Delta Neutral JLP Vault - Vectis Finance

Disclaimer

This report is made in collaboration with Vectis Finance and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

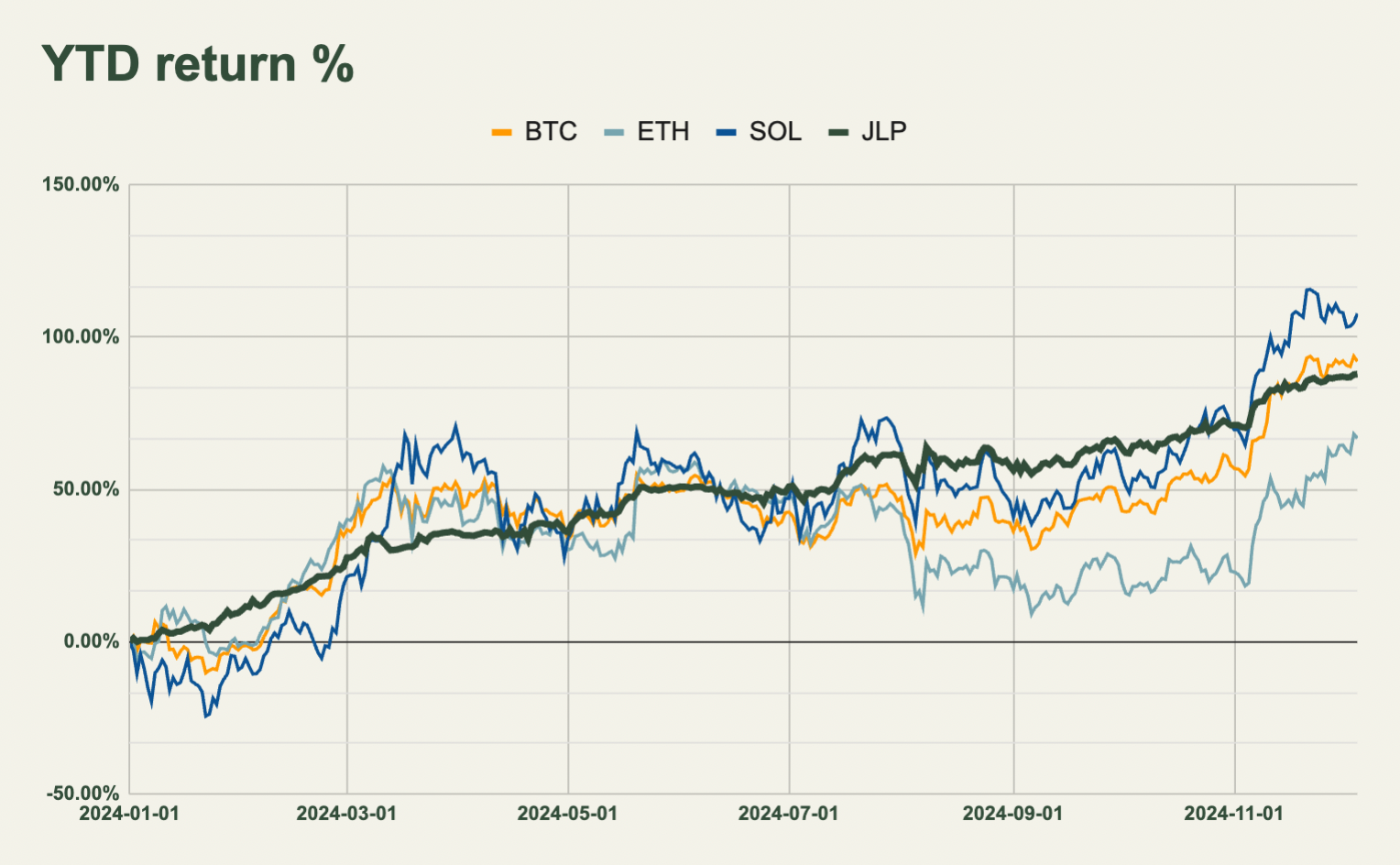

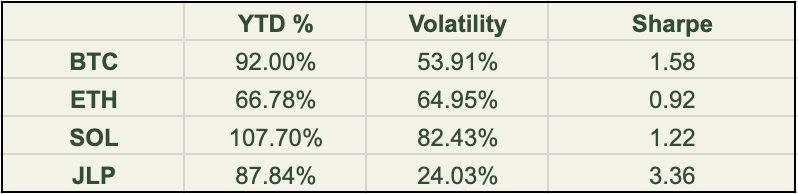

JLP is up nearly 88% year to date. That's a similar performance to SOL and BTC this year, but with one-third of the volatility. From a volatility-adjusted perspective, JLP has massively outperformed nearly all assets this year with a Sharpe ratio of over 3 (versus 1.58 for BTC and 0.92 for SOL).

Vectis Finance recently introduced the JLP Navigator Vault which offers delta neutral exposure to JLP while earning additional fees from mint/redeem arbitrage and farming funding rates. Today's report will cover the design of JLP, its recent performance and finally the JLP Navigator Vault.

JLP

JLP from the Jupiter exchange has been covered on more than a few occasions at On Chain Times. The core design and mechanics were first uncovered in the post below:

