Exploring the Mode L2 and Its DeFi Ecosystem🟡

A report diving into Mode's unique moat in a sea of Ethereum L2's.

This report is made in collaboration with Mode and is therefore sponsored.

Introduction

Earlier this year, a novel layer-2 rollup launched within the Optimism superchain ecosystem. Mode is designed with a modular architecture optimizing the experience for developers, users and its DeFi ecosystem. Since going live earlier this year, Mode has seen an ecosystem of over 30 applications unfold, including apps like Renzo, Velodrome, Ethena and more, while also experiencing over $700m bridged to the chain.

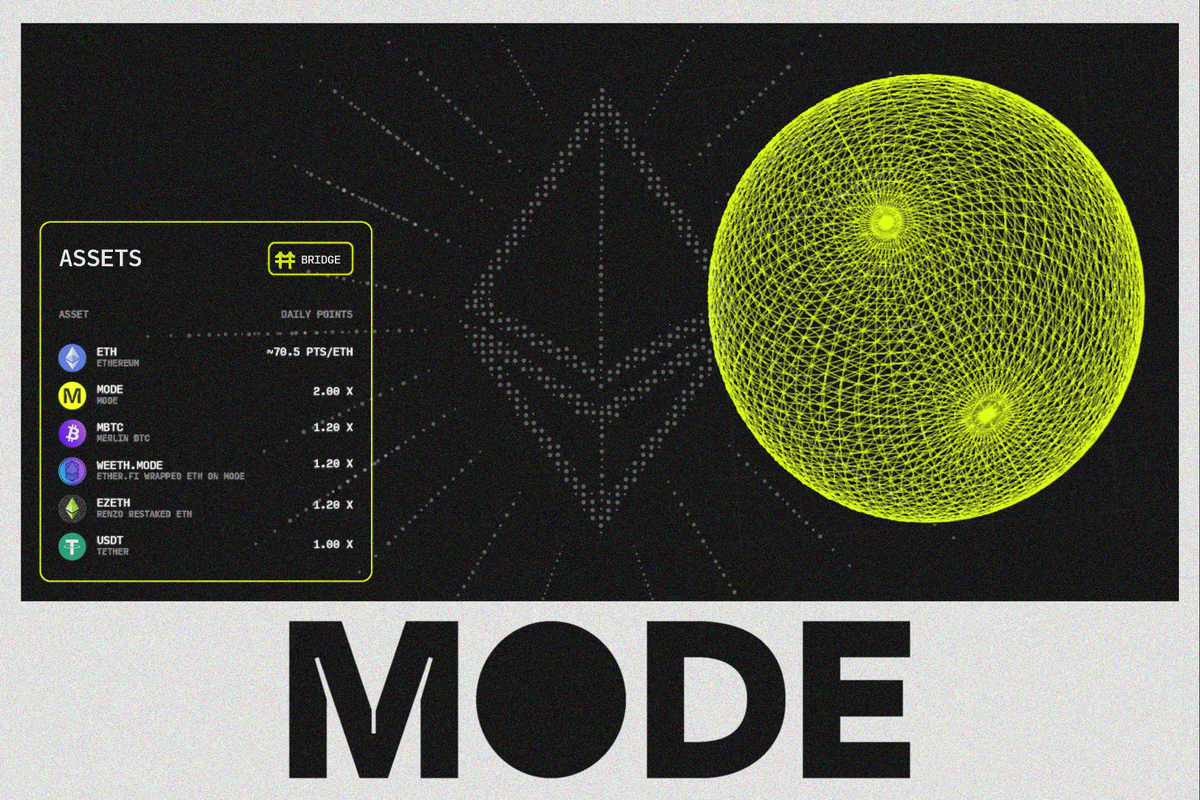

Mode is currently running its S2 points campaign with rewards coming from their OP grant as well as an additional 5% of the MODE token being airdropped to current ecosystem participants. Today’s reports dives into Mode’s recent traction while also breaking down the DeFi ecosystem and finally looking at the potential returns related to the Mode S2 campaign.

Traction

Due to the large list of partnerships and collaborations with popular dapps, the Mode ecosystem has has experienced large growth with nearly $800,000,000 in liquidity bridged to the chain.

As seen from the figures below, 75% of all liquidity deposited into mode applications are in lending markets. The largest individual protocols are Ionic (lending), LayerBank (lending), Renzo (liquid restaking), Sturdy (lending) and Kim (DEX).

Below is a list of assets bridged to Mode according to l2beat. mBTC from the Merlin L2 is by far the most bridged asset followed by ezETH from Renzo.

DeFi Ecosystem

Lending

As portrayed in the previous section, the largest applications on Mode are lending markets. This is not surprising considering that looping assets is a fairly straight forward way of increasing ones capital on the chain and henceforth earning additional MODE points. The two biggest protocols are Ionic and LayerBank which make up nearly 80% of the total amount of assets on the chain. Both are cross chain money markets and supplying assets such as USDT, USDC, LRTs, ETH yields 2x MODE points as well as EIGEN points, LRT points and the respective Layerbank and Ionic protocol native points. Users also receive 1x MODE points for borrowing assets so this utilizing these money markets is an effective way to get leveraged exposure to MODE points.

Additional lending markets on Mode with less TVL include Sturdy Finance, Ironclad finance and Airpuff.

Yieldmarket

With LRTs such as ezETH, eETH and rsETH live on Mode, as well as other yieldbearing assets coming soon (sUSDe 👀), it makes sense to have a yield market where these yields can be traded. While Pendle isn’t live on Mode, a native yieldmarket, Splice, recently launched. The protocol has at this stage integrated ezETH (Renzo), weETH (Ether.fi), wrsETH (Kelp) and MODE. With these markets, users can get access to either fixed yields on these assets by purchasing the PT token or leverage the points exposure by purchasing the YT token. Note that given the recent launch, liquidity is still fairly think on these markets.

