Blockchain Profitability & Issuance - Does It Matter?

A report exploring the different schools of thought to blockchain profitability.

Introduction

How profitable are PoW (Proof of Work) vs PoS (Proof of Stake) blockchains? What about Ethereum versus Solana? Should blockchain profitability even matter for an investor? And what the hell is Vitalik doing with Ethereum’s gas money?

Crypto Twitter has been embroiled in these questions of late. This article is an attempt to unpack these big picture questions around the thorny subject of L1 valuation in Web3.

Sponsor - Swell Network

Today’s report is sponsored by Swell Network, the issuer of swETH (LST), rwsETH (LRT) and Swell L2 (restaking rollup powered by EigenLayer).

The Swell L2 is gaining traction with top DeFi protocols like GammaSwap, Sturdy, Brahma, Ambient, Ion and more now committed to deploying on the chain – plus a host of EigenLayer AVS’s (many of which have publicly committed to airdropping to pre-launch depositors, and others are expected to follow).

Over 35 different assets can be deposited into the Swell L2 including LSTs, LRTs, Ethena’s USDe and more. More exotic assets like Lyra’s eETH & rswETH covered call vaults and PT token from Pendle. Depositing PT tokens grant high fixed yield, often at over 20% APY on various assets, while also making you eligible for Swell L2 airdrops. These PT tokens include PT USDe (25 Jul 2024), swETH (26 Dec 2024), PT rswETH (27 Jun 2024) and many more.

You also retain the points and rewards of all deposited assets. Deposit in the Pre-Launch to earn airdrops from the projects building on the chain, a bonus airdrop from Swell on the launch of the L2 in Q3 and more! Read the full announcement here.

PoW Ethereum Profitability

Suppose we wanted to determine which L1 token had the highest upside. The first step in research is to know something about the underlying profitability of the blockchain. So if you asked a Wall Street analyst how profitable a blockchain is, here’s how they might calculate it:

Revenue (total transaction fees) - Expenses (total token issuance) = Profit

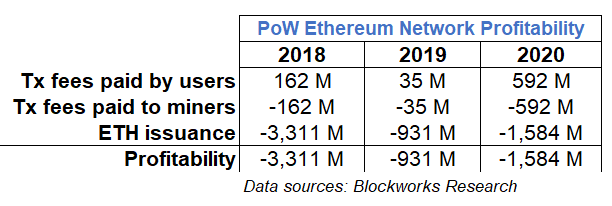

When applied to PoW Ethereum:

The conclusion is simple: Ethereum PoW was unprofitable and its business model was fundamentally broken. 100% of transaction fees were paid to miners, so Ethereum made zero revenue. To make things worse, ETH issuance to incentivize blockchain validation was really high, making the chain deeply unprofitable. Of course we know in hindsight that the price of ETH has gone up, but the price appreciation during those years came purely from the headwinds of speculative fervor, not intrinsic factors.

Post-EIP-1559 and Merge update

Today in 2024, there are largely two critiques of the simple analysis above. The first critique points out that a lot has changed since PoW, while the second makes more subjective, structural arguments (more on this in the next section).

What’s changed?

- Since EIP-1559 in August 2021, Ethereum gas fees are split into a base and priority fee tip. The base fee is burned which makes ETH more scarce, thereby increasing the value of ETH, so “real” value is understated. Priority fees on the other hand are paid to validators as tips.

- Since the Merge in September 2022 and a shift to PoS, token issuance has been drastically reduced.

- Since the release of Flashbot’s MEV-Boost software for a PoS Ethereum, validators are paid additional payments for block inclusion by users, so revenue is understated.

