Omnichain Lending Is Here - Synonym Finance

Enter the defacto money market expanding to a chain near you.

Inevitable advances in an industry moving at the speed of light can easily resolve compromises and limitations we’ve come to accept when it comes to fundamental applications. If it ain’t broke, don’t fix it. What if it’s possible to make it more convenient without reinventing the wheel?

This report is made in collaboration with Synonym and is therefore sponsored.

Introduction

The first DeFi expansion, taking place back in 2018-2020, brought forth a plethora of innovation to the blockspace that has since served as the foundation for decentralized finance as we know it today.

Early adopters and trailblazers introduced us to decentralized exchanges equipped with liquidity pools, yield farming, overcollateralized stablecoins and today’s main focus — money markets.

Lending and borrowing assets are integral to any market as credit and leverage have an unlimited demand, indiscriminate of market conditions. This is reflected in the flow of liquidity across all protocols existing on-chain.

As expected, protocols facilitating these services have remained at the forefront and continue to grow as adoption increases. Following subsequent expansions and the industry evolving as a whole with new platforms utilizing novel technology competing for market share and fragmenting liquidity in the process, money markets are left in an interesting position. Capabilities for providing seamless and efficient interactions through interoperability between multiple blockchains are present and accessible, although the implementations are not as wide-spread as one would hope.

This is where Synonym comes into the spotlight, armed with ambitious plans to enhance the money market experience.

Cross-Chain Credit Layer

Leveraging Wormhole’s tech stack and seemingly limitless reach across blockchains, Synonym is able to offer cross-chain lending and borrowing through a single unified interface. Employing the Hub & Spoke model, with Aribtrum One acting as the hub, scaling across chains by appointing them as spokes alongside Pyth’s extensive price data availability paves the way for setting up additional checkpoints in the future.

A hub-and-spoke model features a single hub chain that functions as either a centralized accounting or liquidity layer, with different spoke chains sending either accounting messages (centralized accounting) or wrapped token transfers (centralized liquidity) upon token movements to the hub.

This also unlocks possibilities for implementing alternative VMs to the already existing lineup, going beyond just the EVM we all know and love.

It is worth noting that Synonym was launched through a merger with New Order DAO (NEWO), in turn inheriting their treasury. The relevance of this merger will be clear once we cover the technical aspects.

Tokenomics

There are 4 tokens associated with Synonym and its operations, some of them having unique properties.

SYNO — protocol token;

vlSYNO — locked Balancer 80SYNO-20WETH LP tokens;

earns a solid portion of protocol fees in WETH

locking a set (>5% of position size) amount of vlSYNO applies boosted yield to earn:

SYNO emissions

ecosystem allocations

governance participation

tSYNO — locked protocol token received from converting NEWO > SYNO;

earns a small portion of protocol fees

eligible to earn ecosystem rewards

premature unstaking (<15 months) is penalized with forfeited gains going to the protocol treasury

rCT — rewards claim token for veNEWO holders who converted to tSYNO;

grants 50% of rewards from New Order’s incubated project tokens that were transferred to the protocol’s treasury

Below is a breakdown of their native token supply distribution. The maximum supply being capped at 800m, although the team doesn’t expect to ever reach this number.

The merger has a profound impact on the tokenomics with the conviction of NEWO converters having the biggest impact on the dilution. Inflation starts ramping up after the fifth month following the first token unlocks, peaking at month 15 and tapering off from there on. These details could be subject to change.

Protocol Mechanics

Synonym’s main selling point is giving its users the freedom to conduct all necessary operations through different chains. For example depositing collateral on Mainnet, taking out a loan on Optimism and making repayments from Arbitrum without the need to bridge in case a balance on a preferred chain is too low. This is made possible by using the hub chain as a centralized accounting layer to accurately and synchronously track states across all supported networks.

Rates for each market (on each chain) are dependent on the utilization rate and its unique interest rate curve. It’s worth exploring all available options for any asset to find the most optimal conditions before opening a position.

