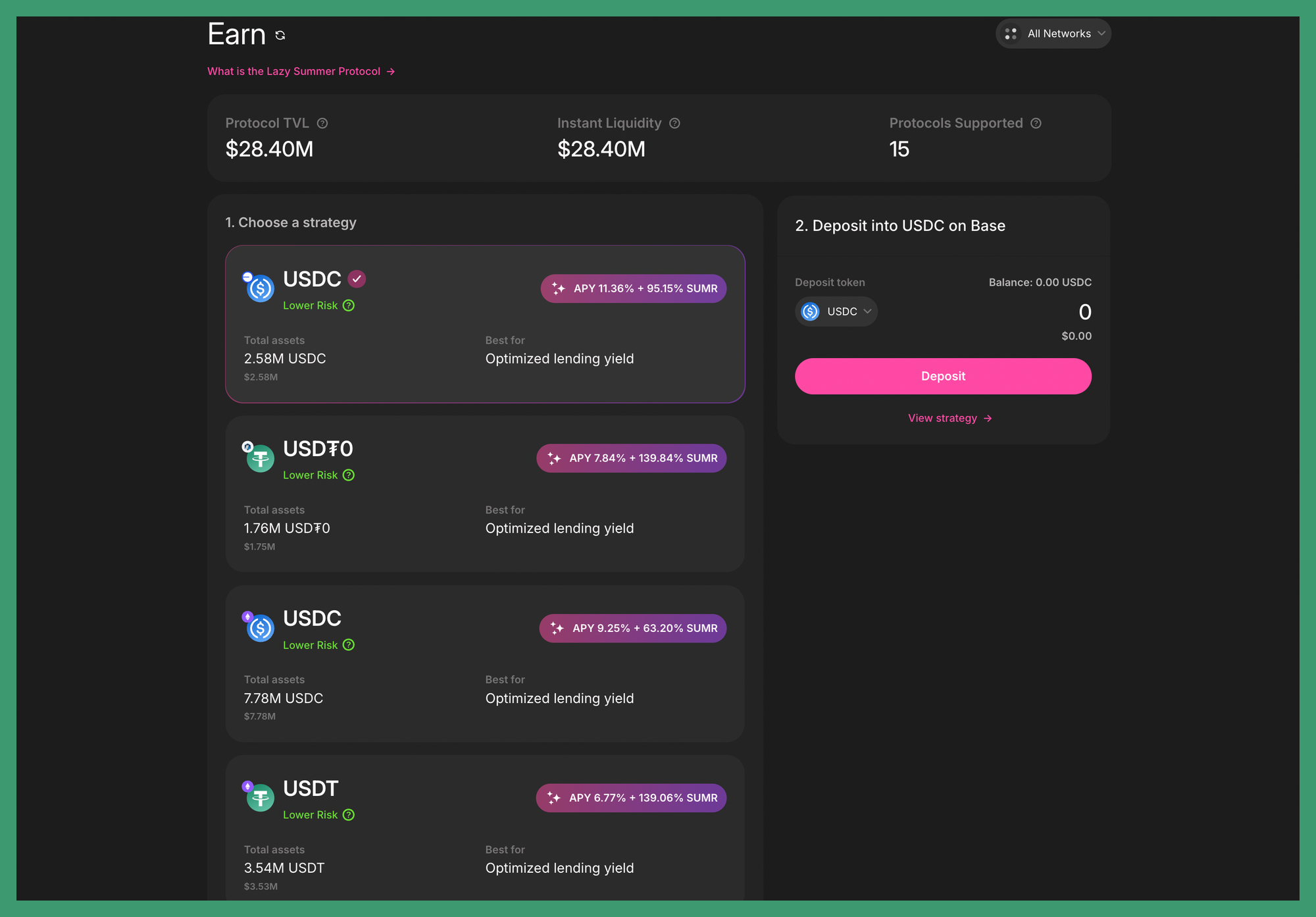

At the moment five actively managed vaults with strategies tailored for lending are available on Base (USDC), Arbitrum (USDT0) and Mainnet (USDC, USDT and ETH) that have amassed roughly $28.4 million in cumulative deposits.

