Analyzing The 2024 Fundraising Landscape

Assessing recent investment flows within the space reveals emerging trends and shifting priorities.

Seeds sown in uncertainty last year have finally started to bear fruit. Retail investors have revealed their hands to everyone around the table, while private capital keeps its cards close. What have they been holding? What outcomes were they betting on? They’ve played it safe ever since being burned by overzealousness the previous time Bitcoin traded at these prices. Has the strategy changed this time around?

Introduction

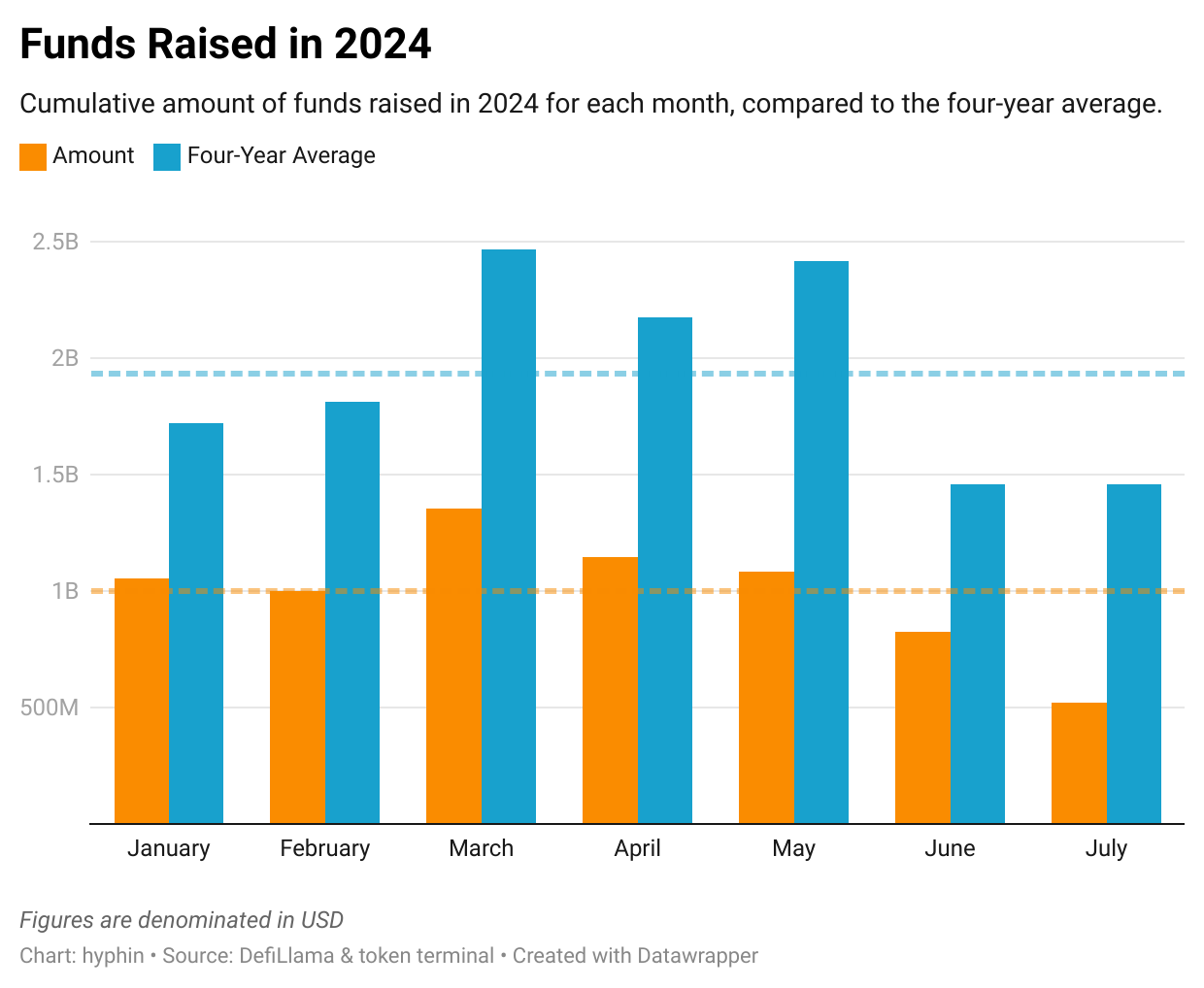

Regardless of the market climate, fundraising will never grind to a complete halt as the industry’s engine of ingenuity is efficient enough to reward those fueling it. The proactiveness, however is heavily dependent on the forecast. Promising conditions historically tend to be alluring for early-stage capital as potential rewards significantly outweigh risks associated. For many onlookers, the increased presence of these for-profit entities signals that the party has either started or will begin soon. It’s evident that we’ve been in a bull market for quite some time with the citadel being in arm’s reach. With this in mind, one would expect cumulative funding to exceed or at least come close to the bar set during the previous cycle.

