L1 Tokens Are Still Outperforming - Here's What You Should Know🔎

L1 tokens continue to outperform the rest of the market. An in-depth analysis of 8 alt-L1's that have been growing over the past months.

In the last bull-run, alt-L1’s like Solana, Avalanche, Fantom and Polygon heavily outperformed the rest of the market in terms of price appreciation and VC funding. Some might argue that this infrastructure dominance is a characteristic of an industry that still is in its infancy.

So has there been a significant change from 2021 to today? Looking at the price performance as seen below, it appears that things remain unchanged.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

This then begs the question: Is this current outperformance in price performance related to improving fundamentals or simply just the same old narratives playbook we saw in the last cycle? This report analyses 8 of the top performing alt-L1’s to try and answer this question.

Want to receive a free DeFi research report every single week?🗞 Subscribe below⚡️

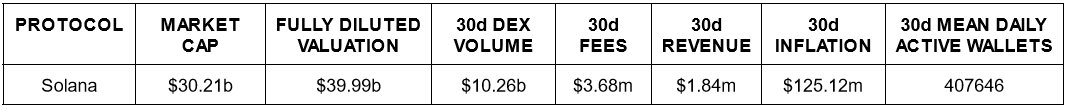

Solana (SOL);

What differentiates Solana from most L1s is the utilization of parallel processing to validate and and execute transactions, eliminating the need for an additional scaling layer. This makes it a cheap and capital efficient platform for users to interact with.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

In terms of user activity, Solana is currently one of the most popular blockchains in the space mostly due to up and coming protocols airdropping tokens to early users. There’s also been a growing interest towards leveraging the capabilities of the Solana Virtual Machine, with projects like Eclipse using it to scale Ethereum beyond it’s current capabilities. A catalyst for Solana is the increasingly lower native token issuance as the SOL inflation decreases every year.

Below are some beta plays that could potentially perform well if the ecosystem continues it’s growth:

- Jito (JTO - $3.0b FDV);

Solana’s premier Liquid Staking protocol has garnered a lot of popularity in the crypto community after its generous airdrop to over 10k users. - Bonk (BONK - $1.4b FDV);

With a huge market cap, Bonk is the most prevalent community coin on the Solana blockchain that has seen a ~400% price surge in the last 30 days as more people use the network and get in on the action. - marginfi (MRGN - N/A);

A decentralized lending protocol with >$240m TVL that currently awards users points in exchange for interacting with their platform. These points will later be used to airdrop users their upcoming token.

In case you are interested in how the airdrop would potentially play out, take a look at the calculator recently published.

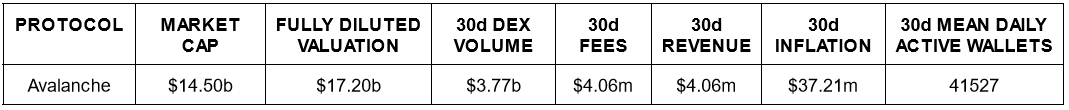

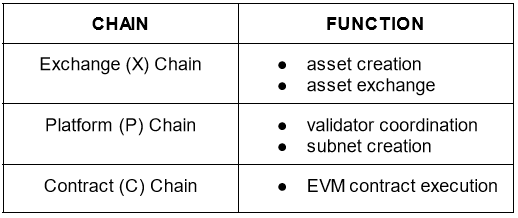

Avalanche (AVAX);

Avalanche is a fast and scalable platform that lets developers build custom blockchains or use existing Subnets (a divided portion of the blockchain). The Avalanche Primary Network actively uses three blockchains.

Most of us are familiar with the C-Chain as that’s where the DeFi applications reside. The Avalanche Primary Network itself is a special subnet. As of now, there are various projects deploying their own subnets on the system, with some notable ones being:

- Beam (gaming) - aims to shape the future of gaming by having a community-driven approach and offering a solid platform for developers;

- UPTN (web3) - piloted in South Korea, integrating blockchain tech into real world businesses;

- DFK (gaming) - gameFi platform and home of DeFi Kingdoms;

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

The “red coin, gud coin” has recently gained traction due to breaking out of a long term price range alongside a huge TVL increase. It’s important to know however that this gain however is due to the appreciation of AVAX and not additional token inflows.

