The Bullish Case for Solana (Re)staking

Introduction

Restaking is a simple yet powerful idea: it enables staked assets to be reused (or restaked) across multiple decentralized services, or what Jito refers to as Node Consensus Networks (NCNs).

This approach offers several benefits. Most notably, it enhances the security and integrity of the decentralized services as they are able to leverage the economic security of a main L1 rather than allocating significant resources to design their own, and potentially weaker, security models. But from a staker point of view, it also maximizes capital efficiency, as a single asset is able to secure multiple decentralized services and potentially earn a higher return on capital.

The implications of this are profound, and many of the brightest minds in the industry see restaking as a killer innovation with the potential to unlock faster progress by enabling a more secure, flexible, and scalable blockchain environment for developers. This has generated significant hype and even if it is relatively early and experimental, restaking has grown to become one of the largest sectors by TVL on Ethereum, with over $21.6 billion—up from just $1.4 billion at the start of the year.

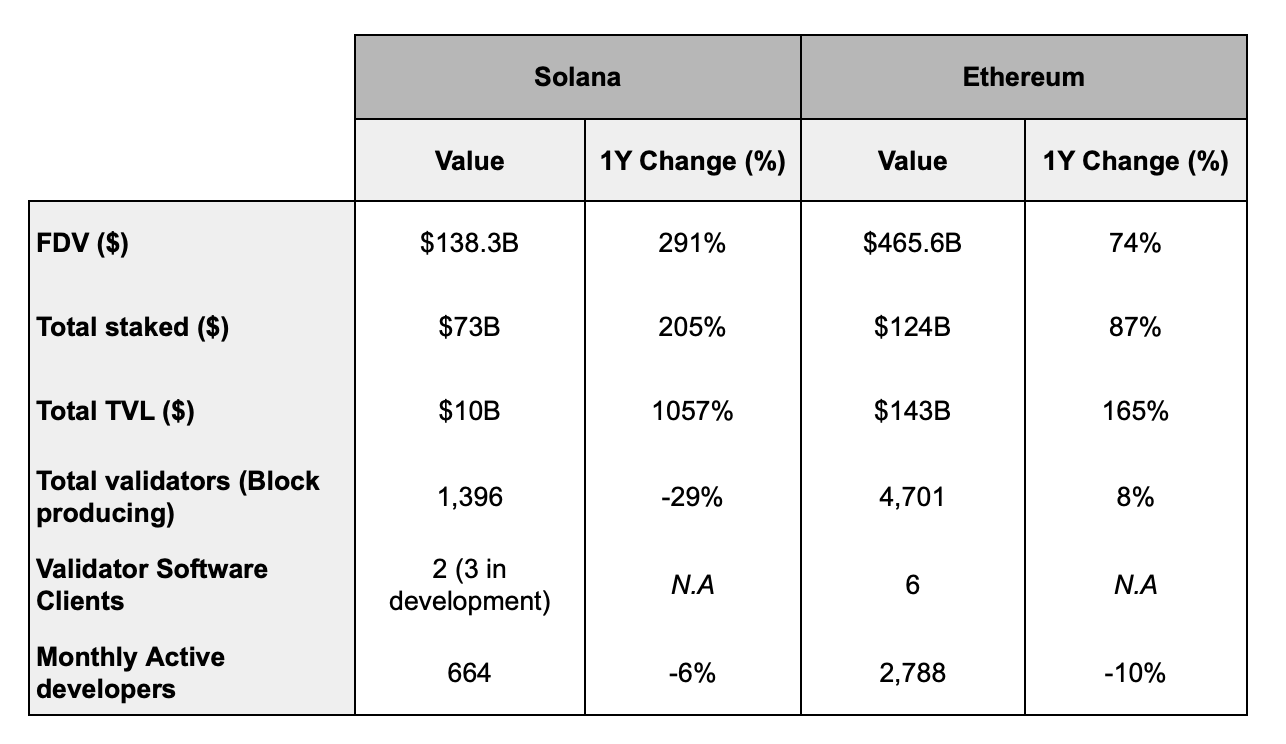

But so far, restaking was primarily focused on Ethereum, as it was considered the most economically secure PoS blockchain with the greatest level of adoption. However, when we take into account Solana's strong growth since the start of this bull market, especially in contrast to Ethereum's more stagnant activity on its mainnet with a lot of it shifting to L2 solutions like Base, a fair question arises: Is there now a compelling case for restaking on Solana?

