Exploring Karak: The Premier Restaking Competitor

A look under the hood at the hottest new restaking platform in the Ethereum ecosystem.

Restaking was relatively unheard of until it took the industry by storm in April 2023. Slightly more than a year later, restaking has absolutely dominated the crypto meta and proven to be the successful vertical with EigenLayer as the second largest protocol in TVL today. While alt-L1s are scrambling to find a theoretical product-market-fit for restaking on their own respective chains, there are others seeking to challenge EigenLayer’s hold over Ethereum restaking. Karak Network is one such player taking on that daunting task. We recently had a chat with the team to explore their vision.

What is Karak?

Karak was founded by ex-Coinbase employees Raouf Ben-Har and Drew Patel, who previously created RiskHarbor, a risk management marketplace for DeFi.

Karak is a restaking marketplace where builders can tap into restaked assets from validators/users to secure their services without having to rely on the significant inflationary token rewards that are the staple of Web3 business models until now.

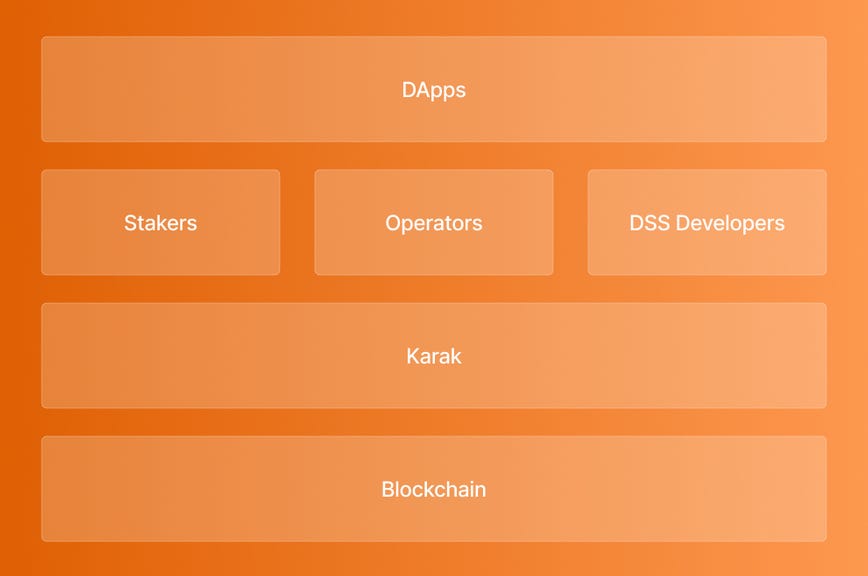

The Karak ecosystem is composed of three key players:

- Distributed Secure Services (DSS)

- Restakers

- Operators

- Distributed Secure Services: The “AVS”-equivalent of EigenLayer, DSS’s are a dapp or chain on Karak that rely on restaked assets to bootstrap the economic security of their underlying chain or business model

- Restakers: Users contributing to economic security by depositing assets into Karak. By doing so, users earn additional yield in exchange for adopting additional slashing conditions to their assets.

- Operators: Middlemen entities overseeing the technical complexity of running the DSS. Restakers will have to choose which operators to delegate their assets to

