An Update on the State of Kamino

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

The ongoing debate around Solana and the immoral schemes of its on-chain charlatans has done little to improve the network’s reputation. Malicious value extractors have once again cast a large shadow over the parts of the ecosystem that are either already delivering or striving to build legitimate use cases. What if we told you that once the dust settles, utility projects will stand tall. Scams out, chads in.

Introduction

To this day, Kamino has remained one of the largest applications on Solana by both market share and presence, riding the chain’s resurgence from the depths of its lows to new all-time highs. However, recent volatility, highlighted by a major liquidation event, has put its risk management and infrastructure to the test. This article takes a deep dive into Kamino’s current state, exploring its growth, resilience, and the evolving dynamics of its ecosystem.

Recent Traction

Suffice to say, it's been a stellar first quarter for Kamino—not only in terms of growth metrics, but also through significant strides in product development and onboarding.

1/ This month has been one of the biggest in Kamino's history:

— Kamino (@KaminoFinance) February 13, 2025

- Stablecoin Supply and Borrow ATH

- JLP Market reaches $1B ATH

- Global Supply and Borrow ATH

Let’s dive in👇🧵 pic.twitter.com/UlCNcnG5kO

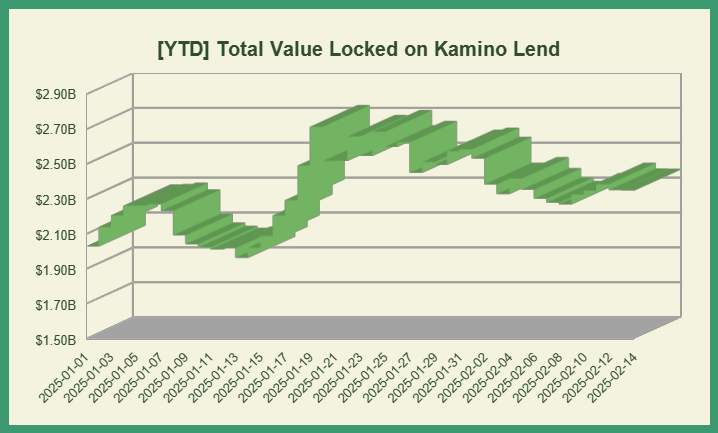

Year to date, the cumulative dollar-denominated value locked across Kamino Lend and Liquidity has risen 16.52% (11.32% in SOL terms), adding $335 million in market share and reclaiming the $2 billion level. This growth has also contributed to a 35% increase in lifetime revenue.

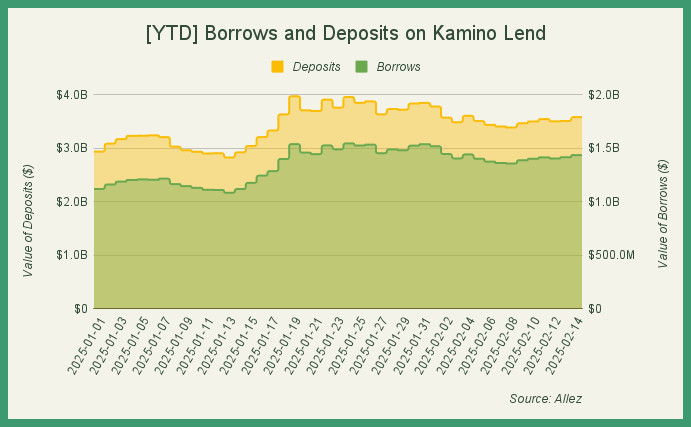

The gains can largely be attributed to a surge in deposits, mainly in stablecoins, cbBTC and various ecosystem tokens, rather than the appreciation of existing assets. As interest in Solana's decentralized finance sector continues to rise, Kamino has positioned itself as the premier money market and leverage outlet on the network, capturing a significant share of incoming liquidity.

