It’s Yield Trading Season on Solana

Introduction

Back in early 2024, we saw the rise of Yield Trading on Ethereum. This trend took off when Pendle integrated with EtherFi and other liquid restaking protocols built on top of EigenLayer. At the time, Yield Trading was seen as the best way to speculate on an EigenLayer or EtherFi airdrop or to secure some juicy APY on ETH, and people rushed into it. This led to a massive Yield Trading season on Ethereum, with plenty of highly attractive opportunities.

Today, we have a similar setup happening on Solana with the emergence of its first Yield Trading protocol and its recent integrations with emerging Solana protocols. While Yield Trading on Solana is still in the early stages, the market potential is huge, and this is giving rise to many new DeFi opportunities and juicy yields to seize.

In today’s report, we’ll explore Yield Trading on Solana, the current opportunities, and how to use it to farm emerging Solana protocols.

Sponsor - Kamino Finance

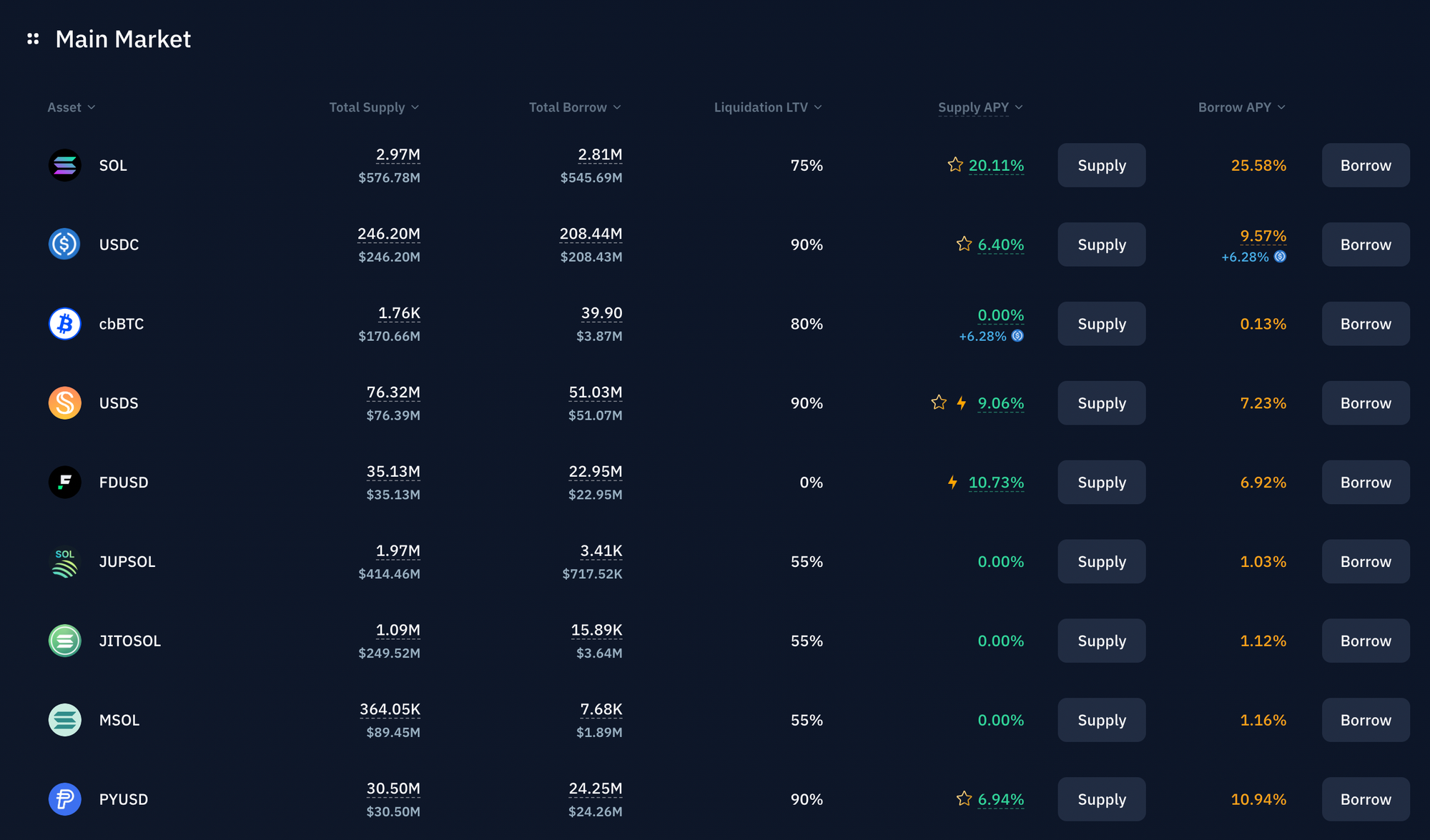

Today's report is sponsored by Kamino Finance. Kamino is a DeFi powerhouse and with more than $2b in TVL, the protocol is one of the largest within the Solana ecosystem. Whether you're looking to swap, borrow, leverage or earn yield on a wide range of assets, Kamino offers it all.

Kamino recently partnered with Coinbase and is, through incentives, offering one of the cheapest ways to borrow USDC against Bitcoin. cbBTC, the Coinbase-issued version of BTC, is currently earning 6.3% annually when supplied on the lending market and USDC can be borrowed for 3.3% in annual interest. With the incentives, which are paid in USDC, you are therefore getting paid to borrow against your BTC. You can read more about this collaboration here.

Some other yields currently offered on Kamino includes 20.11% APY on SOL supplied on the main market or up to 107% APY on JLP multiply positions. Make sure to check out Kamino if you haven't already.

Yield Trading 101

Yield Trading can be quite confusing and is full of complicated jargon. So let’s begin by refreshing our understanding of what Yield Trading is and how it works.

