Here's What VCs are Dumping on You (and Buying)🚨

An overview of recent on-chain activity from notable crypto funds

Welcome back to DeFi Frameworks. Today’s article will take you through recent on-chain transactions of various crypto funds to highlight what has been accumulated and what has been sold off.

Thanks for reading DeFi Frameworks! Subscribe for free to receive new posts and support my work.

1️⃣ DragonFly >|<

DragonFly Capital is a crypto native venture fund founded in 2018 which today consists of a team of 48 members. They have a large portfolio including dYdX, Flashbots, 1inch, Maker, Frax, Polygon and many more.

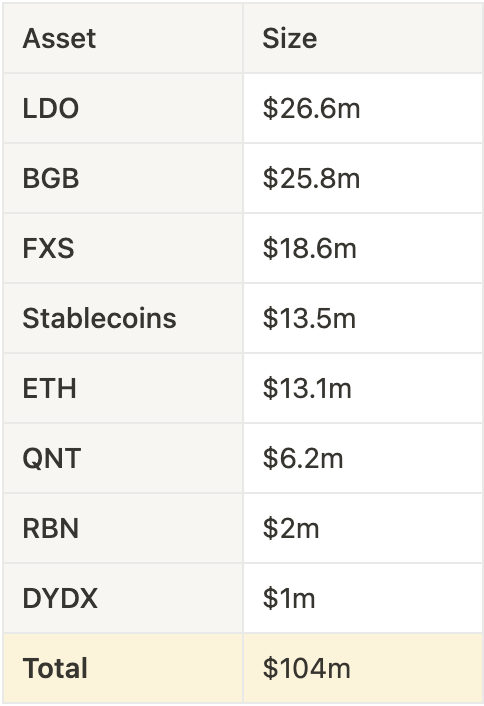

Their top holdings currently are as seen below👇

Note that this is from their labeled on-chain wallets and there are certainly other wallets with additional assets somewhere out there.

Recent activity 🏃💨

1INCH

DragonFly has sold a total of 49.5m 1INCH tokens at an average price of $0.38 July 23rd this year right after the price rallied. The fund had 12m 1INCH which completed vesting in January 2022 and 37.5m 1INCH vested July 18th 2023 just 5 days before selling their position. Current price of 1INCH is $0.266.