Ethena

Ethena has grown to become one of the largest DeFi protocols in just a few months with the USDe structured product reaching a supply of over 2,500,000,000. Ethena is planned to go live on Mode soon with liquidity for both USDe and sUSDe. It’s likely that these assets will be integrated into the various applications on Mode shortly after launching.

Velodrome

Velodrome has become the largest veAMM in DeFi across their different markets (Velodrome on Optimism and Aerodrome on Base). The exchange recently went live on Mode with incentives live as well. Yields for MODE/USDC and MODE/USDT pairs are currently ~100% APY due to the added incentives and the limited liquidity deposited at the time of writing. For the deepest liquidity currently, check out the Kim exchange with $30,000,000+ in liquidity on Mode alone.

Native Yield & Staking

Mode recently introduced ‘MODE staking‘ in which token holders deposit their MODE to the staking contract to farm OP incentives and boost MODE points earned. A total of 20,000 OP is rewarded to stakers each week which is equivalent to a 49% APY given current value of OP and amount of MODE staked. Note that there is a 7 day unstaking period when wishing to withdraw the MODE tokens. In addition, users staking a substantial amount of MODE relative to the rest of their portfolio on the Mode chain, receive a points boost in the following shape:

“You earn 1.25x if staked $MODE is 25% or more of your portfolio.

You earn 1.50x if staked $MODE is 50% or more of your portfolio.”

I.e. if you have $5k worth of assets on Mode and you stake ≥$2.5k worth MODE, you will receive a 50% boost on all the points earned. You can read more about this initiative here.

modeETH

Mode has partnered up with Redacted to bring the highest ETH staking yield to ETH depositors on Mode. ETH bridged to mode will be wrapped as modeETH which deposits the underlying ETH into Redacted’s Pirex ETH which currently generates a 10% APY due to their dual token design and large DeFi integrations. modeETH will capture this yield by growing in value relative to ETH itself. Read more here

modeUSD

Mode has further announced a partnership with Ethena for the modeUSD stablecoin. With Ethena’s sUSDe offering an annualized yield of 37% currently, stablecoin depositors on Mode will be able to earn a high yield while using their stablecoins across the DeFi ecoystem.

Note that both of these will be opt-in so users who don’t want exposure to Ethena and Redacted and their underlying yields can choose not to. These implementations are coming soon with modeETH being launched first. They are being built as omnichain rebasing tokens in collaboration with LayerZero. modeUSD will follow shortly after the launch of modeETH.

Mode S2

When considering the ret for Mode S2. A quick recap of the campaign:

- 500,000,000 MODE tokens airdropped (5% of the supply)

- Campaign live from early May till Sep 6th

- Several new ways to earn additional points through new DeFi protocols, assets and pools

With this in mind, we can explore various ways to earn MODE points. First however, some assumptions:

Total MODE points

- Current points in circulation: 741,552,263

- Points by Sep 6th: 5,200,000,000

- MODE FDV: $440,000,000

- Total Airdrop value: $22,000,000There is roughly 741,552,263 MODE points in circulation as of May 27th which has been emitted in the last 22 days. That is equal to 33,706,921 points per day. With 102 days left, and assuming a 30% average increase in TVL, that’s a total of ~5,200,000,000 MODE points by the end of the campaign.

With the current FDV of $440,000,000, a total of $22,000,000 is airdropped to users. Let’s now take a look at various strategies.

#1 weETH (Ether.fi) on Mode & Splice

For the first strategy, we assume that 10 ETH worth of weETH from Ether.fi is deposited into Splice and used to purchase the YT-weETH token which currently grants 22x leverage on MODE points, 33x leverage on Ether.fi points and 11x on EIGEN points. As mentioned earlier, Splice is the native yieldtrading market in the Mode ecosystem which went live earlier this week. The calculations are as follows:

weETH used to purchase YT-weETH on Splice: 10 ETH worth

Total MODE points earned: 1,628,550

MODE airdrop value: $6,057.44

Total Ether.fi loyalty points earned: 519,750,000

ETHFI airdrop value: $34,650

Total airdrop: $40,707

$ lost from YT token purchase: 10eth*$3,708 = $37,080

Total return = $3,627In this instance, the airdrop from ether.fi is taken into account but the airdrop from EIGEN and native Splice points are not. The assumptions regarding the Ether.fi airdrop is taken from our recent post here:

#2 ezETH (Renzo) on Mode & Splice

Splice also has a market for Renzo’s native LRT, ezETH. With similar calculations to the Ether.fi strategy, we end up with:

ezETH used to purchase YT-ezETH on Splice: 10 ETH worth

Total MODE points earned: 1,466,400

MODE airdrop value: $5,517

Total Renzo points earned: 998,400

REZ airdrop value: $17,812

Total airdrop: $23,329

$ lost from YT token purchase: 10eth*$3,708 = $37,080

Total return = -$13,751Again, the assumptions regarding the Renzo S2 airdrop including the total amount of points are from the linked article above. It’s once again worth noting that the EIGEN airdrop is not accounted for in this calculation. Given current available leverage on Splice, the Renzo strategy appears to be unprofitable however. This could quickly change however so make sure to monitor the available yield and liquidity on Splice.

For additional yield strategies on Mode and Splice, check out the recent post by Stephen below.

Conclusion

Mode is an innovative L2 with a significant ecosystem consisting of various DeFi applications. With several launches still yet to go live, including the native yield on modeETH and modeUSD, there is plenty to be excited about. If you want to stay up to date on what’s happening within the Mode ecosystem, make sure to follow them on Twitter.

If you enjoyed this report, subscribe to On Chain Times! 🗂

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.