Maximizing Yield on Solana with Kamino Multiply

Introduction

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

With SOL continuing to rally towards new all time highs, the yields across the Solana ecosystem have increased dramatically. This is especially prominent on Kamino, the premier money market on Solana which offers some of the highest yields on SOL, SOL LSTs, stablecoins and memecoins. Of all the yield strategies on Kamino, the 'Multiply' vaults stand out as they offer leveraged exposure to a variety of assets and yields.

Today's report will cover the unique design of Kamino Multiply and further dive into two strategies (JitoSOL<>SOL and JLP<>USDC) that are worth looking into currently.

Design

For anyone unfamiliar with Kamino Finance, we recommend checking out the previous report posted a few weeks ago covering the general structure of the protocol:

Kamino's main product is their lending and borrowing market which features a wide range of assets. Kamino's 'Multiply' product utilizes this underlying lending and borrowing infrastructure to seamlessly create leveraged positions on a variety of assets. In essence, an asset is supplied as collateral on one of the various markets on Kamino (JLP, Jito, Main, Ethena or Altcoin market) and another asset, typically a stablecoin or SOL, is borrowed against this. This process is then repeated multiple times in order to create the multiply/leveraged position.

Kamino Multiply is designed in a way to optimize the user experience by making it easy to spin up and wind down positions in just a few clicks while simultaneously minimizing liquidation risk. Multiply utilizes flash loans to create leveraged positions in a single click by taking a loan and repaying it within the same transaction. An example of how this works:

- SOL is borrowed

- SOL is swapped to target asset (eg. JitoSOL)

- Target asset is supplied in K-Lend

- SOL is borrowed against target asset

- Borrowed SOL is used to repay the initial flash loan

- Position is open at target leverage

Liquidations

When creating and managing leveraged positions, the risk of liquidation plays a big role. It is in relation to this that the design of Kamino really shines. In general, a position is liquidated if the loan-to-value (LTV) exceeds a certain threshold. For SOL LST<>SOL looping, the liquidation LTV is 95% i.e if the value of the borrowed SOL exceeds 95% of the value of the SOL LST collateral, you get liquidated. This can happen if the borrow rate stays very high for a long period of time or if the price of the collateral falls more than the price of the borrowed asset (e.g on a SOL<>USDC Multiply position and SOL crashes in price).

Kamino has taken several measures to reduce the risk of liquidation. For SOL LST<>SOL Multiply positions (such as JitoSOL<>SOL) there is usually a risk of liquidation if the LST depegs against SOL. This is not the case on Kamino however as they use the stake rate (SOL staked divided by LST minted) to determine the price of the LST and not the market price. As long as the smart contract is intact, the Multiply positions on Kamino are safe, even if the SOL LST experiences a large short term depeg. As a result of these features, there has never been a single user on Kamino who has gotten liquidated on a SOL LST<>SOL Multiply position.

