🀄️ DeFi Frameworks #007 - Arbitrum Edition

Your biweekly newsletter on the latest performance, news, catalysts and more.

Welcome back to another issue of the DeFi Frameworks newsletter. In today’s special addition, we will be providing extensive coverage on the activity and upcoming developments on Arbitrum.

Bullets

- Ecosystem Overview🗺

- ARB Price Action📈

- Arbitrum Staking💲

- Incentives & Yield Opportunities💸

Every week I aim to deliver a concise and information-packed newsletter presenting the top information needed as a DeFi investor. Subscribe below 🗞

Ecosystem Overview

Most of Arbitrum’s TVL revolves around trading protocols, heavily leveraging the underlying technology, which offers low fees and fast transaction processing. A great deal (approximately ~32%) of the TVL on Arbitrum is in GMX, the most dominant platform on the L2.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Looking at the trading volume breakdown for Uniswap, its unsurprising to see Mainnet capturing most of the value changing hands. A positive takeaway for Arbitrum though is the fact that its the rollup facilitating the most volume by quite a margin.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Judging by the huge uptick in trading volume and activity in general, it’s safe to say that Arbitrum season is upon us (for now at least).

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

In terms of fee generation, Arbitrum has surpassed its peers after a head to head to head battle for dominance between the trio. Despite having very low fees, the L2s generated very solid revenue. Looking more closely, Arbitrum appears to be the only rollup with a significant uptrend in daily fees.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Arbitrum Token Performance

Price action wise, the Arbitrum token is trending upwards with the rest of the market. In the last 3 weeks we’ve seen a clean double bottom and a market structure break on the chart with a bottom around $0.76.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Looking at other L1s & L2s, it’s apparent that in terms of actual market cap and not FDV, Arbitrum still trades significantly cheaper. It’s worth noting however that Arbitrum has the lowest Market Cap / Fully Diluted Value ratio out of all the projects displayed on the chart below. Approximately ~13% of the total supply is currently in circulation, a common occurrence in crypto these days. If buying pressure doesn’t increase significantly, vesting unlocks and/or additional token emissions could put a damper on $ARB price performance.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Arbitrum foundation selling?

Despite outperforming it’s L2 counterparts, some still feel that recent buyers are there to just absorb the selling pressure caused by the Arbitrum Foundation alongside well-known market maker Wintermute acting as a middleman. Reported by Dump Watcher on Monday in a short tweet, they bring out some interesting points to back up the claim.

TLDR; tokens get sent from Prime Deposits addresses to Wintermute ~> tokens instantly get sent to various exchanges (presumably to sell)

The ARB token has fallen ~60% from its all time high of $1.80 which was reached shortly after being available for tradin earlier this year.

Arbitrum Staking

End of last month, the Arbitrum DAO came forth with a proposal to introduce single-sided Arbitrum staking. The staking contract would be funded by a percentage of the total supply, with the exact amount being up for discussion.

The percentages and respective APR% ranges are as follows:

- 1.75% of total supply (13.73% to 137.25%);

- 1.50% of total supply (11.76% to 117.65%);

- 1.25% of total supply (9.80% to 98.04%);

- 1.00% of total supply (7.84% to 78.43%);

- 0.00% of total supply — no funding for staking;

As of yesterday, the snapshot passed with ~66% of people favouring the 1.00% funding option.

Why was this proposition made?

The motivation other than incentivizing holding, seems to be to increase interest in the Arbitrum ecosystem and their native token over other L2s while rewarding long-term investors. Utilizing the unclaimed airdrops worth ~$69m, they don’t need to drain too many tokens directly from the treasury. Activating staking would further allow for composability around a yield-bearing ARB token (e.g. liquid staked ARB), and also taking a first but important step towards introducing different forms of revenue sharing in the future.

How would this play out?

If the proposal ends up passing on Tally, then as per the Arbitrum Foundation’s vision — everything will be governed and analyzed by the Arbitrum Coalition, which is comprised of industry experts from various organizations, over a 12 month period. Staking would be made available to everyone after the staking contract is funded with 100M ARB tokens. Stakers will be able to lock up their ARB tokens for up to 365 days with the optionality of withdrawing tokens earlier but incurring a penalty ranging from 0% to 60%.

What implications would this have on price action?

After an official announcement, we could expect a surge in price with many looking to capitalize on the opportunity to lock up the tokens for yield. Inflation-based staking usually benefits short-term price action, but might ultimately cause selling pressure and dilution of non-stakers in the long run.