In this piece, we will explore this question from different angles and explore the potential market opportunity of restaking on Solana. Let’s dig in.

Sponsor - Kamino Finance

Today's report is sponsored by Kamino Finance. Kamino recently introduced 'Kamino Swap', an intents-based exchange powered by @PythNetwork's 'Express Relay' infrastructure. The limit orders are broadcasted to the Pyth Relay network of 'searchers' who are looking for arbitrage opportunities and are competing to fill orders via auctions. They pay tips to during this auction all of which goes to the user swapping on Kamino.

Due to this architecture, swapping on Kamino is without slippage, MEV or fees and will further be utilized to improve the Kamino Lend liquidation engine.

So far, Kamino Swap has seen $6.7m in volume and $1.63k in additional tips and surplus paid to users swapping on the protocol. Over the coming weeks and months, Kamino Swap will integrate more assets and market orders as well. You can try it out here or read more about it in the post below.

1/ Introducing Kamino Swap

— Kamino (@KaminoFinance) December 5, 2024

An intents-based exchange platform that will offer the best price execution at any size, for any token on Solana, powered by @PythNetwork

Zero slippage. Zero fees. Zero MEV.

Limit Orders are now live in open beta: https://t.co/NJdgIdS07p pic.twitter.com/QipugptlCT

1. Solana is becoming mature enough for (Re)staking

For restaking to make sense, we need strong economic security at the base chain level. This is why Ethereum has been the chosen chain so far. With over 34.3 million ETH staked (worth $124 billion), 4701 block-producing validators, six different consensus clients, and a strong reputation as one of the oldest and most reliable blockchains for building applications, it made logical sense to build the foundation of restaking on Ethereum.

But we humans love to extrapolate the present into the future, assuming the status quo will remain unchanged and that Ethereum will retain its dominant position forever. However, history tells us that this is not necessarily the case, especially at the forefront of technology, where creative destruction forces are particularly strong. Let’s just consider how the consensus once held that Yahoo was unbeatable in search engines, only for Google to overtake it. Similarly, Apple rose to dominance in personal computing after IBM had been seen as the endgame.

Following this logic, we might ask ourselves: Are we witnessing a similar moment in Ethereum’s history? And does it make sense to keep building the entire restaking stack exclusively on it? This is especially relevant when we consider that new asset issuance is leaving Ethereum mainnet for alternative L1 (like Solana) or L2 (like Base) and the lack of clear direction of where Ethereum is heading. You can refer to this post for a full overview of the state of Ethereum.

Make Ethereum Great Again

— Jon Charbonneau 🇺🇸 (@jon_charb) December 2, 2024

Make Ethereum the World Computer pic.twitter.com/XVl0qJHlud

If we agree that restaking is truly a game-changing technology, then we should open up possibilities and make it available on other L1s, not just Ethereum. This would give builders who want to leverage restaking the freedom to choose on which consensus layer they want to derive trust from.

In this context, Solana is a clear candidate for restaking. It’s been the L1 of this cycle so far and has achieved a significant level of growth, maturity and security. As of writing, around 65% of SOL’s circulating supply is staked, which represents approximately $73 billion of economic security. One year ago, this number was $24 billion. Further, the network has nearly 1,400 block-producing validator nodes and two different client validators, with three more (Firedancer, Sig, and Agave) on the way.

On top of that, Solana is extremely cheap and fast, and has seen strong adoption from both users and builders. It is the chain experiencing the highest pace of app development in crypto, with real organic growth and who managed to overcome the 'cold start' problem and built a strong network effect. All of this suggests that Solana has a lot of potential ahead and is becoming mature and established enough for restaking to make sense here.

solana vs ethereum pic.twitter.com/qXDksoPe8i

— Curb◎ (@CryptoCurb) December 11, 2024

2. (Re)staking on Solana offers more possibilities than on Ethereum

Ethereum has been the pioneer of smart contracts but its high costs have limited the scope of applications that developers can build on-chain. Solana’s design, on the other hand, enables developers to have a much broader expression of what they can and want to create on the L1. For this reason, we can argue that the design possibilities for restaking are greater on Solana than on Ethereum.

can't wait to land an ETH tx in 4s on the beam chain in 2030 pic.twitter.com/i8nN3GnTRy

— Brian (@brian_smith_0) November 12, 2024

First, Solana's low transaction and compute costs lower the barrier to entry for NCNs ( Node Consensus Networks). Unlike Ethereum, where high fixed costs limit participation, Solana supports the deployment of smaller, more cost-effective and efficient NCNs that are tailored to tackle specific use cases. This allows more services to be outsourced, reducing the scope of direct applications and expanding interoperability across the ecosystem.

