🀄️DeFi Frameworks Newsletter #003

Your biweekly newsletter on the latest performance, news, catalysts and more

Welcome to the third edition of the DeFi Frameworks Newsletter. Today’s newsletter will touch on the liquid staking landscape and in particular whether $RPL might be undervalued, recent news, on-chain movements, Solana DeFi and much more👇

Bullets

- DeFi Sectors 🗺

- News and Catalysts 📰

- On-chain Movements 🐳

- DeFi Strategy Spotlight 🔮

Every second week I aim to deliver a concise and information-packed newsletter presenting the top information needed as a defi investor. Subscribe below 🗞

DeFi Sectors 🗺

The total liquidity in DeFi is down roughly $1b since last newsletter two weeks ago. This primarily comes from a decrease in prices rather than a significant outflow from DeFi.

There’s been several exploits in the space in the past 14 days alone with the most notable being Conic Finance. As long as protocols are getting exploited and users lose money, new retail entrants will be hesitant entering DeFi. Another takeaway is that, because of the inherent risk with newly launched protocols, it’s likely that institutional exposure in DeFi will be via large and robust applications like Uniswap, Aave etc.

Liquid Staking Derivatives (LSDs)💧

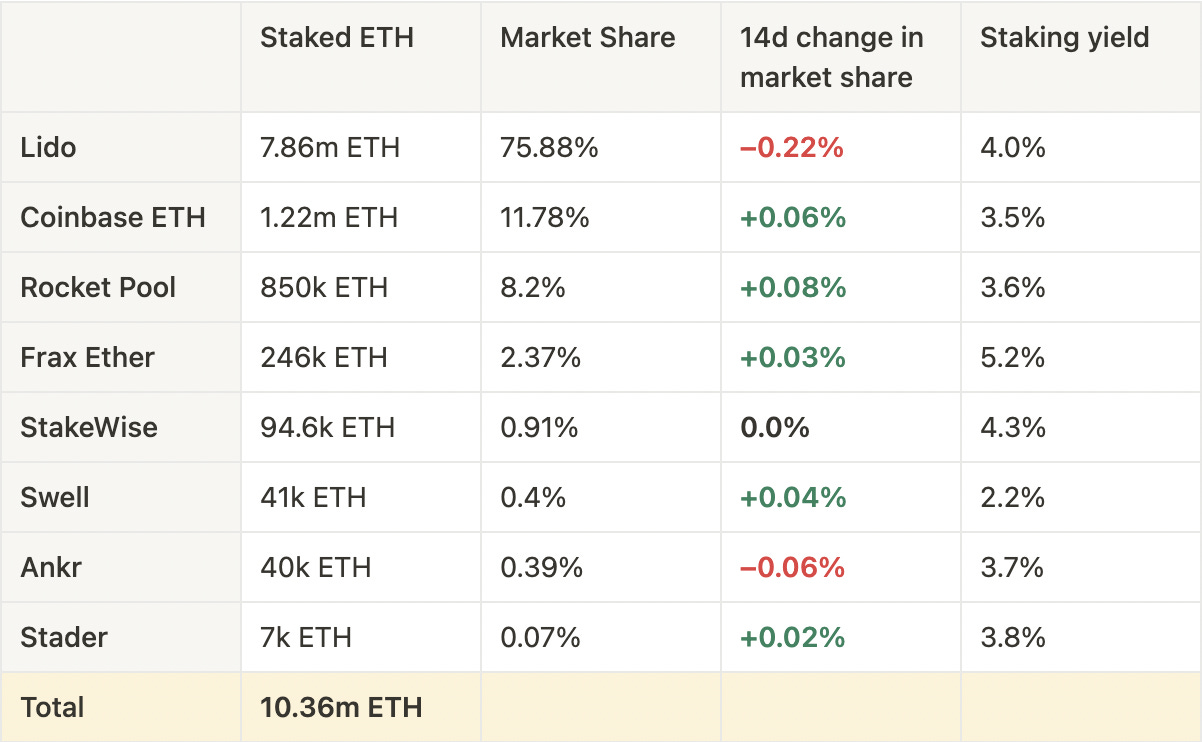

Despite the decrease in overall DeFi liquidity, the ETH liquid staking landscape continues to grow. Roughly 290k ETH ($500m) has flown into liquid staking in the past two weeks. Below is a table portraying the most essential information about this sector.

