Synthetix V3 Is Transcending DeFi To a New Level ⚔️

A Synthetix deep-dive looking at current performance and the long-awaited V3

Synthetix has grown significantly recently. The article today aims to break down what makes Synthetix unique today, how it has performed lately and why V3 is a major innovation in DeFi.

Bullets

- Current state of Synthetix⚙️

- Synthetix V2 metrics📊

- Synthetix V3 🔀

- The path to V3 🛣

- Final thoughts 🧠

Thanks for reading DeFi Frameworks! Interested in more deep-dives? Subscribe for free⚡️

Current State of Synthetix ⚙️

Synthetix was launched back in 2017 by Kain Warwick and Justin Moses. The project was originally known as Havven, which offered a stablecoin (nUSD) overcollateralized by crypto assets. The protocol has come a long way since then and now offers synthetic representations of assets on Ethereum mainnet and Optimism.

Today, Synthetix acts as a liquidity layer for a large range of DeFi protocols. Users on Synthetix stake the native SNX token, which is used as collateral to mint sUSD (synthetic USD). Hence, sUSD is the native stablecoin of Synthetix, which is over-collateralized by SNX and represents the user’s debt on the protocol.

The total available liquidity that can be used by protocols building on top of Synthetix is, therefore, a function of the amount of collateral, i.e., SNX, that is staked on the protocol. Why should users stake SNX to enable this synthetic liquidity? Because stakers are rewarded by native SNX token emissions and fees generated by protocols utilizing this synthetic debt (current APY = 40%). If the amount of SNX staked is below a specific threshold, SNX emissions are increased, which attracts more users to stake SNX and deepen the liquidity.

The liquidity on Synthetix supports two different types of assets: spot and futures. Spot synthetics track all sorts of assets like crypto, commodities, forex, and more. It's a way for users to get exposure to the underlying asset without actually holding it. Synthetic futures allow users to trade leveraged futures of various assets. The liquidity on Synthetix acts as the counterparty to these trades. SNX stakers, therefore, take on counterparty risk, which is worth noting. What's meant by this is that if traders on trading protocols utilizing the liquidity on Synthetix (e.g., Kwenta) make a large profit, the debt of the stakers increases, and vice versa. However, there are mechanisms that reduce this risk, involving arbitrage opportunities for traders (funding rates) if the trading activity is skewed. This aims to make the liquidity providers (SNX stakers) delta neutral, and with V3, isolated risk will be introduced (more on this later).

Kwenta

As of now, Synthetix has $375m in TVL, which means that $375m worth of SNX has been staked. An example of a protocol building on top of Synthetix and utilizing the protocol’s liquidity is Kwenta. Kwenta is a perpetual futures trading protocol on Optimism without native liquidity as they inherit it from Synthetix. All trading pairs on Kwenta are in sUSD, so in order to trade these synthetic assets, users will have to mint sUSD by staking SNX (or buying sUSD on the market).

All trading fees generated on Kwenta are paid to SNX stakers. On average, Kwenta accounts for roughly 60-70% of all fees generated by protocols utilizing Synthetix liquidity. Additional protocols/front-ends building on top of Synthetix:

Infinex

Yesterday, it was announced that the Synthetix team will be building their own front-end (protocol), utilizing the Synthetix liquidity layer. Infinex is an on-chain perpetual exchange that aims to emulate the experience of trading on a centralized exchange, but in a decentralized fashion on-chain. As the user interface and experience is at the core of this protocol, there will be a 'simple' and 'pro' mode to make it easier for new traders to be onboarded.

There will not be a new native token, but the protocol will be governed by SNX governance. Additionally, all revenue will be used to deepen the liquidity on Synthetix by buying and staking SNX. The more volume, the more buy-pressure on SNX, and deeper liquidity. A flywheel might be shaping up. Read more about Infinex here.

Thanks for reading DeFi Frameworks! Subscribe for free to receive more free deep-dives like this⚡️

Synthetix V2 Metrics📊

Below is a chart from Token Terminal which shows the price of SNX and the trading volume conducted by protocols utilizing Synthetix liquidity. As seen, there is currently a large divergence between recent activity and the current price of SNX.

Synthetix has been shipping a lot of products lately, and the Perps V2 upgrade, which introduced a large variety of synthetic assets to be used on protocols like Kwenta, has played a significant role in this increase in activity. It's worth mentioning, however, that Synthetix has received large amounts of the OP token from Optimism, which is being used on protocols like Kwenta to incentivize users to use the product. Kwenta is further also giving out KWENTA tokens on top of this for an even higher incentive.