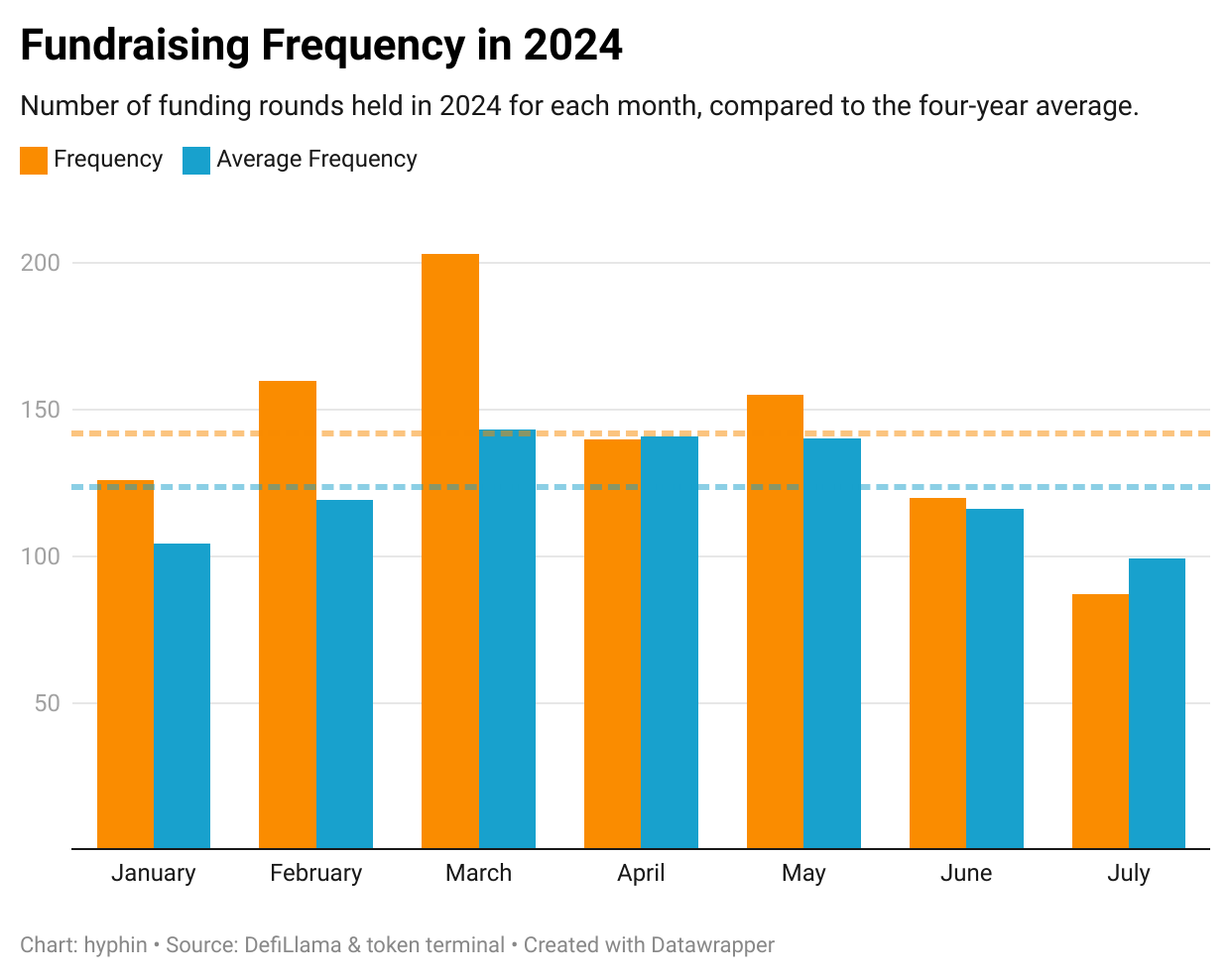

Safe to say that these optimistic expectations got stood up by reality as this year’s monthly metrics are dwarfed by the four-year averages. In contrast to 2018, 2021 and 2022 these numbers are merely a drop in a bucket manufactured during the zero-interest, cheap money era. While the reported financial figures are nothing worth ogling over, they do suggest that access to great deals of initial start-up capital has decreased noticeably as we transition to the new normal. This doesn’t mean that people at the office have kicked their feet up on the table as activity has seemingly died down. On the contrary — the number of investment rounds that have taken place has actually been above average.