Additionally, NCNs on Solana can handle more complex operations and the code can be more dense without minimizing on-chain compute, unlike designs such as EigenLayer on Ethereum. This enables on-chain verifiability, on-chain rewards distribution, on-chain data publication and enhances the overall flexibility and robustness of restaking. Ethereum was the guinea pig for restaking, but over the long run, restaking on Solana seems to have greater potential for real use cases and applications to be built on.

Further, Solana offers significant advantages over Ethereum for liquid restaking tokens (what Jito calls VRTs - 'Vault Receipt Tokens'). On one hand, Solana’s low costs can substantially reduce operational costs of liquid restaking tokens providers like Kyros. In a business model where every basis point matters at scale, this improves profitability and can create space for more competition and a more dynamic ecosystem with diverse VRTs offering diverse restaking strategies and more flexible slashing conditions. On the other hand, liquid restaking on Solana is also far more affordable for users as lower transaction costs lowers the barrier for entry and allow them to utilize liquid restaking tokens more easily across various DeFi applications without constantly worrying about fees. This is an important factor to drive long term capital adoption.

3. (Re)staking could bring new innovation to Solana

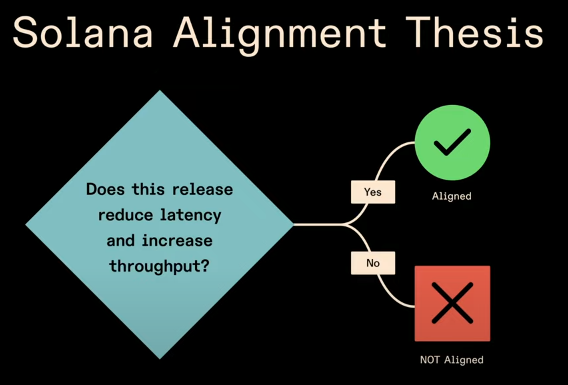

Solana vision is, and has always been, to become a global computer interface where everyone can build upon. To achieve this, the focus has constantly been on increasing throughput and reducing latency on the base chain.

This is a strong vision that makes a lot of sense. However, no one can defy physics and we can’t simply increase throughput 10x or reduce latency 10x tomorrow. It will require a lot of resources and hard work to get orders of magnitude improvements. So even if it is not for now, there’s this common realization that not everything will happen on the L1. This is evidenced by recent conversations around “network extensions.”

Most of the L2-ish things on Solana are better thought of as Network Extensions. While the underlying tech stack might resemble bitcoin or ethereum L2’s, the function and role is so radically different I think founders would best be served by Network Extensions

— Austin Federa | IBRL | 🇺🇸 (@Austin_Federa) September 2, 2024

On that side, we can argue that restaking could open up new design possibilities when thinking of scaling the Solana network and bringing new innovation to “network extensions” programs. The design space is extremely broad and even if it is still unclear if and how this will be implemented, there is a strong chance that it will evolve into a powerful infra tool for scaling. To illustrate this, we can use the example of Sonic which defines itself as the first Solana Layer 2 for sovereign games, built with HyperGrid, the Solana Virtual Machine (SVM) horizontal scaling framework. This project plans to leverage Jito (Re)staking to enhance the security and efficiency of its SVM, supporting a multi-use ecosystem for gaming, DeFi, and other applications on Solana.

In addition to that, the hard guarantees provided by restaking provide real use cases to enhance the reliability of the Solana network. One example is Jito TipRouter NCN which is being developed to decentralize and enhance the security of MEV tip distribution on Solana. Another example is Nozomi, a protocol by Temporal that will use Jito (Re)staking to reshape Solana’s transaction microstructure and address challenges like sandwich attacks, slippage, and transaction timeouts. This fits with the long term vision of Solana and could significantly improve the user experience, ensuring that the chain is not only fast and cheap, but also reliable and easy to use.

More than high performance and strong metrics, Solana is also about the startup spirit it embodies. Over the last few years, we’ve seen the emergence of successful projects like Jito, Kamino, Jupiter, and Helium. But this is only the beginning, and the number of projects choosing to build on Solana keeps increasing.

