A Comprehensive Guide to Ethena S2

So many pools, how to trade? We got you covered with a guide containing everything you need to know

Ethena’s Season 1 ran for six weeks and the best farmers like Defi_Maestro booked profits as high as 8-figures. We conducted a deep-dive interview with Defi_Maestro on that winning trade. If you haven’t checked it out yet, you can do so here:

Uncovering the 8-fig Ethena Trade | Defi Maestro Interview

Thor • Apr 17, 2024

Intro The Ethena protocol and its native USDe stablecoin launched on mainnet earlier this year. This came alongside the season 1 ‘shards‘ campaign leading up to the launch of the native governance token ENA in early April. As of today, ENA trades at a $15b FDV and peaked at a valuation of $20b a few weeks ago. The season 1 campaign lasted for 6 weeks and…

Read full story →

If you missed out on Season 1, the good news is you’re not too late for Season 2. Pools are filling up quickly, but there is still an open opportunity.

In today’s article, we break down three different Ethena strategies and its potential returns.

Still haven’t signed up on Ethena? You can do so here.

We’ve spent weeks on this research, consider subscribing if you haven’t already and like the post to support the publication🫡

Want access to more free research reports? Subscribe below and join 10,000+ weekly readers 🗂

Sponsor - Swell Network

Today’s report is sponsored by Swell Network. Swell is the issuer of the swETH liquid staking token, the rwsETH liquid restaking token as well as the newly launched Swell Layer-2, the L2 for restaking powered by EigenLayer.

By depositing assets into the Swell L2 pre-launch, users receive:

- Ecosystem airdrops from protocols building on the Swell L2 (ION protocol, Brahma, Ambient and more)

- A share of 1 million additional EigenLayer points

- 4x pearls (Swell points) if swETH or rwsETH is deposited

- An additional $SWELL airdrop in Q3

There are many different assets that can be deposited into the L2 aside from Swell’s native assets, swETH and rswETH. These include Etherfi’s eETH, which grants 2x Etherfi loyalty points, Ethena’s USDe, which grants 15x ‘Sats‘, and many more.

Swell is gearing up to become the main hub for restaking and EigenLayer ‘Actively Validated Services‘. In addition, rwsETH will be used as the native gas currency on the chain. The pre-deposits are open for 11 days and can be accessed here.

Primer

Before we dive into the numbers, let’s cover quickly the few primitives surrounding this trade.

1️⃣ Ethena is a protocol that issues USDe, a yield-bearing synthetic dollar/stablecoin. When you buy USDe, you accumulate points (Sats) that counts toward your eventual reward in ENA, Ethena’s governance token. ENA is currently trading at a 14.3B FDV. See our previous article for a comprehensive breakdown of Ethena and its risks.

2️⃣ Pendle is a yield-trading dapp that splits up a yield bearing token into a Principal Token (PT) or Yield Token (YT). PT lets users have isolated fixed-yield exposure, and YT allows isolated yield exposure. Because YT excludes the principal, the value of YT will trend to zero towards the maturity date of the YT Token. For the purposes of the covered strategies in this article, it is the YT that will be mainly focused on.

- Example: 1 USDe has an APY of 17%. When you buy USDe YT tokens on Pendle, the YT token carries only the value of your 17% yield + however many points you accumulate on the underlying protocol (in this case Ethena).

3️⃣ Mantle and Arbitrum are Layer-2 blockchains where Pendle have also deployed on, in addition to Ethereum mainnet.

With all that out of the way, we cover three popular airdrop farming strategies for Season 2:

Low risk: Hold USDe on Ethereum (5x sats/day), or lock it at a minimum period of 7 days (20x sats/day)

Medium risk: Buy USDe YT (Yield Token) on Pendle

High risk: Lock Ethena’s governance token ENA + buy USDe YT on Pendle at a 50:50 ratio

Estimating Airdrop Returns for Ethena Season 2

To begin calculating your potential ROI on your farming requires answering one crucial question: how much Sats will be emitted by the end of Season 2? Based on that all-important answer, we can quantify our airdrop allocation and decide what strategies offer the best risk-adjusted return.