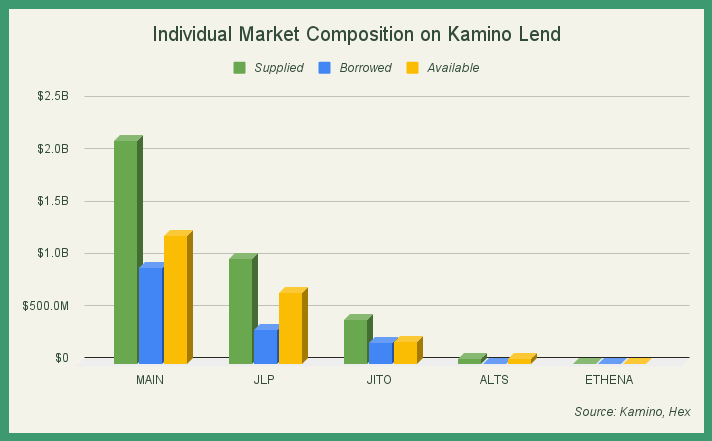

As of now, the protocol is comprised of five lending & borrowing markets, offering support for a diverse range of assets native to Solana as well as select bridged assets hailing from other chains, each governed by its respective risk parameters.

Activity is largely concentrated in the main market, which leads with $2.13 billion in supplied liquidity and $913.42 million in borrowed funds. Other key segments, such as JLP (Jupiter) and Jito, also show strong participation, though with a slightly lower borrow-to-supply ratio. In contrast, altcoins and Ethena's products remain relatively small in both supply and borrowing. This distribution highlights Kamino’s ongoing efforts to diversify its lending markets while reaffirming that its core sectors continue to drive the bulk of activity.

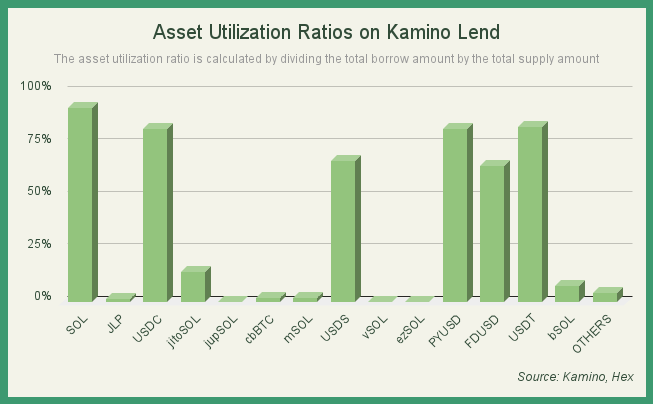

It's evident that there is a surplus of supply across all markets, hinting at a strong preference towards a handful of offerings. Understanding asset utilization is crucial in assessing the efficiency of a lending market. A high utilization rate suggests strong borrower demand, while a low rate may be indicative of that the asset is primarily being supplied as collateral rather than actively borrowed, displaying minuscule interest rates on both sides.

While the ecosystem's native token and stablecoins experience heavy use, others remain underutilized for the most part. This is partly due to lenders depositing yield-bearing tokens to maximize returns or capitalize on incentive campaigns, often creating an oversupply with minimal corresponding demand. Unfavorable price action fuels hesitation to borrow altcoins beyond SOL, however, this dynamic could shift if market conditions improve, potentially offering lucrative borrowing rates to speculators still willing to believe that things ought to be different this time around.

The Great Cascade

The market experienced an unprecedented liquidation cascade on February 2nd, triggered by widespread uncertainty over proposed tariffs from Donald Trump, leading to one of the most severe sell-offs in recent history. While most trader losses occurred on centralized exchanges, the shockwaves were unmistakably felt across decentralized money markets. Extreme volatility tends to cause a surge in on-chain activity due to the abundance of arbitrage opportunities stemming from venue-wide price discrepancies, driving up block space demand and congesting the network. This congestion, coupled with suboptimal liquidity conditions can strain protocol-level mechanisms, potentially leading to unpredictable behavior, further amplifying risk. Such events set the stage for a stress test that is virtually impossible to emulate given the sheer amount of external variables involved. Weathering such a storm unscathed can be considered as a rite of passage and should be the standard for any established platform.

