Exploring Level USD - On Chain Money With High Yield

Disclaimer

This report is made in collaboration with Level and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

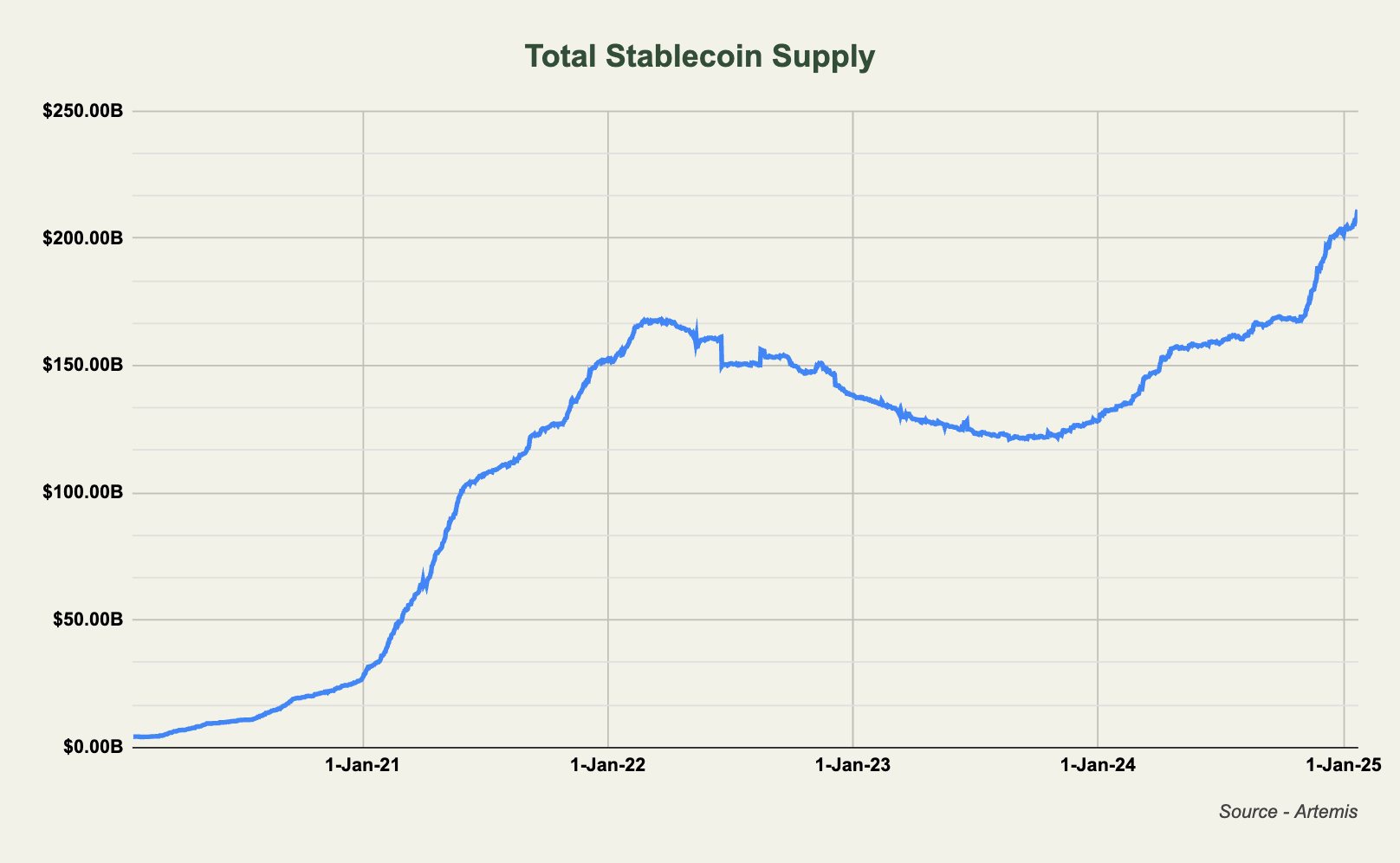

The stablecoin landscape has grown significantly in the past year both in overall supply but also in terms of the amount of on chain alternatives to USDT and USDC. As the market has been exceedingly unpredictable lately, yield famers have been looking for ways to earn reliable yield on their stablecoins.

