The Arbitrum Grants Have Arrived 💸

Will the Arbitrum incentive program kickstart an ecosystem-native bull market? An analysis of the Arbitrum 'STIP'.

Welcome back to DeFi Frameworks - the hub of data-backed DeFi research. Today’s report offers an in-depth analysis of the Arbitrum protocols eligible for a grant as well as the significance this could have on the overall ecosystem.

Thanks for reading DeFi Frameworks! Subscribe if you haven’t already for data-driven defi research every week⚡️

Grant Winners🍾

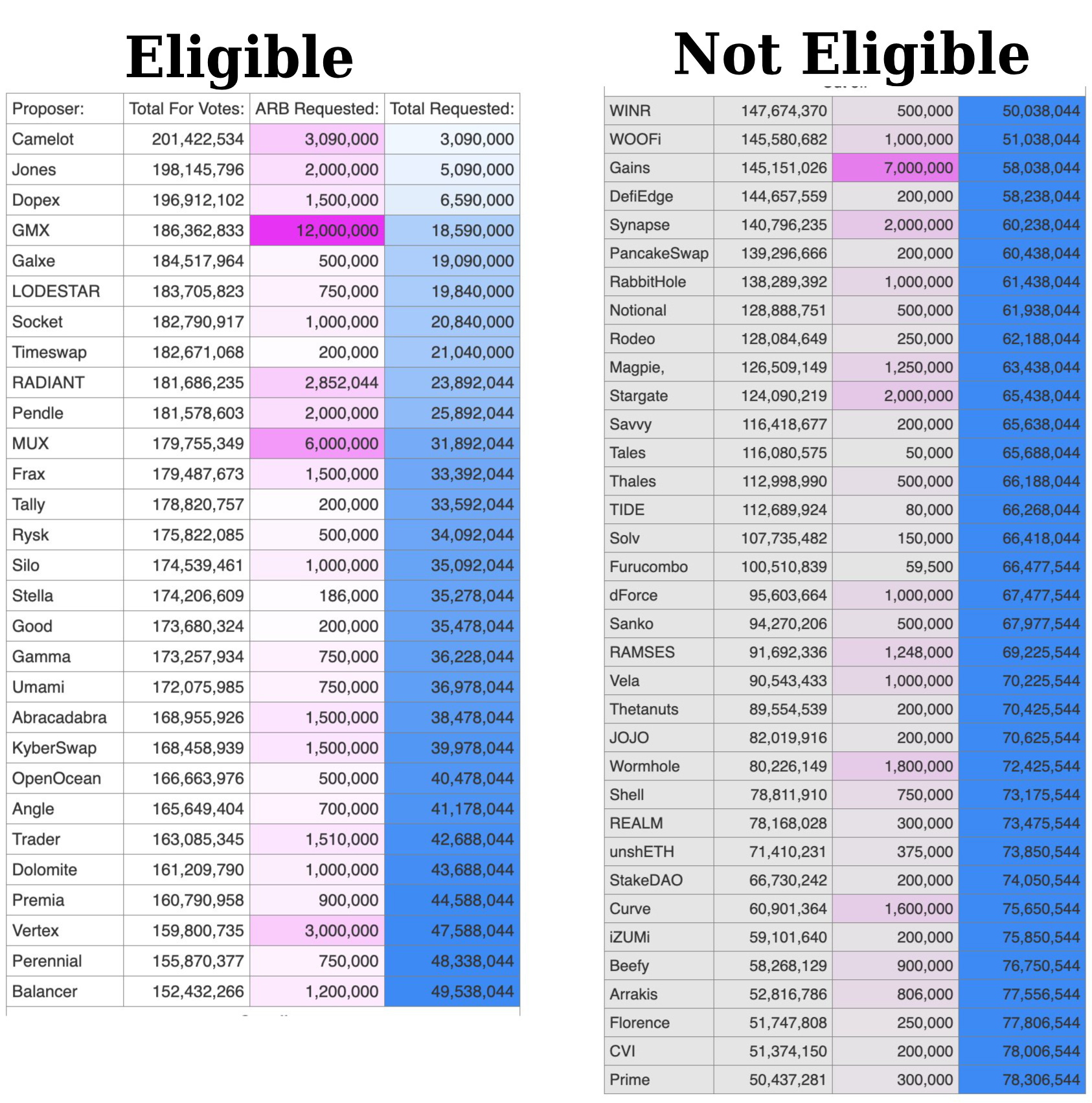

The Arbitrum Short Term Incentives Program (STIP) was proposed September 1st and voted in favour September 18th. A total of 50m ARB ($41.5m) will be distributed amongst winning protocols who will use the incentives to attract new users and liquidity. Voting amongst protocols has now concluded and the winners have been found👇

The 50m grant will be split between the protocols with the most amount of ‘for‘ votes as seen by the image above. For the protocols in the table on the right, despite having reached quorum and the majority of votes in favour for their proposal, due to the large grant demand these will not be receiving any ARB this round.

