Making Liquid Restaking Great

The word "again" wasn't appended to the title for a reason.

Disclaimer

This report is made in collaboration with YieldNest and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Restaking during it's formative period was hailed as the next north star for decentralized finance, thought to usher in a new era of economic security by efficiently repurposing assets committed to safeguarding the sovereignty of their respective networks. Spearheaded by EigenLayer on Ethereum and later followed up by the likes of Babylon and Symbiotic, the sector managed to onboard a significant amount of liquidity yet the discussion surrounding the narrative has been inversely correlated with its market size.

Introduction: Untapped Potential

Emerging novel primitives tend to attract significant interest, especially in stagnant markets. The meteoric rise of restaking exemplifies this notion, demonstrating how an established, practical concept can evolve by extending its utility to the application layer without compromising foundational integrity. An approach that enables restaking applications (RAs) to effectively transmute liquidity into trust. As any alchemist knows, the law of equivalent exchange states that to obtain something, one must offer something of equal value in return. Here, that price is yield.

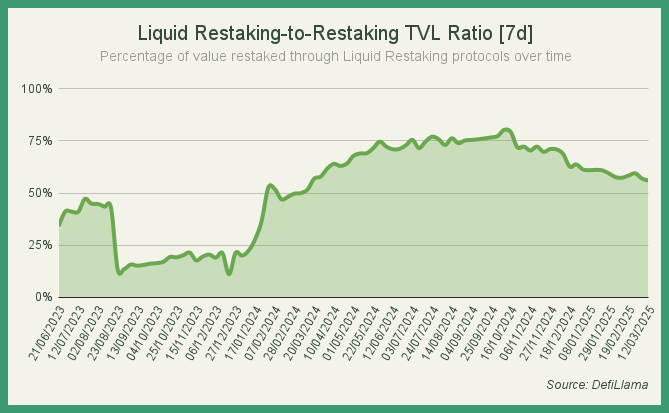

Naturally, protocols issuing liquid restaking derivatives quickly capitalized on the momentum by providing a means of capturing yield and accumulating upcoming ecosystem allocations, while retaining partial freedom of utilizing the exposure on third-party venues supporting these assets (e.g. money markets and yield trading instruments). Leverage introduced by the liquid receipts and subsequent integrations assisted in funneling even greater flows to restaking service providers on an industrial scale.

Eventually, cracks began to appear in the facade of expectations. It became evident that current use cases often rely heavily on token emissions rather than sustainable yield sources, creating artificial economics that may not withstand market downturns. The disconnect between capital supply and actual demand for restaking applications has resulted in speculative dynamics that prioritize short-term growth over long-term sustainability.

"Many RAs operate like early-stage ventures, lacking proven business models and stable revenue streams. Their token launches often precede substantial utility, relying on points-based or airdrop-centric incentives. Consequently, capital providers may hesitate to stake assets without evidence of sustained demand for these applications."

- LlamaRisk @ Beyond Shared Security: The Evolving Role of Restaking in DeFi

Intermediary fees incurred in the background further eat into any returns generated by partaking in the process, eroding investor confidence. Ultimately providing little to no additional benefit beyond the base staking yield, invalidating the value proposition in the eyes of many, unless they're in the business of altruism or included in a vesting schedule.

