Orderbooks vs AMMs - Democratizing Market Making w/ Elixir Protocol🔮

One of the big differences between orderbooks and AMMs is the liquidity design. Elixir Protocol is creating a trustless liquidity layer for orderbook based perpetual futures.

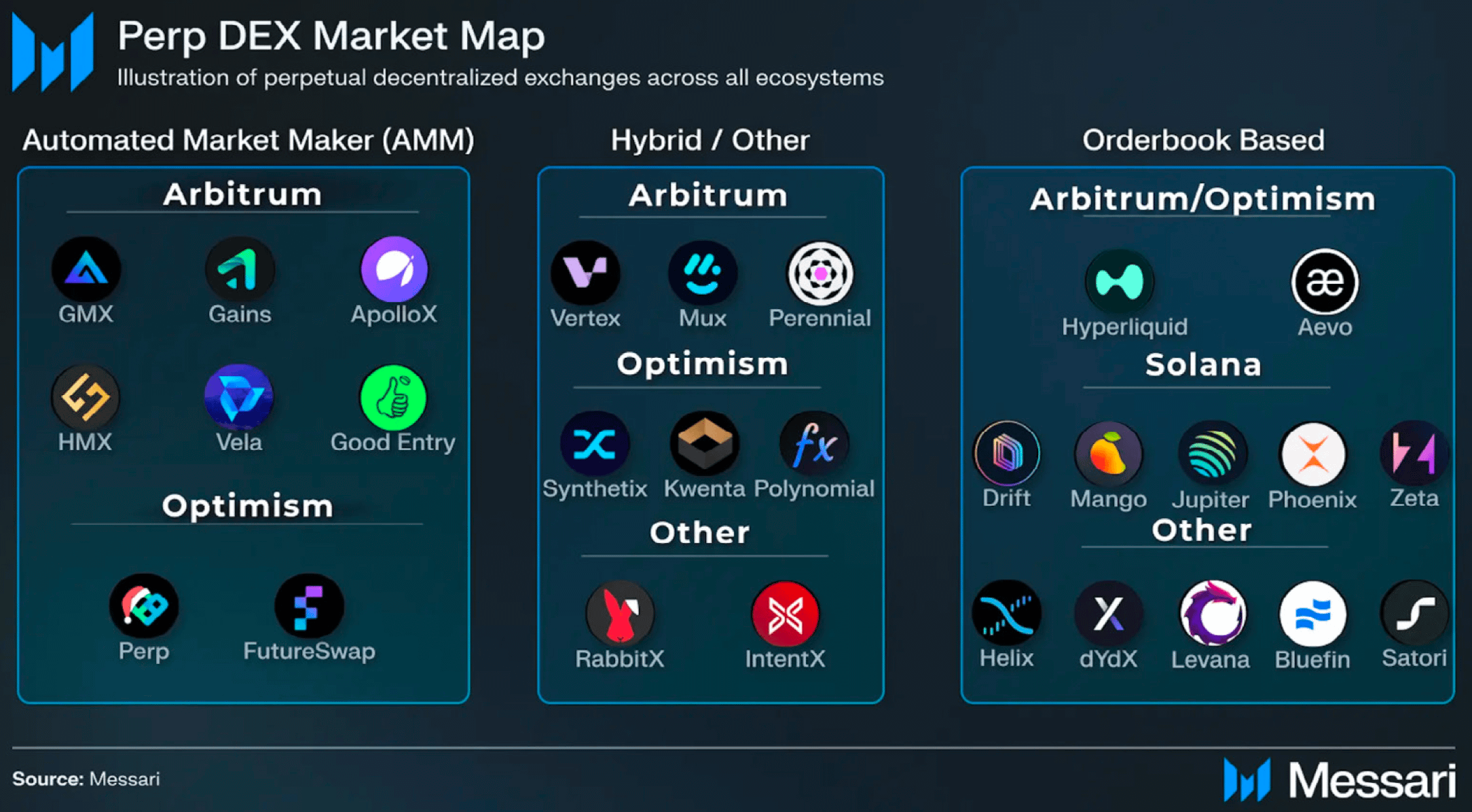

Perpetual futures remain one of the largest verticals in DeFi and have evolved a lot since being introduced by Bitmex many years ago. Today, there are many different on-chain iterations of perpetual futures including orderbook based protocols like dYdX, Vertex, Hyperliquid and Aevo but also AMM based protocols like GMX, Gains and Synthetix.