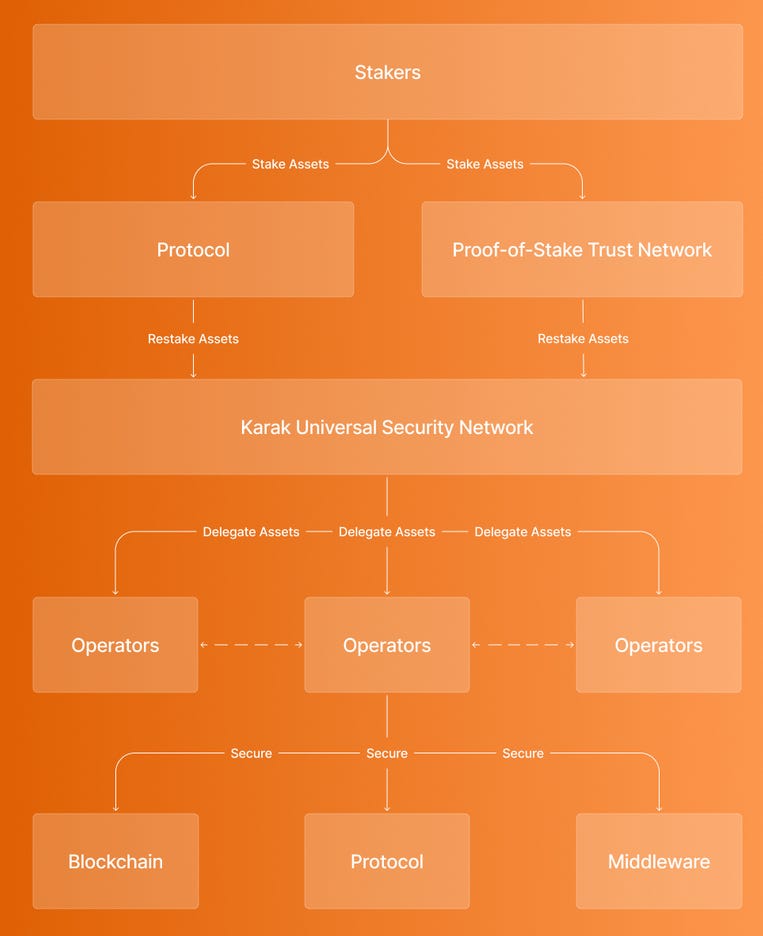

An example user flow is as follows:

- Users deposit ETH on Lido in exchange for stETH

- Users restake their stETH onto Karak

- Users delegate their assets to chosen Operators to earn an additional layer of yield at the cost of additional slashing risks

- Operators assign restaked assets to secure the respective DSS

- Should users wish to unstake, a 7 day waiting period begins. During this period, points continue to accrue.

The standard risks of restaking platforms apply here. Users should be wary of what node operators they delegate assets to. Operators are directly incentivized to validate as many DSS’s as possible so as to offer users layers upon layers of compounding yield, but that also increases the surface area of risk. When operators fail to comply with DSS’s rules, that also results in your collateral being slashed. Restaked collateral is also subject to depegging risk, particularly for less liquid LSTs, LRTs, and stablecoins. Although audits will be done, there will always exist smart contract risks.

What makes Karak different?

For restaking on EigenLayer, only ETH and its related LST/LRT derivatives are accepted. That makes sense given ETH’s proven market-tested record for securing the largest decentralized ledger today.