The bull-case for Avalanche is the increasing number of subnets deployed by platforms with niche app-specific needs that chose this over one of the L2 solutions currently available on the market.

Some Avalanche beta plays that could potentially perform well if the ecosystem sees a sustained uptrend:

- Trader Joe (JOE - $307.81m FDV);

The chain’s top DEX and staple in the ecosystem has been actively rolling out updates and generating vast amounts of fees amidst the volume surge.

Benqi (QI - $182.74m FDV);

Benqi offers a suite of DeFi products such as lending/borrowing, liquid staking and validator rentals. Alongside a huge TVL increase of their liquid staking arm, the price of QI has rallied ~250% in the last 2 weeks.

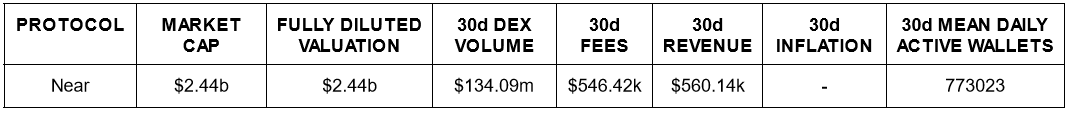

Near (NEAR);

Near is a blockchain, that has also dubbed itself as an operating system that offers interoperability across any blockchain. Their central focus is scalability, achieved through “sharding”, which divides the network into smaller parts to process transactions more efficiently while maintaining speed, low costs, and decentralization.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

In partnership with EigenLayer, Near’s upcoming “fast finality layer” will enable faster and cheaper transactions for Ethereum roll-ups. The testnet is said to launch Q1 2024. Additionally, real-time market data provider Pyth made its way to Near with their oracle solutions. This enables easy use of equity, commodities and market data for on-chain applications.

Some beta plays that could potentially perform well if the ecosystem continues it’s growth:

Meta Pool (META - $2.27m FDV);

A multi-chain liquid based ecosystem with a suite of products, that offers: LSTs, liquidity provision, a launchpad and bonds. Meta Pool has a cumulative TVL of $42.56m, with 97% of the value being on Near;Ref Finance (REF - $9.39m FDV);

With a TVL of $16.87m, Ref is the largest AMM on Near, where users can trade spot or perps with low transaction costs.

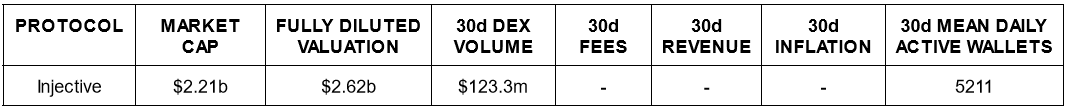

Injective (INJ);

Built on the Cosmos SDK, Injective is a blockchain catered towards financial applications by providing rapid transaction processing and low gas fees alongside strong interoperability with various other chains (e.g. Ethereum, Solana).

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

The project is well funded and backed by a myriad of well-known investors in the tech industry and crypto. Despite it’s market cap, apart from staking, not too much on-chain activity is taking place, but there are significant onboarding efforts taking place to invite builders to the platform. Earlier this year a $150m ecosystem fund was created to accelerate interoperable infrastructure and DeFi adoption. While the daily trading volume has been trending up in the past months, $5-$7m is not much for a chain with a market cap of $3b.

