🀄️ DeFi Frameworks Newsletter #005

Your biweekly newsletter on the latest performance, news, catalysts and more

Welcome back to another issue of the DeFi Frameworks newsletter. Today’s edition will dive into recent market performance, analyze the top revenue generating protocols in the past month and more!

Bullets

- Market Sectors 🗺

- News and Catalysts 📰

- DeFi Airdrops & Strategies 🔮

Every second week I aim to deliver a concise and information-packed newsletter presenting the top information needed as a defi investor. Subscribe below 🗞

Market Sectors 🗺

General Performance

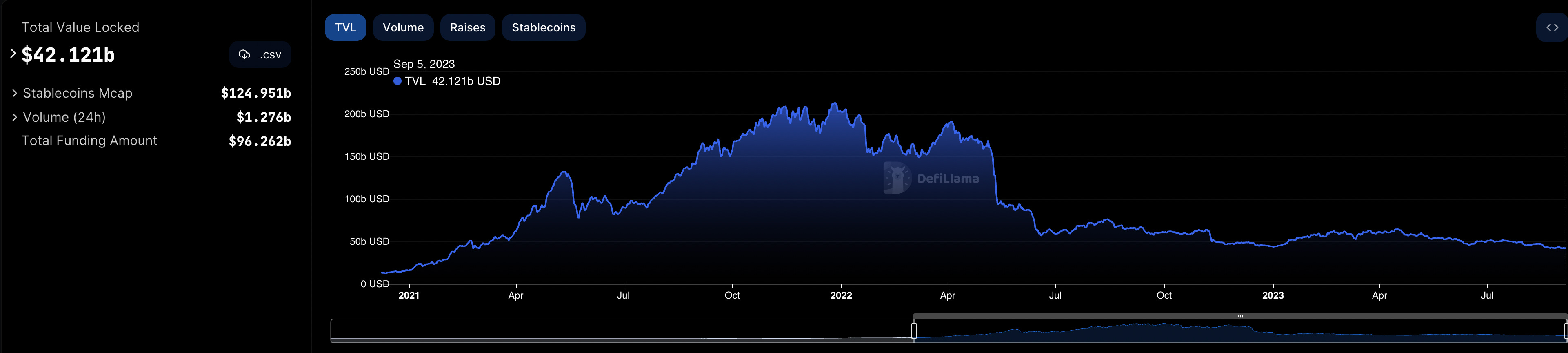

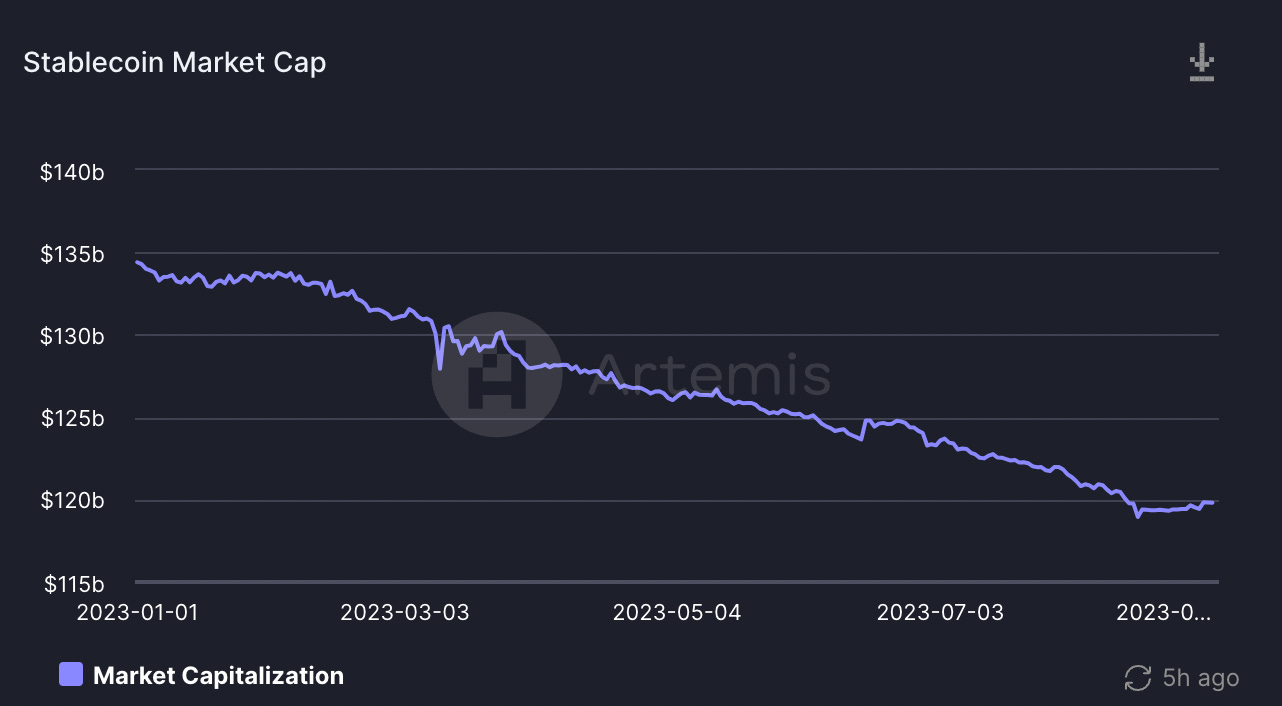

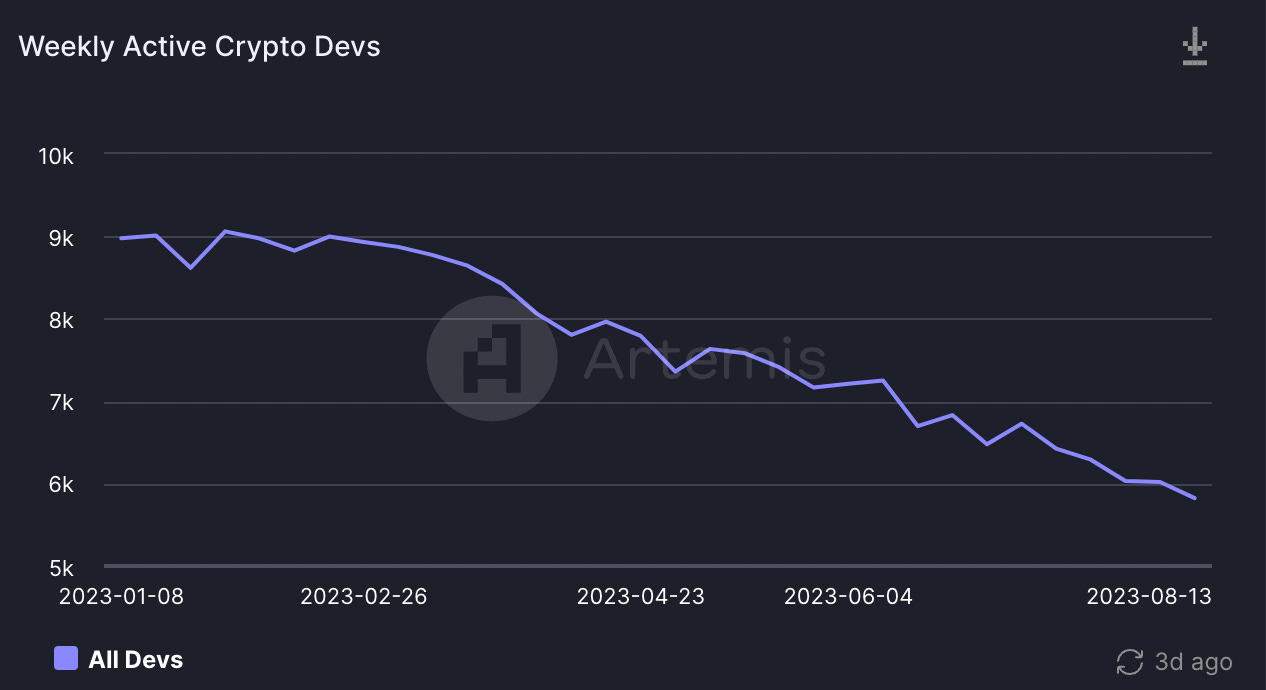

3 useful charts to monitor current performance of blockchain and DeFi adoption👇

