Outperforming the Market with Stablecoin Yields?

The market is boring but stablecoin yields are hot. Some strategies to look into.

Introduction

Excitement around airdrop farming has dwindled as new tokens launch at more modest but perhaps also realistic valuations. As a result, it is no longer possible to earn 40%+ APY on your stablecoins on, e.g., Pendle or various lending markets. As a somewhat conservative investor personally, who prefers to keep a part of my portfolio in stablecoins, last week I went on X to ask about the best stablecoin farms on the market. I was overwhelmed with more than 150 answers and several teams reaching out, explaining the high yield that can be earned with their products.

What's the best place to park stablecoins these days?

— Thor Hartvigsen (@ThorHartvigsen) July 25, 2024

46% APY PT-sUSDe market just expired today so need to find something new.

Having spent the past week examining these various strategies, this report is an attempt to present the best places for yield on stablecoins (and structured stablecoin-like products).

#1 JLP

JLP is not a stablecoin. Not at all, actually. It's a structured product that bears resemblance to GLP from GMX, which was quite popular back in 2022/23. Of the many strategies I looked at, however, JLP stood out the most and called for a deeper analysis.

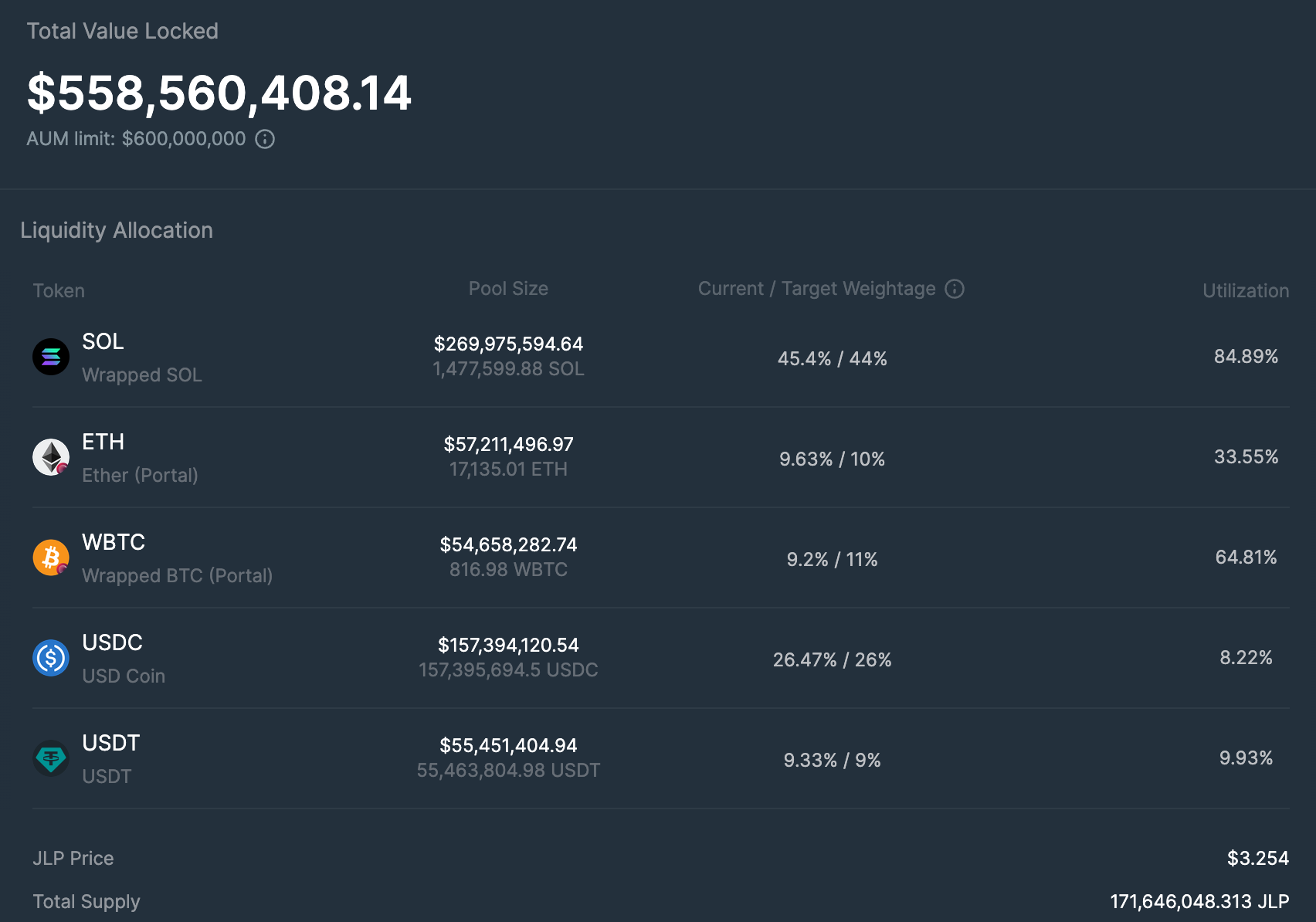

JLP is a structured product from the Jupiter exchange on Solana. Among other things, Jupiter offers perpetual futures trading on BTC, ETH, and SOL with up to 100x leverage, and JLP acts as the liquidity and counterparty to these traders. JLP is made up of a basket of assets, as seen below.

For every $1 of JLP bought, you are effectively buying:

- $0.454 SOL

- $0.0963 ETH

- $0.092 BTC

- $0.2647 USDC

- $0.0933 USDT

The price of JLP is, therefore, first and foremost a function of the prices of the underlying assets. If BTC, SOL, and ETH appreciate, so does JLP, but less since it contains ~35% stablecoins, and vice versa. More specifically, the price of JLP is a function of three things:

- The price of the underlying assets (BTC, ETH, SOL, USDC, and USDT)

