A Comprehensive Analysis of the On-Chain Perpetual Landscape📊

Decentralized perpetual trading platforms could 10-20x in volume over the coming years. Let's explore how.

Kain Warwick, founder of Synthetix, was recently featured on the Empire podcast (by Blockworks Research), in which he claimed that one of the biggest use cases in crypto is trading crypto.

- I tend to agree.

And while this might indicate that we are early or that there’s still a long road ahead before mass adoption, it also gives us a good idea as to which protocols could experience a large inflow of capital in the coming months and years.

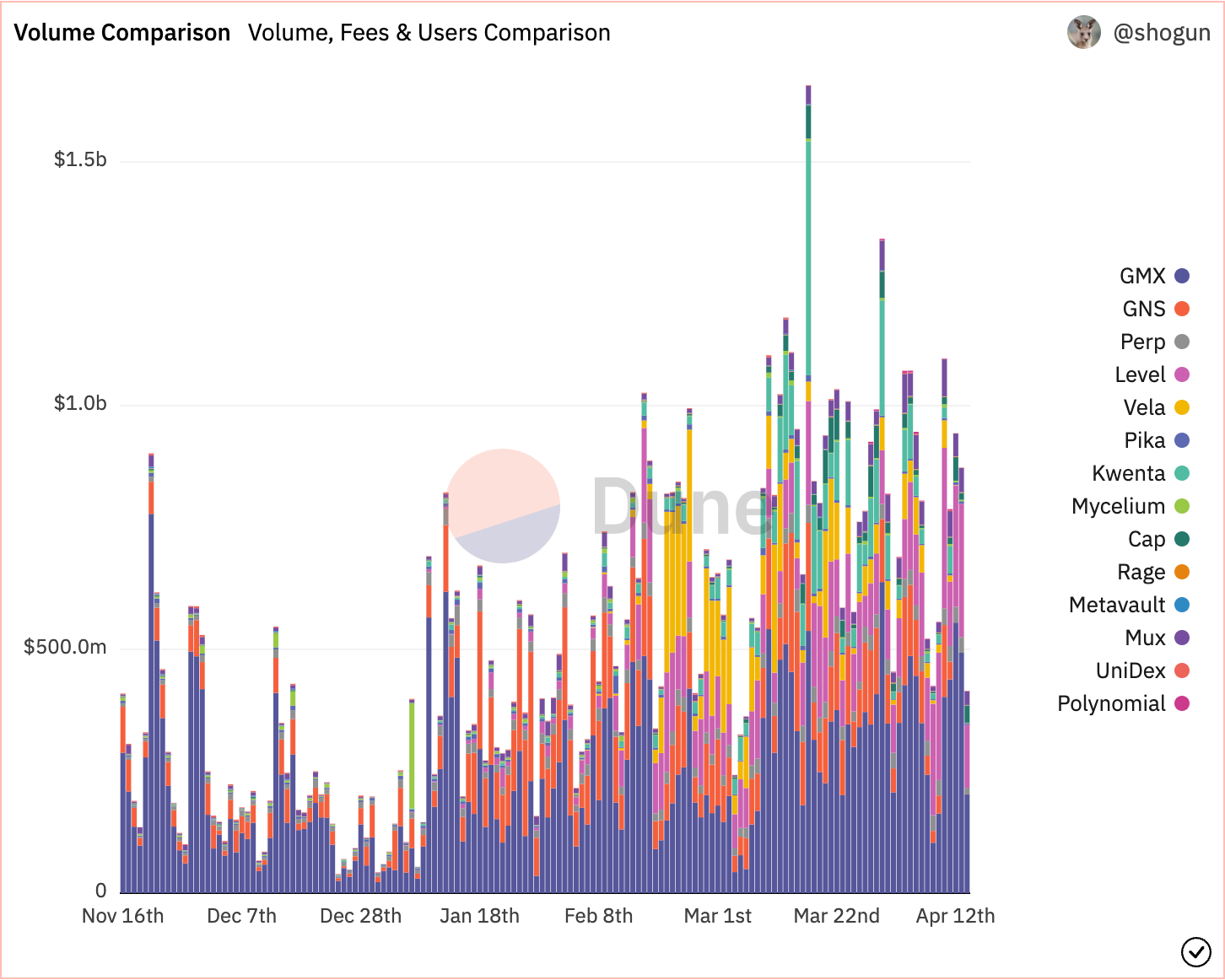

Since the collapse of FTX, an increasing amount of traders have abandoned centralized exchanges in favour of on-chain alternatives. Decentralized perpetual exchanges have seen a massive increase in cumulative trading volume and user activity in the past 6 months, despite a bearish macro environment and no new liquidity flowing into DeFi on a broader scale.

Decentralized perpetual trading is one of the few sectors in DeFi with product market fit, and on top of this, most of the native tokens have an actual purpose other than governance, such as receiving a dividend/yield from protocol revenue. This report will dive into the decentralized perp-exchange sector as well as explore individual protocols with potential future tailwinds.