It's evident that most of the deposits are concentrated on Mainnet and sport slightly lower yields than their rollup counterparts. Largely due to the core allocation of Morpho products offering more attractive rates for stablecoins on Base and Arbitrum. Though these figures vary and are subject to frequent change, they still manage to remain competitive against the rest of the market.

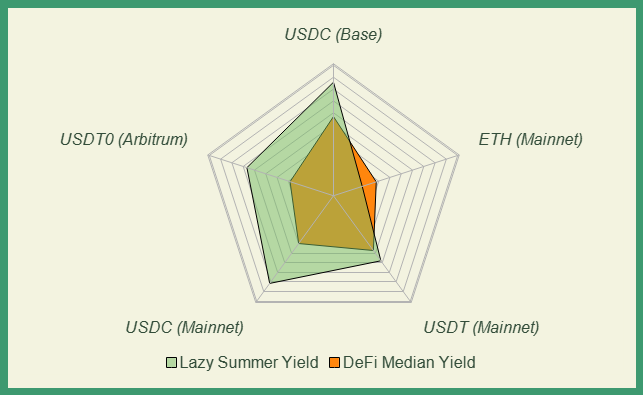

The net chart indicates that vaults on Lazy Summer marginally outperform the median DeFi yield for each asset apart from vanilla Ether, underscoring the efficacy of it's rebalancing mechanism. Keep in mind that this is merely the base yield.

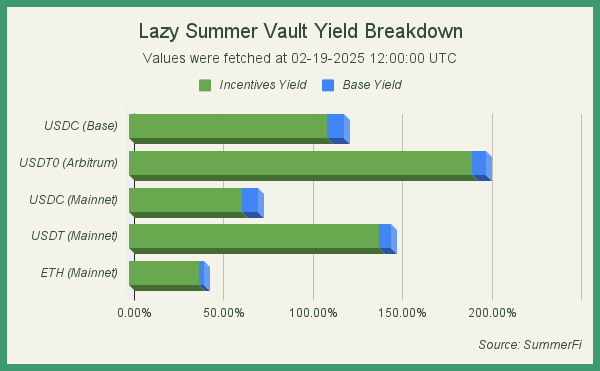

Since the protocol is still in its bootstrapping phase, incentives (SUMR) are generously distributed to depositors with reward percentages surpassing triple digits for a few offerings. A detailed breakdown of the token and its distribution follows later in this article.

An important thing to note is that while combined yields are significantly higher for less utilized strategies (e.g. USDC on Base), they will most likely normalize over time as engagement rises, granted the reward rates scale with deposits. Nonetheless the additional incentives on top of the underlying yield provide a fairly lucrative farming opportunity irregardless of directional bias for the token's future performance.