In short, a Yield Trading protocol takes a yield-bearing asset, splits it into two components—the principal (PT) and the yield (YT)—and mints tokenized representations of each. These tokens are then traded separately in a market and with a given maturity.

PT (Principal Token)

This is the easiest and most straightforward strategy. Buying PT on a Yield Trading protocol locks in a fixed APY until the vault matures.

Yields fluctuate based on market conditions, but once PT is purchased at a given APY, the yield is guaranteed. As a rule of thumb, the higher the fixed APY, the more attractive PT becomes.

YT (Yield Token)

With YT, users forgo the real yield but gain leveraged exposure to implied yield (which is tied to protocol points).

Each YT provides exposure to the points of an entire yield-bearing asset, and since YT is much cheaper than the asset itself, it offers high leverage on points farming—essentially, points on steroids.

It's important to note that the price (and therefore the respective APY) of YT and PT is determined by the market and is based on their ratio, which always adds up to 1.

LP (Liquidity Provisioning)

For this yield trading mechanism to work, we need a market. And to create a market, we need liquidity. Hence, on top of YT and PT, users can also provide liquidity by depositing a yield-bearing asset into the protocol in exchange for LP tokens, which enable YT and PT to be traded.

With LP, holders benefit from the same advantages as the yield-bearing asset, as well as additional yields from trading fees and potential exposure to airdrops from the Yield Trading protocol.

TL;DR

By decomposing a yield-bearing asset, Yield Trading has created a new set of DeFi opportunities, and this has generated a lot of hype. Indeed, as mentioned earlier, this new meta led to a surge of activity on Ethereum in early 2024, giving rise to what I call the “Pendle Season.” Let’s dive deeper into what happened.

The “Pendle Season” on Ethereum

The date is January 10, 2024: Pendle announced its integration with EtherFi's eETH (liquid restaking token on top of EigenLayer).

