Leveraged Points Farming With Airpuff.io

The EigenLayer and restaking season is around the corner. Get leveraged exposure with Airpuff's money market

This report is made in collaboration with Airpuff and is therefore sponsored

Introduction

Farming airdrop points with leveraged exposure likely remains the best strategy you can find in DeFi currently. The Ethena season 1 campaign participants saw a return of 100-500% depending on their leveraged exposure to Ethena’s ‘shards‘. Many people are anticipating Eigenlayer and its LRT ecosystem to be of similar size in terms of returns, with the EIGEN points being valued at $0.2-$0.4 currently. One way to get leveraged exposure to these restaking points campaigns is via Airpuff.

Airpuff is a multi chain money market granting leveraged exposure on points programs like Eigenlayer, Renzo, Etherfi, Kelp, Ethena and more. Users can either get up to 12.75x points leverage or take the other side of the trade by lending assets which pays up to 50%+ APY. Airpuff is further gearing up for their $APUFF TGE with the Fjord Foundry LBP being live until April 11th, 12 PM UTC. Today’s report will break down the Airpuff protocol, the $APUFF token and finally specific strategies and estimated returns.

Leveraged Points Farming with Airpuff

AirPuff at it’s core, is comprised of two key components that work hand-in-hand to facilitate leveraged points farming.

1. Lending

All necessary borrowing actions are performed through the Lending Pool, which allows depositors to earn high yields by providing liquidity to the platform across multiple networks.

There aren’t any fees on depositing, however withdrawing assets from a lending pool is subject to a fixed 0.2% fee.

Interest received from supplying an asset is determined by the utilization rate of the collateral pool, meaning that it constantly fluctuates based on demand. Snapshots of accruing interest are taken on an hourly bases and distributed into the value of tokens being lent, leading to efficient compounding of yields.

In most cases ETH is in high demand and with the most attractive yield, largely due to the fact that borrowing non-ETH assets incur additional price risk to the borrower by automatically converting the collateral to ETH when opening a position, effectively going long on it.

An added benefit of participating in the lending market is being awarded a share of all points earned from farmers utilizing the collateral.

Liquidity providers have cumulatively earned roughly ~$77k worth of points (prices are from WhalesMarket) across all lending pools.

Lenders are also entitled to AirPuff’s points program rewards based on the specific asset (ETH and stETH receive greater rewards), time and amount supplied.

2. Farming

Amplified airdrop rewards can be farmed using Buffs, the protocol’s native airdrop strategies.

At the moment, 12 buffs on 3 different networks are available with most strategies pertaining to LRTs that offer EigenLayer points alongside its native protocol incentives. However there options that include additional unique ecosystem rewards (e.g. Mode points for strategies on Mode).

Depending on the strategy, users can utilize up to 15x leverage with numerous collateral options to maximize potential rewards from campaigns (including AirPuff). It’s important to be mindful of the higher than normal interest rates when borrowing any assets and taking the intricacies of using non-ETH collateral into account.

10% of all points farmed from leveraged positions are distributed to lenders, and another 5% to veAPUFF participants. Closing a position is also subject to a fixed 0.2% fee.

For speculators with a smaller risk appetite, optionality for unleveraged farming while taking advantage of the reward boosts and incentives by the platform is also available.

Estimating Returns

To illustrate the potential return on the strategies, let’s take a look at the rsETH liquid restaking token from Kelp. The image below shows the vault on Airpuff. While it’s nearly filled at this point, the capacity will likely be increased in the future.

In this example, 5 ETH is deposited as collateral and wstETH is borrowed against it with 10x leverage. The wstETH is then converted into rsETH with each loop. As Airpuff takes a cut of the points to distribute to veAPUFF holders as well as lenders, the effective points leverage is 8.5x. In the lower left corner, the interest rates on various assets can be seen.