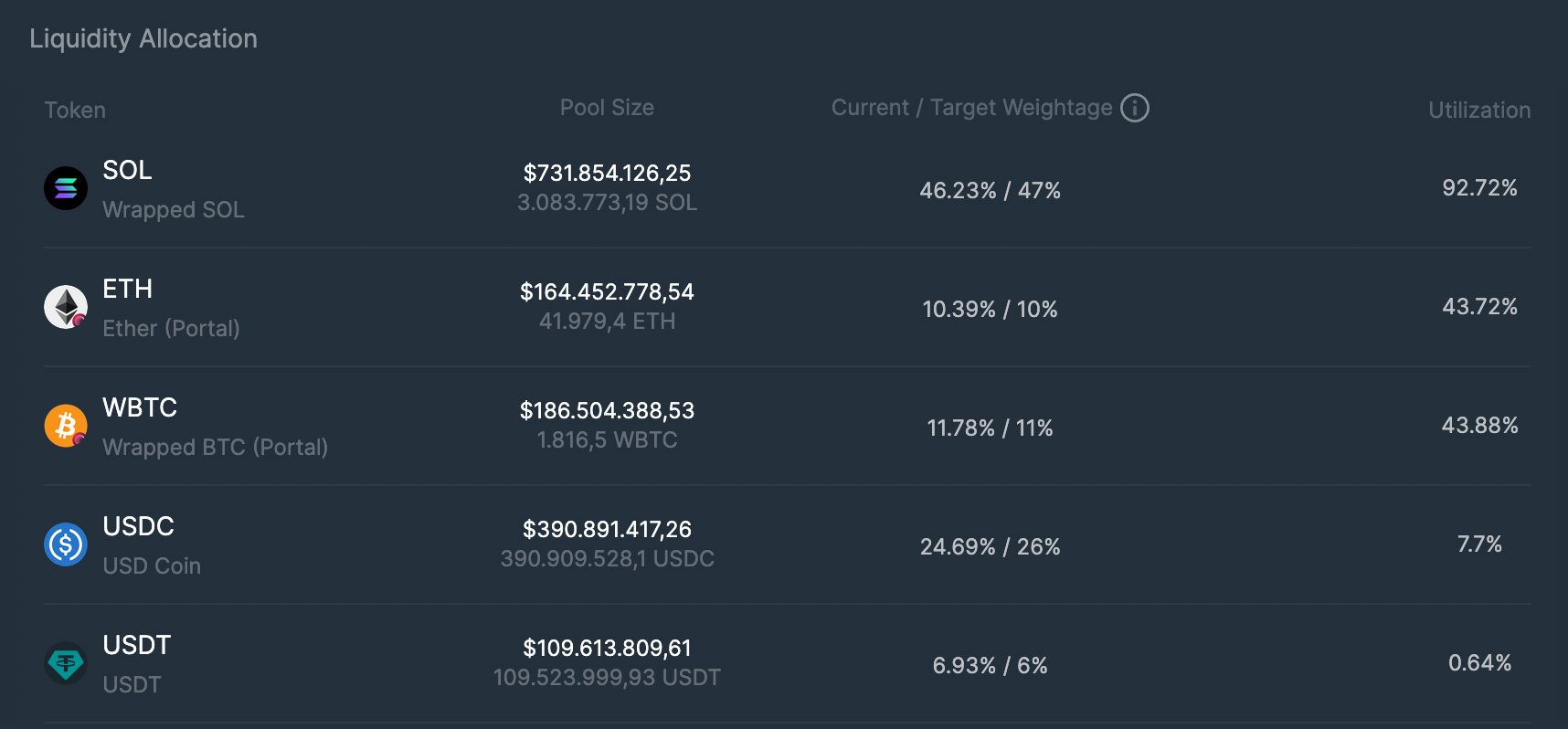

In any case, here's a quick overview. The Jupiter protocol offers perpetual futures trading on SOL, ETH and WBTC with up 100x-150x leverage. Rather than having a classic orderbook design, Jupiter perps are very similar to perp exchanges like GMX namely as liquidity for traders is supplied via an AMM (JLP). JLP is essentially an index fund or a tokenized basket of assets consisting of the following:

Because of this design, users purchasing JLP obtain exposure to the underlying assets making up the JLP basket. Buying $1 of JLP currently gets you exposure to $0.46 of SOL, $0.1 ETH, $0.11 WBTC and $0.31 stablecoins. As JLP consists of 30% stablecoins, it is usually less volatile than SOL, ETH or BTC.

The target weights are set by the team and depend on the demand for the respective assets making up JLP. If an asset is above the target weight, e.g. WBTC as seen above, there will be additional fees to mint JLP with WBTC whereas minting JLP with SOL will receive a fee discount as it is current under the target weight.

Holding JLP is beneficial as the pool receive 75% of all fees generated by traders. Specifically, the following fees are captured by JLP holders:

Interest fees

Position fees

Liquidation fees

JLP Spot trading fees

JLP Mint/Redeem fees

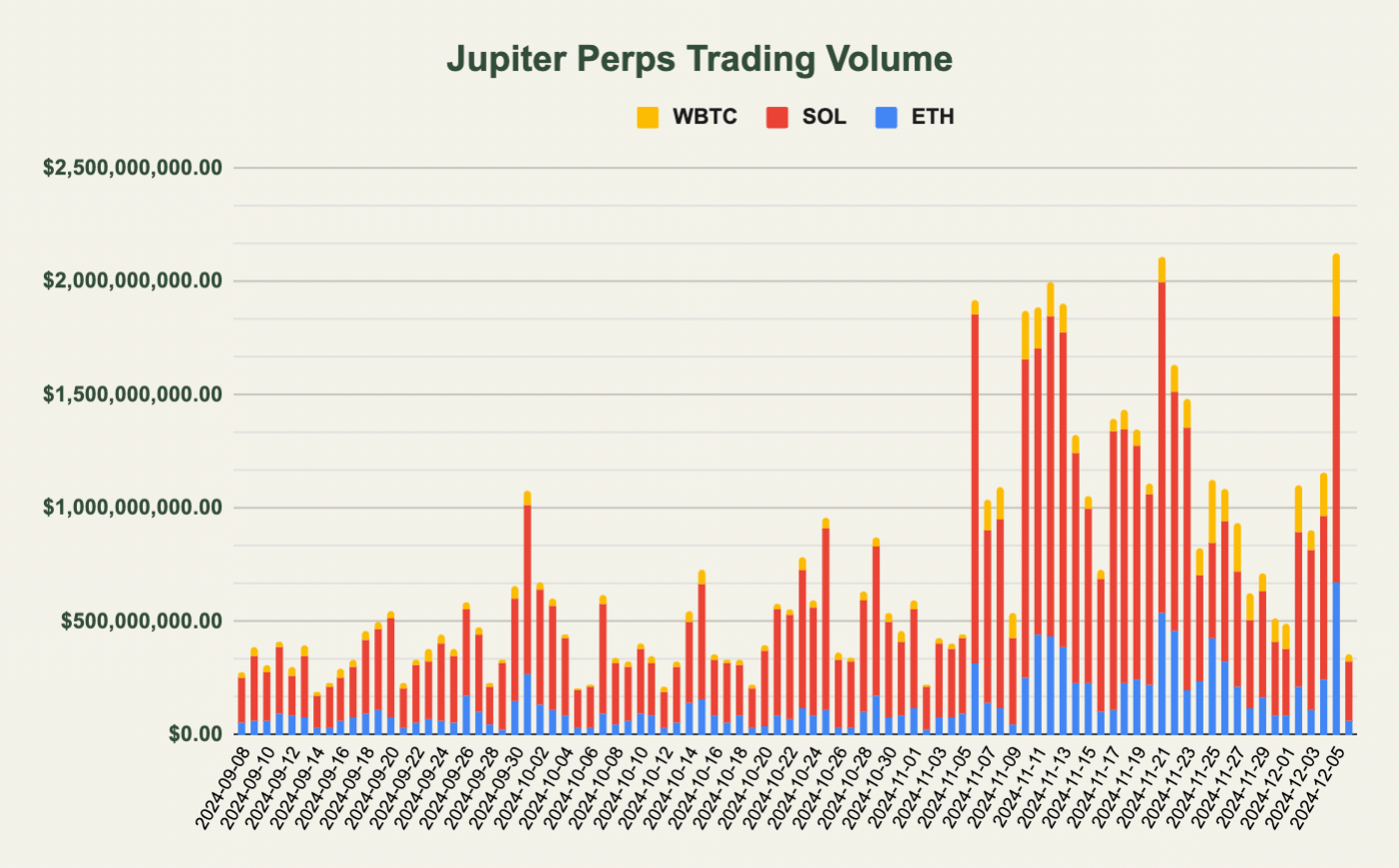

As seen below, trading volume has increased drastically recently with multiple days around $2b. This has caused fees earned by JLP holders and therefore the JLP APY to increase a lot, currently sitting at 60-100% APY on most days.

The fees received by JLP are not to be claimed but will be reflected in the price of JLP. The price of JLP therefore depends on the price of the underlying tokens, SOL, ETH, BTC, trader PnL and fees earned. Keep in mind that the APY displayed on the Jupiter website only portrays the fees paid by traders and not the other aspects impacting the price (SOL/ETH/BTC exposure and trader PnL).

For a deeper guide into JLP, take a look at the docs.

JLP Performance

As seen from the graph below, the JLP chart is as close to 'up and to the right' as a chart can be. With nearly no severe drawdowns, JLP is up 87.84% year to date.

In comparison, SOL is up 107.7% on the year, BTC 92% and ETH 66.78%. For an asset that consists of 30% stablecoins, that's an impressive return relative to the industry majors. The reason JLP is able to perform on a similar level (or even outperform) while having substantially fewer drawdowns is due to the large amount of fees paid by traders to the pool throughout the year.

As seen from the table below, when considering returns from a volatility-adjusted perspective (Sharpe ratio), JLP has been a far superior asset year to date with a Sharpe of 3.36.

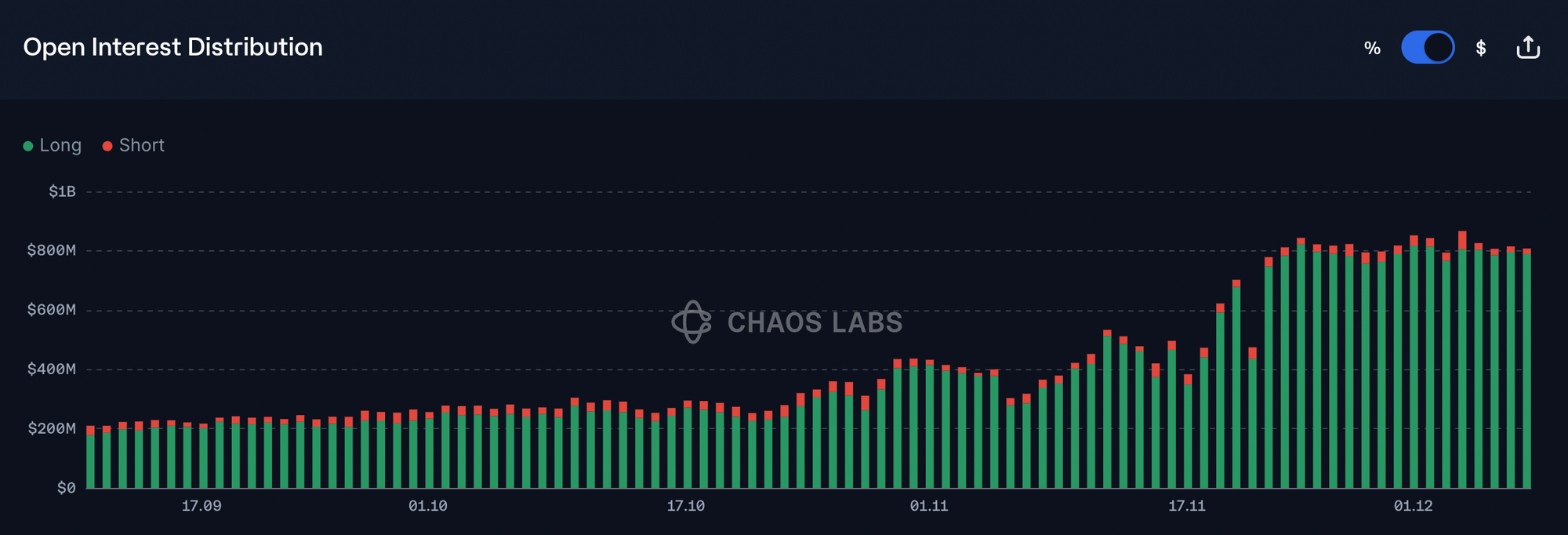

On Jupiter, nearly all traders/open interest is long (95-97% on average) as seen below. Most of this OI is further in SOL which means that trader performance is highly correlated with the price of SOL.

