Exploring EigenLayer, Etherfi and Renzo S2 Airdrops

Everything you need to know on aping into EigenLayer, Renzo and EtherFi S2

As we head into a bull market trap cooldown, one thing’s for certain: liquid restaking (LRT) remains hot on the Ethereum agenda.

What kind of return should you expect on LRT airdrop farms and is it even worthwhile?

Today’s article breaks down the various investment strategies of EigenLayer, Renzo and EtherFi Season 2 airdrop campaigns – completely free-of-charge. If you liked this article, do subscribe to On Chain Times and support the publication!

Liquid Restaking Primer

Before we get into the calculations, first a quick liquid restaking primer.

EigenLayer is a restaking protocol that builds upon the successful product-market-fit of the liquid staking dapp Lido. Ethereum liquid staking emerged primarily as a result of capital illiquidity from ETH being locked on the Ethereum Beacon Chain until the network upgrade in 2023 known as the Shapella hardfork. Lido allowed ETH holders to earn a compounding yield while simultaneously retaining liquidity of locked ETH via its stETH (staked ETH) derivative.

stETH has proliferated DeFi as a collateral asset, allowing users to take out loans on Aave or to be used as liquidity provision on Uniswap – all while helping to maintain the economic security of Ethereum.

But If Lido’s stETH can be used as collateral in DeFi, what if we could also stake it as collateral for validating another chain’s proof-of-stake network consensus? That bold idea would accelerate the go-to-market strategies of aspiring chains by bypassing countless hours and dollars previously spent on bootstrapping one’s own native token to be used as chain collateral – this is where EigenLayer comes in.

EigenLayer runs a platform of “operators” that directs your restaked stETH collateral to such projects (actively validated services/AVS’s) that don’t want to go through the tedious token bootstrapping process. In return, restakers can earn additional layers of yield on top of Lido yield, subject to slashing conditions.

Since the start of 2024, EigenLayer’s TVL has skyrocketed from 1.3B to 15B TVL. The early success of the restaking meta has opened the door to a slew of LRT protocols such as EtherFi, Renzo, Swell and more building on top of EigenLayer that provide the service of simplifying restaking for users. In sum, here’s a graphical representation:

Estimating Airdrop Returns

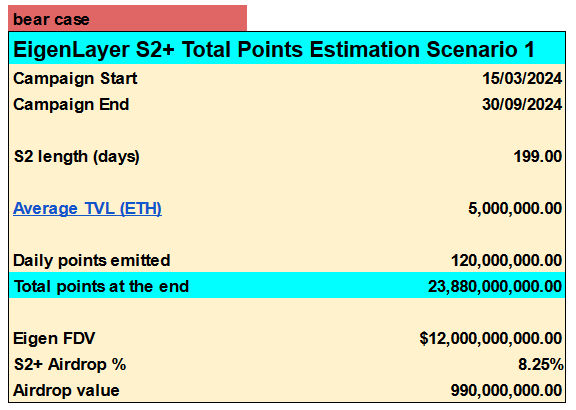

To begin calculating your returns on various LRT airdrop farms starts with the all-important question of how many total EigenLayer points will be emitted by the end of Season 2.

Here, we take a conservative assumption that the average TVL by the end of EigenLayer Season 2 stays stagnant at current levels of 5M ETH. Since EigenLayer emits 1 point per ETH per hour, Season 2 concludes with ~23.9B points emitted in total.

Next, we make an estimation of the total EIGEN airdrop value. Though EIGEN was recently airdropped, the token remains non-transferable. Based on the perps futures market on Aevo, we estimate a projected FDV of EIGEN at ~12B FDV. As such we can derive that the dollar value of 1 EigenLayer point = $0.041 (see next table).

Before we dive into the actual calculations, there are three things of note here.

- Firstly, while we know that there is another 10% airdrop allocation still up for grabs, we do not know if that allocation is exclusively for Season 2 (i.e. 15th March - 30th September). As such, there is a chance that the remaining 10% allocation may be split into further campaigns and therefore have named the table as “Season 2+” rather than just “Season 2”.

