Solving Modular Fragmentation With The Avail Trinity

Avail is a modular stack set to go live this year - an overview of the tech stack, use cases and more.

Introduction

This report is made in collaboration with Avail and is therefore sponsored

The modular era is upon us. The four roles of a blockchain, execution, consensus, data availability and settlement, are now commonly split between multiple chains. Rollups scale execution by taking compute off-chain but the growth of rollups places substantial demands on Ethereum for data availability. Today, with the expansion of the modular era, rollups can adopt alternative solutions for much cheaper data-availability.

But which parts of these different stacks are optimal for rollup-construction? And how do we avoid a vastly fragmented landscape where you are forced to connect your wallet to 100’s of different chains and deposit liquidity to all of these? That’s what Avail is aiming to solve with their tech stack consisting of a DA layer, a zk verification layer and a shared security layer.

Avail aims to become unification layer layer of web 3 and recently announced their $27m seed round led by Founders Fund and Dragonfly, with participation from Nomad Capital, SevenX Ventures and Figment Capital. Today’s research report dives into Avail, specifically the tech stack, the use cases and the roadmap.

Thanks for reading On Chain Times. Subscribe to receive a free research report once/week 🗞

The Avail Trinity

Avail is a proof-of-stake blockchain network built with the Polkadot SDK and consists of three main components which enable the modular expansion of crypto. Below is a quick breakdown of each.

1. Avail DA

“The rollups on Ethereum today bear the cost of using Ethereum as DA. They pay somewhere around $1300-$1600/MB or even beyond when gas fees rise. Hence, we see that many chains want to use Avail as the DA layer for their chains. This reduces their operating cost by 70-90%, depending on their construction choices and batch sizes. They still post their proofs on Ethereum and use it as their settlement layer. In reality, they just use Ethereum as their canonical bridge“

Rollups are hungry for data, as the proofs of execution are only good when the data behind it is available and hence data needs to be scaled hand-in-hand with execution. In relation to this, most of the costs related to running a rollup are tied to data availability. This is why several rollups like Manta, Eclipse, Berachain, Aevo and many more have chosen not to use Ethereum mainnet for data availability but other data availability layers instead.

