Analyzing Hyperliquid's Fundamentals

Introduction

Since the launch of HYPE, Hyperliquid has seen massive growth in terms of trading volume and revenue. HYPE launched at $2 on November 29th and has increased by over 1400% in less than a month. Today's report dives into the fundamentals of Hyperliquid and HYPE, exploring the HYPE bull case and potential valuation considering volume and revenue growth in 2025.

At On Chain Times, we've been Hyperliquid-pilled for a long time. While this post covers the recent growth of Hyperliquid and $HYPE performance, you can check out our post 'All In on Hyperliquid' below which is an interview with the team covering the present and future of Hyperliquid.

Sponsor - Swell Network

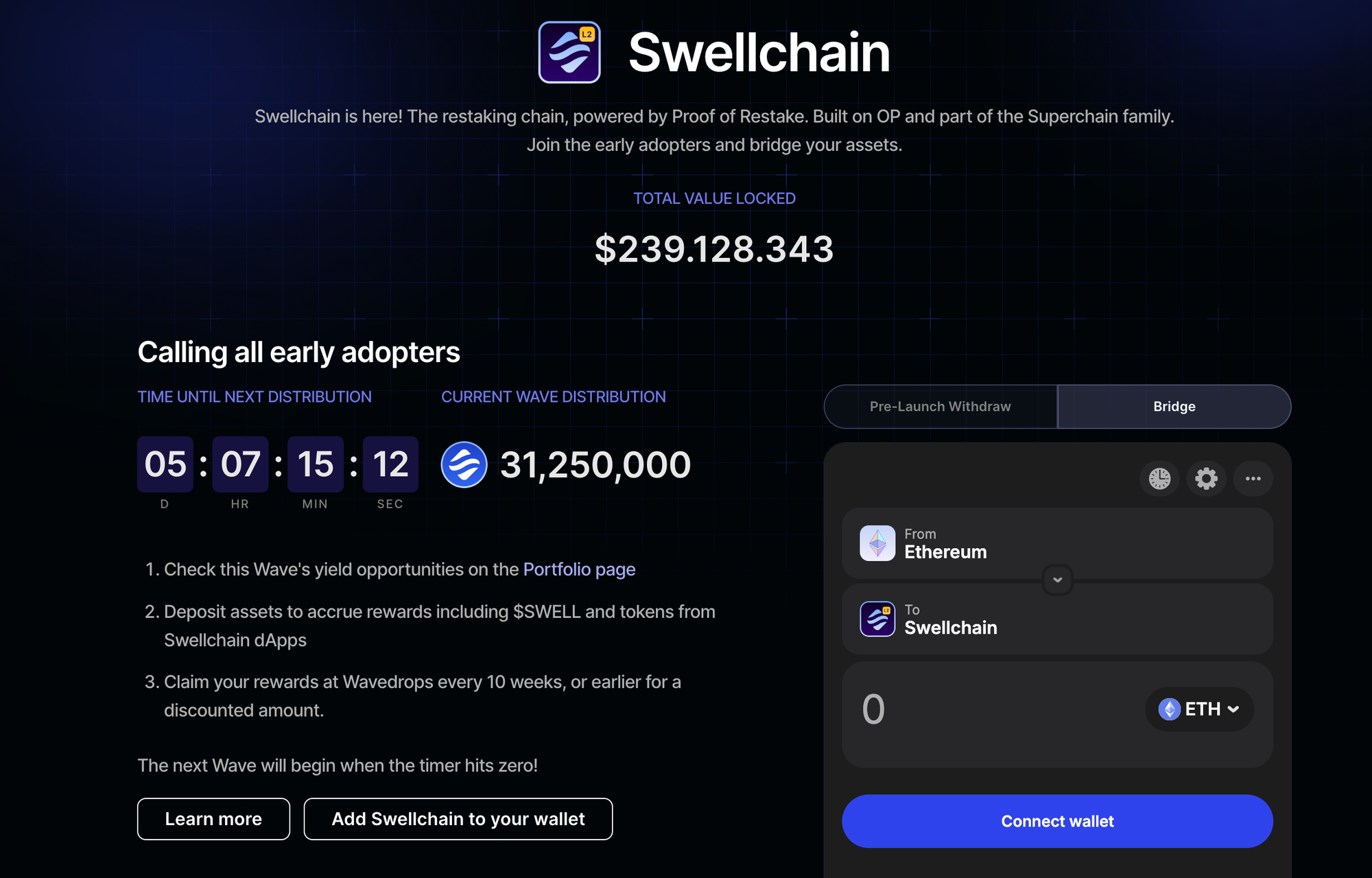

Today's report is sponsored by Swell Network. Swell is one of the leading protocols withib liquid staking and restaking and boasts over a billion dollars in TVL across its products. In addition, Swell recently launched their mainnet for Swellchain, a hub for restaked assets within the Optimism and Ethereum ecosystem. Swellchain is built as an Optimistic rollup, incorporating Chainlink, RedStone, AltLayer, Symbiotic, Eigenlayer and more. Its ecosystem consists of a large number of applications such as Euler finance, Ambient and ION protocol and has integrated several launch partners like Ethena, EtherFi and more.

Wave 1: Bridge and Hold. There are currently 5 days left of the first Swellchain campaign where users will share 31.25m SWELL simply by holding assets on the chain. As seen below, the TVL is currently sitting at ~$239m. Following this campaign, wave 2 will introduce additional SWELL rewards alongside token rewards from protocols within the Swellchain ecosystem. Check it out here.