- Fees paid by traders

- Trader PnL

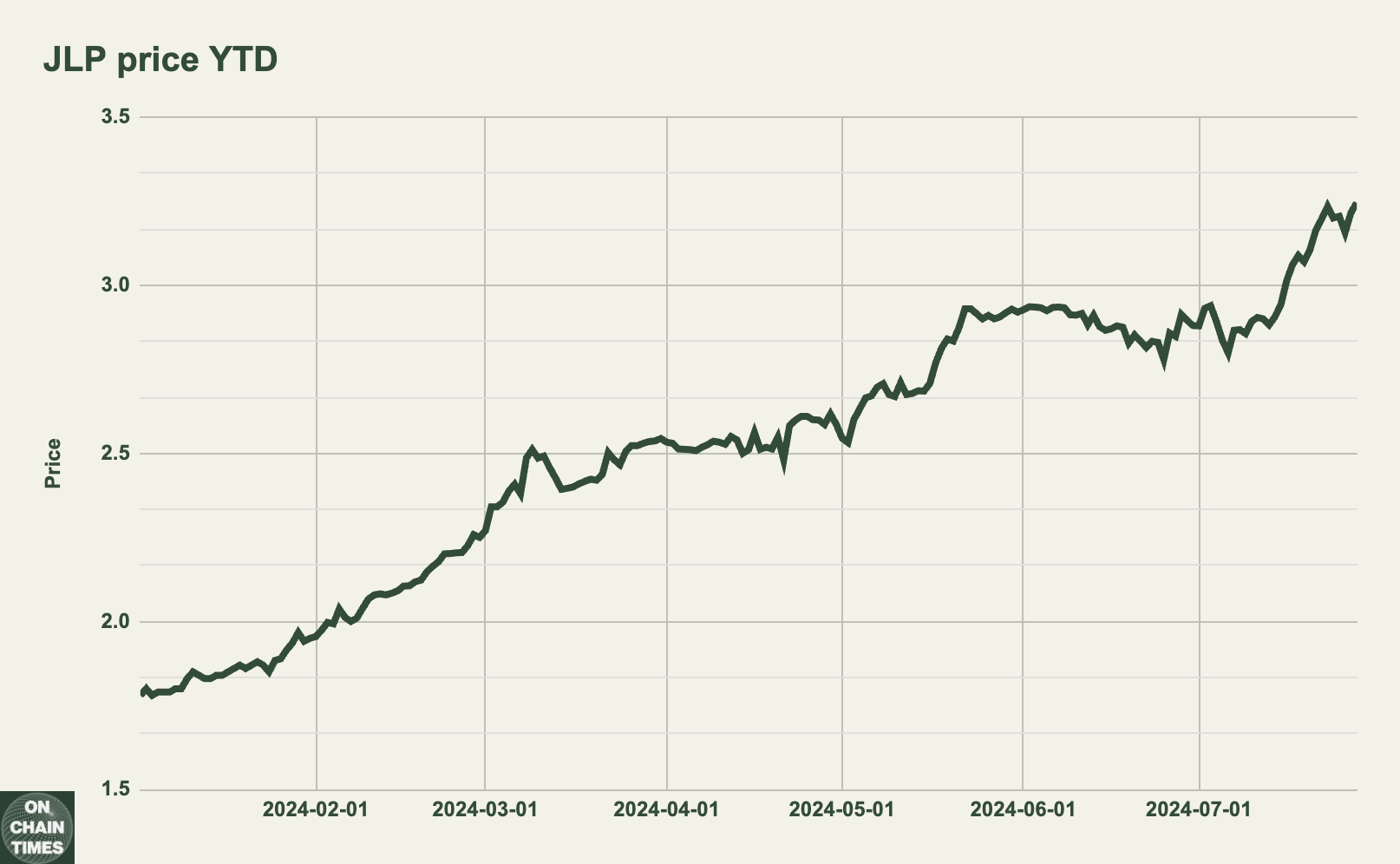

75% of all fees generated by traders on Jupiter perps go to the JLP vault. This equates to a 50% APY at current fee levels and is accrued via JLP price appreciation. Finally, JLP acts as the counterparty to traders on Jupiter. If a trader is profitable, the gain is paid out from the JLP vault, and if a trader is unprofitable, the loss is added to the vault. The chart below shows the price of JLP since the beginning of the year.

Notably, JLP is up from $1.78 to $3.25 this year alone as a function of underlying assets having appreciated and a lot of fees collected by traders. This is a 61.28% gain with very modest drawdowns, resembling a nearly up-only chart. A 61.28% ROI YTD is equivalent to a 106.5% APY, which far outperforms any sort of stablecoin product. Comparing this to a stablecoin strategy is, however, somewhat dishonest as JLP only contains a 35% stablecoin composition. Holding JLP versus farming with a stablecoin entails taking on more risk (e.g., trader PnL exposure) and volatility from the underlying assets.