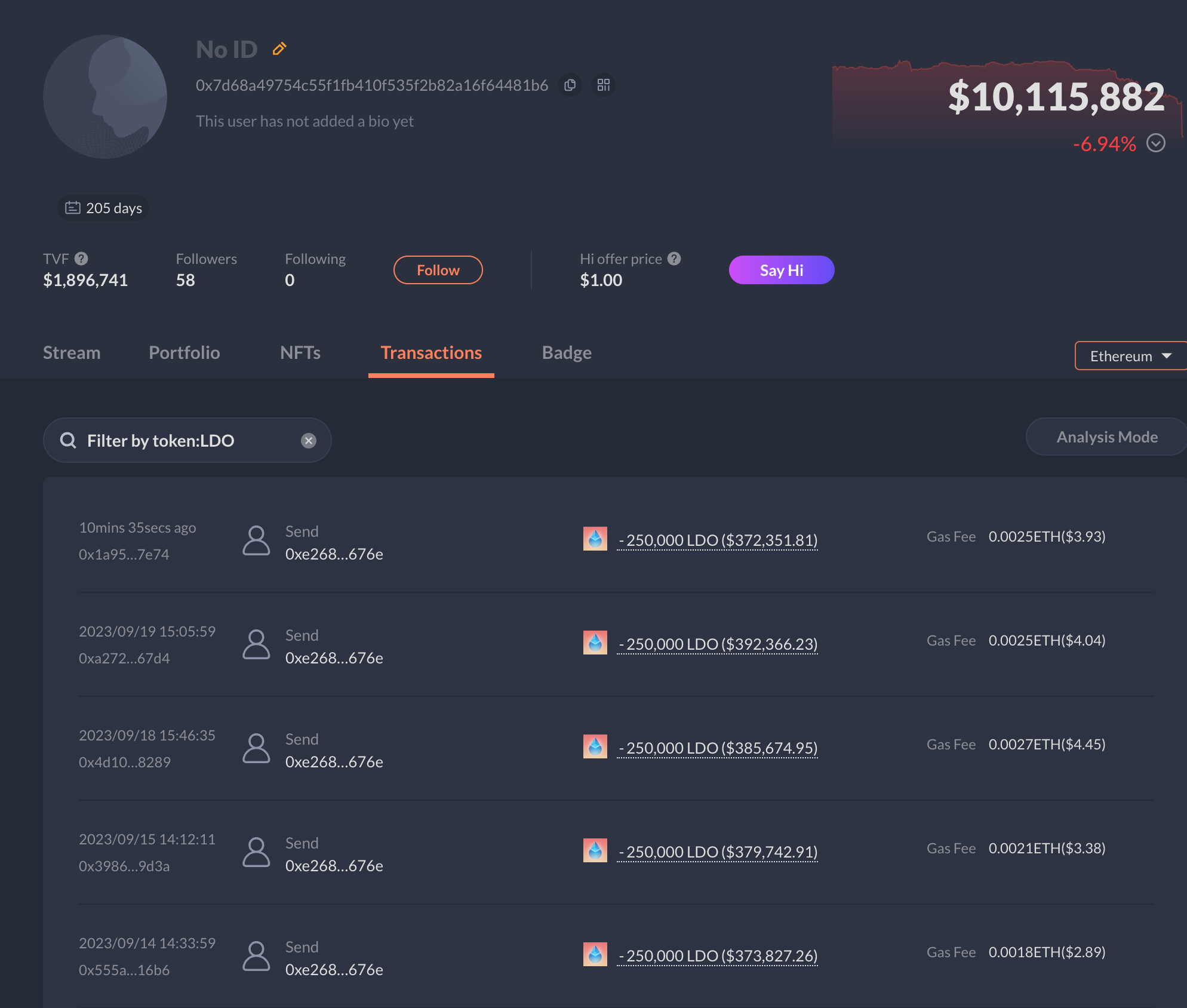

LDO

DragonFly is an early investor in LDO and finished their vesting earlier this year. The round was 10m $LDO with a one year lock between 25th of August 2022 and 25th of August 2023. The tokens are now fully unlocked according to Token Terminal.

While DragonFly still holds $30m in $LDO, they’ve been selling off heavily earlier this year. At the peak, DragonFly held close to $100m worth of $LDO on-chain.

They deposited 3.6m LDO ($10.4m) to Binance in early March at an average price of $1.6 per $LDO and continue to sell off batches of $250k at a time as seen per the image below.

FXS

DragonFly receives 46k $FXS every month from the Frax Finance Treasury and Advisor development wallet. They have apart from that also bought $FXS on several occasions and now hold a total of 3.55m $FXS ($18.6m).

