Liquid Restaking 2.0 w/ YieldNest

Yieldnest is fostering an expansive restaking ecosystem through optimized yields, simplicity, transparency and superior risk management.

This report is made in collaboration with Yieldnest and is therefore sponsored.

It’s been quite a while since we were last treated to a groundbreaking trend that shows signs of longevity and abundance of opportunities. Trailblazers have quickly cemented themselves into upper echelons and formed a standard. What does this entail for disruptors looking to change the meta for the better?

Introduction

Although nowhere close to its total value locked glory days, the Ethereum on-chain ecosystem has seen significant in-flows across the board with the most relevant categories remaining at the forefront in terms of liquidity captured.

Most sectors have enjoyed consistent growth as fresh capital flows into the space, essentially moving in a single file with liquid staking dominance remaining uncontested. However upon closer inspection, two categories stand out in terms of establishing their presence. Following the remarkable success of EigenLayer, restaking and liquid restaking have garnered an astounding amount of deposits over a mere five month period.

From a performance standpoint, strong interest in this new narrative is glaringly obvious with liquid restaking protocols leading the rally by a significant margin. Incentives play a huge role in this situation, with hordes of speculators eagerly deploying their assets in hopes of receiving ecosystem allocations for what is believed to be the next big thing.

It’s evident that huge sums are involved, but how does the value distribution look like? This is worth looking into as it allows us to determine whether a single protocol has gobbled up a vast majority of the market share, indicating that competing will be a daunting task for new builders looking to enter the space. Using liquid staking as a close comparison, let’s chart these two categories against one another.

Metrics displayed on the bar chart signify that the total amount of deposits in liquid restaking protocols are more evenly distributed than their counterparts, based on market share captured by the average and median protocol. A glimmer of hope for upcoming projects and a win for the free market.

Most LRTs offer nearly identical features with the only differences being logos and array of collateral assets supported. This is to be expected since the landscape is still in its infancy with more than enough room to grow.

Fortunately there are already signs of trend shifts and alternative approaches being employed to differentiate from the crowd.

Backed by the industry’s finest, with prominent founders and key figures from other protocols such as Curve, Moralis, Convex, KyberSwap and more getting involved.

YieldNest and its unique take on the liquid restaking narrative will be the subject of today’s post.

Simple, Risk-Adjusted Restaking

Abstracting away complexities associated with EigenLayer and its ecosystem, the team behind YieldNest has set out on a mission to provide a comprehensive one-stop-shop for liquid restaking. Novel implementations radically change the overall interaction with LRTs as we know it. Yes, really. It will become apparent as we start narrowing down the list of fundamental advantages.

Risk Matters

As the list of actively validated services (AVSs) on EigenLayer continues to grow in size, so does the necessity of conducting due diligence to account for possible risks prior to allocating any resources. Assessment of these entities have been entrusted to the YieldNest Risk Team, operated by LlamaRisk.

Funded by Curve, the team specializes in measuring risk for a broad spectrum of crypto assets, including stablecoins, LSTs, LRTs and RWAs.

In order to identify whether an AVS is fit for integration, it is subject to a thorough evaluation that involves a detailed review of their unique attributes and mapping out the risk to reward ratio. This aids in maintaining the integrity of the system and protecting investors, by only including vetted protocols instead of shortsightedly chasing incentives.

An additional step in the assessment process is the categorization of AVSs, paving the way for structured LRT products that are safely isolated, and with their individual deposit caps, risk to reward ratios. Beneficial not only for bolstering security but also for ensuring equitable yield and airdrop distributions for holders exposed to a specific category.

Collaborations between liquid restaking protocols and actively validated services are a common occurrence as it’s mutually beneficial for both parties. Possessing a solid risk framework attracts many less diluted AVSs, whose rewards are shared with a smaller crowd, providing access to additional high yield options for the platform and its users.

Freedom of Exposure

Addressing concerns of inefficient rewards distributions to restakers and the lack of exposure options, strategies for isolated and basket AVS categories are implemented. Facilitated using two token types instead of a single wrapper.

- Native Liquid Restaking Tokens (nLRTs);

As the name suggests, nLRTs solely support vanilla ETH as a collateral asset and earn staking yield from Ethereum validators on top of additional rewards from EigenLayer. - Liquid Restaking Tokens (LRTs);

To accommodate for the diverse range of available AVSs and assets used to operate them, various collateral options are accepted to directly receive dividends from protocols.