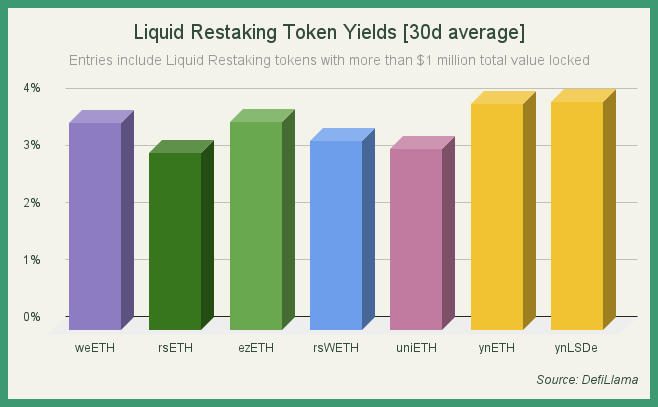

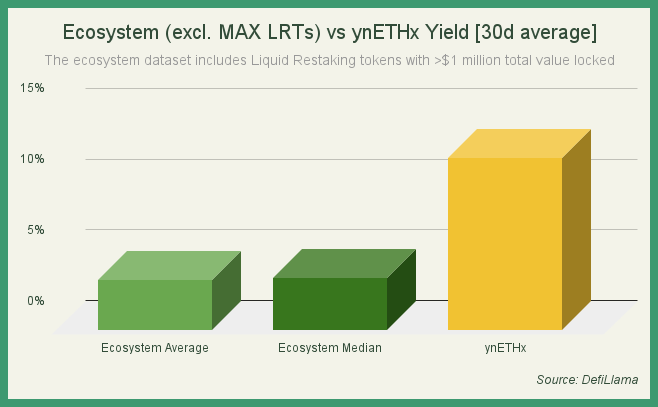

Simply looking at the average 30-day yields, it doesn't take a qualified financial analyst to confirm that the entries barely manage to outperform Lido's staked Ether yield (3.05%). From a risk-to-reward perspective, undertaking additional smart contract risk for a negligible increase in earnings is hardly justifiable.

These shortcomings highlight the need for a more integrated, efficient approach to restaking—one that transcends isolated security functions, while offering competitive incentives to unlock the primitive's full potential through the auxiliary employment of diverse yield strategies.

MAX LRTs: A Paradigm Shift in Restaking Yield Optimization

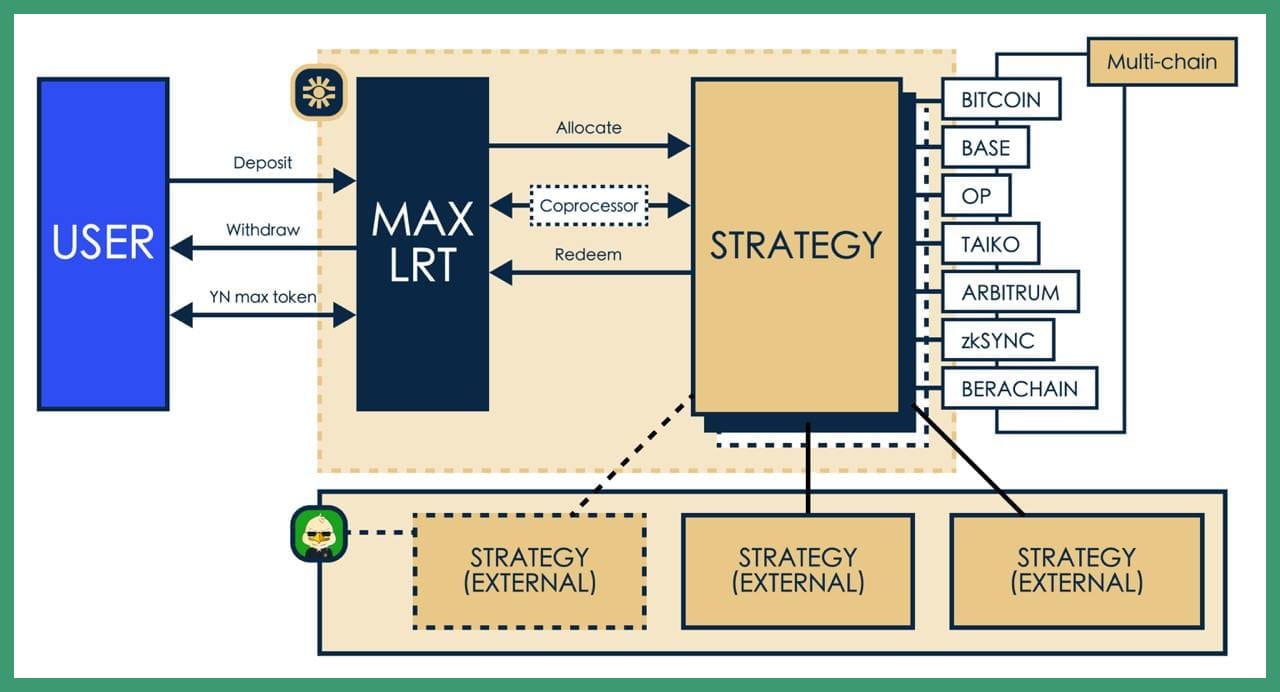

Unlike traditional staking or even first-generation restaking tokens, YieldNest's latest line of flagship products, Maximum Liquid Restaking Tokens (MAX LRTs), function as comprehensive, AI-powered asset management vaults that dynamically allocate exposure across various sources on multiple chains. These tokens serve as top-level aggregators that coordinate activity across specialized strategies, creating a modular system that can adapt to the rapidly evolving landscape providing an abundance of lucrative opportunities that would otherwise be inaccessible to conventional solutions. Something yet to be seen in this corner of the market.