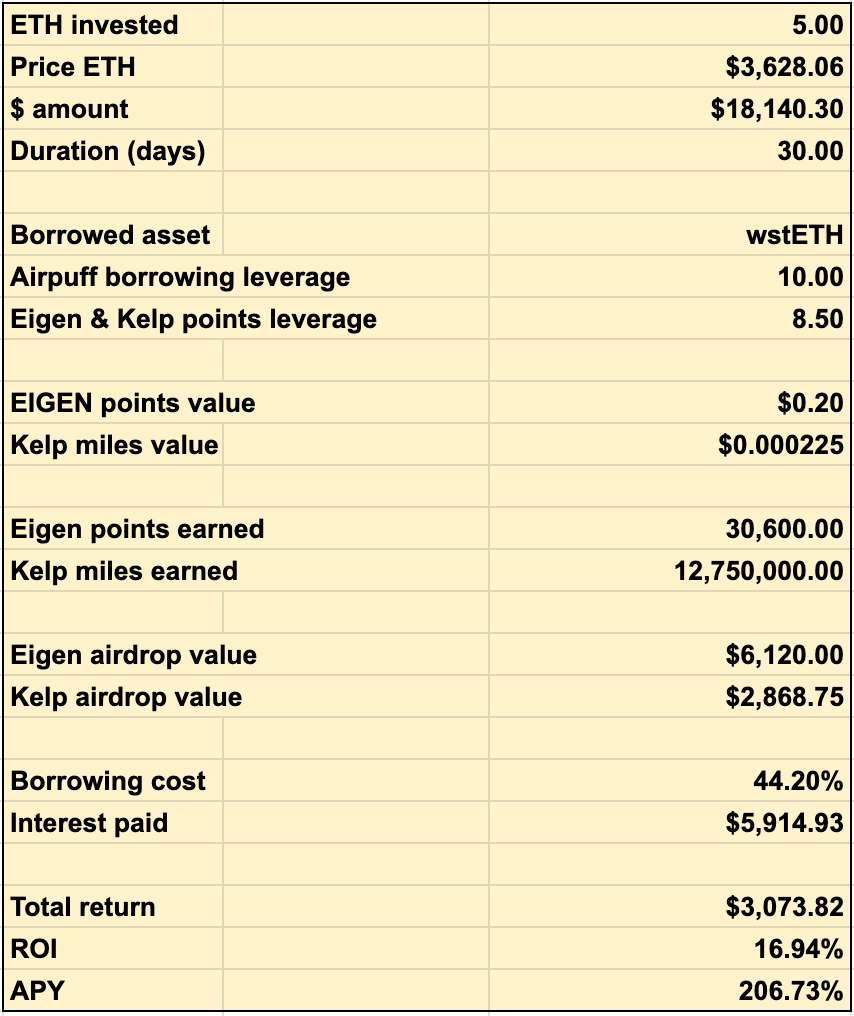

Below are the calculations for the return of the strategy. The value of EIGEN points and Kelp Miles are based on projections of TVL and airdrop % made in a separate post and should be taken with a grain of salt (however these are priced to the more conservative side). As seen, with a 5 ETH deposit, 10x leverage and 30 day duration and borrowing wstETH, the strategy nets a return of 16.94% ROI which is equivalent to an APY of ~206%. Keep in mind that there are a LOT of assumptions so the real return is likely different from the estimation.

As the utilization rates on the various markets are above 80%, the interest rate for borrowing is extremely high which is what impacts the return negatively at the moment (paying nearly $6k in interest). Some more information on these:

- 0-80% Utilization Rate: Interest rates will grow linearly from 5% to 15%.

- 80-100% Utilization Rate: Interest rates will experience a linear increase from 15% to 45%.