As seen, Lido has lost some market share despite gaining 100k ETH in TVL. The large winners are Coinbase ETH, Rocket Pool, Frax and Swell. Despite Swell offering a low staking yield, the airdrop farming campaign continues to attract new liquidity.

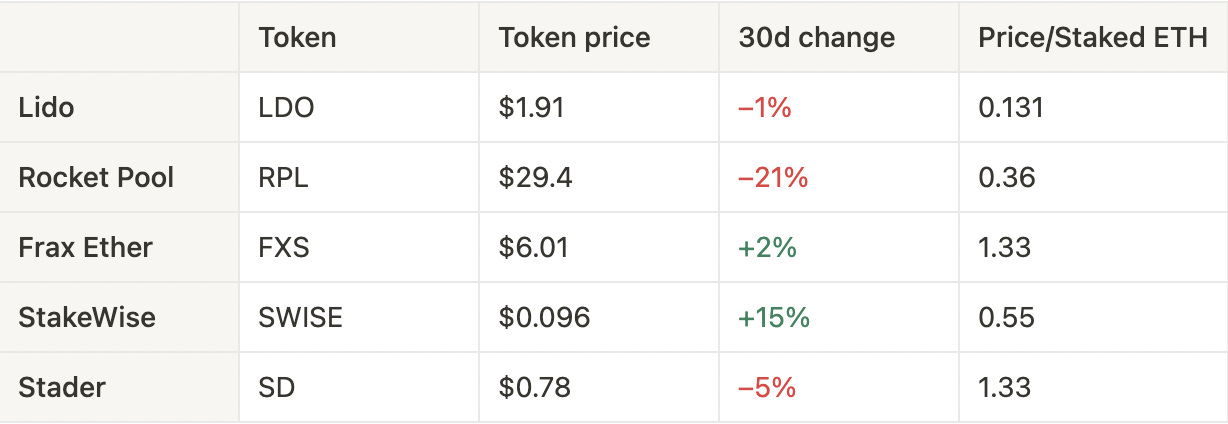

Below is a table looking at recent price performance of native tokens from the liquid staking protocols and their valuation relative to the amount of ETH staked.

As mentioned in previous newsletters, the lower the number the better the valuation.

$RPL

RPL has seen a large sell-off the past month. The token has been sold by various VCs earlier this year when the price hit $60 including Blockchain Capital, LayerX capital and more. From a fundamental standpoint, RPL is trading at a far better valuation compared to earlier this year. The amount of ETH staked has been up only despite the large downtrend in the price recently. This is seen in the chart below.

Interestingly, $RPL peaked on the very day that the ‘Atlas’ upgrade went live. Atlas introduced 8ETH minipools which makes it easy and attractive to run a validator on Rocket Pool.

Why did the price enter a downtrend immediately after the launch of the potentially largest upgrade to Rocket Pool?

1) The overall market peaked around this time. More importantly however:

2) The market is driven by narratives and these type of catalysts are often over-hyped causing the asset to be priced too high compared to the actual impact of the upgrade.

So has the market now priced in the fair impact of the Atlas upgrade? Well since the launch of Atlas, $RPL is down 60% and the TVL is up ~90%. So it could indicate that the market is mispricing $RPL to the downside (at least relative to the valuation earlier this year). It’s generally very difficult to estimate a fair valuation for protocols in crypto as we can’t rely solely on a P/E ratio and let that dictate our investments. The recent growth in ETH-staked dominance and the improved Price/ETH-staked valuation (as shown in the tables above) makes $RPL worth keeping an eye on in my opinion.

Because of travelling (to EthCC), there wasn’t time to analyze the recent data from perp-protocols. This will be included in the next newsletter⚡️

News & Catalysts 🗞

1️⃣ Chainlink CCIP Goes Live

The cross-chain interoperability protocol (CCIP) has been a long awaited product from Chainlink. It enables cross-chain messaging for dapps looking to expand and use liquidity on multiple chains in a seamless way. It went live last week and currently offers cross-chain messaging between, Ethereum, Avalanche, Optimism and Polygon. This also benefits the LINK-marines as $LINK is used for fee-payments. Several protocols have already announced that they will be integrating this service including Synthetix which will offer cross-chain liquidity with their V3 model. Read more about the features here.

