All In on Hyperliquid

Introduction

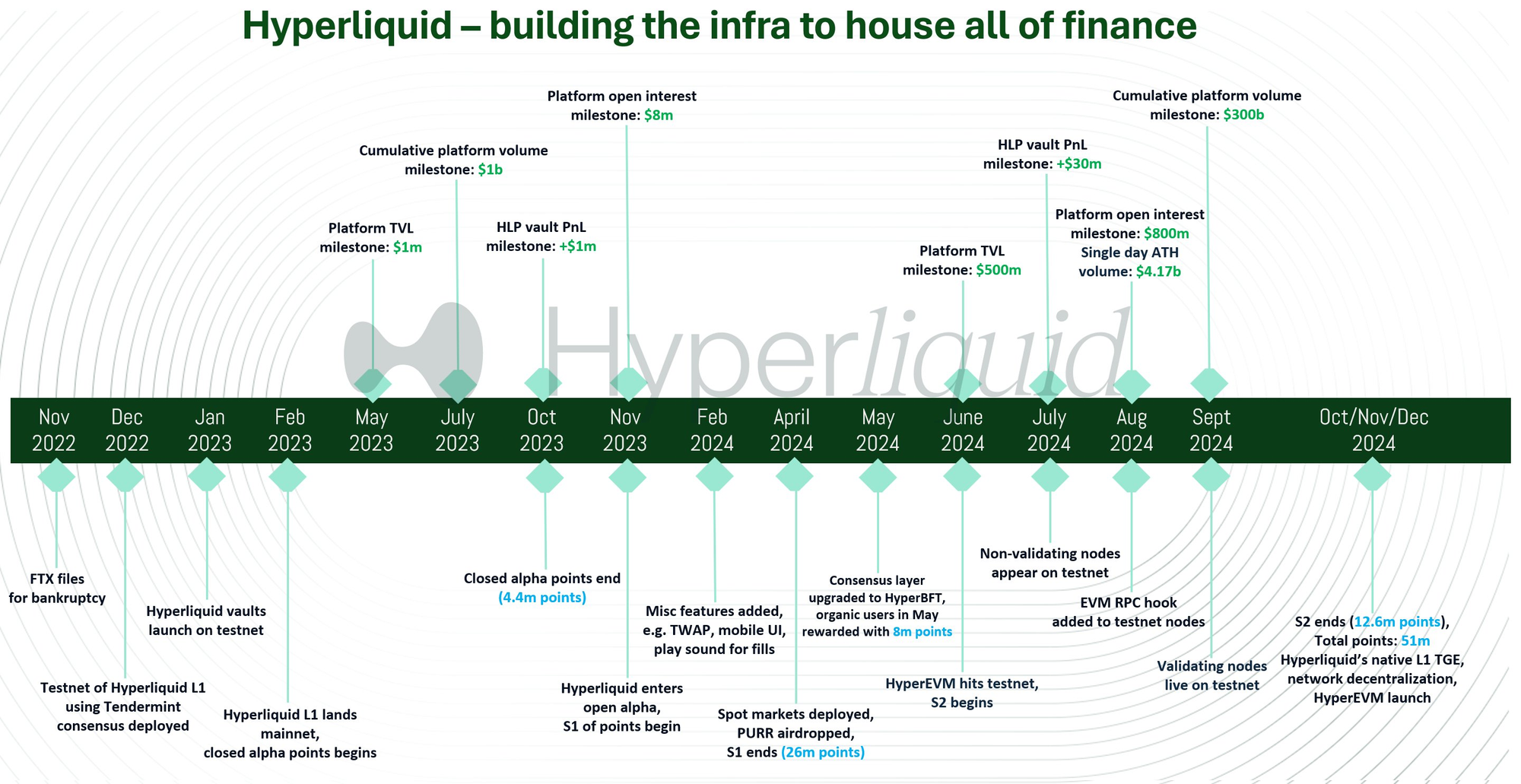

In a time characterized by an abundance of low-float, high-FDV, VC-backed tokens, Hyperliquid, a community-centric on-chain exchange, shines as a beam of light. Hyperliquid has successfully managed to grow one of the most vocal and energetic communities in the space and has, in the span of a year, grown its vision from being an on-chain perp exchange to a fully-fledged ecosystem of applications built on the HyperEVM.