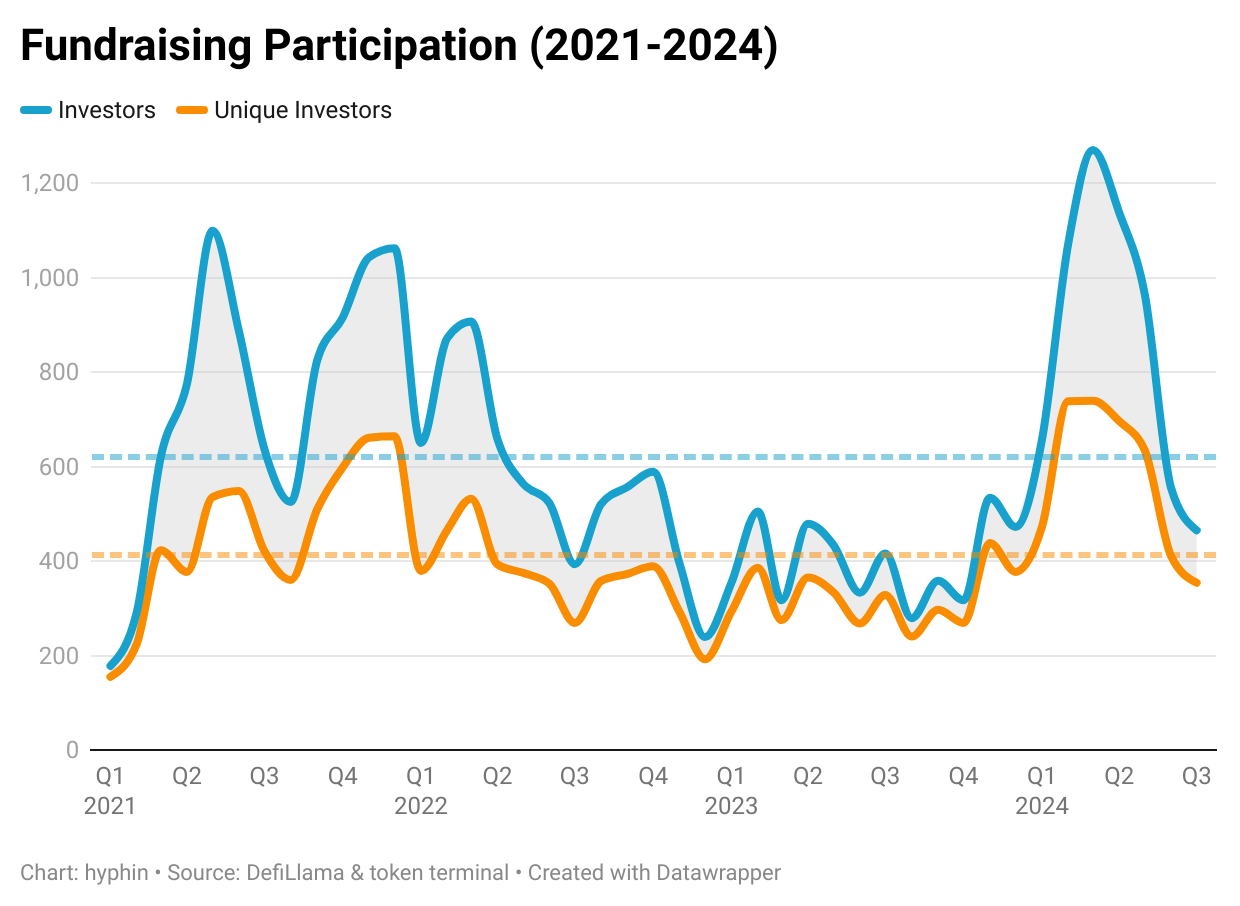

Leading up to Bitcoin’s run-up to fresh all-time highs, the velocity at which drafted fundraising announcements were distributed accelerated considerably, showcasing the robust participation in bootstrapping operations behind the scenes. This surge was largely driven by sidelined participants entering the market en masse and engaging in more rounds than usual. However, activity has slowly tapered off, as summers are historically known to be fairly uneventful.