Possible applications for structured LRTFi Products are boundless as categorization allows YieldNest to cater to speculators with all kinds of different risk appetites and market outlooks. Conservative users could opt into more broad and diversified strategies whereas individuals bullish on a specific category have the option to narrow their exposure to a set of operators specializing in that vertical.

A massive change in direction and a push towards transparency in addition to increased optionality for the end user, abandoning the current standard of leaving the heavy burden of allocation to liquid restaking service providers.

Unified Liquidity

Protocols issuing multiple tokens often find themselves in a scenario where there isn’t ample liquidity for all of their synthetics, leading to severe liquidity fragmentation. In order to prevent such a situation ever taking place, engineers at YieldNest resolved this innate design pitfall by developing a clever custom liquidity model.

Keeping in mind that assets withdrawn from EigenLayer are temporarily unavailable, users desperately in need of quick capital resort to exiting through liquidity pools. So, instead of deploying a pool for each individual asset, a single liquidity hub was created. Made possible by representing ETH in the withdrawal-escrowed state as a liquid token that can be minted against any LRT on the platform, and subsequently sold in the unified liquidity pool.

EigenLayer Tokenomics

Decentralization and healthy competition is promoted by a clause in EigenLayer’s token allocation model that depicts a single LST, LRT, user, or entity being barred from receiving more than 33% of the total airdrop allocation. Excessive amounts of assets deposited into one protocol leads to reduced incentives for all users.

With YieldNest being a new addition to the sector, users can expect to earn exactly as much as advertised since dilution is not an issue.

Strategic Partnerships

By getting cozy with Frax and establishing a long-term partnership to develop new strategies and explore future integrations, a sizeable amount of frxETH liquidity will provided to YieldNest. Exact details of this can be found on the snapshot proposal page. This is one of many collaborations coming into fruition as the liquid staking protocol etches itself deeper into the ecosystem.

Seeds, Seeds, Seeds

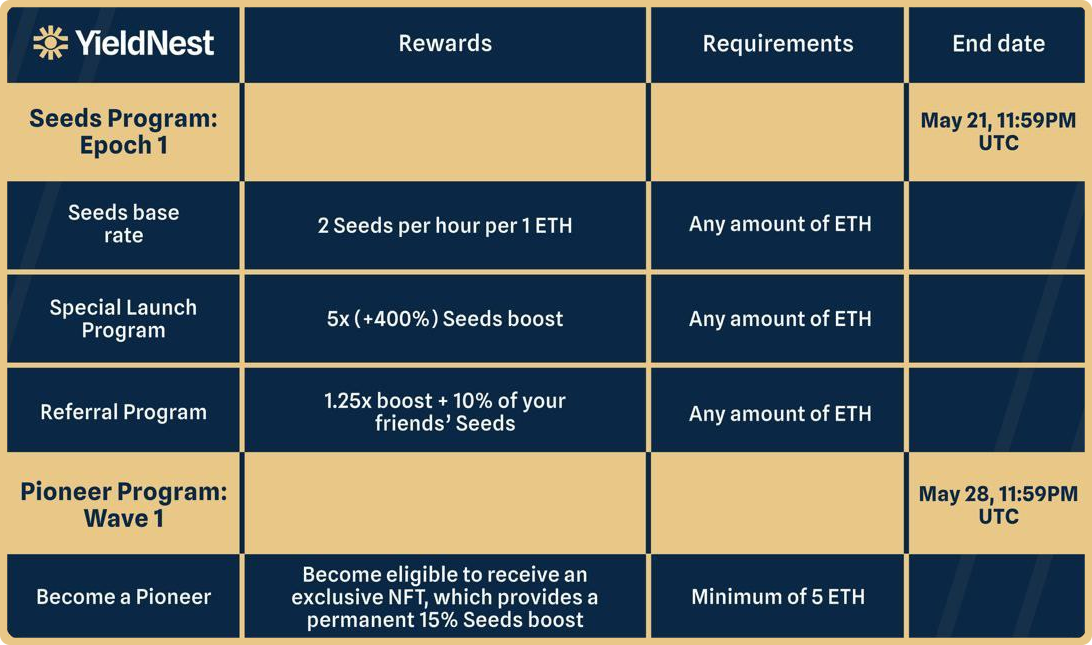

Engagement with the protocol is incentivized by none other than an industry mainstay, points! Active users are treated to seeds (non-transferable), most simply obtained by depositing assets. Rewards received from the initiative can be further boosted either through events or other means to maximize accrual.