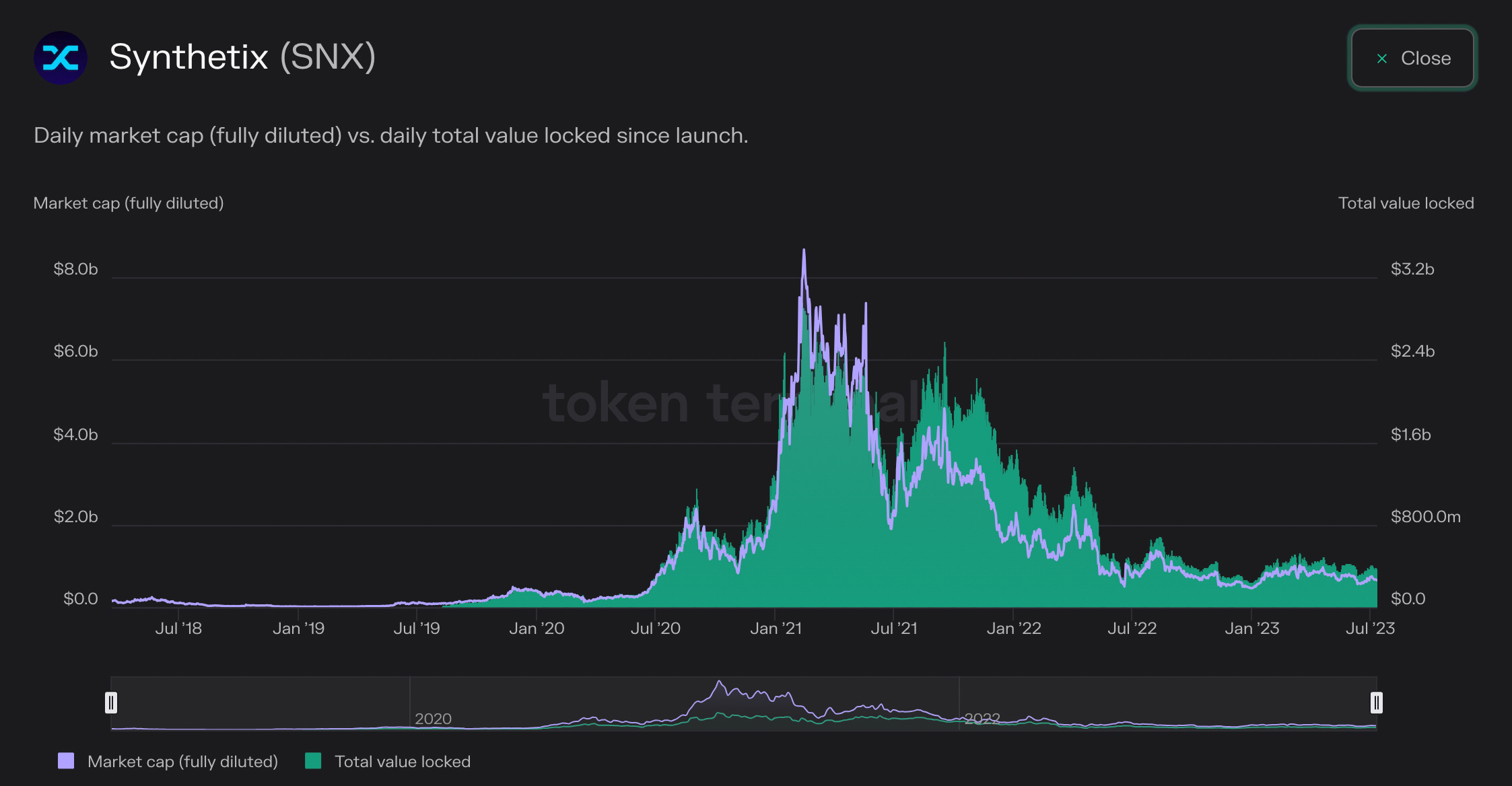

Below is a chart of the TVL, which is unique in the case of Synthetix as it is directly correlated with the price of SNX, as seen below. This is the case as SNX is the only asset that can be staked on the protocol, as mentioned earlier.

Synthetix is a core piece of infrastructure in DeFi, and the liquidity is used by several protocols, as portrayed above. A limitation to the amount of liquidity or TVL currently is the fact that only SNX can be staked on Synthetix. This will change with V3👇

Synthetix V3 🔀

Synthetix V3 consists of a large range of upgrades that overall take Synthetix to the next level: a cross-chain liquidity layer for all of DeFi. V3 is currently in alpha, and different features will be rolled out gradually as they are completed.