They embody a philosophical shift from static yield generation to adaptive capital management, treating the underlying assets not as passive vehicles but as actively managed portfolios that continuously seek optimal risk-adjusted returns based on agentic inputs. A trend that is becoming increasingly prevalent in the space, following advancements in risk monitoring systems and the extensive use of machine learning models for identifying and evaluating opportunities based on incomprehensible amounts of high-frequency blockchain data.

Based on, not Bound to

A key distinguishing factor is the vault's settlement-centric nature. By anchoring all accounting and state management to the layer-1, while enabling capital to be deployed across various roll-ups, MAX LRTs maintain the security guarantees of base layers while capturing yield opportunities wherever they appear. Combining the stability of established networks with the potential of emerging ecosystems.

Frictionless Withdrawals

Acting as a dynamic safety net, the Buffer Strategy ensures immediate access to funds in case a depositor needs to withdraw their assets. Earmarking a portion of assets in readily accessible, yield-boosting channels, enables the facilitation of seamless redemptions even during market turbulence. A blend of liquidity pools and queue systems stabilizes the buffer, balancing efficient capital use with rapid liquidity. In case reserves dip below an inadequate level, assets from other strategies are reallocated to replenish the buffer.

Deposit Today and Walk Away

By default, the vault auto-compounds any pending rewards, eliminating the need to figure out the perfect interaction frequency needed to make the action worthwhile, especially on Mainnet due to its innate costliness even for simple transactions. As rewards are distributed and compounded, the value of the vault token grows.

Intelligent Capital Delegation

Rather than relying on a dedicated team of fund managers collecting exorbitant management and performance fees while underperforming benchmarks, AI agents sit atop of the helm, analyzing market conditions and risk factors on behalf of the depositors.

When threats emerge, the collective can autonomously implement protective measures—from rebalancing exposure to completely ejecting from compromised strategies. Theoretically reducing incident response times from hours to mere minutes or less, preventing potential losses while creating a self-improving system that makes increasingly informed capital allocation decisions based on accumulated data and experience.

To learn more about the exact specifications, additional details can be found in the technical documentation page (https://docs.yieldnest.finance/protocol-design/max-lrts).

The aforementioned architectural approach creates several, but not limited to, distinct competitive advantages:

(i) Unified Exposure: Users gain diversified access to multiple yield sources through a single, liquid token that maintains consistent settlement guarantees.

(ii) Dynamic Reallocation: Capital flows automatically to the most favorable opportunities based on real-time market conditions, without requiring user intervention.

(iii) Continuous Optimization: Sophisticated algorithms constantly evaluate risk-reward profiles across different strategies, adjusting allocations to maintain optimal performance.

(iv) Composable Design: The tokens themselves become building blocks for external applications, enabling deeper integration throughout the ecosystem.

Representing an incremental upgrade to the application as a whole, YieldNest is able to address common inefficiencies, while also providing additional value to their existing offerings, which up until now have been liquid restaking strategies.

