Navigating Solana DeFi Yields: Trends and Insights

Liquidity is flowing to Solana. But where are the yields?

Introduction

For the first time ever, more than 50% of my personal on chain portfolio is on Solana. The tweet below was more controversial than initially anticipated and sparked a series of amusing replies such as 'i don't fear god, i fear this'.

First time ever that >50% of my portfolio is on Solana.

— Thor Hartvigsen (@ThorHartvigsen) August 22, 2024

I'm not a chain/ecosystem maxi. I go where the yields are. And right now, the yields are on Solana. Several people have asked about what is worth looking at yield-wise on Solana, so I thought I'd break it down in today's report.

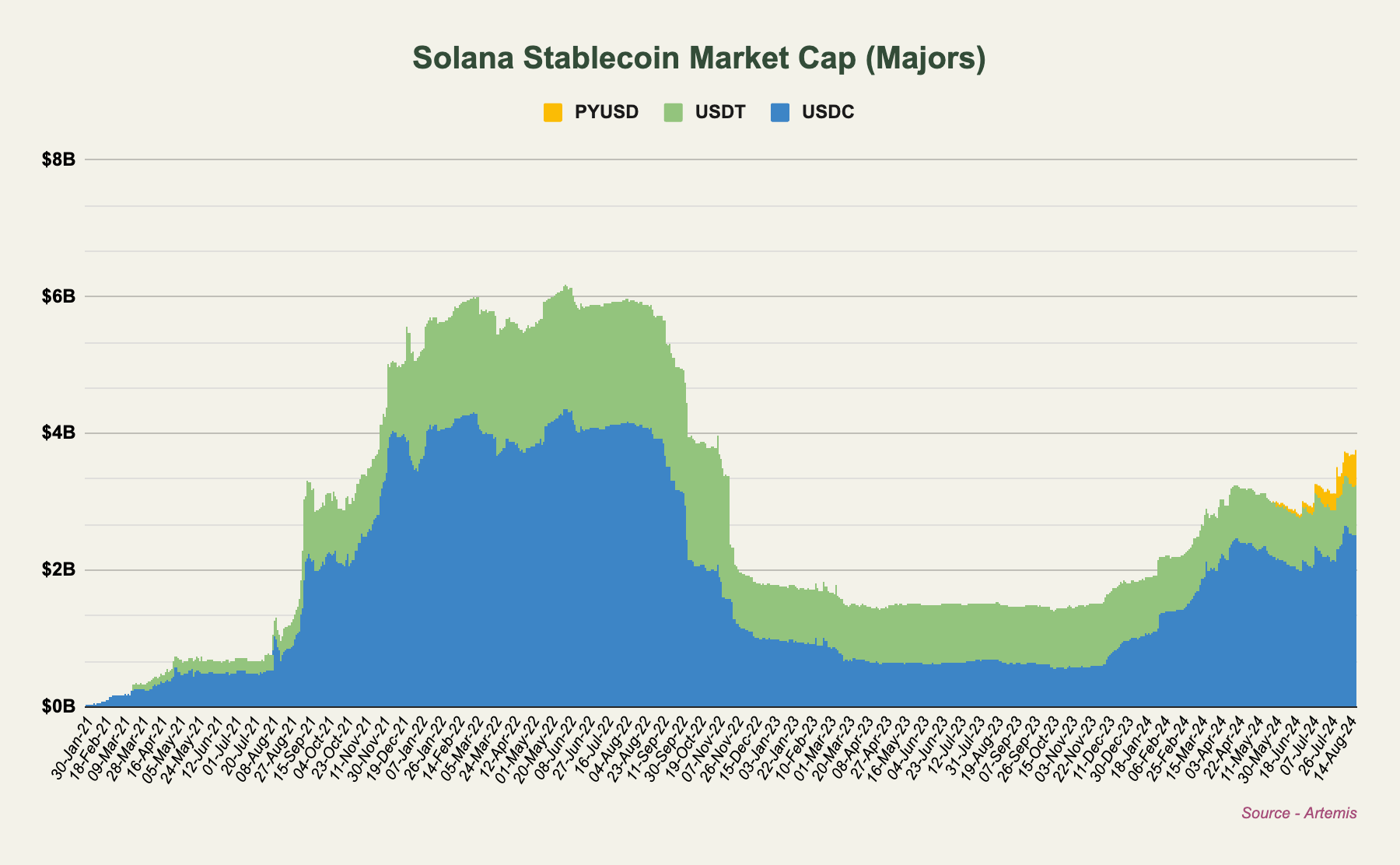

Stablecoins (PYUSD)