The V3 tl;dr

- Multi-collateral staking instead of only SNX

- Permissionless liquidity layer

- Developer-friendly ecosystem

- Seamless cross-chain implementation

Multi-collateral staking

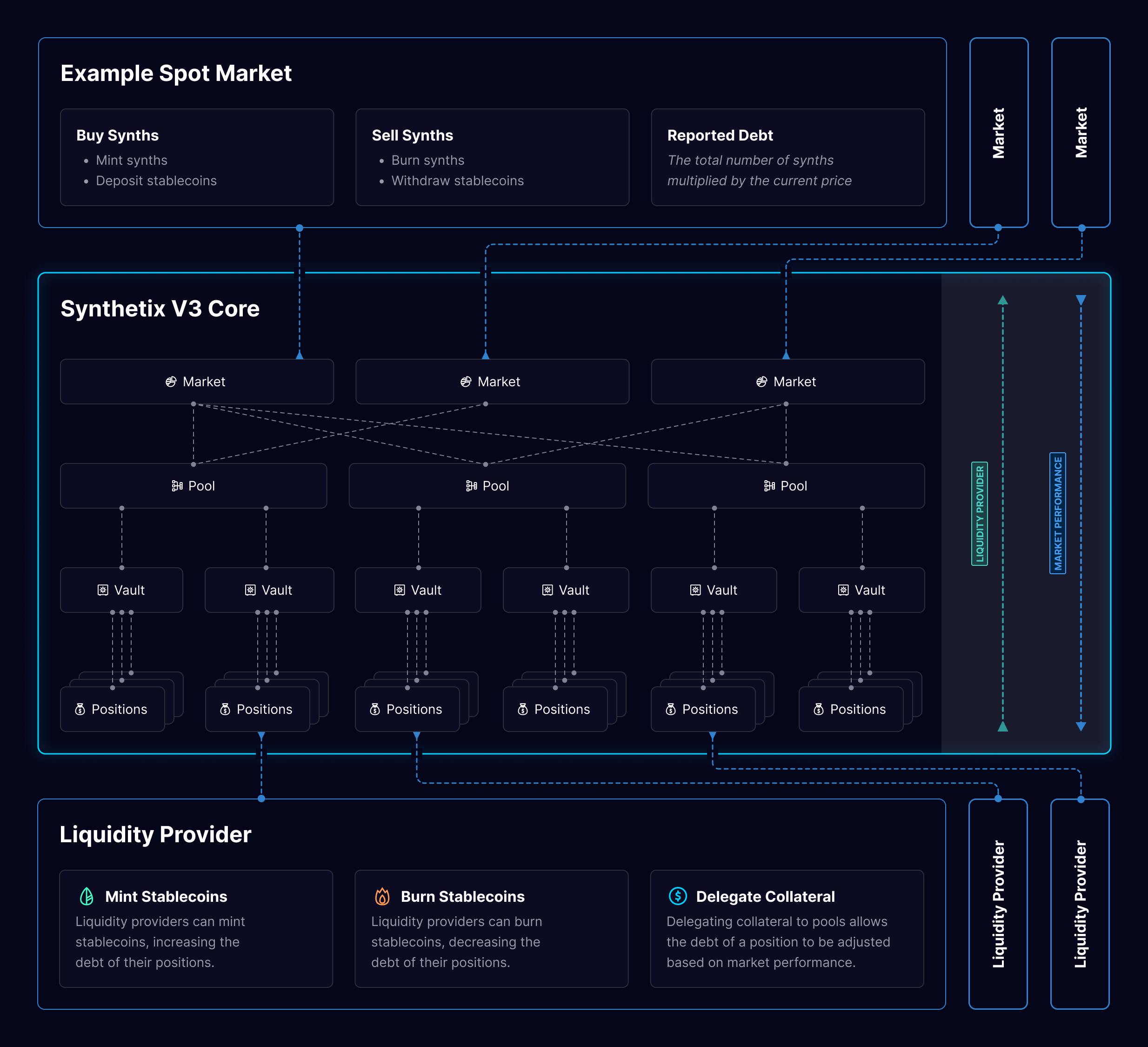

Multi-collateral staking is one of the core principles of the Synthetix V3 vision. As of now, only SNX can be staked to enable the liquidity used by synthetic spot and perpetual markets. V3 introduces a vault design where each vault is represented by one type of collateral (token). One vault could be ETH, another SNX, and a third wBTC. The collateral types making up these vaults are added via governance. Additionally, vaults can be added into pools that can be used by protocols wishing to utilize specific liquidity for their market. An example could be a pool consisting of the ETH vault and the DAI vault, which can then be used on an on-chain derivatives market (like Kwenta). Some of the benefits:

- More freedom as a staker as you can choose which asset you want to provide as collateral and earn a yield against

- Isolated risk as pools are connected to specific markets, which is transparent to the staker. A risk-averse investor might only provide liquidity to pools used in BTC and ETH markets and not riskier assets.