Accessing Sustainable Yields

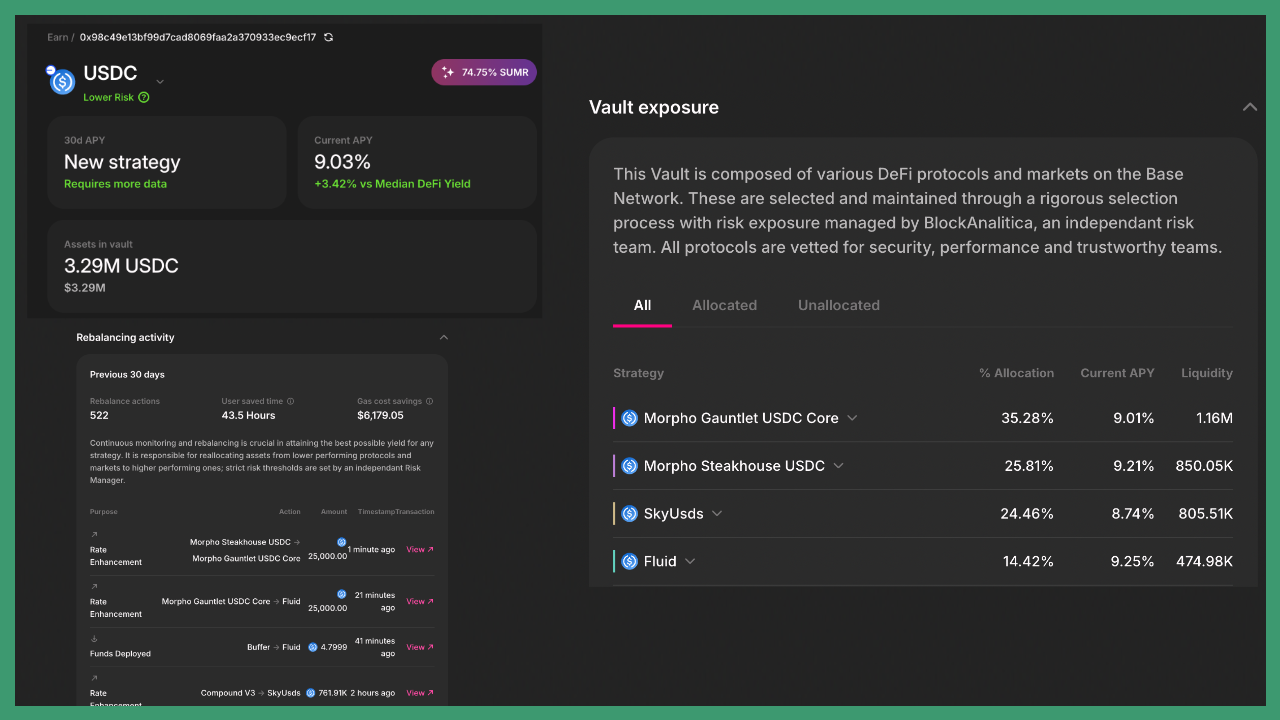

As portrayed earlier, there are several high yielding strategies on Summer.fi that all are easily accessible. Head over to https://summer.fi/earn and find the asset and chain of your preference. The APY's are displayed on the UI as seen above and more info about the various strategies can be found under 'view strategy'. As seen below, for the USDC strategy on Base, the current APY is 9.03% + 74.75% APR in SUMR incentives, with $3.29m in TVL. The exact vault exposure can also be viewed on the page and in this instance, the vault is allocated to Morpho, Sky and Fluid.

In order to access more customized strategies, head over to https://pro.summer.fi/ where you are able to select specific assets and protocols you'd like exposure to as seen below.

Keepers in Action

Having invoked the all-too-familiar "AI" buzzwords, it would be a disservice not to delve deeper and provide meaningful context beyond mere marketing jargon.

As stated earlier, keepers are specialized off-chain autonomous agents tasked with identifying yield opportunities and executing rebalancing strategies to deliver optimal returns.

To ensure security and prevent any unpredictable behavior or misuse of funds, only whitelisted keepers, operated by either the protocol itself or governance-approved third parties, are permitted to execute transactions on behalf of the vaults. This restriction is in place during the initial rollout of Lazy Summer, allowing for a controlled and secure launch while the system is gradually tested and refined. Any third parties engaging in rebalancing activities must adhere to rigorous transparency standards and undergo frequent audits to ensure compliance with guidelines. These measures help maintain security, accountability, and alignment with the best interests of the protocol. However, the infrastructure enabling these entities will gradually evolve into a permissionless, decentralized capital management network—allowing anyone to participate in the ecosystem.