Granted, the average checks written out to founders are definitely not what they used to be, forcing builders to be resourceful and wisely manage their burn rate to successfully take their creations to the finish line.

Sentiment

Having insight into the current fundraising landscape, we can confidently deduce that venture capital expects some upside in the unforeseeable future. Although the size of the wagers doesn’t instill too much confidence, the risk appetite might. Funds can be raised at various stages of a company’s development, each with its own considerations and industry-standard sum ranges.

To learn more about the general know-how and terminology, we advise you to check out our previous article on the subject before continuing.

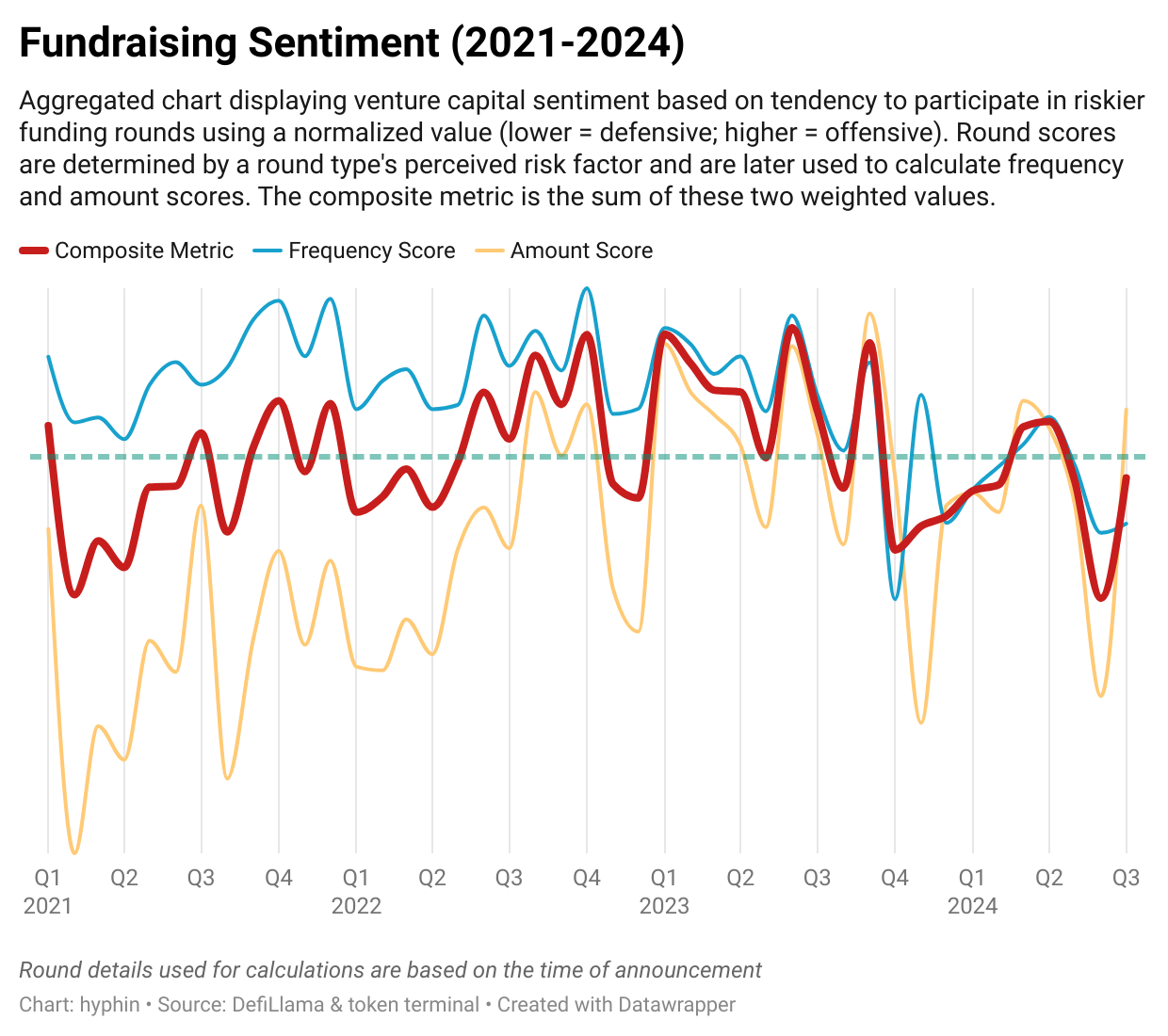

By categorizing investment types based on their individual characteristics, we can assign them an approximate risk score. This enables us to broadly gauge the risk tolerance of all vested parties as a whole, thereby determining the confidence in the continuation or change of a trend by quantifying their collective tendency to engage in speculative undertakings.