Dynamic Allocations: Breaking Down the Vaults

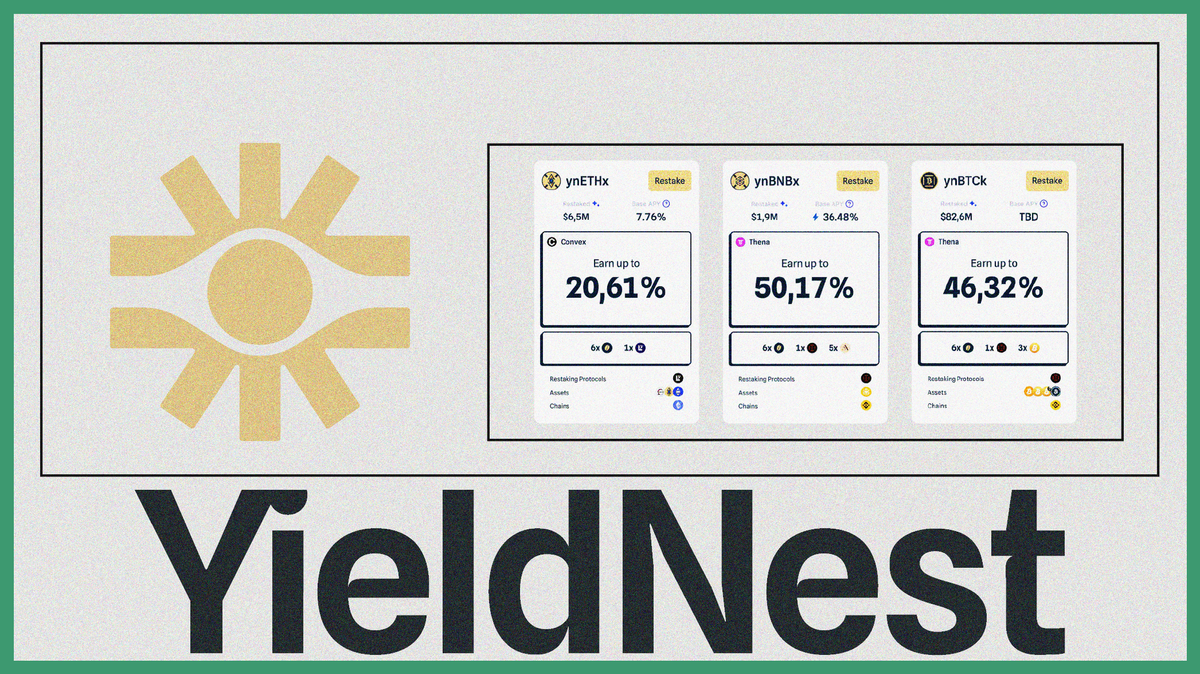

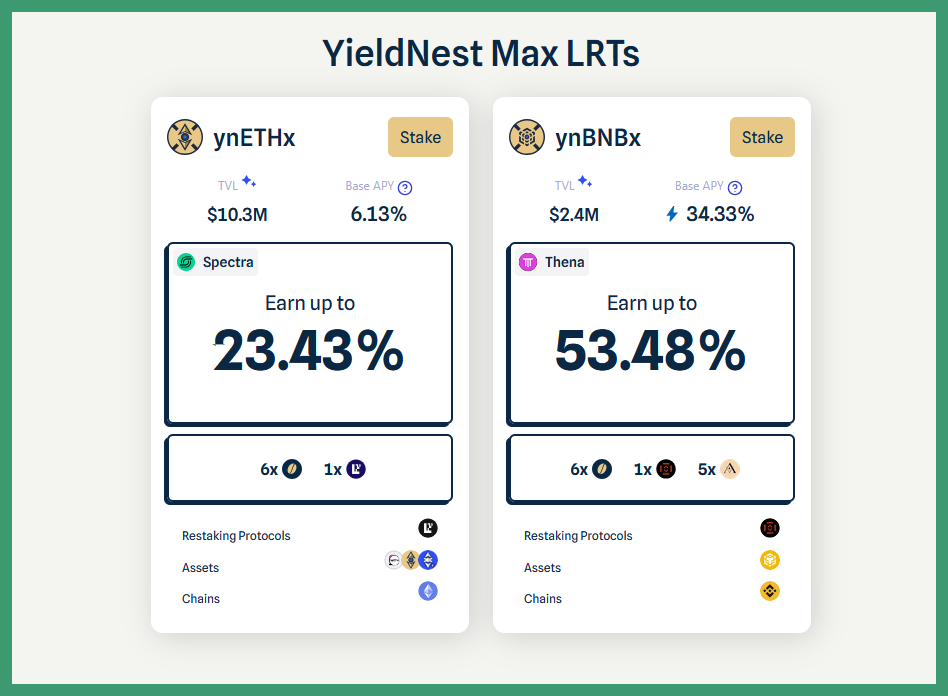

The pioneering implementations of MAX LRTs currently include ynETHx and ynBNBx, each targeting different base assets while following the same fundamental design principles. Due to a large amount of requests from the community for vaults supporting alternative underlying assets, additional iterations like ynBTCx and ynUSDx will be shipped some time in the second quarter of this year and are subject to a waitlist.