Hyperliquid aims to become the on chain Binance and is well on its way. At On Chain Times, we had the pleasure of chatting with @KingJulianIAm, a core contributor at Hyperliquid, as well as several community members, to learn more about the past, present and future of Hyperliquid and its ecosystem.

Bullets

- Chat w/ Julian

- HyperEVM

- Ecosystem & Community

- Conclusion & Appendix (Airdrop Calculator)

Casual chat w/ Julian from Hyperliquid

Building an on chain perpetual futures exchange from the ground up is no small feat. Can you walk us through the early stages of Hyperliquid's development?

"Early days, it was more about deciding the architecture and how it can best work as no blockchain can and could support a fully on chain orderbook. The project started just before the FTX collapse and the collapse really made it clear that this solution was greatly needed. The project is completely bootstrapped by the team."

How does Hyperliquid differentiate itself from the many other on chain CLOBs and perp dexes?

"The Hyperliquid L1 is performant enough to operate an entire ecosystem of permissionless financial applications – every order, cancel, trade, and liquidation happens transparently on-chain with block latency <1 second. The chain currently supports 100k orders / second.

Compared to other DEXs or order-books that might have their matching engines off chain, Hyperliquid has everything on chain in a transparent way."

When Hyperliquid initially launched in Alpha, you introduced the Friend-Index, a unique and unconventional product compared to those offered by other on chain exchanges. Have you considered expanding beyond pre-markets to offer additional exotic products?

"Hyperliquid is still in alpha, but back then it was closed alpha, where users could only use the platform by getting a referral link.

While the friend tech index was a great way for users to onboard to the platform, there has not really been demand for other exotic perps of that kind anymore. The team actively tracks demand in case something else does come up."

One of the unique aspects of Hyperliquid is its approach to market-making without dedicated market makers. Can you shed light on how market-making strategies operate in this environment and the mechanisms in place to ensure liquidity and fair pricing?

"Hyperliquid does not have any direct deals with any market makers, however, there are still plenty of market makers on the platform.

While HLP is able to provide base liquidity across all pairs, there are plenty of Market Makers who also interact with the platform and offer liquidity to users, it is a nice harmony for everyone. In terms of fair pricing, most MMs want to offer the best price because that is how they make money, offering bad prices tends to lose them money. (this is very very simplified)."

Hyperliquid has recently seen a few people contribute a large amount to the Open Interest on the platform, specifically 2TheMoon with his BTC position filling 1/4 of the BTC OI, what thoughts do you have regarding the potential risks associated and how would your risk engine solve a liquidation of that size?

"Order-books are able to scale quite well even if users want to hold large positions, examples like 2themoon just show that the product is robust and can handle large traders. There were plenty of MMs taking the other side of 2themoons trades. in terms of liquidations and so on, all info on how that works is int he docs and can be found here."

What is your vision for the growth of the Hyperliquid ecosystem? How do you see more applications and projects integrating with or building on top of Hyperliquid?

"With the EVM coming out, Hyperliquid is being setup in such a way that it can support all of finance. EVM allows for general purpose smart contracts so multiple different apps will be able to be built in the ecosystem. We will see the first batch of apps soon as they are already building on testnet."

Are there specific types of applications or projects that you would like to see launched on Hyperliquid, even if you don’t plan to incubate them yourselves? What gaps or opportunities do you think these projects could address?

"There are plenty of applications, low hanging fruit such as cross chain messaging protocols integrating. Also lending markets and other CDP type of products. There are plenty of cool things that can be built and Hyperliquid is excited to support anyone looking to build on HyperEVM. In terms of gaps and opportunities there is a lot of space if a team looks at what can benefit the ecosystem."

In your view, does it ever make sense for other perpetual futures exchanges (perp DEXs) and decentralized exchanges (AMMs/DEXs) to deploy on Hyperliquid? What would be the potential benefits or drawbacks of such an arrangement?