2️⃣ Aave Launches $GHO

$GHO, the native stablecoin on Aave, which has been in development for a long time finally went live on Ethereum mainnet. The $GHO supply is controlled by so-called Facilitators, which are entities chosen via governance who controls the minting and burning of $GHO depending on market demand. As of now, users can borrow $GHO for a fixed interest rate of merely 1.5% (1.1% if $AAVE is staked).

3️⃣ Conic Finance Exploited for $4.2m

Conic Finance is a protocol built on top of Curve Finance that offers asset-specific vaults (omni-pools) and deploys this liquidity strategically into Curve in order to generate a high yield. On July 21st, the newly launched ETH omni-pool was exploited via a flash-loan attack. Flash-loan attacks are one of the more common types of exploits in DeFi and has also impacted protocols such as Sturdy Finance earlier this year. While only $4m of the total $160m TVL was impacted, the TVL has dropped to $41m as LPs don’t want to take any chances.

4️⃣ Mantle Is Live on Mainnet

Mantle is a layer-2 chain on Ethereum, incubated by the Bit-DAO team and with a treasury of $2.4b in primarily $MNT, $ETH and $USDC/$USDT. As of now, the TVL sits at a modest $4m as very few protocols have launched at this stage. There are however several large protocols working on launching on Mantle including Eigenlayer, Entangle and Pendle Finance which recently was approved for a $MNT grant. Given the large war-chest (treasury), the experienced team and upcoming launches, I would not be surprised to see Mantle do well in the future.

$MNT currently sits at a market cap of $1.7b and a fully diluted valuation of $3.3b.

On-chain Movements 🐳

Spartan Group accumulates $PENDLE

The Spartan Group has been an early investor in $PENDLE (2021) and still holds all their 1.42m $PENDLE which finished vesting last year. They’ve recently increased their position by purchasing an additional 433k $PENDLE on Binance at $0.71 per $PENDLE ($310k in total). Their total holdings are now 1.86m $PENDLE ($1.34m).

Large $1INCH sell-offs

- Dragonfly Capital is an early investor in 1Inch and have received a total of 50m $1INCH over two periods in 2023 as they finished vesting. All has been sent to centralized exchanges and are most likely sold. The 50m $1INCH has been sold for an estimated $19.15m in total.

- Wallet with a large early investment in $1INCH has been receiving 7.5m vested $1INCH tokens every 6 months since early 2022 and have deposited it on Binance right away every time. The wallet received 7.5m $1INCH July 17th and seemingly sold it on Binance at an average price of $0.56 ($4.24m total).