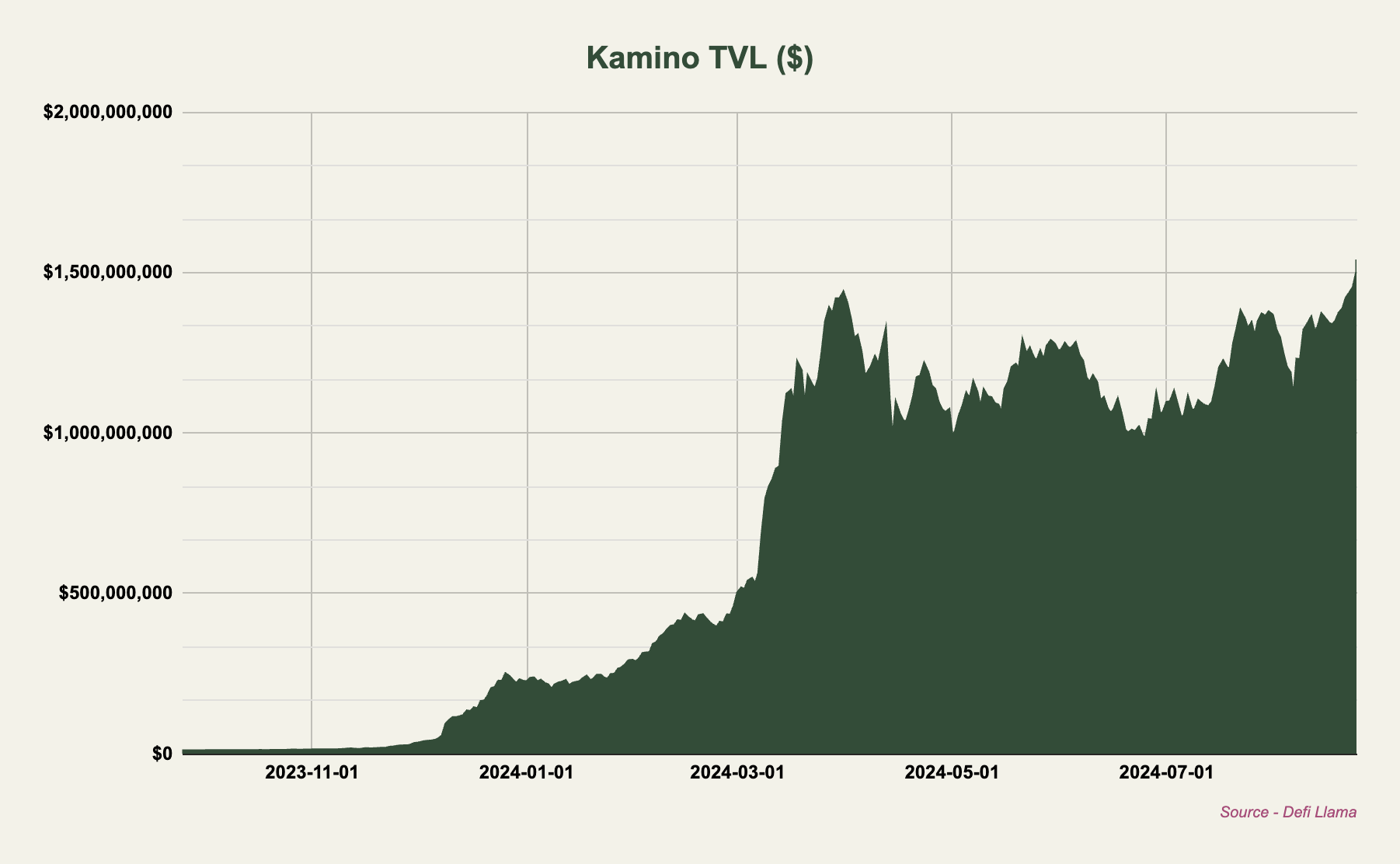

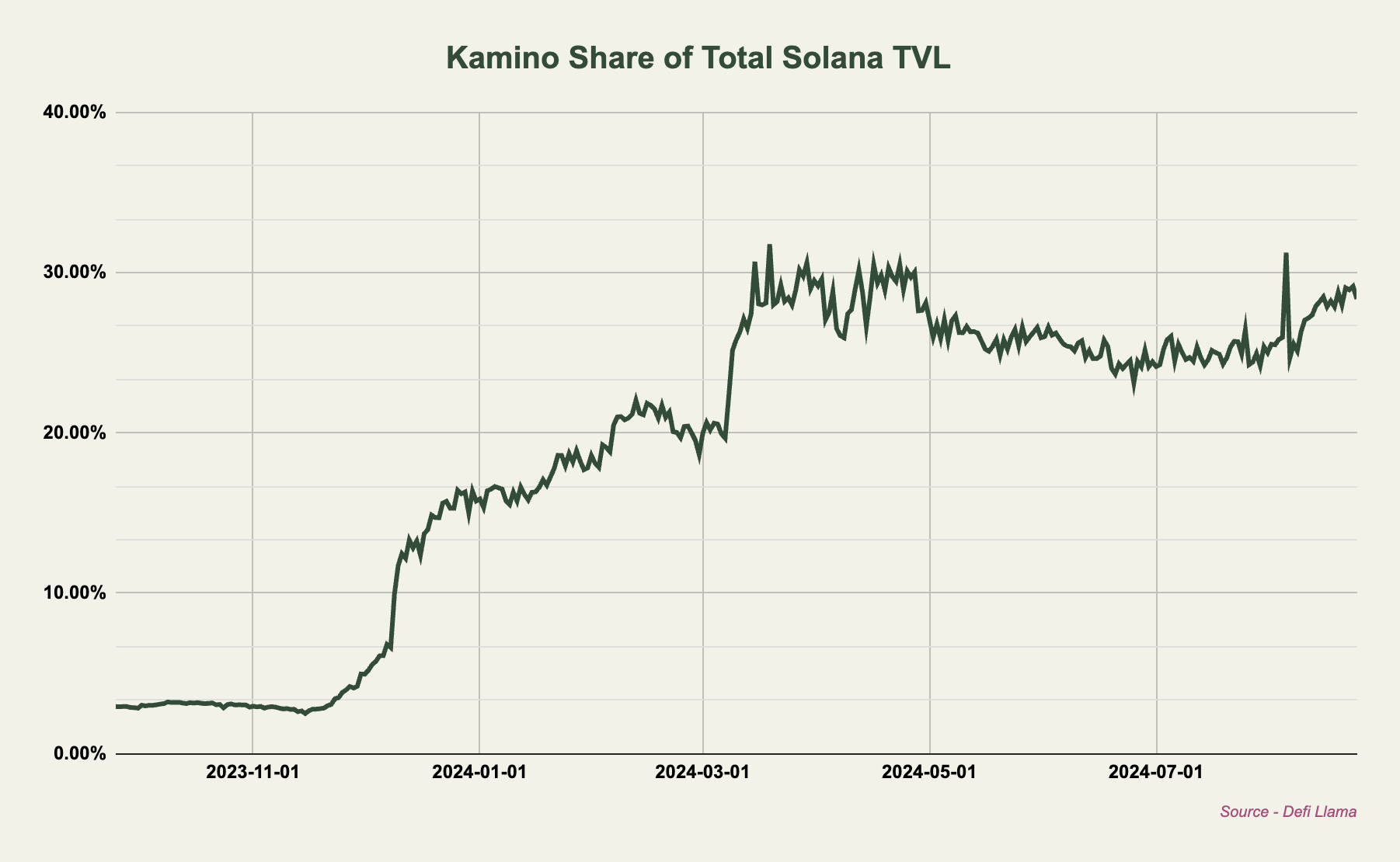

Kamino

Kamino is the go-to money market on Solana and the second largest application in terms of TVL after Jito. Kamino has over $1.5b in liquidity deposited across its different markets and makes up nearly 30% of all the liquidity on Solana.

