Aerodrome - The DeFi Revenue Giant

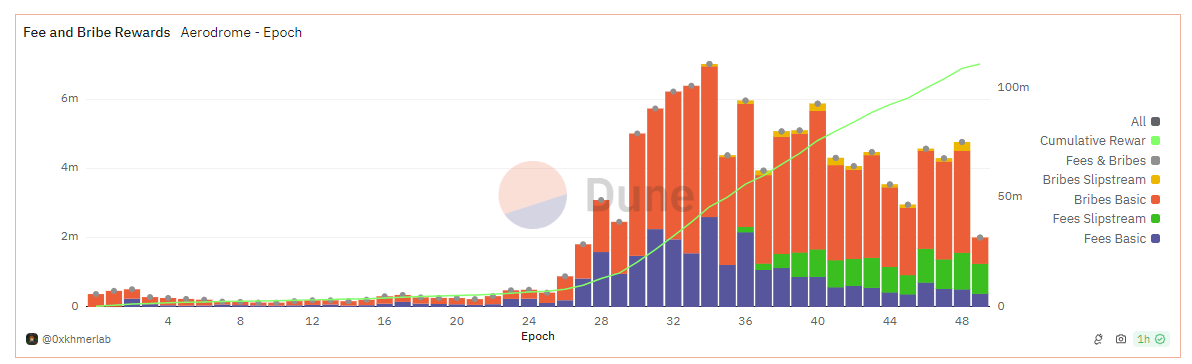

Aerodrome generates more than $100m in yearly revenue, all of which is distributed to token holders.

Introduction

Aerodrome has been the dark horse in terms of 'Holders Revenue' earned by any DeFi protocol this cycle. With a massive $110M paid out to token holders in less than a year, it is beating nearly every other protocol in this metric. Below is a deep dive into how this is achieved, an analysis of an early ve(3,3) lockers performance and more.

Bullets

- Part 1 - Aerodrome Under the Hood

- Part 2 - The ve(3,3) Flywheel

- Part 3 - Holders Revenue

- Part 4 - Additional Info

Part 1 - Aerodrome Under the Hood

Aerodrome is a ve(3,3) METADex on Base. A METADex is a protocol that combines features of Uniswap v2 and v3, Curve Finance and Convex / Votium into a single streamlined protocol with no fee-extracting middle layers. It serves as the central trading & liquidity marketplace on Base. Aerodrome is a fork of Velodrome, run by the same team. Velodrome started out based on Solidly, but has since evolved with its V2 into a complete rewrite both on frontend and backend and added several new features.

AMM

The Aerodrome AMM consist of three different pool types;

- sAMM - Stableswaps based on curve stablepools

- vAMM - Variable swaps based on uni v2

- Slipstream - Concentrated Liquidity similar to uni v3

Trading fees are configurable per pool and ranges from 0.01% - 2%.