Arbitrum Ecosystem Boost⚡️

In general, should one expect an increased inflow of capital to Arbitrum with this 50m ARB grant program? In order to determine this, let’s consider the first Optimism grant:

42m OP began distributing July 2022. At the time, the price of OP was $0.5. In the months after the grant distribution started, the TVL on Optimism grew by over $600m reaching more than a billion dollars as seen per the image below. In the same period, OP rallied over 300% before consolidating back to the lows (image 2). It’s worth noting that $ETH went from $1000 to $2000 in the same period so the uptrend should also be attributed to general market bullishness. Nonetheless, OP (+324%) as well as Optimism native tokens like VELO (+1200%) and LYRA (+600%) outperformed the market and ETH by orders of magnitude. It’s likely that the incentive program played a role in this.

So should we expect ARB to appreciate 300% and GMX 500%? Well, likely not. The market conditions are vastly different today than they were in July 22 and it’s probably too much to expect ETH to 2x in the coming 3 months. Nonetheless, I think there is a scenario where ARB and Arbitrum ecosystem tokens outperform ETH over the next 3-6 months. I further believe this scenario is somewhat probable IF the market doesn’t nuke. The next 3-6 months also line up with the EIP-4844 hardfork which decreases fees on Ethereum rollups and improves the profit margin amongst the L2s like Optimism and Arbitrum.

With that in mind, below is an analysis of some of the ecosystem grant winners. Scroll down to the bottom to see an in-depth analysis of all of the grant winners.

PENDLE

Proposed amount: 2m ARB

Grant use: 1.1m ARB as incentives to Arbitrum pools to deepen liquidity. 800k ARB used for campaigns to increase trading volume on Arbitrum markets. 100k ARB as ecosystem incentives for protocols integrating Pendle products.

