Identifying The Winning L1/L2 Tokens - A Framework For Evaluating Chains & Rollups

A comprehensive comparison and analysis between chains - where are innovation and activity taking place?

With the ever increasing list of L1s and L2s available on the market, the sheer amount of different blockchains outweighing actual users seems to be the status quo. Surely there must be some that capture a majority of the activity in the space. This begs the question — how can we differentiate the good from the bad, the useful from the useless? The most obvious answer would be looking at easily accessible metrics such as active addresses, total value locked, and so on. In most cases that would suffice, but with the existence of mercenary capital and other factors, we need to delve deeper. That would take a lot of time and effort (rightfully so), but since time is a valuable resource, we aggregated this analysis methodology and some examples into this article.

Bullets

- Value Extraction

- Operational/Security Expenses

- Monitoring User Activity

- Stablecoin Flows

- Roll-up benefits to Ethereum

Stay up to date with DeFi news and deep-dives that cut straight to the chase without putting you to sleep 🧠

Where does value accrue?

In the previous vividly-remembered bull run, infrastructure projects like Ethereum, Binance Smart Chain, Polygon and Solana saw astronomic growth in terms of market capitalization and user activity. Will things differ this time around with improvements in cross-chain capabilities, more scalable/efficient L2 roll-ups and dedicated app chains (e.g. dYdX Chain)?

Value Extraction

How can we accurately quantify the value of a blockchain’s native token? Due to the highly subjective nature of asset valuation, we can try our best to estimate by doing fundamental analysis and letting the market confirm or invalidate our hypothesis. A good place to start is by looking at the amount of revenue and fees generated.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Ethereum and Tron ranking at the top of the list shouldn’t come as a surprise to anybody, although the L2 trifecta — Arbitrum, Optimism and Base, piggybacking on Ethereum’s infrastructure and vast local capital availability, are giving some well-known L1 chains a run for their money (literally).

Being already familiar with the rest of the crowd on the table above, let’s figure out what warranted the recent success of these three.

Arbitrum

In case you are not up to speed with recent developments, Arbtrium’s STIP (Short-Term Incentive Program) grants are stimulating the local DeFi ecosystem with various protocols such as GMX, Pendle, Camelot offering users additional rewards for interacting with their products. With single-sided ARB staking potentially coming to fruition, the L2’s visibility has increased greatly, aiding the onboarding of new users and in turn churning out more revenue.

Optimism

Second place in terms of revenue and active addresses is Optimism. With ongoing efforts to keep growing the already existing ~90k active user population, projects such as Synthetix and WorldCoin have migrated to the L2 roll-up thanks to it’s scalability capabilities. In addition, the Optimism Foundation is currently hosting an on-chain competition with various submission categories which might explain an influx in activity.

Base

Powered by Optimism’s tech stack and backed by the exchange giant Coinbase, the new-comer made a splash when most of CT bridged their funds and partook in the shenanigans that usually follow the launch of a new chain. Most of the L2’s activity stems from friend.tech and DEXs. Base currently has an active grant program with the intention of bringing more builders to the platform.

As of now, the main revenue distributors on the list are L1 protocols, who offer token incentives to validators processing transactions for the network and keeping it secure. We will be discussing this in more detail in the next segment.

Operational/Security Expenses

The costs associated with running a blockchain (proof-of-stake specifically) are by no means cheap, as one would expect. To guarantee sufficient security and the continuous handling of transactions, compensating validators is a top priority for any network. Their necessity can’t be understated and is clearly reflected in income statements.

Why are validators important?

They essentially act as guardians overseeing the network and making sure that everything adheres to the rules and standards.

What are the responsibilities of a validator?

After staking a certain amount of the blockchain’s native token as collateral, they inherit the following responsibilities with the intention of being honest:

- verifying the legitimacy of transactions;

- proposing and creating new blocks that include validated transactions;

- maintaining the security of the network;

How are validators compensated?

To ensure the existence of consistent network validators, their effort is incentivized with various issuance rewards:

- block rewards from newly mined blocks;

- transaction fees;

- staking rewards;

Below is a table containing the operating costs (token incentives) of different blockchains.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

A Fee/Incentive Ratio of less than 1 entails that the operating expenses exceed the amount of fees generated by the network. In this case we can see that only two of the eight projects listed yield more than they spend. Excessive token incentives lead to high inflation, which coupled with weak buying pressure can devalue the price of a blockchain’s native token on a higher time frame.