An overview of the decentralized perpetual landscape

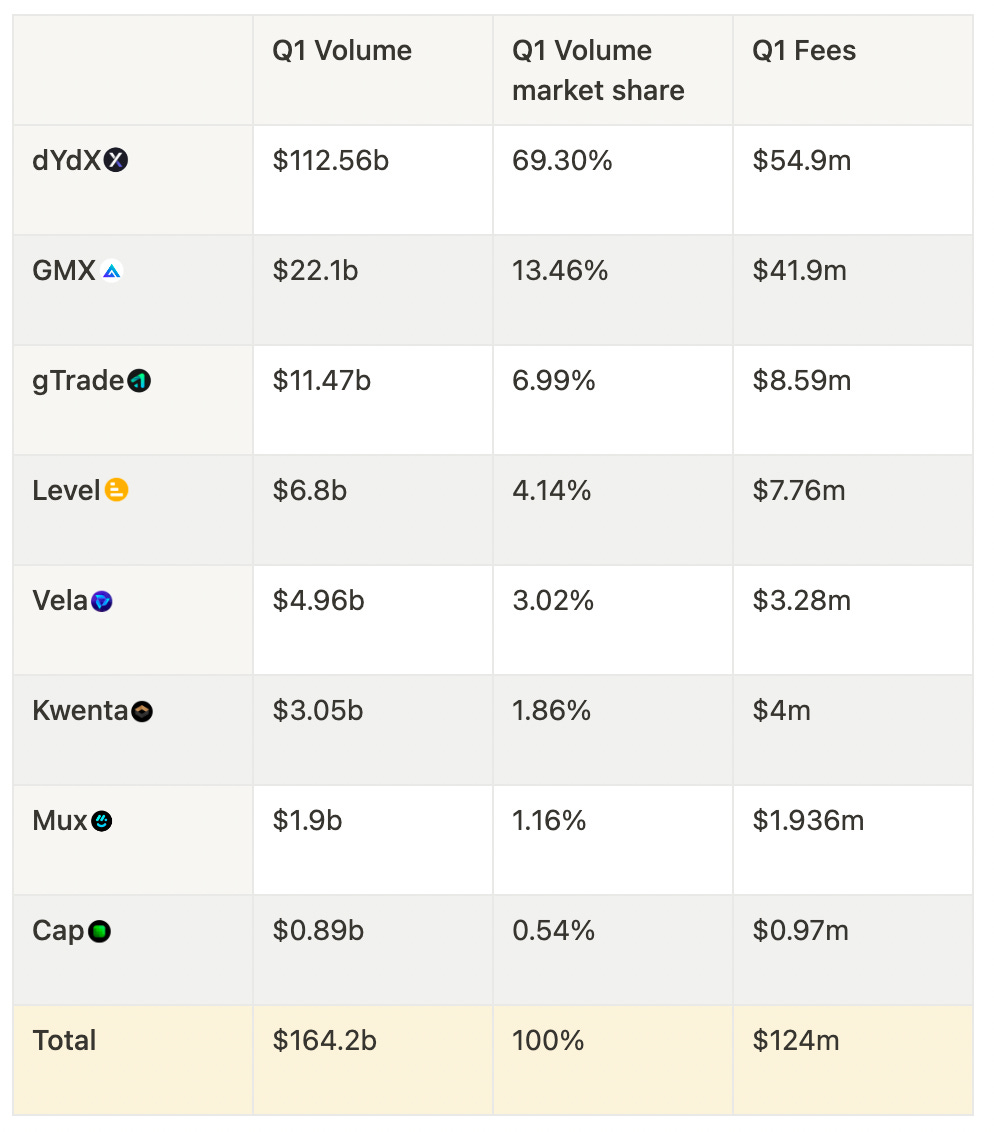

In Q1 2023, a total of $164 billion were traded in volume across decentralized perpetual exchanges, marking a massive increase from previous quarters. Most of these perp protocols have also been hitting all-time highs in daily volume throughout April. The table below shows the Q1 volume and fees generated by the largest protocols in this sector, as well as their market share.

Based on the large growth in the first half of April, it appears that Q2 might be an even better quarter for these protocols. Looking ahead, it wouldn't be surprising to see the total trading volume surpass $300 billion for Q2, and potentially exceed half a trillion for either Q3 or Q4.

By the end of 2025, I predict the total volume on decentralized perpetual exchanges to reach between two and four trillion dollars per quarter. Considering that Binance alone did roughly $4.5 trillion in derivatives volume in Q1 2023, the aforementioned prediction seems obtainable.

So, ask yourself, if the trading volume 10-30x in the years to come, what will the token prices of the leading on-chain perpetual trading protocols look like? And which protocols are currently positioned as future winners?

To answer these questions in a proper fashion, we must look beyond trading volume, future growth projections, and token market cap, in order to estimate a realistic valuation. As crypto is still in a very early stage in terms of both adoption and technology, the market is driven by narratives more than anything else. GMX might not have the most competitive trading fees, but their novel approach to liquidity with the GLP pool sparked the 'real yield' narrative. Communities are important, but also much more difficult to evaluate. Investors also care more about tokenomics than they did a year ago. Here are some things to consider:

- Treasury

- Community

- Tokenomics

- Recent growth

- Liquidity model

- Volume & daily users

- Fee structure & distribution

dYdX

📊 Total trading volume: $913b

📈 14d trading volume: $12.15b

📈 14d fees: $3.24m

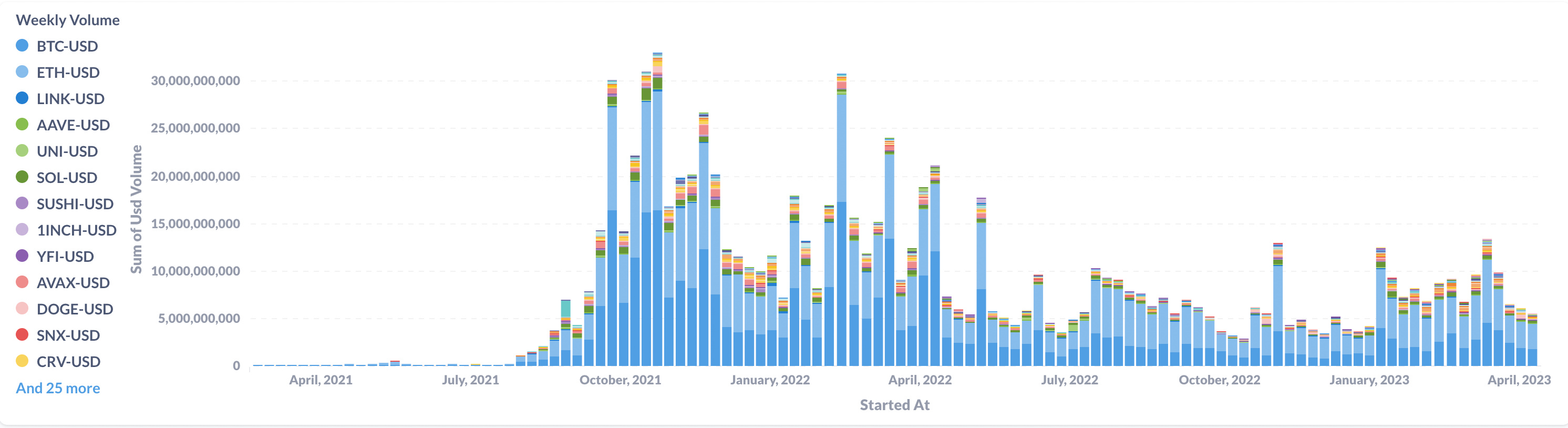

dYdX is one of the first on-chain perpetual exchanges to launch in the space. Despite a decrease in trading activity since 2021, to this day dYdX still does more in daily trading volume than all of the other perp protocols combined.

Currently, dYdX operates on a custom layer 2 blockchain developed by Starkware, which allows for high throughput and low fees. Trades are settled and bundled together on the rollup which utilizes zk-proofs and sends the bundles of transactions to Ethereum mainnet for finality.