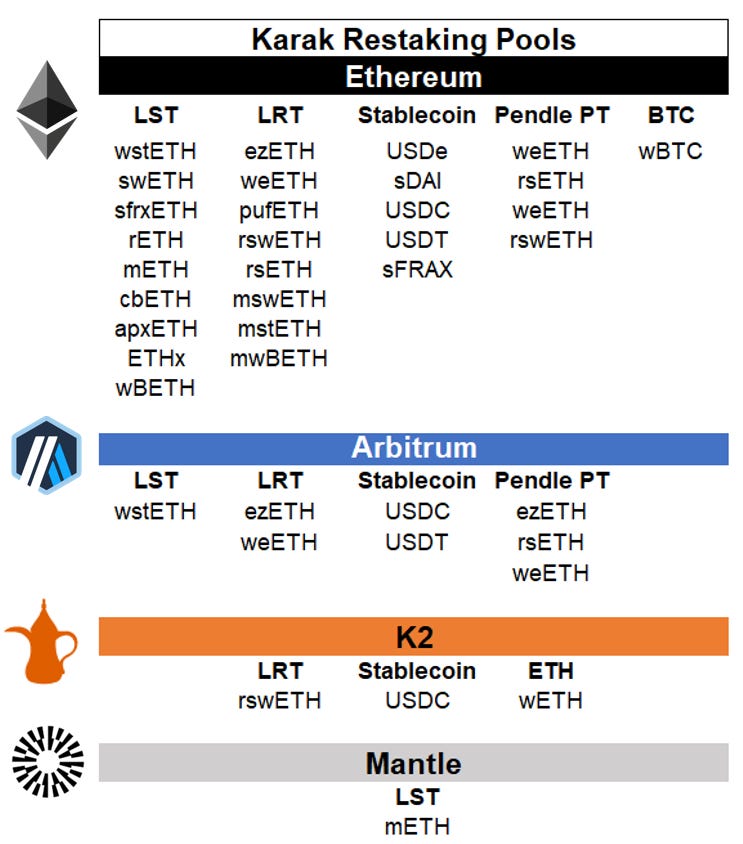

It is here where Karak immediately differentiates itself. Karak accepts a wider variety of assets for restaking: ETH, LSTs, LRTs, WBTC, stablecoins and Pendle PT (Principal Tokens). If you’re an ETH-maxi, securing a chain with anything other than ETH may strike you as questionable, as some Karak detractors have pointed out. For Karak though, this differentiator serves to diversify the risk of DSS failure:

Our fundamental belief is it’s a DSS’s prerogative to decide what assets it wants to security from. We also believe a diversified basket of assets is a lot more secure than relying on a single asset, even if it's as liquid and big as ETH. For example, stablecoins are worth hundreds of billions in market cap today and the biggest use case in crypto today. If you can leverage that to restake networks, that unlocks billions in idle capital that both users and developers can tap into to help secure a network and earn some yield as well has unlock access to a more robust and stable security model.

While EigenLayer is exclusively on Ethereum mainnet, Karak is building a universal security model with an open strategy with deployment on Ethereum, Arbitrum and Mantle. Note that multichain does not imply assets are used to secure DSS’s across different chains – restaked assets are siloed on its respective chains. DSS’s can also choose to test launch on Karak’s L2 “K2” which serves primarily as a sandboxfor DSS’s to test launches.

Despite all the restaking hype that has swept Web3, monetization around restaking is still unclear. Most believe restaking platforms can enter into a revenue-sharing agreement to monetize around onchain activity such as gas fees and MEV. In the case of EigenLayer, the team is betting on creating an internal flywheel around data availability hence the use of EigenDA to leverage restaked capital.

Given Karak’s multiasset and multichain strategy, it seems in a better position to build out a larger ecosystem that the protocol can leverage for more avenues of monetization down the road such as incubation of projects under the Karak umbrella. The team has also mentioned that their community-centric approach, novel technical architecture, as well as unique ecosystem partnerships enabling new experiences and use cases, will be key differentiators to help build network effects and universal alignment that separate it from the rest.

Karak is currently in the private access phase where we’re bootstrapping security for different assets and chains. In the coming weeks, we’ll be unveiling the first core DSS on Karak, Karak V2 which introduces a novel technical architecture as well as native restaking, and begin onboarding dozens of ecosystem projects and operators who are eagerly on standby. We’ll also be sharing some of the new product areas that we’re excited about and unique DSS’s that will help to bring universal security to everyone.

Finally, Karak is offering a suite of tools and a premier SDK that enable developers to easily iterate and deploy a DSS on its network. The SDK is slated to be ready by June 2024.

Karak market traction

As of June, Karak has amassed $1B in TVL, all without native restaking enabled (i.e., staking Beacon chain ETH) and all organically, making it the fastest restaking protocol to reach a billion dollars in security.