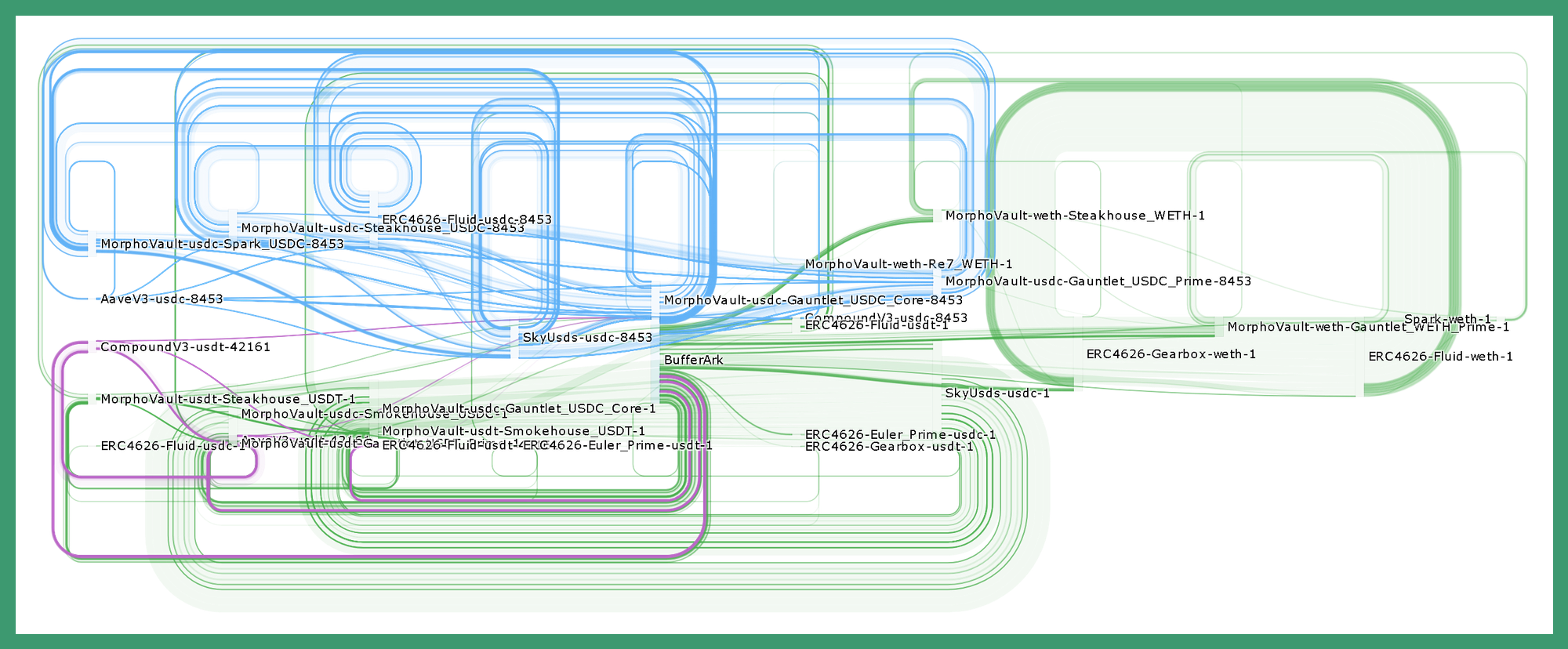

Relevant activity logs for keeper operations are publicly displayed under individual vaults and the global activity section of the site, ensuring full transparency. These data points provide valuable insights into fund movements across different yield sources, allowing users to track rebalancing activity in real time. In just eight days, a total of 926 rebalancing events have occurred, averaging 23.15 adjustments per vault per day. This high frequency of interactions suggests that the system is incredibly responsive to changes and is able to redistribute assets effectively at a moment's notice. Visualizing the flows provides a clear understanding of the scale and dynamics of capital rotations.

Green lines on the chart indicate contract interactions on Mainnet, blue represents Base, and pink corresponds to Arbitrum. In terms of transaction count, the single vault on Base has seen the most frequent adjustments, whereas Mainnet strategies experience fewer but higher-value transactions. Across all chains, these rotations have generated approximately $240.3 million in volume, with an average transaction size of $97,765.05.

While it's still early to gauge the full impact of the mechanism, the protocol interface suggests that keepers have already saved users 77.2 hours of research and due diligence, along with $5,512.60 in gas fees that depositors would have otherwise incurred.

Tokenomics

Designed to give users direct influence over yield optimization, contributor accountability, and fund allocation, the SUMR governance token has been introduced to the protocol and plays a pivotal role in shaping the platform's future. According to documentation and official communications, token holders have the power to curate existing and upcoming yield opportunities, ensuring that only the best-performing and safest markets are utilized. Additionally, they can oversee third-party contributors, such as keepers and Risk Curators, to ensure capital is managed responsibly. Governance decisions extend to protocol revenue allocation, balancing short-term rewards with long-term sustainability.