- Second, delegating your EIGEN airdrops could very well have an impact on your Season 2+ airdrops, but we’ve omitted this from our calculations.

EigenLayer

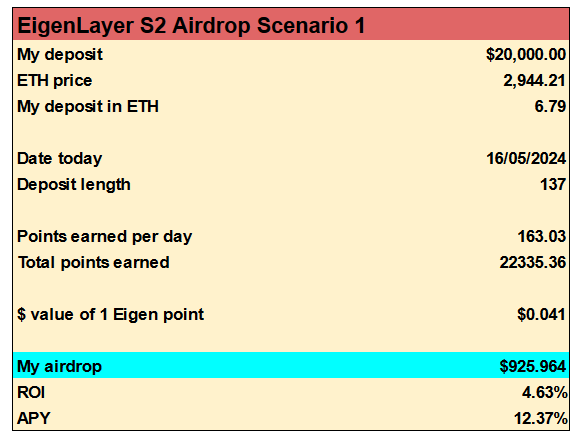

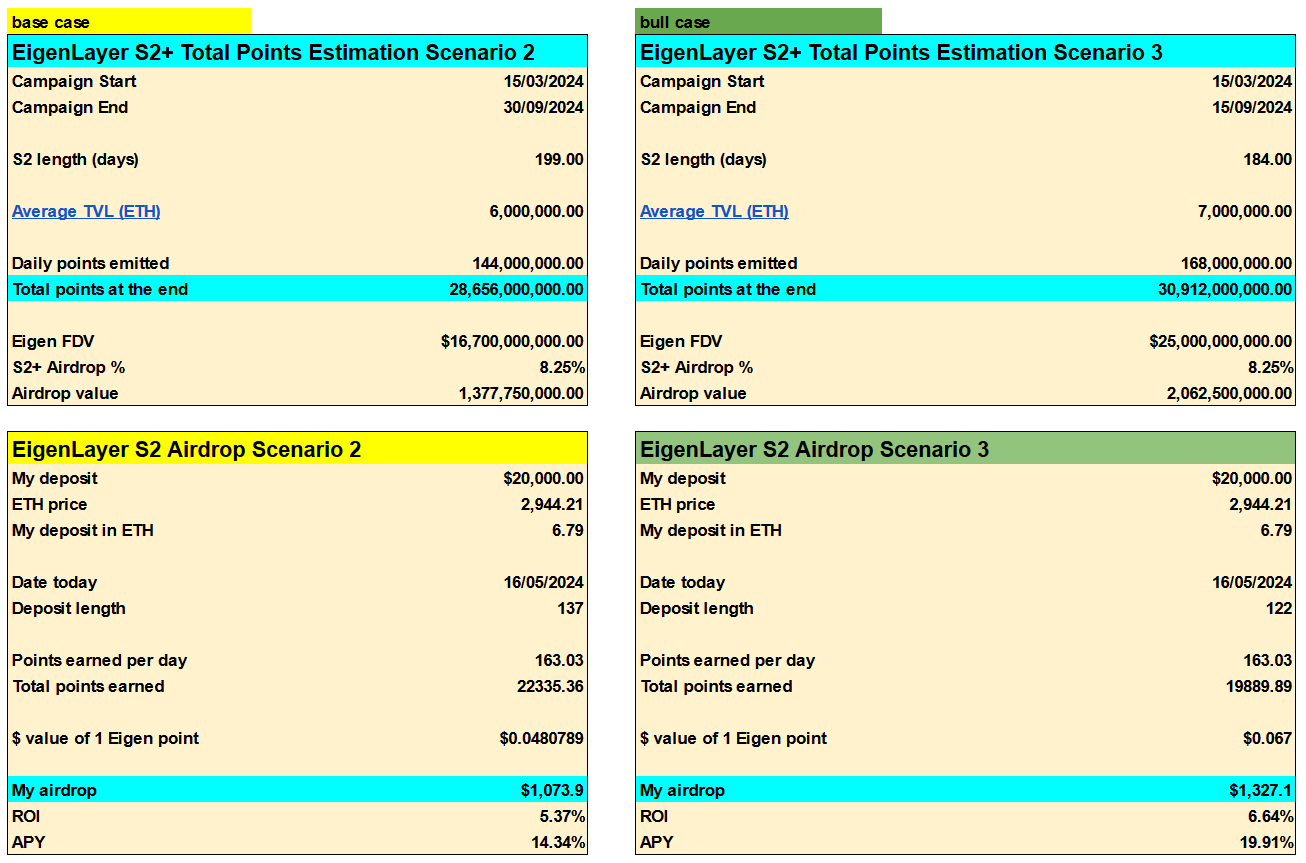

Let’s first consider naked staking into EigenLayer. A deposit of $20,000 (~6.6 ETH) on today’s date to the end of September would return an airdrop value of $1,098 at an APY of ~15%. That’s pretty decent, but not exactly the eye-popping gains that we’ll see with Pendle YT strategies on Renzo and EtherFi later.

Are we too bearish on EigenLayer? In the following set of tables, we’ve introduced a base and bull case with average TVL and total points emitted tweaked to be higher. As you can see, this marginally increases the returns on your airdrop from 12% APY (bear) to 14% (base case) and 20% (bull case) accordingly. If you’d like to tweak your own assumptions, you can find the spreadsheet attached at the end of this article.