Incentives & Yield Opportunities

Thanks to the generosity of the Arbitrum Foundation, many projects receiving ARB token grants have put them into good use by offering various incentives to keep the community engaged and grow their user bases.

We’ll be going over some of the most attractive opportunities available on the list of projects that received a grant.

GMX

Yesterday on the 8th of November, GMX signaled the launch of their 12M ARB token distribution program. Rewards can be earned (at the moment) by providing liquidity to various GM pools on their V2 platform. Over the course of 12 weeks, additional incentives will be offered for GLP ~> GM migrations and for trading on the exchange. Token incentive allocations are adjusted on a weekly basis and posted on their Notion article.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

An auxiliary allocation of 2M ARB tokens will be budgeted towards grant incentives for developers and protocols that build on GMX V2 and, thereby, further Arbitrum’s growth. The GMX team will offer three grants with varying values to spearhead this effort:

- Micro Grants - budget up to $10k;

- Open Grants - budget up to $100k;

- Requests For Proposal (RFP) - no set budget (circumstantial);

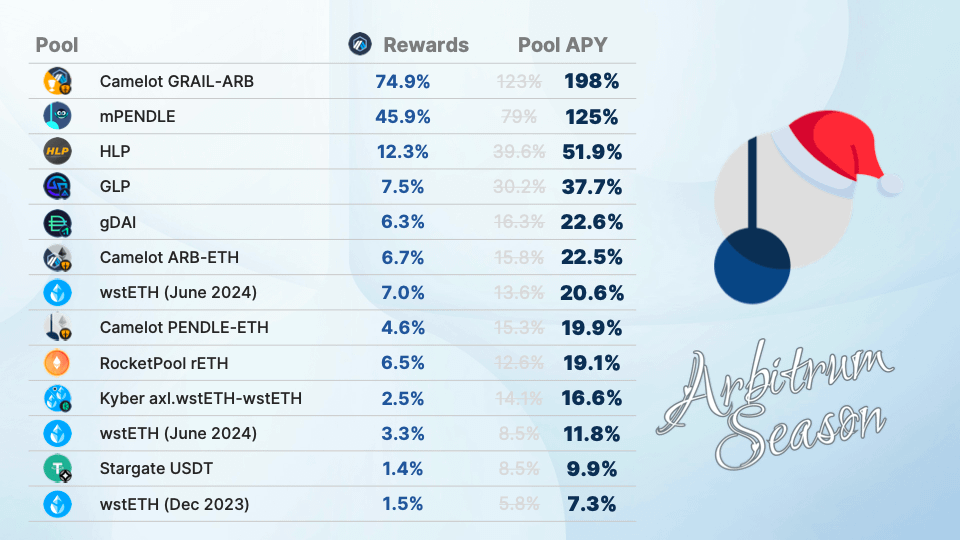

PENDLE

As of today, Arbitrum Season on Pendle has officially begun. As per the team’s announcement 2 days ago on Medium, liquidity providers on Pendle’s Arbitrum platform will be eligible for extra ARB rewards on top of their current yield. Note that the ARB rewards are in fact boostable by vePENDLE. The reward token allocation will be determined weekly by Pendle governance participants.

In addition to liquidity provision incentives, traders can now qualify for ARB Fee Rebates. A total of 26500 ARB will be used for the aforementioned rebates each week (the amount might be adjusted after a few weeks).

- buying/selling PTs and YTs, zapping in/out of LPs warrants a 75% fee rebate;

- ARB will be used to compensate 75% of the fees paid for any transactions;

Once the rewards run out for the week, you will have to wait until the stack is replenished.

An interactive dashboard tailored for this program will be available on Pendle’s website in approximately 1 week (on the 16th). The dashboard will contain all relevant metrics related to the Arbitrum Season event.

Radiant

Up to ~72% of Radiant’s 2.8M strategic ARB token reserve will go towards airdropping depositors that lock their dLP for 6-12 months after Block #147753665 and before the next snapshot, which should take place in the next 30-90 days. Rewards are based on TVL milestones proposed by Radiant.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

dLP interactions on protocols like Magpie and PlutusDAO will also be eligible for rewards, although the distribution of said rewards will ultimately be decided by the respective protocols.

The qualification period for these rewards will end before January 31, 2024.

That’s all for this week - thanks for reading! If you found the newsletter valuable, don’t forget to subscribe to receive the newsletter in your inbox every week. Also, I really appreciate any feedback in the comments below - Have a fantastic rest of the week! ☀️

Nothing stated is financial advice!