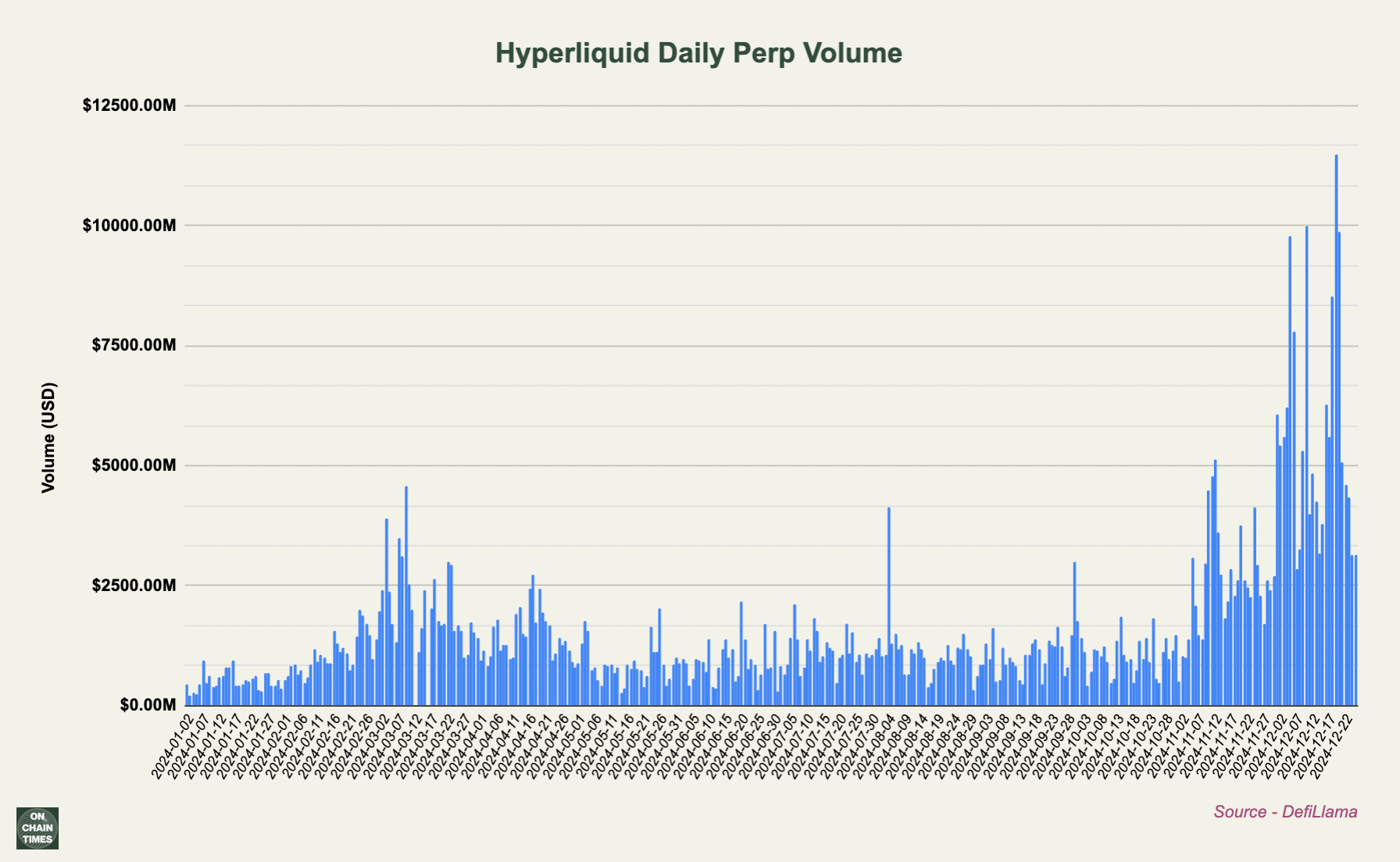

Trading Volume

Prior to the release of HYPE, skeptics anticipated low trading volume after the airdrop, as past behavior among perpetual decentralized exchanges has shown exactly that.. Mercenary capital rotates from one protocol to the next depending on where the highest rewards are. Notably, the trading volume on Hyperliquid has increase dramatically since the release of HYPE hitting several new daily all time highs of over $10b in a single day. Apart from the previously large incentives given to traders, Hyperliquid is a superior on chain product which most traders who have used the platform will agree on.

It is also worth noting that, while the first airdrop consisted of 31% of the HYPE supply, there is an estimated 42.81% of the total supply left for future emissions and community rewards. While it is to be expected that a portion of these rewards are dedicated as staking incentives and potential rewards centered around the HyperEVM L1 ecosystem, there is a non-zero chance that current trading volume and/or HYPE holders are earning some sort of reward without knowing it.

Every single month hyperliquid has been live there’s been “points”

— moon (@MoonOverlord) December 25, 2024

There’s very likely a secret points month going right now

It’s probably the #1 thing to farm (again) in 2025 as it was in 2024 https://t.co/eFxuGpOYqe

42.81% of the HYPE supply is equivalent to ~$11b (at $25 per HYPE), which is a substantial amount of rewards and this makes trading on Hyperliquid even more appealing for perp-traders. However, keep in mind that this is pure speculation.