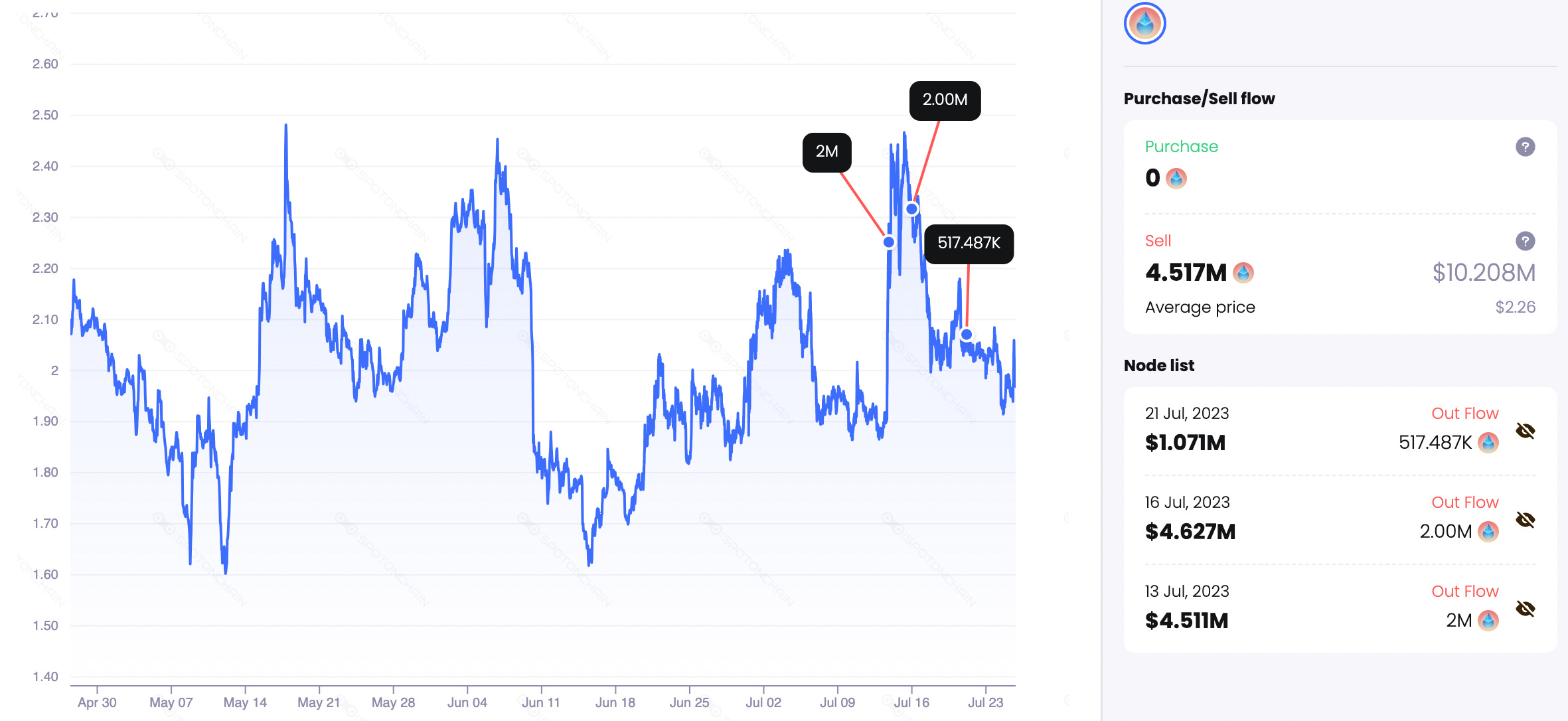

Certus One sells large amounts of $LDO

Certus One, a company owned by Jump Trading, invested early in Lido and received 10m $LDO back in 2020. They've been holding all of this until recently when they sent 4.5m LDO ($10.1m) to Binance in three batches throughout July. This most likely indicates that they've sold this $LDO and done so when the price recently spiked above $2.4. See chart below for reference:

DeFi Strategy Spotlight 🔮

1️⃣ Solana DeFi 2.0

Despite what you may think, Solana DeFi is on the rise. There are several protocols that recently launched and are incentivizing early users with airdrops:

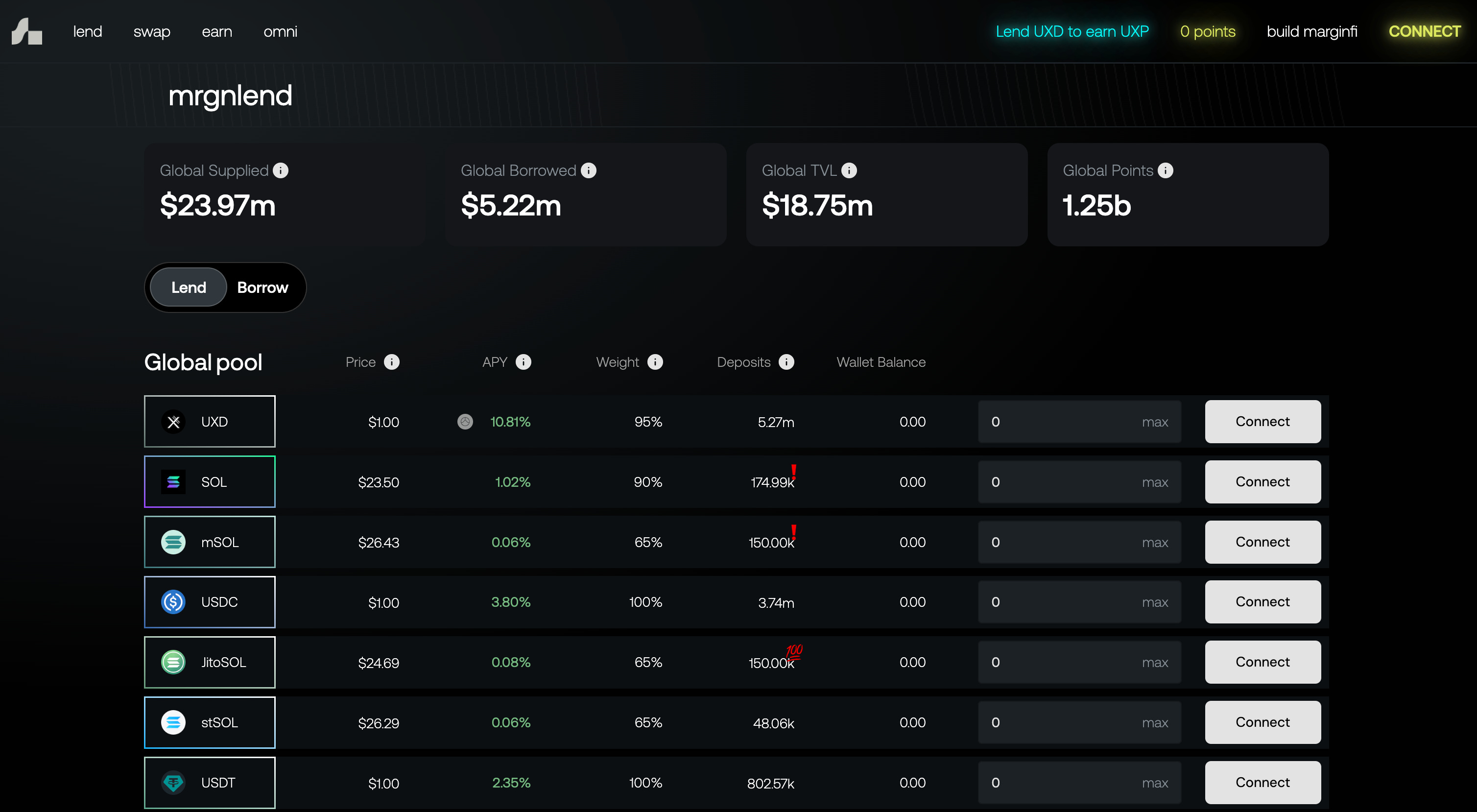

Margin Fi

Margin Fi is a new borrowing and lending market on Solana. Current yields are not very attractive but it might be worth farming the upcoming airdrop. Every day, users receive 1 point for each $ that’s lend out and 4 points for each $ that’s borrowed.

Risks: Margin Fi has been audited by Ottersec however it’s important to be cautious with new protocols. Never deposit all your funds into one protocol and be aware that smart contract risks are very much real.

Read more about how you can earn points here.

Cypher

Cypher is a derivatives market on Solana that offers perpetual trading on SOL, BTC and ETH. Similarly to Margin Fi, users receive points by interacting with the protocol. In this instance, it involves borrowing and lending but also in particular perpetual trading.

Risks: The TVL is only $1m and there are no external audits at this point so I would exercise caution when interacting with Cypher.

Read more about the points program here.