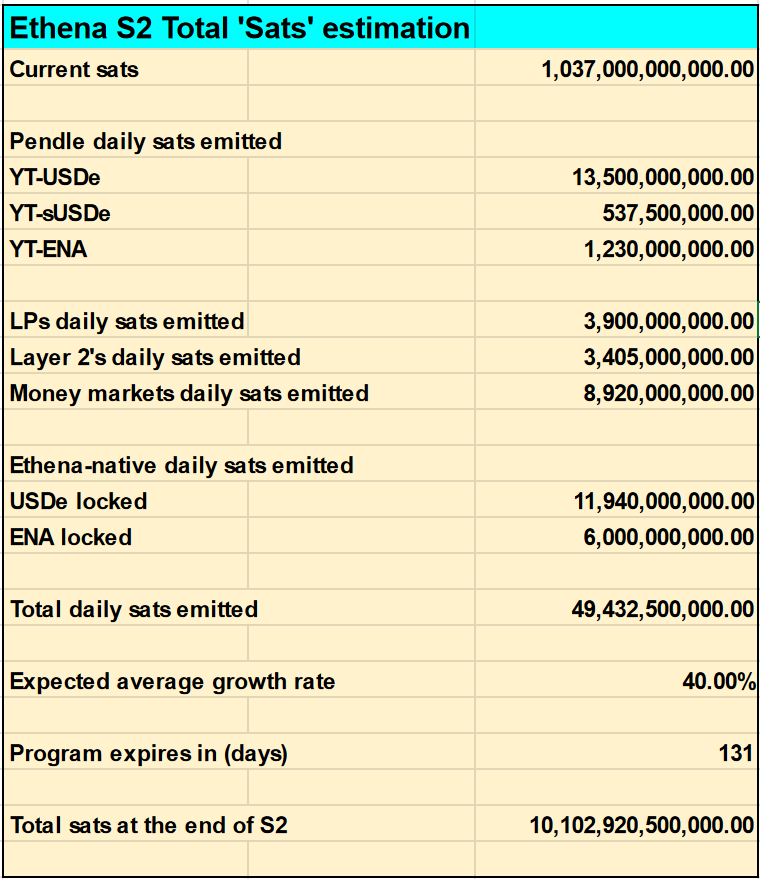

Here, we take a conservative estimate that the growth rate of Sats is 40%, resulting in a total of 10.1 trillion Sats emitted by the conclusion of Season 2 (2nd September 2024). Season 2 also concludes if a total of $5B TVL is reached but we think this is unlikely at present TVL levels of $2.4B.

!function(){"use strict";window.addEventListener("message",(function(e){if(void 0!==e.data["datawrapper-height"]){var t=document.querySelectorAll("iframe");for(var a in e.data["datawrapper-height"])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

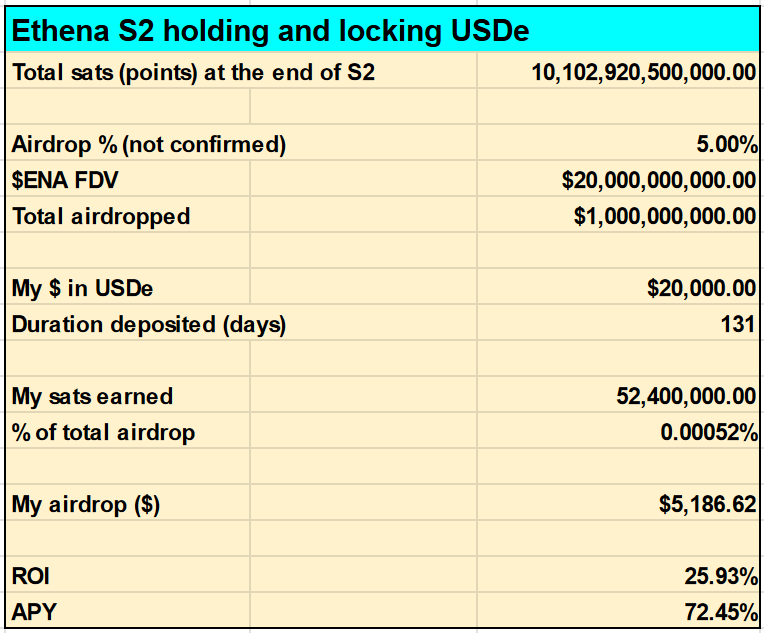

First strategy: Hold and lock USDe

Now let’s calculate our ROI for simply holding USDe, the lowest risk strategy here. Here are our assumptions:

- 5% airdrop allocation (assuming same as Season 1)

- $20B FDV to estimate the total airdrop value (current 14.4B)

As you can see in the below table, if you locked $20,000 USDe at a 20x multiplier today (131 days left in Season 2), that would net you $5,186 in profit, effectively a 25.93% ROI or 72.45% APY.