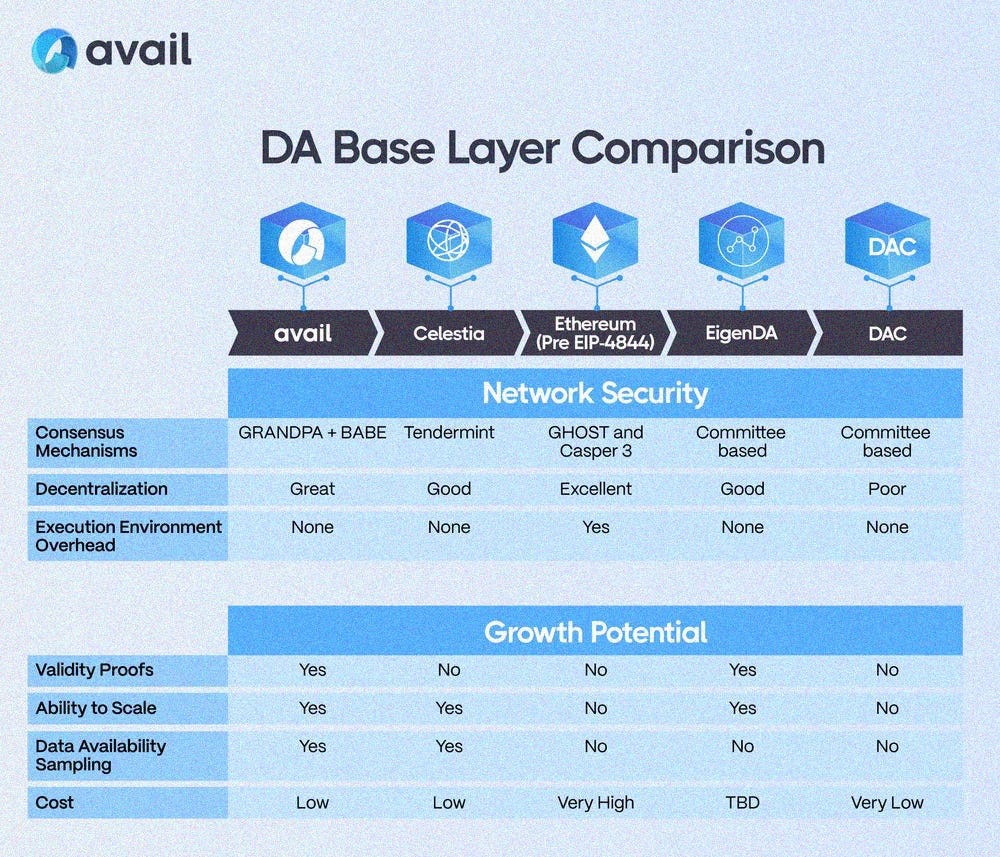

Avail DA is a data availability layer that implements data availability sampling (DAS) with validity proofs. the Avail DA layer offers cheap and secure data availability blobspace for rollups which allows these to access and post their large quantities of transactional data in a scalable manner. Unlike existing modular DAs that rely on an optimistic approach, Avail’s use of validity proofs enables 10x faster guarantees on transaction ordering resulting in a responsive experience for users. Now, 100s and 1000s of rollups can emerge allowing the trustless future to be built by composing application specific rollups as well as Dapps on general purpose rollups.

A more in-depth description of the tech stack:

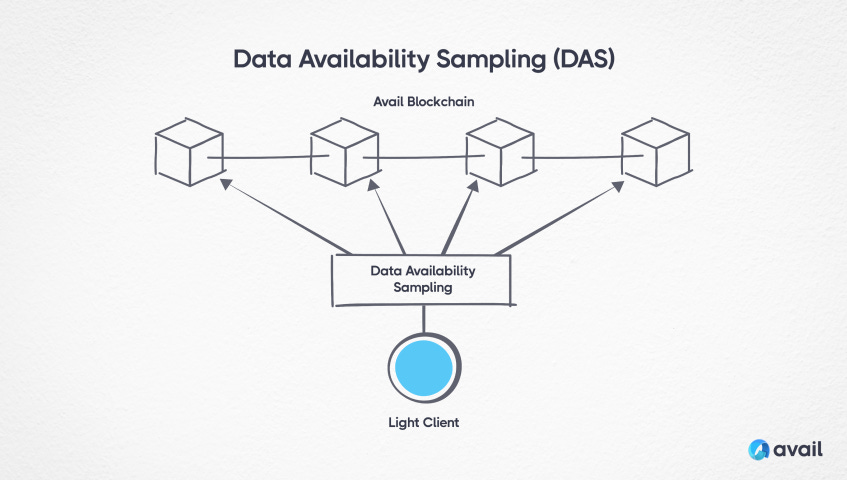

Light clients

A light client is a type of node that you can run to secure the Avail DA layer without having to download all of the current and past data. A light client is orders of magnitude less intensive to run than a full node and can be operated on phones, smart watches, and browsers. The light clients are embedded into various types of products like wallets, sequencers and more to ensure data availability within the network. Having a large network of light clients securing the Avail DA layer also ensures a higher level of decentralization. Light clients utilize data availability sampling to ensure that the data is posted and correct.

Data availability sampling

Data availability sampling (DAS) is a method used by light clients to scan the data and ensure that it is available without having to download all of it. In short, light nodes take samples of the data from the Avail blockchain and for every sample taken, the probability of the data being correct increases significantly. Within 8-30 samples the data availability guarantees reach close to 100%.

In its final form, Avail will have a peer-2-peer network consisting of multiple lightnodes it can sample data from. What makes Avail stand out is this ability which is unique for the Avail DA layer and results in an increasingly decentralized network.