The charts paint a pretty clear picture. Money is dwindling out of DeFi. With less demand for on-chain products, less developers are needed hence the decline. While prices and metrics like these continue to trend down, it’s more so because of a hostile economic environment rather than idiosyncratic risk in crypto. If you’re still here, two years into the bear market, you likely believe things will change for the better in the future. So let’s identify the current winners 🔎

Revenue Winners

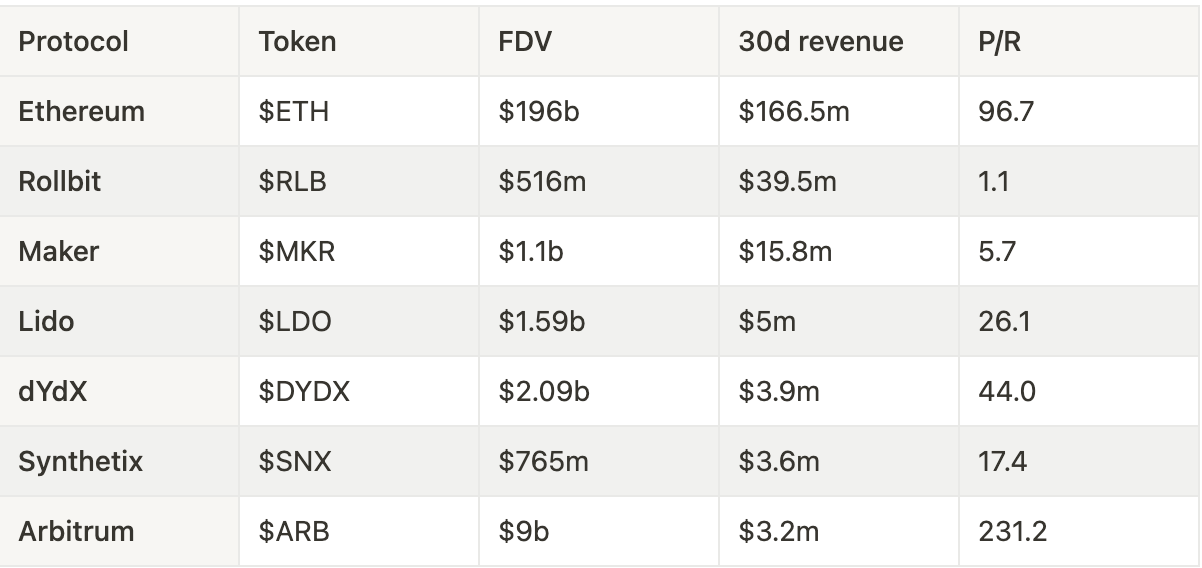

Below is a table of the top protocols in terms of 30d day revenue and their respective valuations👇

As you can see, Ethereum is still the leading application in terms of revenue with a 30d rev of $166.5m. The additional protocols generating more than 6-digit revenue are Maker and Rollbit.