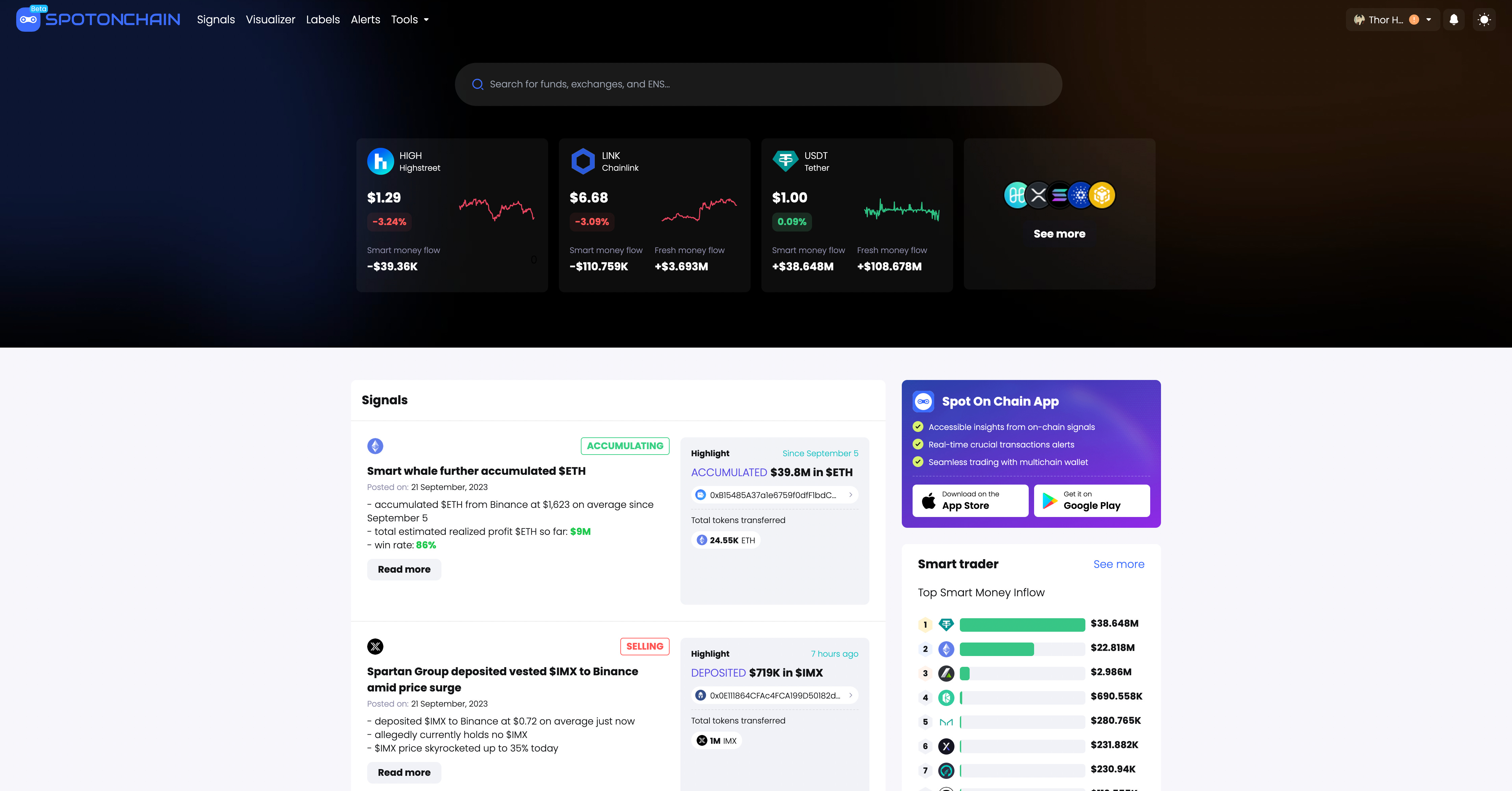

Spot On Chain

All information aggregated for today’s article is from Spot On Chain. The website has a variety of features that makes it easy to access on-chain data completely free. These include:

- Signals

- Labeled entities (such as crypto funds)

- Friendex (friend tech analytics tool)

- Custom alerts

- Visualizer

And more - sign up here

(oh, and they’re doing an airdrop for early users👀)

2️⃣ Spartan Group

The Spartan Group operates a variety of funds across gaming, DeFi, infrastructure, venture and more. Their AUM is over $500m with portfolio companies such as Arbitrum, Celestia, Synthetix and more. $25m of their portfolio is tracked on-chain👇