In summary, there are four variables impacting the profitability of the Ethereum network:

- Base fee (burned)

- Priority fee (paid to validators)

- MEV (paid to validators)

- ETH issuance/inflation (paid to validators)

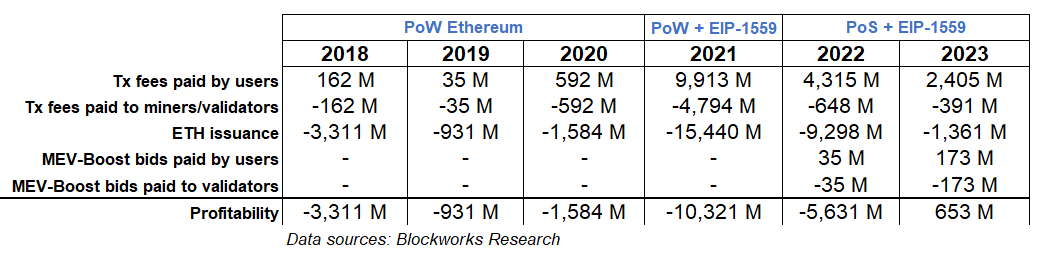

When we update the table above:

- Since EIP-1559, a portion of network transaction fees are burned, as indicated in the fees paid by users minus the portion paid to validators

- 2023 is the first full year by which the network is “profitable”, largely thanks to the shift to PoS

- MEV payments are paid in full to validators, so ETH holders see none of that revenue

Conclusion: Ethereum PoW used to be deeply unprofitable and its business model was fundamentally broken. But thanks to the more efficient gas pricing of EIP-1559 and the huge reduction in token issuance since the Merge, Ethereum runs a profitable business today.

Note that PoW miners/PoS validators also spend money on electricity and hardware, but it’s been omitted here since that is an external cost borne by the validator and not the “network”. Since March 2024, blob fees are also a revenue item paid by L2 rollups to Ethereum, but that is relatively minor so it has also been omitted.

Is token issuance even a cost?

The second critique argues that it is entirely a mistake to treat token issuance as a cost. This argument has been made by notable figures like Jon Charbonneau, Kyle Samani, and particularly Anatoly as seen in the recent debate with Justin Drake on Bankless.

Treating token issuance as an expense implies that tokenholders are diluted – the same way the Federal Reserve dilutes your dollar savings with its money printer. But that is not the case since users have the right to receive the network’s inflationary token issuance on PoS chains by staking with a liquid staking platform like Lido. In addition, ETH stakers also earn priority fees and MEV payments.

If you’re onboard with this line of thinking, the question you’d ask yourself then is this: The real yield on my ETH from staking in a liquid staking platform is net-positive. Why do I as an ETH holder then care if Ethereum is “profitable” since I can easily access this cash flow?

Consider a thought experiment where all the money inflated from central bank printers is equally and efficiently distributed to every citizen at the same time. In such a scenario, no one is made worse or better off. The Gini coefficient has not changed, and everyone’s fiat holdings is nominally higher but the same amount of real value chases the same amount of goods and services. Of course, this is not the case in the real world. When money printer goes brrr, the inflated money supply reaches different actors in the economy at different times, thereby benefiting those who receive the new money supply first (known as the Cantillon effect). But this is in fact what is happening in a PoS blockchain economy.

As such, just as it is pointless to obsess over the “profitability” of the American economy when everyone receives the same amount of cashflow from the central bank’s money printer equally, it is pointless to look at the “profitability” of the Ethereum blockchain.

That’s not the end of it. If the logic of this analysis is right and token issuance is not a cost, then that implies that non-stakers are in fact being diluted, since they do not receive token issuance.