"It really depends on how they position themselves, if they are offering something unique that is not part of the Hyperliquid core protocol then of course there is space for more projects. "just another perps dex" does not offer that though."

You’ve opted for a custom oracle solution rather than partnering with established providers like Chainlink or Pyth. What led to this decision, and how does your oracle solution enhance the platform's functionality and security?

"The Hyperliquid oracle is part of the core chain infrastructure, this makes it more robust and also more transparent without the need for 3rd party solutions. It will also allow for cool things to be built on the EVM as the chain itself has a native oracle."

What is the Hyperliquid endgame? Is there a world where an onchain exchange like Hyperliquid scales to Binance/Coinbase levels volume-wise?

"There is no 'end game', but it has been clear that Hyperliquid aims to be able to host 'all of finance on chain. This includes everything Binance currently can do but on chain."

Thanks to Julian for taking the time to answer these questions!

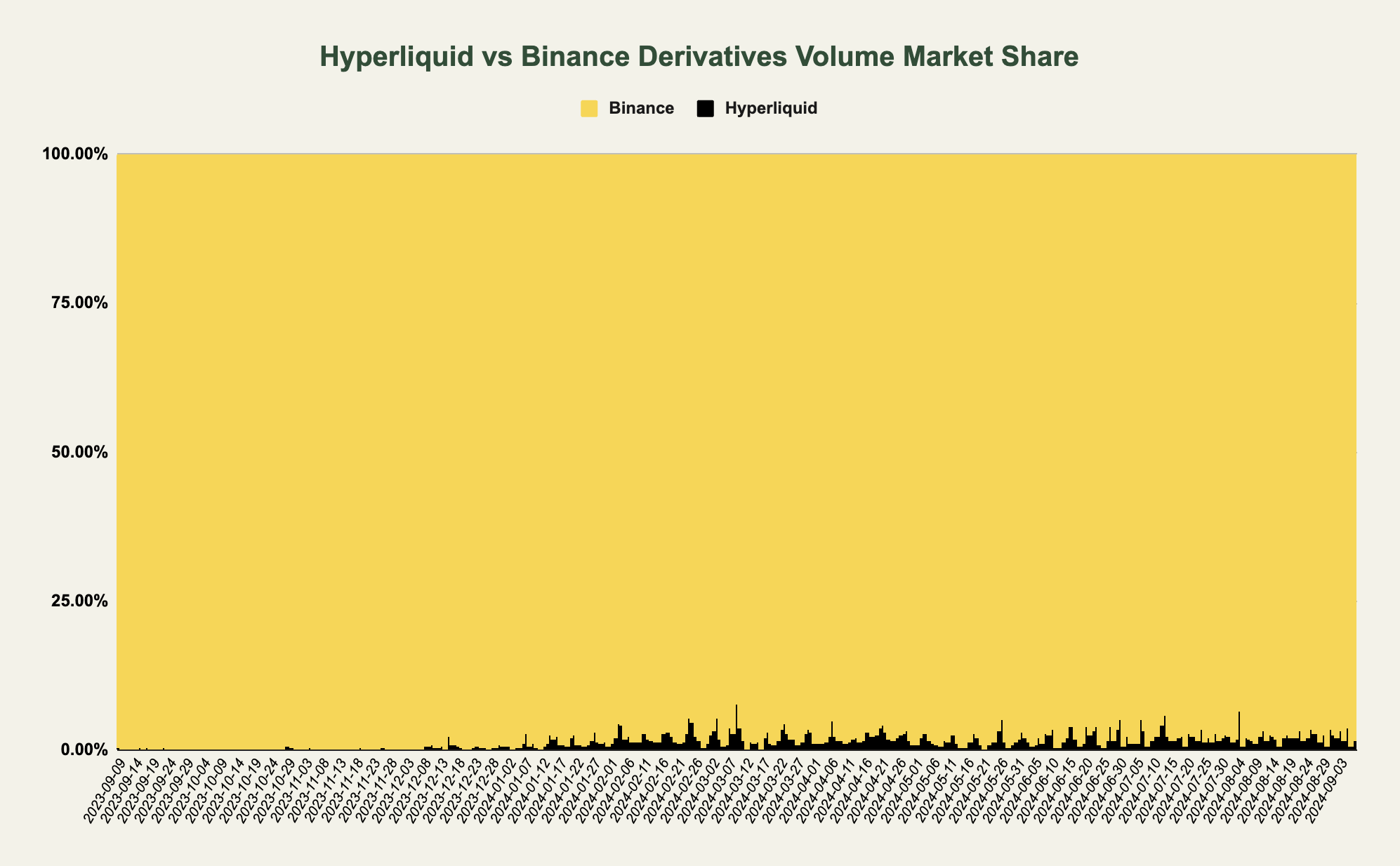

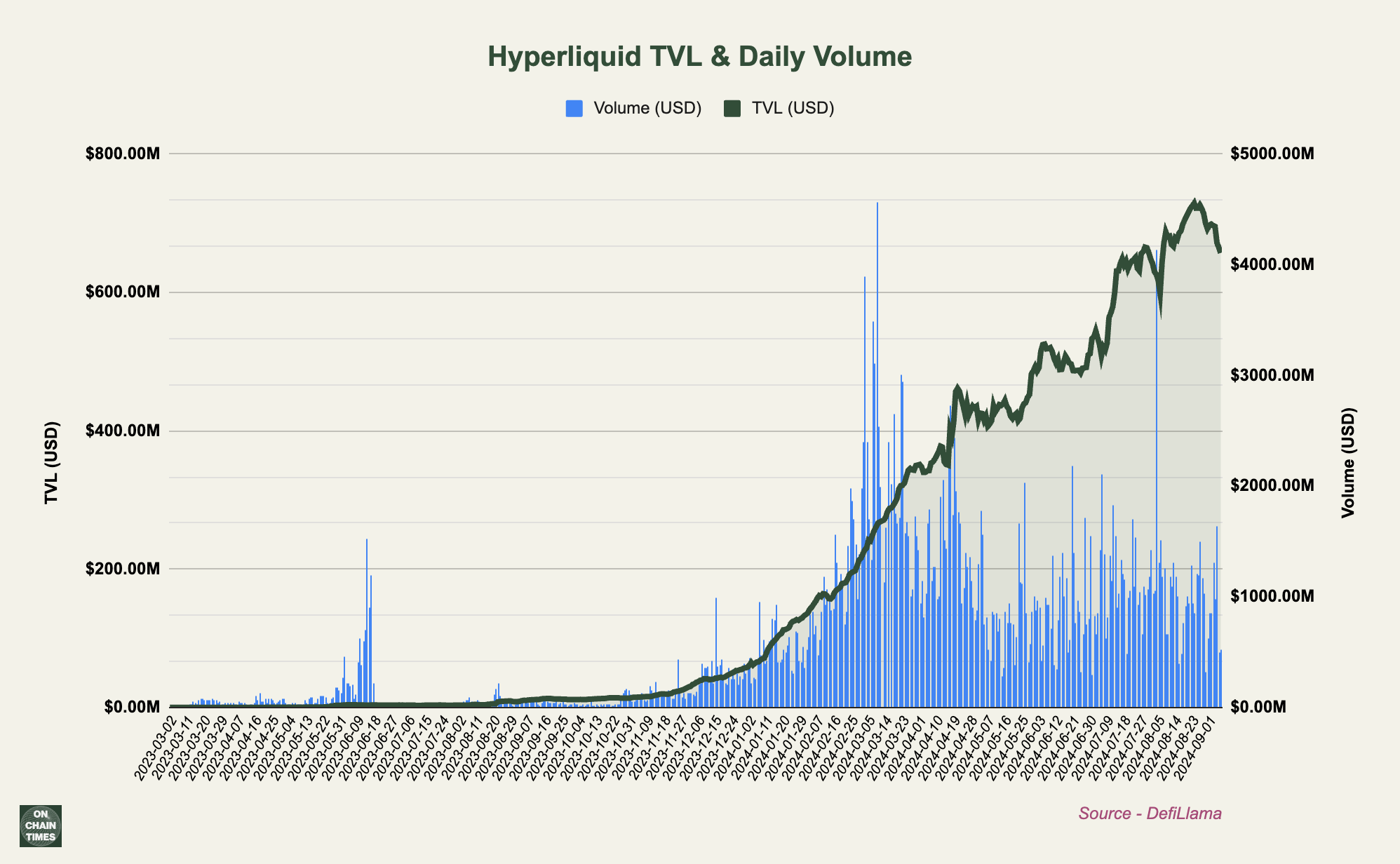

While Hyperliquid dominates on chain trading and facilitates significantly more trading volume than all of its competitors, there is still a long way to go before reaching Binance:

Binance facilitates between $40 and $60 billion in trading volume on an average day from its futures trading alone. With this in mind, the total addressable market for an on chain Binance competitor like Hyperliquid is huge, even without considering an inflow of new users to crypto.

HyperEVM

"My thesis is that everything that has happened up until the release of the HyperEVM (slated to be released by EOY) is merely just pure testing...

...it’s time to cast a much, much wider net – Simply playing for table stakes against onchain perpetual platforms (who are not the true competition) is simply the first domino in the pursuit of moving trading and eventually the rest of finance onchain". - from a recent post by 0xOmnia

Hyperliquid is developing the HyperEVM L1, a high-throughput, low-latency blockchain aiming to host a fleet of high-performance DeFi apps. The L1 is EVM-compatible, making it simple for Ethereum applications to launch on the chain. Being built for speed, the chain aims to process thousands of TPS, enabling an efficient trading experience. Another benefit of the HyperEVM L1 is its gas efficiency, allowing for low transaction fees even during periods of high network activity.

The HyperEVM is rumored to launch by the end of the year, with several apps already building on the testnet. As posted by Jeff recently, validators have recently arrived on the testnet, one of which is Luganodes.

interesting things happening on testnet pic.twitter.com/wie4XUK3zE

— jeff.hl (@chameleon_jeff) September 8, 2024

1/

— Luganodes (@luganodes) September 13, 2024

Luganodes is thrilled to be live on the @HyperliquidX Testnet!

We're proud to be among the earliest validators, supporting Hyperliquid with enterprise-grade blockchain infrastructure. Let’s dive into how this is big step and why we're excited to support Hyperliquid 🧵👇 pic.twitter.com/bXts8fpoMT