Unlike the subsequent strategies, you keep your entire principal as this strategy does not involve Pendle.

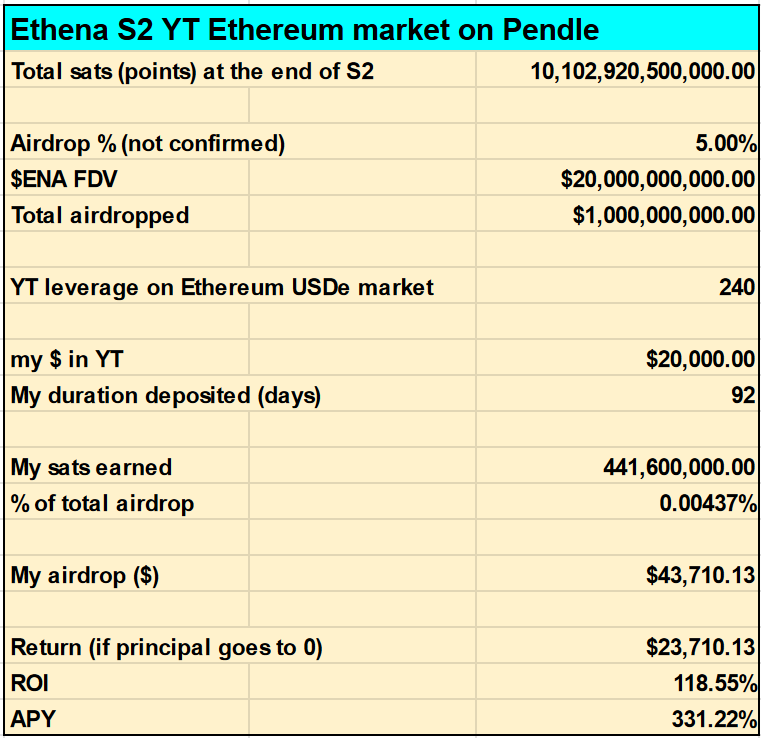

Second strategy: Pendle YT strategy

Now let’s look at a medium risk YT USDe strategy for the Pendle pool on Ethereum mainnet.

For the same capital of $20K (but different duration at 92 days), you would net a ~$23.7K return, about a 4x larger return than the first strategy! As a reminder, your YT value trends to zero on maturity, hence the $20K deduction of your principal.

Note that the projected earnings in our following calculations are based on the current market conditions of leverage in Pendle. YT leverage is affected by the market demand for YT as well as the respective maturity dates of Pendle pools.

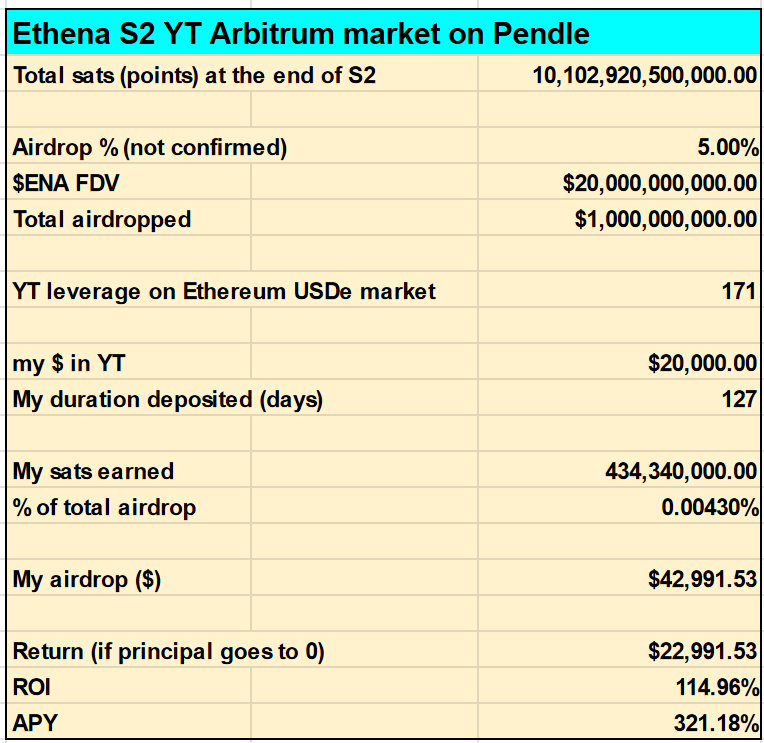

The same strategy deployed on an Arbitrum Pendle pool would net you a slightly lower ROI and APY. Your absolute returns would be slightly lower. Again, the difference is due to the different levels of YT leverage on these respective pools.