Round Scoring Logic

A score represents the perceived riskiness of an individual investment round. The higher the score, the riskier the investment.

10; Pre-seed

9; Seed

8; Series A, Undisclosed

7; Series B

6; Series C

5; Series D, Strategic

4; Series E, Private, Angel

3; Mergers & Acquisitions

2; Grant

The sentiment in our illustration will be represented by a composite metric, calculated by adding up the weighted frequency-based and amount-based scores using the values we established earlier.

Weighting Logic

To balance the importance of each metric in the composite calculation, weights are incorporated to better account for nuances.

α = 0.6 (frequency)

β = 0.4 (amount)

A lower composite metric indicates a more defensive stance, while a higher value suggests an aggressive position. The shift between these stances can be determined by whether the value crosses the mean (marked as a dotted green line on the chart).

Although slightly overwhelming, the graph provides an intriguing view of how positioning and investment approaches evolved over time. In the previous cycle, low amount and high frequency scores led to a relatively tame composite metric, as substantial sums were primarily invested in high-valuation series rounds. Many well-capitalized firms made significant bets on the industry through infrastructure and institutional products. This sentiment began to shift towards the end of the rally, with riskier early-stage funding becoming more prominent as greater emphasis was placed on incubating emerging projects, while maintaining conservative commitments. A change in pace can be seen around the last quarter of 2022, when massive individual rounds were conducted during the time FTX collapsed and the future of crypto was called into question. Following a cataclysmic capitulation and the formation of a market bottom, private capital took a gamble by immensely scaling up its financial support for developing companies well into Q4 2023. Subsequently, larger private sales and series, strategic rounds came to the forefront. This trend has consistently continued throughout most of this year, resulting in a decline in the frequency score despite record-breaking activity. Indicating that investors are being more cautious and selective with their allocations, favoring safer ventures.

Funding Analysis

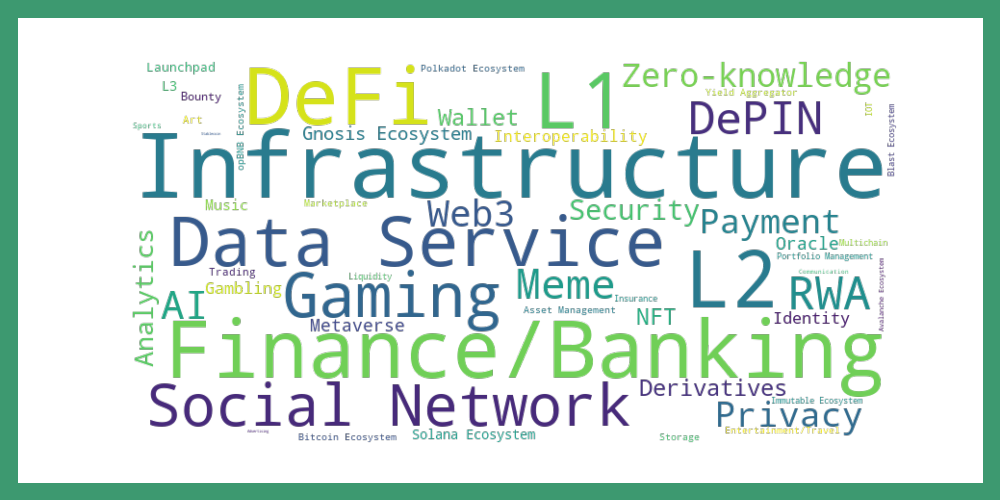

It’s been a tough year for most altcoins, with a minority from just a handful of categories outperforming major assets. Even those receiving discounted tokens aren’t immune, as the downside potential for more speculative investments has proven to be virtually bottomless. Picking the correct niche has become more important than ever. To get a bird’s-eye view of the flow of funds and evaluate the most sought-after narratives, we can map raised sums to their respective categories. For the sake of consistency, all publicly traded Bitcoin mining companies have been excluded from the dataset. It’s worth noting that not all raises have reported figures, so the actual composition might slightly differ.