Ecosystem & Community

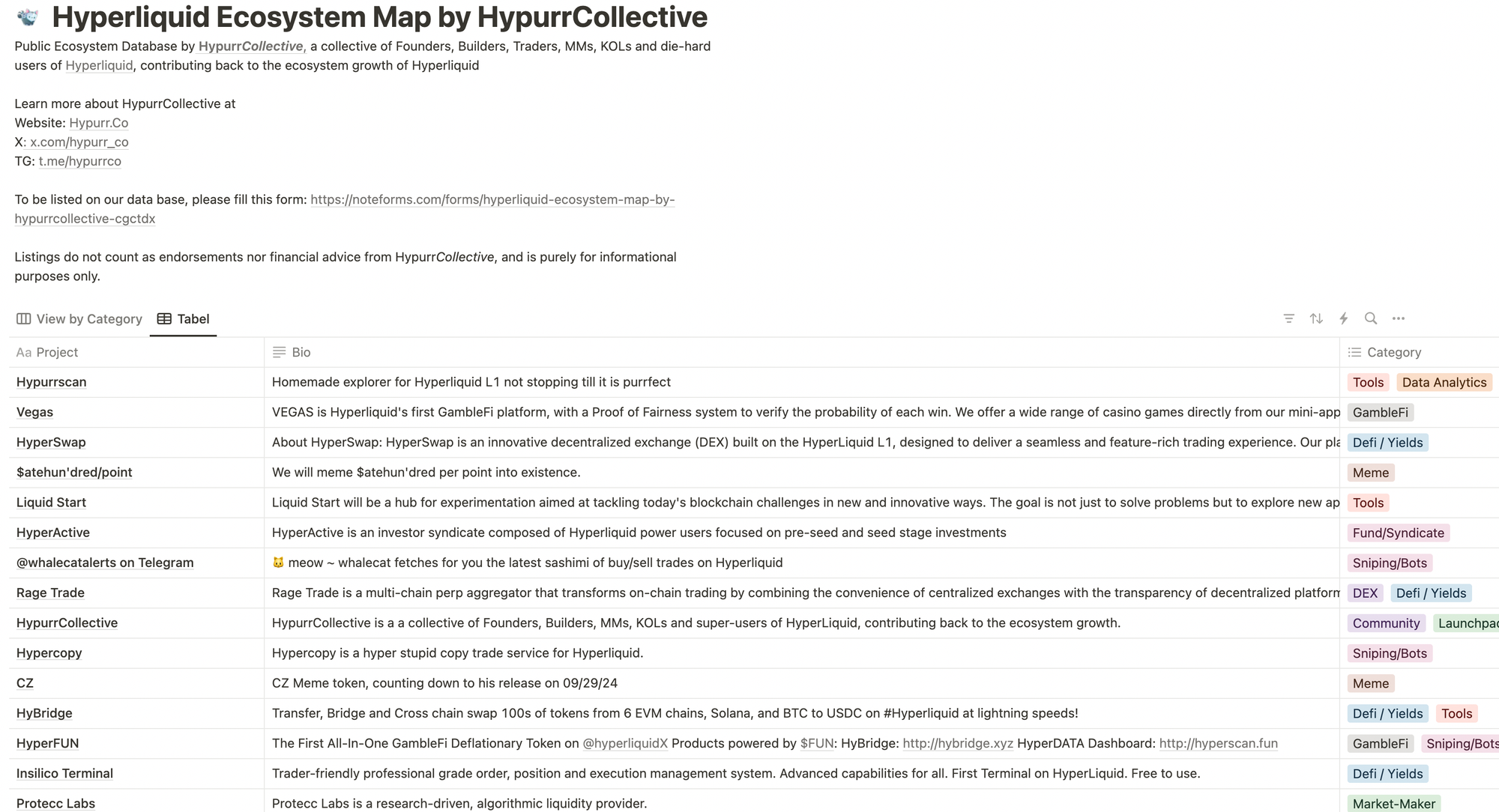

With its futures, spot market and upcoming HyperEVM L1, Hyperliquid is far more than an on chain perp exchange. The ecosystem is growing rapidly with a long list of projects looking to launch on the L1 once it goes live. Hypurr Collective, a group of founders, builders, KOLs, MMs and power users, has built an incredibly comprehensive Notion database covering the Hyperliquid ecosystem which you can find here.

Hyperlend

Hyperlend is an upcoming lending market set to launch on the Hyperliquid L1. We asked the team why they chose to build on Hyperliquid:

"I was really intrigued by how the community has developed and how everyone in the ecosystem was willing to help us and achieve better things together. Another aspect is how capable their technology has become; their managing of a very high TPS is very interesting and scalable in the long run.

Hyperlend is a lending protocol that will solely focus on Hyperliquid's network, providing as many financial services and opportunities as we can for the whole ecosystem.

At the core, I simply have long-term HL conviction. We are still building, yet we were offered a lot of good incentives for bridging/building/ramping to a bunch of other L2s. Many of them we still reject because, as a founder, you need to have solid conviction. I am aligning myself with Julian on this."

Hyperscanner

There are a variety of analytics platforms providing insights into the Hyperliquid exchange. One being Hyperscanner which provides insights into the traders, tokens, vaults and more of Hyperliquid. In addition, the Hyperscanner team has done some great write-ups on various subjects such as the Hyperliquid vaults and large traders on the exchange.