All aboard the Pendle LRT 🚄

— Pendle (@pendle_fi) January 10, 2024

Next stop - eETH by @ether_fi

With this, Pendle enters the restaking/LRTfi stack, allowing you to earn more, do more with your Liquid Restaking Tokens (LRT) 🧪 pic.twitter.com/nYViklOQJC

At the time, Pendle hadn’t yet had its “Aha” moment. It was a good protocol but wasn’t gaining much mindshare and only had around $220M in TVL.

But everything started to change with this first LRT Yield Trading integration as it unlocked a bunch of new ways for people to get exposure to EigenLayer and EtherFi points (two of the most hyped projects at the time) or enabled them to secure some juicy APY on ETH.

For instance, instead of simply holding eETH to accumulate EigenLayer or EtherFi points, you could now participate in YT-eETH to accumulate points with a lot of leverage. This was like points farming on steroids and led to some crazy opportunities (just look at this post from Pendle Intern back in late January 2024).

EigenLayer points have been trading for $0.31-$0.46 per point on @WhalesMarket.

— Pendle Intern (@PendleIntern) January 31, 2024

Which also means at their current rate, 1 ETH worth of YT-eETH/YT-rsETH are tracking to generate over $13,000 worth of airdrops 👀 pic.twitter.com/Xfqipn6B9b

Furthermore, there was also a popular trade that emerged where traders would buy PT-eTH and loop it to earn some super high APY on ETH.

It's simple.

— Pendle Intern (@PendleIntern) February 23, 2024

1. Buy PT-eETH or PT-rsETH

2. Deposit as collateral

3. Pick your LTV ratio - the higher this is, the more you can borrow, but also higher liquidation risks

4. Borrow senUSD, sell into USDC (to buy PT)

5. Rinse and repeat with more PT pic.twitter.com/kydr0kAR0b

As the market started to understand those opportunities, Pendle's TVL started to go parabolic. In less than 5 months, Pendle's TVL went from $220M to around $5B. Similarly, EtherFi TVL also mirrored Pendle and saw a strong surge of TVL of the similar order of magnitude.

Of course, EtherFi wasn’t the only liquid restaking protocol growing alongside Pendle. Projects like Renzo, Puffer Finance, Kelp DAO, and Swell also followed this path. But EtherFi was by far the largest and generated the most hype.

In any case, the key takeaway here is that the combination of Restaking + LRTs + Yield Trading became the holy trinity of DeFi strategies on Ethereum (whether for farming points for the most hyped projects or securing the highest APY on ETH).

And this is what I refer to as the "Pendle Season."

A similar setup on Solana?

Now, why does it matter to know what happened during the “Pendle Season” on Ethereum? Well, it matters because we have a similar setup happening on Solana.

Restaking on Solana is still in its early days, but the momentum is quickly building up. Jito recently expanded to restaking with the launch of Jito (Re)staking; Solayer, another restaking protocol, went live; the first Solana liquid restaking protocols have also emerged; and on top of that, we saw the emergence of the first yield trading protocol on Solana.

This is creating the same set of DeFi strategies as we saw on Ethereum with EigenLayer, EtherFi, and Pendle, but now it's on Solana (the best-performing L1 of this cycle):

-> Instead of EigenLayer, we have Jito (Re)staking or Solayer.

-> Instead of EtherFi, we have Kyros or Adrastea

-> Instead of Pendle, we have protocols like Exponent or RateX.

But there are also much more interesting opportunities emerging, both for SOL or USD, with Yield Trading on Solana. Let’s explore the main strategies on the two leading Yield Trading protocols: Exponent and RateX.

Yield Trading opportunities on Exponent

Exponent is a fixed-rate and leveraged yield farming protocol on Solana. This is powered by their in-house yield stripping mechanism, which separates a DeFi product’s yield from its principal value, creating two tradable assets: PT and YT. Further, these tokens can then be exchanged through Exponent’s AMM — a novel Solana-based AMM designed specifically for yield assets with maturities. To me, they have the best UI and most transparent tech among other yield trading platforms on Solana.

