An Introduction to Yield Arbitrage

Introduction

Yield arbitrage involves hedging the delta exposure of an asset while earning a yield on both the long side and short side. This is a popular strategy amongst traders and funds and can offer a high volatility adjusted return especially in bullish environments. This report will dive into how this trade works and show specific examples of it used. We have further created a calculator that shows you the exact return and what variables to keep an eye on. Find it below.

Sponsor - Vertex Protocol

The sponsor of today's report is Vertex Protocol. Vertex is an on chain cross-margin futures exchange with several unique features. The exchange fuses a central limit order book and AMM model providing deep liquidity for traders. Aditionally, The Vertex platform features a native lending market and spot exchange in which assets from here can be utilized as margin for futures trading.

Over 50 pairs can be traded on Vertex across five different chains (Arbitrum, Mantle, Sei, Blast and Base). With Vertex Edge, the in-house liquidity engine, traders can tap into liquidity across all the chains Vertex is live on, increasing market depth and reduces slippage.

Vertex recently unveiled the 'VRTX Vertical Program' which introduces new aspects to the VRTX tokenomics. This upgrade involves a reduction in VRTX emissions, a larger incentive to market makers as well as auto-compounding staking rewards. In addition, new VRTX stakers will be able to immediately access the maximum staking rewards which comes from VRTX emissions, trading fees and a loyalty reward from early unstakers. The average staking APY is usually in the range of 20-30%. You can read more about the VRTX Vertical Program below:

Yields Across DeFi

There are many ways to earn yield in DeFi, most of which have been covered in previous reports here on On Chain Times. The first half of 2024 was characterized largely by points/airdrop farming across various protocols like EigenLayer, LRTs and Ethena. Other methods of yield farming include providing liquidity to decentralized exchanges, lending on money markets and more. What most of these have in common is the exposure to volatile assets, whether that is BTC, ETH, SOL, or smaller altcoins. The strategy's exposure to volatility can have a big impact on the return and results in return unpredictability.

As an example, farming the EigenLayer airdrop by buying pendle YT tokens came with a lot unpredictability. Traders had to try and estimate when the airdrop would take place, what the total supply of points would be, the price of EIGEN at launch, what specific rules were decided in terms of vesting and so on. A lot of uncertainty but a big potential payoff (at least if you asked people earlier this year). Other strategies like farming stablecoin yields entail significantly less risk, volatility and unpredictability but the payoff is often much smaller.

A popular strategy amongst sophisticated investors and funds involve being delta neutral in asset exposure while capturing a return from e.g funding payments on futures exchanges and yield on the underlying spot token. Let's explore this further.

Delta Neutral Positions

Being delta neutral means having no exposure to price movements of a given asset. If an investor opens a $100 BTC short but also holds $100 worth of spot BTC ($200 total), no matter which direction the price moves, the return will, in theory, be zero (excluding fees & slippage).

As a simple example: Suppose BTC increases in price, the short position might be at a $20 loss but the spot long BTC held will be up $20 in value (net $0). A delta neutral position can be constructed in several different ways, one popular way being opening a short position on a perpetual futures protocol and a long position by holding spot, e.g holding 1 ETH in your wallet and shorting 1 ETH on Hyperliquid.

Yield Arbitrage

What is the purpose holding a delta neutral position on e.g BTC or ETH? To capture yield on the two sides of the position. Let's break this down.

Short side (futures)

On perpetual futures, whether it being Binance, Bybit, GMX, Hyperliquid, Vertex or somewhere else, there are so-called funding payments paid by one side of the market to the other. The purpose of this mechanism is to ensure that the price of the perpetual futures contract is as close to the underlying spot price as possible.

As an example, if a lot of traders are longing BTC on Binance (i.e buying the BTC futures contract) the price of the futures contract might be higher than the spot BTC price. Funding payments act as the incentive to bridge this price gap and in this specific instance, the long positions will pay a funding fee to the short positions.