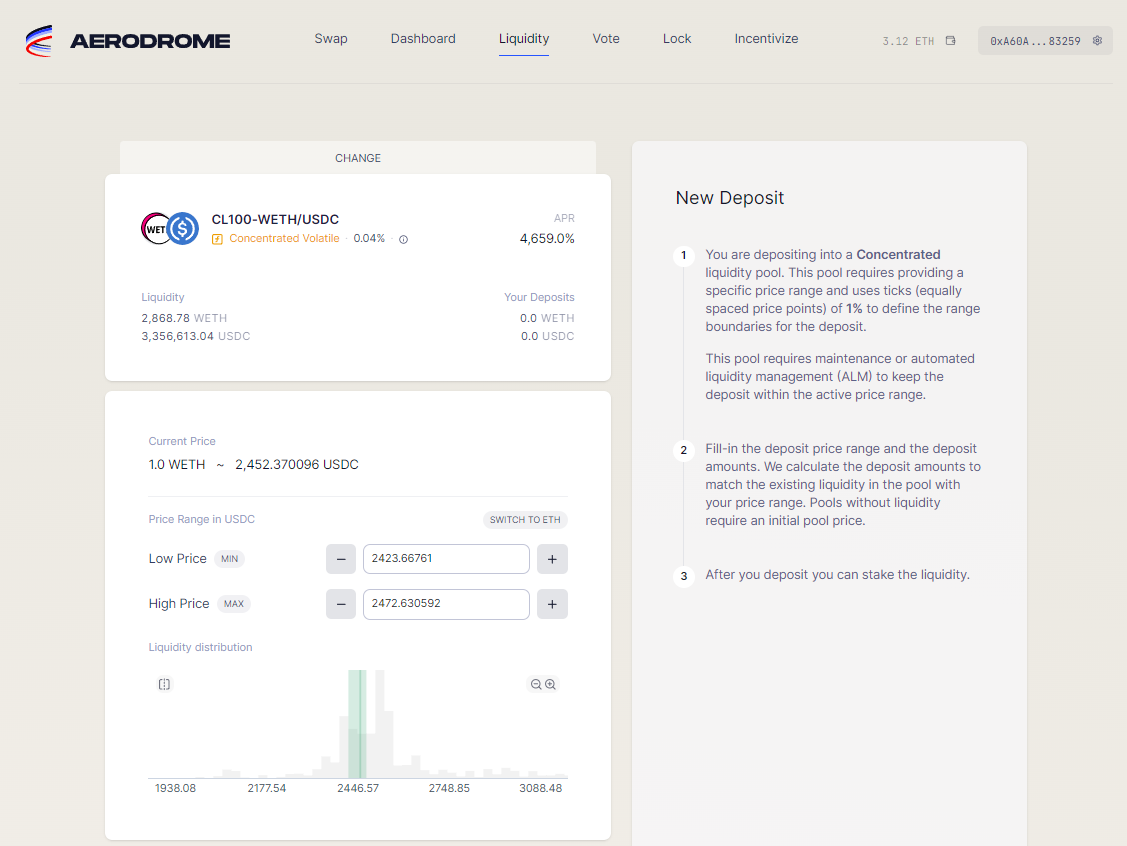

Slipstream AMM

The Slipstream Concentrated Liquidity AMM is based on Uniswap v3, but instead of individual users choosing fee settings, the pool is created with configurable fee settings and 2x larger (some even lager) tick spacings. Rewards (AERO) are consistently streamed to LPs rather than being dependent on volume. These reward LPs for staying active, even during slow or volatile days, and help retain liquidity when most needed.