Renzo

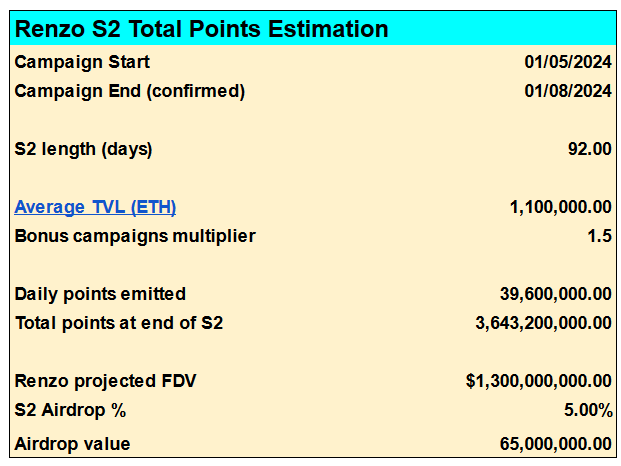

Renzo’s Season 2 campaign runs for three months. We assume that the average TVL for Season 2 will be ~1.1M ETH (currently 1.03M ETH). Since Renzo emits one point per hour per ETH, the total cumulative points comes up to 3.6M. Next, we estimate an FDV of 1.3B (currently 1.1B), bringing the total airdrop value to $65M.

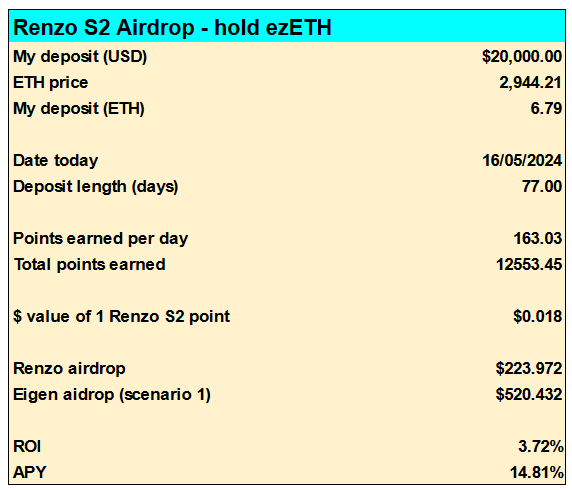

The lowest risk strategy to farm Renzo is to simply deposit ETH and hold its ezETH derivative. Note that LRT farms also accrue EigenLayer points on top of the points you earn from the individual LRT protocol, which we’ve accounted for below. Therefore, with a deposit of $20,000 starting from today, this strategy nets you a total airdrop of $224 REZ + $520 in EIGEN.