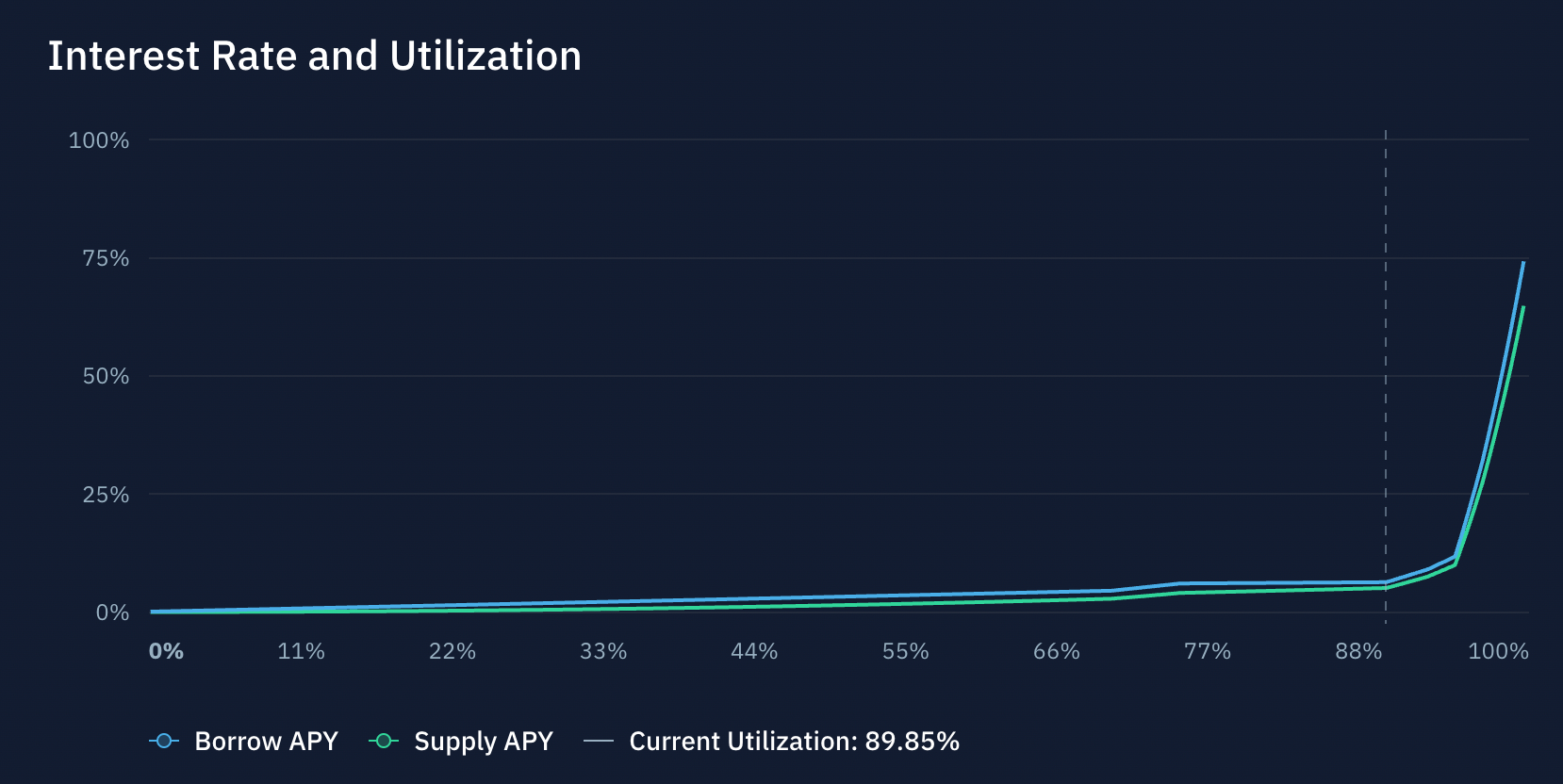

Second, to mitigate the edge case of sustained high borrowing costs, the Kamino team is actively monitoring utilization rates across markets and can impose individual utilization caps (e.g 90% cap on the JitoSOL multiply vault). Keep in mind that while the overall risk of liquidation on most Multiply positions is fairly low, it is still recommended that you regularly pay attention to your LTV and borrow rate.

You can read more about the multiply design in their docs and in this tweet.

Strategy #1 SOL LST Looping

'SOL LST looping' refers to supplying a SOL liquid staking token (LST) such as mSOL, JitoSOL, JupSOL etc and borrowing SOL against this. The borrowed SOL is then converted into more SOL LST which, once more, is used as collateral to borrow SOL. This process is repeated a certain number of times depending on how much leverage is applied. On Kamino Multiply, this is all done automatically and you can open close levered positions in just a few clicks.

The purpose of looping SOL LSTs is to capture the high staking rate while still being exposed to SOL. With a 10x leveraged JitoSOL/SOL position, you don't get a higher return from SOL going or a greater loss if SOL goes down as your debt is denominated in SOL. The price exposure remains the same but in all instances, the exposure to the staking yield is 10x (minus the cost of borrowing SOL of course).