Core contributors of the protocol are ex-Kamino and ex-Squads, who have raised over $2 million from top angels in the Solana ecosystem, as well as Robot Ventures, Solana Ventures, and Mechanism Capital.

1/ We are excited to announce our $2.1M fundraising round, to build @Solana's first DeFi fixed rate market.

— Exponent (@ExponentFinance) November 21, 2024

Led by @Rockaway_X, with participation from @SolanaVentures, @CherryVentures Crypto, @MechanismCap, @RobotVentures, and numerous angels from the ecosystem. pic.twitter.com/Ovm3udF8n0

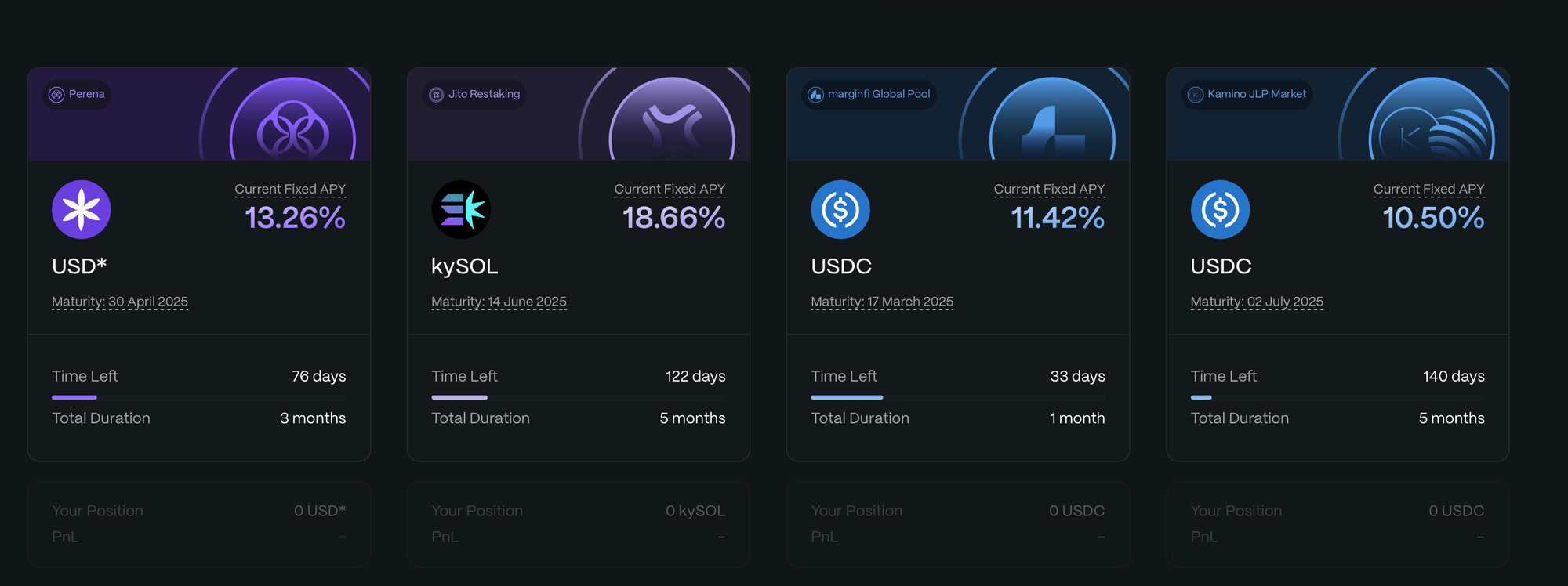

As of writing, they are still early, with around $8M in TVL, but they seem to be on the right track to becoming a leader in Yield Trading on Solana. For now, there are only four assets that they have integrated into their platform and the two most interesting one in my opinion are USD* and kySOL. Let’s look at each one of them.

kySOL with Kyros

Kyros is a Solana-native liquid restaking protocol built on top of Jito (Re)staking. While Solana (Re)staking is still an early narrative, I think it is a very interesting one with a lot of potential and already strong use cases.