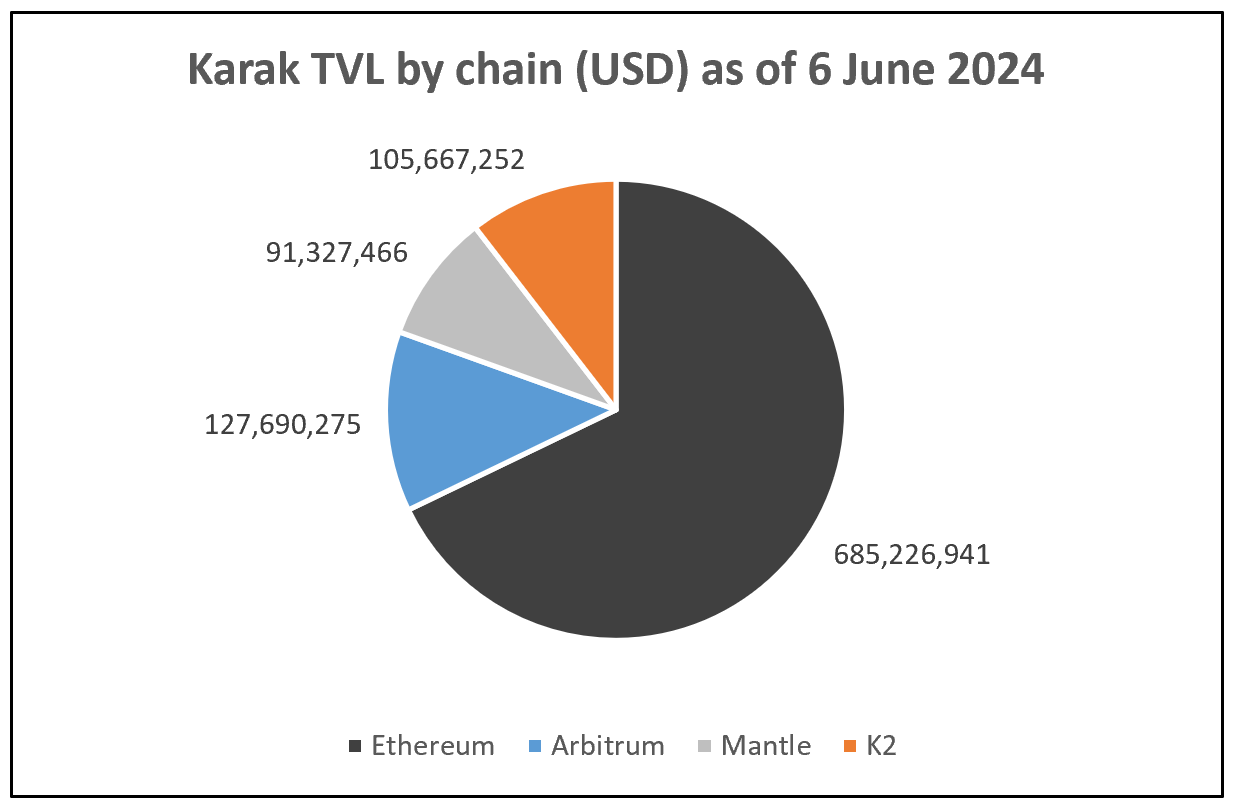

Despite its multichain strategy, Karak’s TVL has formed the largest share on Ethereum.

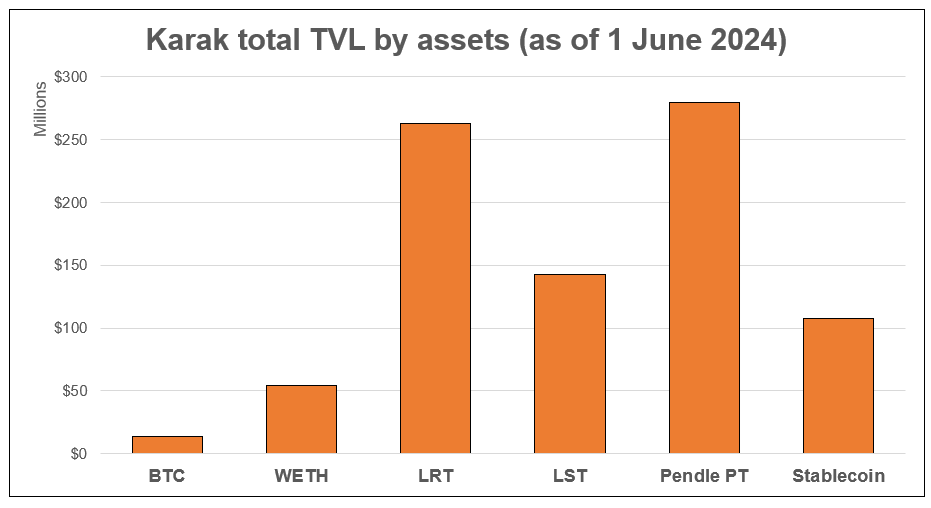

Interestingly, Pendle PT tokens make up the bulk of restaked assets at ~$280M. For context, Pendle is a yield-tokenization dapp that splits yield bearing tokens into a Principal Token (PT) or Yield Token (YT) with a specified maturity date. PT tokens let users have isolated fixed-yield exposure.