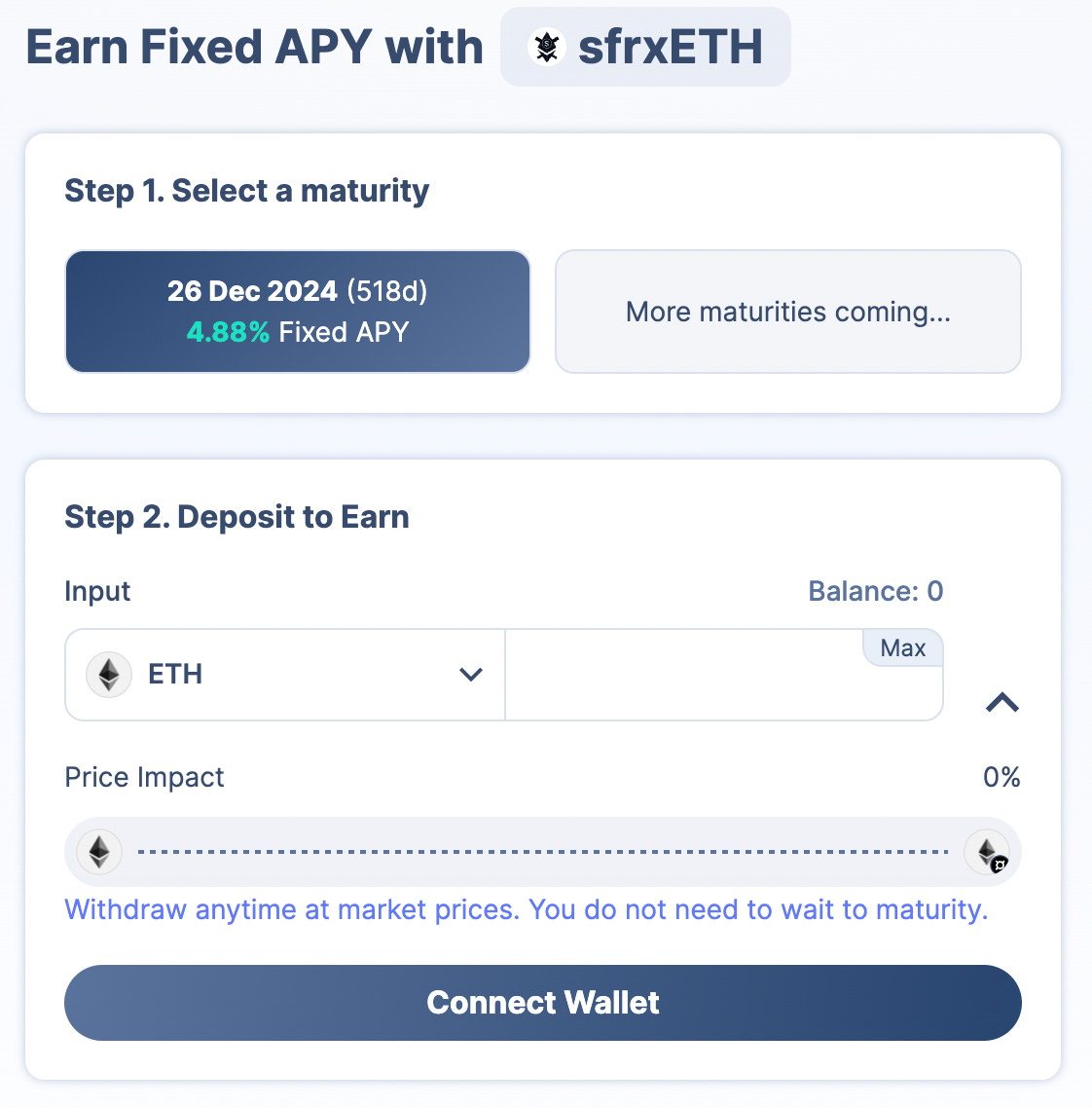

2️⃣ High Fixed Income on Staked ETH

As most readers probably are aware of, Pendle Finance offers interest-rate trading on yield bearing assets. This allows for fixed yields on a longer time frame on several assets such as various types of liquid staked ETH. As seen below, users can deposit their ETH or sfrxETH to earn 4.88% APY until maturity (518 days). This is quite attractive as most staking yields are at 4% or below and variable as well. With this strategy, users deposit single-sided into the pool so there is no impermanent loss and it’s further possible to withdraw at any given time.

Risks: Smart contract risk on Frax Finance and Pendle Finance.

Thanks for reading! If you found the newsletter valuable don’t forget to subscribe to receive the newsletter in your inbox every 2nd week. Also, I really appreciate any feedback in the comments below - Have a fantastic Wednesday☀️

Nothing stated is financial advice!