Maker earns a fee on all of the collateral backing the $DAI stablecoin. As of now, over 50% of this revenue comes from the real-world-asset-collateral backing DAI such as US treasury yield. The business model is pretty straight forward and in order for Maker to increase their revenue, they have to increase the supply of $DAI. $MKR is also trading at a fairly low valuation relative to the revenue. Price/revenue (P/R) is calculated as the FDV divided by the 30d revenue annualized.

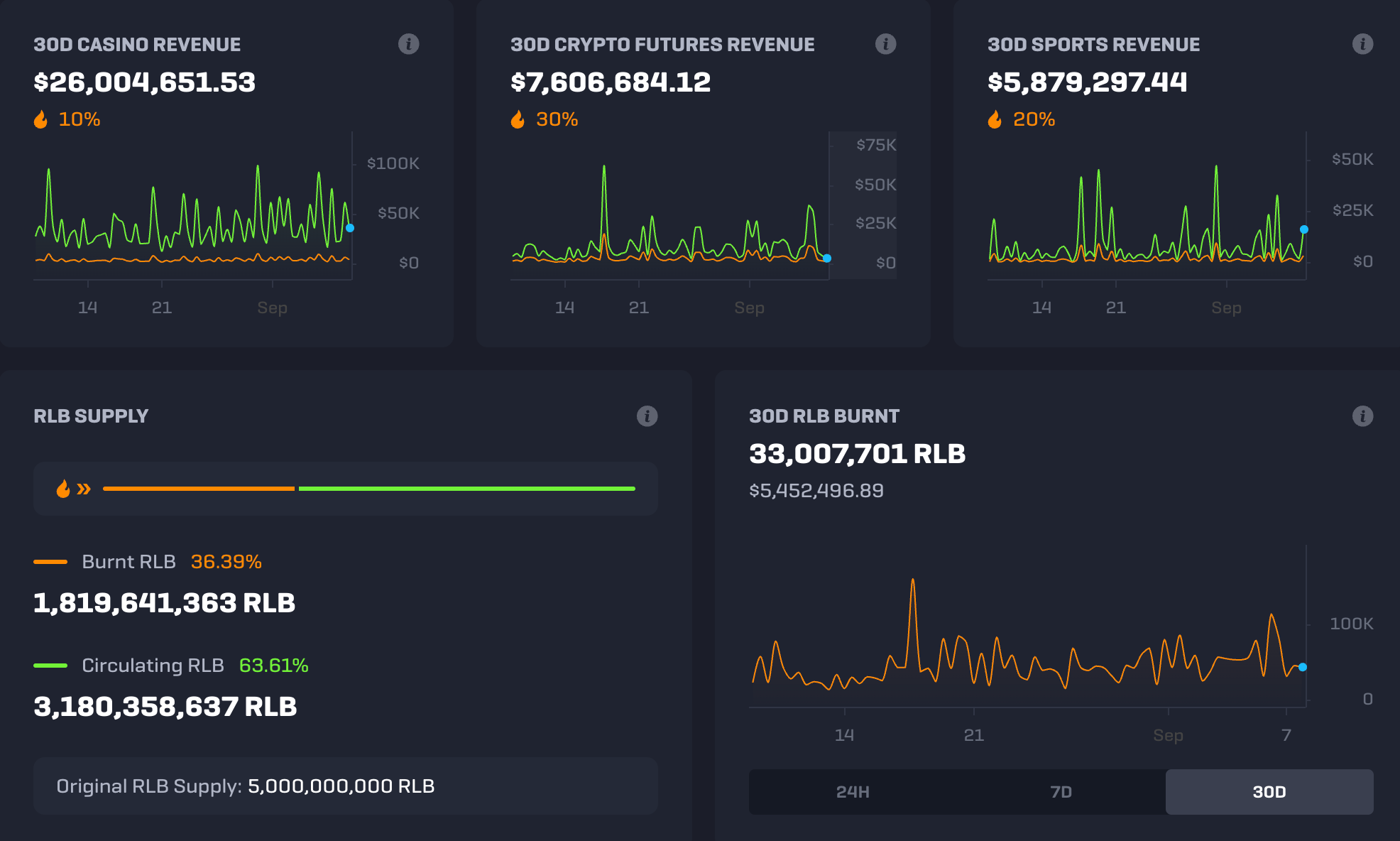

Rollbit is another impressive protocol in terms of 30d revenue with $RLB sitting at a modest 1.1 P/R multiple. Rollbit generates revenue from its casino, sports betting platform and crypto futures trading. It’s worth noting that revenue can’t be verified on-chain and the revenue dashboard (as seen below) needs to be trusted. A part of the revenue from each of these products are used to buy back and burn $RLB which puts deflationary pressure on the token.

Other recent revenue-winners include Synthetix, dYdX, Lido and Arbitrum as seen per the table from earlier.

News and Catalysts 📰

This edition of “News and Catalysts“ will highlight 3 protocols with large upgrades coming up.

1️⃣ Frax Finance

Frax Finance has a large set of upgrades coming to their ecosystem:

- frxETH V2

The Frax ETH-liquid staking solution continues to yield the highest return amongst LSDs because of the two-token nature with frxETH and sfrxETH. V2 will introduce permissionless validating rather than a team-picked subset. V2 will act as a lending market between ETH stakers (lenders) and ETH validators (borrowers). The purpose is to ensure a capital efficient but decentralized staking system.

- FRAX V3

Frax recently passed a proposal to onboard real world assets as $FRAX collateral. This upgrade (Frax V3) is expected later this month and the yield generated from these RWAs will be passed onto $FRAX holders through so-called Frax-bonds with different annual maturities. Read more here.