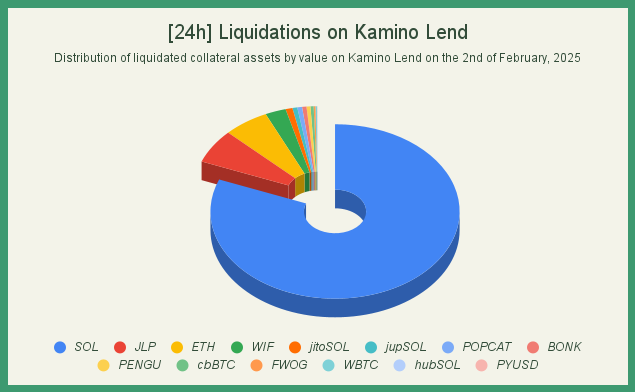

As for Kamino, within 24 hours, 1316 individual liquidations across 819 unique wallets were processed, resulting in approximately $5.67 million in seized collateral.

The ratio of liquidated loans to total loans (~157,087) implies that most users were not affected, indicating that while leverage was present, it wasn’t excessive.

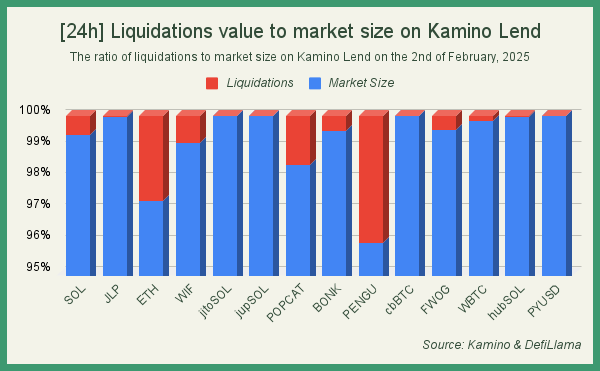

Most of the seized collateral was made up by SOL (81%), followed by JLP (6.3%) and ETH (5.9%), underscoring SOL's dominance as the primary asset used for borrowing on Kamino. Although the supply for memecoins is relatively low compared to other markets, they contributed disproportionately to liquidations due to their extreme volatility and lower liquidity—suggesting that borrowers using these assets as collateral were more vulnerable to forced liquidations, as sudden price drops rapidly eroded their positions.

The liquidation data showcases that highly speculative assets such as memecoins (and ETH) experienced the largest impact during the cascade, whereas SOL, its derivatives and other established assets remained stable throughout. This trend highlights the inherent risks of leveraging highly volatile assets in lending markets, as they tend to face outsized liquidation pressure during market-wide sell-offs.

Relative to Kamino's total market size, the figures are shockingly low, indicating healthy overall borrowing activity and resilience in the face of volatility. Despite the widespread liquidations, the protocol maintained stability, suggesting that most positions were well-collateralized and that risk management mechanisms functioned effectively.

Yields

For anyone looking to earn yield in the Solana ecosystem, Kamino is the go to hub.

cbBTC

Since cbBTC went live on Solana, Coinbase (the issuer of cbBTC) has allocated significant rewards across the Solana DeFi ecosystem to cbBTC markets in order to incentivize growth. As of right now, $75k USDC is rewarded weekly to cbBTC lenders on Kamino and an additional $75k USDC weekly to USDC borrowers (when USDC is borrowed against cbBTC collateral). You can read more about this here.

As a result of this, more than $170m worth of cbBTC has been deposited into Kamino. 6% APR on BTC is not bad in this market and being able to borrow USDC at only 3% annual interest makes it even more interesting. USDC can be borrowed with up to 70% LTV (and a liquidation LTV of 80%). Borrowing at a 70% LTV and converting the USDC into cbBTC to finally lend it, increases the strategy APY to 8.37% (including borrowing cost) but be aware that the position can get liquidated should cbBTC drop significantly in price. Also keep an eye on the weekly USDC rewards as the can change in the future.