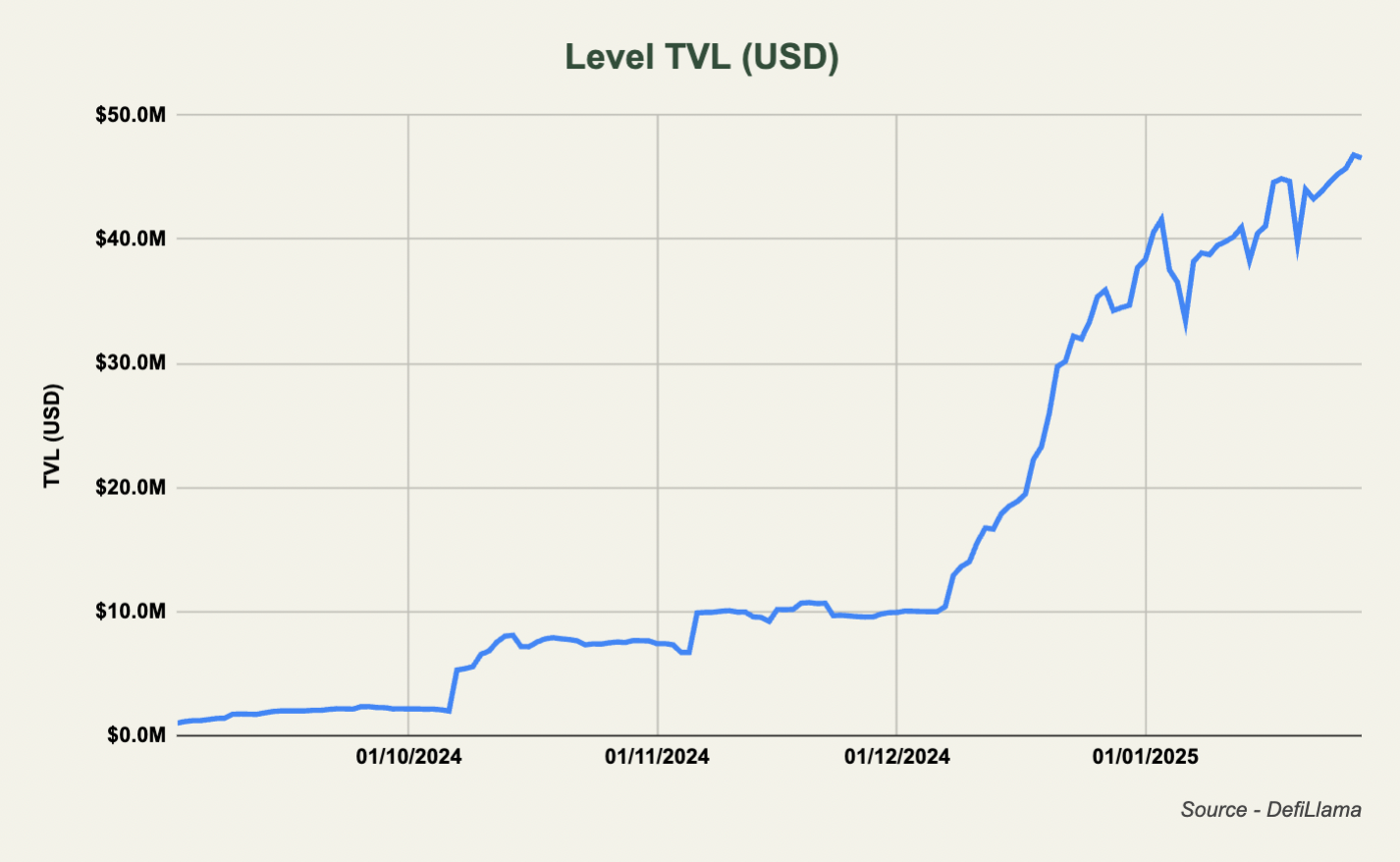

Level is a premier stablecoin protocol and issuer of lvlUSD which went live late last year and has grown to a supply of over $25,000,000. Level is backed by funds such as Dragonfly, Polychain Capital and Robot Ventures and offers unique yield opportunities via their lvlUSD and slvlUSD products. Today's report will dive into the design of Level, recent traction and finally yield opportunities with lvlUSD.