Recent activity 🏃💨

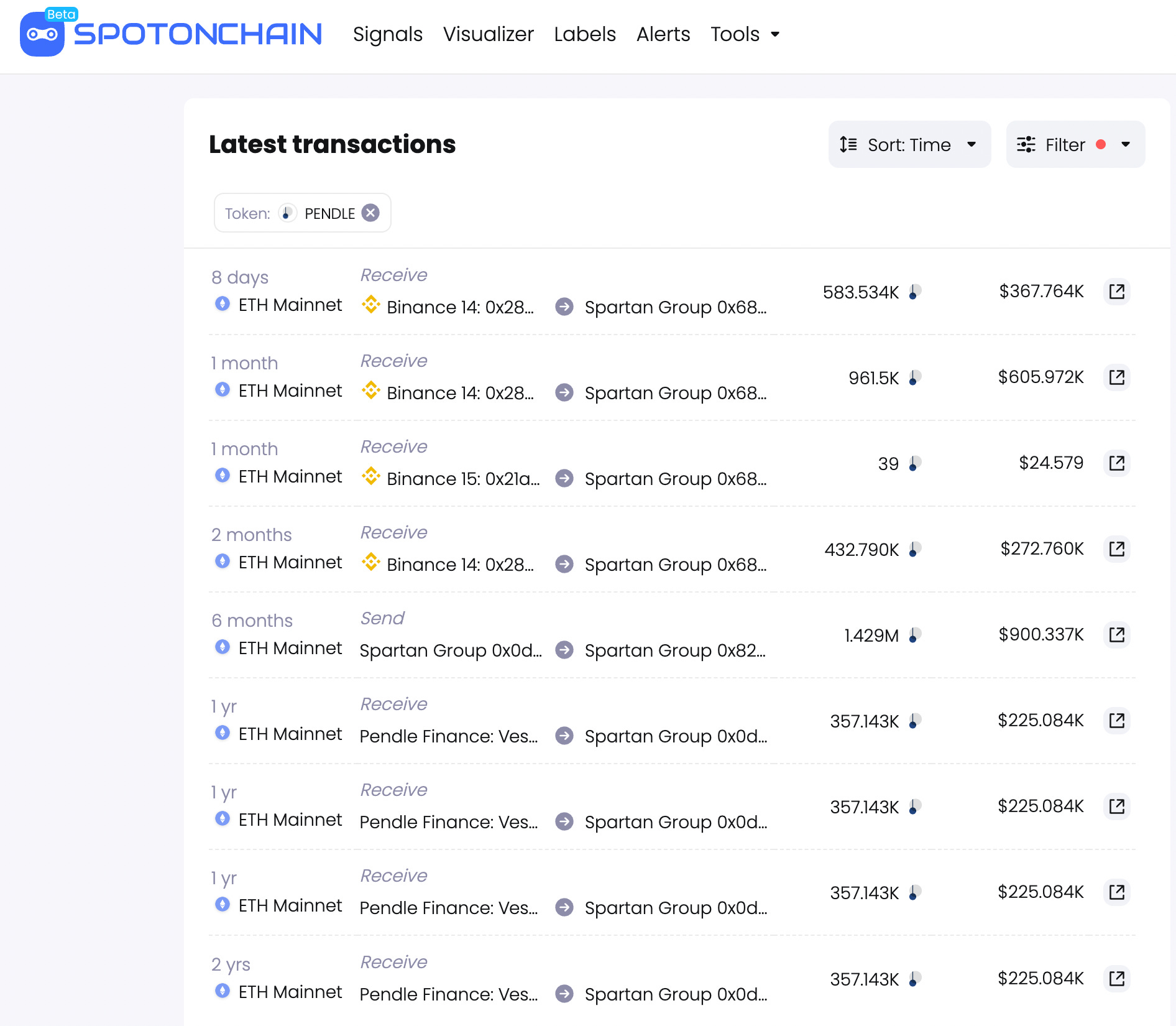

PENDLE

Spartan Group was a part of the initial Pendle round and has further been buying $PENDLE on the market for the past couple of months.

As seen per the image below, Spartan Group received 1.429m $PENDLE split into four transactions (357k per tx) and received every 3 months for a year between 2021 and 2022. Other funds in the initial Pendle round are CMS Holdings, Signum Capital, Mechanism Capital and more.

Beyond the private sale, the image also illustrates the recent purchase of 1,977,863 $PENDLE from Binance at an average price of $0.63 which is equivalent to current market price. Will they continue to accumulate at these prices?🤔

Thanks for reading DeFi Frameworks! Subscribe for free to receive new posts and support my work.

3️⃣ $MKR movements

The native token of Maker ($MKR) has been one of the most traded tokens by funds over the past months. Below is an overview of recent movements.

Paradigm - Paradigm has exited their $MKR investment. They bought a total of 51k $MKR back in 2019 and 2020 through various sales at an average price of $431 per $MKR ($22m). They’ve sold their entire 51k MKR this year: 48k $MKR in March at a price of $740 and 3k $MKR in late July at a price of $1187. This brings their total profit from this investment to $17.16m (+78%).

a16z - a16z has been selling off their $MKR investment heavily throughout July this year as seen per the image below. They’ve sold a total of 26k $MKR over this period at an average price of $1076 ($28.1m total).

They received 60k $MKR from the MakerDAO sales back in 2018 at an unknown price. 28k of this $MKR was sold between March and September 2021 at $2,742 on average ($76.35M).