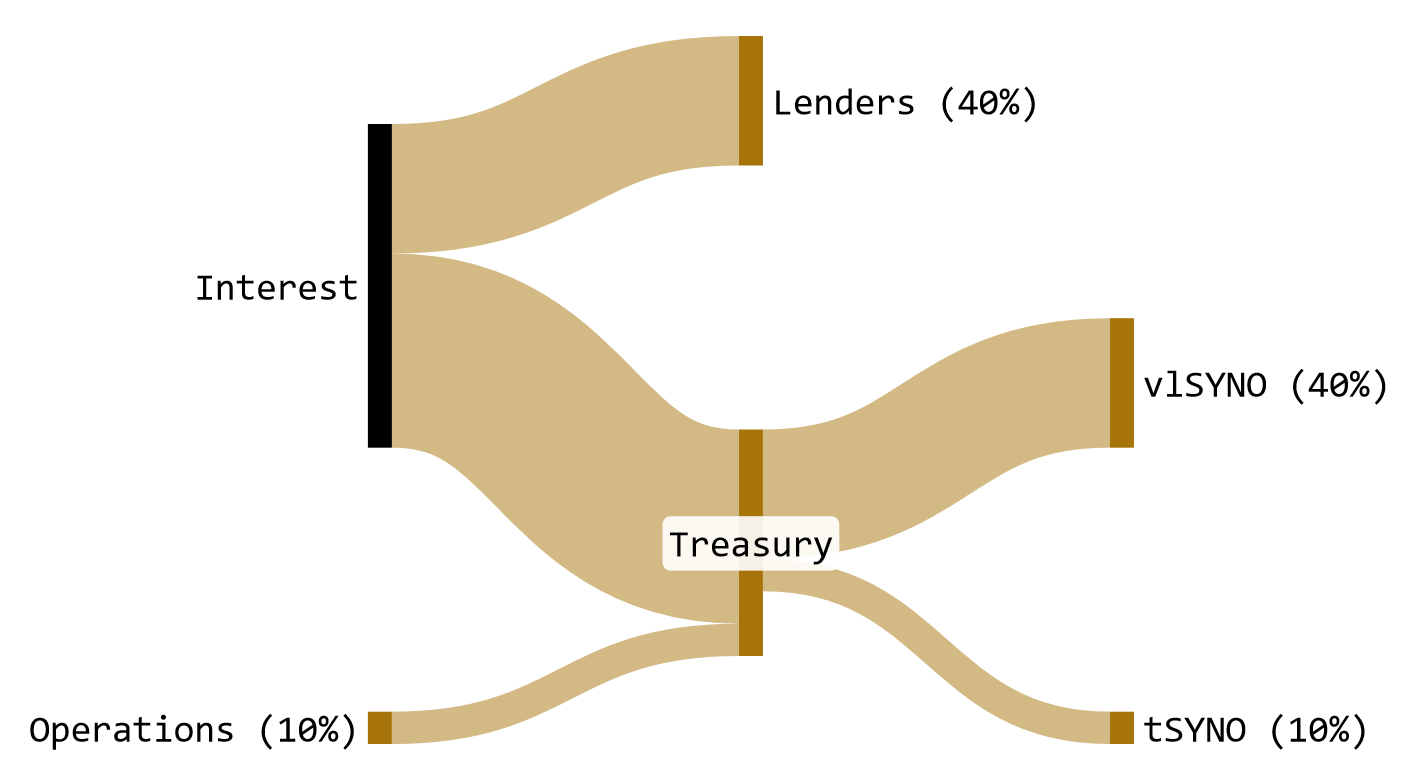

Accrued interest payouts are distributed to multiple parties with the schematic looking as follows:

For actively contributing to the money market, asset suppliers receive 40% of fees generated, with the remainder being routed through the treasury to liquidity token lockers, users having converted their NEWO and the protocol itself to cover operating expenses and accelerate development.

Incentives

Complimentary to any new protocol, volume and time based incentives through a points program are available for anyone interacting with the application. Native token and multichain ecosystem rewards are provisioned by the BIPS (Synonym Basis Points) program.

Given the fact that Synonym is present on multiple blockchains, the odds of being eligible for additional ecosystem specific allocations is greater than a protocol residing on just one network. The protocol has already received sizeable allocations from Pyth, Arbitrum (400k ARB) and Wormhole (400k W) that have been included in the ongoing campaign, accompanied by SYNO emissions that will eventually be distributed to participants. In a meta where airdrops and other rewards are frequently offered, more and more allocations will be given out as time goes on.

This campaign will be active for multiple seasons and was recently initiated. To get in on the action, points can be obtained by doing any of the following actions:

Supplying: 1 BIP per $1 worth of assets supplied per 24h

Borrowing: 2 BIP per $1 worth of assets borrowed per 24h

Locking LP for vlSYNO: 0.5 BIP per vlSYNO (~$0.1 for 1 month lock) per 24hThe current state of the leaderboard suggests that dilution isn’t an issue and that there is room for newcomers to rack up rewards before the first season ends.