Design

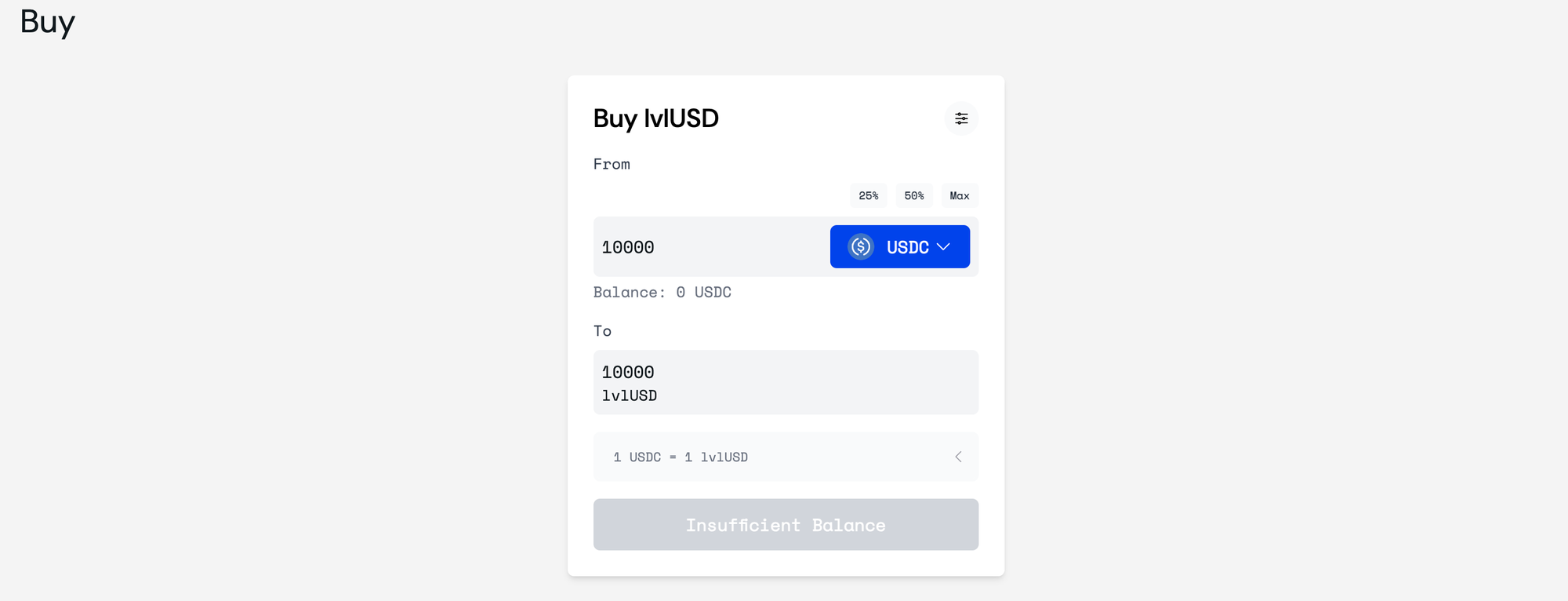

Level can be accessed on Ethereum mainnet where a wide range of assets such as USDC, USDT, ETH, wBTC, EIGEN, ENA and more can be swapped to lvlUSD. lvlUSD is minted and collateralized 1:1 against USDT and USDC which, in the background, is earning yield resulting in high APY for stakers of lvlUSD (18%+).

lvlUSD is designed to optimize yield generation through a multi-layered strategy:

- lvlUSD can be minted using USDC or USDT

- The deposited USDC/USDT are supplied to lending protocols (e.g., Aave) to generate yield

- Receipt tokens from these lending protocols are then restaked on restaking platforms (e.g. Symbiotic) to earn restaking rewards

- Both the lending yield and restaking rewards are distributed back to lvlUSD users.

What Makes lvlUSD’s Design Unique?

Essentially, lvlUSD provides liquid and stackable yield from multiple on-chain sources, eliminating any exposure to CEX. Unlike many yield-bearing stablecoins that rely on tokenized centralized yield, lvlUSD is built to generate returns exclusively from DeFi-native sources. This approach ensures not only the absence of counterparty risk but also enhanced on-chain transparency.

Traction

The protocol went live in September last year and has grown steadily now sitting at a TVL of more than $45m. TVL is counted as all the assets in the Level XP Farm and lvlUSD collateral.

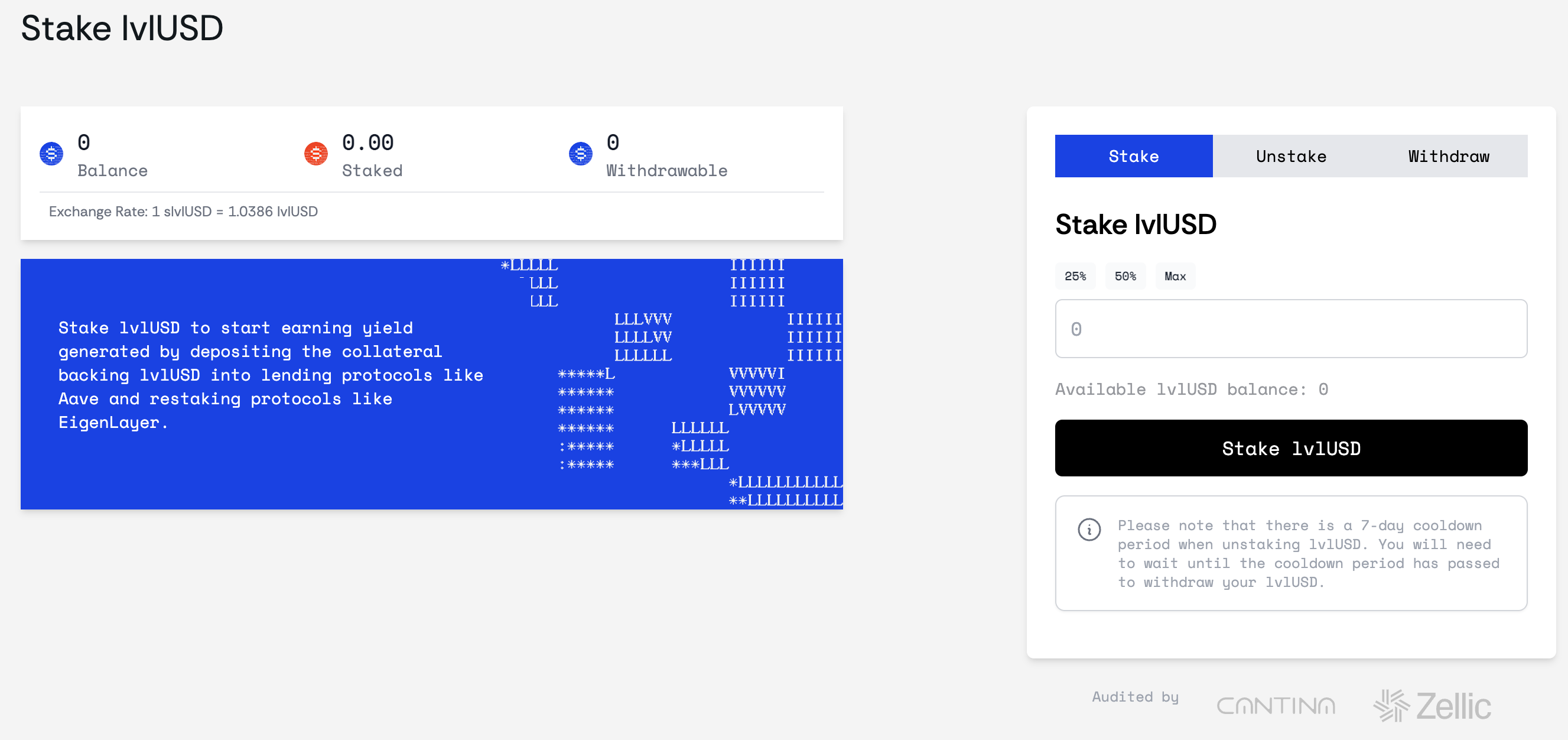

Staked lvlUSD Yield

lvlUSD can be staked as 'slvlUSD' which accrues the yield captured by the protocol. Similar to other stablecoin protocols, users have the choice between earning the underlying protocol yield versus points (XP).