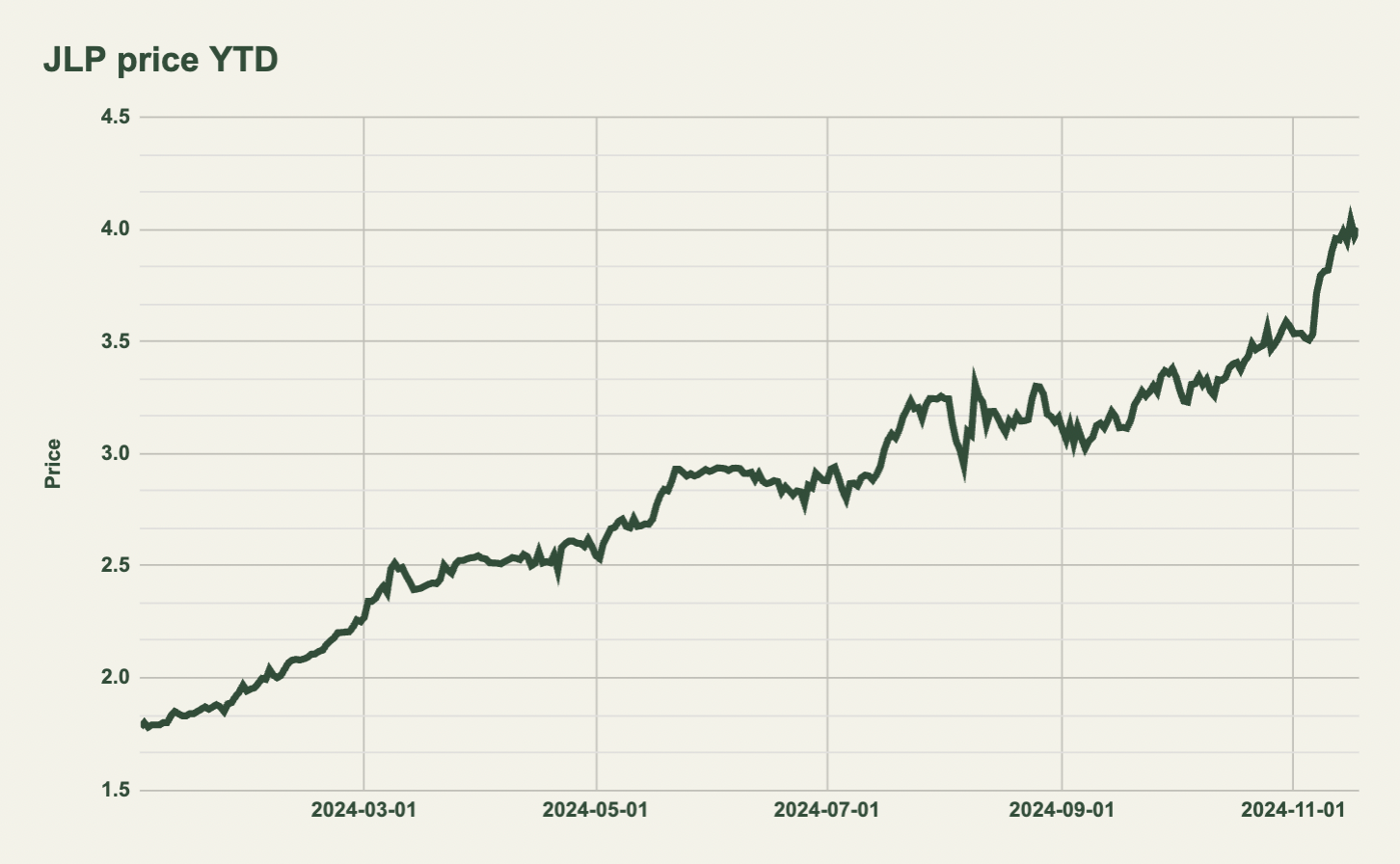

In most cases, the yield earned on SOL liquid staking tokens (LSTs) is captured via price appreciation. Hence, if the staking yield is at an average of 8% for a year, the price of JitoSOL will be 8% higher than the price of SOL in a year. See the image below.

Recently, Kamino added an isolated Jito market for JitoSOL and SOL. Isolated markets are a big part of Kamino V2 as it allows for custom risk parameters such as higher LTV ratios (loan-to-value). The higher the LTV ratio, the more leverage can be applied to the position. The Jito market has the only Multiply vault, JitoSOL/SOL, where user can get up to a 10x multiple due to the higher loan-to-value ratio of 90%. The return on this vault is very simple to calculate. It's roughly the JitoSOL staking APY minus the borrow APY times however many times you loop. If the staking APY is 8% and the annual borrow rate is 5%, the yield will be roughly 30% annually.