Monitoring User Activity

There are plenty of ways of gauging user activity on a chain, with the most popular ones being:

cumulative DEX volume;

daily statistics;

transaction count;

active wallets;

gas fees by contract;

The former could be the best indicator for organic activity, as the latter might easily be inaccurately interpreted due to high potential for noise created by bots, airdrop farmers or other automated operations. This is especially relevant with low transaction cost chains.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

In terms of trading volume on decentralized exchanges, the top 5 blockchains are: Ethereum, Arbitrum, Solana, Polygon and Binance Smart Chain. This is largely due to most DeFi activity taking place there.

An interesting thing to note is that L2 protocols are starting to appear more prevalent. This is evident as Arbitrum has easily surpassed Binance Smart Chain and Solana in terms of volume, two heavy-weights in the space. If this trend continues, then do L1s such as Solana stand a chance against the roll-up takeover?

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Looking at the chart above, the market seems to be heavily favoring L2s at the moment. Cumulative layer-2 trading volume is even gunning for Ethereum’s dominance with the difference between the two being fairly close.

Vertex Protocol🏔

Today’s edition is sponsored by Vertex Protocol, an Arbitrum native DEX offering spot, perpetual futures and money markets with universal cross margin.

Vertex utilizes a hybrid orderbook and AMM design and has facilitated over $5.3 billion in trading volume the past 30 days alone making it the onchain derivatives platform with the second highest monthly trading volume right after dYdX.