The following calculations for Renzo and EtherFi assumes the bear case scenario of EIGEN FDV $12M and TVL stays stagnant at 5M ETH.

What about a higher risk Pendle YT strategy?

Pendle is a yield-trading dapp that splits up a yield bearing token into a Principal Token (PT) or Yield Token (YT). PT lets users have isolated fixed-yield exposure, and YT allows isolated yield exposure. Because YT excludes the principal, the value of YT will trend to zero towards the maturity date of the YT Token.

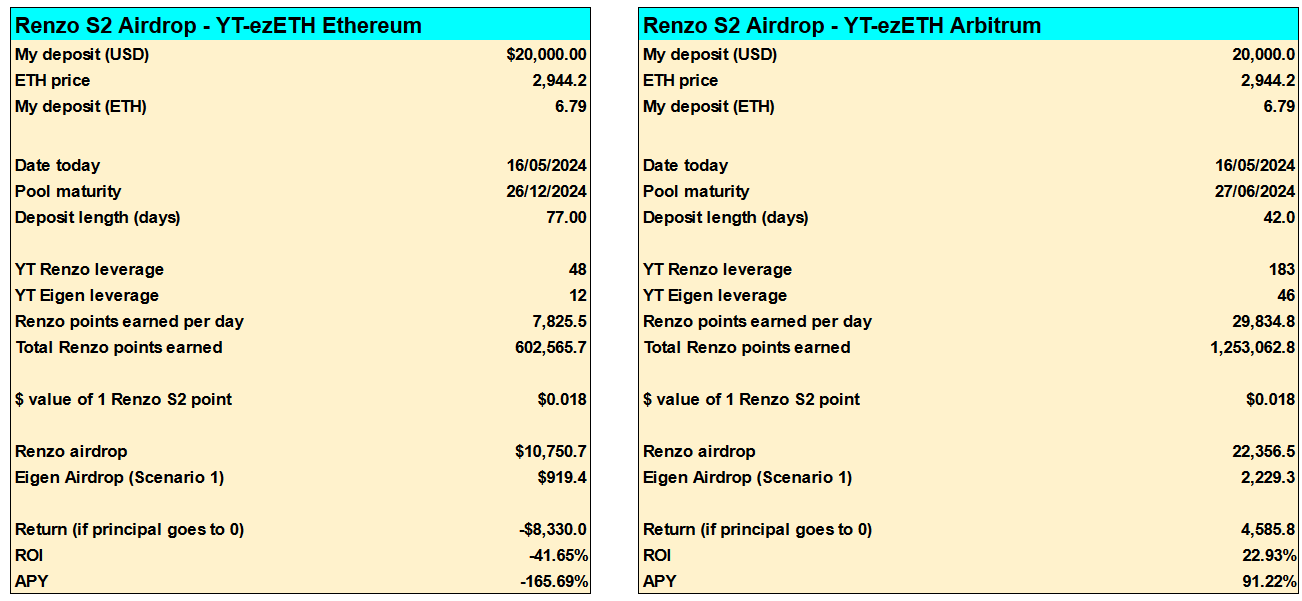

Currently, buying Renzo’s ezETH YT on the Ethereum Pendle pool (26 December 2024 maturity) would actually net you a negative return of -$8,330 on an initial capital of $20,000.

Why is that? The reason is largely due to the less attractive current market conditions of leverage in this particular Pendle pool. Leverage is affected by demand and supply for YT tokens, and YT tokens tend to have much higher leverage when the pool is nearing its maturity date. This is due to many traders likely dumping their YT tokens (time-preference!) as principal trends to zero. Since this particular YT pool has a far-off maturity date of 26 December 2024, the leverage is not financially attractive and is therefore not a profitable trade.