Recent traction

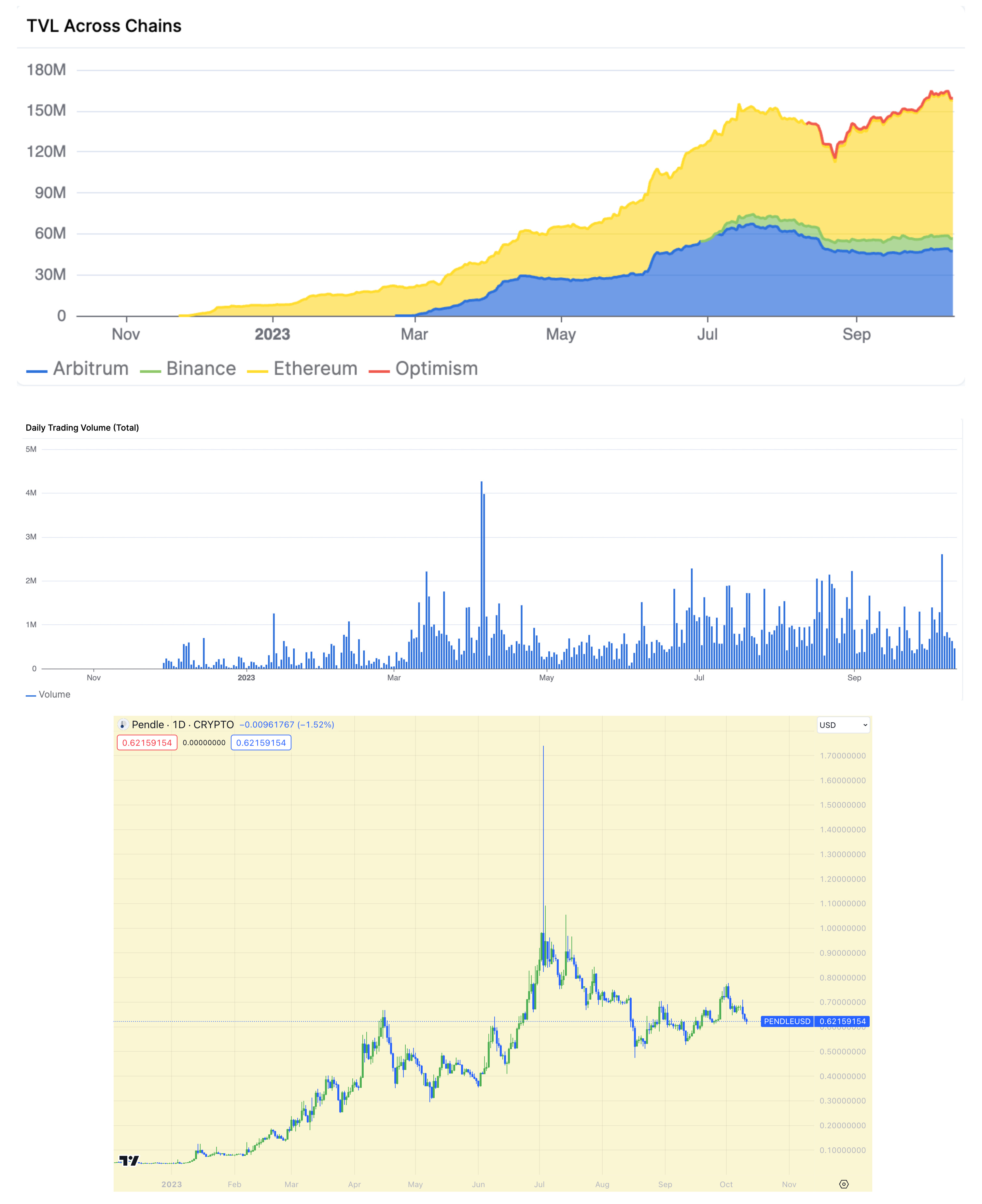

Pendle has been one of the only DeFi protocols with sustained growth throughout the bear market both in $-terms and ETH-terms. The team integrates new assets on a weekly basis with the most recent being the sDAI token and various ETH-LSTs.

Because of the underlying mechanisms, Pendle offers extremely competitive yields on a large range of assets which is why the protocol has been able to attract so much liquidity lately.

Pendle stats can be viewed here, noteworthy however is the high trading activity still happening on the platform. Most volumes across decentralized trading protocols are at yearly lows while the trading volume on Pendle continues to be at highs. The token price is currently at 60 cents (down 65% from the highs on the day of the Binance listing) and sits at a market cap of $59m. While it’s important to keep in mind that $PENDLE is emitted to incentivize liquidity, it’s clear that the price correlates with the TVL. If Pendle is able to keep growing its TVL, the token could appreciate on a higher time frame.

Radiant Capital

Proposed amount: 2,852,000 ARB

Grant use: 2,060,000 ARB as incentives to new lenders and new dLP lockers (RDNT/ETH lp). 792,000 ARB as strategic ecosystem incentives.