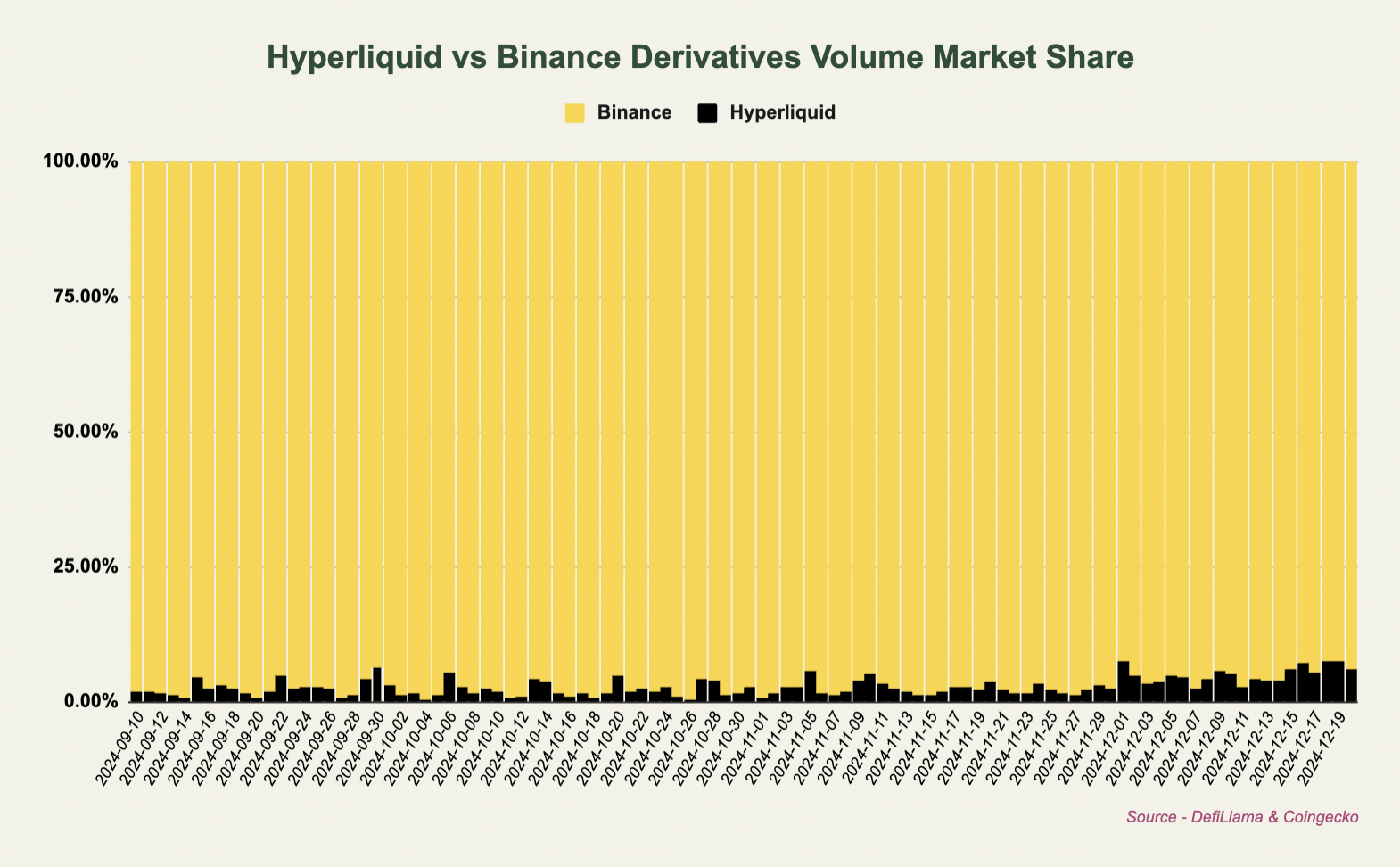

Hyperliquid vs CEXs

We've long been tracking the Hyperliquid perp volume relative to that of centralized exchanges like Binance (aka 'off chain Hyperliquid'). Over time, the bull case for Hyperliquid involves growing market share as more users and volume move on-chain. Comparing Hyperliquid with Binance, it's clear that there still is a long way to go. There has however been a clear uptrend in Hyperliquid marketshare in December, as seen below. In the past two weeks, Hyperliquid relative marketshare has been around 5-8%. According to Coingecko, Binance has recently been doing between $60b-$150b in daily derivatives volume. Keep in mind that there is no way to actually verify these volume numbers from centralized exchanges, so it might be worth taking these with grain of salt.