![[{"type":"numbered-list","children":[{"type":"list-item","align":"left","children":[{"text":"a16z deposited 1,350 $MKR to Coinbase at $1,278 ($1.73M) 13 hours ago, right before the price dropped (TXID"},{"text":" ","color":"#2f54eb"},{"type":"link","url":"https://etherscan.io/tx/0x99feaf3a4111b8c64c379b6e13850a95fe9832eed492cf861a9e525153cee14c","children":[{"text":"here","color":"#2f54eb"}]},{"text":")."}],"color":"red"},{"type":"list-item","align":"left","color":"red","children":[{"text":"a16z then transferred the last 5,646 $MKR ($6.85M) in main wallet 0x05E to wallet 0x1A8 3 hours ago, probably to deposit to Coinbase later (TXID "},{"type":"link","url":"https://etherscan.io/tx/0xbf815642200b5b9f268791ef7d3c076cf5a0b715470e4f827676d5314a3a4236","children":[{"text":"here","color":"#2f54eb"}]},{"text":")."}]},{"type":"list-item","align":"left","color":"red","children":[{"text":"In total, a16z has deposited 26,086 $MKR to Coinbase at $1,076 ($28.1M) over the past 22 days of sell-off."}]},{"type":"list-item","align":"left","color":"red","children":[{"text":"Addresses:"}]}]},{"type":"bulleted-list","children":[{"type":"list-item","align":"left","color":"red","children":[{"text":"main address:"},{"text":" ","color":"#2f54eb"},{"type":"link","url":"https://platform.spotonchain.ai/profile?address=0x05e793ce0c6027323ac150f6d45c2344d28b6019","children":[{"text":"0x05e793ce0c6027323ac150f6d45c2344d28b6019","color":"#2f54eb"}]},{"text":""}]},{"type":"list-item","align":"left","color":"red","children":[{"text":""},{"type":"link","url":"https://platform.spotonchain.ai/profile?address=0x05e793ce0c6027323ac150f6d45c2344d28b6019","children":[{"text":""}]},{"text":"$MKR holding address: "},{"type":"link","url":"https://platform.spotonchain.ai/profile?address=0x1a82173fe17904c520a3596f090d0aaef25b4a0a","children":[{"text":"0x1a82173fe17904c520a3596f090d0aaef25b4a0a","color":"#2f54eb"}]},{"text":""}]}]},{"type":"paragraph","align":"left","color":"red","children":[{"text":""},{"type":"link","url":"https://platform.spotonchain.ai/profile?address=0x1a82173fe17904c520a3596f090d0aaef25b4a0a","children":[{"color":"#2f54eb","text":""}]},{"text":""},{"type":"link","url":"https://platform.spotonchain.ai/profile?address=0x1a82173fe17904c520a3596f090d0aaef25b4a0a","children":[{"color":"#2f54eb","text":""}]},{"text":""}]},{"type":"image","url":"https://soc-app-assets.spotonchain.com/5736_f1edb40317.png","children":[{"text":""}]},{"type":"paragraph","align":"left","color":"red","children":[{"text":"Fig 1. a16z's latest deposit of 1,350 $MKR to Coinbase at $1,278."}]},{"type":"paragraph","align":"left","color":"red","children":[{"text":""}]},{"type":"image","url":"https://soc-app-assets.spotonchain.com/5737_846c7294f6.png","children":[{"text":""}]},{"type":"paragraph","align":"left","color":"red","children":[{"text":"Fig 2. a16z's deposits of 26,086 $MKR to Coinbase (average depositing price: $1,076)."}]}]](https://www.onchaintimes.com/content/images/2024/07/https-3a-2f-2fsubstack-post-media-s3-amazonaws-com-2fpublic-2fimages-2fb59a4fad-bc84-452b-ac9e-c1efb0e9588a_1248x844.png)

Rune (Maker founder) - as seen per the image below, Rune has been buying a large amount of $MKR since early this year. Most recently, Rune bought 409 $MKR ($415k) at an average price of $1013.

Parafi - was one of the investors in $MKR back in 2020 and further acquired 17k $MKR OTC back in 2021 and 2022 at an average price of $2922 (~$50m total). Over the past months, Parafi has been selling $MKR (entire ~18k $MKR) over the spring/summer at a price between $600 and $800 per $MKR. They continue to receive vested $MKR every month.

That’s all for today! If you enjoy these type of in-depth analysis, make sure to subscribe to the newsletter!🗞