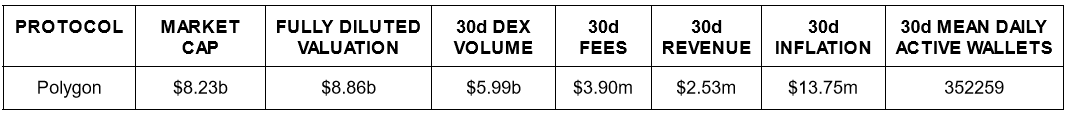

Polygon (MATIC);

Polygon (PoS) is an EVM-compatible sidechain that was designed for low cost, fast transactions.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Polygon DEX volumes have increased slightly over the past months however the growth is not on the same level as chains like Solana or Avalanche.

In a blog post released in July, this year, Polygon announced their 2.0 upgrade. Polygon is building a modular stack with components such as ‘Supernets‘ (app-specific chains), privacy rollup and further the recent launch of the Polygon zkEVM.

General takeaways from this update are:

redesigned protocol architecture;

token rebrand from MATIC ~> POL;

ecosystem benefits:

enhanced security;

increased scalability;

These could act as catalysts for the MATIC token in 2024. A beta play that’s worth paying attention if MATIC rallies:

- Quickswap (QUICK - $45.02m FDV);

Deployed on multiple Polygon layers with most of it’s $125.65m TVL residing on the PoS chain, users can swap tokens and trade perps alongside a wide array of products and services beyond DeFi. QuickSwap has generated $10.3m in fees and ~$11.1b of cumulative volume this year.

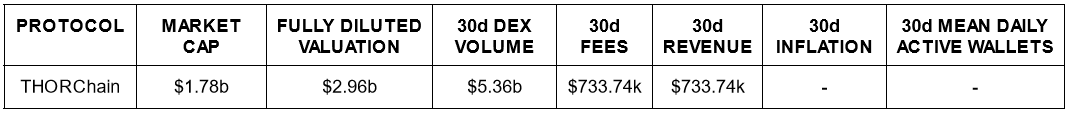

THORChain (RUNE);

THORChain operates as an independent L1 cross-chain AMM, allowing users to swap native assets across multiple chains without the need for wrapped or pegged assets.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Evident from the volume metrics, the protocol’s underlying technology is being leveraged effectively for on-chain trading. A chunk of RUNE’s supply is being actively burned by a lending protocol endorsed by THORChain. Its lending model allows users to borrow BTC or ETH, against a variety of collateral options, with zero-interest and no liquidations. However these loans require a higher minimum collateral ratio ranging from 200-500%, based on market conditions.

Some beta plays that could potentially perform well if the ecosystem continues it’s growth:

- THORSwap (THOR - $129.54m FDV);

The DEX aggregator offers token swaps between 10 chains and +5000 assets in just one click and 75% revenue share to users staking their token. The protocol is currently conducting monthly token burns based on trading volume and recently reached a TVL of $1b.

Maya (CACAO - $73.03m FDV);

A THORChain fork and cross-chain DEX built to directly compete with centralized exchanges by mitigating risks associated with such entities, while offering deep liquidity and low fees.

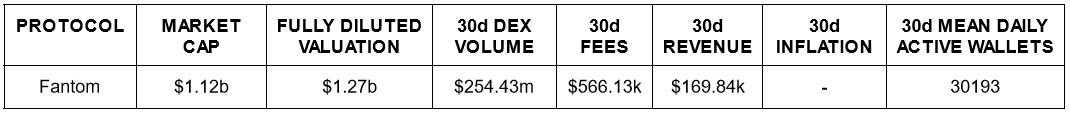

Fantom (FTM);

Fantom is a high-performance blockchain from the previous cycle which hosted one of the largest DeFi ecosystems. Since the collapse of Terra, the depeg of Tomb and the Multichain bridge exploit, Fantom has seen a large decline in activity.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Despite going through a rough patch, the team remains active with plans to soon ship out brand-new blockchain technology in a bid to remain competitive. Utilizing a new VM, improved storage capabilities, their upcoming iteration named “Sonic” is expected to achieve more than 2000 TPS. The upgrade is expected to roll in spring 2024.