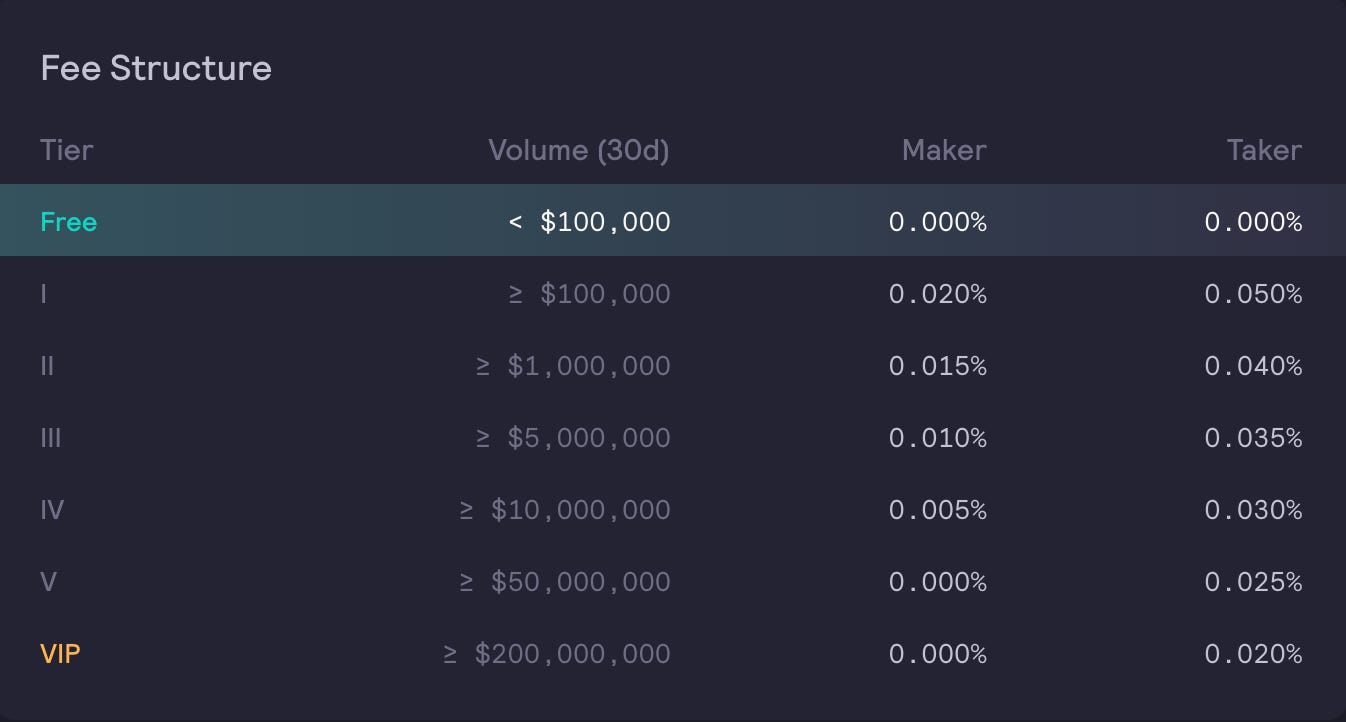

Compared with other on-chain perpetual trading protocols like GMX/gTrade/Level, dYdX operates more similarly to a CEX because of its low trading-fee structure including not having to pay fees on the first $100k traded and avoiding Ethereum gas on all deposits > $500. This works to dYdX’s advantage as CEX’s pulls significantly higher volumed relative to their on-chain counterparts.

V4

For over a year, dYdX has been building V4, which is all about making dYdX decentralized. More specifically, dYdX is launching its exchange on a custom app-chain in the Cosmos ecosystem. The orderbook, which was previously operated in a centralized fashion off-chain, will now be managed by validators on the app-chain for increased decentralization (in-memory orderbook). Trades are therefore committed by the validators each block to ensure that all transactions go through and that they have the same version of the orderbook. Current testing has achieved > 500 transactions/second.

Tokenomics

dYdX has historically received a lot of criticism for their poor tokenomics. While the platform has been raking in fees, $DYDX has not been a lucrative investment to date (down 90% from ATH at $28). A large unlock of 40% of the supply was scheduled for January this year but was changed after criticism from the community. The large unlock is now scheduled as follows:

- 30% December 1st 2023

- 40% in equal monthly installments on the first day of each month from January 1st 2024 to June 1st 2024

- 20% in equal monthly installments on the first day of each month from July 1st 2024 to June 1st 2025

- 10% in equal monthly installments on the first day of each month from July 1st 2025 to June 1st 2026

The current utility of $DYDX includes governance and trading fee discounts. Weak utility creates a weak holder base and worse price performance. With V4, $DYDX will gain several use cases such as securing the network (gas fees potentially paid in $DYDX) and likely also revenue accrual. The centralized entity dYdX Trading Inc. currently collects all of the fees generated by traders to grow the exchange. From dYdX:

“Beginning with dYdX V4, dYdX Trading Inc. will not operate any part of the protocol. As a result, it will no longer receive revenue based on trading fees from the protocol. The same is true for all other centralized parties, unless the community decides otherwise.“

Nothing is confirmed specifically, but there’s speculation that fees will accrue to $DYDX holders in some way or the other (potentially through staking?).

V4 is scheduled for Q3 this year and with a somewhat decent macro, I would not be surprised to see $DYDX pick up momentum leading up to the launch (especially when more news arrives regarding the new and improved token utility).

GMX

📊 Total trading volume: $100.5b

📈 14d trading volume: $4.93b

💰 Total fees: $148.2m

📈 14d fees: $7.43m

The success of GMX last year sparked the now huge on-chain perps narrative. The novel liquidity model (GLP) and real yield distribution of fees to liquidity providers and $GMX stakers played a big part in this. Reflecting on the early success of GMX, there are two things the team did incredibly well:

- Kickstarting the real yield narrative: Coming from a time of highly unsustainable yields like Wonderland, Anchor, etc., most investors were skeptical of yield farming. GMX was one of the first protocols to offer sustainable yield paid in ETH generated by trading fees on the protocol.