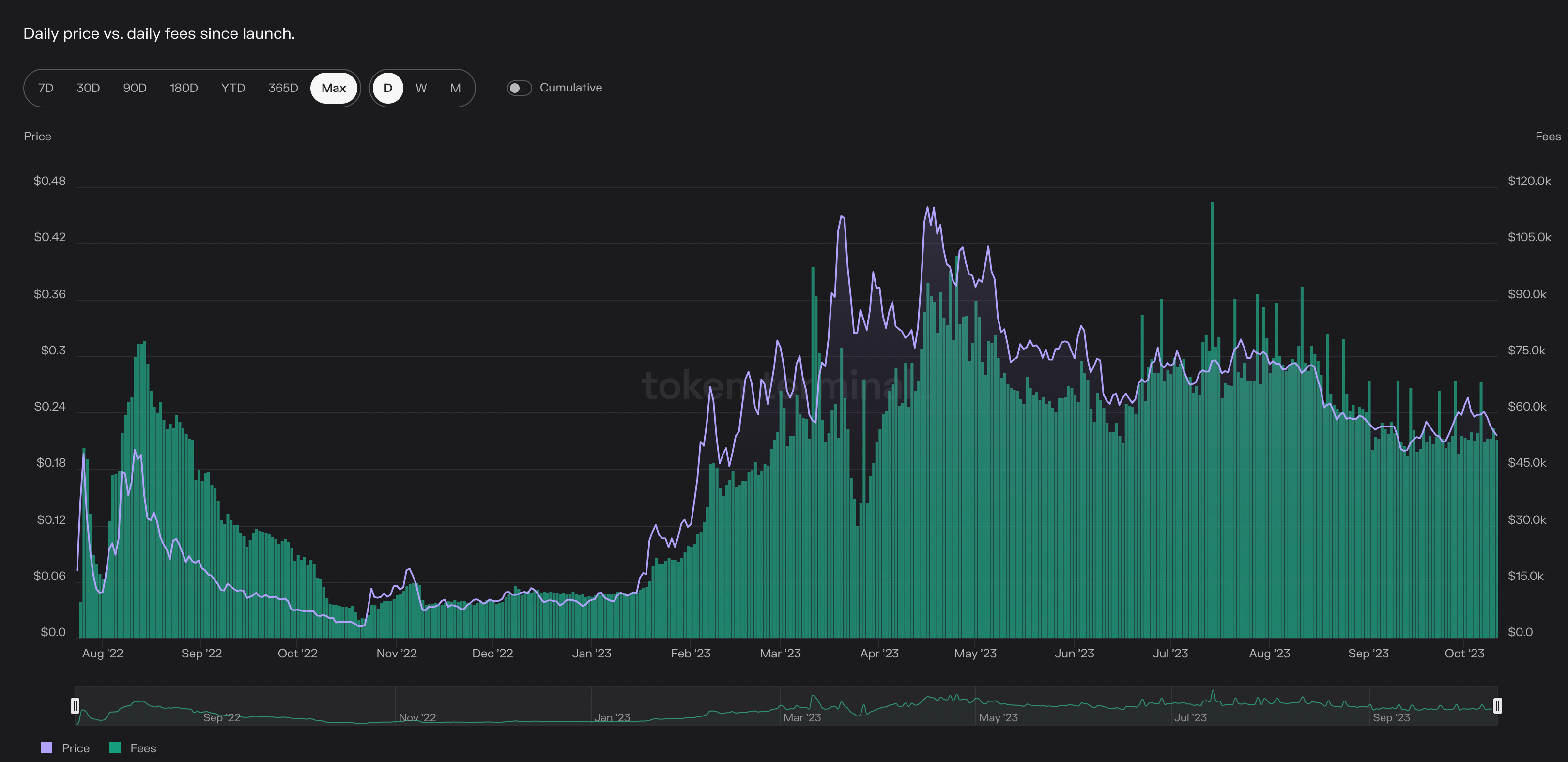

I’ve made content on Radiant Capital several times throughout the year across Twitter and Youtube as they launched their V2 platform, integrated new assets and grew in TVL. Radiant has generated $16.6m in fees this year alone, half of which has been distributed to protocol lenders and the other half distributed to $RDNT stakers.

As seen from the image below, the fees shot up earlier this year around the time of the Radiant V2 launch. While the daily fees have declined over the past months, they remain relatively high. What’s further interesting is the high correlation between the daily fees and the price of $RDNT. It seems that an increase in fees would be be a positive catalyst for the token.

Can we expect the fees to increase anytime soon? Well potentially yes for two reasons. First, Radiant is a few days away from launching on Ethereum mainnet which could attract new liquidity and additional lenders/borrowers. Second, the ARB grant for their Arbitrum market. The combination of these could act as the catalyst needed for Radiant to reverse its downtrend in both price and daily fees.

GMX

Proposed amount: 12,000,000 ARB

Grant use: 5m ARB as trading incentives including trading contests. 5m ARB towards liquidity incentives. 2m ARB as support for protocols looking to integrate GMX products.