// Base Points Accrual Rate

1 Seed = 1 ETH per 30 min

// Non-Event Boosts

* Referring ~ current rate + 0.25x & 10% of invitee's ETH deposits * base rate

* Loyalty Boost ~ current rate + 0.005x per day w/o a withdrawal (capped at +1.0x)

* Providing Liquidity ~ TBDPeriodically, temporary time-based or goal-oriented promotions are put into effect, enhancing everyone’s base rates. To kick off the campaign and celebrate the Mainnet deployment, an incentive schedule to reward early contributors has been announced.

More events will be added as time goes on, so the exact details could be subject to change.

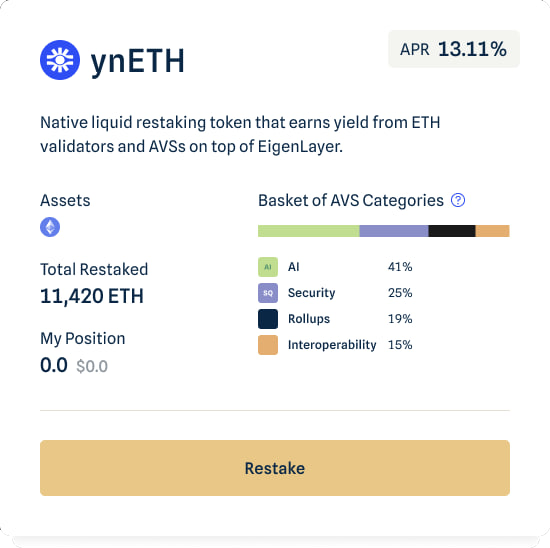

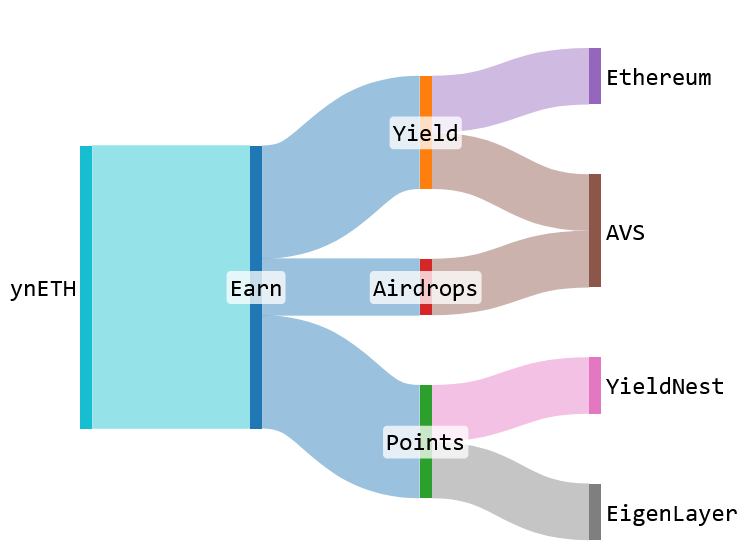

ynETH

Making it’s debut on Mainnet launch (14th of May), the first available asset on the platform will be ynETH — a native liquid restaking token that provides exposure to a dynamic set of carefully curated actively validated services, vetted by the YieldNest Risk Team.

Relevant information about the risk team, updates and their ongoing activities is accessible either on Twitter or HackMD.

Within the first hours of being live, multiple millions ($) in deposits have already been made. To get in on the launch incentives and everything else YieldNest has to offer, mint ynETH on their website — https://app.yieldnest.finance or directly from here.

At the moment any details regarding the contents of the basket have yet to be unveiled. However, we can inspect an example outlined in the documentation to get a rough idea of what’s to come.

The potential returns for this asset can be determined by summing up all the yield sources its exposed to, of which there are many and varied.

Base yield from staking Ethereum alone is already attractive on it’s own to most, but being on the receiving of additional incentives sounds even better. Considering how much ground a diversified basket covers, rewards from AVSs in an outperforming sector could prove to be extremely lucrative from a value capture perspective. All this, just from possessing a single asset.

To further amplify returns, ynETH can be supplied to liquidity pools for extra revenue from trading fees and liquidity mining or leveraged through a money market by using it as collateral to borrow ETH and then restaking it.

Something worth noting is that the token is not rebasing, meaning that any accrued gains made by holding the token can be realized by either withdrawing underlying collateral or simply swapping it on a decentralized exchange.

Conclusion

Directly contributing to the advancement of the liquid restaking ecosystem, YieldNest is poised to find relevance and is positioned well to capitalize on existing limitations by introducing novel mechanics to the market. Categorization of actively validated services and operators allows restakers to have more control over their entrusted assets while helping optimize yield. This approach will most likely become commonplace across the sector since it’s an upgrade over currently available methods.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.