Compared to last year, interest has undeniably diluted, with some previously neglected traditional sectors gaining more traction alongside novel areas, as financiers employed a broader ecosystem and infrastructure approach. This further supports the notion that risk is being carefully evaluated and exposure to newly forming or reemerging narratives is limited.

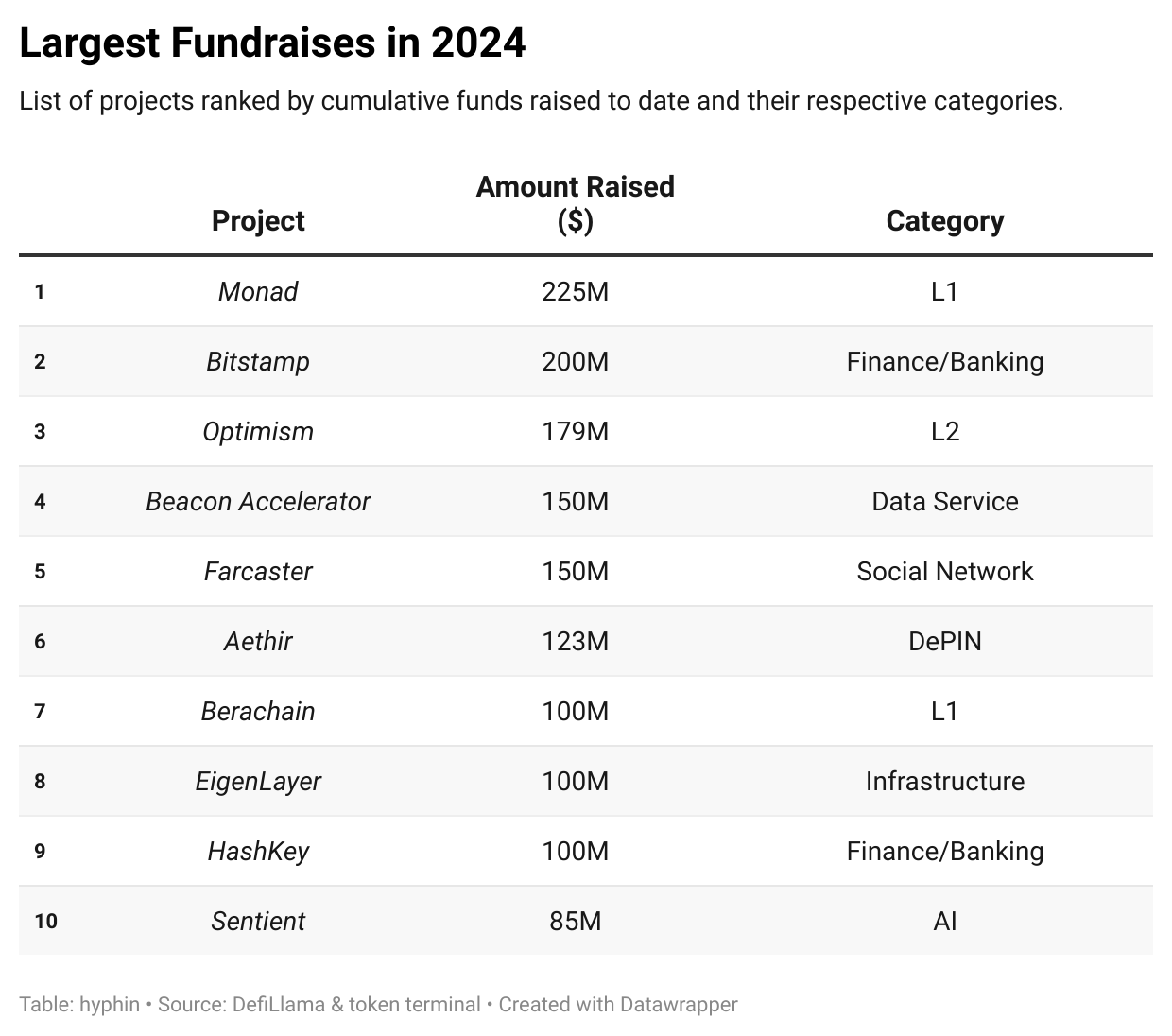

Focusing on the prevalent sections, infrastructure rightfully stands out as the fundamental pillar of the industry, with projects like EigenLayer paving the way for new primitives and generating vast amounts of economic value and activity. Unexpectedly, various trading venues and financial services aiming at expanding existing operations and introducing new products tailored for both institutions and regular users were also subject to generous funding. Keen attention to this corner of the market was last seen in 2021, when onboarding and simplified yield efforts were at an all time high. Regarding other entries on the list, funding amounts have either declined or remained relatively stable compared to last year, leaving only a few noteworthy observations.