- Frax Chain

Coming at a later point is a custom hybrid rollup which has yet to be named. The chain will host all of the various Frax applications and products like FraxSwap, FraxLend, frxETH, FraxFerry etc but will not be exclusive to native Frax apps. The chain will use frxETH as native gas which could boost the staking yield for sfrxETH holders significantly.

“Fraxchain is not an appchain, we’re aiming to be the biggest L2 on Ethereum. Our goal is we want this to be the largest L2. And the way that we're actually trying to do that is by making it that the most useful yield from the fed rate, the best POS [staking] rate for ETH and the best inflation protected rate. All of these extremely useful ways to earn yield is the hallmark and central point of Fraxchain,” - Sam Kazemian.

2️⃣ Radiant Capital

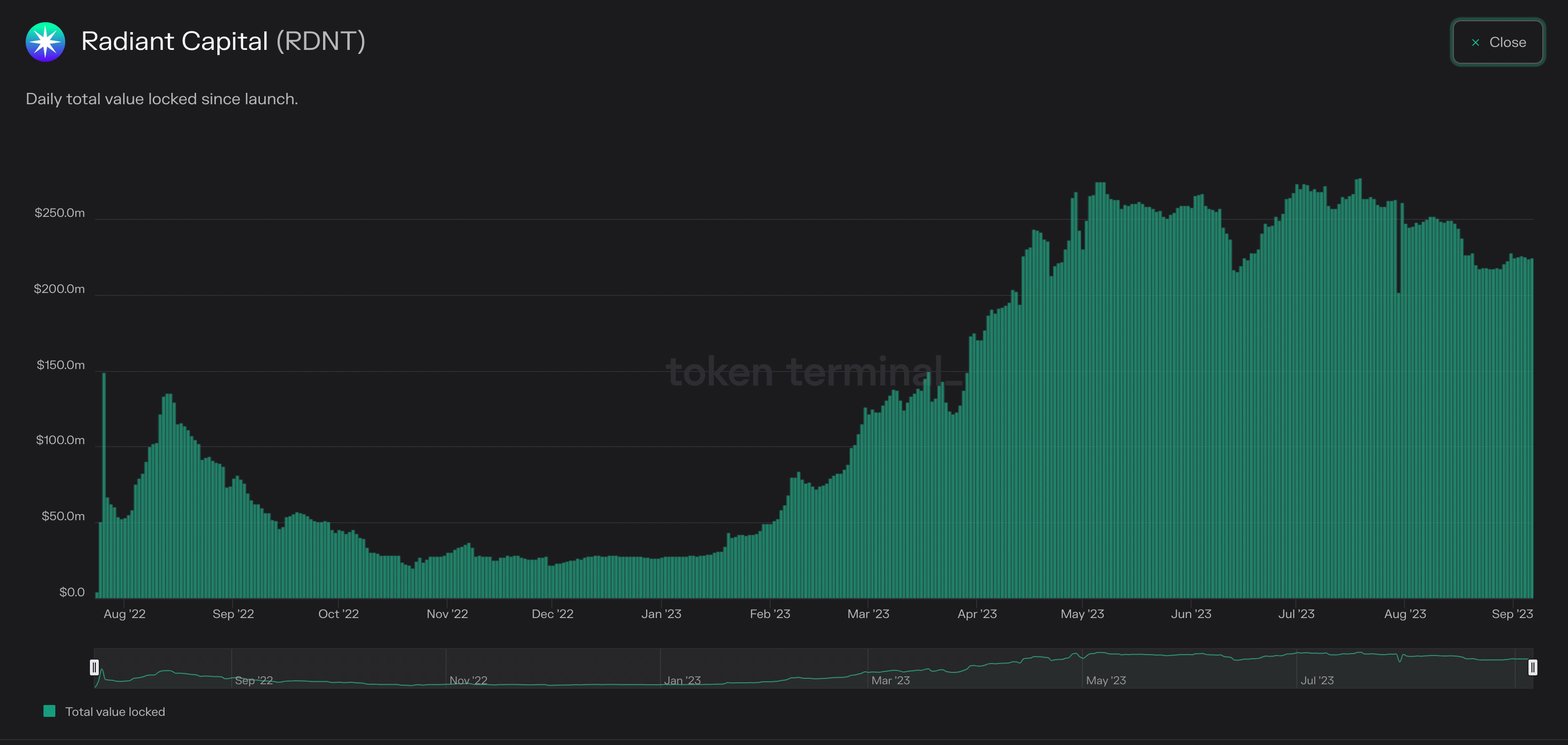

Radiant Capital is a cross-chain lending and borrowing market on Arbitrum and the BNB-chain. They launched V2 earlier this year which introduced new assets on the money market as well as a new emission structure for RDNT to make it more sustainable. This caused the TVL and general adoption to surge as seen per the image below

Radiant will be expanding to their third chain, launching on Ethereum mainnet in early October. This could attract additional capital to the protocol as Ethereum mainnet remains the center of liquidity in DeFi. It is not yet known what assets will be supported on Ethereum yet.

3️⃣ Synthetix

Synthetix is getting closer to launching the full version of Synthetix V3 which aims to make Synthetix the liquidity hub for all protocols across the EVM landscape. Front-ends like perps, options protocols and DEXs will be able to easily tab into the liquidity on Synthetix across various chains.