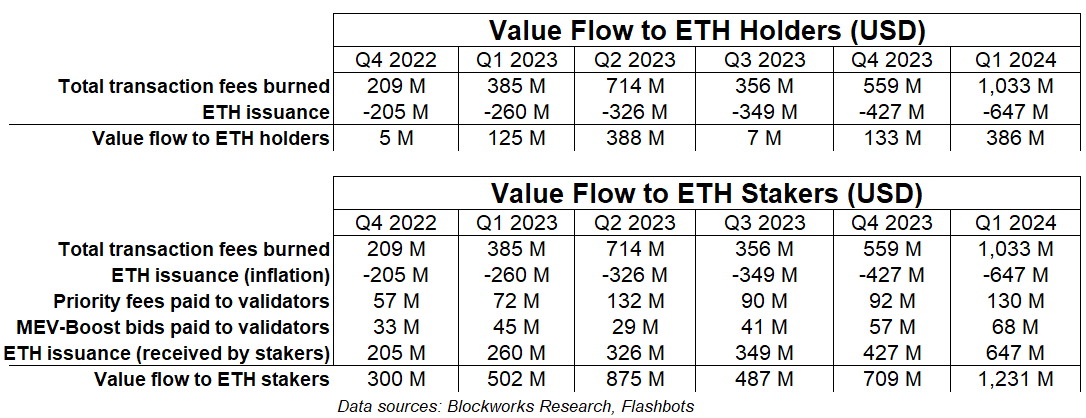

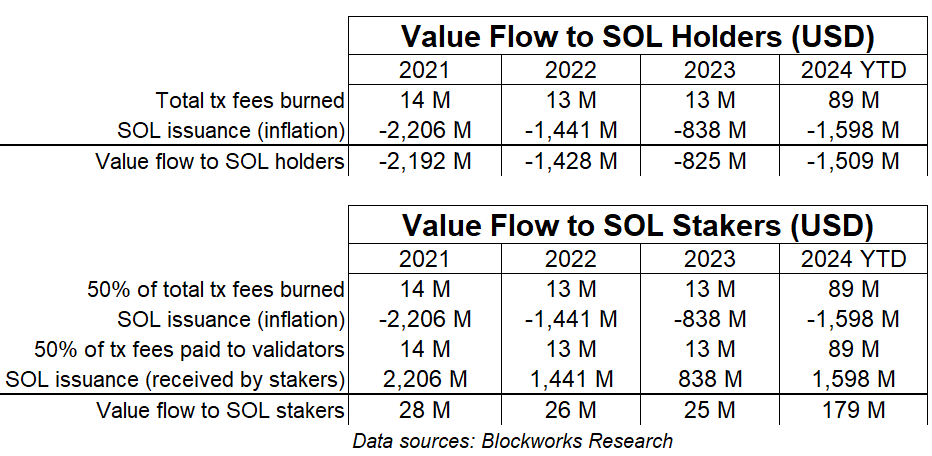

The key analytical question then is: what is the difference in value flows to ETH holders vs ETH stakers?

A few things of note here:

- Priority fees, MEV payments and ETH issuance are now all flipped from “cost” to “revenue” items

- ETH holders are still net-positive thanks to EIP-1559’s burn and the shift to PoS. But ETH stakers receive a larger share of value by contributing to network validation.

- A negligible cost item to stakers here is the ~10% commission rate for staking on Lido

In summary, an “unprofitable” blockchain seems terrible, but stakers remain net-positive from value flows. The simple revenue - costs = profits framework above makes sense in TradFi since shareholders have a legal claim on dividend payouts or assets. But equities are not the same as L1 tokens and hence a macroeconomic view of “blockchain profitability” is less relevant.

Solana network profitability and value flows

Now let’s look at Solana.

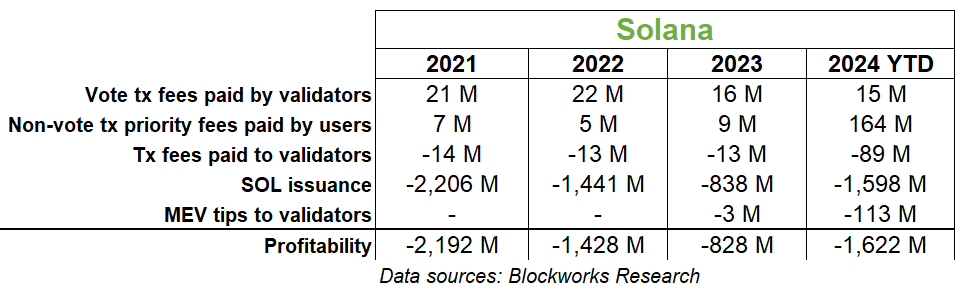

- Solana’s transaction fee model breaks fees into voting transactions and non-voting transactions. Voting transactions are submitted by validators to vote-sign for network consensus, while non-voting transactions are the primary metric to track network activity as it refers to SOL transfers between different Solana accounts/smart contracts. Both are counted here as a revenue item.

