A Look Inside the Memecoin Trenches of Solana

"It wasn't a fad all along, the meme supercycle is here. We are being escorted to the promised lands. There are no pullbacks in the new paradigm." - everyone on Twitter posting memecoin price predictions.

Introduction

Ever since we last covered memecoins back in March of this year, the total market size of the sector alongside its mindshare have displayed consistent growth with no clear signs of stagnation. Undoubtedly making it the fastest horse on the racetrack.

This occurrence can be attributed to their innate virality leveraged by social media, extremely low barrier of entry and the constant emergence of new narratives that keep speculators engaged, though many, if not most, fail to sustain any meaningful attention for extended periods of time. Nonetheless, market participants have become accustomed to it by frequently rotating in and out of lucrative short term trends, capitalizing on momentum, while staying more loyal to higher conviction bets with greater sticking power. As much as some hate to admit it, a meme that has been around for a while and thoroughly vetted by the market in the current climate going to zero is less probable than one would expect from an asset purely fueled by impressions and providing no real utility other than transferring capital from one person to an other.

Though Solana might not be the sole contributor to the large total market capitalization of these tokens, most of the activity within the space does take place in the trenches of its on-chain ecosystem. For this reason, the chain will remain the focal point of this article attempting to provide a bird's eye view of the landscape.

Respect the Pump

Following the inception of pump dot fun, a memecoin incubation platform native to Solana, the dynamics of the local market underwent a significant shift. Interacting with speculative coins became simpler, cheaper and safer (from a security perspective) than ever. Standardized token deployments in a controlled environment through a user-friendly interface allowed anyone to create new tokens based on a common configuration, eliminating potential exploitation vectors hidden inside smart contracts by bad actors. Effectively requiring only some creative input from the deployer without the need for any technical savviness. Abstracting away all complexities aggregated attention to the one thing that truly mattered – gambling at scale.

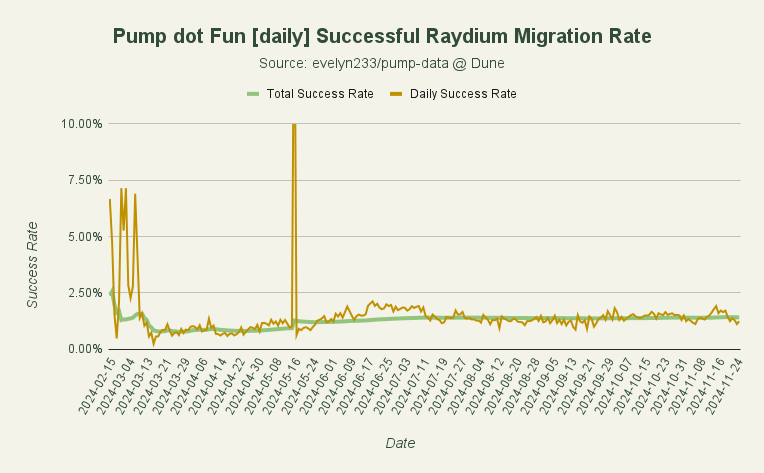

After a tokenized meme had been spawned, it became directly tradable within the platform's internal market and upon reaching a market capitalization of around 69 thousand dollars, automatically deployed to Raydium. However, most creations are unsuccessful in their attempts to reach this threshold, never to be released into the wild.

Roughly one out of a hundred tokens "graduate" from pump dot fun college, due to immense saturation and limited liquidity among other reasons outside the scope of this article. Those stepping into the ring had to present something interesting, shocking or unique for the trench warriors to even take notice. Despite these odds, it didn't take long for the protocol to establish itself as the de-facto gateway for trading micro-cap coins and launching new ones, swiftly surpassing all other venues in this domain.