The first product of Kyros is kySOL, a liquid restaking token tied to SOL, where users are effectively exposed to JitoSOL and all its benefits, including Solana staking rewards and MEV rewards. Additionally, kySOL accrues extra restaking rewards by providing economic security to Node Consensus Networks (NCNs). In fact, kySOL is already helping secure the TipRouter NCN, which processes over $2.5B in yearly tips and distributes 0.15% of that to JitoSOL (re)stakers, driving an interesting yield for kySOL.

Kyros is still early, with a TVL of around $43M, and it also does not have a token yet, making it a super interesting protocol to watch on Solana.

On Exponent, users can currently use YT-kySOL to either farm Kyros points on steroids (with a 17.01x multiplier) or secure over 18.66% APY on SOL through PT-kySOL until June 2025 (with $3.5M+ in liquidity). If you are a long-term SOL holder, this is definitely something to consider.

Current stats:

- Liquidity: $3.60M

- PT-kySOL yield: 18.66%

- Implied YT yield: 18.65%

- Yield Leverage: 17.01x

- Maturity: 14 June 2025

USD* with Perena

Perena is building the foundational infrastructure for the future of digital money. It was founded by Anna Yuan, former head of stablecoins at the Solana Foundation.

Its flagship product, Numéraire, is a stableswap AMM designed to optimize stablecoin trading, liquidity provision, and capital efficiency. By using composable, extensible pools, it reduces idle liquidity common in traditional AMM designs. Basically, Numéraire unifies liquidity through a hub-and-spoke model, where all trades route through a core “hub” stablecoin asset, USD*.

Like Kyros, this project is still in its early stages, with around $18.7M in TVL, and it has not yet launched a token. This is definitely another interesting project to farm on Solana.

Perena has also launched a vault on Exponent, where PT-USD* currently offers the highest fixed stablecoin yield on the platform at 13.26%. Additionally, YT-USD* provides up to 36.76x leverage on Perena points, which might lead to an interesting airdrop.

Current stats:

- Liquidity: $1.3M

- PT-USD* yield: 13.26%

- Implied YT yield: 13.26%

- Yield Leverage: 36.76x

- Maturity: 30 April 2025

Also worth noting that all these Yield Trading opportunities most likely earn Exponent points (even though it’s not confirmed yet and points are not live). So, this is a good chance to secure high APY on USD or SOL, farm Perena and Kyros points, and, on top of that, get exposed to the Exponent airdrop, which could further increase your APY.

Yield Trading Opportunities on RateX

RateX is another interesting Yield Trading protocol on Solana that offers PT, YT, and LP on different assets. They won the Solana Renaissance Hackathon and have completed a seed round with investors such as Animoca, Solana Ventures, KuCoin Ventures, and others.