As of writing this article, slightly more than $12.5 million in liquidity has been amassed between the two, with YieldNest's cumulative TVL sitting at $114 million.

Both yield-bearing tokens can be accessed on the project's website: https://app.yieldnest.finance and currently offer six times greater YieldNest points than regular restaking strategies. The protocol itself is fairly underfarmed and could lead to a decent airdrop once the token generation event takes place.

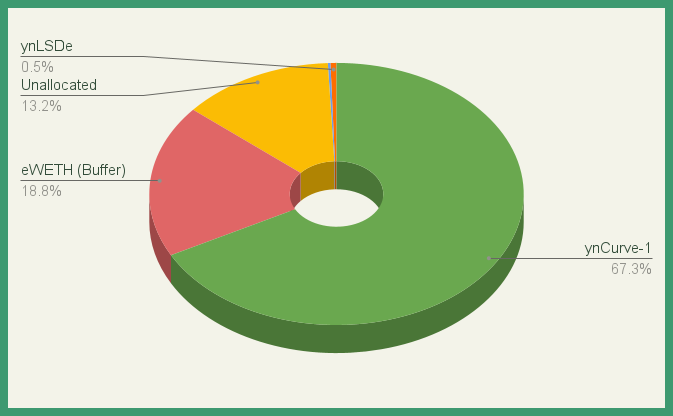

Given the team's commitment to transparency, all vault interactions are displayed under each token's section. Armed with the necessary resources to verify, we can easily break down the compositions of existing vaults and directly measure their efficacy by comparing performances to their counterparts.

ynETHx

Considering the fact that most yield prospects reside on the Ethereum L1, ynETHx is poised to make full use of its aggregation capabilities beyond the primitive's scope.

Assets deposited to the vault are currently spread between 4 individual strategies, concentrating 67.3% of holdings in ynCurve-1, to stack Curve trading fees atop native restaking rewards from both ynETH and ynLSDe—effectively creating yield inception. The second biggest exposure (18.8%) for the vault, being the buffer, is busy earning interest from lending Wrapped Ether on Euler. Meanwhile, the 13.2% unallocated WETH is reserved as dry powder, ready to be deployed at a moment's notice.

The numbers don't lie: ynETHx is rewriting the liquid restaking yield playbook on Mainnet. While conventional liquid restaking tokens languish at sub-4% yields, ynETHx delivers a market-leading 10+% return—more than tripling the ecosystem averages with the same underlying asset.

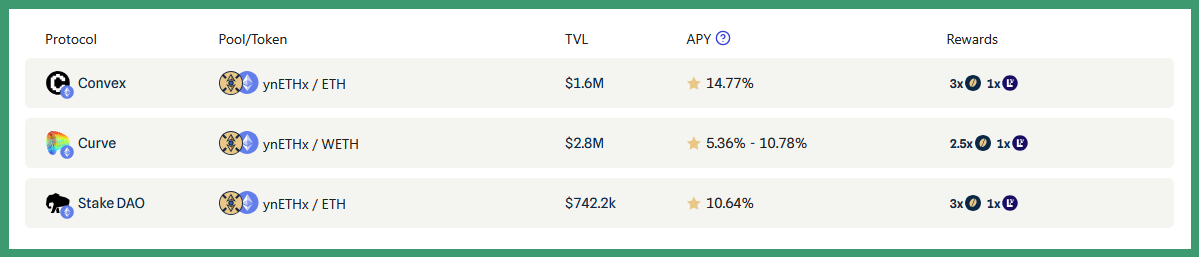

To bump the yield and points rewards up a notch, ynETHx can be subsequently paired with vanilla or wrapped Ether to provide liquidity on either Curve or StakeDAO. Alternatively, a fairly sizeable yield trading market has been created for the token on Spectra, a permissionless Pendle competitor.

ynBNBx

Though the Binance Smart Chain might not be considered the epicenter of restaking, Kernel has established a significant $375 million market for economic security. Taking advantage of attractive incentives available during bootstrapping periods and relative underutilization on a broader scale as the local environment develops, ynBNBx has made significant strides in becoming the network's leading option for LRTs.