Jito has incentivized SOL deposits on the market with $JTO emissions which translates into more SOL deposits and a lower borrowing rate. As seen below the borrow APY is a function of the utilization ratio. As more of the supplied SOL is borrowed, the cost of borrowing increases and vice versa.

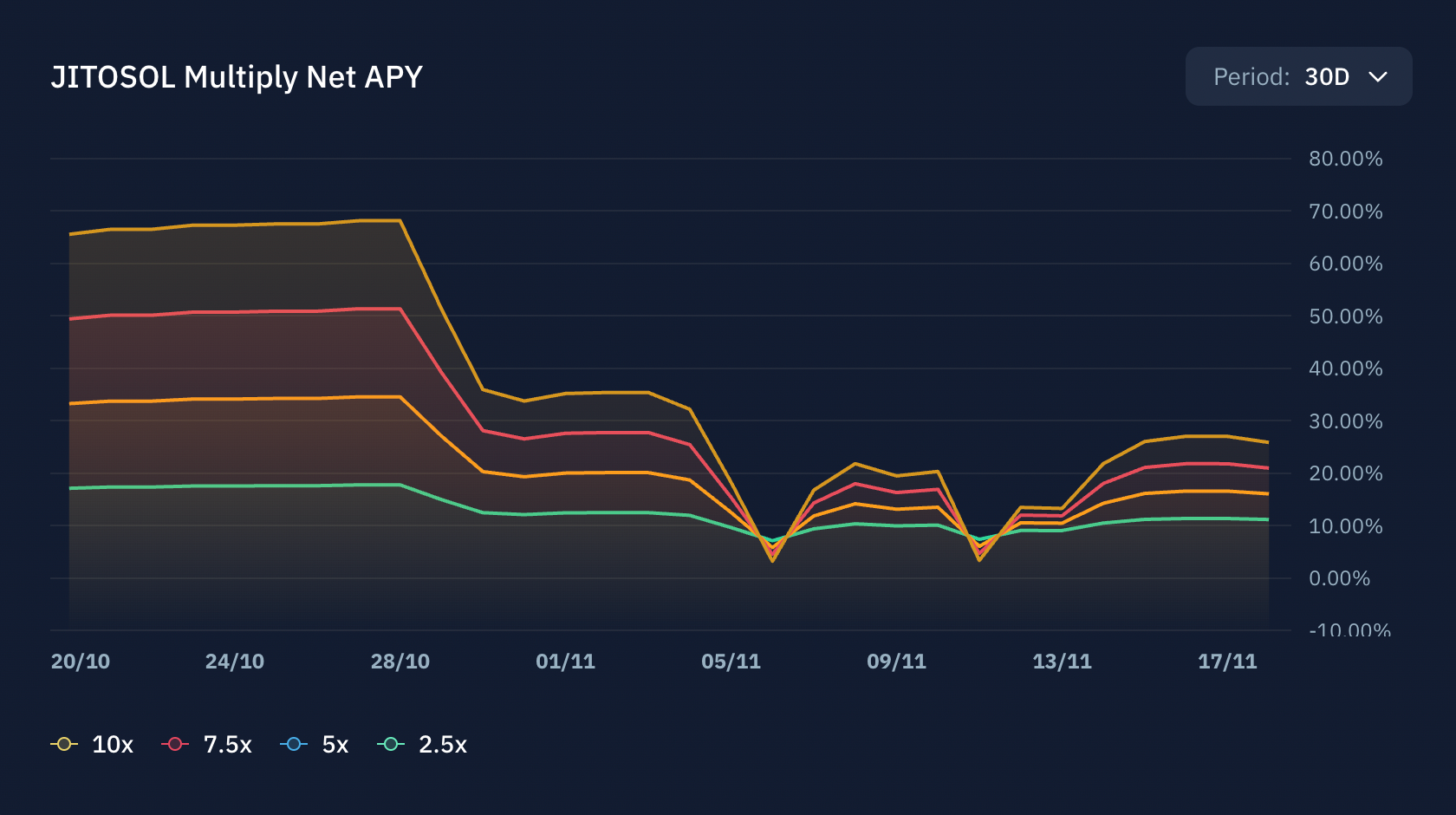

As of writing this article, the JitoSOL staking yield is 8.25% and the SOL borrowing rate is 6.9%. With 10x leverage, the APY is 25.88%, 7.5x 20.98% and 5x 16.09%.