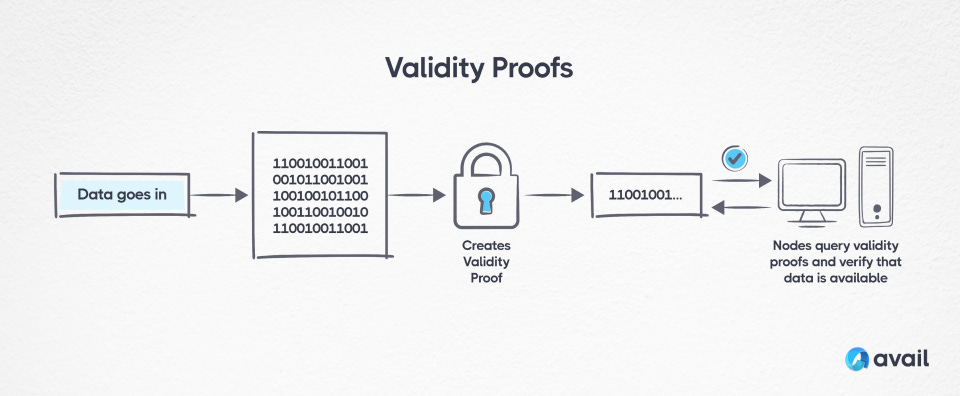

Validity proofs

Another feature of the Avail data availability layer is the use of validity proofs. This opens the ability for developers to access and ensure that the data is indeed available themselves - verify, don’t trust. With this, Avail is able to finalize blocks within 60 seconds making it one of the fastest data availability layers.

Other features making Avail a core piece of tech for the modular stack includes expandable blockspace, erasure coding and more. Read about it all here.