Resurgence of L1s and L2s

Following some high-profile raises, blockchains as an investment have once again found themselves in the spotlight. Despite the saturation of the layer-1 market, Monad ($225 million) and Berachain ($100 million) among others, received substantial liquidity injections, similar to those handed out in 2022. Nearly tripling the total value poured into the sector in contrast to last year. Roll-ups have also shared in this success, with their cumulative funding slightly surpassing that allocated to base chains, attributed to new, exciting developments in the space. While layer-2 solutions on Ethereum, or those leveraging its underlying technology, have been the focal point for what feels like forever, alternative virtual machines and chain deployments show signs of growing interest. Bitcoin and Solana are prime examples of this.

The Rise of Social Networks

Though decentralized social platforms have been around for a while, they have struggled to capture a large user base or secure significant funding. The biggest challenge for these platforms has been converting Twitter users, which remains the de facto stage for crypto discourse. However, Farcaster, which launched in late 2023, has achieved remarkable success, reaching close to 40 000 daily active users before raising $150 million in a billion-dollar Series A round led by Paradigm.

Ecosystem Contributions

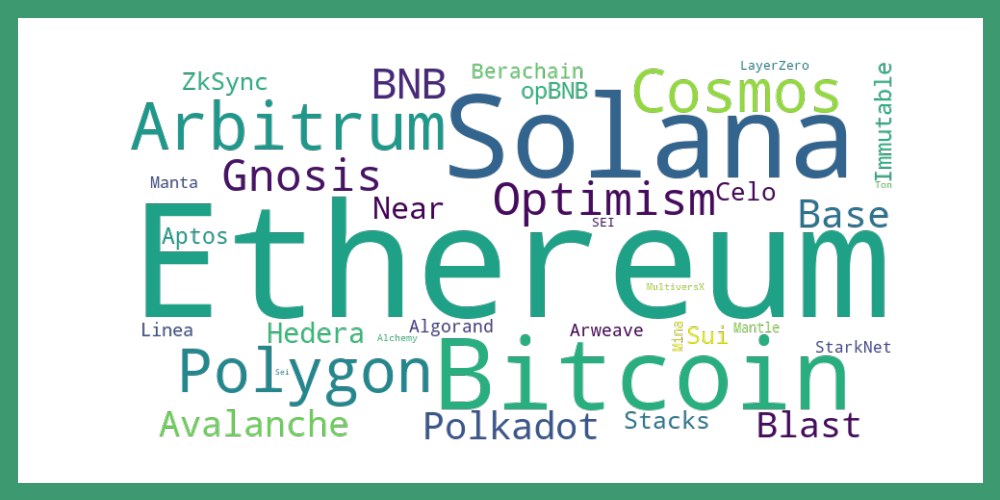

Ethereum, and more recently its scaling solutions, have remained as the primary hub for ecosystem-specific investments, although their dominance is decreasing year-over-year as emerging ecosystems provide abundant opportunities less common in mature, established environments.

Most of the flows were consolidated into Ethereum, Bitcoin, and Solana, with other chains struggling to compete. Solana has improved its position over the year prior, witnessing an influx of unique active addresses, enormous trading volumes, and the popularization of its virtual machine. The same can’t be said for Bitcoin, as it failed to retain momentum and was overtaken by Solana, partially due to the focus shifting towards mining operations. Nonetheless, the Bitcoin ecosystem is developing rapidly and is still somewhat in its infancy.

Conclusion

In spite of Bitcoin’s favorable price action and the strong presence of institutions, the cumulative amount of funds raised has been unexpectedly low, only marginally improving over the previous year. Activity spiked temporarily but has since reverted below the mean, reflecting seasonal patterns. Sentiment has thus far been relatively passive, with venture capital remaining cautiously on the fence. With four months left until the Year of the Snake, there’s plenty of time for Bitcoin to establish a range and display a clear direction. A clean break to the upside, along with altcoins finally being safe to long again, should give the green light to participating in riskier endeavors.