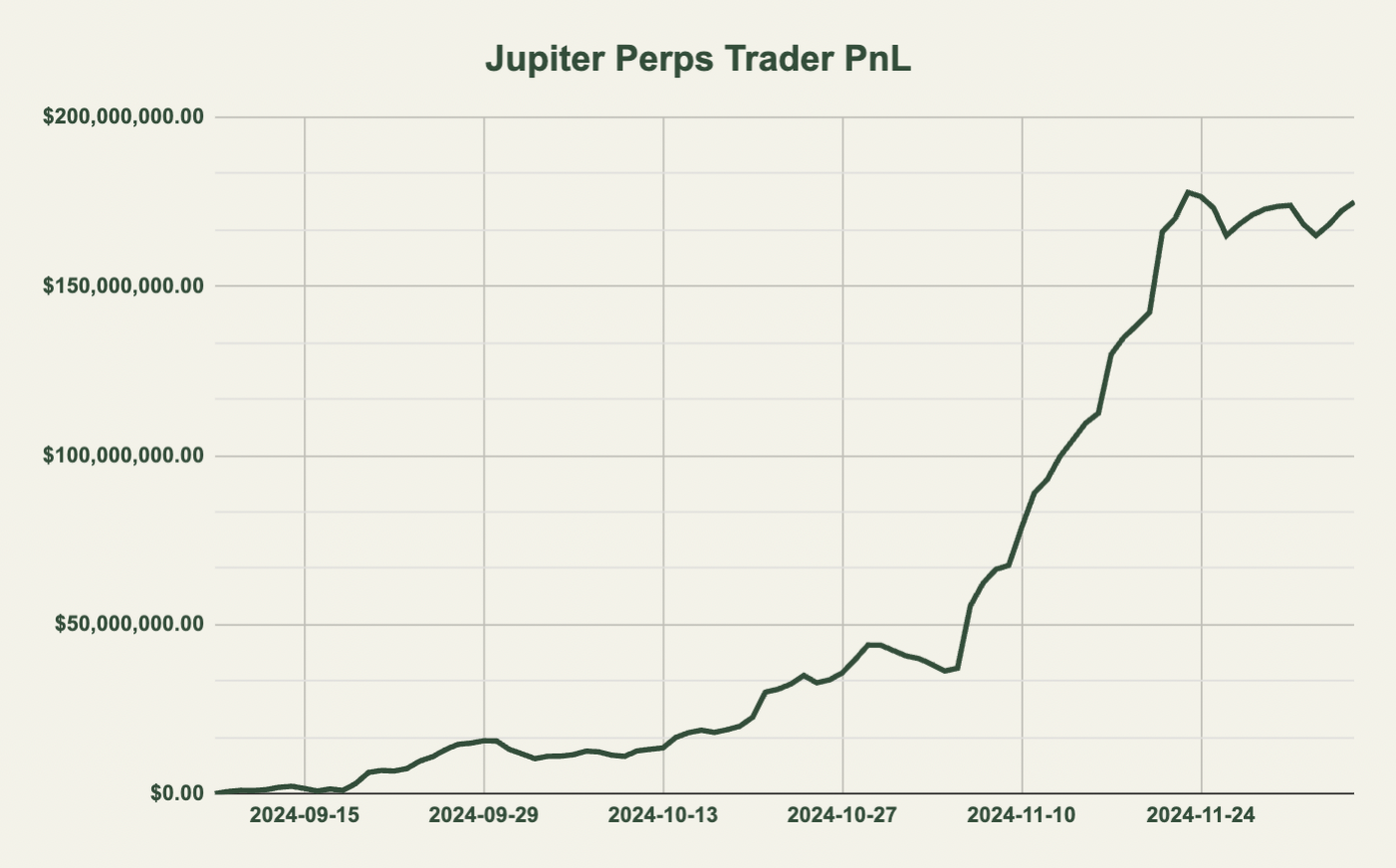

As the recent environment has been incredibly bullish, and SOL has increased significantly in price, Jupiter trader PnL has increased as well. This consequently has a negative effect on the price of JLP as profits are paid by the JLP pool. JLP therefore usually does exceptionally well (relative to SOL) in markets with high volatility both to the upside and downside as a lot of fees are captured but PnL stays more flat than it has recently.

Recently, fees have been very high but so has trader PnL resulting in a more dampened JLP performance relative to simply holding SOL (although from a volatility-adjusted perspective still outperforms).

But what if it was possible to remove/hedge price exposure and trader PnL from JLP to isolate the high fees earned by the strategy?

This is possible with Vectis Finance:

Delta Neutral JLP Vault on Vectis Finance

Vectis Finance offers exposure to the JLP yield without any exposure to underlying price movement or trader PnL. To understand how this works, let's take a look at the design of JLP once more.