- Referral system/community: GMX has quite high fees compared to many other perpetual exchanges. So how come GMX is one of the protocols pulling the most volume? The GMX community quickly grew last year, which in return attracted a lot of traders. Higher fees also mean more rewards to referrers, which resulted in many large traders sharing their GMX ref links all over Twitter. This, combined with the GMX Blueberry club, created a strong brand around the protocol, which no doubt has played an important role in the current success

Fees & distribution

- 0.1% open/close fee on perpetual trading

- execution fee (network cost)

- borrowing fee = (assets borrowed) / (total assets in pool) · 0.01%

GMX operates with a dual token model; $GMX as the governance token and $GLP as the liquidity token. 70% of fees are used to pay for liquidity i.e paid to $GLP holders for being exposed to smart contract and counter-party risk. The remaining 30% is paid to GMX stakers. esGMX emissions recently ended which means there is very little inflation of $GMX at this point. All in all very solid tokenomics and proper token-utility.

Looking ahead, GMX is getting close to launching V2 (synthetics) which will introduce a new liquidity structure to the protocol, a large amount of trading pairs, new asset classes and much lower fees. An ongoing proposal suggests that GMX adopts custom low-latency oracles from Chainlink for better real-time pricing of assets in return for 1.2% of fees generated on the protocol.

There has for a long time been concerns regarding trader PnL and the risk liquidity providers (GLP holders) are exposed to (especially considering the rise in trader profit this year in the more bullish environment). V2 will introduce separate liquidity for trading pairs with isolated risk e.g ETH/USDC will have a pool of ETH as long collateral and USDC as short collateral. The introduction of synths will introduce many new tradable assets. A hypothetical example could be SOL/USDC with an isolated pool consisting of ETH as long collateral, USDC as short collateral and SOL as the index token. While isolated liquidity might have lower efficiency than e.g the DAI pool on gTrade, which is the counterpart to all pairs, risk is reduced significantly with this model.

New trading pairs + a novel liquidity model on GMX could very well result in increased trading volume on a longer time frame. Considering that nearly 25%+ of the volume traded on gTrade (Gains Network) comes from stock and forex pairs, introducing these asset classes to GMX in the future would likely increase trading demand.

Gains Network

📊 Total trading volume: $35b

📈 14d trading volume: $1.8b

💰 Total fees: $25.4m

📈 14d fees: $1.6m

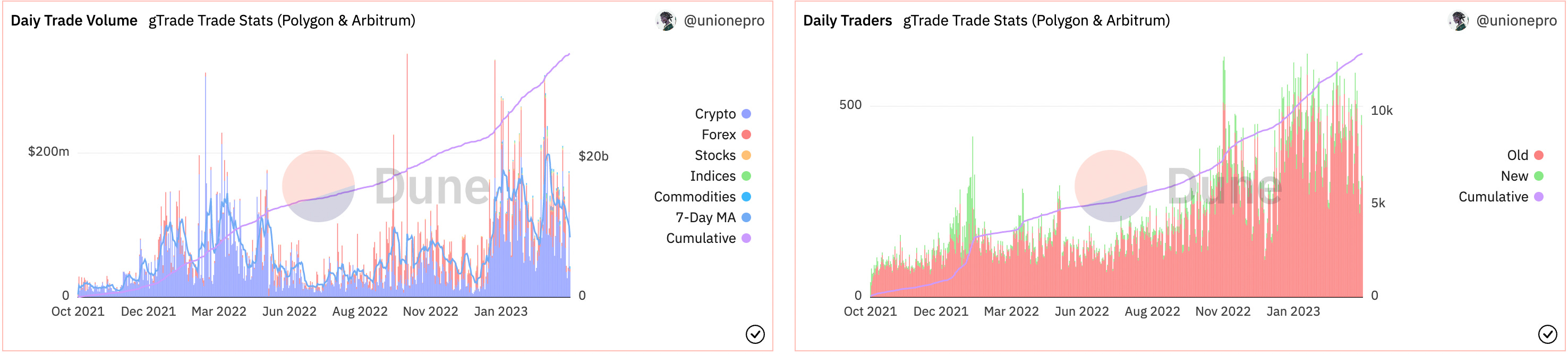

Gains Network is originally a Polygon native perpetual trading platform with one of the most unique designs. gTrade🍏 (trading protocol on Gains Network) offers 45 different crypto pairs, 23 stock pairs and 17 forex pairs available to trade. $GNS started to pick up momentum with the perp narrative in the latter half of 2022. It was in January this year however that Gains Network really took off in terms of daily trading volume, active traders and liquidity in the DAI pool.

How come? Because Gains expanded to Arbitrum. 3 months later, 75-80% of all volume happens on Arbitrum and cumulative users has increased from 9k to 13k.

Gains network has the benefit of being one of the only on-chain forex trading protocols. Roughly 25% of the daily trading volume comes from forex trading whereas stock trading only makes up less than 1% of total daily volume.

Tokens, fees & distribution

- 0.08% open/close fee on crypto pairs

- 0.015% fee on updating stop/loss

- Variable rollover & funding fees

- 0.012-0.02% open/close fee on forex pairs depending on type of forex

- 0.08-0.12% open/close fee on stock pairs depending on type stock

Liquidity is provided to traders through the DAI vault which underwent a major upgrade this year and is now ‘gDAI’. gDAI is the liquid representation of your share of the liquidity provided in the DAI vault which acts as the counter-party to traders. The gDAI vault provides liquidity to all pairs which creates high capital efficiency and makes it easier to list new pairs as there doesn’t need to be bootstrapped liquidity. gDAI is an interest bearing stablecoin that appreciates in price based on trading fees collected and trader PnL (current APR = 11%). If the vault becomes under-collateralized from positive trader PNL there is a longer withdrawal period from the vaylt and users have the ability to mint gDAI at a discount which helps recollateralize it.

$GNS is the native utility and governance token of the protocol and users can stake it to earn ~32.5% of the opening/closing fees generated by traders on gTrade. $GNS does not have a fixed supply or large FDV as it is minted and burned based on trader PnL. If traders loose money, a percentage of that loss will be sent to the ‘GNS OTC pool’ wherein users are able to sell $GNS for DAI from the liquidity pool. The $GNS sold will be burned by the protocol. Vice-versa, if traders have large profits and the vault becomes undercollateralized, $GNS is minted and can be bought OTC in return for DAI which recollateralizes the vault. To date since this mechanism was implemented, a net 100k $GNS has been burned.

Could a $GNS death spiral occur where traders drain the gDAI pool and $GNS is inflated into oblivion? The short answer is no as GNS is capped at 18% inflation/year. The increased withdrawal period as well as being able to mint gDAI at a discount, further ensures that the gDAI vault stays collateralized however holding either of these tokens does come with risks.

The gDAI model allows the liquidity provided to traders to be used throughout DeFi (in AMM’s, lending/borrowing etc.) The model is not unique to DAI however and could also be created around BTC, ETH or some other asset. While there has been no talks regarding new collateral types one could imagine this would increase the liquidity on the protocol.