Locking & Voting

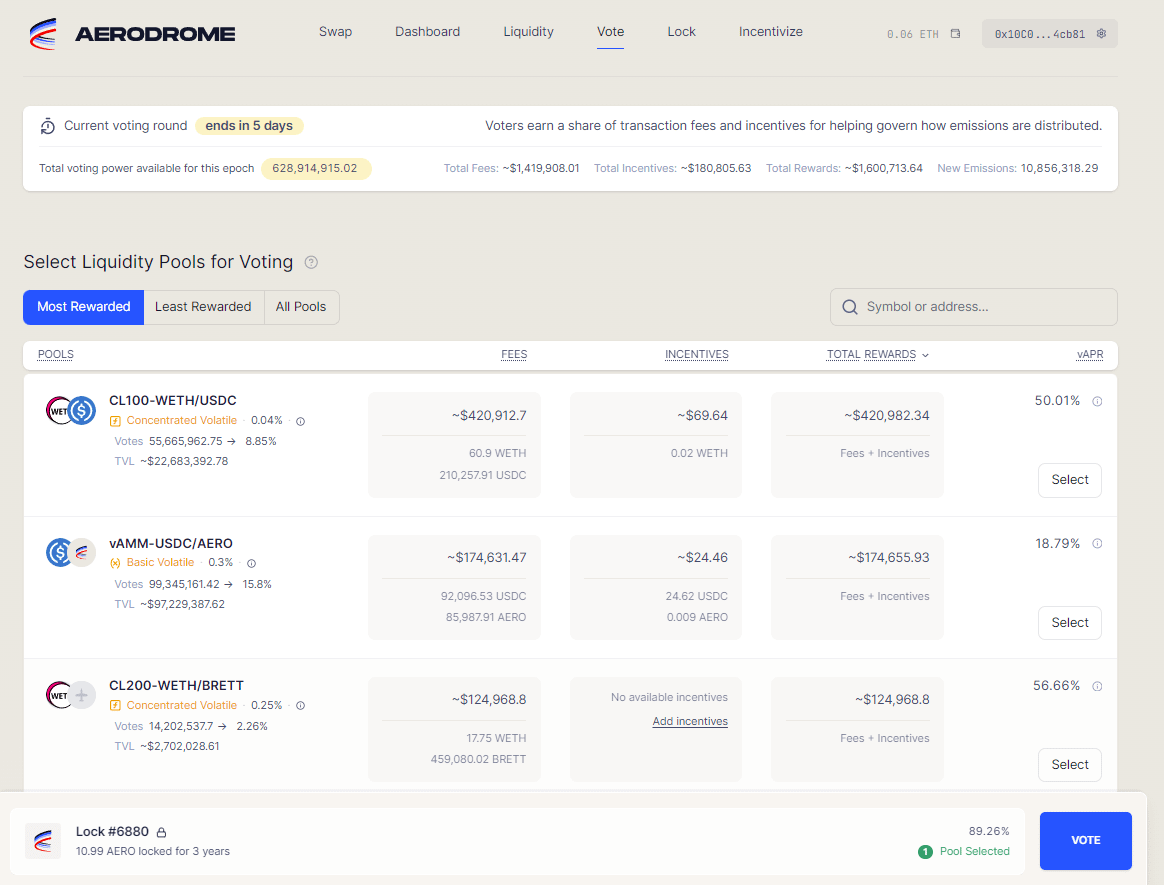

Locking your AERO for veAERO for up to 4 years makes you eligible to earn trading fees, incentives (previously bribes) and rebases. Locks normally decay linearly, but can be permanently locked with no decay. veAERO is a transferrable NFT so users can sell it on NFT marketplaces. veAERO lockers can in addition vote for gauges to earn trading fees and incentives every epoch. The votes will direct AERO emissions to the gauges.

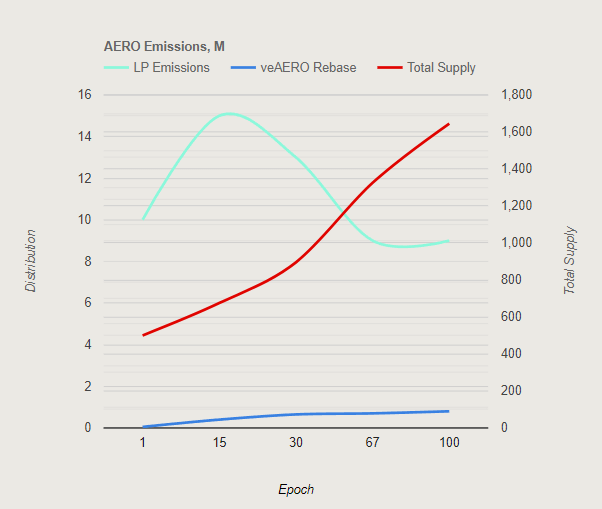

Rebases & Emissions

Part of the Emissions of AERO are given to veAERO lockers as an anti-dilution protection. These can be claimed and compounded into the veAERO NFT. AERO emissions are in addition directed to LPs as liquidity mining rewards according to the votes last epoch, and a small portion to rebases.