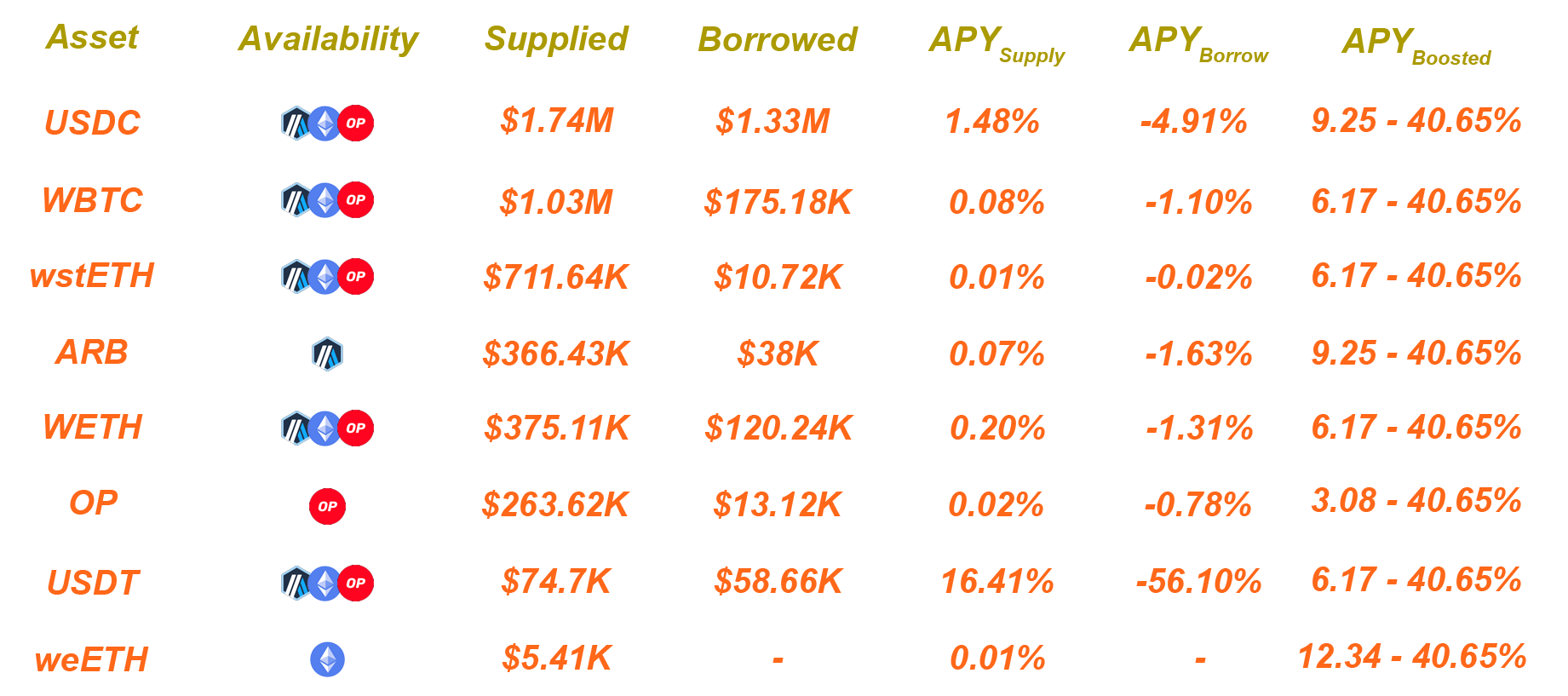

Market

As of writing this article, Synonym has integrated a total of 8 assets that are available on Arbitrum, Optimism and Mainnet with a total market size of $4.56m. More than a third of all supplied collateral is actively being utilized.

Participants lending assets to or borrowing from the market are entitled to a base boosted yield thanks to the ongoing rewards campaign, which can be further amplified by locking vlSYNO tokens.

Average additional yield for lenders without locking tokens is ~7.33% and can be increased from 10.33% to 40.65% based on lockup period.

Average additional yield for borrowers without locking tokens is ~13.22% and can be increased from 16.22% to 40.65% based on lockup period.

In contrast to other money markets available on the supported chains, interest rates are relatively low and could be lucrative for borrowing and arbitraging or executing delta neutral strategies by taking advantage of high yields on certain assets.

As Synonym’s ecosystem coverage expands with upcoming changes, additional assets and chains will be listed in the future. By the time this article is live, Synonym has also launched on Base with assets such as wETH and cbETH, allowing for even more cross-chain opportunities and strategies.

Moving Forward

Following the successful testnet campaign and live protocol launch two months ago, Synonym is far from stepping on the brakes and has plenty of exciting developments in the pipeline.

EVM 🤝 SVM

By bridging the gap between Ethereum and Solana, users will soon be able to frictionlessly interact between the two competing virtual machines. The exact details of its release are yet to be set in stone, but is expected to take place in the following months.

Triple Yield

With the team’s LTIPP received, Synonym users will be entertained by a scenario where they can earn yield from an additional third source (ARB) on top of the current SYNO and W rewards.

LRTs

Capitalizing on the popular restaking narrative and filling the use case demand, more LRTs will soon make their way to the platform with cross-chain support, including the upcoming Solana expansion.

Still in its growth phase, the next six months could prove to be a big needle mover for the project if they manage to convert ambitions into reality, establish a strong presence in the space by preaching the narrative and onboard users from the massive addressable market.

Conclusion

Causing an upset and breaking through in a mature, saturated market such as lending is by no means an easy feat. To make a noticeable impact, teams need to come out the woodwork with something special in order to capture viscous and sticky liquidity. Considering the state of lending markets as they are now, cross-chain adaptations such as Synonym can greatly ease the user experience and reduce time and funds spent on constantly bridging between the ever increasing number of networks.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.