The protocol yield is derived from the underlying collateral used to mint lvlUSD. This collateral yield is 'stackable' in the sense that it is intended to earn yield from multiple sources:

- Base yield - The majority of the lvlUSD collateral is deposited into secure DeFi protocols to capture stable yield. This is currently only the the Aave V3 USDC and USDT lending markets but will include additional sources in the future.

- Restaking yield - On top of this, the collateral receipt tokens, from Aave in this instance, are deposited into restaking protocols to earn additional yield. These protocols include Eigenlayer, Symbiotic and Karak and could include additional restaking platforms moving forward.

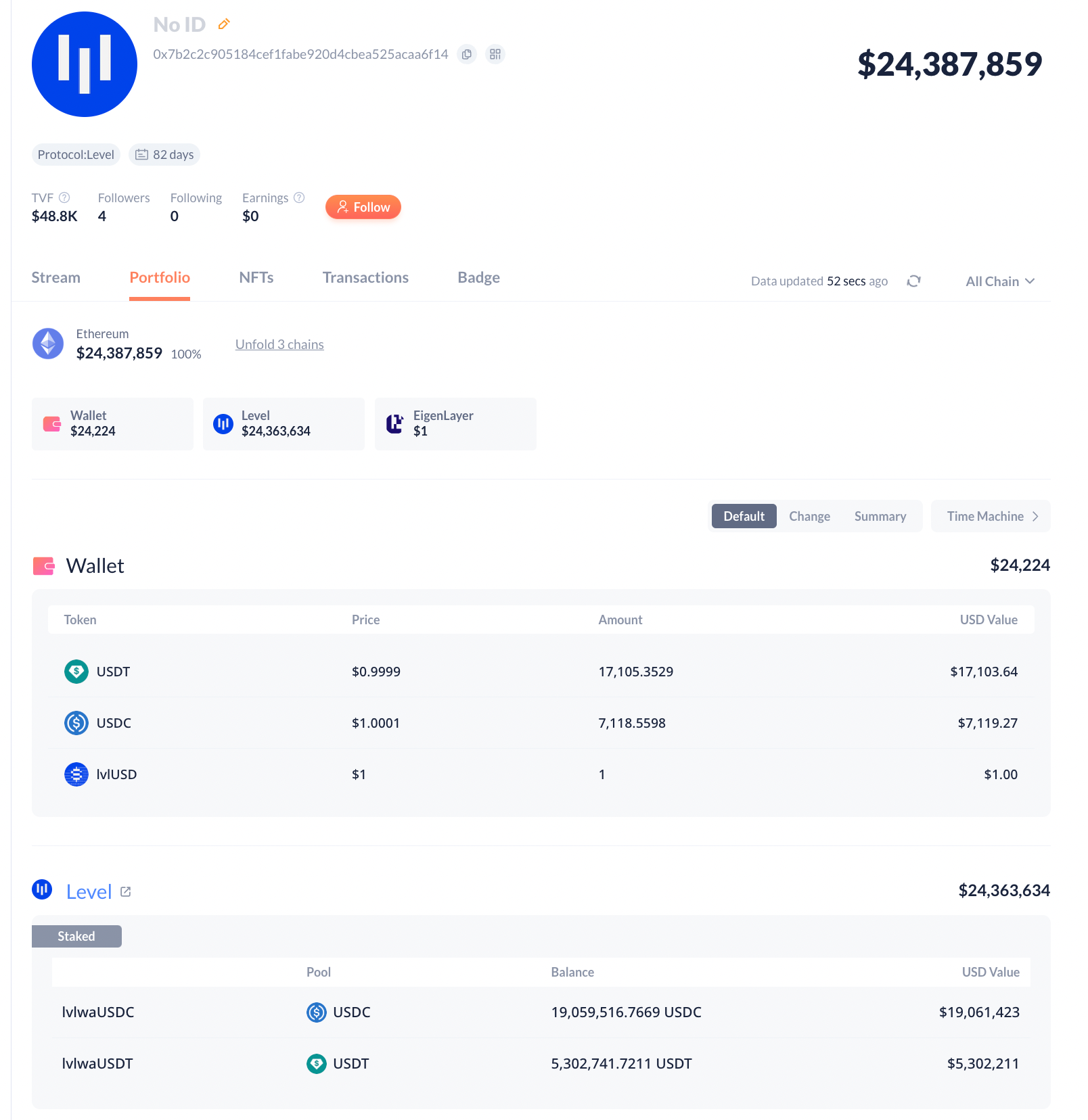

As of right now, nearly all of the lvlUSD collateral is deposited as USDC and USDT into Aave as seen below. It was just announced that a portion of these receipt tokens will be restaked on Symbiotic to generate additional yield.

All of the lvlUSD can be tracked via the addresses on the Level transparency page.