PayPal's PYUSD

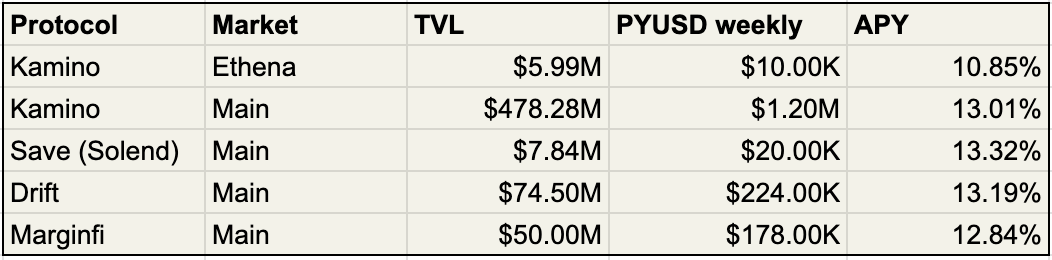

PayPal has made big strides in their crypto efforts this year. Their native stablecoin, PYUSD (PayPal USD) has grown to a supply of over one billion, split 65/35 across Solana and Ethereum mainnet. Most of the growth has occurred within the past two months, since PayPal launched their incentive program on Solana. One of the biggest recipients of these incentives is Kamino finance. Since June, PYUSD lenders on Kamino have been earning a yield of 10-20% annually paid out in claimable PYUSD rewards. There are two markets funded, namely the PYUSD Ethena market which receives 10k PYUSD weekly (10.85% APY) and the PYUSD main market which receives 1.2m PYUSD weekly (13.01% APY).

Other recipients of PYUSD incentives include Drift and Save (formerly Solend). Below is a table showing current rewards:

SOL

Holding spot SOL has been a great strategy year-to-date outperforming both BTC and ETH. For SOL spot holders, there are several ways of earning additional yield while remaining exposed to this asset. The strategy containing the lowest risk involves simply staking SOL with one of the liquid staking solutions in the ecosystem. These liquid staking tokens (LSTs) are, in order of TVL, jitoSOL (Jito), mSOL (Marinade), INF (Sanctum), JupSOL (Jupiter) bSOL (Blaze Stake), LST (MarginFi) and others. It's important to note that the ~7-8% APY comes primarily from SOL inflation, even with the recent increase in fees generated on the network. This means that the real yield is closer to 1-2% annually (if we assume the SOL emissions are sold by the recipients).

The SOL staking strategy can be taken a step further however as most of these LSTs are integrated across various Solana money markets and can be used as collateral. On Kamino, users can loop the staking yield by

- Depositing the SOL LST as collateral

- Borrowing SOL against this

- Converting the SOL into more of the SOL LST

- Repeat

The highest yield can currently be obtained with the JupSOL LST which yields 8.3% APY and up to 16.4% APY when this is looped 5 times (80% loan-to-value on the position). This is done automatically With Kamino Multiply in which users simply deposit SOL or JupSOL.

Please keep in mind that looping the position exposes the user to liquidation risk. As SOL is borrowed against JupSOL, the position will only be liquidated if JupSOL depegs significantly against SOL however. Nonetheless, this is a risk to keep in mind and is more present, the higher this is multiplied.

- At 5x leverage, the position will get liquidated if JupSOL depegs by more than 11%

- At 4x leverage, the position will get liquidated if JupSOL depegs by more than 16%

- At 3x leverage, the position will get liquidated if JupSOL depegs by more than 25%

- At 2x leverage, the position will get liquidated if JupSOL depegs by more than 44%

JLP

To read the rest of the report, you must be a subscriber (free)