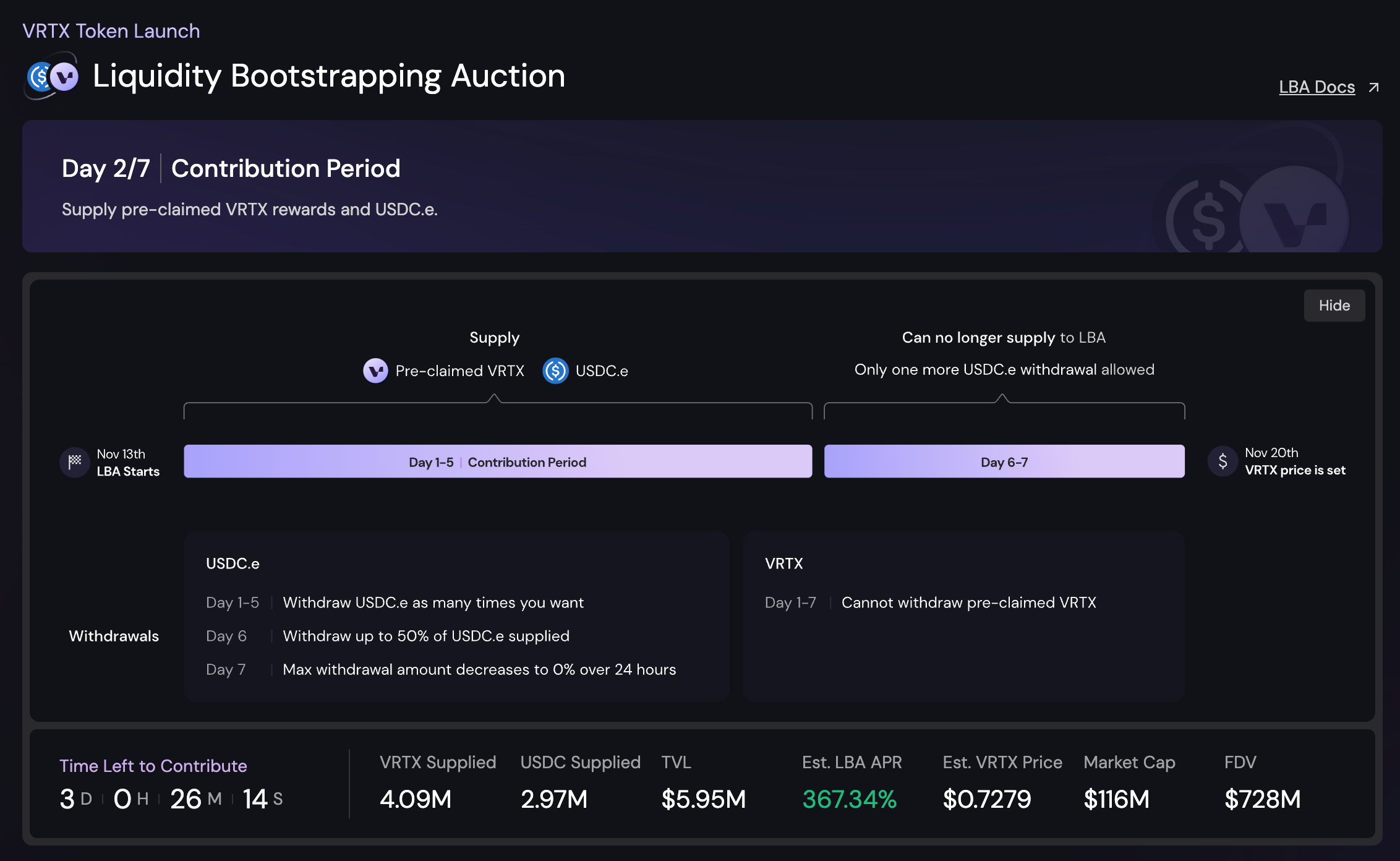

The $VRTX Liquidity-Bootstrapping Auction (LBA) is currently live till November 19th and is a novel approach for seeding initial token liquidity and distribute the early token supply to liquidity providers. In the first five days, users will be able to lock up USDC and pre-claimed VRTX which will be locked & vested over 180 days while earning VRTX tokens. For more information, see the link here.

Stablecoin Flows

Stablecoins are an intrinsic part of crypto, allowing users to self-custody real world currencies on-chain. Having a stable asset onchain comes in handy for hedging against the price fluctuations of tokens.

Is stablecoin supply relevant?

Yes. The stablecoin supply on a chain creates a baseline for liquidity to move from stablecoins to assets on the chain, increasing the likelihood of price appreciation of those assets. Significant capital on a chain often invites additional capital.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

This seems to be the case when analyzing the distribution of stables across all chains since most of the supply is concentrated on chains with high valuations and significant locked value.

Does stablecoin composition matter?

It depends. Centralized stablecoins such as USDT (issued by Tether), USDC (issued by Circle), BUSD (issued by Binance) are widely used in many applications, but don’t exactly engage with the respective communities they reside in. Whereas decentralized stablecoins often times contribute to the growth of an ecosystem in other ways than just providing liquidity.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

The demand for centralized stablecoins heavily outweighs alternative options, comprising ~95% of the total market capitalization.

Roll-up benefits to Ethereum

The introduction of L2s have, without a doubt, been a net positive for Ethereum. Allowing additional layers to be built on top of already existing infrastructure, paves the way for innovation and experimentation while embracing the core values of the network.

Why use a L2 protocol over Ethereum Mainnet?

Most layer-2 protocols seek to add new unique features and also address various technical concerns of it’s underlying layer (usually related with scalability), such as:

- slow transaction processing speed;

- expensive transaction fees;

- more efficient & secure contract execution;

- lack of transaction confidentiality;

Thanks to recent developments, many DeFi protocols have found their home on Ethereum that would’ve otherwise deployed elsewhere due to cost-effectiveness. This in turn has caused a massive uptick in on-chain activity and revenue. Rapid and cheap bridging between chains opens up the possibilities of efficient capital rotation and ease of access to chain-specific applications.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

As seen on the bar chart, a significant amount of fees have been generated, showcasing strong demand for products and capabilities these roll-ups provide.

Conclusion

Identifying a successful blockchain for the most part comes down to some key metrics and being able to spot innovation in the space where conditions are ripe. Platforms addressing certain pain points, incentivizing contribution and offering great user experience see the most growth and consistent usage. For these reasons the chains we analyzed are where they stand today and will continue to garner popularity.

That’s all for this week! Make sure to subscribe for weekly analyses like this delivered straight to your inbox completely free of charge🫡

Nothing stated should be construed financial advice!