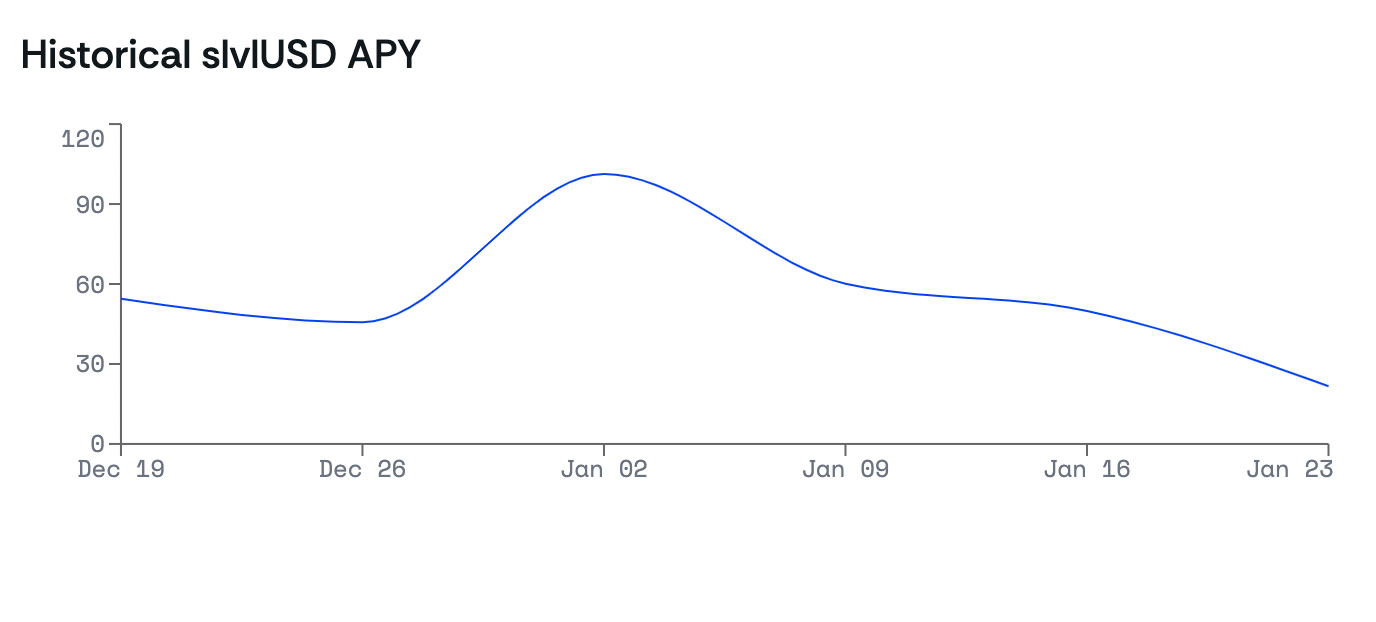

slvlUSD is a non-rebasing token which means that the yield is captured via price appreciation. As lvlUSD doesn't receive any of the underlying yield earned, but can be used to earn XP instead, slvlUSD holders earn a boosted yield. The less lvlUSD is staked as slvlUSD, the higher the staking APY for slvlUSD will be. As seen below the current trailing one week staking yield is 18.34% which comes from the Aave lending yield and the fact that only a fraction of lvlUSD is staked as slvlUSD.

This concept was also covered well by David from Level in the post here.