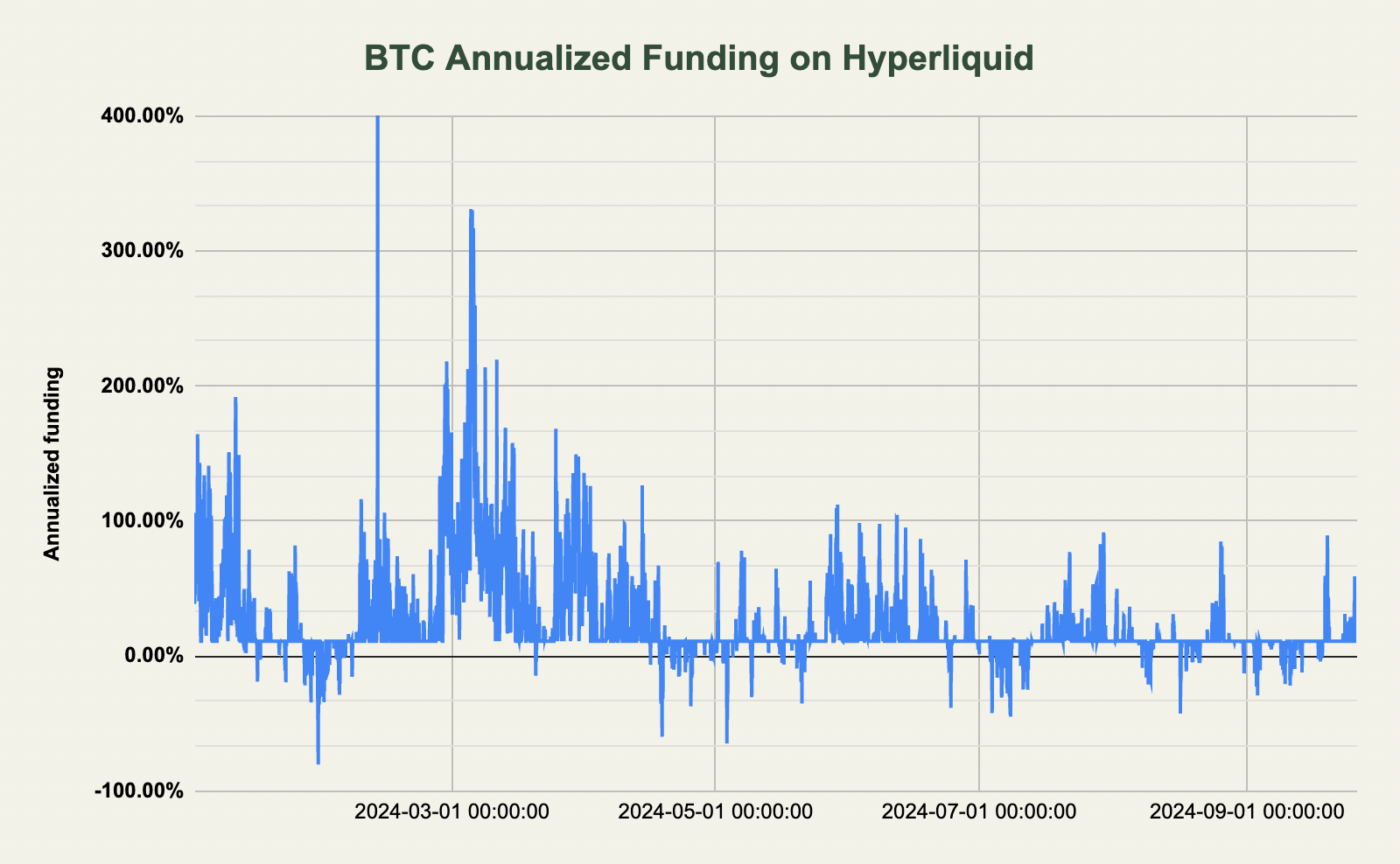

Below is the year-to-date annualized funding for BTC on Hyperliquid. When the funding is positive, longs pay shorts and vice versa.

Throughout this year, traders have, on average, been getting paid to short BTC. As seen above however, there are periods in which the funding is negative and short positions pay funding to longs.

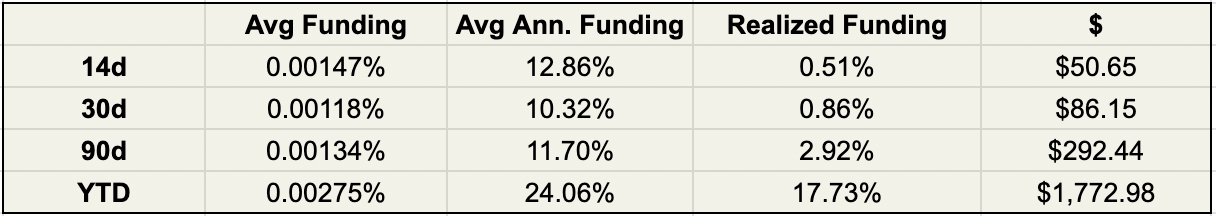

The table below illustrates that the average funding has been positive over various time horizons. The realized funding is the actual return earned in this period and the '$' column shows the returns in $ from a $10k position.