You can also choose to deploy the same strategies on Mantle or Zircuit Pendle pools.

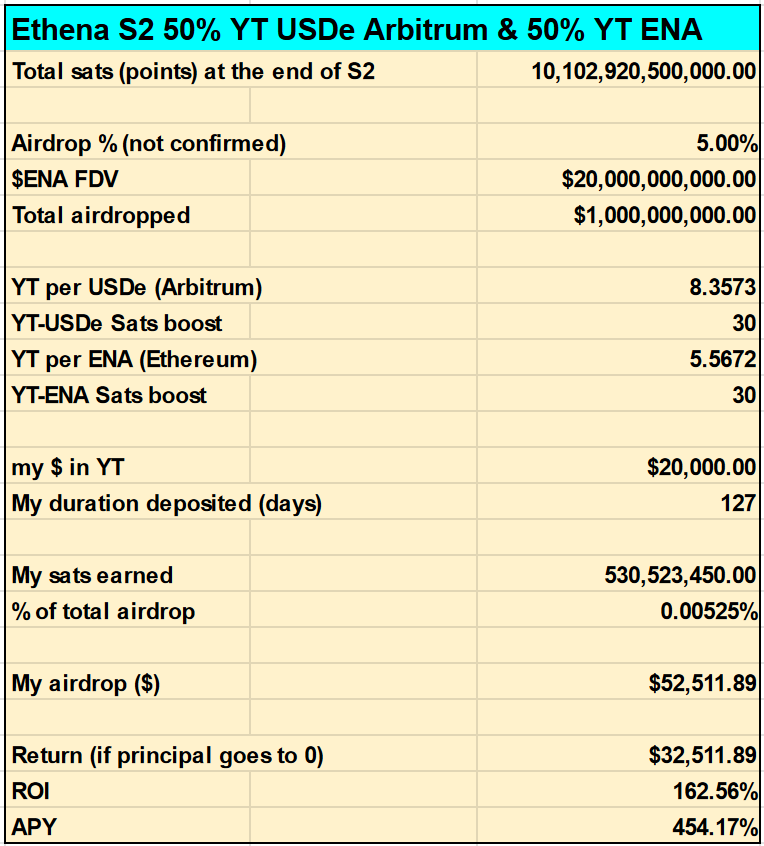

3rd strategy: Buy ENA YT + USDe YT

Finally, let’s consider our final, highest risk strategy that allocates an equal split 50:50 capital ratio between locking ENA and buying Pendle’s USDe YT.

Why the added layer of complexity? This is being directly incentivized by Ethena for users who lock ENA at a minimum of 50% of their total USDe holdings per wallet. By holding the YT-ENA and YT-USDe in the same wallet, that boosts your total rewards in both pools by YT-USDe by 50%.

https://twitter.com/ethena_labs/status/1777306583921529163

This is also likely the strategy of the most sophisticated YT traders who have had half their S1 airdrop vested to capitalize on the higher sats multiplier.

As you can see, this strategy on Pendle (Arbitrum) nets the highest return. This higher reward is commensurate with the higher risk that traders are taking on for having to lock ENA, a liquid token.

[EDIT: Ethena counts the boost eligibility in amount of YT tokens, not $ value. You therefore need to have at least 50% YT-ENA tokens relative to YT-USDe and not 50% of the $ value]

If you find estimations valuable, consider subscribing to On Chain Times and signing up on Ethena with our referral link here.

Concluding notes

Before buying Pendle YT, consider the level of leverage. Leverage increases when the market is selling YT (the likely outcome closer to maturity date), and vice versa. Although leverage is ever changing based on the underlying YT markets, the leverage level you purchase at does not change and lasts for the whole duration.

📜 ➡️ We’ve made the spreadsheets available to all subscribers of On Chain Times so you can fork and tinker with your own assumptions.

How to access the spreadsheet if you’re a subscriber? Head to our Substack chat where the link is posted:

substack.com/chat/1589185

If you’re reading this somewhere other than Substack, you need to create an account and subscribe to On Chain Times to access the chat.

If you found this useful, do share this article or follow On Chain Times on Substack.

Want access to more free research reports? Subscribe below and join 10,000+ weekly readers 🗂

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.