V3 tl;dr

- Potentially multi-collateral staking (ETH as the first integration)

- Permissionless liquidity layer

- Developer-friendly ecosystem

- Seamless cross-chain implementation (collateral on one chain can be used to mint debt on another) - integrating Chainlink CCIP

A recent blog post by Kain Warwick discusses the next steps for V3 in terms of cross chain expansion and whether additional tokens should be enabled as collateral. On one hand it could create much deeper liquidity but it could also decrease the utility for SNX. The post suggests that the first cross chain expansion happens on Base with ETH as the staking/collateral option there:

“If we are unleashing ETH collateral on a new network, I think Base is the best choice. It will allow us to generate incremental volume without threatening trading revenue on Optimism. It is also lower stakes than Arbitrum. This should be a win for SNX LPs. The counterargument is this: Had we instead let people migrate SNX to Base and LP there, SNX would capture 100% of the fees on both networks, rather than sharing the fees. This is true, but there is minimal risk to SNX LPs because we control governance. We can run this controlled experiment and then decide what is best for SNX holders once we have the data.“

DeFi Airdrops & Strategies 🔮

Swell Network & $SWELL Airdrop

Swell is an ETH liquid staking provider with their native swETH LSD. Holders of this token earn ‘pearls‘ over time (more ETH and longer duration = more pearls). Pearls will translate to the $SWELL token once it launches later this year/next year.

In addition, users can boost the pearls they receive by depositing $swETH into various defi protocols such as Pendle Finance, Maverick or Balancer.

By depositing via a signup link, you will earn additional pearls per ETH. Earn a bonus by using the link here.

Risks: Smart contract risk on Swell and additional smart contract risk if deposited into another DeFi protocol.

Stablecoin Farming

There are several ways to earn stablecoin yields on-chain. Some of these include:

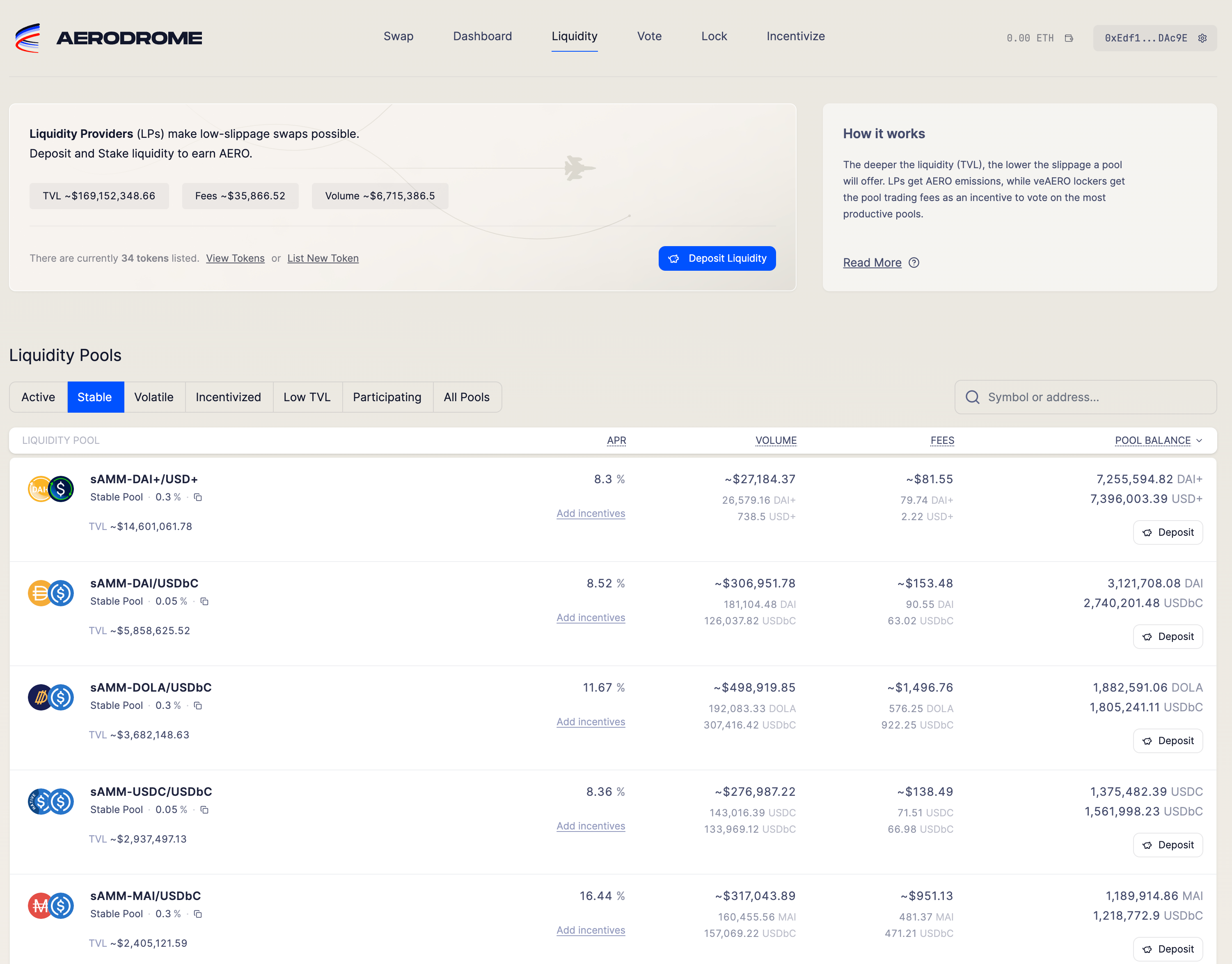

Aerodrome

Aerodrome is a Velodrome fork on the Base L2 which launched recently and has attracted roughly $170m in TVL. There are several stablecoin pools which are incentivized with $AERO paying out 8-16% yield without any impermanent loss.

Risks: Smart contract risk. Note also that yields are in $AERO and can fluctuate due to this.