Having a $10k BTC open since the beginning of the year would have earned you $1772.98. Having a $10k BTC open the past 14 days would have earned you $50.65.

Long side (spot)

This part is more simple. There are several ways to earn yield on spot holdings, one example being staking your ETH by holding stETH, which generates roughly 3% APY. This can be taken several steps further such as introducing Pendle PT tokens, looping yield-bearing tokens on lending markets and more, most of which will be discussed further down.

To consider an example of this sort of trade, look no further than Ethena. Ethena holds assets such as staked ETH on the long side and hedges this 1:1 by shorting ETH across centralized exchanges. The profit from this trade is paid out to sUSDe holders.

Calculator

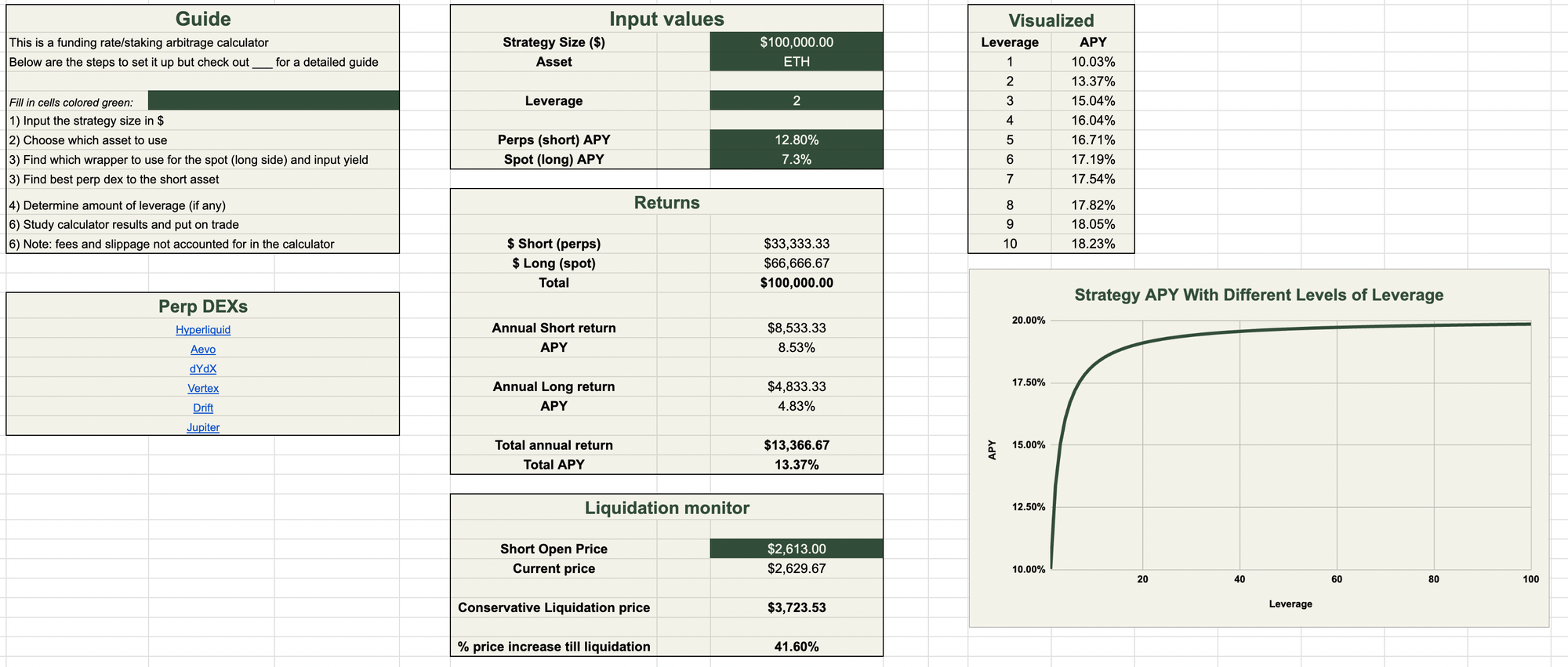

We have built a calculator that lets you model your expected return across different assets and leverage values amongst other things. Before diving into specific examples, we'll provide a brief description of this.

In order to access the calculator and read the rest of the article (strategy examples), you must be a subscriber to On Chain Times (free).