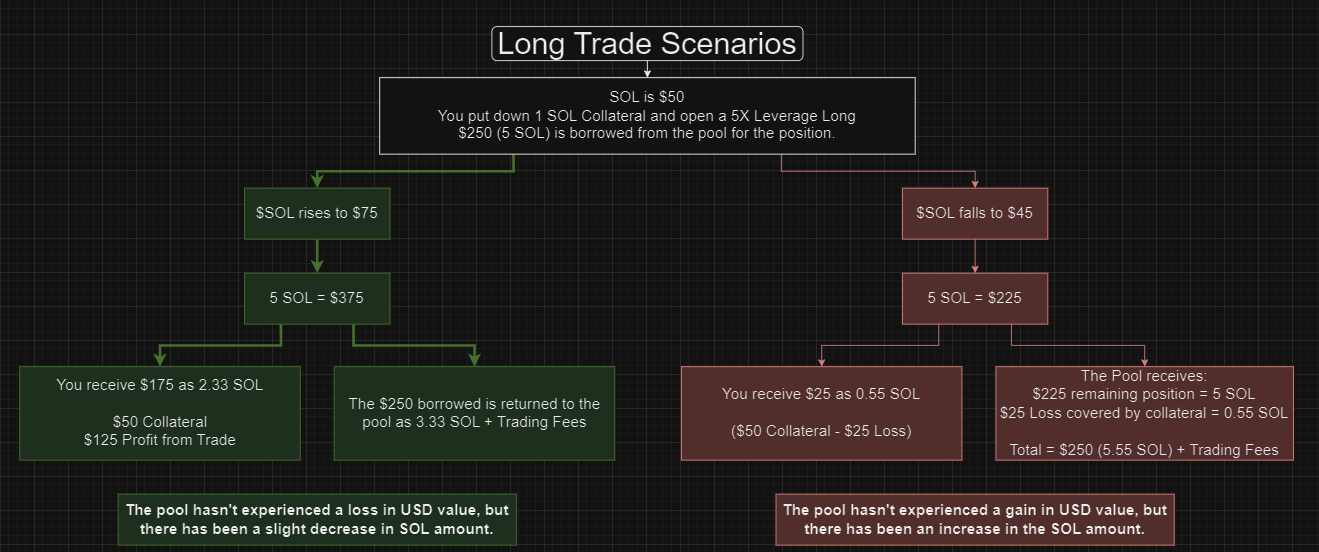

On traditional orderbook exchanges, traders borrow USD to go long or short an asset. When the position is closed, the trader will repay the USD debt + fees and gain/lose $ based on the performance of the asset traded. On Jupiter, when a trader longs an asset, like SOL, that specific asset, rather than USD, is borrowed from the JLP pool. Should a trader make a profit, the JLP pool will lose that amount of SOL but JLP will stay flat in USD terms as SOL has increased an equivalent amount in price. If a trader loses on a SOL long because SOL depreciates in value, the JLP pool will gain SOL but stay flat in USD terms. This is also explained in the image below.

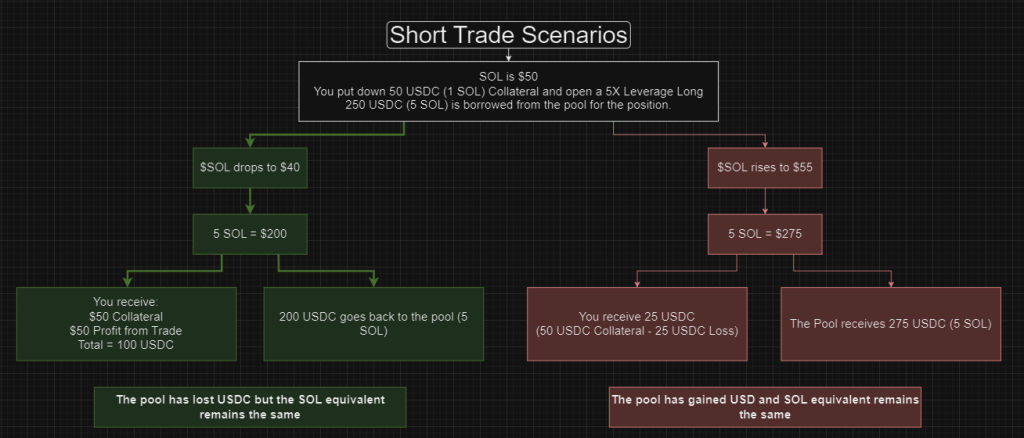

Conversely, traders shorting assets on Jupiter perps borrow USD. If a trader is profitable, JLP will experience a loss in USD terms but not in the amount of the token that is shorted:

For more details on this, check out the docs.

Vectis Finance

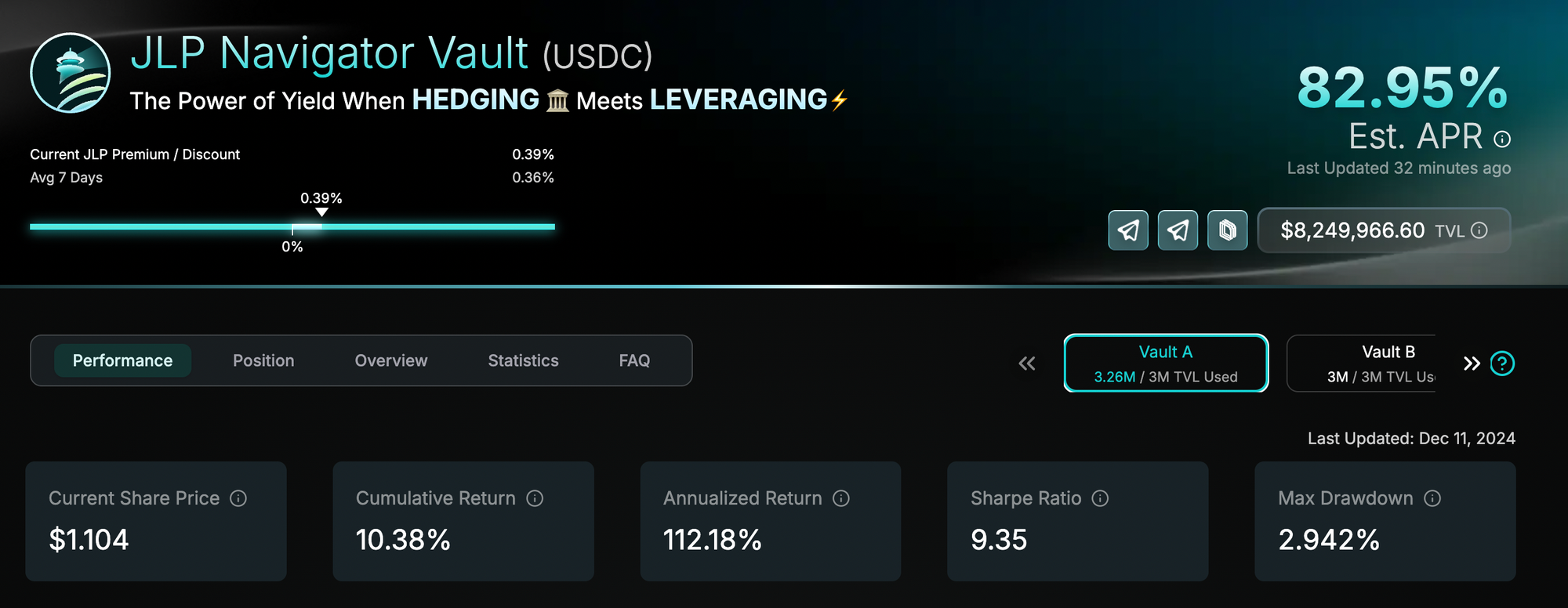

The JLP Navigator Vault on Vectis Finance offers both leveraged and delta neutral exposure to JLP resulting in a high and stable yield.