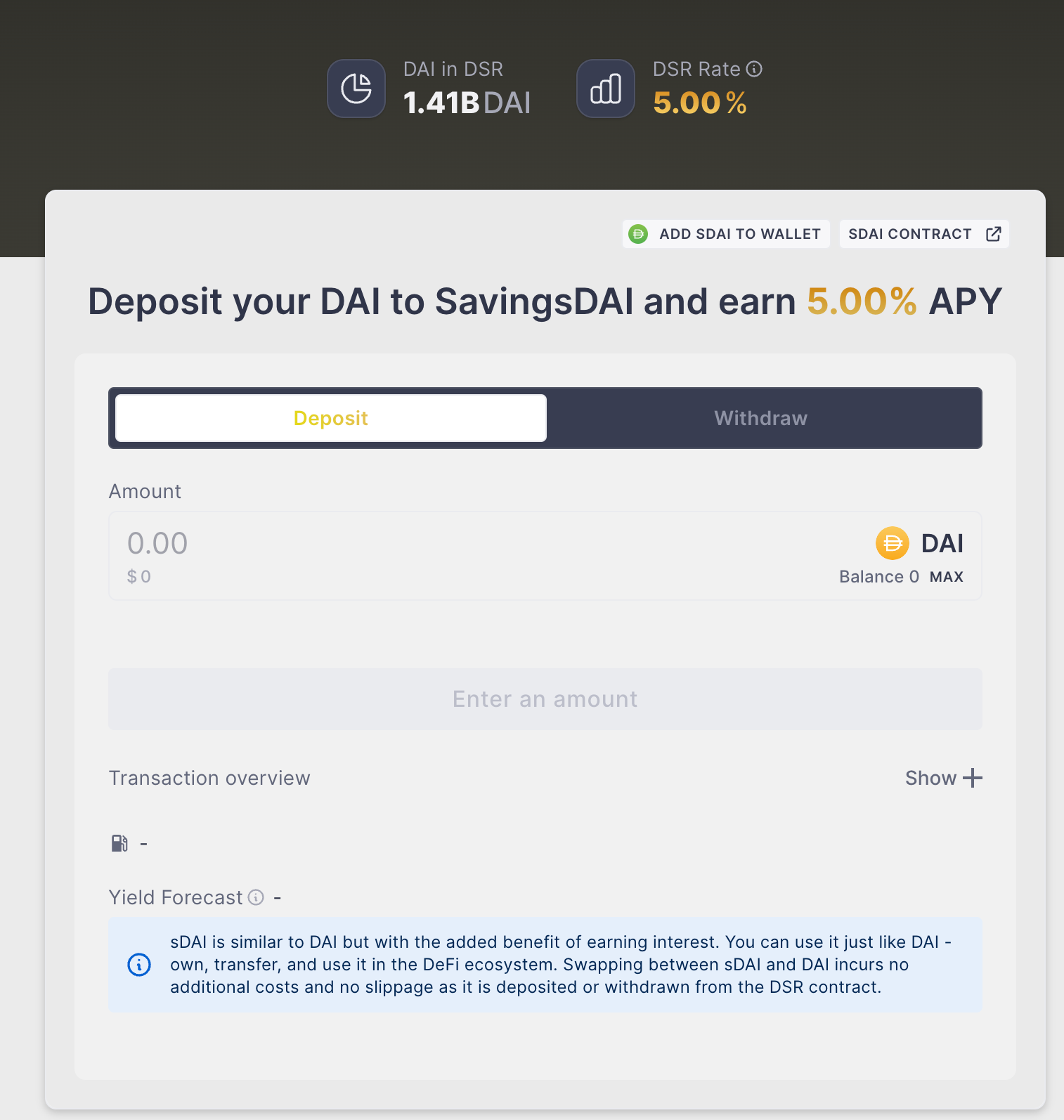

DAI Savings Rate (DSR)

As mentioned earlier, Maker generates a ton of revenue from the collateral backing DAI. A large part of this revenue is being used to return a 5% fixed yield on single-sided $DAI staked in the DSR vault on the Spark Protocol (their native lending market). Yield comes from sustainable revenue and is distributed in $DAI itself.