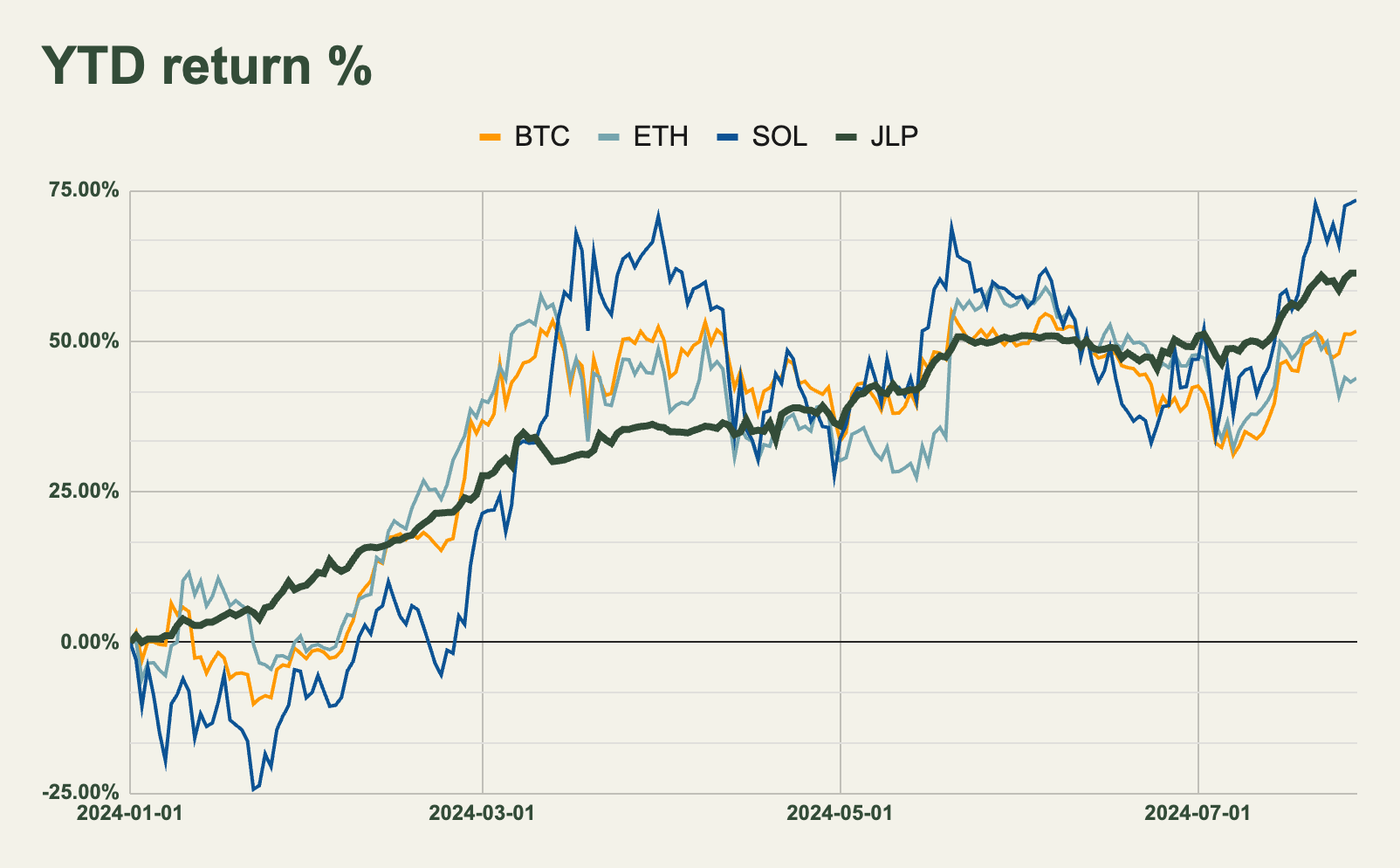

But what about JLP performance versus BTC, ETH, and SOL? As the chart below depicts, JLP has outperformed both BTC and ETH, but not SOL year-to-date.

Is JLP a safer investment than being long SOL outright, however? To take this analysis a step further, we can compare the JLP return with BTC, ETH, and SOL on a volatility (risk) adjusted basis.

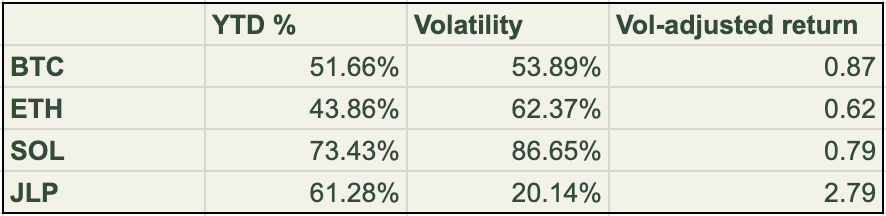

By taking the YTD price performance of these assets, subtracting the risk-free rate, and dividing by their volatility, we obtain a risk-adjusted return metric known as the Sharpe ratio (vol-adjusted return). The higher this number, the better the investment. As the table depicts, JLP is a far less volatile investment compared to just holding BTC, ETH, or SOL, and has therefore significantly outperformed on a vol-adjusted basis YTD. Please note that past performance is not indicative of future performance, but this is still interesting nonetheless.

Volatility-adjusted returns are not the same as risk-adjusted returns, however, as JLP contains more risk vectors than simply its volatility. When holding JLP, you are exposed to smart contract risks, and the price could also be affected negatively if traders become highly profitable (partially draining the JLP vault). As there are no long-tail assets to be traded on Jupiter, the risk of price manipulation is small, and an incident like what happened with AVAX, where GLP was partially drained back in the day, is of low probability.