If you’d like to stay on Ethereum, an alternative to consider is a recently opened Ethereum ezETH YT pool with a September maturity date here.

On Pendle’s Arbitrum market however, market leverage is much higher (183) since its maturity date is in 45 days. A deposit of $20,000 today would therefore net a return of $4,585 at an APY of 91%.

In short, Pendle trading strategies depend crucially on leverage levels. Leverage is ever changing based on the underlying demand and supply of YT markets, but note that the leverage levels by which you buy in at does not change and lasts until the maturity date.

EtherFi

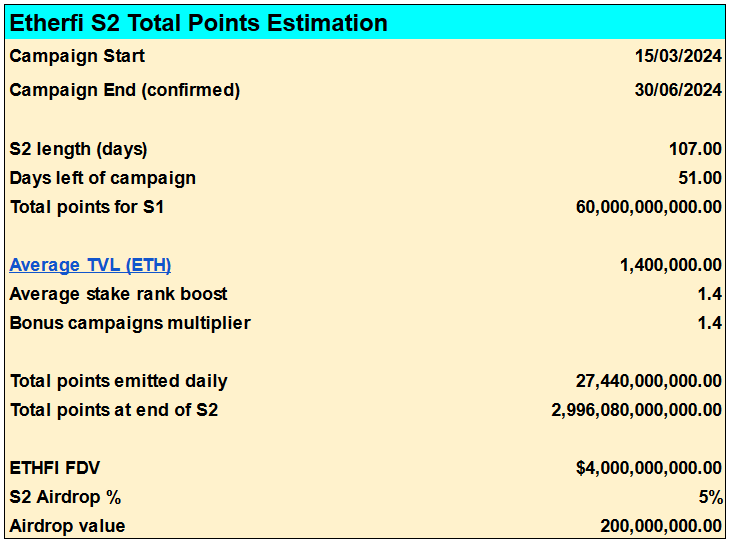

Finally, we come to EtherFi. Calculating EtherFi returns is especially tricky due to its StakeRank system which incentivizes a longer lock-up (users advance 1 rank level every 100 hours of staking their ETH). For simplicity’s sake, we’ve assumed an average StankRank boost of 1.4x.

Additionally, EtherFi points are emitted across its “Liquid” product and dozens of different dapps across DeFi. For simplicity, we have assumed an average 1.4x multiplier across all these DeFi pools.

The assumed TVL is 1.4M ETH and an FDV of 4B. At a points emission rate of 10,000 per ETH daily, total points at the end of Season 2 comes to ~3T.

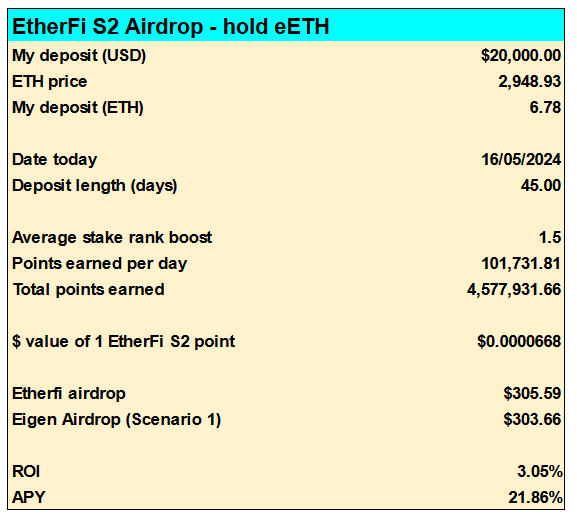

Now, let’s look at the first strategy of staking ETH and holding EtherFi’s eETH derivative. This low risk strategy nets a return of $305 in ETHFI and $303 in EIGEN, an approximate APY of 22%.