- From a network POV, Solana is deeply unprofitable.

But as proponents of Solana tend to argue, the above valuation model is irrelevant since SOL holders can stake to receive network issuance. So let’s look at the value flows to SOL holders vs stakers:

- As expected, value flow to holders runs deeply negative since SOL holders are massively diluted by network issuance. But SOL stakers are net-positive as they receive the network issuance.

- Due to Solana’s ultra-cheap gas fees, the network suffers from perverse incentives to spam transactions on a FIFO basis. To mitigate this problem, Solana devs include an option for users to pay a priority fee that is paid 50% to block builders (called “leaders”), with the other 50% burned. Both of these are included as revenue items since SOL stakers gain value from both. It’s worth noting that as of a week ago, governance has changed this to allocate 100% of priority fees to validators.

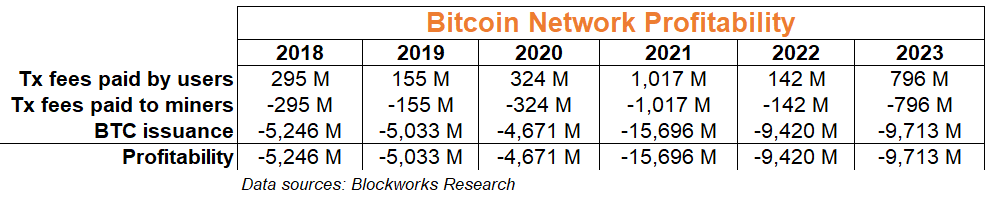

A quick note on PoW consensus

To bring the point back full circle, remember that value accrual applies only to the L1 tokens of PoS chains.