Tokens can be acquired by interacting with Lazy Summer in numerous ways, all structured to maximize rewards efficiently when combined strategically. This model is put in place to encourage active participation and ensure that governance remains dynamic and responsive.

Direct Deposit

With a strong community-first approach, the protocol distributes approximately 215,000 SUMR tokens daily to vault depositors. These rewards auto-compound, growing over time without requiring any manual intervention. Early participants benefit the most, as the vaults are currently less saturated, allowing for higher individual allocations. Data presented in a previous segment suggests that the vaults residing on Base and Arbitrum offer the most lucrative outcomes.

Stake & Delegate

Existing token balances can be staked and delegated, unlocking additional rewards through governance participation. By transferring voting power to a delegate, users gain a share of governance-derived incentives. To maximize returns, it's advisable to delegate to active participants who consistently contribute to the ecosystem, minimizing reward decay. While this method requires slightly more frequent engagement, the added benefits make up for it.

Govern the Future

For those looking to take a more active role in shaping Lazy Summer, becoming a delegate offers both influence and rewards. Think of it as being a key opinion leader on a governance forum, but without the shady backroom deals. By receiving delegated voting power from other SUMR holders, one can vote on key proposals and earn incentives in return. However, rewards are tied to activity—delegates who fail to show any signs of life within 60 days, will see their influence and earnings gradually decrease due to voting decay, affecting both themselves and those who delegated to them. To circumvent penalties, staying engaged is essential. With a fixed monthly SUMR allocation, the more voting power delegated to an entity, the greater their share of the pie.

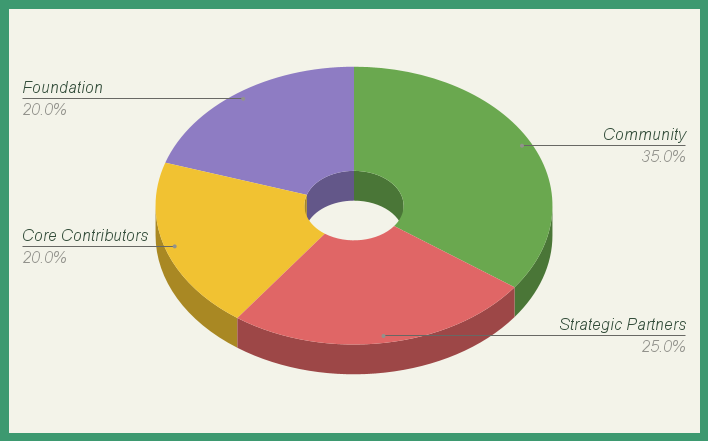

The total supply for the token is fixed at 1 billion, with the distribution broken down into four groups to fairly compensate users and contributors alike.

Proportionally, the largest share of tokens (35%) is allocated to the community, aiming to stimulate activity and adoption. While the general framework for it is established, the precise distribution percentages are still yet to be set in stone by the DAO. A quarter of the supply is set aside for key partnerships to incentivize external collaboration. The remaining 40% is split equally between core contributors and the foundation's reserve fund overseeing development, ecosystem growth, marketing and driving long-term growth initiatives.