Risks: Smart contract risk on Spark Protocol

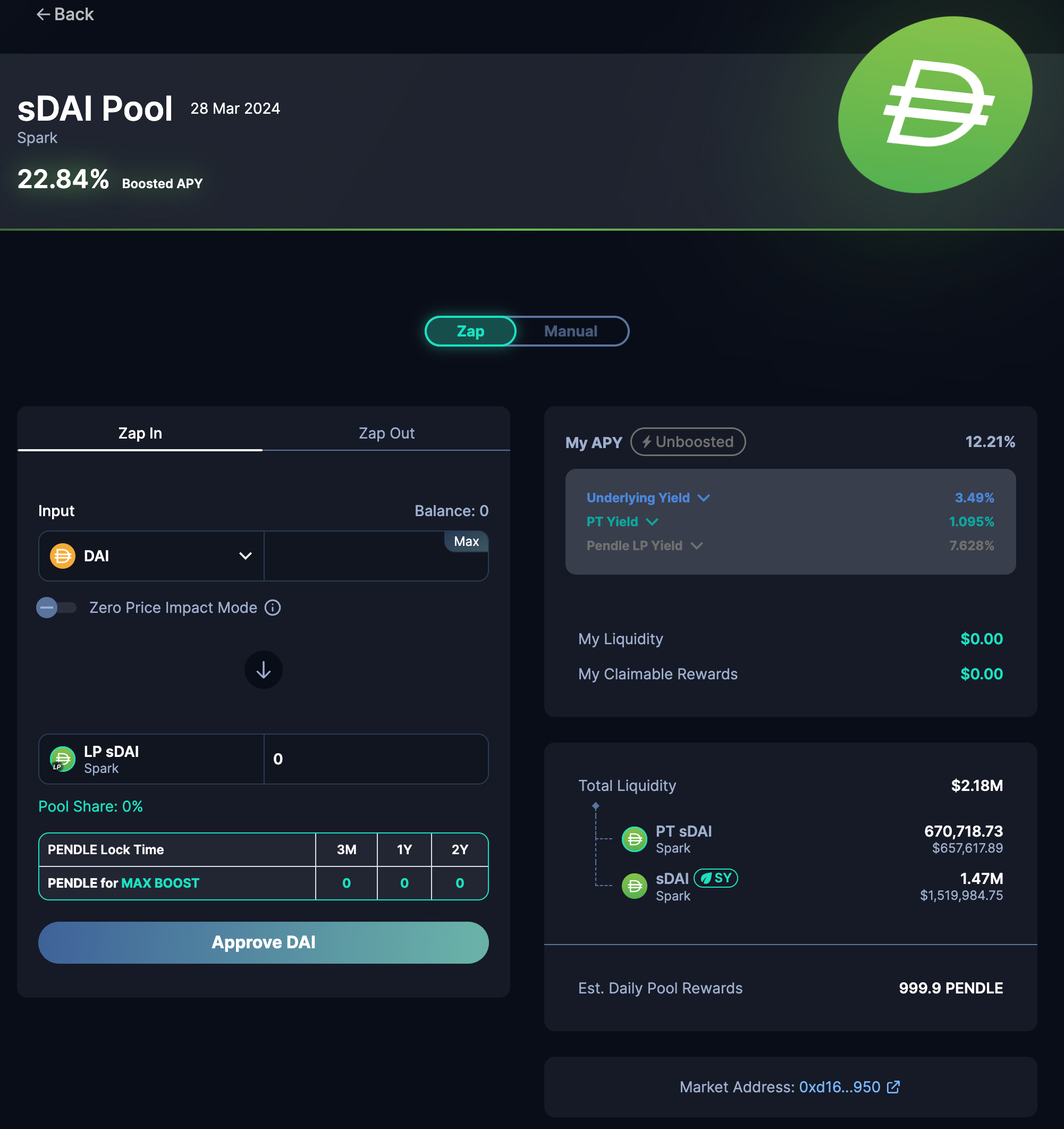

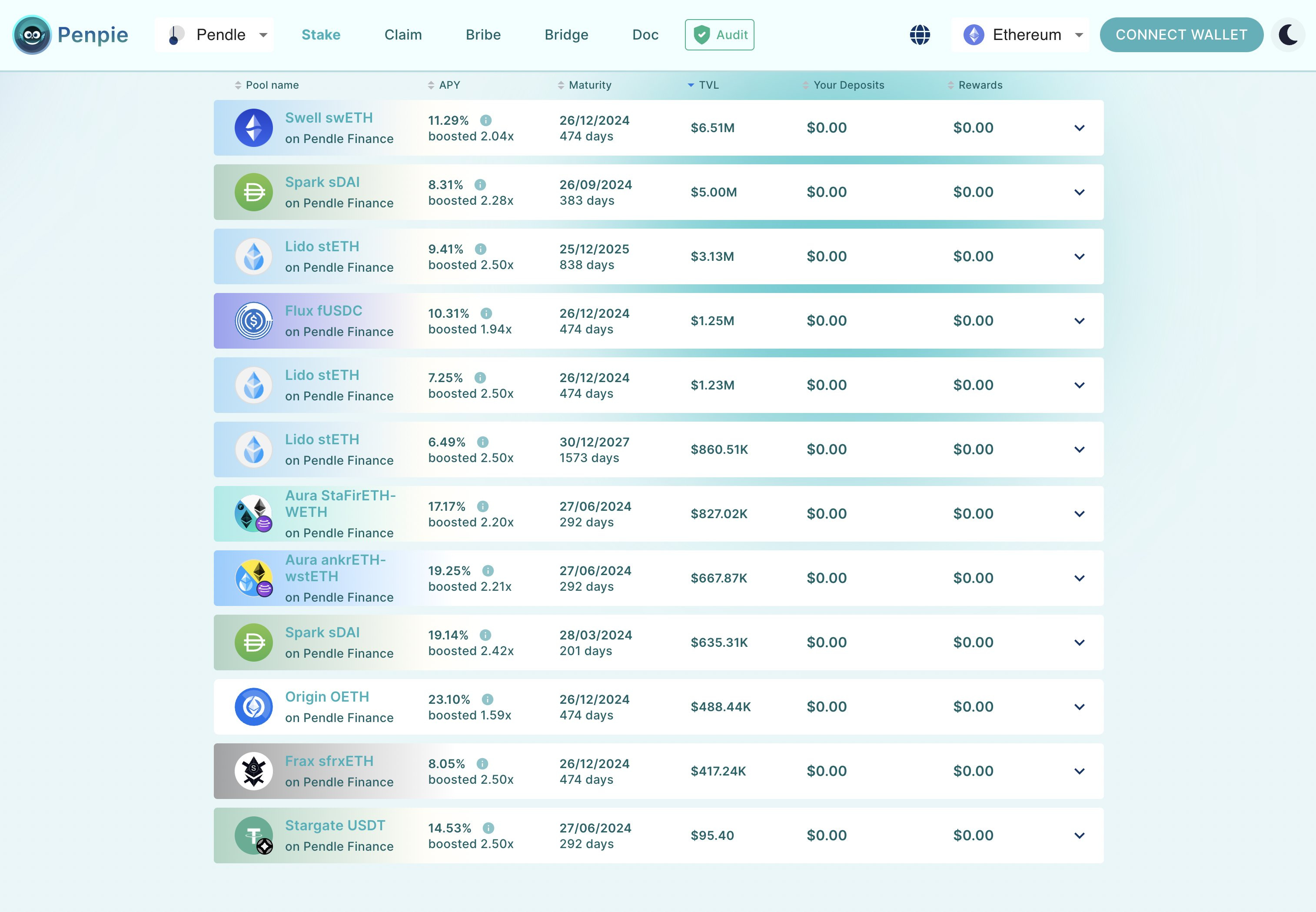

Pendle Finance

For an increased yield, deposit the sDAI (liquid representation of $DAI in the DSR) into the Pendle Finance liquidity pool. Current yield is 12% APY unboosted and and up to 22.8% APY if $PENDLE is locked as vePENDLE. Yield comes from the underlying 5% yield + trading fees + PENDLE emissions.

Risks: Smart contract risk on Spark Protocol and Pendle Finance. Minimum impermanent loss

If you’re unfamiliar with how Pendle works, check out my video guide here.