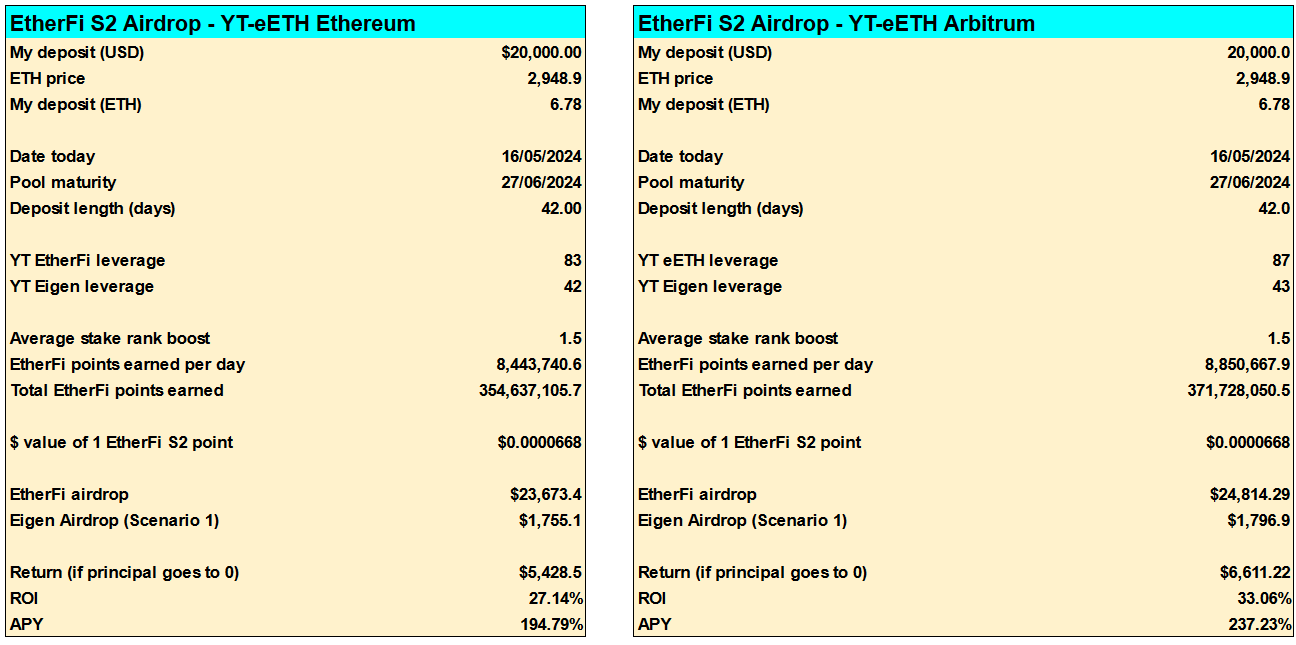

Deploying a higher risk Pendle YT strategy on eETH pools on both Ethereum and Arbitrum nets a more profitable ROI of ~27-33%. As expected with higher leverage, the returns are better than the Renzo YT-eETH Ethereum pool. This is likely the best trade strategy right now. Risk-averse investors can opt for PT eETH on that same pool at a fixed yield of ~22% APY, but this is a far cry from the ~200% APYs (estimated) on YT strategies.

Still haven’t signed up to Etherfi or Renzo? You can do so here👇

Concluding Thoughts

As you can see, there are numerous assumptions going into these calculations. Feeling more bullish than us and want to tweak your own assumptions?

📜 ➡️ We’ve made the spreadsheets available to all subscribers of On Chain Times so you can fork and tinker it yourself. How to access the spreadsheet if you’re a subscriber? Head to our Substack chat where the link is posted:

substack.com/chat/1589185

From there you can access the Notion page which includes the sheet. If you’re reading this somewhere other than Substack, you need to create an account and subscribe to On Chain Times to access the chat.

If you found this useful, do share this article or follow On Chain Times on Ghost.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.