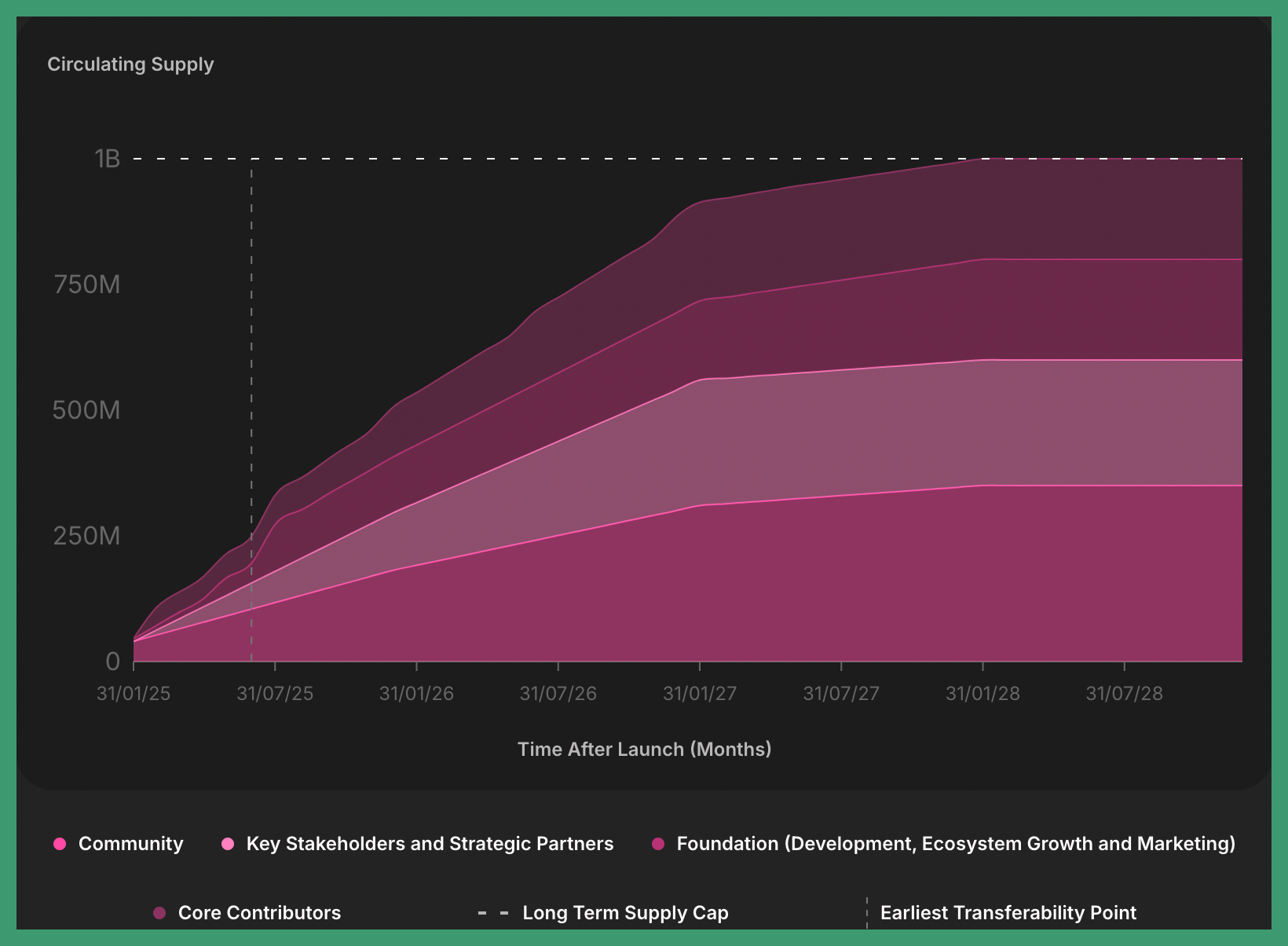

In an effort to prevent early price volatility and build a strong foundation of committed, long-term holders, the SUMR token will initially be non-transferable until July 1, 2025. During this period, the token cannot be transferred, traded, or sold, ensuring that governance power remains exclusively in the hands of active participants who align with the protocol’s vision. After this date, the community can vote to enable transferability.

Over approximately three and a half years, the total supply will be distributed across the four key groups, with emissions peaking within the first two years and subsequently tapering off.

Parting Thoughts

Though yield optimization isn’t the most thrilling concept, SummerFi’s unique approach to vault management offers a refreshing take. By leveraging autonomous agents, it not only enhances efficiency but also strengthens the case for artificial intelligence solutions playing a larger role in decentralized finance beyond customer support chat bots on the home page. Whether for passive yield seekers or active participants, the protocol provides a solid means of maximizing returns without the complexities of hands-on management.