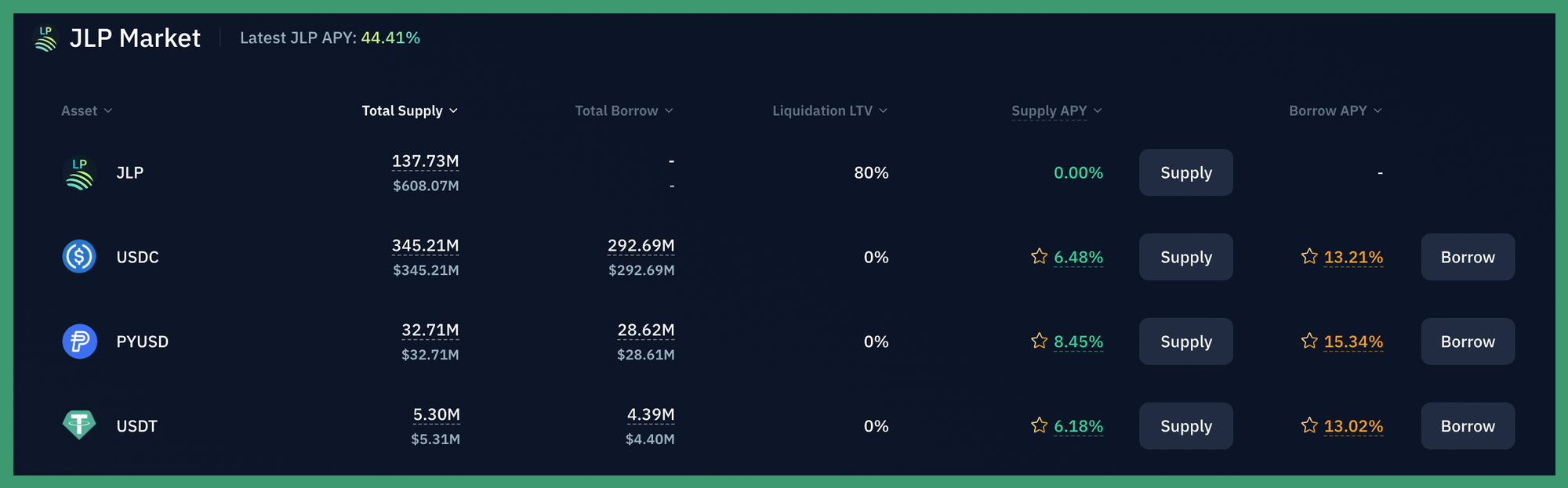

JLP Loop

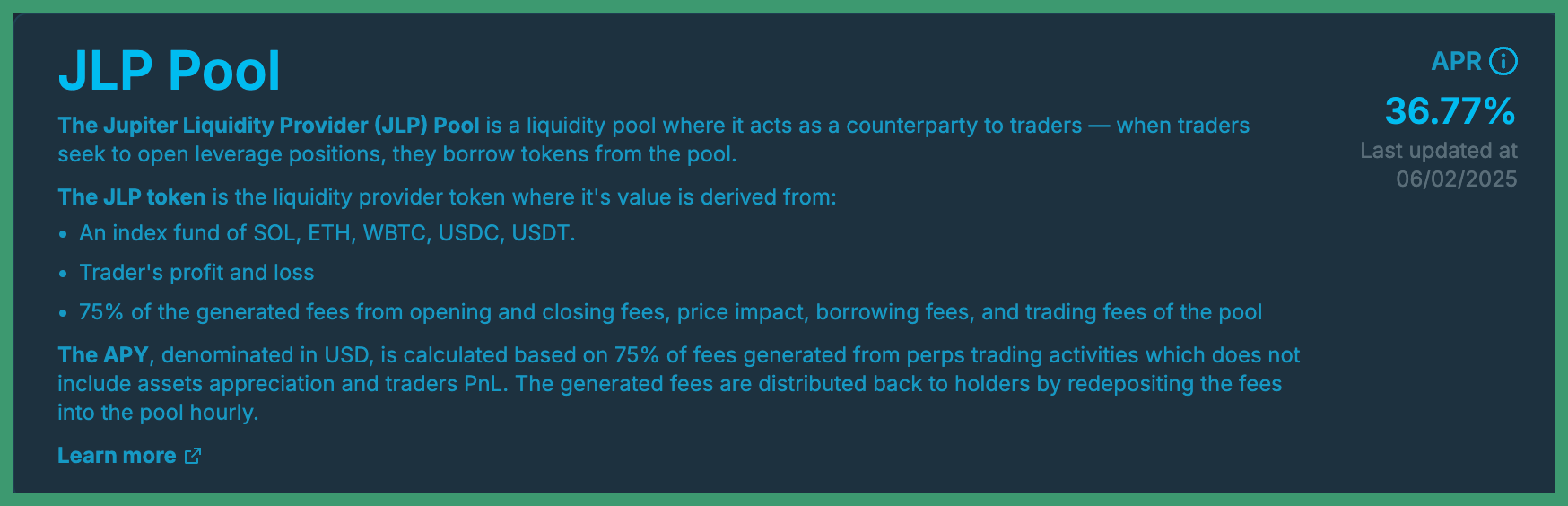

The JLP multiply strategy on Kamino remains very interesting as JLP has been a solid performer for more than a year now (especially from a risk-adjusted perspective). JLP collects fees from Jupiter perps traders and consists of a basket of tokens (wBTC, ETH, SOL, USDT and USDC). A primer on how JLP functions and its design:

As JLP partially consists of stablecoins, it experiences low volatility (relatively speaking) and the JLP multiply strategy therefore faces lower odds of liquidation. As a general rule of thumb, JLP multiply is profitable as long as the APR collected by trading fees exceeds the borrowing costs. As seen from the images below, JLP has recently been collecting 36.77% APR in fees whereas it costs 13% in annualized borrowing to loop the position via JLP multiply. The spread is therefore quite substantial and offers strong yield as of writing.

Keep in mind that there are many factors influencing the return of holding JLP such as BTC, ETH and SOL. When we first mentioned JLP July 31st 2024, JLP was trading at $3.25 and is up 38.5% since then which equates to an annual return of 72.44% (not bad). From this, it's easy to tell that having looped this at 2x on Kamino in this period would have netted a substantially larger return, even when considering borrowing costs.

There are three different variations of the JLP loop (JLPUSDT, JLPUSDC and JLPPYUSD). Deciding which to choose comes down to which stablecoin has the lowest borrow cost. As seen from the screenshot above, USDT and USDC are both around 13% annualized.

For a better understanding of Kamino Multiply (including JLP looping) and what to consider when utilizing these sort of strategies, please see our recent report covering this in depth:

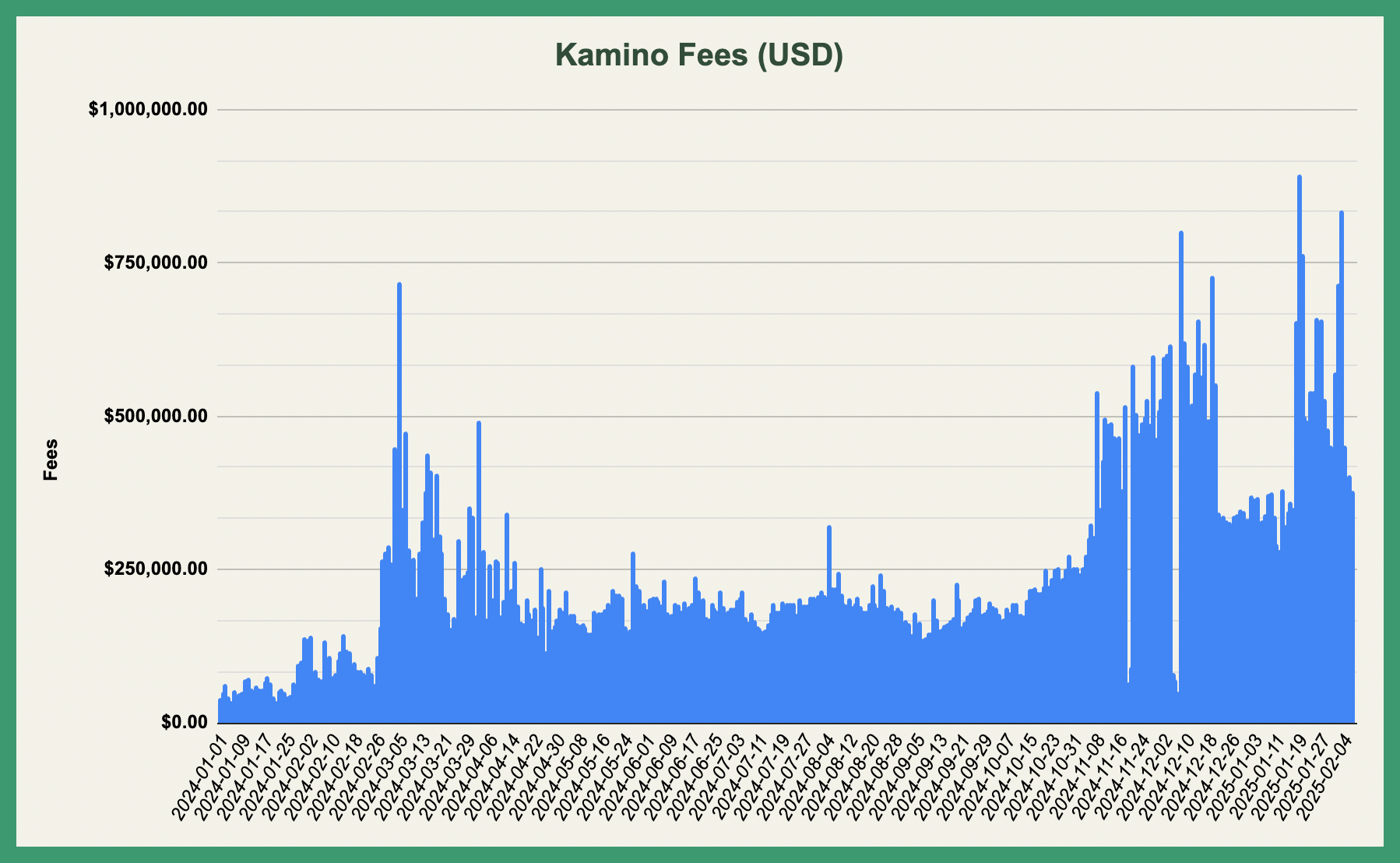

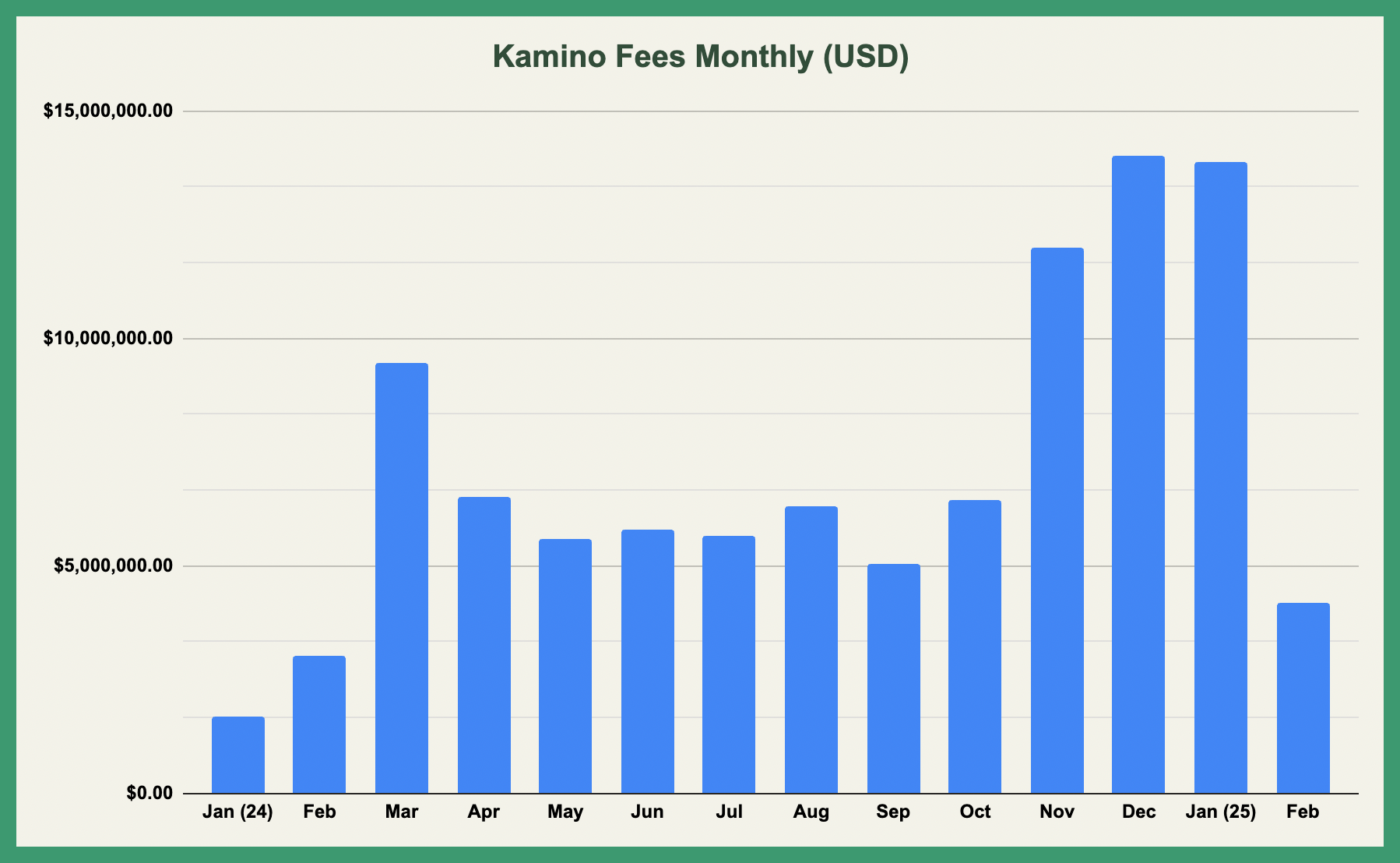

Fees & Revenue

With the recent TVL growth, the launch of Kamino Swap and the integration of new assets, fees generated by Kamino are higher than ever averaging more than $300k on most days.

Looking at this from a monthly perspective, Kamino had its three best months in November, December and January and is on track to reach $10m+ again in February.

Kamino generates fees from borrowers on Kamino lend and swap volume on Kamino liquidity. Based on last 30 days of fee generation, Kamino is set to produce $183.11m in annual fees and $52.02m in annual revenue. Currently, revenue goes into the foundation treasury but may be redirected elsewhere in the future (speculation however).

Conclusion

Looking at the data, the performance speaks for itself. Even in the most dire conditions, core mechanisms worked as intended and solvency was ensured. The February 2nd liquidation event served as a critical stress test, reinforcing the platform’s risk management mechanisms and the relative stability of its assets. Additionally, lucrative yield opportunities—such as cbBTC incentives and JLP looping strategies—continue to drive participation, appealing to both risk-tolerant and conservative investors. With record-high fee generation and sustained adoption, the protocol is well-positioned for further expansion. However, its long-term success will depend on how it navigates changing market conditions, adapts to new risks, and continues to ship additional features.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.