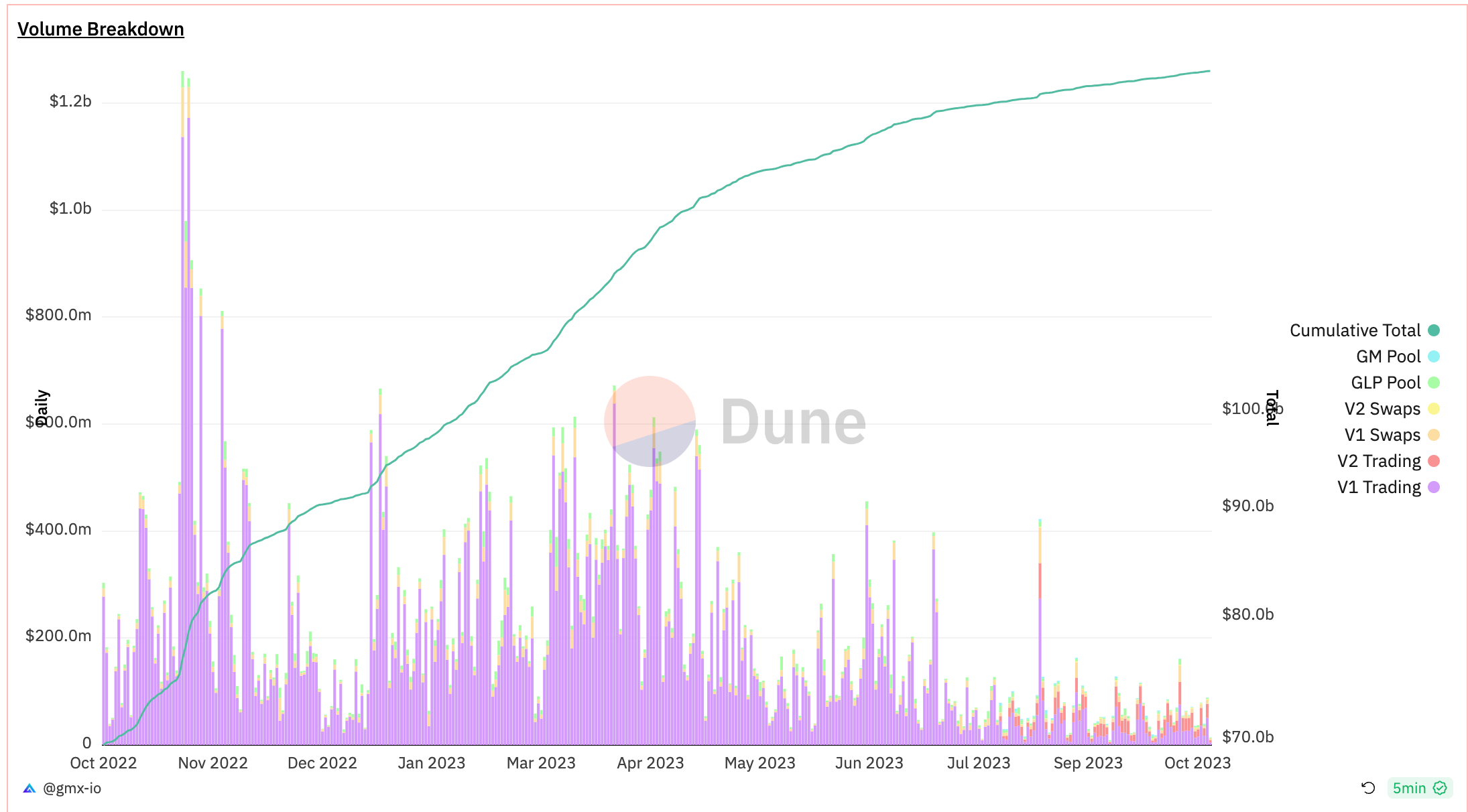

The trading volume and by extension the fees are down significantly from earlier this year. This most likely is a product of a less volatile environment with volume having decreased across the entire market but also the emergence of competitors like Synthetix, Vela, Level, Vertex etc. The price of GMX has also taken a beating and is down 60% from the all time high at $91.

Comparing GMX directly to its competitors is doing the protocol injustice to a certain extent. GMX has not had trading incentives at any point this year which is in contrast to most decentralized perp-dex protocols. Vela, Level, Kwenta, Polynomial etc. all had trading incentives in some shape either through native token emissions or airdrop farming.

With a sizeable ARB grant that’s used both to deepen liquidity and attract traders, GMX could see a significant increase in trading volume and fees generated. As seen below, the price of $GMX recently rallied over 40% (from $30 to $42.5) after the announcement of the ARB incentives program. The majority of the move has since then been erased due to the tough market conditions.