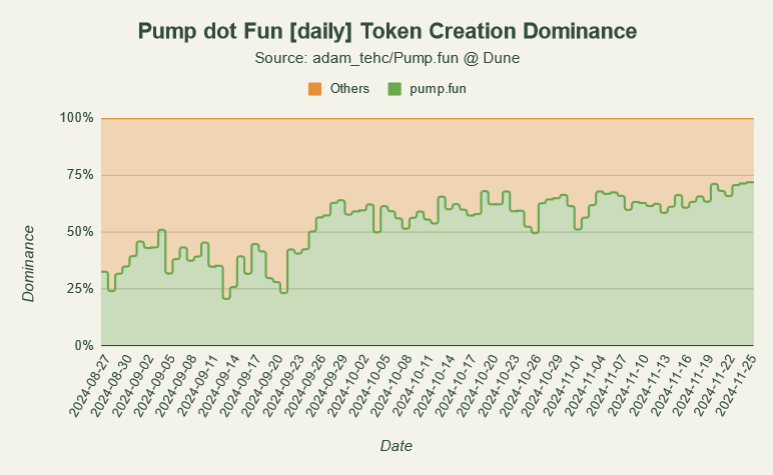

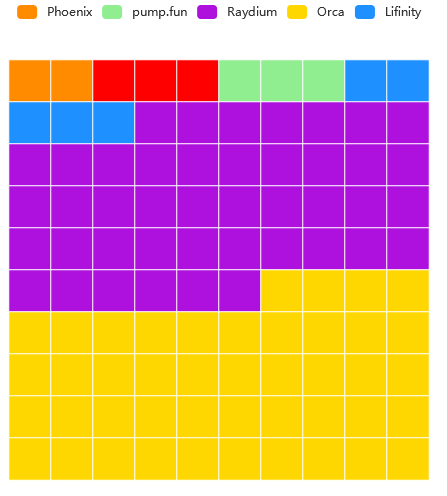

As of today, the deployment dominance over alternatives has reached a staggering 71.9%, showcasing the widespread popularity and profound impact of the application. Recent developments have catapulted it to the mainstream, onboarding many new users from TikTok with ambitions of making it big, adding more fuel to the fire.

All Roads Lead to Raydium

No matter whether it's a stealth launch, pump fun or presale token; an overwhelming majority of memecoin liquidity pools are housed on Raydium. A mass exodus of memes flooding the market subsequently increased its market share to a point where the decentralized exchange comprises a sizeable percentage of Solana's current on-chain trading volume.

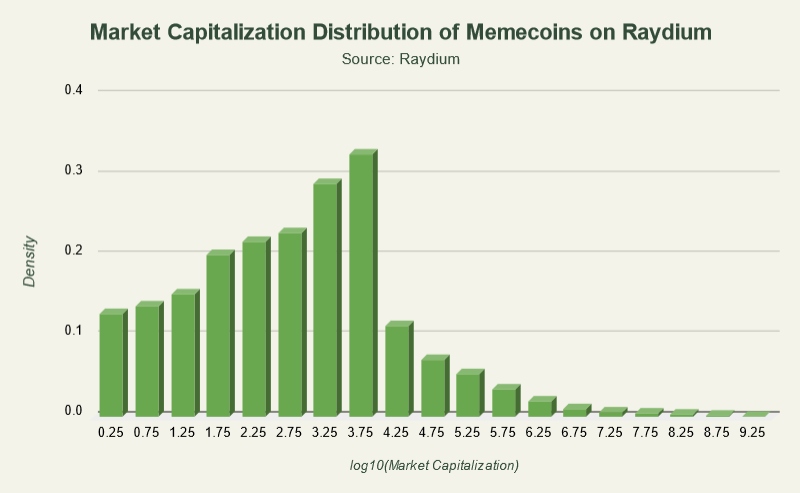

In a gold rush, those selling shovels to opportunists tend to reap the most. That analogy applies to the topic at hand as well. Regardless of how well memecoins perform, platforms facilitating the trading activity benefit heavily from the volume generated by increased speculation. Anecdotal evidence and common sense suggest that only a handful of tokens reach prominence, with the rest destined to fade into obscurity. This notion can be confirmed or disproved by simply observing the market capitalization distribution across all existing trading pairs.

Discerning memes from non-memes on a broader scale is rather difficult due to the lack of efficient labeling from data providers. After careful consideration, the approach taken for curating a comprehensive dataset was to gather information on all Raydium liquidity pools (as of 25-11-2024) with non-zero liquidity and excluding legitimate projects featured in official token lists and CoinGecko. The remaining 493 203 pools containing 474 161 unique tokens will serve as the basis for this segment's analyses.

Most entries with even a modicum of motion at any point in its existence tend to be clustered within the one hundred to ten thousand dollar range, forming noticeable peaks in the early and mid thousands. It's evident that the chart is heavily right-skewed, forming a smoother gradually declining tail – highlighting fewer coins with higher valuations, which is to be expected since sustaining a modest market capitalization in such an attention-driven environment is challenging. Granted this example encompassed the entire dataset, it's also worth exploring any potential structural differences in distribution between tokens originating from pump dot fun and of those deployed to Raydium directly.

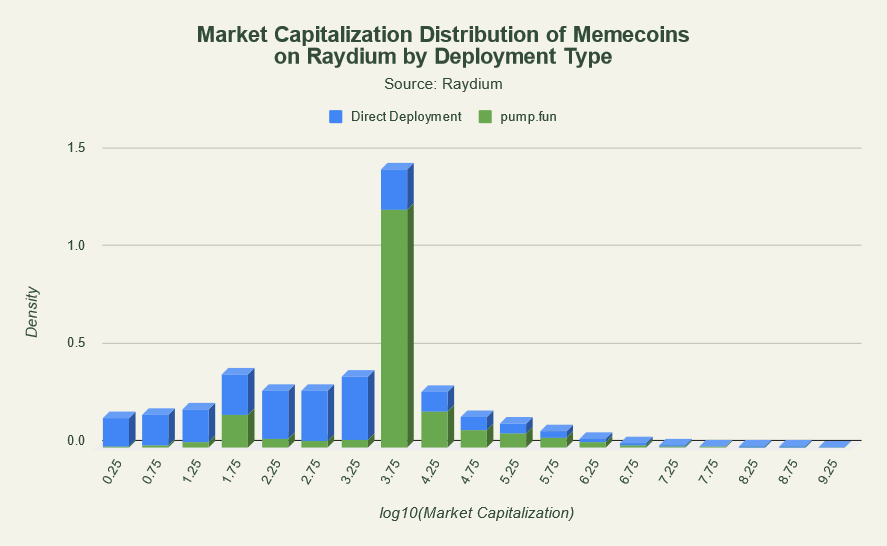

Separating the two provides valuable insight into patterns visible in the overall distribution and their individual performances alongside showcasing unique characteristics.