2. Avail Nexus

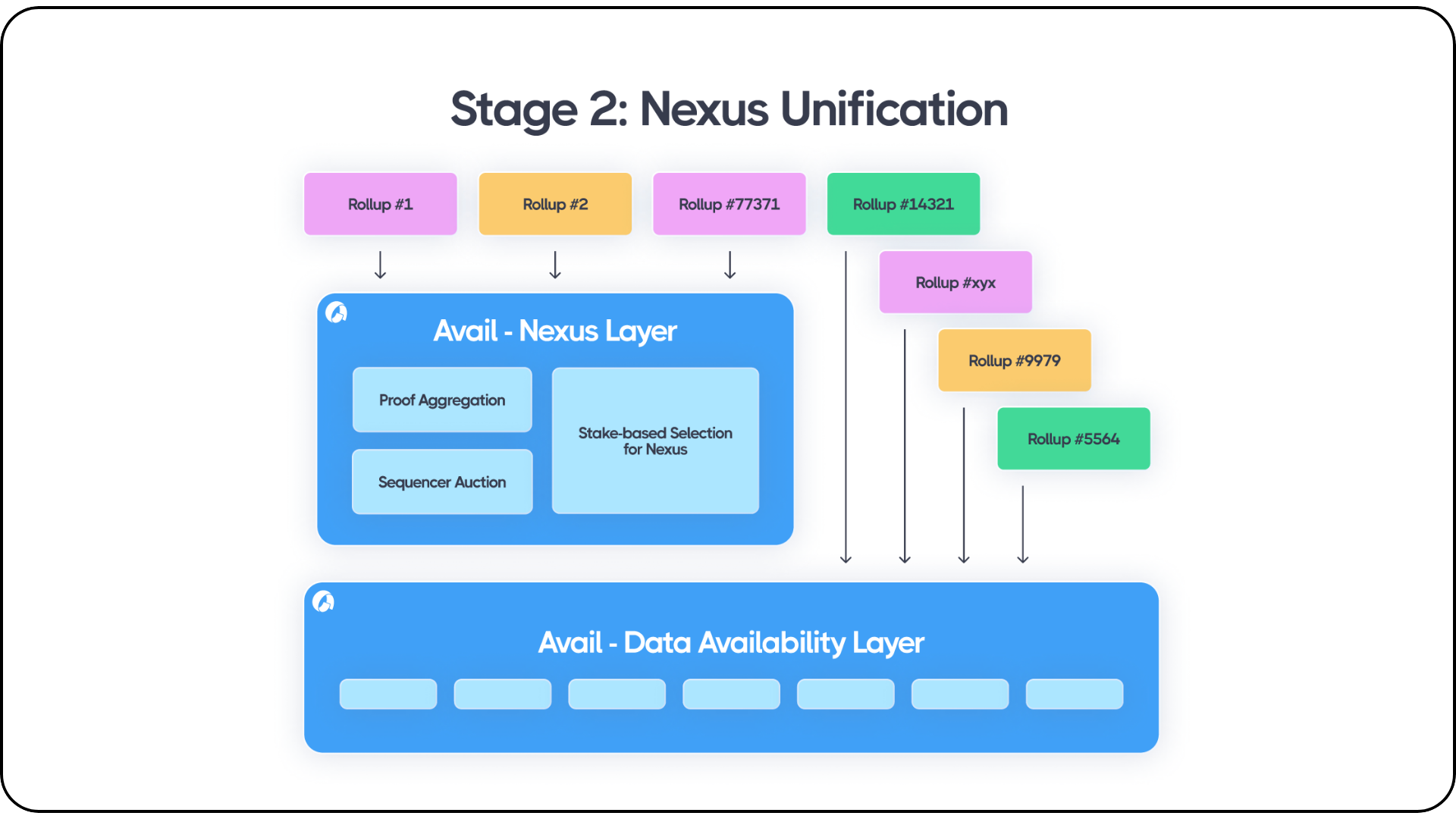

This proliferation of rollups enabled by cheap DA, however, leads to fragmentation of liquidity and user experience, which is already somewhat the case with L2s on Ethereum. Such fragmentation is causing friction pushing non crypto native users away from Ethereum onto other monolithic blockchains. To address this fragmentation of UX and liquidity, rollups should be able to interoperate with each other in a trust minimized manner. This requires a unification framework that includes both proof aggregation and data aggregation and that is what Avail Nexus offers by unifying rollups across web3 via proof aggregation and verified by Data Availability Sampling on top of Avail DA.

Specifically, Avail Nexus is a zk coordination rollup which consists of a proof aggregation/verification layer as well as a sequencer selection mechanism that is enabled by tapping into the Avail DA stack. Acting as a verification hub, rollups on top of the Nexus layer can communicate easily via a single proof verifying the state of all the other rollups.