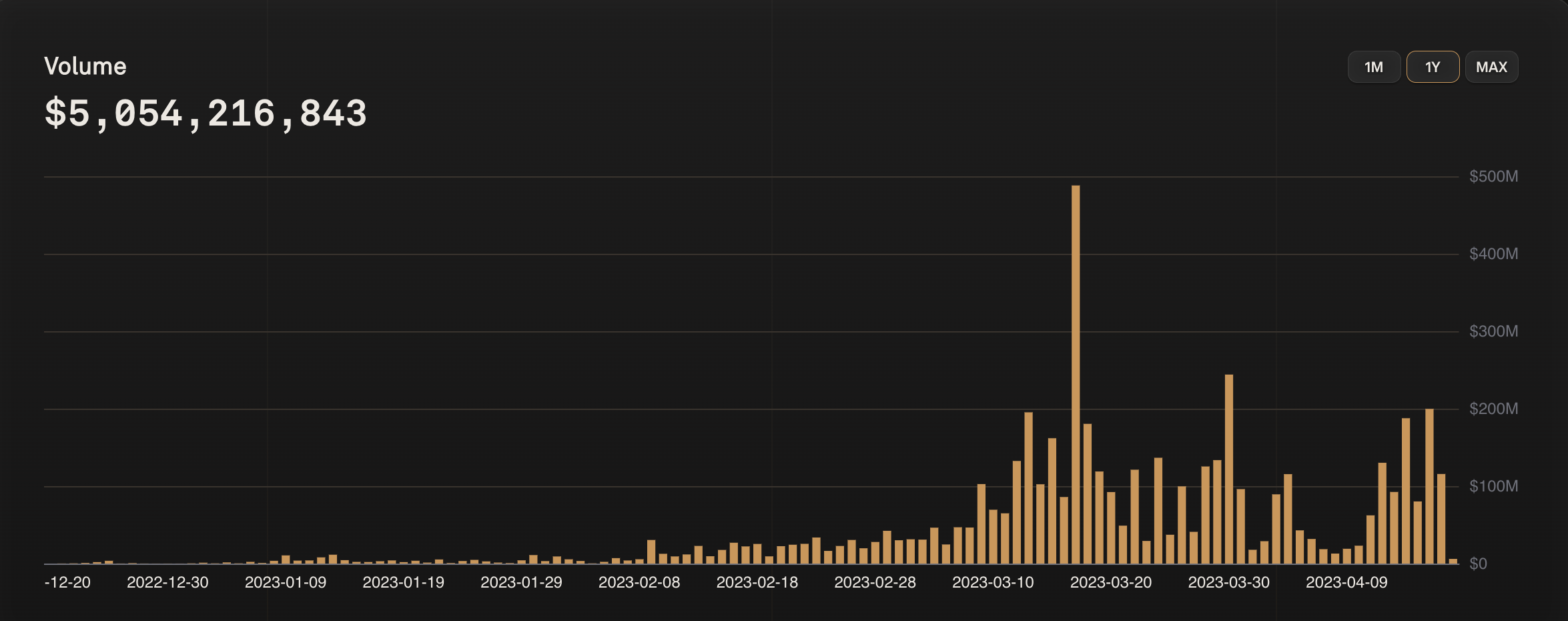

Kwenta

📊 Total trading volume: $6.4b

📈 14d trading volume: $0.5b

💰 Total fees: $12.6m

📈 14d fees: $0.8m

Kwenta is a decentralized derivatives trading platform that offers both perpetual futures (powered by liquidity from Synthetix) and options (powered by liquidity from Lyra). The perpetual futures platform is operating on Optimism and has seen significant growth in trading volume Q1 this year.

Some core features include 19 crypto pairs, 2 commodity pairs and 3 forex pairs that are tradable with up to 25x leverage. The protocol offers deep trading liquidity by inheriting the pooled sUSD liquidity from Synthetix. Synthetix acts as the liquidity layer for a lot of protocols like Lyra, Thales, Polynomial, Decentrex and more however Kwenta accounts for ~95% of the volume generated by this liquidity. Kwenta V2 went live in February introducing 22 new trading pairs and the ability to earn $KWENTA rewards when trading.

Tokens, fees & distribution

- An exchange fee is charged by Synthetix whose fees are sent to the fee pool for Synthetix (SNX) stakers to claim