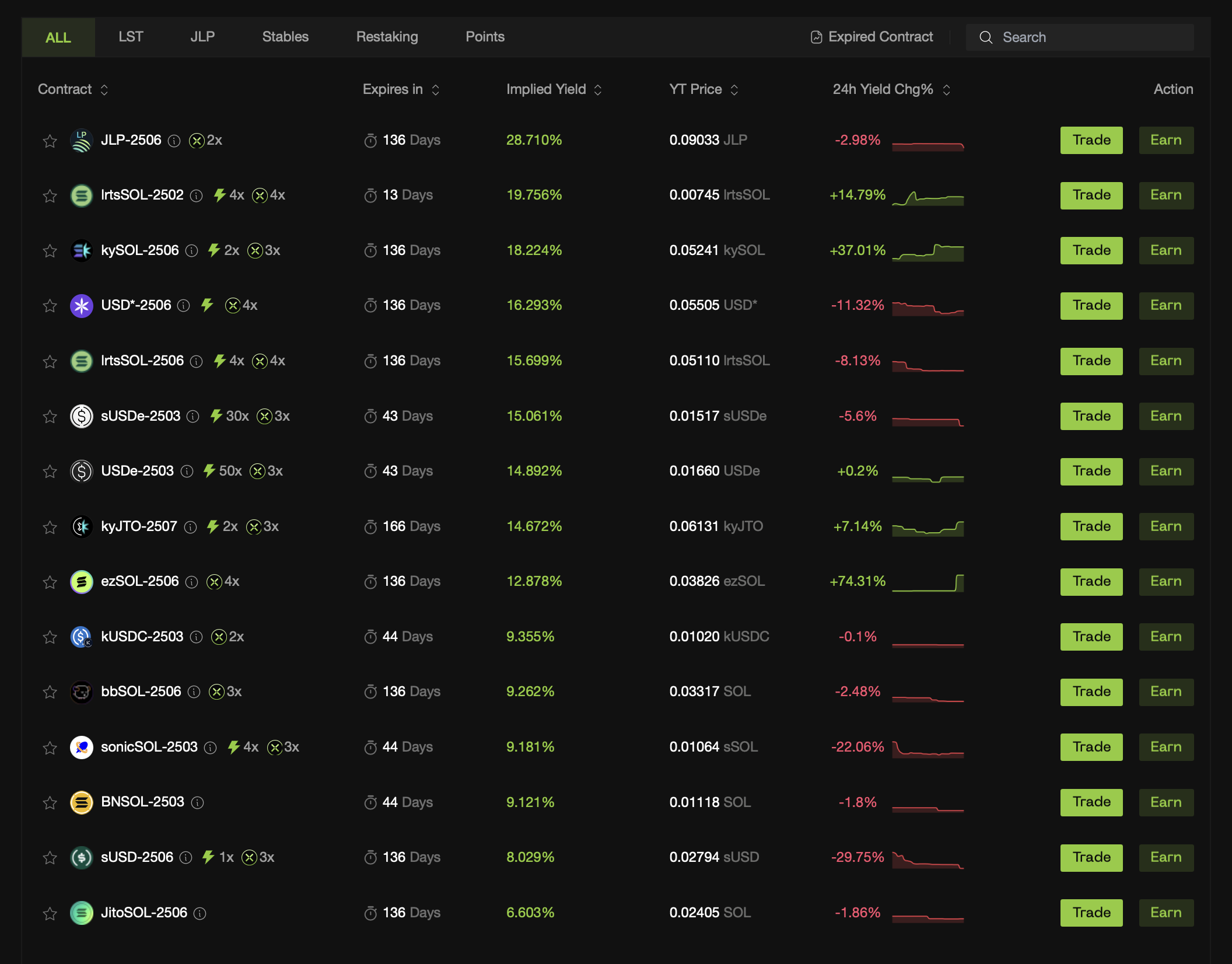

Currently, RateX is the biggest Yield Trading protocol on Solana, with over $37M in TVL, and it also has the widest set of DeFi integrations. However, I found their UI a bit less clear and more confusing than Exponent's.

There are many different opportunities on RateX (as seen below), so we are not going to cover all of them, only the most compelling ones.

kySOL with Kyros

This is the same opportunity as with kySOL on Exponent and you even secure a fixed APY on SOL or farm Kyros points. However, the market stats are slightly different for RateX. Please find them here:

Current stats:

- Liquidity: $630k

- PT-kySOL yield: 17.20%

- Implied YT yield: 18.24%

- Yield Leverage: 19.2x

- Maturity: 25 June 2025

lrtsSOL (2506) with Adrastea

Adrastea is a composable protocol that simplifies advanced DeFi strategies, like Liquid Restaking, making them easily accessible on Solana. This protocol is similar to Kyros, but while Kyros is built on top of Jito (Re)staking, Adrastea is built on top of Solayer.

In this context, lrtsSOL is a liquid restaking token (LRT) on Adrastea, representing a user’s restaked position in Solayer, where users are efficiently exposed to additional yield generated by Solayer AVS. As of writing, TVL in Adrastea is approximately $25M.