XP

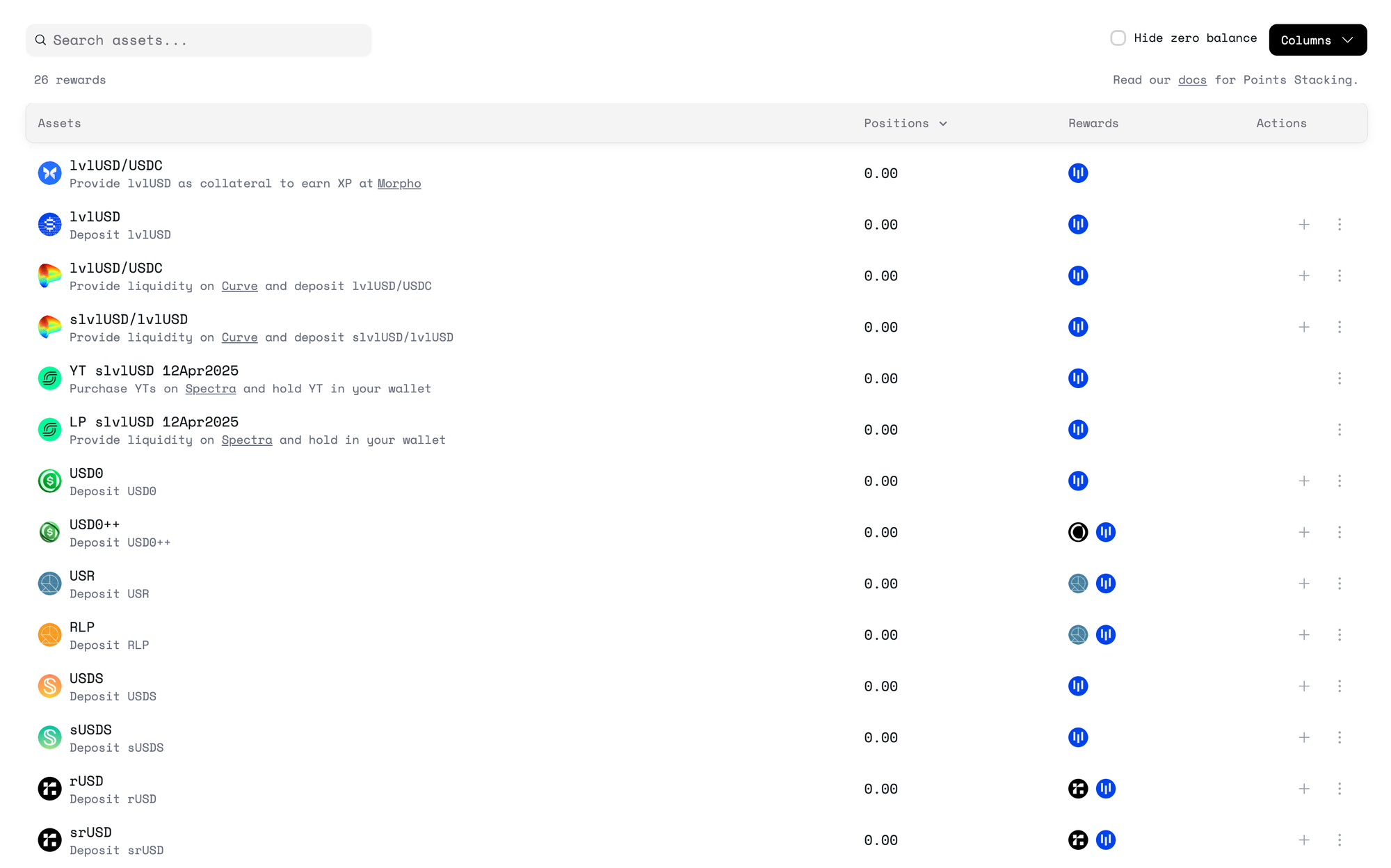

Should you choose to farm the Level points (XP) program, and forego staking yield, there are several ways of doing so:

- Depositing lvlUSD on the Level app (10x boost to XP)

- Provide liquidity in one of the various liquidity pools containing lvlUSD and another stablecoin (15-20x boost to XP)

- Depositing lvlUSD into one of the many integrated DeFi protocols (more info below)

- Depositing other assets like USR, RLP, USDS and more on the Level app.

- Want to farm level XP? Sign up Here

The base XP rate is 100 XP per hour per unit of asset. As an example, holding 1,000 worth of lvlUSD and depositing it on the Level app for a 10x boost grants 24m XP daily.

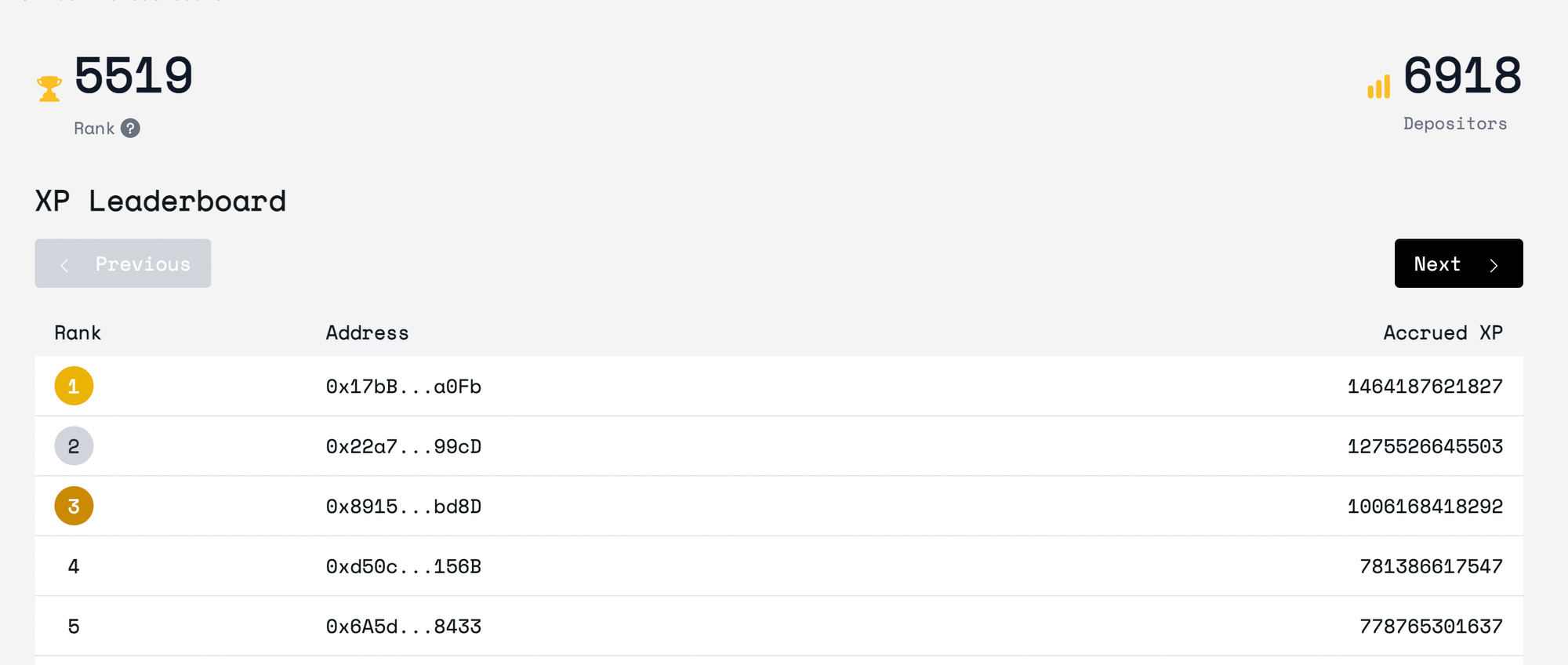

As of writing this, there are nearly 7000 depositors on Level and top enter the top 100 on the leaderboard, 35.6b XP is needed.

lvlUSD DeFi Integrations

Level has already integrated a number of partners including several DeFi protocols such as Morpho and Spectra that lets you put your lvlUSD to work and earn additional yield on top of the underlying protocol yield.