What all of these have in common is that deep liquidity for traders is more important than nearly anything else. The difference however lies in the fact that orderbook liquidity primarily comes from sophisticated market makers, whereas AMM liquidity is provided in a more permissionless fashion. Elixir is the first protocol to introduce trustless liquidity provision to orderbook based perpetual trading protocols like Vertex, dYdX and many more.

I interviewed Cole0x from Elixir Protocol to hear more about the protocol design, upcoming integrations and $ELXR token launch.

Bullets

Orderbook vs AMM

The Orderbook Design

The Role of Market Makers

The AMM Design

Elixir Protocol

Overview

Dex Integrations

Technical Design

Upcoming Developments in 2024

Thanks for reading DeFi Frameworks! Subscribe to receive a free research report once/week 🗞

Orderbook vs AMM

The first generation of crypto perpetual futures platforms (Bitmex, Binance etc.) all employ the popular CLOB (central limit orderbook) model from legacy finance. While this design has been changed and evolved upon since moving on-chain by protocols like dYdX and Hyperliquid, others have moved in a different direction. GMX, Gains and and ApolloX amongst others operate with a more decentralized solution; the AMM (automated market maker) model. The image below illustrates many of the different perpetual futures designs.

The Orderbook Design

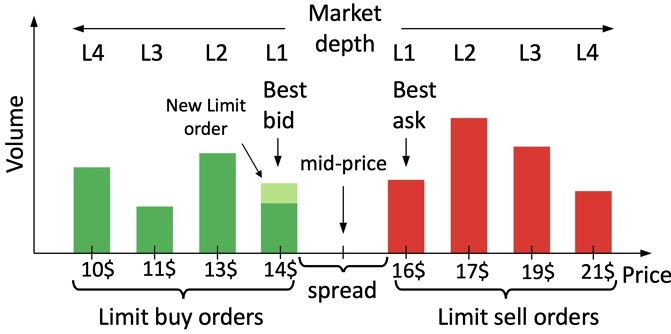

Orderbooks are used by nearly all exchanges both inside and outside of crypto and is an efficient design to accurately price assets and ensure a good overall trading experience. On orderbook exchanges, there are two types of traders: Makers and Takers

- Taker - wants to buy or sell an asset at the current price and therefore places a market order

- Maker - wants to buy or sell an asset at a specific price and therefore places a limit order

Furthermore, if a trader wants to buy an asset, it is called a ‘bid‘ and if a trader wants to sell it is called an ‘ask‘.

The orderbook is a collection of the total amount of limit orders. Placing a limit order therefore deepens the orderbook liquidity whereas taker orders remove liquidity from the orderbook. This is also why maker orders usually have lower fees than taker orders.

The more (and the larger) limit orders an exchange has, the better the liquidity and trading experience. The spread of an orderbook exchange is the difference between the highest bid limit order and the lowest ask limit order. The lower the spread, the better the liquidity.

Orderbook based perpetual trading protocols are often more centralized than AMMs as the orderbook is run from a single point of control. dYdX V4 is one of the first protocols to fully decentralize its orderbook as validators on the chain now are in full control.

The Role of Market Makers

The role of market makers is to ensure that there is deep liquidity on the orderbook in the shape of limit orders. Any trader placing a limit order is technically a market maker however the term typically refers to larger and more sophisticated players whose sole purpose is to ensure deep orderbook liquidity. These include firms such as Wintermute and Jump Trading who are able to generate large profits in various ways through market making. As exchanges are interested in deep liquidity, they commonly work together with market makers by giving them benefits such as fee rebates.