The strategy obtains delta neutral exposure by shorting the volatiles assets (SOL, ETH and BTC) in JLP. The amount of each asset that is hedged (shorted) depends on their weight in JLP as well as the trader utilization ratio. Utilization is a measurement of how large a percentage of the volatile assets are borrowed by traders on Jupiter. Currently, utilization on SOL is 83% with ~98% of this being long positions. As explained above, when traders long assets they are borrowed from the JLP pool. As a result, a high utilization ratio for SOL reduces JLP's SOL exposure as price appreciation is offset by traders winning. This is considered in the JLP Navigator Vault as to not over-hedge.

Aside from the JLP fees paid by traders, as covered earlier in the article, the JLP Navigator Vault earns additional yield by e.g taking advantage of the discrepancy between the JLP mint price and market price. This results in arbitrage profits as JLP is gradually minted at discounts and gradually sold on the market when it's trading at a premium. This is also how the leveraged exposure to JLP is obtained, specifically by borrowing USDC on Drift to mint more JLP when the market price is high relative to the mint price.

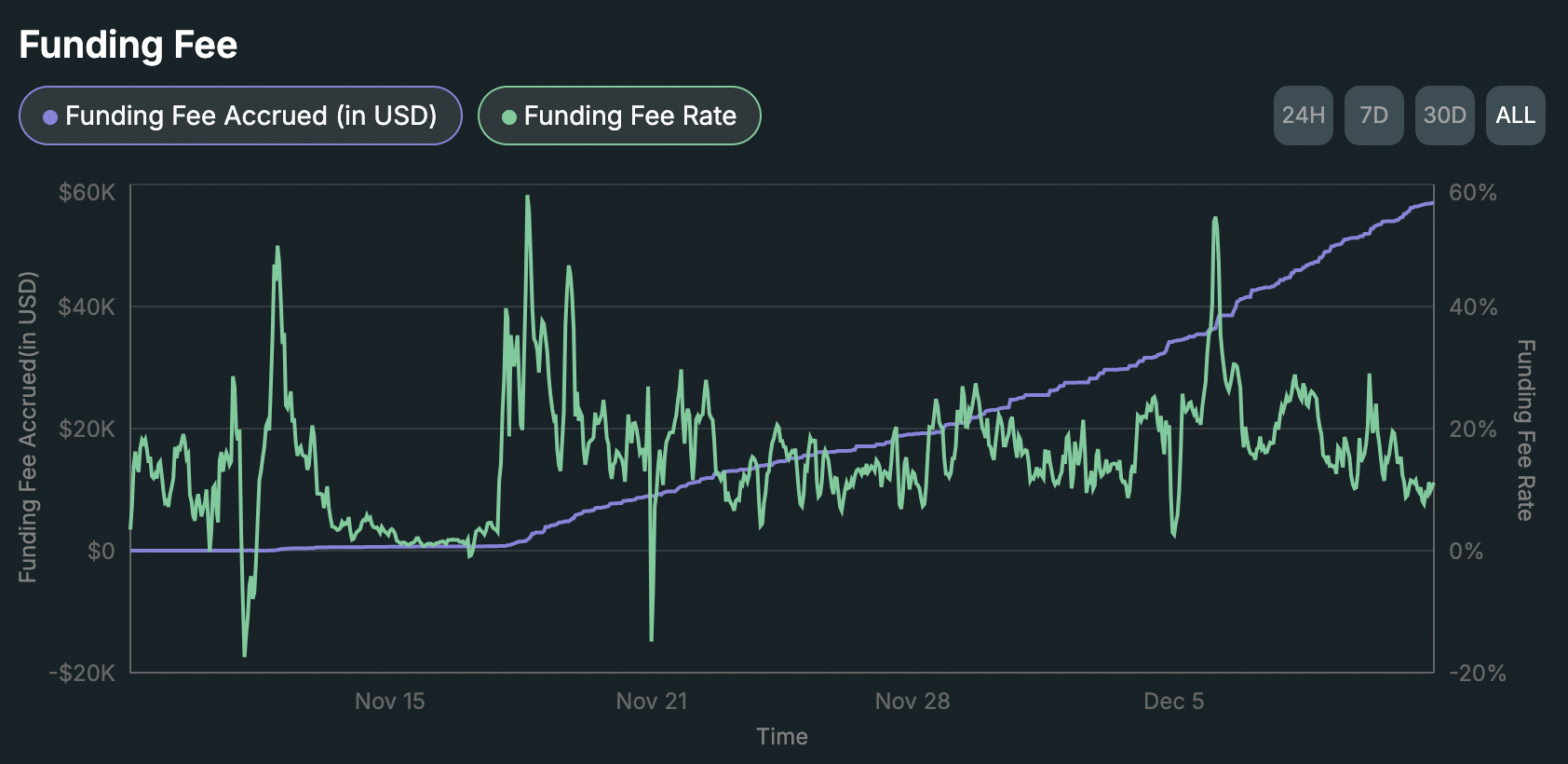