It's worthwhile paying attention to the staking and borrow rate spread as the yield can become quite great in certain instances. As seen below, in the latter half of October, the return was close to 70% annually with a 10x multiplier due to the borrow rate being quite low.

Strategy #2 JLP Looping

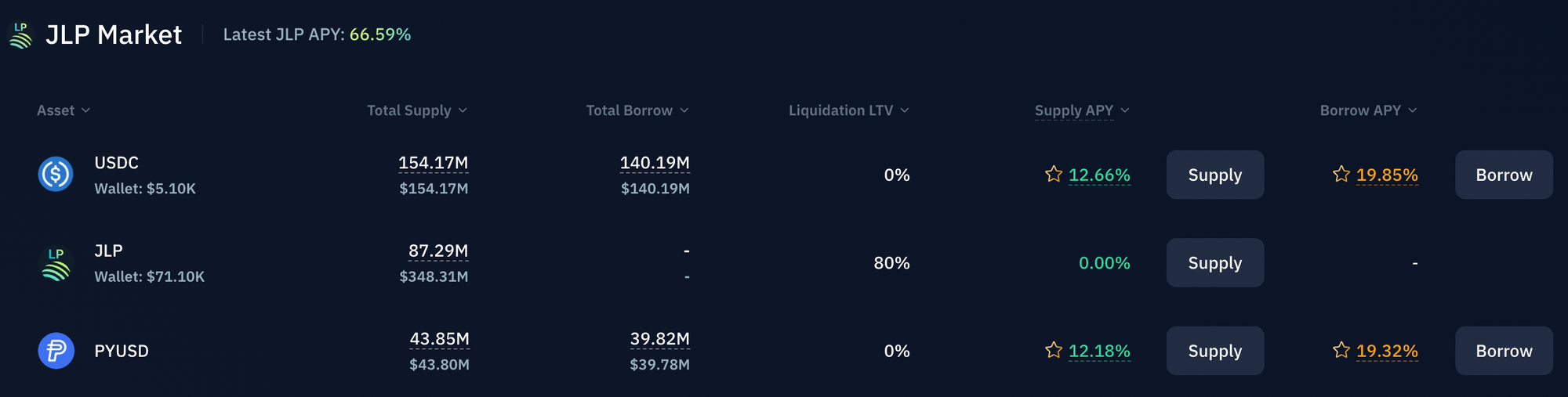

Another strategy utilizing Kamino Multiply and currently offering a high yield is looping JLP. On the JLP market, both USDC and PYUSD can be borrowed against JLP posted as collateral with a max loan-to-value of 67% (80% liquidation LTV).