3. Avail Fusion

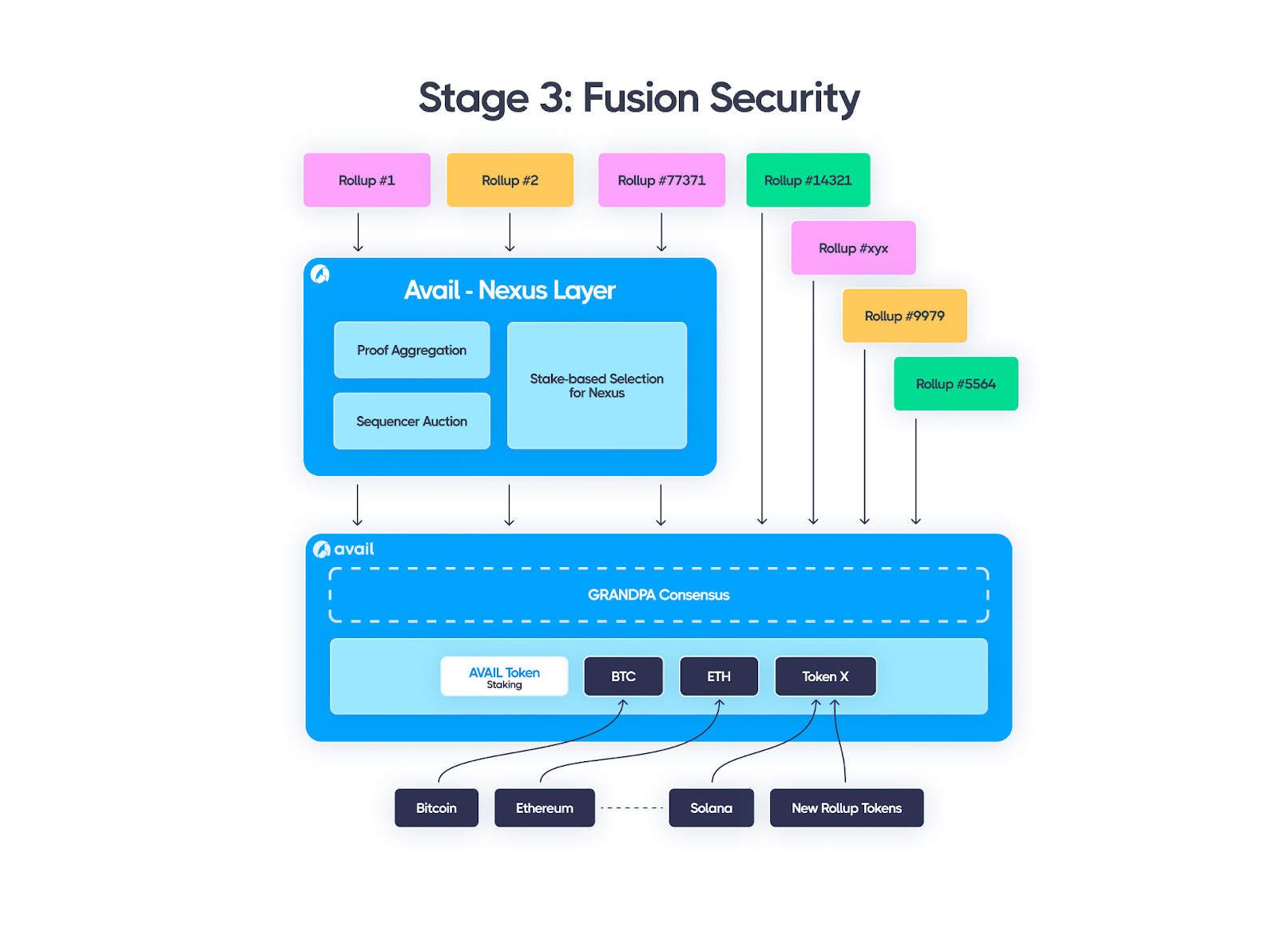

Coordination of value across blockchains and rollups requires extensive shared economic security in the unification layer. This is what Avail Fusion Security provides.

Unification = modularity + aggregation + shared security

Fusion allows base-layer tokens like BTC, ETH, SOL and more to contribute to the Avail consensus in addition to $AVAIL. Rollups building on top of Avail are in addition able to help secure the Avail base layer with their own token. By allowing multiple different tokens to contribute to the security of Avail, the economic security has the potential to be magnitudes higher than other modular tech stacks.

Use-Cases

Avail has made several posts on integrations which you can find here. Below are some examples.

Sovereign Labs ~ Sovereign Labs offers an SDK for spinning up zk-rollups in an easy manner. These are so-called ‘sovereign rollups‘ in the sense that they utilize another source for e.g data-availability - such as Avail or Celestia. With the alpha release of their rollup SDK, Avail has partnered with Sovereign Labs by creating an adapter, making it easy to leverage the Avail base layer as a zk-rollup. In short, this makes it possible to easily build rollups on top of Avail via the SDK and adapter.

Optimism ~ Optimism has developed the OP stack which is a modular framework for rollups. To date, many of the largest rollups are build using the OP stack including Aevo, Lyra, Base, Mode, Zora, Mantle and several more. Avail is extending the capabilities of the OP stack by allowing rollups to tap into the Avail DA layer and effectively reduce their DA costs by up to 90%.