If Solana is becoming the go to chain for builders, then restaking has its place here. This could extend Solana’s economic security to key services of the ecosystem that often operate outside the base layer, such as oracles, bridges, and sequencers, but that are nonetheless essential. While smart contracts and their interactions inherently benefit from Solana's security, these other components often require their own economic security models. This means either raising significant capital to incentivize validators or compromising on security. Therefore, we could end up in a situation where the smart contracts are secured and perform the correct calculation on-chain but based on an oracle that provided incorrect data. This presents a paradox: there’s little value in having strong security at the smart contract level if other parts of the system aren’t equally secure, as, ultimately, it is the weakest link that determines the overall security and resiliency of a system. For this reason, it makes sense for some Solana-focused services to leverage Solana's restaking. For example, Switchboard, a permissionless oracle network on Solana, is working with Jito (Re)staking to ensure the reliability of its data feeds. If successful, this approach could increase both the security and reliability of the Solana network.

4. (Re)staking to optimize capital efficiency of DeFi users on Solana

Restaking offers higher APY opportunities compared to simple staking on Solana. Since one of the primary objectives of DeFi users is to optimize capital efficiency, restaking presents an attractive opportunity. It enables DeFi users to unlock new yield opportunities on Solana without the need for additional capital. For instance, instead of buying a liquid staking token to earn yield on SOL and using it within DeFi, a user could buy a liquid restaking token to earn even more APY while still being able to do whatever he wants in DeFi. However, it is also worth noting that restaking comes with added risks and this needs to be taken into account. But if managed properly, it could provide interesting risk to reward opportunities.