- 0.08%/0.12% maker/taker fee

- Fixed execution fee

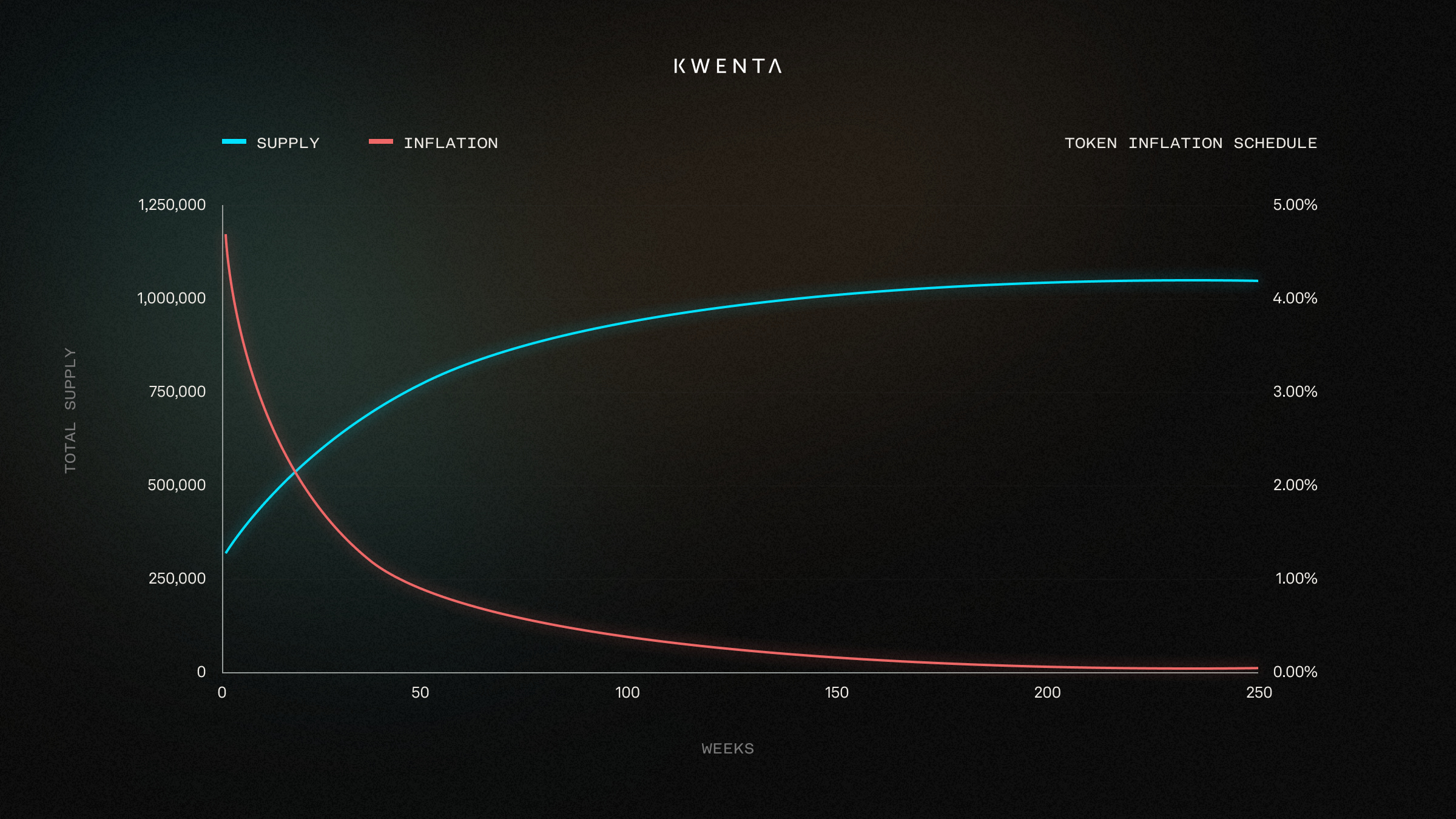

$KWENTA is the native governance token of the protocol. Staking $KWENTA grants governance power as well as inflationary rewards in escrowed $KWENTA. The escrowed $KWENTA is a form of trading rebate as the more users trade on Kwenta and the more $KWENTA they have staked, the more rewards they will receive. See the inflation schedule below:

$OP trading rewards will go live April 19th in collaboration with Synthetix which could attract an increasing amount of liquidity in this period. A potential short term catalyst.

Below is the roadmap for Kwenta which includes

- Updated UI/UX

- Synthetix V3

- Cross margin V2

- Staking V2

Synthetix V3 will introduce additional assets other than $SNX that can be used as collateral to mint sUSD. This could very well increase the liquidity on Synthetix which improves the trading experience on Kwenta.

Level

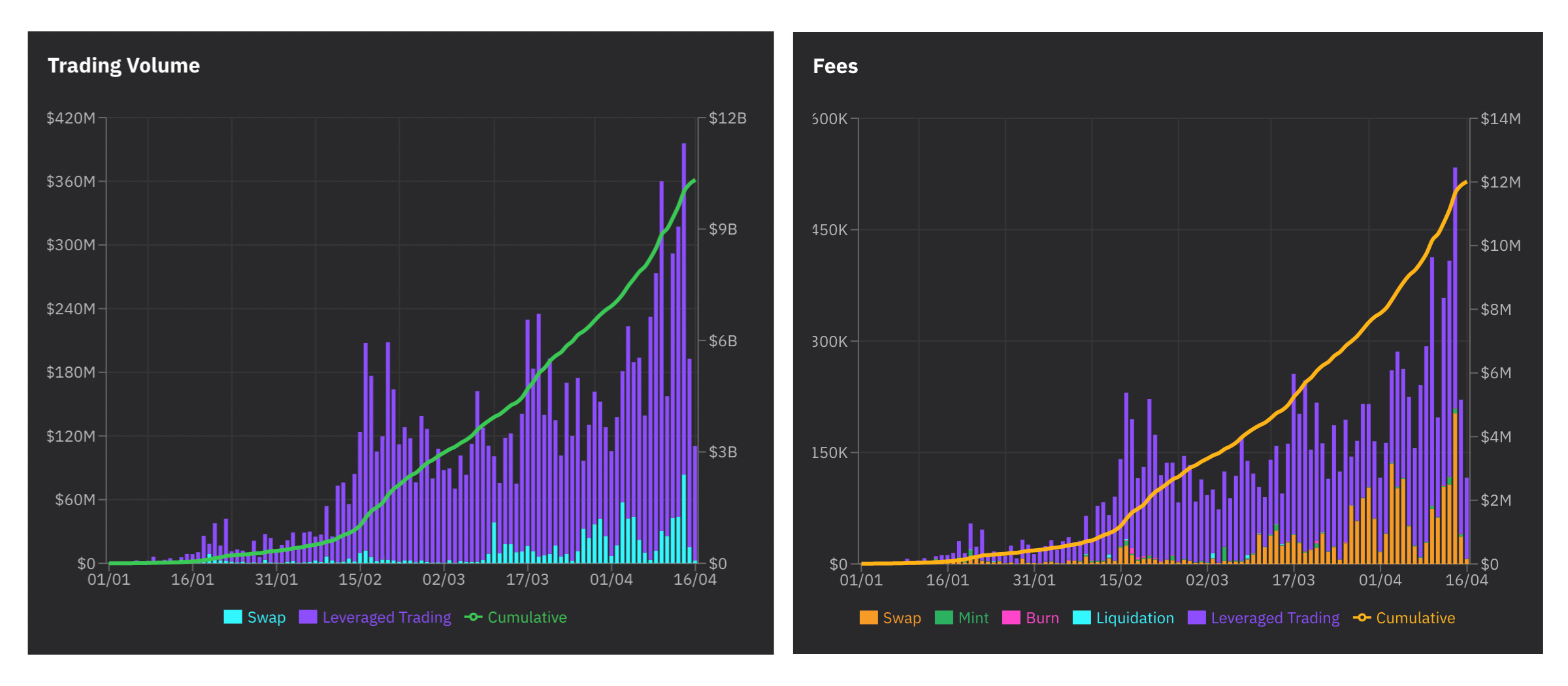

📊 Total trading volume: $10.3b

📈 14d trading volume: $3.2b

💰 Total fees: $12m

📈 14d fees: $3.9m

In three months $LVL has increased from $0.1 to $11 (110x). The trading volume on Level Finance has increased exponentially this year and especially in April with the protocol doing more daily volume than GMX on several days. Level has an intuitive trading UI/UX with up to 50x leverage on just 4 trading pairs:

ETH/USD, BTC/USD, BNB/USD, CAKE/USD

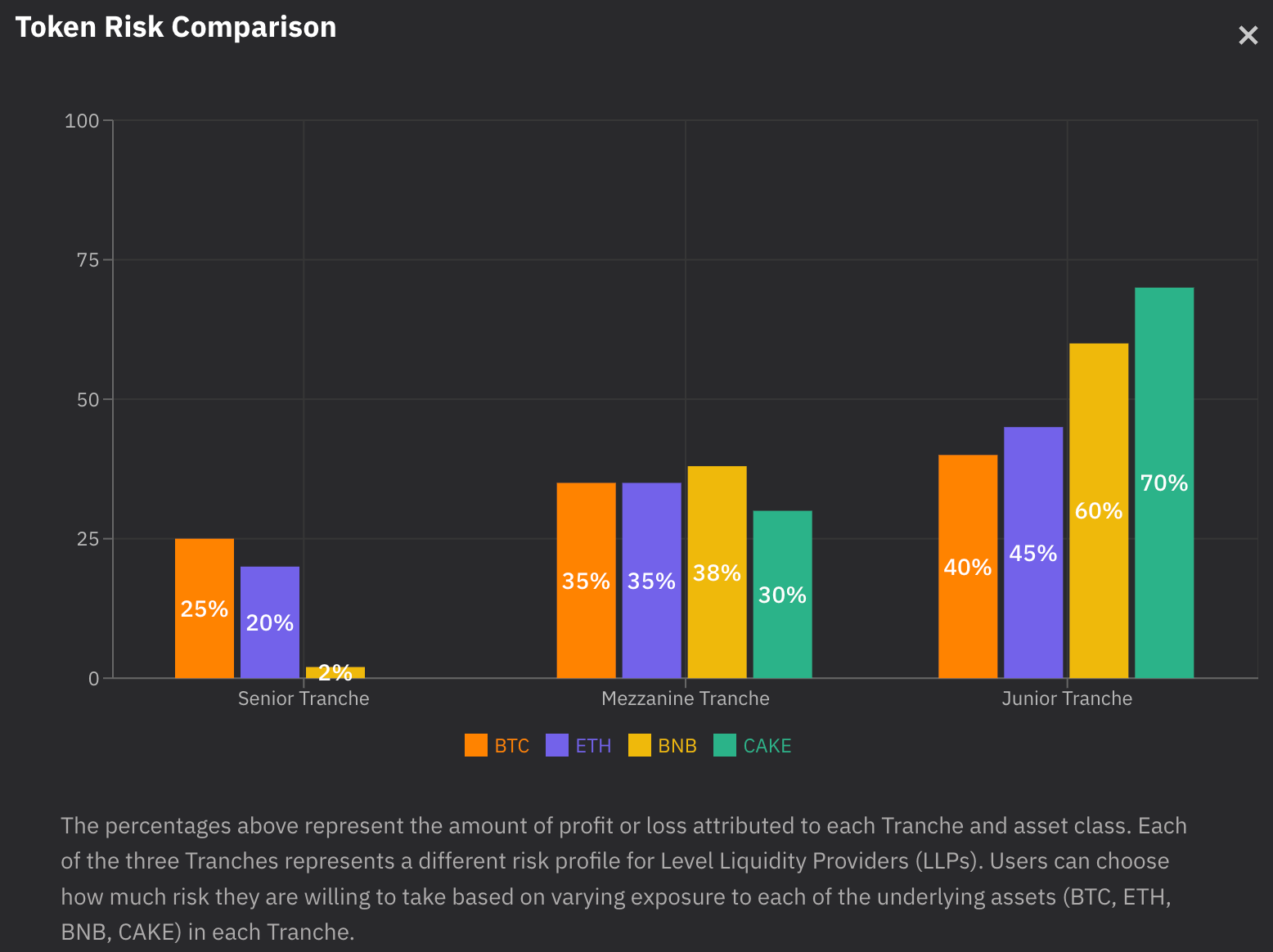

Liquidity is provided to traders through tranches; The senior tranche (low risk), mezzanine tranche (medium risk) and junior tranche (higher risk). Each tranche is composed of the tradable assets and stablecoins (like GLP) in a unique fashion with different exposure to the pairs depending on the risk profile (see below). Depositing into the Junior tranche yields ~3x the yield compared to the senior tranche as you take on more counter-party risk and therefore also get compensated more heavily from trading fees.

Level is a BNB chain native protocol as the only one mentioned in today’s report. While the BNB chain is rarely talked much about on ct (crypto-Twitter), there are ~1.2m active daily addresses on the network whereas there is ~450k on Ethereum mainnet, ~350k on Polygon and 200k on Arbitrum.

Tokens

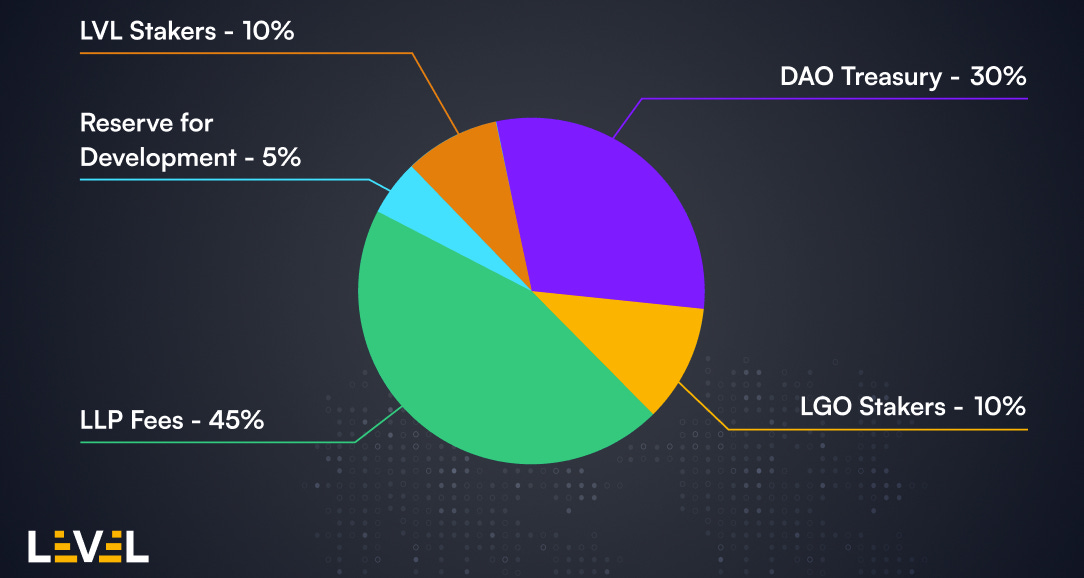

Other than the liquidity tranches, Level operates a dual token model with $LVL (utility token) and $LGO (DAO governance token). Both tokens can be staked single sided to earn 10% of fees. $LVL can also be staked in the DAO staking vault to earn $LGO which is the only way to obtain this token (other than weekly auctions on the Level protocol).