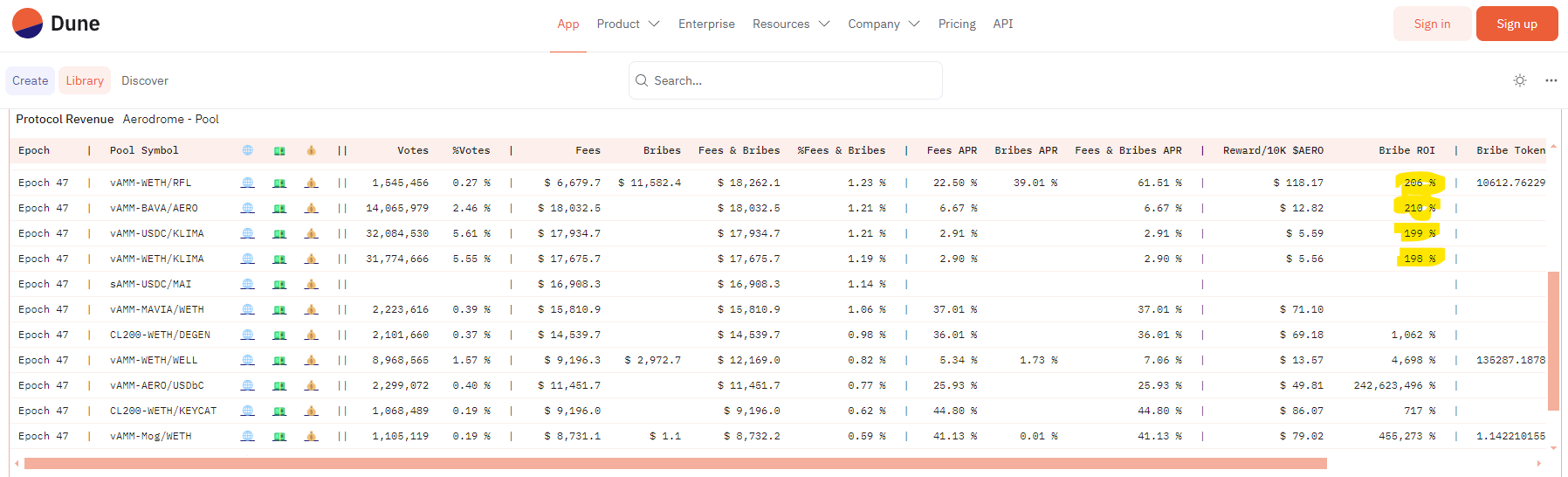

Incentives

Also known as bribes, protocols can incentivize voters to vote for their gauges to direct AERO emissions to the LPs. Currently, protocols are getting ~2x $ worth of emissions compared to the incentives they deposit. If they deposit $10k worth of incentives, they would receive ~$20k worth of token emissions.

Holders Revenue

Aerodrome distributes 100% of the protocol revenue to veAERO lockers depending on the pool they vote for. The revenue comes from:

- 100% of Trading Fees

- 100% of Incentives (bribes)

Aerodrome works on weekly epochs. Votes must be cast before 23:00 UTC every Wednesday and bribes can be collected at 01:00 UTC Thursdays. Gauge emissions will update at 00:00 UTC Thursdays.

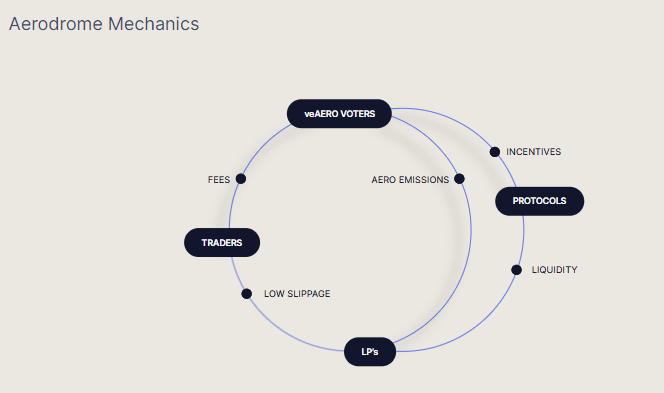

ve(3,3) Model

The ve(3,3) model describes the relationship between the different participants in the protocol.

- Users lock AERO for veAERO which grants voting power

- Emissions are controlled by voters and go to LPs

- Voters receive trading fees + bribes for voting on gauges

- Traders get low slippage

- Protocols pays bribes and get liquidity

Airdrop

The entire supply of AERO was airdropped to veVELO holders. The holders got a veAERO lock about 1/3 of the size of their veVELO and some liquid AERO as voting incentives at launch. That veAERO is now worth 3x more than the veVELO and earning ~7x more rewards per week.