Most market makers are delta neutral (no directional exposure) and earn fees from the orderbook spread but some also trade the market more actively through a certain edge such as sophisticated market making algorithms or privileged information.

There is a lot more to market making but this is an introduction the general structure of the business.

The AMM Design

The automated market maker was first introduced by Uniswap on their V2 spot markets and later as perpetual futures in various iterations on protocols such as Synthetix and GMX. AMMs allow for a higher degree of decentralization as the centralized market maker on orderbooks is replaced by a group of liquidity providers. On AMMs, users can in an easy and permissionless fashion provide liquidity to spot and futures markets without having to operate a large scale operation and work directly with the exchange itself behind the scenes.

All in all, market making (providing liquidity) can be highly lucrative and profitable if done correctly, however from a retail perspective this has previously primarily been possible on AMMs and not orderbook exchanges.

This is what Elixir is changing.

Elixir Protocol

Overview

I had the pleasure of speaking with Cole0x about the Elixir Protocol design and upcoming developments.

In short, Elixir is a chain agnostic DPoS network that lives off chain and allows users to provide liquidity to orderbooks in a similar fashion to being a liquidity provider on an AMM like Uniswap V2. Elixir can tap into virtually any blockchain and power liquidity on native DEX’s whether it’s Arbitrum, Ethereum mainnet, Solana, Injective or somewhere else.

The goal isn’t to provide a proprietary high alpha trading strategy with large risk. Instead, Elixir offers a permissionless and trustless liquidity network that allows users to one-click supply USDC liquidity to order book pairs for both perps and spot and get paid by the exchanges for having their liquidity there.