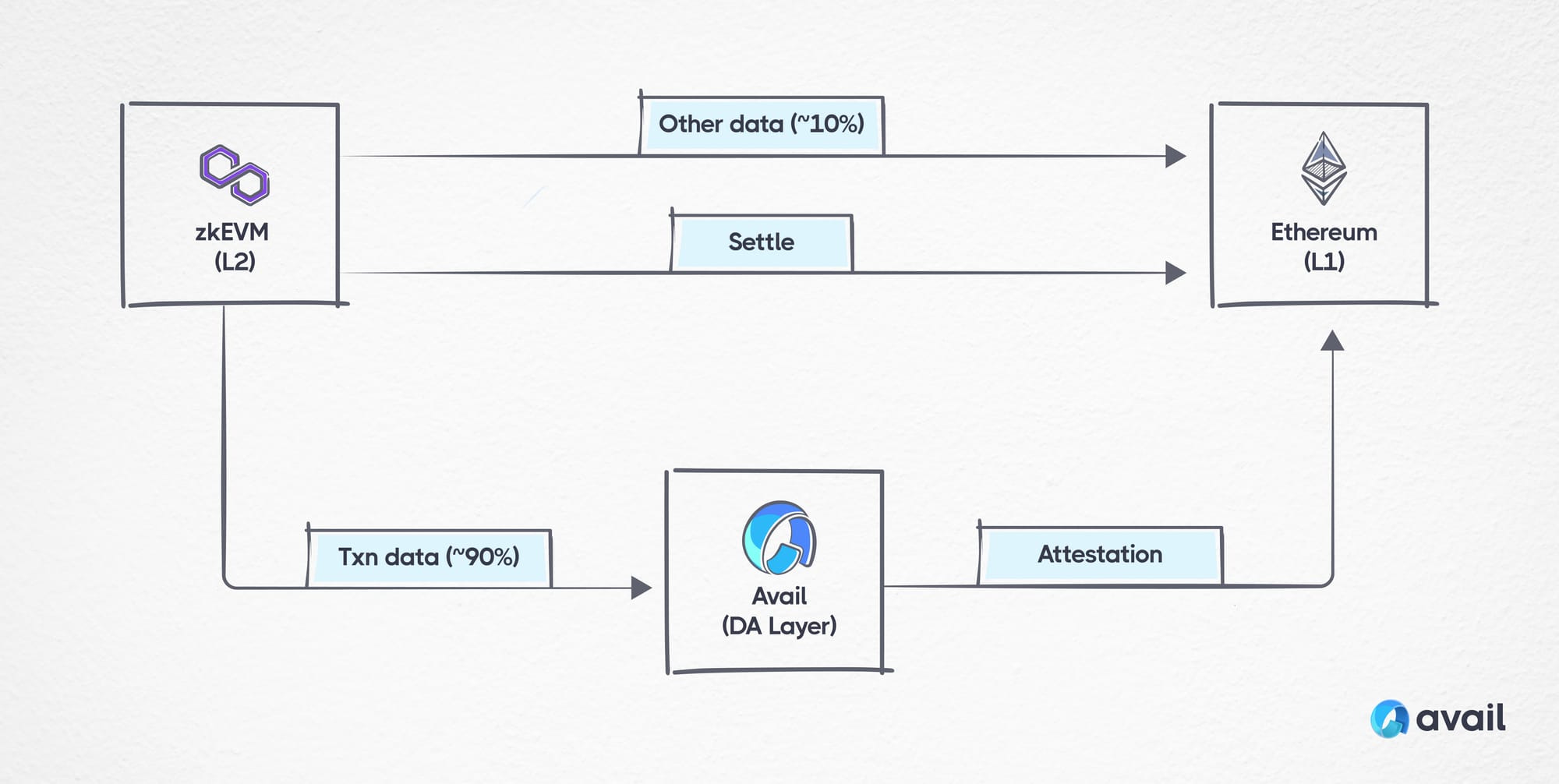

Polygon ~ In a similar fashion to the above, Avail can power ‘Polygon zkEVM Validiums by providing significantly cheaper DA. A zkEVM Validium is a modified version of the zkEVM, built with the Polygon CDK, that utilizes avail for data-availability. Avail was originally a Polygon native product but was spun off as a separate project last year.

Dymension ~ Dymension is a Cosmos chain powering ‘Rollapps‘, a standardized template for modular rollups built on top of the Dymension hub and powered by the Cosmos IBC bridge. Rollapps settle on Dymension but use non-native data-availability solutions. Dymension initially partnered with Celestia for DA (and airdropped DYM to TIA stakers) but has since gone ‘multi-DA‘ by partnering with Avail as well.

“The future is modular with various DAs with different potential characteristics. Some DAs will provide great economic security, some might focus on lower costs whereas others on community and partnerships. RollApps will choose which DA works best for them.” - source

Thanks for reading On Chain Times. Subscribe to receive a free research report once/week 🗞

Conclusion

Avail is set to launch on mainnet soon which will allows rollups of different kinds across different modular stacks to access cheap data-availability, high interoperability and strong security. With the many different rollup solutions across different ecosystems, projects like Avail help unify this landscape and decrease fragmentation. It’s evident that there are going to be 100’s of rollups in the future with many different designs. Application specific rollups have been trending over the past year as Aevo, dYdX, Frax, Lyra, Hyperliquid and many more have launched on their own native chain for higher throughput. It will be interesting to see how the launch of Avail will impact the fast growing modular landscape and tackle the issues of fragmentation across these ecosystems. Read more about Avail here.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.