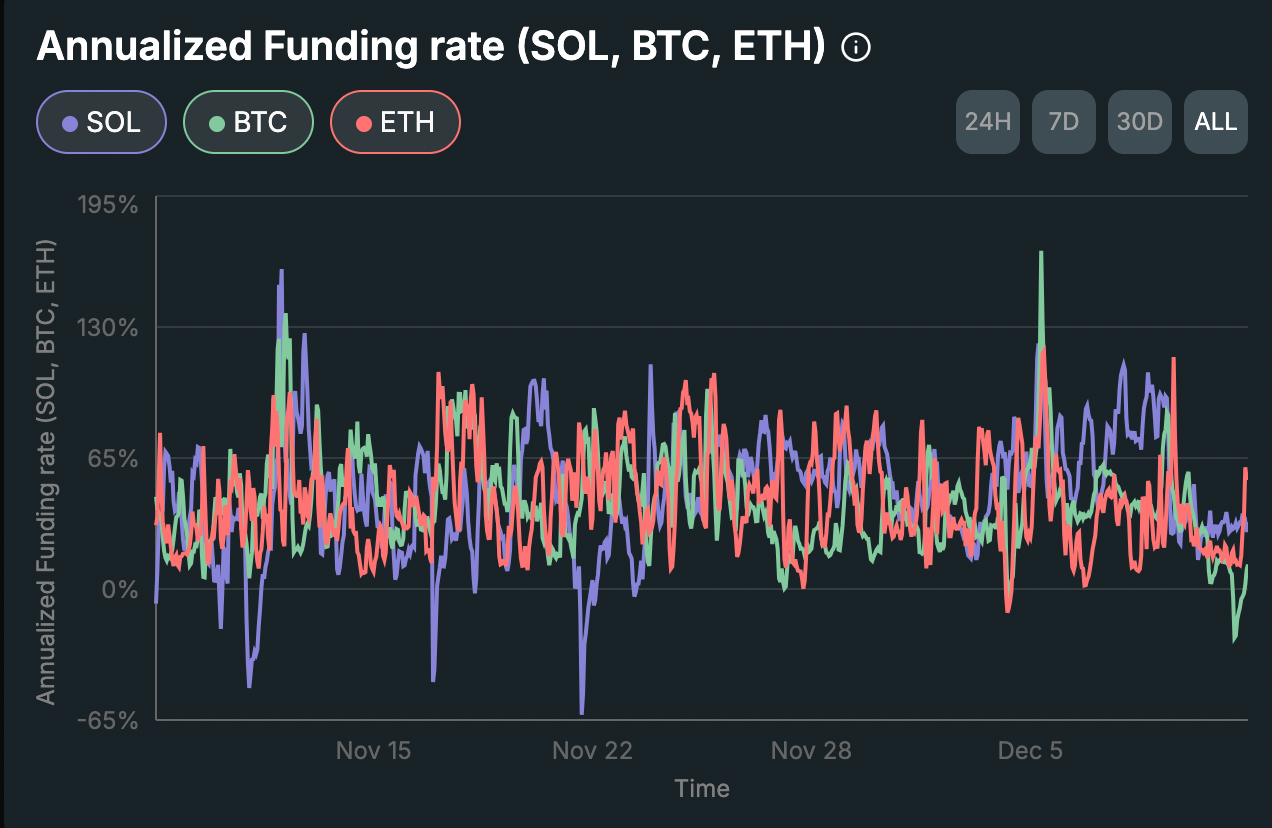

Additionally, when hedging volatile asset exposure on Drift, the vault earns fees from funding payments adding to the overall yield earned by depositors.

There are no deposit, withdrawal or management fees on the vault but only a 20% management fee charged if the vault is in profit.

Performance

There is currently $8.4m deposited into Vectis Finance. The JLP Navigator Vault is split into three sub-vaults, Vault A, B and C. They all operate the same strategy but might have different returns as they have been opened at different times. The reason for multiple smaller vaults rather than one large is related to margin requirements on Drift and obtainable leverage on the strategy.

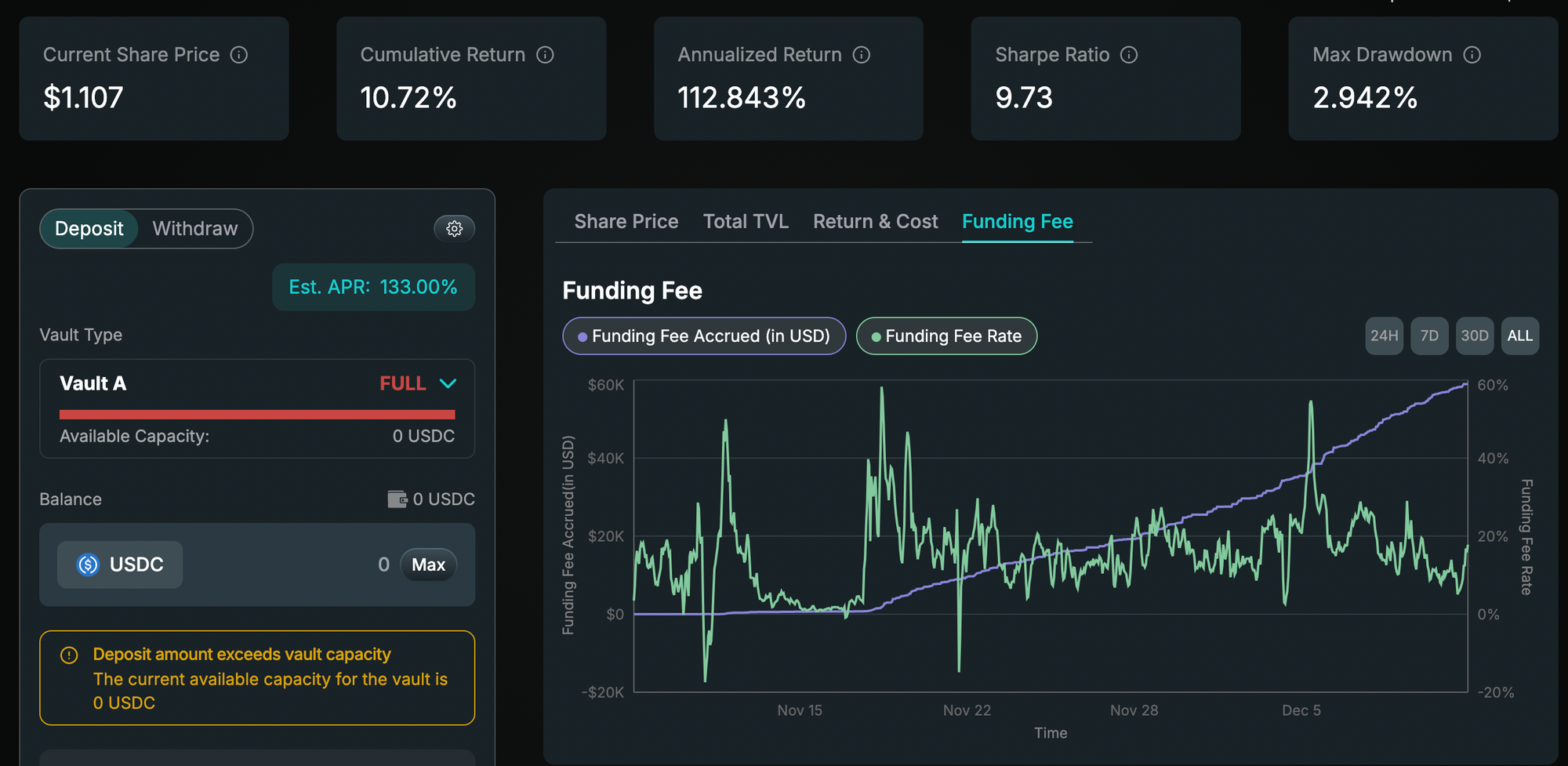

Looking at vault A, the strategy is up 10.72% since going live November 8th which corresponds to an annualized return of 113%. When considering borrowing costs related to borrowing USDC as well as funding payments, the APR comes out to 133%. Note that this APR fluctuates daily. In any case, an APR exceeding 100% on a delta neutral strategy is certainly impressive. Vault A, B and C have reached full capacity at $3m each but there is still room left in Vault D.