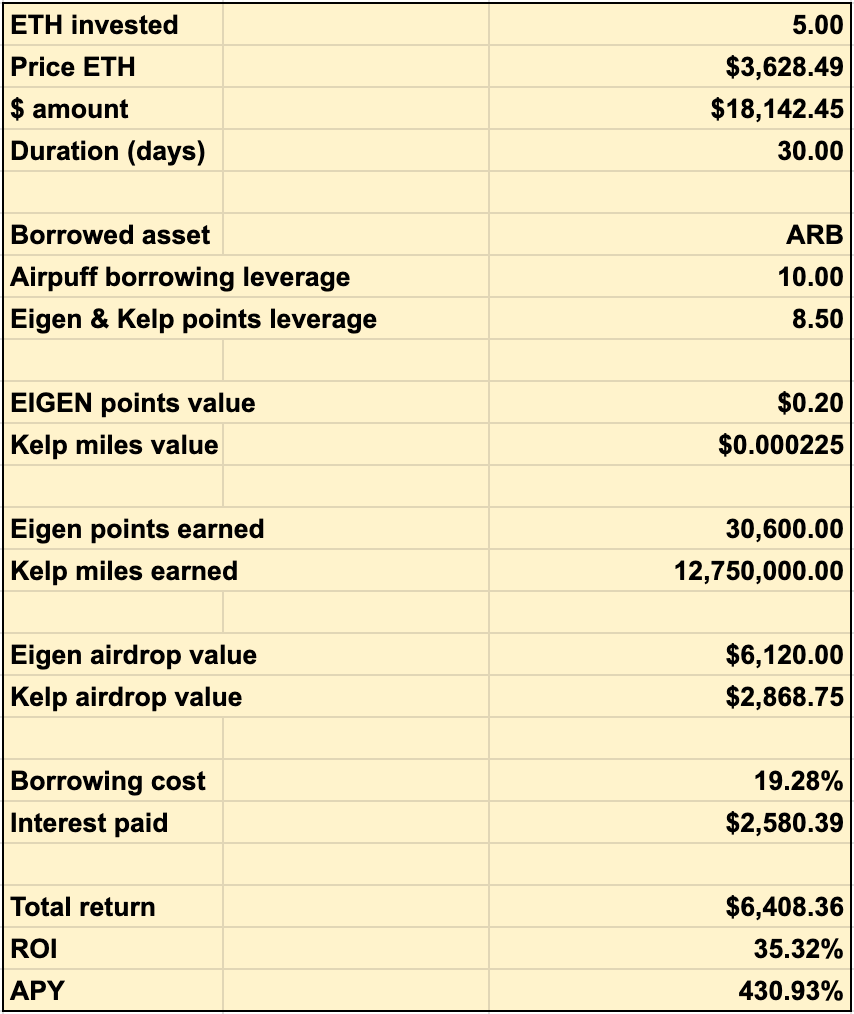

So why not borrow against USDC or ARB instead as the borrowing rates are much lower? Because you are taking on more liquidation risk. If rsETH drops in value against USDC or ARB, you could get liquidated and lose your entire deposit. With higher leverage, the risk of getting liquidated increases. The risk when borrowing wstETH is much lower as they both track ETH but if rsETH depegs you could also get liquidated. The returns for borrowing ARB instead of wstETH:

As seen, the return is signficantly higher. As mentioned however, keep in mind that the risk of liquidation is higher as well.

TGE & $APUFF

Early depositors on Airpuff are in addition to farming the underlying points from Eigenlayer and LRTs also earning ‘Airpuff points’ which will translate to an $APUFF airdrop in May. In total, 7% of the $APUFF supply will be airdropped to protocol users over two seasons. 4% will be airdropped in the first season and 3% in the following season. For more info on how to become eligible, see the page here.

Additionally, the $APUFF liquidity bootstrapping pool (LBP) is currently live on Fjord Foundry from April 8th, 12 PM UTC to April 11th, 12 PM UTC. At the time of writing, Airpuff has raised $2.5m $APUFF in the LBP which puts the token at a $8.7m market cap and $58m fully diluted valuation. You can find the link to the LBP here:

https://app.v2.fjordfoundry.com/pools/0xc2A81026e9698918923896cC46d706a7eFaB092d

Once the LBP concludes, the $APUFF token will go live. The initial circulating supply will be 16% (15% from the LBP and 1% from their private sale). Below are some comparative metrics between Airpuff, Pendle and Gearbox.

APUFF Tokenomics

Airpuff utilizes a dual token model for $APUFF. Users can choose to lock $APUFF for veAPUFF (similar to vePENDLE) which grants the ability to vote on the token incentive distribution across the various markets and are earning a yield though bribes. These bribes come from protocols paying Airpuff to build out vault strategies and direct emissions to these as a means of growing their protocol and increase adoption.

To further strengthen the token holderbase and in order to become eligible for $APUFF emissions, users must lock a minimum of 5% worth of their position’s USD value in veAPUFF. Finally, Airpuff takes a 5% cut on all points farmed by lenders and borrowers (EIGEN points, LRT points etc.) and distribute to veAPUFF holders to further increase the token utility.

Conclusion

2024 is the year of points trading and Airpuff enables this in a unique way with their money market and built-in leverage. Over the coming months, Airpuff will integrate new vaults and launch on additional chains while releasing the $APUFF token which makes it possible to get even more exposure to the various points programs.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.