The [8] Largest Cash Cows in Crypto

A fundamental analysis of the top revenue generating protocols in crypto

![The [8] Largest Cash Cows in Crypto](/content/images/size/w1200/2024/07/17ed1e04-2def-4e6a-8175-f0ae306085d4_1764x1176.png)

Introduction

Thousands of projects come and go in the brutally fast-paced industry of crypto. Those that stand the test of time are the few enviable projects that have tapped into some form of product-market-fit. Which protocols are users actually paying money to use? This article breaks down the top revenue-generating business models of crypto since 2024.

[8] Base

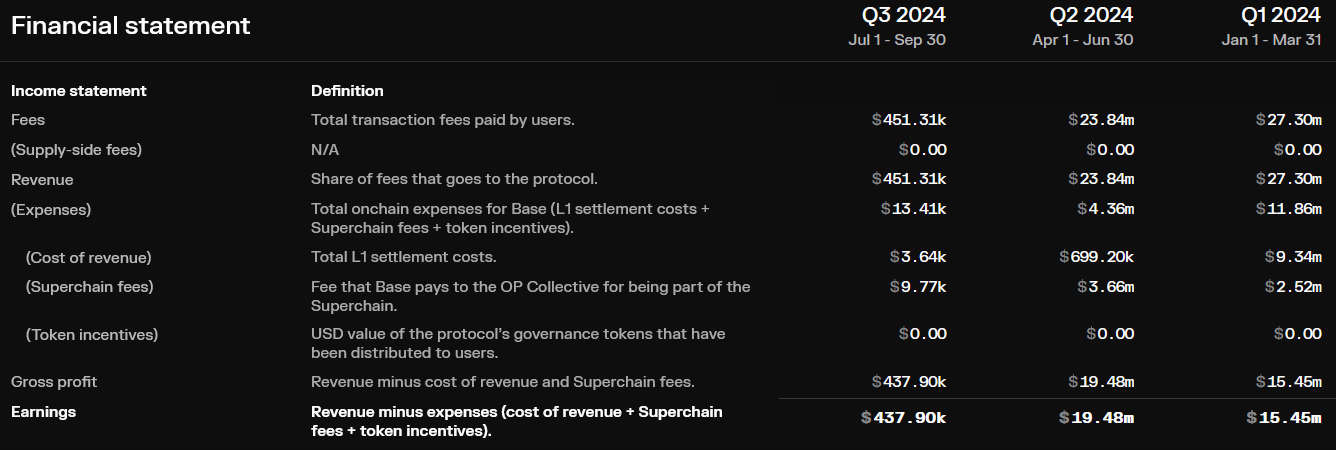

Launched in Q3 2023 by Coinbase, Base is an Ethereum L2 chain built off the Optimism Stack. In less than a year after going live, Base has generated an impressive $52M in revenues YTD, making it the 8th highest protocol. Revenue is generated by users paying fees to transact on the rollup.

On the earnings side, Base’s profits are fairly impressive with ~$35M YTD. There are two key factors at play here. Firstly, Base has significantly reduced data availability costs thanks to the use of blob fees in EIP-4844, implemented on 13 March. Base took advantage of blob fees immediately and data availability costs were cut from $9.34M in Q1 2024 to $699K in Q2 2024, a significant reduction of ~13x. Secondly, Base’s high earnings relative to its L2 competitors is also due to zero costs in token incentives paid out as it does not have its own native token.