DEX Integrations

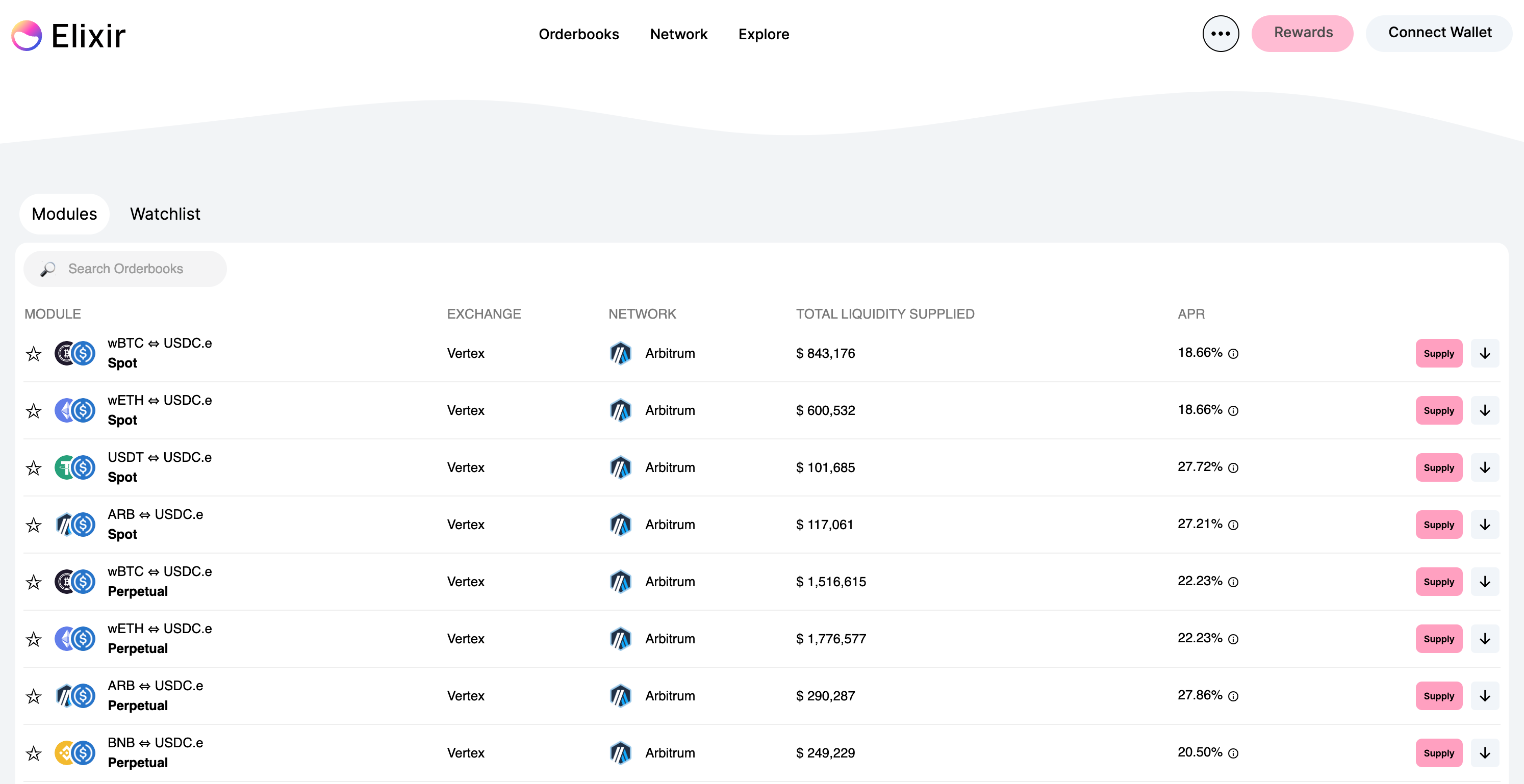

Elixir is currently live on the Vertex Protocol, a hybrid orderbook and AMM DEX on Arbitrum. Users can act as liquidity providers on the Vertex orderbook for both spot and futures markets as seen below.

The yield earned by liquidity providers on Elixir depends on the specific market making benefits that the integrated DEX operates with. In the case of Vertex, the rewards are a function of uptime (how long time the orders are live on the orderbook) as well as the size (volume) of the liquidity provided.

“I would say at the end of day, the most important thing is what percentage of the total liquidity on the exchange we represent. For Vertex, we represent about half their orderbook liquidity, which rewards us (our users) and makes it easy to quote somewhat wide and avoid picking up toxic order flow, but still capture a decent amount of volume.“

Due to the market making requirements on DEX’s as well as the 1-second delay from the off-chain syncing on Elixir, liquidity ends up being quoted roughly two or three ticks down from the top of book. This allows Elixir to be actively earning rewards from the market making programs, fee distribution and token incentives, which is passed on to the user.