Data on the Grant Receivers📊

All in all, it’s safe to assume that the grant won’t have the same explosive effect as it had on the Optimism ecosystem because of the bearish environment. Nevertheless, the grant could act as tail wind for many Arbitrum native protocols and improve their fundamentals in the short- to midterm. The specific impact on the price is difficult to predict but I would not be surprised to see some of these tokens outperform ETH over the next few months.

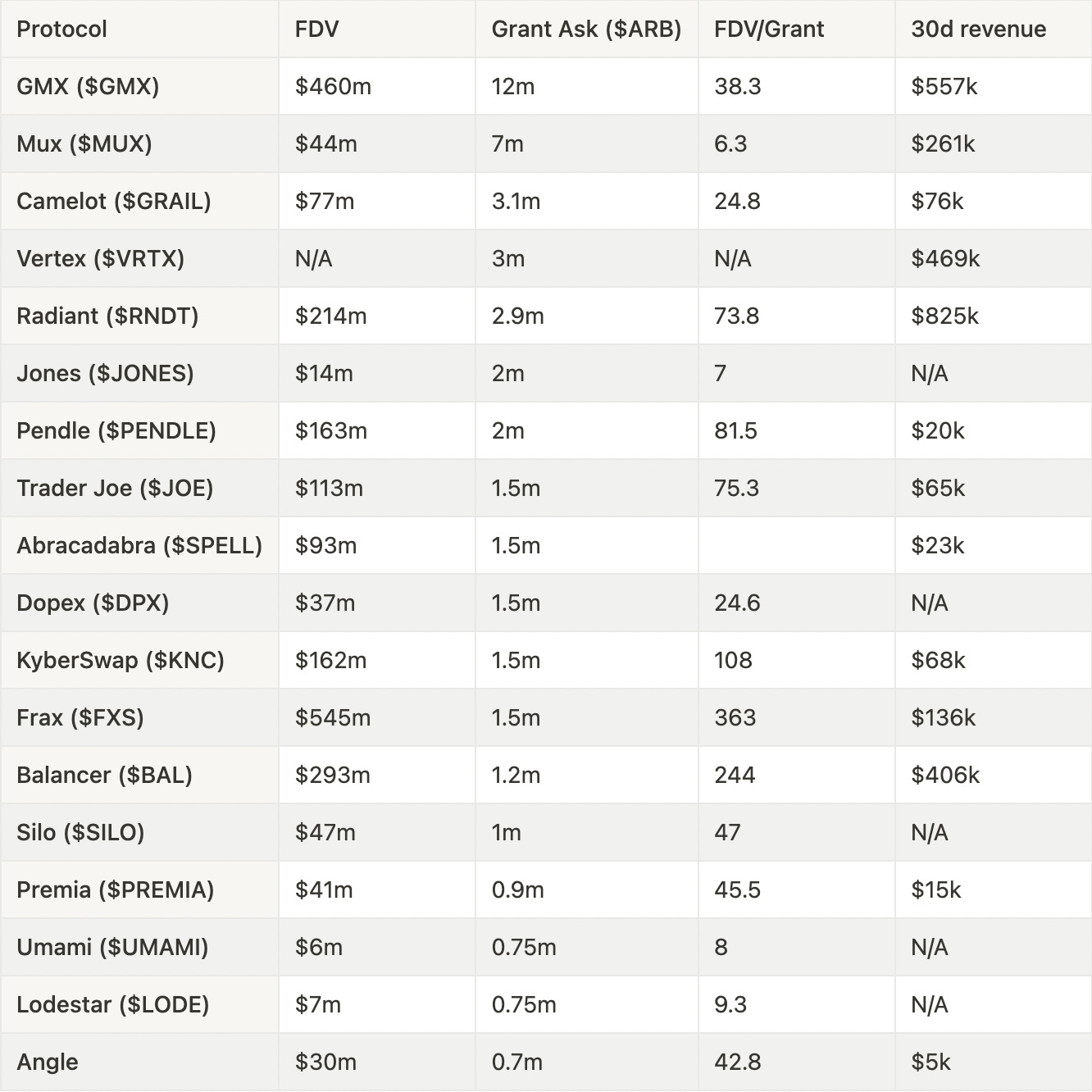

Below is a table of all the larger winning protocols, their respective grant proposals, FDV, FDV/grant and 30d revenue. The lower the FDV/grant ratio, the more $ARB these protocols are receiving relative to their valuation.

That’s all for today! Enjoyed the research? Make sure to like and subscribe for more reports coming every week⚡️

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.