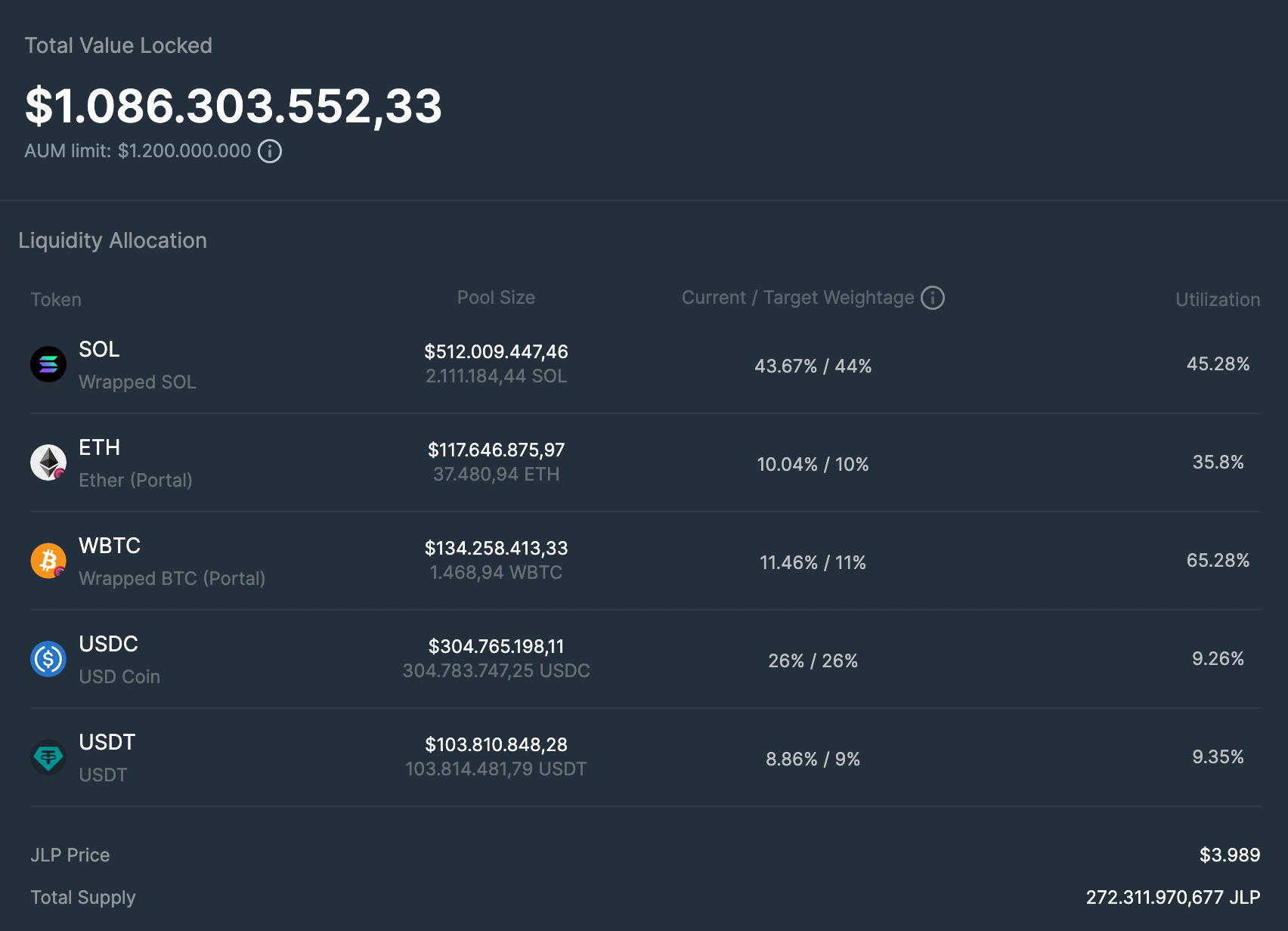

JLP is unique in the sense that it is a tokenized basket of assets, namely SOL, ETH, BTC, USDC and USDT and is used as liquidity for perps traders on the Jupiter exchange.

The underlying value of JLP is therefore impacted by the price of it’s underlying tokens, and their respective weighting, as well as fees captured from trades and finally trader PnL. For a complete explanation of JLP, please see the article below which goes more in depth with the design and historic performance.

In short however, JLP has been one of the best performing passive strategies this year, especially from a risk-adjusted perspective, as also seen from the chart below. This performance can to a large extend be attributed to the performance of SOL but also the high amount of fees captured by the vault.

On Kamino, JLP can be posted as collateral. Due to this, and in a similar fashion to the JitoSOL<>SOL loop, JLP can be looped by borrowing either USDC or PYUSD and converting it into JLP. With a JLP multiply position users get leveraged exposure to JLP which means leveraged exposure to:

- the price of the assets in the basket

- fees earned by the vault

- trader PnL

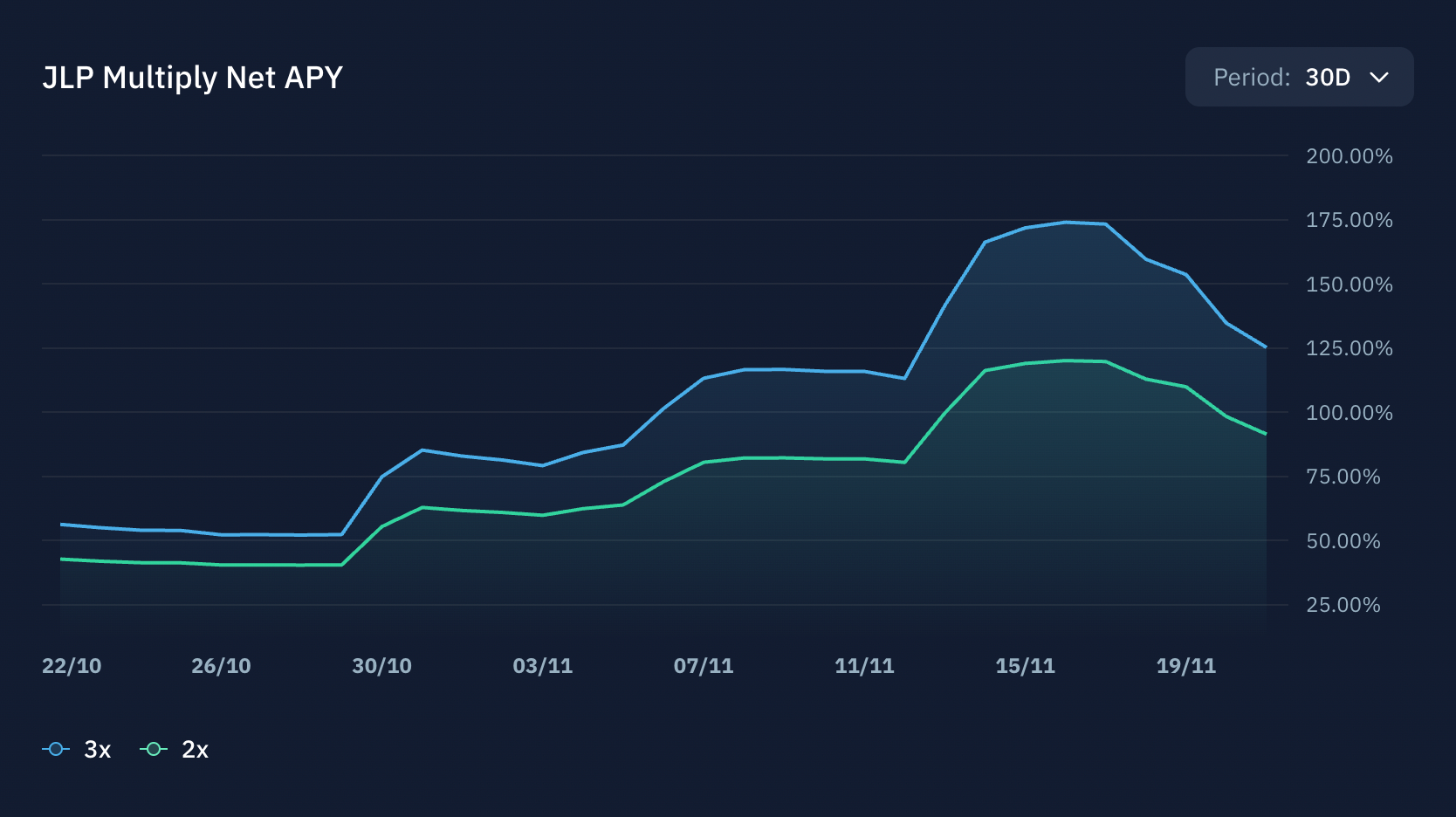

As a general rule of thumb, and as with the JitoSOL<>SOL loop, the leveraged position is profitable if the APY from fees exceed the borrowing cost. As of right now, the USDC and PYUSD borrowing rate is 24% annualized and the JLP APY is 57.7%. At 3x leverage, the APY is 125% and at 2x 91.5%.

Different to the JitoSOL<>SOL loop however, even though the JLP APY is high, JLP can drop in price if the underlying tokens, SOL, BTC and ETH, experience a pullback. There is therefore a larger risk of liquidation at higher leverage. JLP can however only be leveraged up to 3.2 times rather than 10 and is generally less volatile than assets like BTC, ETH and SOL as ~35% of the basket consist of stablecoins.

You can track the APY of JLP in real time by using the Gauntlet dashboard here.

Conclusion

Kamino's Multiply vaults on Solana offer users easy exposure to leverage on a variety of assets while minimizing liquidation risks. The SOL LST<>SOL and JLP<>USDC Multiply strategies offer great ways to get leveraged yield exposure. As mentioned, the key to these strategies involve monitoring the spread between the yield on the collateral asset and the borrowing cost on either SOL or USDC (depending on the strategy). The higher this difference, the better the return.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.