Here are some beta plays that could potentially perform well if the ecosystem continues it’s growth:

- SpookySwap (BOO - $11.33m FDV);

Fantom’s leading DEX that offers local and cross-chain token swaps, funneling a portion of the trading fees to stakers. - BeethovenX (BEETS - $4.43m FDV);

Forked from Balancer V2, BeethovenX is an AMM which provides users optimal swap rates with minimal slippage and solid yield opportunities. Token holders receive a percentage of swap fees generated by the platform. - WigoSwap (WIGO - $14.12m);

Offering a suite of products ranging from trading to gaming, Wigo aspires to be the heartbeat of Fantom’s ecosystem.

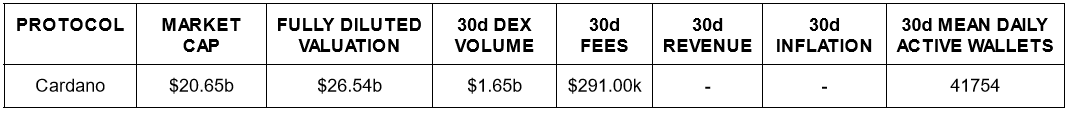

Cardano (ADA);

Heavily adored by retail, Cardano is a PoS blockchain which emerged in the last cycle. Despite Cardano heavily being a meme amongst many, the ecosystem has grown both in $ and ADA terms signalling increased adoption.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Not known for it’s DeFi scene, Cardano has performed admirably with it’s loyal community spearheading the growth of value and activity on-chain. To further spark usage and network efficiency, the pain point surrounding scalability is being addressed with an L2 solution dubbed as “Hydra”, which was released earlier this year. Hydra is defined as an isomorphic L2 for off chain processing that can handle 1,000 TPS per Hydra ‘head‘.

Some Cardano beta plays:

- Indigo (INDY - $114.91m FDV);

The go-to CDP platform for Cardano offers users the creation of fully collateralized synthetic assets such as BTC, ETH and USD.

Minswap (MIN - $174.28m FDV);

Community-centric protocol Minswap remains on the forefront of DEXs in the ecosystem despite a vulnerability incident earlier this year in terms of TVL and volume.

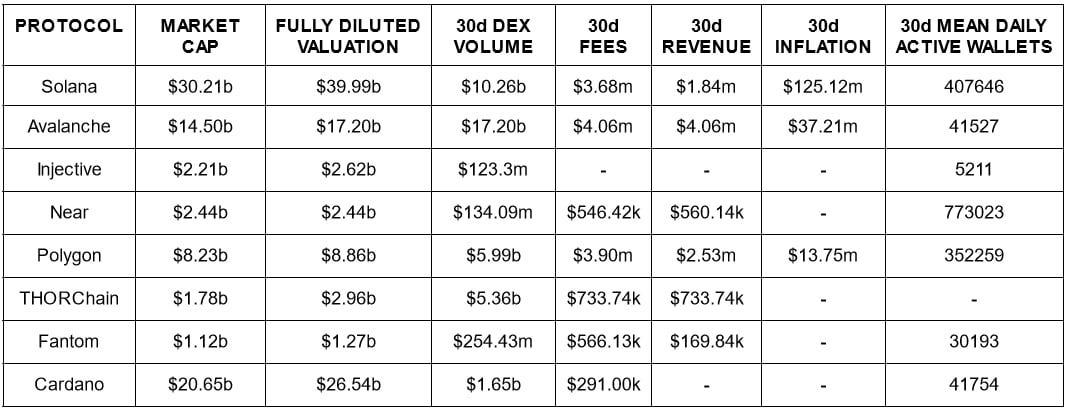

Below is a summary of the metrics for each of the L1’s presented in today’s research report.

In conclusion, its clear that several of these L1’s have grown in fundamental metrics like daily users, TVL and trading volume. It’s further clear however that the recent price appreciation amongst many of these have far outpaced the fundamental growth. In our oppinion, these tokens should be treated more as narrative trades rather than long term fundamental investments.

What are your thoughts? Comment your opinion below👇

Nothing stated in this article should be construed as financial advice!