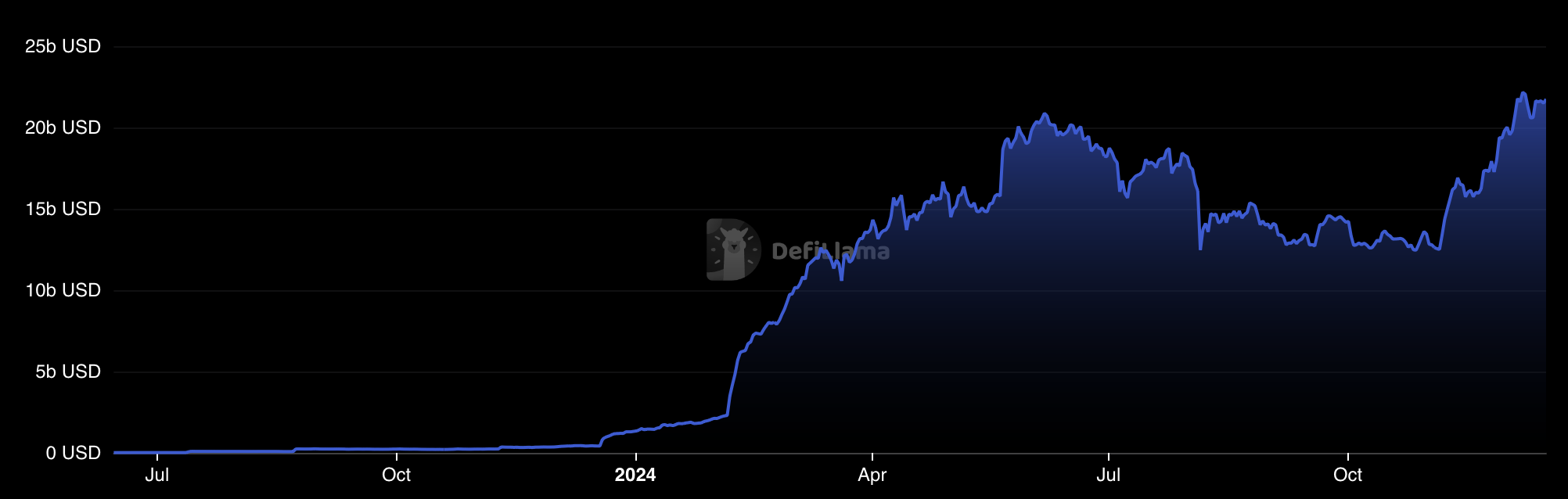

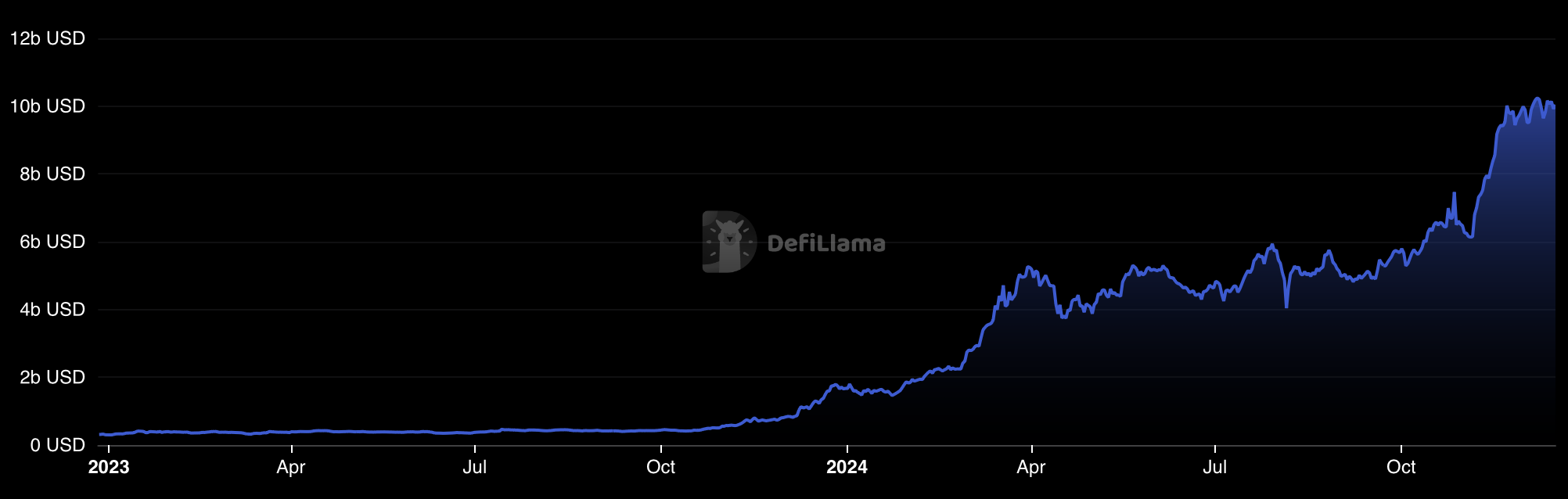

Looking at the growing adoption of DeFi on Solana, we could argue that having a mechanism to optimize capital efficiency can attract a lot of liquidity over the long term. Indeed DeFi activity is surging on Solana Over the last year TVL has grown from just $1 billion to over $10 billion and the momentum is still strong.

Moreover, activity on Solana is on an upward trend, as evidenced by the surge in fees generated by the network. Recently, we’ve seen weekly fees of over $13 million, a significant increase from less than $1 million just a year ago.

DeFi on Solana is just getting started. From a user perspective, this means that there is going to be an increasing demand for solutions to optimize capital efficiency, and this once again makes the case for Solana restaking.

Closing words

Restaking on Solana is still in its early, experimental stages, but it represents a promising narrative and a lot of interesting use cases are already emerging. As the ecosystem continues to mature and gain traction, the case for restaking will only grow stronger. If we assume that over the long run, Solana can capture a market share comparable to Ethereum's restaking market, the market opportunity is substantial.

Currently, two main protocols dominate the restaking infrastructure on Solana: Solayer and Jito (Re)staking. Solayer, as a first mover, has built a full restaking stack and already achieved over $350 million in TVL. However, Jito appears better positioned to lead this narrative in the long run. With a strong technical foundation, the highest TVL among Solana protocols, and a clear vision, Jito has established itself as a leader in the Solana ecosystem. Its flexible restaking stack, with built-in liquid restaking tokens (VRTs) integration that is asset-agnostic from day one further enhances its potential.

From a user perspective, this highlights a significant market opportunity for liquid restaking on Jito. If you’re interested in this emerging narrative, this post provides an overview of the key tradeoffs between different VRTs:

In any case, I’ll leave you with a quote from Freeman Dyson: “When the great innovation appears, it will almost certainly be in a muddled, incomplete, and confusing form. To the discoverer himself, it will be only half understood; to everybody else, it will be a mystery. For any speculation which at first does not look crazy, there is no hope.”

This perfectly describes the current state of Solana (Re)staking: early, promising, and a land of new DeFi opportunities ahead.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.