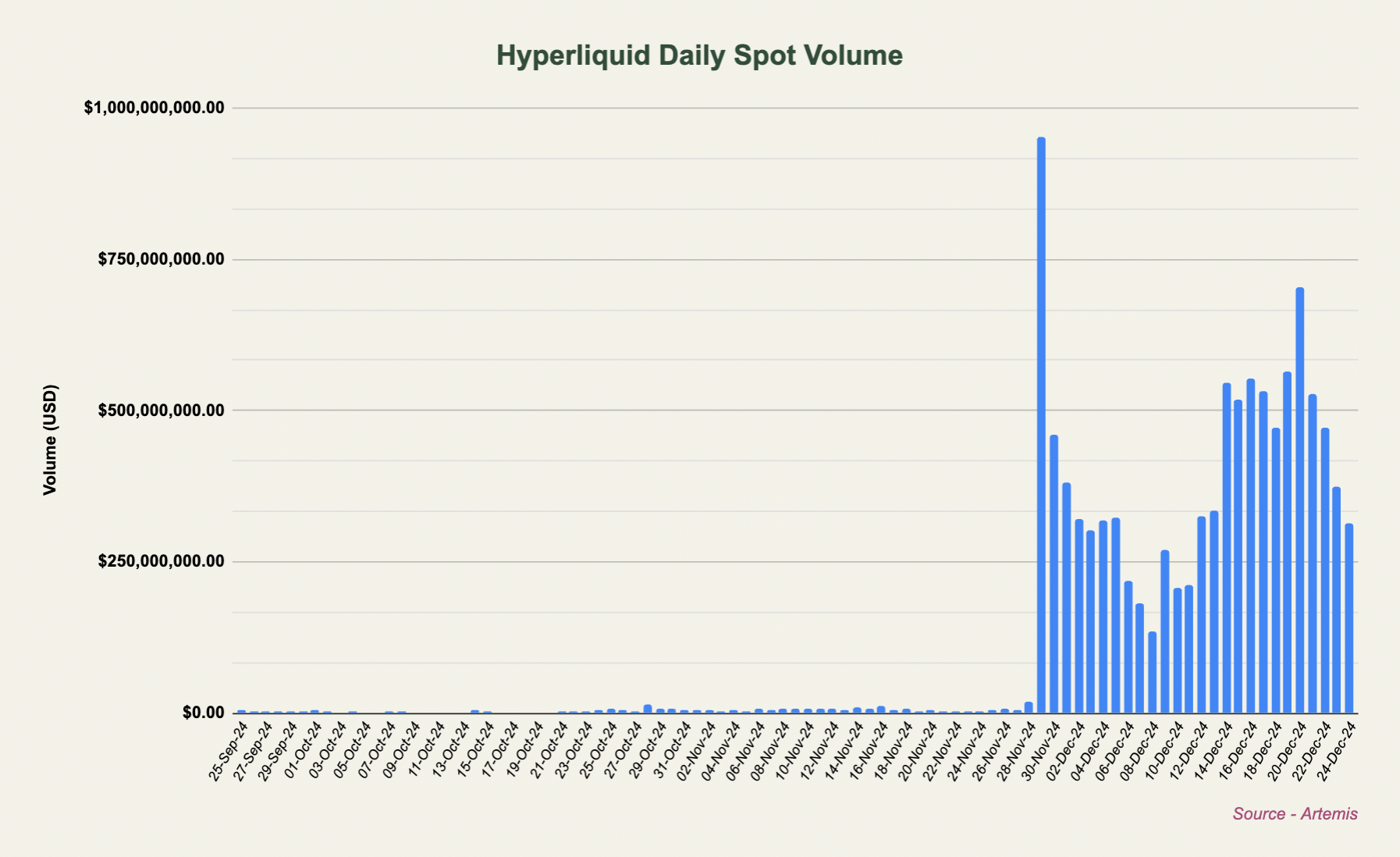

Spot Volume

As you are likely aware, Hyperliquid also has a market for spot tokens., Hyperliquid also has a market for spot tokens. Since the launch of HYPE, spot volume has increased significantly, with the largest tokens by volume being HYPE, PURR, HFUN, and PIP.

Tokens are added to the Hyperliquid spot market via auctions where the highest bidder get to launch their ticker. These occur every 31 hours and are currently going for ~$300k as seen