- Better hedging as pools are connected to specific markets, reducing counter party risk

Permissionless liquidity layer

With V3, developers can create new markets utilizing liquidity pools on Synthetix in a permissionless way. One of the large obstacles in DeFi is bootstrapping liquidity early on, and this is often done by heavily incentivizing with token emissions.

Besides being able to choose which liquidity pools the market should integrate, market creators can choose which oracles should be used for their product and create custom reward structures for liquidity providers. Listing new synthetic assets will also no longer be done through governance but can be easily implemented. These assets can be anything from spot OP to ETH options.

Synthetix will ultimately act as a liquidity-as-a-service platform that can be easily integrated by new products.

Seamless cross-chain implementation

The end goal for Synthetix V3 is to be available on any EVM chain. So-called teleporters will enable liquidity on one chain to be used on other chains. If a user has provided liquidity to pools on, for example, Optimism, a market on Arbitrum could utilize this liquidity for their platform.

Below is an overview of how a Synthetix V3 spot market is structured: Users deposit their assets into vaults, which are added to specific pools. The pools can be used by protocols creating markets on top of the Synthetix liquidity pools. These markets are what users interact with on the dapps building on Synthetix, such as Kwenta.

The path to V3 🛣

On July 3rd, an article named ‘Getting to the Synthetix v3 End Game‘ was released and it breaks down what’s in store leading up to the complete version of Synthetix V3. Below is a summary:

Stablecoin migration - A new synthetic stablecoin is introduced with V3 to replace the current V2 sUSD. The name has yet to be decided but one suggestion is to keep ‘sUSD’ for the new stablecoin and then renaming the current V2 version to ‘oldUSD’ or ‘legacyUSD’. Over time as the new V3 stablecoin and synthetic assets gain liquidity and utility, users will need to migrate their assets from V2 to V3 (via a Curve pool).

Perps V3 - Perps V3 will introduce the multi-collateral staking mentioned earlier. The significance for traders on protocols like Kwenta, Polynomial etc. is that all synthetic assets (not just sUSD) can be used as collateral for trading. The UI/UX will also be made simpler and more intuitive for traders. Most of the core code is complete and is close to audit. Testnet could go live later in July.

Upgrade V2 SNX stakers to V3 LPs - A feature that allows current SNX stakers to migrate to V3 without having to repay their debt and close their position. (SIP-306).

Teleporters - Teleporters are a crucial part of the cross-chain functionality that V3 presents. To allow liquidity to be used cross-chain, they essentially burn sUSD on one chain and mint it on another, which removes slippage and the need for bridges. Teleporters are currently in development and are live on several testnets. (SIP-311).

Cross-chain pool synthesis - This is another core aspect needed for the omnichain liquidity vision. It enables markets and pools to know about the state of collateral on other chains. With this, new perp markets can launch on one chain and use the liquidity from another chain. Currently in testnet (SIP-312).

These are some of the core mechanism of V3 that are being built currently and will unlock the full vision of V3.

Final thoughts 🧠

At the end of the day, the endgame for Synthetix is extremely exciting, but it's all about creating demand and attracting developers to build solutions utilizing Synthetix as the liquidity layer. The more protocols, like Kwenta, that build on top of Synthetix, the more yield liquidity providers (stakers on Synthetix) will receive. With higher yield, more liquidity is provided, and with deeper liquidity, more protocols will be looking to build on top of Synthetix. It's a reflexive flywheel.

As mentioned earlier, 60-70% of fees earned by SNX stakers come from traders on Kwenta alone. Trading on Kwenta is heavily incentivized by large OP and KWENTA token emissions, so it's difficult to estimate how organic the recent user growth has been.

If you want additional information regarding Synthetix and their upcoming rolloup of V3, check out the ressources here:

- Podcast with Kain and Token Terminal

- Getting to the Synthetix v3 End Game

- What is Synthetix V3

- Infinex by Kain Warwick

Please be aware that nothing stated in this article is financial advice!