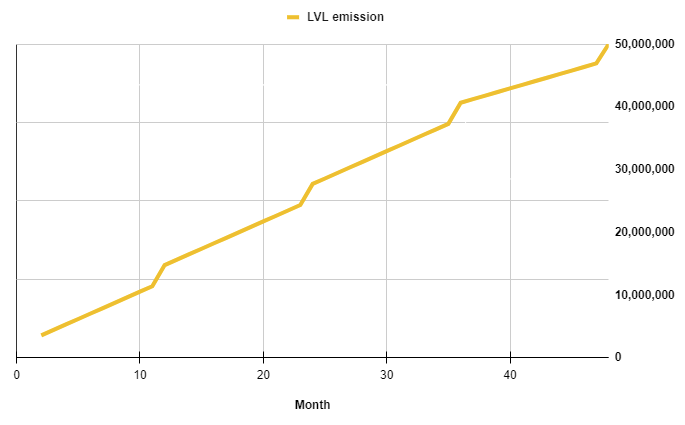

$LVL is emitted as following:

a loyalty program | 16000 LVL/day (will decrease in the future)

liquidity providers | 2000 LVL/day

LVL/BNB pool | 1000 LVL/day

referral program

LVL inflation schedule

It’s worth acknowledging that part of the large growth in trading volume is the trader loyalty program (16k LVL emissions/day.) I’ll note however that it’s unprofitable to use Level for wash-trading to drain the rewards as trading fees are larger than LVL trading rebates. See calculations here.

Fees & distribution

0.1% open close fee on perpetual trading as well a borrowing fee = (assets borrowed) / (total assets in pool) · 0.01%

Fee structure:

Looking ahead, Level has strong momentum as the leading decentralized perp exchange on the BNB chain. Level further has several large upgrades in the horizon including a cross-chain expansion, further empowering of the DAO and an upgrade to the liquidity model.

Comparative Analysis & Growth Projections

Below is an overview of recent trading volume, fees, and native token valuation. In regards to the yellow columns, a lower FDV/volume and FDV/fees is better as it indicates that the token is trading at a lower price relative to the fees/volume the protocol is generating.

It’s worth noting that part of the large recent growth in volume for Kwenta and Level is due to trading rebates. While this can be a good bootstrapping mechanism, we need to see that there is organic demand as these incentives decrease over time.

From the perspective of FDV/volume and FDV/fees in Q1, $GNS and $GMX are the tokens trading at the best value. What both of these have in common is that most/all of their tokens are in circulation whereas the other protocols trade at a quite high fully diluted valuation. In some instances FDV can be considered a meme and calculating the same values with market cap instead of FDV would make $LVL and $DYDX the best valued investments currently. On a longer time frame I think it’s important to consider the FDV as a high token inflation also can have a negative impact on the price movement.

“A rising tide lifts all boats”

As mentioned, I firmly believe that the on-chain perpetual exchange sector will see a large inflow of liquidity and an increase in trading volume over the coming years. Most protocols with a sticky user base will therefore likely be decent investments however I believe that a select few winners will appreciate massively in the coming years. Hence, finding these winners is how one might outperform the market. The five protocols mentioned today are the ones I’m paying the closest attention to as of now but I would not be surprised to see new entrants emerge over the next years attracting large amounts of liquidity. Both dYdX and GMX have large catalysts coming up and I believe they will likely hold a significant market share in the future. They are however trading at large valuations compared with some of the other protocols.

If:

- quarterly volume were to 20x in two-three years as predicted

- Current protocols adopted all of this increased liquidity

- Tokens were trading at a similar relative valuation as they are now

$DYDX could be trading at $60, $GMX $1700, GNS $150 and so on.

While there is obvious growth potential here, I however wouldn’t expect on-chain protocols to overtake CEXs in perpetual trading volume because of centralized exchanges larger marketing budgets and ability to more easily onboard retail.

There is also an obvious headwind concerning regulatory uncertainty - tokens paid as a yield (dividend) by protocols from the revenue generated to token holders resemble securities to a significant extend. While this could end up being a non-issue it’s likely larger entities from tradfi are more reluctant investing in these tokens because of this. On the other increased regulatory pressure could also move more users on-chain so it’s difficult to predict the impact this will have.

Nonetheless, I will continue to monitor this DeFi sector and am looking very much forward to the new features and implementations many of these protocols have in the horizon.

(Nothing mentioned should be interpreted as financial advice!)

Support:

Like/retweet the thread:

https://twitter.com/ThorHartvigsen/status/1648320306761863168

📊 Trade on GMX: https://app.gmx.io/#/trade/?ref=thor

📊 Trade on gTrade: https://gains.trade/referred?by=thorh

📊 Trade on dYdX: https://dydx.exchange/r/AUTXDHFU

Sources

Perp market Dune dashboard: https://dune.com/shogun/perpetual-dexs-overview

dYdX dashboard: https://dydx.metabaseapp.com/public/dashboard/5fa0ea31-27f7-4cd2-8bb0-bc24473ccaa3

Token terminal: https://tokenterminal.com/terminal

dYdX thread: https://twitter.com/Cryptotrissy/status/1634175750713769985

dYdX docs: https://dydxprotocol.github.io/v3-teacher/#terms-of-service-and-privacy-policy

dYdX V4 article: https://dydx.exchange/blog/v4-full-decentralization

GMX V2 thread: https://twitter.com/NintendoDoomed/status/1645101280917090305

GMX stats: https://stats.gmx.io/

GMX stats: https://gmxio.gitbook.io/gmx/

Gains Network thread: https://twitter.com/blockworksres/status/1606005227861090305

Gains network docs: https://gains-network.gitbook.io/docs-home/

Gains network stats: https://dune.com/unionepro/Everthing-Gains-Network

Kwenta stats: https://kwenta.eth.limo/stats/

Kwenta docs: https://docs.kwenta.io/

Level docs: https://docs.level.finance/

Level stats: https://app.level.finance/analytics/overview

Thanks for reading Thor’s Substack! Subscribe for free to receive new posts and support my work.