Pump dot Fun

Keeping in mind that pump dot fun tokens require to pass a certain market capitalization threshold to be granted a liquidity pool, they are generally valued higher due to greater amounts of liquidity supplied at launch, thus populating more of the five to fifteen thousand dollar range. Indicating that most graduated tokens fail to sustain nor exceed valuations seen prior to migrating to Raydium. These coins also have more prevalent representation among the mid-range (hundreds of thousands to early millions) as the deployment pipeline somewhat filters out unappealing memes and allows the community to leverage notoriety or traction gained on the platform during the process as a catalyst for growth.

Direct Deployment

A noticeable density persists in the lower market cap bands, hinting at many smaller, less desirable tokens that struggle to gain significant traction. This may be partially caused by saturation, the timing at which these coins were introduced to the market or plainly the lack of narrative, originality and proper shilling on Twitter. Though barely visible, there is a larger concentration of extremely high-cap memes that are listed on multiple centralized exchanges and were created long before pump dot fun came to be.

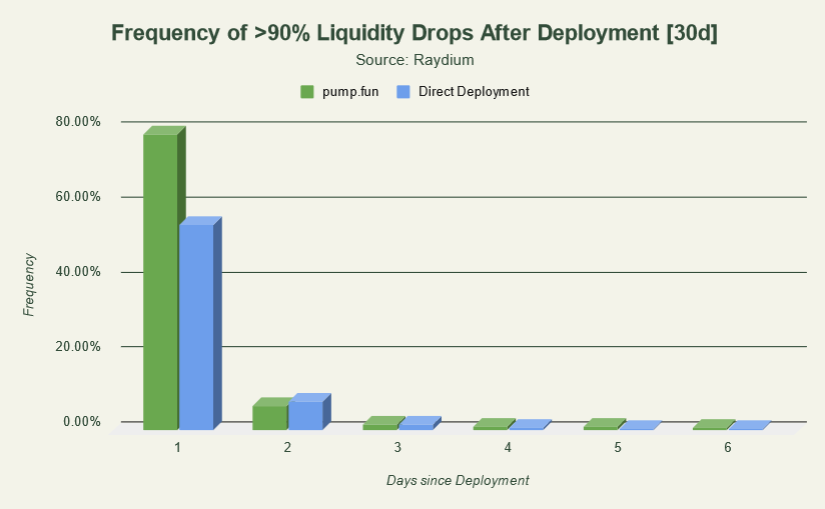

The consistent clustering of tokens around lower valuations in our dataset confirms the notion prefaced earlier. While trend exhaustion and the inevitable pop of the speculation bubble are massive hurdles for any token, misaligned incentives contribute greatly to the instantaneous downfall and subsequent death of many memecoins. Negligible consequences for pseudo-anonymous charlatans misleading their audiences and so called "developers" with malicious ulterior motives have effectively normalized blatant fraud in the space, leaving a lot of seemingly promising concepts dead on arrival. Upon closer inspection, a significant portion of tokens are intentionally set up for failure in order to extract maximum value from unsuspecting speculators and remains a constant threat to those brave enough to sit behind the table and take a chance. Newsy Johnson.

In the last thirty days alone, nearly two out of three coins have been slaughtered within the first 24 hours with >90% of available liquidity evaporated. Recovering from such a cataclysmic event in the formative period tends to be improbable, but occasionally, disgruntled holders perform a community takeover in an effort to regain lost momentum by creating new social media accounts and begin anew out of stubbornness or in some cases spite. The results of this are how you'd expect, however if done properly, it might grant the proponents a good exit.

Conclusion

The memecoin landscape on Solana is as unpredictable as it is dynamic, defined by a mix of boundless creativity, rampant speculation, and the ever-present risk of exploitation. Platforms like pump dot fun and Raydium have become the epicenters of this thriving ecosystem, offering both opportunities and challenges to participants. While the meteoric rise of a few standout tokens fuels dreams of overnight success, the sobering reality is that most memecoins fail to sustain their initial momentum, leaving a trail of dashed hopes in their wake. As this speculative frenzy continues to evolve, one thing remains clear: due diligence and caution are paramount in a world where virality often outweighs substance. Whether you're a curious observer or an active participant, navigating the niche market demands both a sharp eye for trends and an unwavering skepticism toward promises of easy riches.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.