Community

It's clear that Hyperliquid has taken a very community-centric approach to growing the platform. Having spoken with several Hyperliquid users over the past weeks, it is clear that very few communities are as vocal and passionate. The Hyperliquid community consists of traders, researchers, builders, validators and more. We asked asked a large trader on the exchange about why they trade on Hyperliquid:

"I trade perps on Hyperliquid because it gives me a tier 1 cex trading experience (speed, price, liquidity) and has the lowest fees in the market. Also, I’m never worried about my account randomly being shut down or frozen for some erroneous reason." - @crypto_adair

Conclusion

With its community-focused approach and highly scalable infrastructure, namely the HyperEVM L1, Hyperliquid is positioning itself as one of the leading on-chain financial ecosystems. The Hyperliquid vision is clear: offer everything that Binance does and more, but on-chain and in a decentralized fashion.

Big thanks for HypurrCollective for feedback and ecosystem introductions.

Appendix

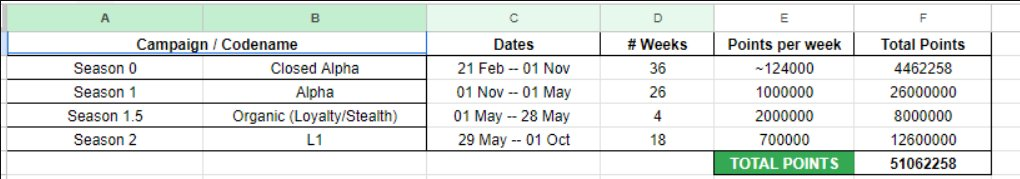

Hyperliquid launched a points program in November 2023 which has been ongoing for several seasons. Thanks to @SamuraiTakedown for the figure below.

Season 2 is coming to an end October 1st and users are speculating on whether there will be additional seasons before the launch of a potential Hyperliquid token.

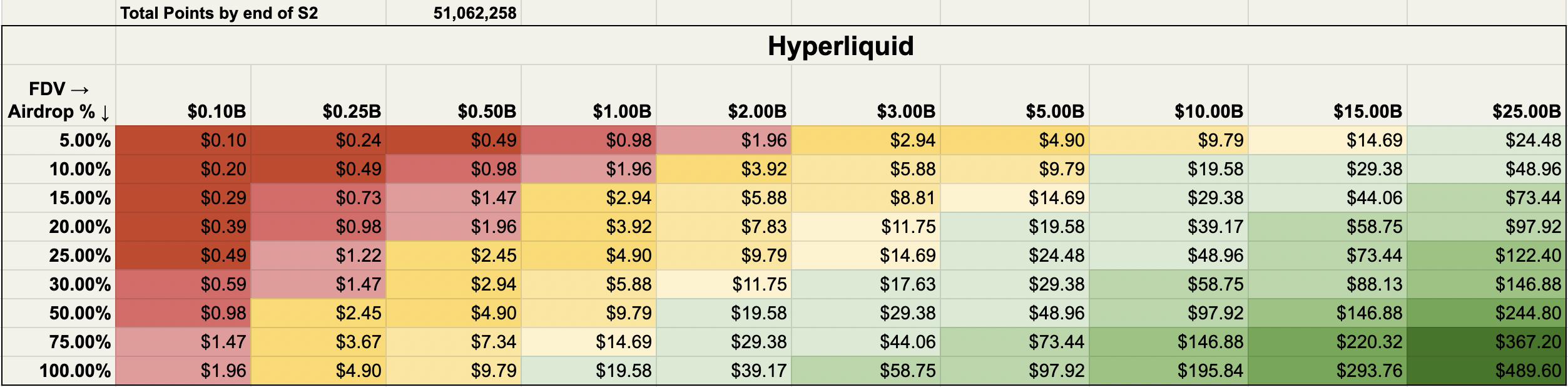

At the end of season 2, the total amount of points will be 51062258. The figure below shows the price of 1 HL point at various token FDVs and airdrop percentages, assuming there will be no additional points emissions following the end of season 2.

(to read the rest of the article, you must be a free subscriber to On Chain Times)

You can access this calculator below (copy to your own sheet to modify numbers):

Note that this is pure speculation and no token has been confirmed by the Hyperliquid team!

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.