Morpho

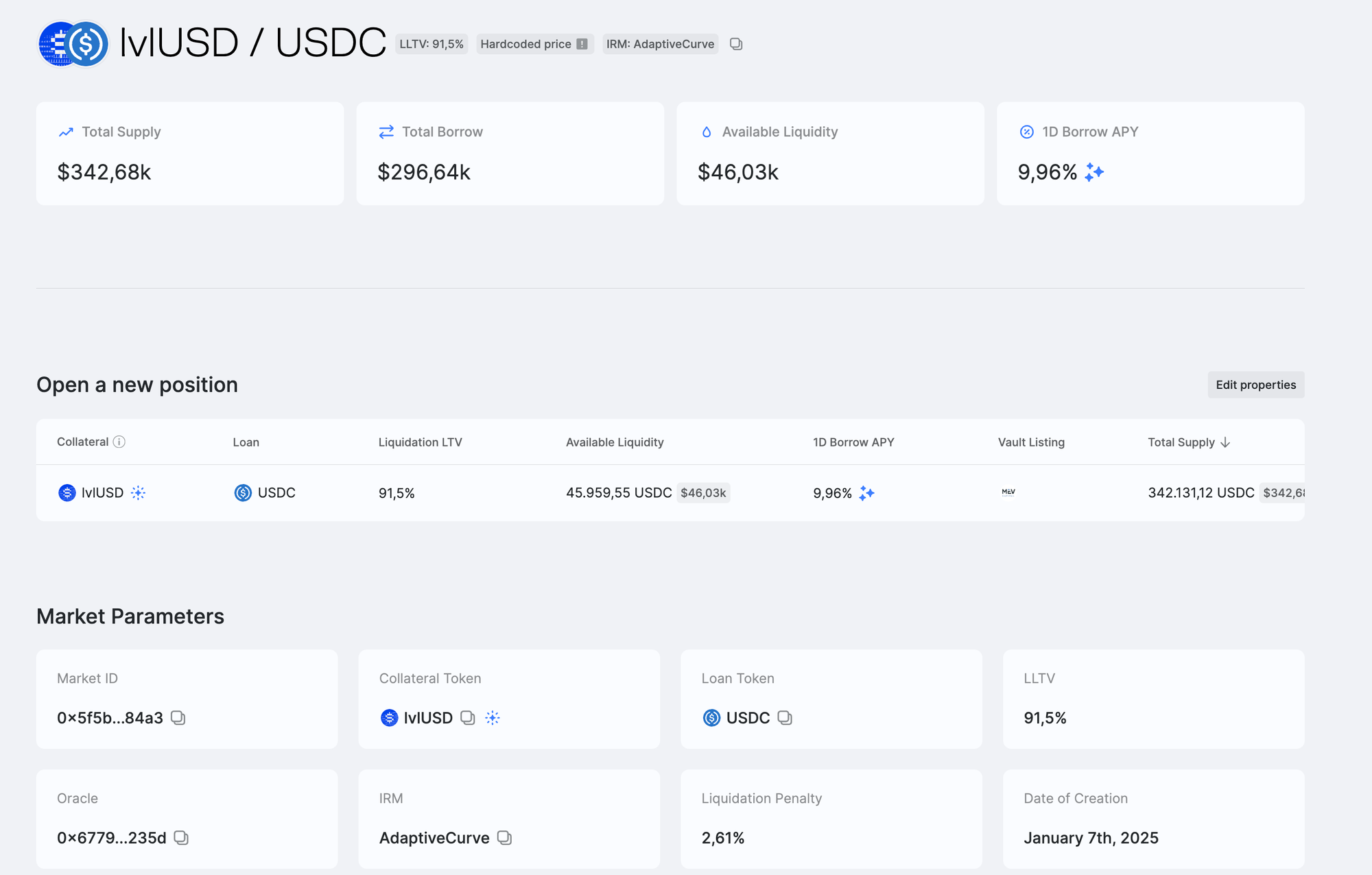

There are several ways of earning XP with lvlUSD across different DeFi protocols. For one, users can deposit lvlUSD into Morpho, a money market with isolated vaults and curators. A lvlUSD<>USDC market went live earlier in January curated by Mev Capital.

lvlUSD can be deposited as collateral which earns a 7x XP boost. On top of this, USDC can be borrowed against lvlUSD at a ~10% annualized borrow rate. To create a looped position, you can swap USDC back into lvlUSD, redeposit this as collateral to then again borrow USDC. As long as the price of lvlUSD doesn't deviate sharply from USDC, the position shouldn't be liquidated (although it is advised to keep the LTV somewhat modest to prevent against depeg risk even though it might be unlikely).