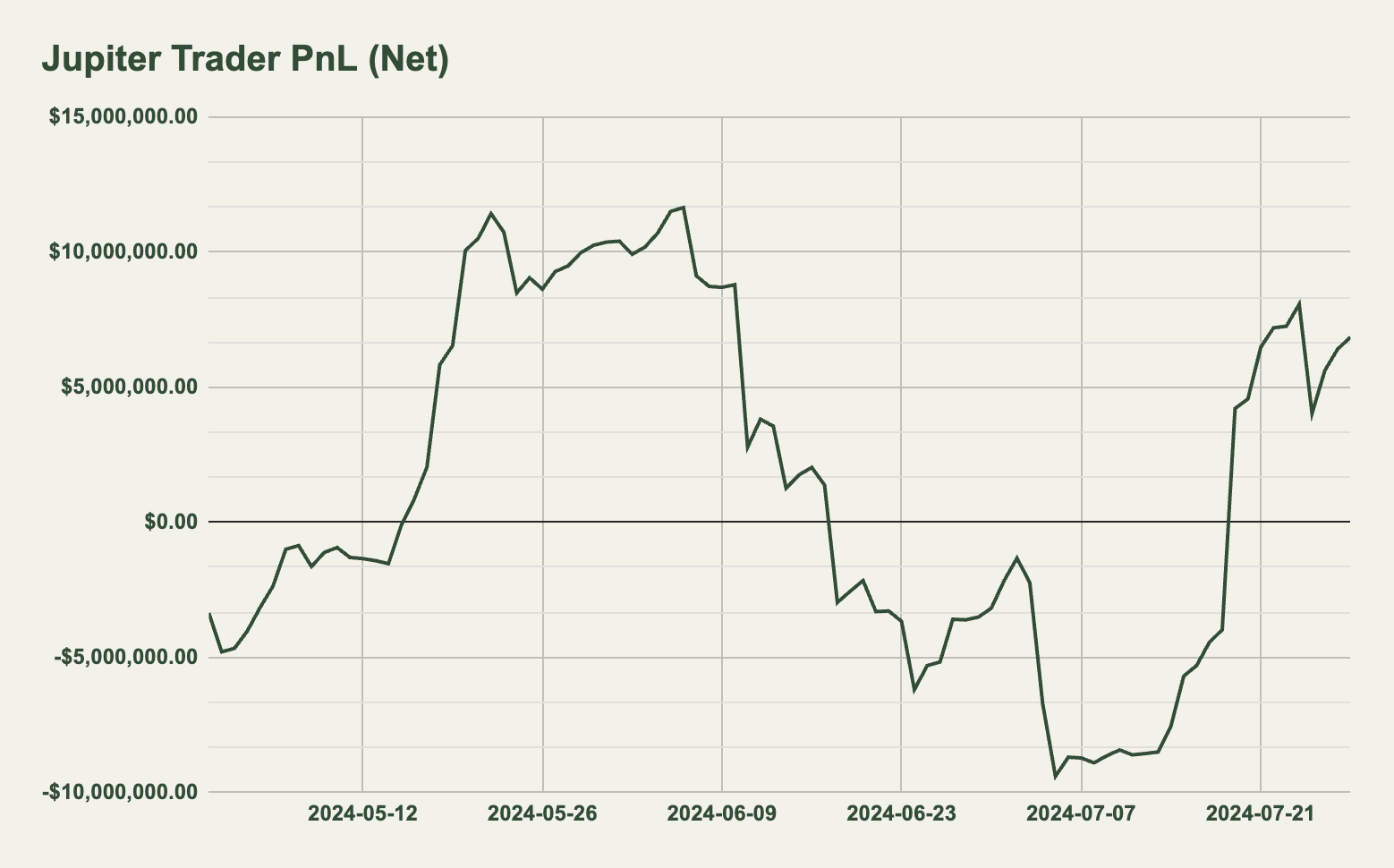

Nonetheless, we can examine the aggregate trader performance on Jupiter to try and quantify the JLP counterparty risk. The chart below shows the Jupiter net trader PnL over the past three months.

Notably, traders have been net profitable in the past three months with a cumulative gain of $6.85 million. This effectively means that $6.85 million of the JLP vault has been paid out to traders, impacting its performance negatively. Despite this, JLP has been a strong performer due to the high fees paid by traders simultaneously.