On RateX, users can currently use YT-kySOL to farm multiple points simultaneously, including Sonic, Adrastea, and Solayer. Additionally, they can also secure a fixed APY of 14.84% through PT-lrtsSOL until June 2025, with over $6.5M in liquidity.

Current stats:

- Liquidity: $6.5M

- PT-lrtsSOL yield: 14.84%

- Implied YT yield: 15.70%

- Yield Leverage: 19.6x

- Maturity: 25 June 2025

USD* with Perena

Again, this is similar to the USD* opportunity on Exponent but with the market stats of RateX:

Current stats:

- Liquidity: $1.1M

- PT-USD* yield: 15.39%

- Implied YT yield: 16.29%

- Yield Leverage: 18.2x

- Maturity: 25 June 2025

sUSDe and USDe with Ethena

USDe is Ethena's first dollar-denominated token and does not accrue the yield earned by the protocol. sUSDe, on the other hand, is the staked version of USDe, which retains its value and benefits from funding rate yields.

I think by now, Ethena needs no introduction, so I won’t go into more details here. But both USDe and sUSDe have interesting yield opportunities on RateX.

USDe

PT-USDe is currently offering a 14.06% APY, while the YT-USDe implied yield is at 14.88%, with a 50x sats multiplier.

Current stats of USDe:

- Liquidity: $832k

- PT-USD* yield: 14.09%

- Implied YT yield: 14.89%

- Yield Leverage: 58x

- Maturity: 25 March 2025

sUSDe

On the other hand, PT-sUSDe is offering a fixed yield of 15.1%, while YT-sUSDe has an implied yield of 15.95%, with a 30x sats multiplier.

Current stats of sUSDe:

- Liquidity: $1.1M

- PT-USD* yield: 14.25%

- Implied YT yield: 15.06%

- Yield Leverage: 62.5x

- Maturity: 25 March 2025

kyJTO with Kyros

kyJTO is another liquid restaking token from Kyros that is tied to JTO. With kyJTO, users gain exposure to JTO while earning additional restaking rewards from securing TipRouter NCN. PT-kyJTO offers an attractive APY on JTO, while YT-JTO, similar to YT-kySOL, earns Kyros points on steroids.

Current stats:

- Liquidity: $113k

- PT-kUSDC yield: 12.78%

- Implied YT yield: 13.56%

- Yield Leverage: 18.9x

- Maturity: 25 July 2025

Similar to Exponent, these opportunities also earn RateX points, which often come with an interesting multiplier depending on the vault. If you’re bullish on RateX, then this is one of the best ways to farm their airdrop.

Closing words

Yield trading on Solana is still new, but as we've seen in this report, the market opportunity is significant. It is enabling many interesting yield opportunities for both SOL and USD, along with airdrop farming potential from emerging Solana projects.

If you're a long-term SOL holder, I recommend checking out the PT opportunities on the Yield Trading protocol of your choice. The most attractive right now is PT-kySOL on Exponent earning a fixed APY of 18.66%. But PT-kySOL on RateX follows closely with an APY of 17.20% until June 2025. Plus, you'll gain exposure to the potential airdrops from these Yield Trading protocols.

On the other side of the spectrum, if you hold a lot of stables, you can secure over 15% APY with PT-USD* on either Exponent or RateX. This is one of my favorite yield trading plays for stables right now. Perena is also an interesting protocol and I highly recommend checking it out.

Lastly, for airdrop farmers, you now have everything needed to farm on steroids some emerging Solana protocol like Perena or Kyros.

As this meta gains traction, it will be important to monitor the TVL growth of Exponent and RateX to see who is likely to lead this narrative on Solana. New yield opportunities will also emerge.

We have an exciting future ahead for Solana DeFi and Yield Trading. Now is the time to pay attention before it goes mainstream and the most asymmetrical plays become fully priced in.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.