You can also read more about this collaboration in the X article from Nemi below:

— Nemi ネミ 🌖 (@Nemi_0x) January 15, 2025

Spectra

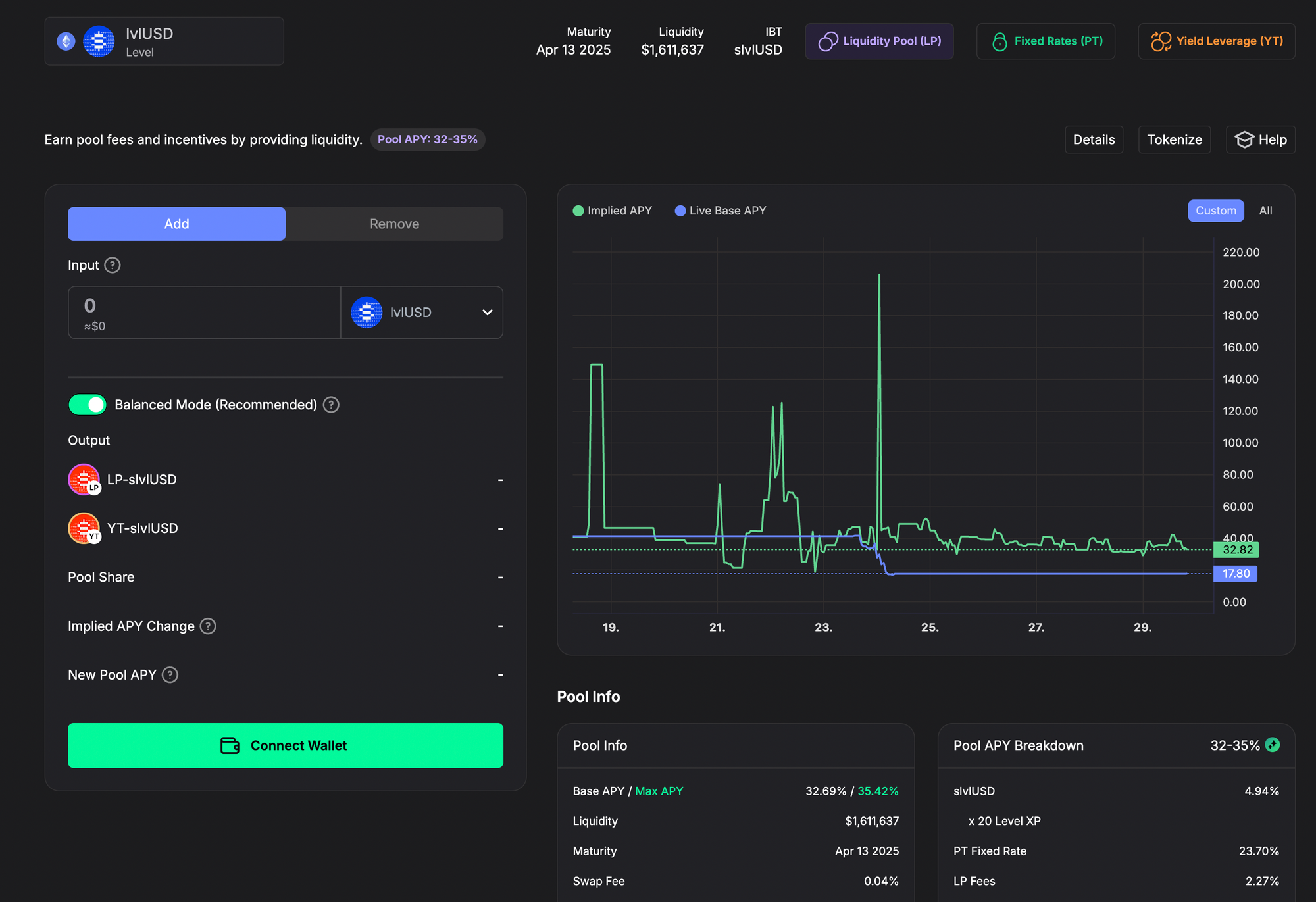

Another popular way of getting exposure to Level XP is via Spectra Finance. Spectra is a yield trading protocol similar to Pendle but with the ability to permissionlessly launch markets and pools. A slvlUSD market went live last week with expiry on April 12th. Just like on Pendle, there are three different ways to get exposure to this market:

- Fixed yield (pt-slvlUSD) which foregoes all XP but locks in a fixed yield lasting till April 12th. If you're less interested in Level XP but looking for high fixed yield on stablecoins, this might be for you.

- Increased XP exposure (yt-slvlUSD) these trend towards $0 as the market moves closer to maturity but is the most efficient way to get high exposure to Level XP. If you're bullish on Level and their XP program, this might be the strategy for you.

- LP'ing which earns XP (although less than buying YTs), fixed yield from the half of the LP that's in the pt-slvlUSD, trading fees and also $SPECTRA emissions. This yield currently sits at 35.42% APY

As a general rule of thumb: If the implied yield in the market is high, pt (fixed yield) tokens are often a good purchase and if it's low yt (leverage XP exposure) are cheaper and might be worth scooping up.

Read more about this below:

— Nemi ネミ 🌖 (@Nemi_0x) January 22, 2025

Note that the profitability of these strategy (namely Spectra YTs and the Morpho loop) depends on the value of the XP earned and it is advised to come up with a personal valuation framework for this.

Conclusion

As the overall supply of stablecoins continues to grow, investors are looking for high and reliable yield. Level offers this with their stackable yield earned on the collateral of lvlUSD and as the protocol matures and grows, lvlUSD will integrate additional yield sources. For people looking to get exposure to the Level protocol, the XP program offers many ways to do so, either by using the lvlUSD stablecoin across DeFi strategies or by depositing into one of the many farms on Level.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.