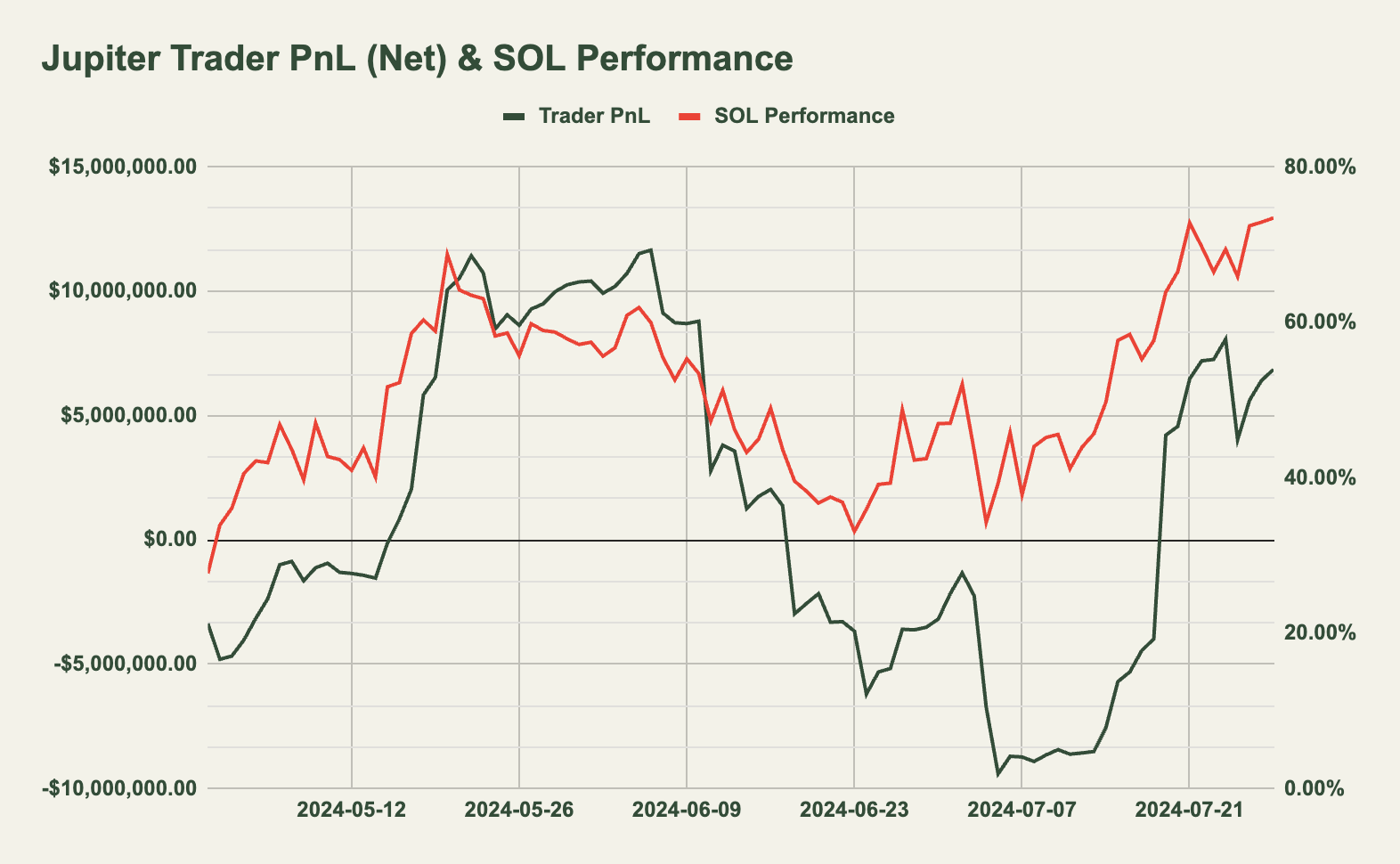

What's further interesting is that there seems to be a high correlation between the cumulative trader PnL on Jupiter and the price of SOL, as seen below.

This indicates that SOL is the most traded asset on the Jupiter perps, which is confirmed by the 24-hour volume being $139 million for BTC, $80 million for ETH, and $633 million for SOL (74.3% of all volume). At the same time, it also indicates that the open interest is skewed to the long side, i.e., most traders are long rather than short.

To sum up, in a scenario where SOL absolutely rips, traders could be profitable, which impacts the JLP price negatively. At the same time, however, SOL appreciating impacts JLP positively, so there's somewhat of a hedge. It is important to keep in mind that this is not a stablecoin strategy as you have SOL, BTC, and ETH exposure. If you're bearish on SOL, this is likely not the strategy for you. Finally, another risk with this asset is the smart contract exposure and the risk of an exploit on Jupiter.

#2 Syrup

To read the rest of the report you must subscribe to On Chain Times (free).