Technical Design

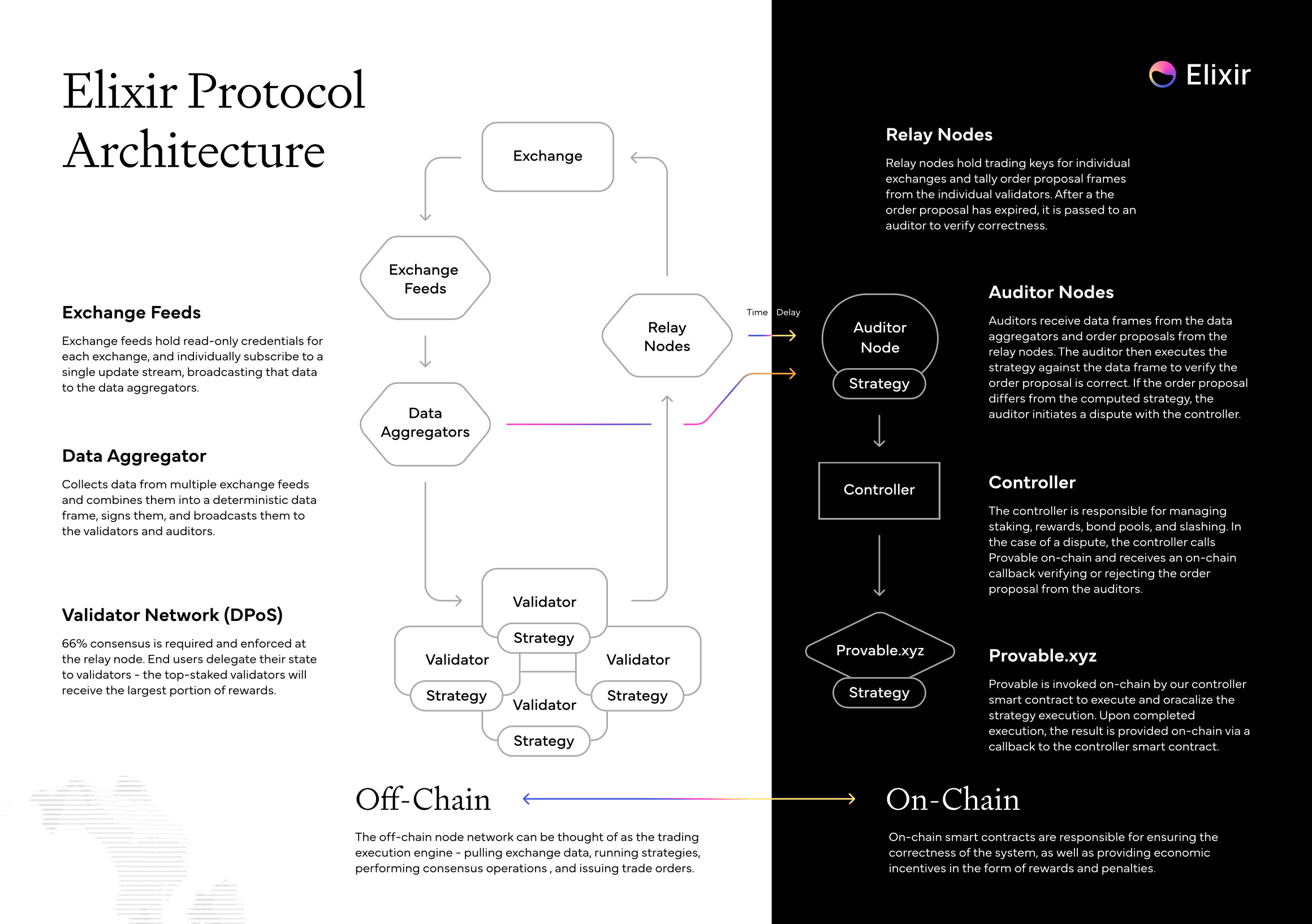

Elixir is powered by the protocol validators and will be moving to a fully decentralized structure with the introduction of the native Elixir token. Validators spin up a server to run the Elixir network, all running separate instances of the protocol. Elixir then pulls orderbook data from integrated exchanges and runs it through the set of validators who all compute the same information separately. If they validators have come to consensus, the protocol then relays the orders back up to the exchange level. As this process happens off-chain it takes a little under a second.

The design can be seen in a more detailed fashion in the image below.

Upcoming Developments in 2024

As Elixir moves towards its full launch in 2024, several new markets will be integrated for users to provide liquidity to. In the short to midterm, these include RabbitX, a Starknet native orderbook DEX, dYdX V4, Bluefin on Sui, Injective and more.

In addition to this, the network token $ELXR is set to go live at some point next year. At that point, $ELXR must be staked in order to spin up a validator and users can delegate their $ELXR to active validators to capture a piece of the network fees. Elixir mainnet is currently scheduled for late Q1 which will see the validator network and the $ELXR token go live which fully decentralizes the protocol.

Elixir is at the tip of the iceberg in terms of what’s possible with their liquidity design. I’m quite excited to see Elixir launch its mainnet next year and integrate new markets for liquidity providers to tap into. If you want to stay up to date with Elixir you can find them on Twitter here.

If you enjoyed this article, consider leaving a like and subscribe for free weekly research reports like these🗞

Not Financial Advice!