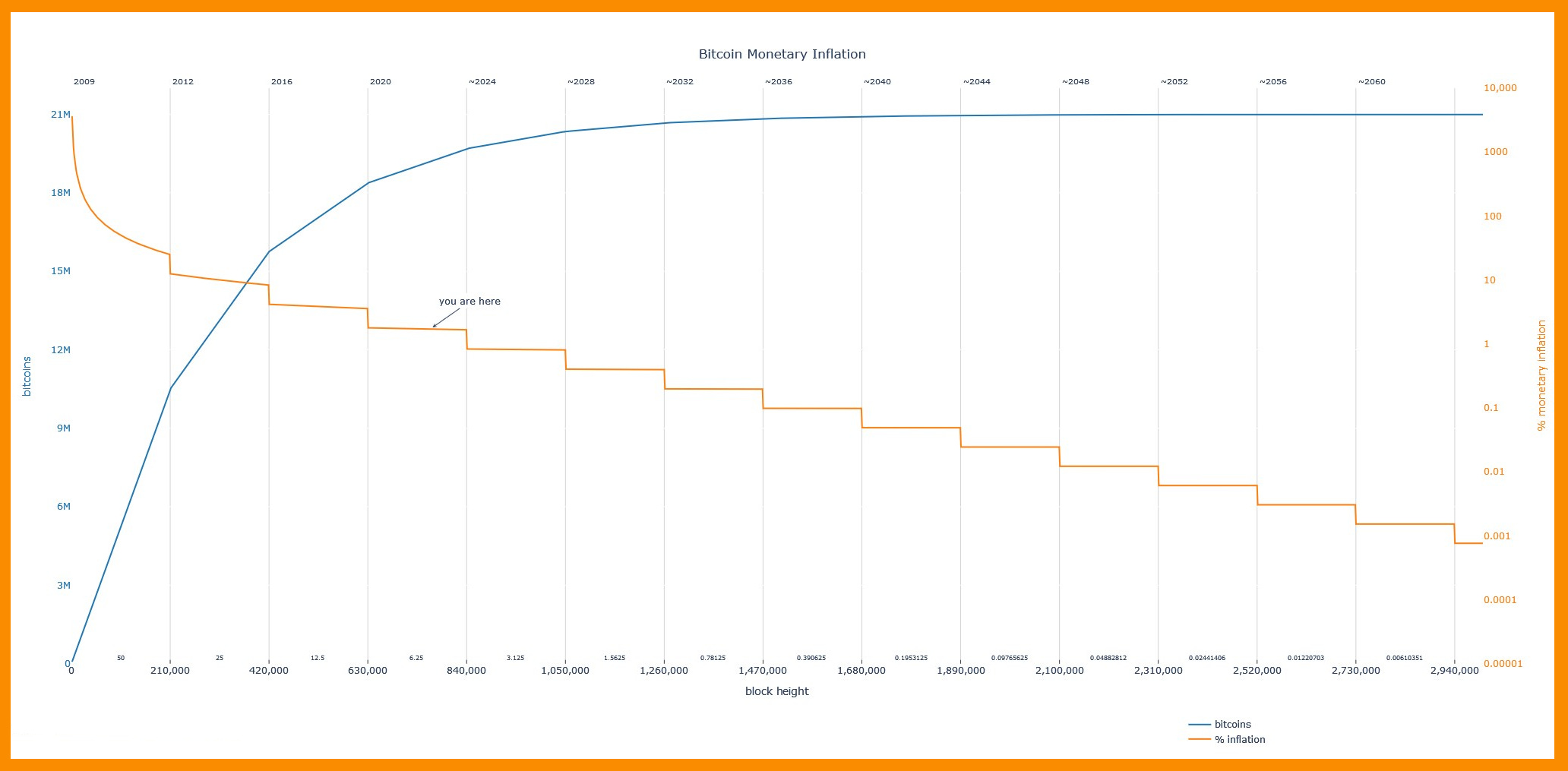

In the case of a PoW chain like Bitcoin (or Ethereum pre-Merge), there is no such value accrual since there is no “Lido” where you can opt into to receive a share of BTC issuance. BTC issuance is a direct expense to the network, akin to the FED printing USD and diluting the real value of anyone holding the dollar.

To make things worse, 100% of BTC issuance is paid out to miners expending mammoth amounts of electricity to provide a service in exchange for a reward. Miners will be selling BTC to pay for their operating costs, and therefore are contributing to sell pressure on the market. In summary, if you’re holding BTC, not only are you being diluted from token issuance rewards, your holdings are also subject to significant sell pressure from miners.

This all makes Bitcoin seem like a terrible digital asset built on broken tokenomics. However, this conclusion stems from an attempt to shoehorn the same valuation model used for ETH into BTC. A Bitcoin maximalist would likely argue that this commits a grave analytical mistake of treating BTC and ETH as the same type of asset, when BTC is more akin to a commodity-like money asset.

If so, valuing BTC then demands a different kind of model that rightfully prices in its monetary premium, rather than a simple revenue - costs = profits framework.

Conclusion

Whichever side of the debate you’re on, it’s undeniable that in an ideal world, token issuance would be zero, or at least close to zero. Even if tokenholders have a simple way to escape dilution, there still exists a loss in value to non-stakers, as Polynya points out here. All non-stakers eat the inflationary pressures of token issuance – including anyone holding their tokens in a cold wallet for security reasons, crypto investors who aren’t on chain, anyone deploying their L1 tokens towards higher risk yield DeFi activities, etc.

Key thought leaders in the Ethereum community have typically fallen on the side of the “token issuance is a cost” debate, with alt-L1s on the other side. Given the extensive amounts of effort that Ethereum devs have dedicated to making ETH deflationary today, in addition to ongoing discussions around further lowering ETH issuance, it’s easy to see why Ethereum leaders have placed such a huge emphasis on treating issuance as a cost.

On the other hand, alt-L1s tend to have much higher token inflation, and staking rates tend to be far higher on chains like Solana relative to Ethereum, which might explain the motivation to explain away token issuance as a cost.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.