Want to increase this yield even further? Head over to Penpie where the Pendle pools are boosted by their large vePENDLE holdings. It allows you to earn boosted yield without having to lock up $PENDLE yourself.

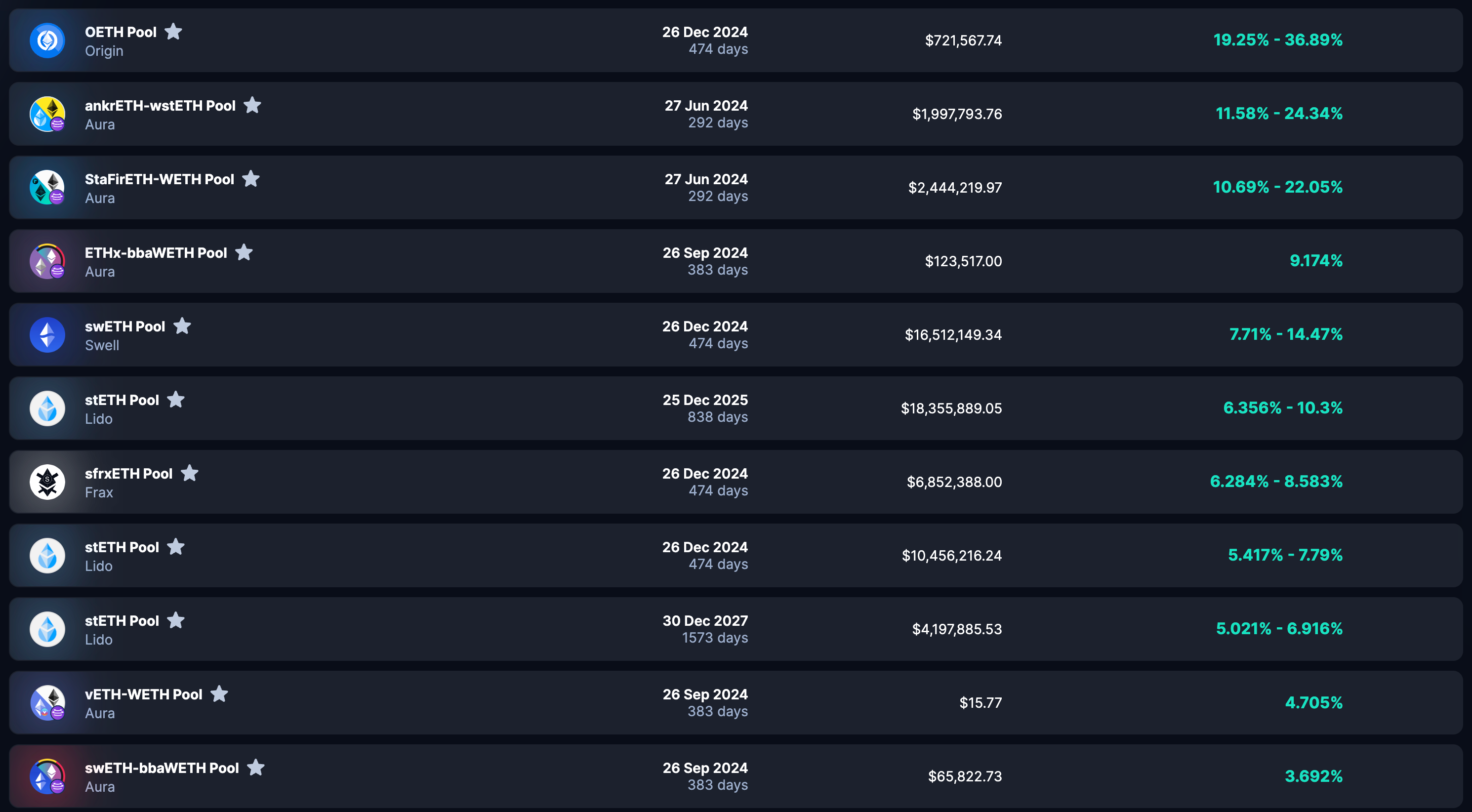

ETH yields

Pendle also offers high yields on various ETH LSDs. As mentioned, these pools consist of the ptToken and the Token itself so there is minimal impermanent loss. The main risk you’re exposed to on Pendle is smart contract risk.

Thanks for reading! If you found the newsletter valuable don’t forget to subscribe to receive the newsletter in your inbox every 2nd week. Also, I really appreciate any feedback in the comments below - Have a fantastic Weekend☀️

Nothing stated is financial advice!