Despite a lot of volatility lately, both with traders being in significant profits on JLP and BTC, ETH and SOL doing 10% daily candles, both green and red, the max drawdown of the vault has been a mere 2.9%. With this volatility and return in mind, the Sharpe Ratio is currently 9.73. As noted earlier, holding JLP throughout 2024 returned a Sharpe of 3.36 and holding SOL 1.22. From a volatility-adjusted perspective, the JLP Navigator Vault has significantly outperformed nearly all assets since going live in November.

There are a lot of additional statistics related to the vault performance which might be helpful to study before depositing liquidity. These include current JLP market premium/discount, USDC borrow rates, funding fees and more. You can check out all the stats here.

Keep in mind that there are risks related to this strategy. Like with everything in DeFi, you are exposed to smart contract risk. While Vectis has taken several steps do reduce risk, like limiting deposits and using Drift Protocol's vault architecture, nothing in DeFi comes without risk.

Conclusion

JLP has been one of the best performing assets this year, particularly from a volatility adjusted perspective. The JLP Navigator Vault on Vectis Finance offers exposure to the underlying JLP yield, derived from trader fees, while eliminating exposure to price changes and obtaining additional yield via JLP arbitrage and funding rates.

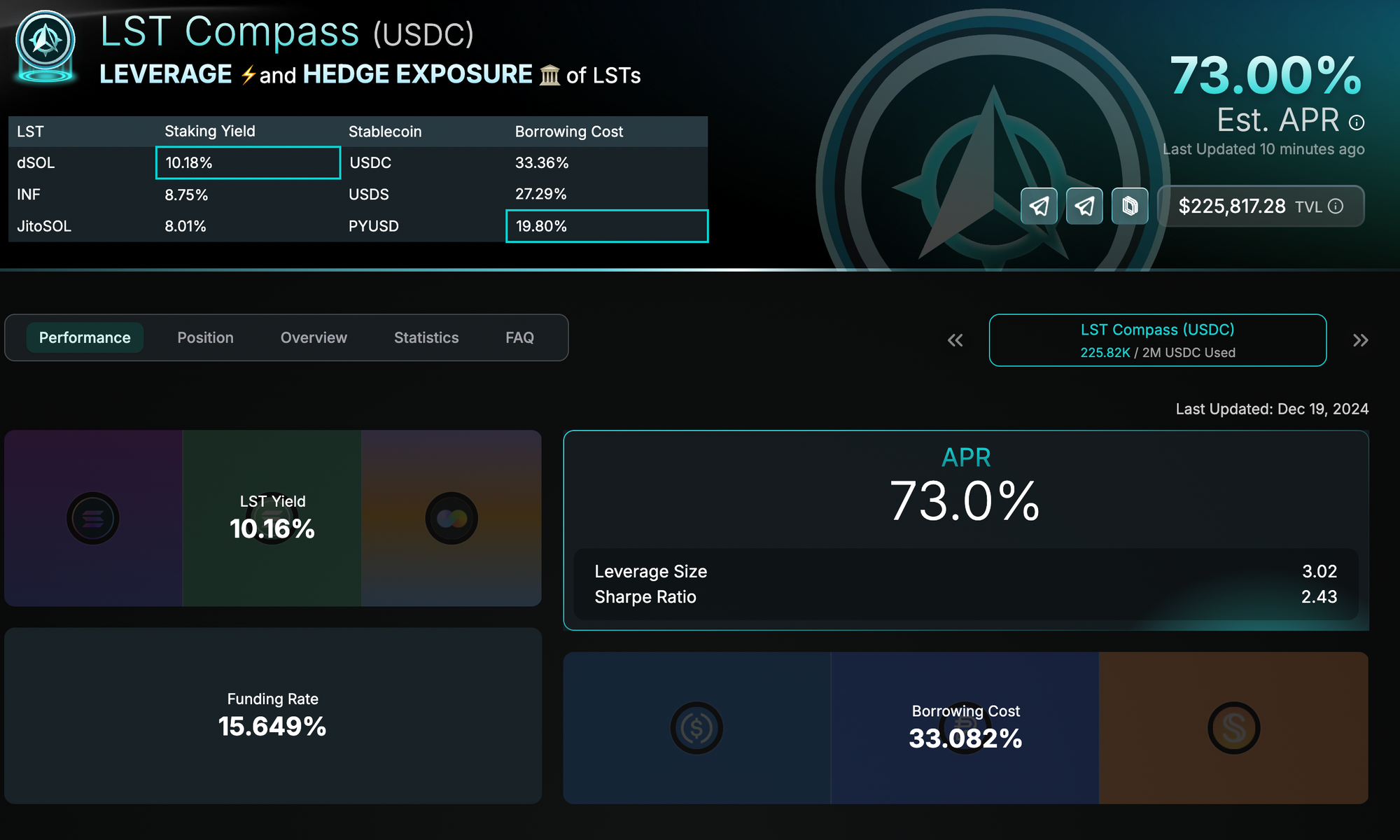

Aside from the JLP vault, Vectis recently unveiled their 'LST Compass' Vault which obtains leverage exposure to SOL staking yield while hedging all SOL price exposure and farming funding rates at the same time. You can find it here.

Lastly, Vectis will be expanding into a larger ecosystem of products including money markets, dynamic vaults, and multi-asset pools in the future. Make sure to follow the on X.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.