Given that PT tokens eventually expire and assets on Karak will be used to secure a hypothetical chain’s security, this brings into question if DSS’s may need to perform a more hands-on level of chain security monitoring at the expiry dates of these PT tokens. This seems to run contrary to the point of restaking i.e., allowing builders to take a relatively hands-off approach to chain security but I suspect it can be easily hedged against by capping exposure or implementing some form of native integration with Pendle that allows yield assets to be automatically transferred across pools.

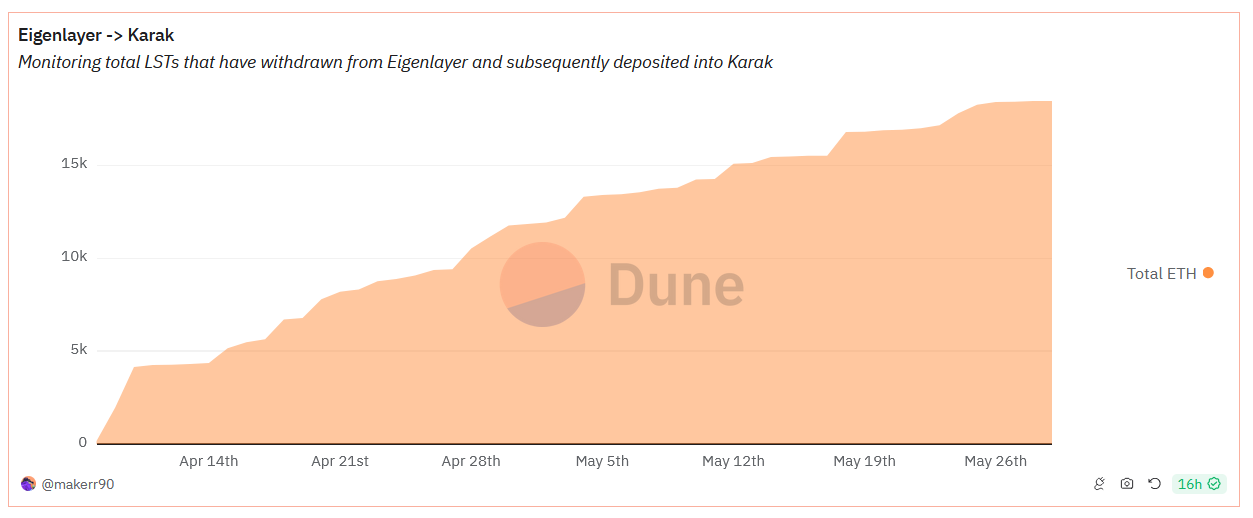

LRTs and LSTs have also amassed a significant share of deposited assets on Karak. Together, they make up $405M, having attracted ~18.5K ETH ($70.3M) from EigenLayer depositors in the last two months

Finally, stablecoins pulled in third at just above ~$107M, with wBTC forming the smallest share of $13.5M. If restakers are concerned about the “best” economic security, it is then somewhat surprising since Bitcoin and stablecoins are some of the most battle-tested tokens alongside ETH. One might argue that “wrapped” Bitcoin and stablecoins carry a third-party custodian risk: BitGo in the case of WBTC and Tether/Circle/Maker/Frax in the case of stablecoins. Yet this is no different from the same risks that the slew of approved LRT tokens on EigenLayer similarly carry.

Rewards and Incentives

Karak is also running a points program. Users earn XP by restaking assets, and earn more by referring users or being an active community member in Discord by creating content/memes (feel free to use our referral code: qgQ4p).

As of the past week, Karak has launched three Pendle pools for leveraged yield tokenization:

Pendle x @Karak_Network: Part 1@ethena_labs USDe (Karak) is now LIVE on Pendle!

— Pendle (@pendle_fi) May 29, 2024

Get ready to juice up your Karak yields with the Pendle special:

🍊 2x Karak XP

🍊 20x Sats/day

But hurry up - there's a limited cap of 100M on Karak initially for this pool pic.twitter.com/pytUKbKINU

Roadmap ahead

Led by a bold strategy focused on bringing universal security and alignment across every asset and every chain , Karak’s growth in TVL has been nothing short of impressive. In the near-term, users can expect a few key milestones: the release of the DSS SDK next month and the protocol’s V2 launch. In speaking with the team, more Ethereum L2s and even possibly non-EVM chains like Solana are being considered in the roadmap, but don’t get your hopes up.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.