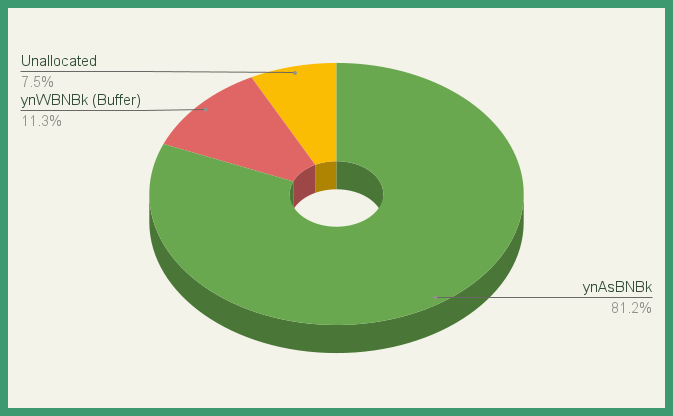

The vault holds an overweight position (81.2%) in ynAsBNBk, which captures dual rewards from Kernel restaking and Binance launchpad incentives. Compared to the previously discussed vault's diversified allocation approach, the system for this iteration has determined that concentrating most of its liquidity to a single strategy outweighs any potential opportunity cost or liquidity concerns. Hence the modest 11.3% buffer being maintained through ynWBNBk.

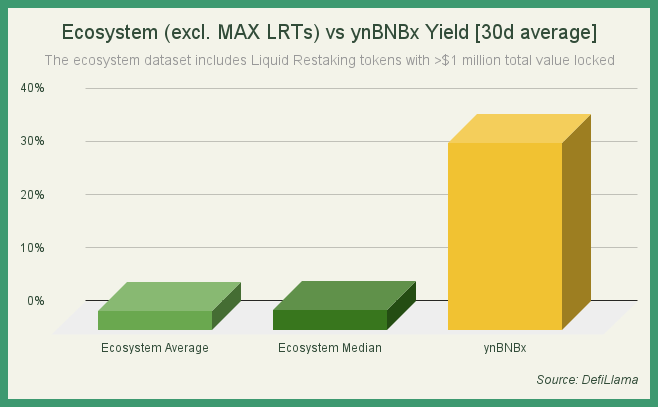

It's evident that across all markets, the BSC deployment dramatically outperforms the ecosystem averages approximately seven-fold, blowing every other competitor out of the water.

Additionally, the ynBNBx/BNB liquidity pool on Thena offers boosted rewards for liquidity providers at a humble APY of 19.41%. Even running a strict delta-neutral strategy with present funding rates, would offer double digit returns comparable to those commonly advertised on the timeline.

Looking at both vault contracts closely, some patterns can be spotted. The bulk of the liquidity tends to be allotted to very lucrative positions that act as the driving force behind the value accrual. Less than a fifth of the total composition is dedicated to highly liquid strategies to facilitate instantaneous withdrawals at any given time. Any idle capital sitting in the contract is likely due to new deposits or in the process of awaiting further directions. The charts had to be edited multiple times during the editing process due to frequent rebalances as to provide an accurate overview, underscoring the active management mechanism.

Unfortunately, the vault tokens themselves can't be borrowed against on reputable markets just yet, but can be utilized for liquidity provision purposes for those attempting to reach the pinnacle of capital productivity.

To sum it up, MAX LRTs demonstrate impressive performance metrics, highlighting the efficiency challenges faced by the sector and affirming the need for such a sophisticated solution to be deemed a viable option for yield farming. With clear product-market fit and quantifiable early success, these structured products are positioned to become industry standards or inspire similar implementations. Aggregation represents the natural evolution for liquid restaking tokens in their current state.

Conclusion

Looking past the substantial benefits of restaking for on-chain applications requiring economic trust, the present incentive structures remain a hurdle for the average depositor. To overcome restaking's execution failures, YieldNest is building tomorrow’s restaking infrastructure while enabling yield generation through DeFi's current optimization capabilities. The fundamental thesis is: build sustainable yield infrastructure that works today while maintaining strategic optionality for tomorrow’s opportunities. MAX LRTs represent an notable evolution by leveraging the security guarantees of restaking with AI-driven strategy execution and efficient capital deployment, these tokens create infrastructure that could make interacting with ecosystem more worthwhile. For users, investors, and builders, the next generation of restaking assets provided by YieldNest, offer a glimpse of what becomes possible when we move beyond fragmented, manual capital management toward integrated, intelligent systems without forsaking the core objective.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.