below. The highest auction was for $GOD December 16th in which nearly $1m was paid to win the auction.

Fees & Revenue

Perps

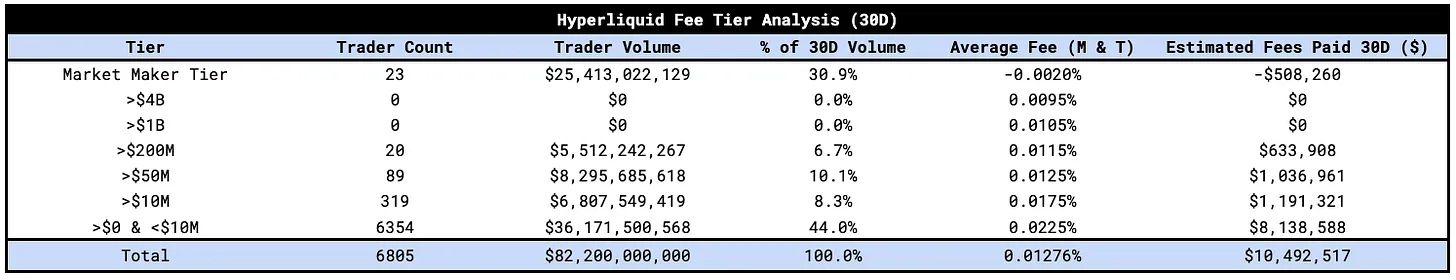

Fees on Hyperliquid are paid by traders on the platform. These are kept low relative to other exchanges, like Binance, to incentivize trading activity. For perpetual futures trading, fees are, for most people, 0.035% for market orders (taker) and 0.01% for limit orders (maker). The more volume you do, the lower your fees:

To calculate the fees earned by the protocol, one would have to calculate the average fee paid by traders (taker vs maker volume and average fee tier). ASXN did a great job analyzing this in their report from September as seen in the image below. From this, the average fee paid was estimated to be 0.01276% which is a conservative/worst case value due to assumption around market maker rebates. You can find their full report here.

With this average fee-value in mind, should Hyperliquid average $5-$10b in daily perpetual futures volume, that equates to $232,870,000-$465,740,000 in yearly fees (which in reality likely is higher due to the conservative assumptions around the average fee).

These fees are collected by the HLP market making vault, the insurance fund, the assistance fund and a few other miscellaneous addresses on Hyperliquid. There is no public information from the team on the exact distribution of fees generated by trading activity on the platform making it difficult to accurately estimate HYPE buybacks.

Spot

The fees paid by traders on the spot market are used to buy and burn the token traded. To no surprise, HYPE makes up most of the spot volume on Hyperliquid. To date, over 100k HYPE (>$2.5m at current price) has been burned from the spot fees on HYPE. In the grand scheme of things and compared to the buybacks from the Assistance Fund, this doesn't have a material impact on the HYPE supply (at least yet).

100k HYPE burn has been achieved internally. pic.twitter.com/JtTli3oIRw

— ASXN (@asxn_r) December 23, 2024

Spot Auctions

Hyperliquid also generates significant revenue from the money paid by the winning bidders of spot auctions. At $300k per auction, that's an additional $84,774,000 in yearly revenue for Hyperliquid. Flo posted a great analysis on X covering the Hyperliquid revenue at different values for spot auction prices and daily volume. At $1m per spot auction and $6b in daily volume, Hyperliquid revenue is estimated to be $829.5m yearly. At a 30 P/E ratio, that would land HYPE at $74.52 per token.

3 digits $HYPE doesn't seem crazy if auctions reach 8-figs https://t.co/tUSnQM0Oju pic.twitter.com/UHftdYlcoi

— Flo (@fmoulin7) December 17, 2024

Assistance Fund & HYPE Buybacks

While it's uncertain exactly how revenue from spot auctions and perp trading is distributed between the Assistance Fund (AF), the insurance fund, HLP and other addresses, we can measure the daily HYPE buybacks via the AF. A few days ago, I posted an analysis on X looking at the 48h HYPE buyback from the AF. At the time, 151k HYPE was purchased in 48 hours which corresponds to $686m in annualized buy pressure. On those two days, Hyperliquid saw an average $8b in daily volume.

In the past 48 hours, the Hyperliquid Assistance Fund has purchased an additional 151,010 $HYPE at an average price of $24.899.

— Thor Hartvigsen (@ThorHartvigsen) December 19, 2024

That's $3.760m of buy pressure in two days and $686m/year when annualized.

The assistance fund receives USDC from fees generated on Hyperliquid and… pic.twitter.com/Ru4ChaDz1I

In contrast to many other protocols in crypto, HYPE gains direct value from revenue generated by Hyperliquid as it is used to buy HYPE on the market.

Looking Ahead

The bull case for HYPE going into 2025 is a bet on growing volume on the Hyperliquid exchange and growing demand for spot auctions as it leads to increased revenue and by extension larger HYPE buybacks. One argument for growing adoption of Hyperliquid is the several billions of dollars still set aside for future rewards which makes Hyperliquid a very lucrative place to trade. Hyperliquid has a very strong user-centric community which has resulted in large mindshare and strong narratives around the protocol and HYPE.

With new features such as staking, coin margin for perps trading and the ecosystem of applications coming with the HyperEVM, there are a lot of potentialy tailwinds and things to look forward to.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.